AI in Aerospace and Defense Market Size and Forecast 2025 to 2034

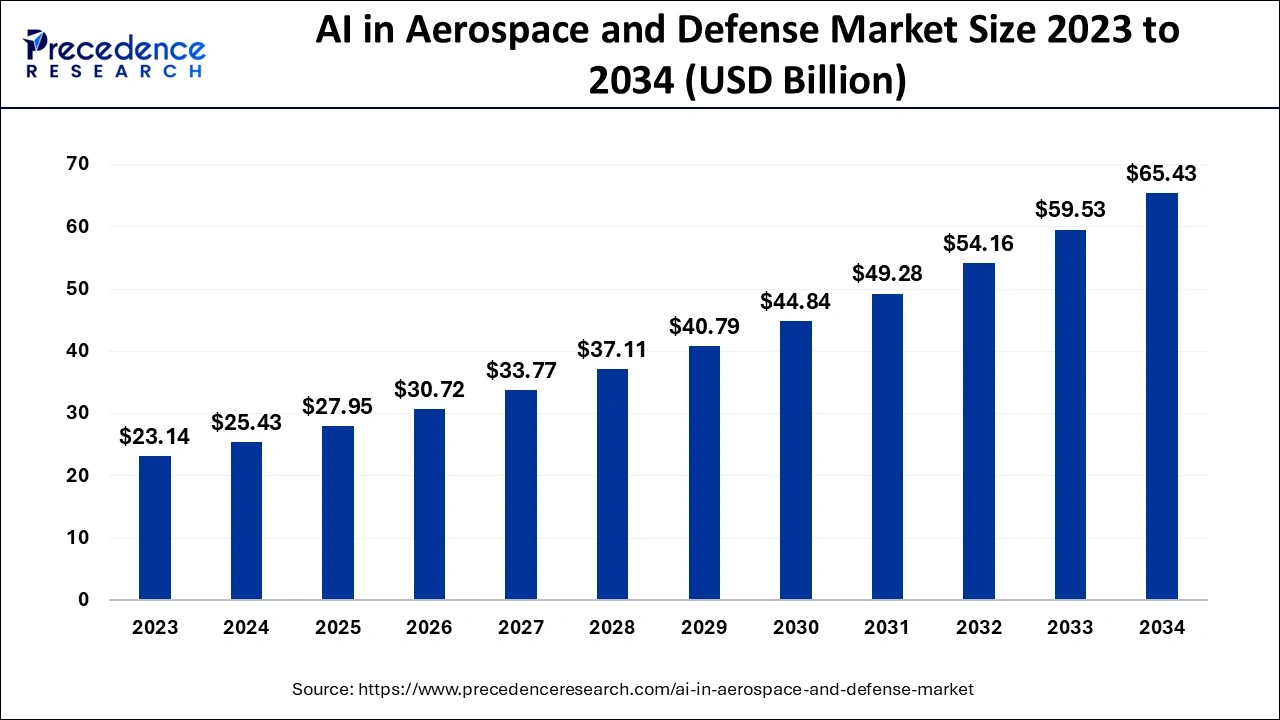

The global AI in aerospace and defense market size accounted at USD 25.43 billion in 2024 and is expected to exceed USD 65.43 billion by 2034, growing at a CAGR of 9.91% from 2025 to 2034. The AI in aerospace and defense market is growing due to its utilisation to accelerate speed in terms of concept and detailed design phases and enhances the surveillance, security and training in defense sector.

AI in Aerospace and Defense Market Key Takeaways

- The global AI in aerospace and defense market was valued at USD 25.43 billion in 2024.

- It is projected to reach USD 65.43 billion by 2034.

- The AI in aerospace and defense market is expected to grow at a CAGR of 9.91% from 2025 to 2034.

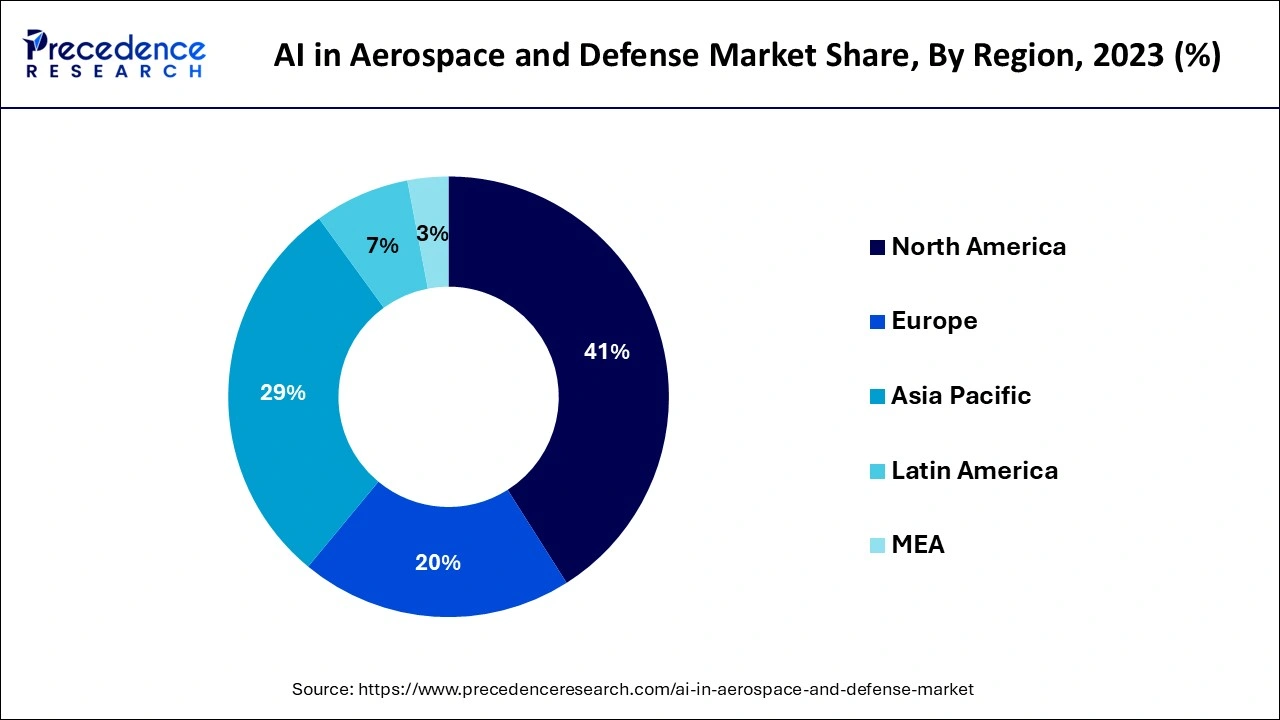

- North America dominated the AI in aerospace and defense market with the largest market share of 41% in 2024.

- Europe is expected to grow at the fastest CAGR in the market during the forecast period.

- By component, the solutions segment dominated the market with a 68.20% share in 2024.

- By component, the services segment is expected to grow at the fastest CAGR of 11.10% over the forecast period.

- By deployment mode, the on-premises segment holds a 56.70% market share in 2024.

- By deployment mode, the cloud-based segment is expected to grow at the highest CAGR of 12.30% over the forecast period.By technology, the machine learning (ML) segment dominated the market by holding 28.90% share in 2024.

- By technology, the computer vision segment is expected to grow at the highest CAGR of 12.90% during the forecast period.

- By application, the defense & national security segment held a 42.60% market share in 2024.

- By application, the public safety & security segment is expected to grow at the highest CAGR of 11.70% during the projected period.

- By the end of 2024, the defense & intelligence agencies segment dominated the market with a 46.80% share 2024.

- By the end of the government bodies, the law enforcement agencies segment is expected to grow at the highest CAGR of 10.40% over the study period.

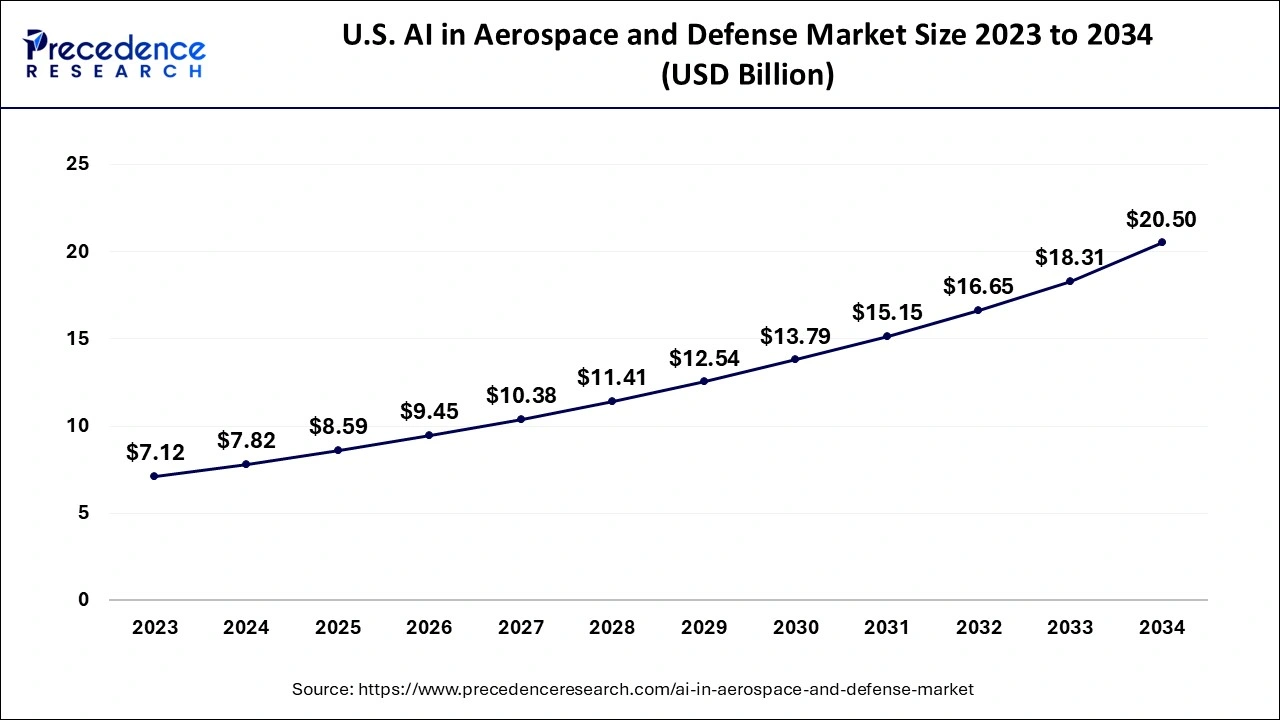

U.S. AI in Aerospace and Defense Market Size and Growth 2025 to 2034

The U.S. AI in aerospace and defense market size was exhibited at USD 7.82 billion in 2024 and is anticipated to be worth around USD 20.50 billion by 2034, growing at a CAGR of 10.12% from 2025 to 2034.

North America dominated the AI in aerospace and defense market in 2024. The dominance of this region is stimulated by robust investment in both commercial aviation and defense sectors. Companies such as Boeing, Lockheed Martin, and Northrop Grumman are greatly investing in AI to enhance their capabilities in aircraft design, autonomous systems, and military applications. The U.S. government and military are investing highly in AI and demanding the presence of AI on government contracts.

Europe is expected to grow at the fastest CAGR in the AI in aerospace and defense market during the forecast period. The growth in this region is due to Europe's global leadership in the production of civil andmilitary aircraft, helicopters, drones, aero engines, and other systems and equipment. The large aeronautical enterprises are located in countries such as France, Germany, Italy, and Spain.

- The European Industry of aeronautics provides 405000 jobs, generates Euro 130 billion in revenues, and plays a leading role in exports, amounting to Euro 109 billion.

Asia Pacific is expected to grow significantly in the AI in aerospace and defense market during the forecast period. The growing security concerns in the Asia Pacific are increasing the demand for the use of AI in aerospace and defense. At the same time, various investments are also driving its growth. Additionally, new development and collaboration within the companies are also contributing to the same. Therefore, to enhance these developments and support them, various initiatives are also being introduced by the government. Thus, all these factors are promoting the market growth.

Market Overview

The concept of artificial intelligence in aerospace and defense represents the adoption of AI systems by companies to speed up their design cycles, which is a crucial phase before the manufacturing and final deployment with air traffic control. AI in aerospace and defense market is implemented in manufacturing and maintenance, which includes factory automation, supply chain streamlining, and processing large data sets to help maintenance engineers.

The application of AI in aerospace and defense market is not a futurist concept. The Department of Defense, the Air Force, and the U.S. Navy are all considering the incorporation of AI in military applications and weapons systems, commencing with cloud initiatives such as DOD Cloud One. AI-powered modeling platforms are essential to designing and developing a new aircraft system quickly, safely, and efficiently.

Data and Statistics in the AI in Aerospace and Defense Market

- In July 2022, Raksha Mantri Shri Rajnath Singh launched 75 newly developed Artificial Intelligence products and technologies during the ‘AI in Defence' (AIDef) symposium and exhibition organized by the Ministry of Defence in New Delhi.

- According to the International Air Transport Association, the demand for global air passenger traffic measures in revenue passenger kilometers is expected to grow by 11.6% in 2024 compared to 2023.

- The U.S. Department of Defense increased its fiscal year 2024 budget to USD 842 billion—USD 100 billion more than FY 2022. The focus is on integrating technologies such as AI, automation, and advanced manufacturing into defense systems.

- In November 2024, Odyssey Systems Consulting Group, a leading provider of outstanding management, analytical, and technical support services, won a 5 year USD 531 million contract to provide advisory and assistance service to the U.S. Air Force's Intelligence, Surveillance, Reconnaissance (ISR) and Special Operations Forces (SOF).

| Company | Country | Investment |

| Boeing | United States | USD 17.5 billion |

| AIRBUS | France | USD 14.4 billion |

| Lockheed Martin | United States | USD 9.5 billion |

| Northrop Grumman | United States | USD 6.8 billion |

| Raytheon Technologies | United States | USD 6.0 billion |

| General Dynamics | United States | USD 5.3 billion |

| BAE Systems | London | USD 5.2 billion |

| Safran | France | USD 4.0 billion |

| Thales | France | USD 3.5 billion |

| Pratt & Whitney | United States | USD 3.1 billion |

AI in Aerospace and Defense Market Growth Factors

- Factory automation: This helps improve factory operation and supply chains, reduce delays, improve customer experiences, lower costs, and increase productivity.

- Preventative maintenance: The existing application of AI in aerospace engineering is commonly used to track, schedule, and manage maintenance based on historical data and predictive analytics. This predicts and schedules the required parts beforehand.

- User experience: AI has the potential to improve customer interaction by incorporating chatbots to converse with customers, find out the problem, and provide solutions.

- Fuel efficiency: With the help of historical recorded data as a base, AI optimizes fuel consumption during the most taxing part of the flight. This advanced system has the ability to create custom profiles based on pilots, aircraft, locations, weather, and more.

- Training: The training platform for pilots and engineers is advancing with virtual reality (VR) and augmented reality (AR). AI collects and analyses training data which showcases the pilot's strengths and weakness to create a detailed report for the trainers.

Market trends

- In June 2025, to develop and validate next-generation radiation-hardened microcontroller (MCU) technology with the help of the Alpha Customer Program of VORAGO, a collaboration between Sidus Space and VORAGO Technologies, which is a well-known semiconductor firm, was announced. Thus, with this collaboration, VORAGO's next-generation MCU components will be accessed early by Sidus, which are developed to enhance the reliability in the space and defense demanding environment. Furthermore, to validate and refine the technology through system-level testing and integration will be the focus of this collaboration.

- In December 2024, to develop and supply AI solutions throughout the intelligence space and defense, the joint initiatives were announced by the collaboration between C3 AI, which is an Enterprise AI application software company, and Collins Aerospace, which is an RTX business. Furthermore, to utilize AI in critical defense operations, as well as to advance the technology adoption in support of federal priorities, will be the main goal of this initiative. Additionally, different applications of C3 AI Defense and Intelligence Suite for defense and intelligence, such as C3 Generative AI and C3 AI Readiness, will be deployed by C3 AI and Collins.

(Source: https://www.benzinga.com/ )

(Source: https://www.businesswire.com/)

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 65.43 Billion |

| Market Size in 2024 | USD 25.43 Billion |

| Market Size in 2025 | USD 27.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.91% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Deployment Type, Platform, Technology, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Driver

Technological advancements

The AI in aerospace and defense market has revolutionized the manufacturing process and provided efficiency and productivity. By analyzing larger sensor data from aircraft systems and components, AI algorithms detect anomalies and failure detection and trigger maintenance action before an issue occurs. Predictive maintenance technology helps optimize performance and reduce downtime.

- Swiss International Airlines incorporated AI to boost efficiency and claims it could optimize more than half the flights in its network and save 5 million Swiss francs in 2022.

Additionally, quality control also plays a crucial role by leveraging computer vision and machine learning algorithms, the AI in aerospace and defense market systems rapidly inspect and identify defect in components with great accuracy.

Restraint

Flawed prediction and incorrect decision

Several companies have reported several negative impacts of AI applications in the AI in aerospace and defense market. As AI algorithms solely depend on high-quality and relevant data, and when companies contain inadequate or biased data, the outcome is inaccurate decision-making.

Another issue with the AI in aerospace and defense market is the inability to explain the reasoning behind AI decisions. In safety-critical aerospace applications, explainability and interpretability are crucial aspects to gain user trust. Additionally, growing work efficiency is leading to job displacement. For instance, an analyst at Georgetown University presented an incident where AI mistook atmospheric conditions over Bering Strait as a missile attack and launched missile interceptors, which China then viewed as an attack against them.

- According to the World Economic Forum, 75% of companies are expected to adopt AI technology in the next 5 years, and up to 26 million record-keeping and administrative-related jobs will be eliminated.

Opportunity

Innovation in aerospace and defense using AI

The implementation of the AI in aerospace and defense market services provides a promising future with innovative discoveries. One feature that is expected to be witnessed in the aerospace industry is autonomous space explorations; this feature consists of AI-powered robots that deal with complex tasks in space, paving the way for deeper exploration and colonizing other planets. Personalized air travel features let an individual passenger adjust cabin temperature and pressure according to the desired comfort. Another feature is hypersonic flight, which allows a vehicle to travel at several times the speed of sound. AI helps in developing a safe and efficient hypersonic travel experience.

Moreover, AI in aerospace and defense market has various applications, such as warfare systems, including weapons, sensor navigation, aviation support, and surveillance, which can employ AI to operate much more efficiently. Drone swarms, strategic decision-making, data processing and research, combat simulation and training, threat monitoring, cybersecurity, and transportation are some additional aspects where AI is applicable and is expanding with novel discoveries.

Offering Insights

The hardware segment contributed the biggest share of the AI in aerospace and defense market in 2024. The dominance of this segment is due to its quick processing of large datasets with efficiency and scale. Some commonly used AI hardware components are processors, AI accelerators, and specialized memory units. Each hardware component of artificial intelligence has different aspects. For instance, processor speed directly impacts the AT model calculation performance, and memory and storage affect the quantity of data handled and accessed.

The software segment is anticipated to witness significant growth in the AI in aerospace and defense market over the studied period. The growth is attributed due to rising popularity to install software on aircraft and space vehicles. The manufacturing and system suppliers must meet the strict regulatory requirement standards such as DO-160, DO-178C and DO-254 in aviation. A comprehensive software is required to experience a seamless workflow from model definition to real-time testing.

Deployment Type Insights

The on-premises segment held a 56.70% market share in 2024. The dominance of this segment is noticed as on-premises runs AI services and applications with the organization's physical environment; it is operated by the organization's employees, which is an ideal choice for controlling in the aerospace and defense sector. This also allows enhanced security and privacy with customized and controlled applications.

The cloud-based segment is expected to grow at the highest CAGR of 12.30% over the forecast period. Cloud AI allows companies and enterprises to utilize AI's full potential, such as machine learning, natural language processing, and computer vision. The integration of cloud-based AI offers multiple advantages to the organization, equipping businesses with a competitive edge.

Platform Insights

The airborne segment led the global AI in aerospace and defense market in 2024. Airborne intelligence, surveillance, and reconnaissance offer faster targeting and response for threat identification, security built into the model to detect and prevent tampering, optimizes SWAP management by model compression, increases the capability and payload of drones and other airborne devices, and the data can be offloaded post-mission for data deeper analytics. All these factors contribute to the growth of this segment.

The space segment is expected to grow at the highest CAGR in the AI in aerospace and defense market during the forecast period. The Space Force officials are urging increased investments in AI and machine learning to maintain the country's dominance in air and space industries. The growth is attributed to AI's transformative advancements in exploration, in-space servicing, command-and-control decision-making, and more resilient communication.

Technology Insights

The machine learning (ML) segment dominated the market by holding a 28.90% share in 2024. The dominance of this segment is observed due to its transformative property in the aerospace sector. The application of machine learning is used in aircraft design and optimization, structural health monitoring, flight control, navigation, satellite image analysis, and space exploration. These advanced contributions of machine learning technology are growing the aerospace and defense industry.

The computer vision segment is expected to grow at the highest CAGR of 12.90% during the forecast period. The growth of this segment is due to the rising demand to eliminate global threats and boost military capabilities. Computer vision technology offers organizations a large amount of visual data, allowing them to make quick and accurate decisions. In the defense sector, this technology improves operations, safety, and decision-making.

Application Insights

The defense & national security segment held a 42.60% market share in 2024. The dominance of the segment can be linked to the increasing geopolitical tensions and threats, coupled with the rapid innovations and adoption of AI technologies. In addition, governments are increasing their defense budgets to improve national security.

The public safety & security segment is expected to grow at the highest CAGR of 11.70% during the projected period.

The growth of the segment can be driven by growing security threats like crime and terrorism, coupled with the ongoing adoption of innovative technologies such as Artificial Intelligence (AI) and Big Data. Moreover, there is a rising need to safeguard critical infrastructure from threats.

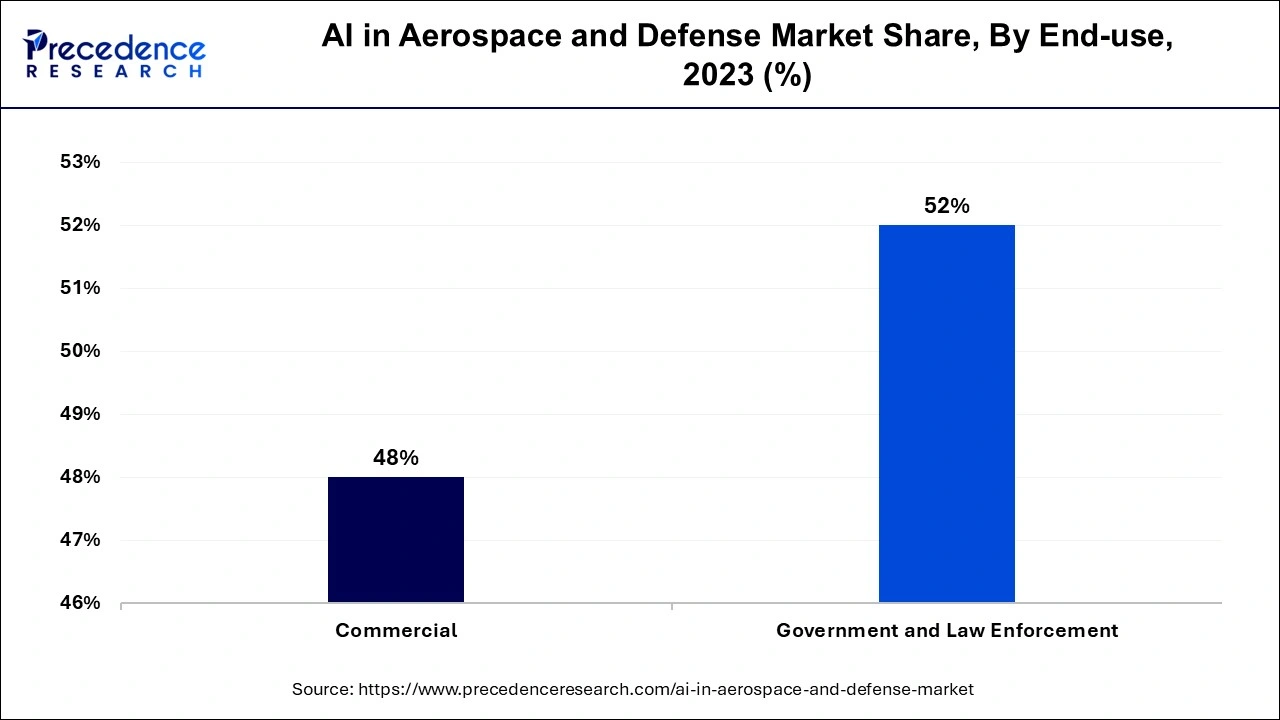

End-use Insights

The government & law enforcement segment accounted for the highest share of the AI in aerospace and defense market in 2023. The rising demand for government & law enforcement is noticed to provide public safety, criminal justice, and security. Artificial intelligence has the ability to collect data from various sources, such as sensors and satellites, and submit a conclusion that helps government & law enforcement to undertake operations or tasks all by themselves.

The commercial segment is anticipated to grow at a solid CAGR in the AI in aerospace and defense market during the projected period. The application of commercial aircraft manufacturing with generative AI is boosting this segment, it offers a easy and effective tailors design for specific operation.

- In 2023, NASA's research engineer claims to use commercially available generative AI to design specialized parts called evolved structures. These designs weigh much less than traditional components.

Component Insights

The solutions segment dominated the market with a 68.20% share in 2024. The dominance of the segment can be attributed to the growing demand for improved operational efficiency and sustainability, along with the rising use of AI for intelligent systems. Also, AI solutions play a significant role in improving the cybersecurity of defense organizations by revolutionizing the sector.

The services segment is expected to grow at the fastest CAGR of 11.10% over the forecast period. The growth of the segment can be credited to the growing demand for improved operational efficiency through AI-driven supply chains, maintenance schedules, and logistics. Additionally, AI-driven platforms provide adaptable and realistic training scenarios for personnel, driving segment growth soon.

End Government Bodies Insights

The defense & intelligence agencies segment dominated the market with a 46.80% share in 2024. The dominance of the segment is owed to the growing focus on cybersecurity and autonomous systems, along with the growing global geopolitical tensions. Furthermore, the rapid digitalization of military operations, from combat to logistics systems, creates an expanded attack surface, boosting the need for innovative cyber defense.

The law enforcement agencies segment is expected to grow at the highest CAGR of 10.40% over the study period. The rising demand for government & law enforcement is noticed to provide public safety, criminal justice, and security. Artificial intelligence has the ability to collect data from various sources, such as sensors and satellites, and submit a conclusion that helps government & law enforcement to undertake operations or tasks all by themselves.

AI In Aerospace and Defense Market Companies

- The Boeing Company

- Lockheed Martin

- Northrop Grumman Corporation

- RTX Corporation

- Thales Group

- Honeywell International Inc.

- Deutsche Telekom AG

- General Electric Co.

- Indra Sistemas SA

- Intel Corporation

- International Business Machines Corporation

- Iris Automation

- Microsoft Corporation

- NVIDIA Corporation

- Raytheon Technologies Corporation

- SparkCognition Inc.

- Safran

Recent Developments

- In June 2024, Safran, primarily a manufacturer of aircraft parts, acquired Preligens, a leading geospatial artificial intelligence (AI) start-up establishment, for USD 236 million with France's defense industry. The acquisition is gained with 220 employees and 140 engineers in research and development. Safran aims to add diverse AI capabilities to its product offering and accelerate its digital transformation.

- In April 2024, Officials of the Naval Air Systems Command at Patuxent River Naval Air Station, Md., announced a USD 657.1 million order from Boeing Co. Defense, Space & Security segment in St. Louis Friday for two additional MQ-25 System Demonstration Test Article aircraft -- air vehicles four and five.

- In September 2024, Lockheed Martin and Tata Advanced Systems Limited teamed up to expand their business relationship through the C-130J Super Hercules tactical airlifter. This initiative has taken a significant step in enhancing India's defense and aerospace capabilities while deepening the United States' strategies.

Latest Announcements by Industry Leaders

- In June 2024, Safran CEO Olivier Andriès shared insights on the group's future plan, “With multiple applications, it will represent a step-change for the company's defense and space technology businesses and will also allow the company to deploy AI-enabled digital inspection methods to support and focus on flight safety and quality.”

- In September 2024, Sukaran Singh, chief executive officer and managing director of Tata Advanced Systems, stated, “Collaboration with Lockheed Martin on the C-130J platform proposition for IAF's MTA project is a milestone for Tata Advanced Systems,”. On that, Rod McLean, vice president and general manager of the Air Mobility and Maritime Missions line of business at Lockheed Martin, responded, “This teaming agreement between Lockheed Martin and Tata Advanced Systems further demonstrates Lockheed Martin's commitment to a self-reliant India and the confidence that exists in our relationships with our partners in India and the Indian industry at large.”

Segments Covered in the Report

By Component

- Solutions

- AI Software Platforms

- Data Management Tools

- Model Development Frameworks

- Decision Support Systems

- Services

- Professional Services

- Consulting

- System Integration

- Training & Support

- Managed Services

By Deployment Mode

- On-Premises

- Cloud-Based

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Technology

- Machine Learning (ML)

- Supervised Learning

- Unsupervised Learning

- Reinforcement Learning

- Natural Language Processing (NLP)

- Computer Vision

- Deep Learning

- Speech Recognition

- Robotic Process Automation (RPA)

- Predictive Analytics

- Context-Aware Computing

By Application

- Public Safety & Security

- Crime Mapping & Prediction

- Facial Recognition

- Video Surveillance Analytics

- Transportation & Smart Infrastructure

- Traffic Flow Optimization

- Autonomous Systems in Public Transport

- Smart Parking

- Healthcare & Social Services

- Predictive Healthcare Analytics

- AI-based Disease Surveillance

- Welfare Distribution Optimization

- Tax & Revenue Management

- AI-based Fraud Detection

- Predictive Tax Compliance

- Automated Tax Filing Support

- Legal & Judicial Systems

- Case Outcome Prediction

- Legal Research Automation

- AI-assisted Sentencing

- Environmental Monitoring

- Climate Modeling

- Air & Water Quality Monitoring

- Disaster Forecasting & Response

- Defense & National Security

- Threat Detection Systems

- Autonomous Military Vehicles

- Intelligence Analysis

- Administrative Automation

- Chatbots for Public Queries

- Virtual Assistants

- Document Classification & Routing

By Government Function / Level

- Federal/National Government

- State/Provincial Government

- Local/Municipal Government

By End Government Bodies

- Defense & Intelligence Agencies

- Public Health Departments

- Transportation Authorities

- Law Enforcement Agencies

- Judiciary Bodies

- Environmental Protection Agencies

- Tax & Revenue Departments

- Urban Planning Authorities

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting