What is Inertial Measurement Unit Market Size?

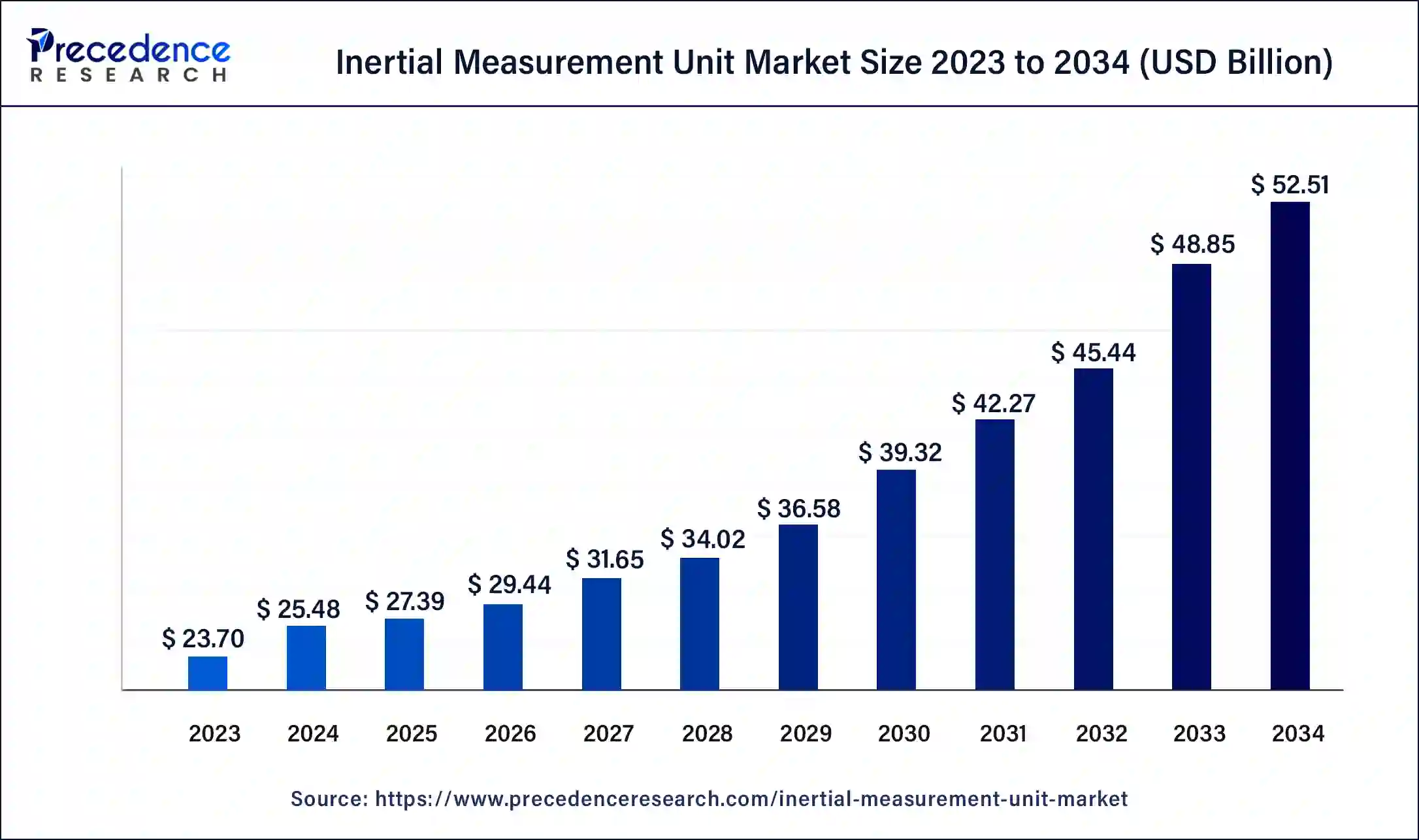

The global inertial measurement unit market size accounted at USD 27.39 billion in 2025, and is expected to reach around USD 56.00 billion by 2035, expanding at a CAGR of 7.41% from 2026 to 2035. The market is expanding due to the quick modernization of military hardware and defense systems.

Market Highlights

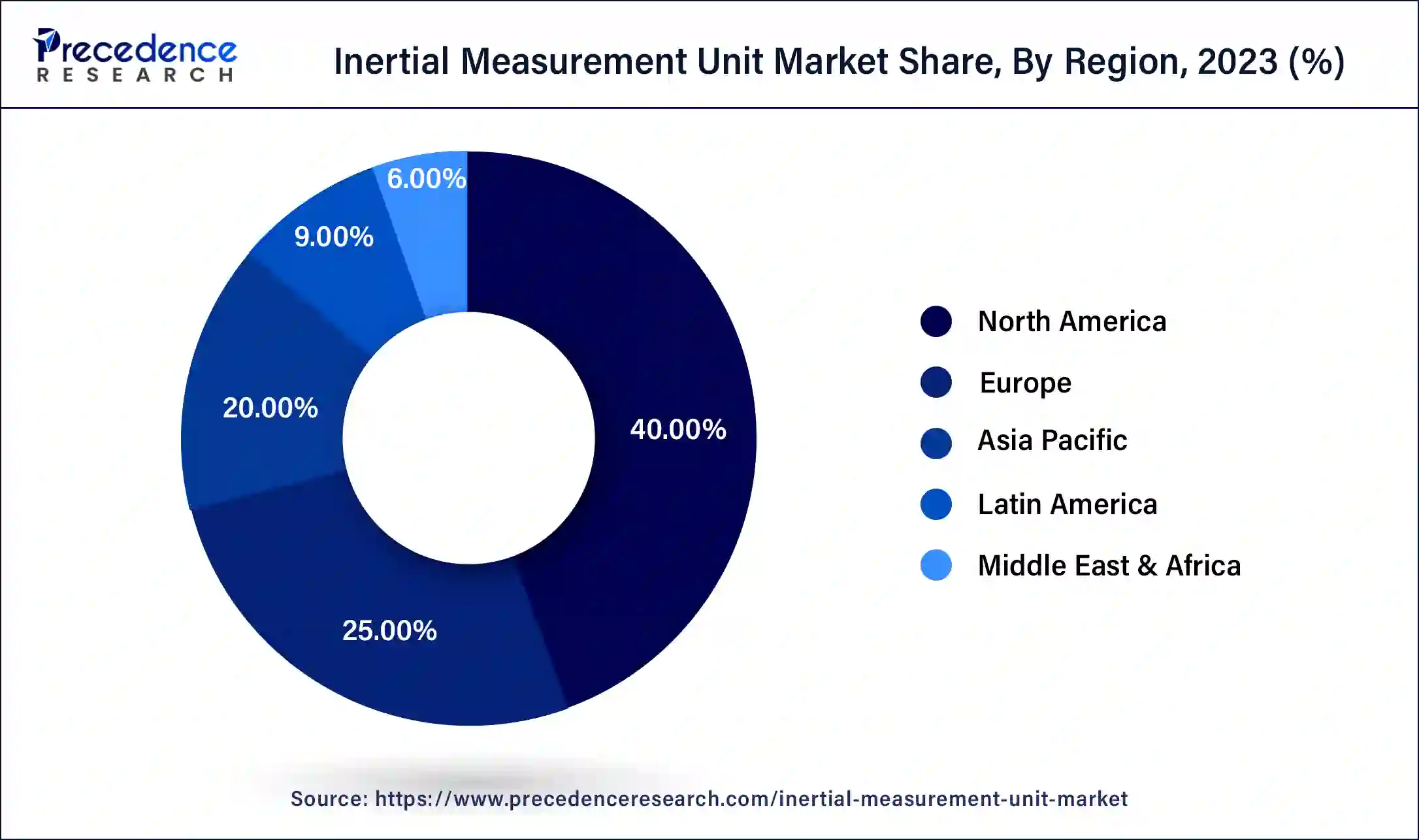

- North America dominated the global inertial measurement unit market with a revenue share of 40% in 2025.

- Asia Pacific is expected to experience the highest growth in the global market.

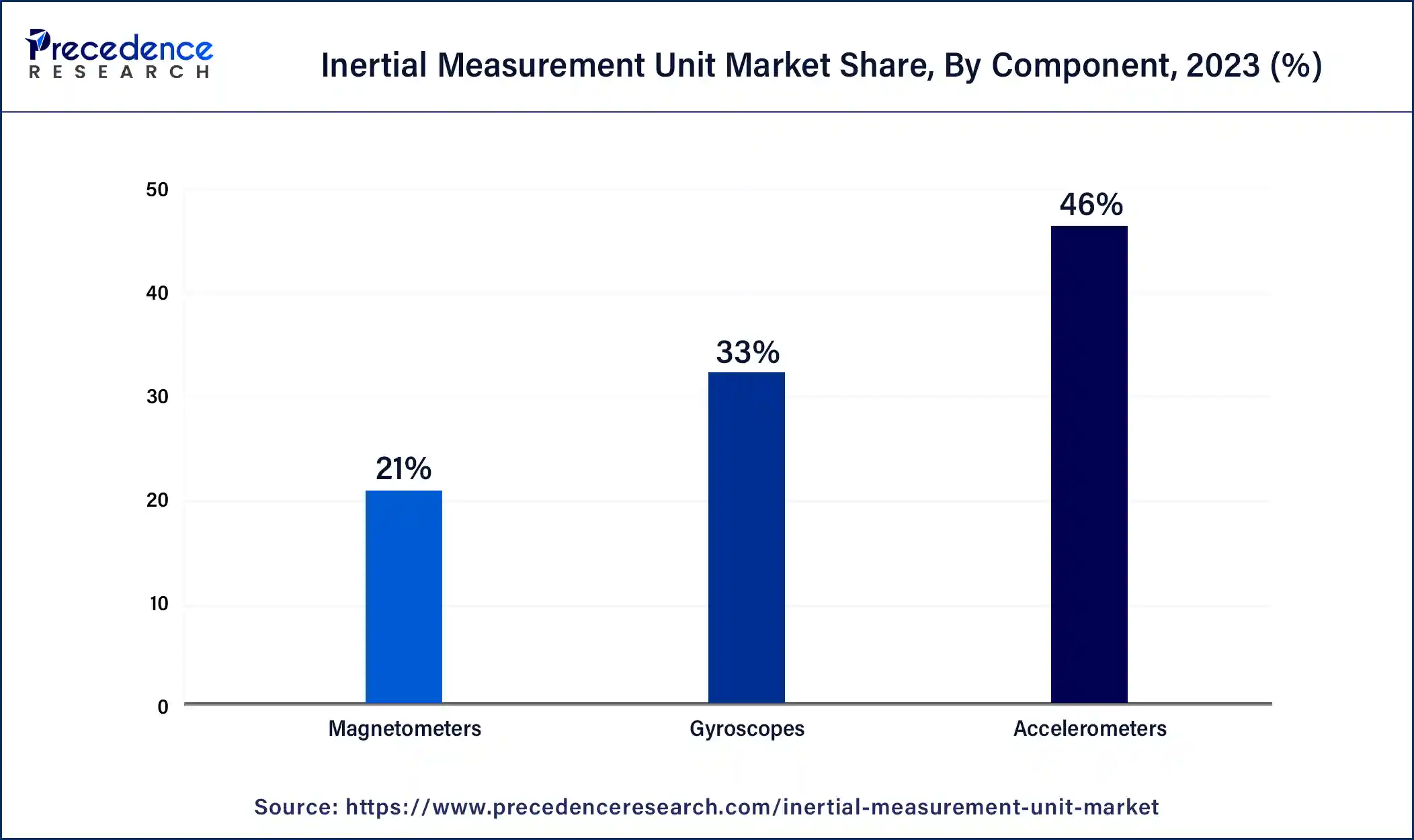

- By component, the accelerometer segment has contributed the highest revenue share of 46% in 2025.

- By technology, the ring laser gyro segment held the largest market share in 2025.

- By platform, the space segment held the largest market share in 2025.

- By end use, the aerospace and defense segment dominated the market in 2025.

Market Overview

An inertial measurement unit (IMU) is a crucial sensor device used in various applications to measure an object's velocity, orientation, and acceleration relative to a fixed frame of reference. It combines different sensor types, such as gyroscopes, accelerometers, and sometimes magnetometers, to provide comprehensive motion data for different dynamic systems. IMUs find wide applications in robotics, navigation, virtual reality, aerospace, and other industries due to their ability to function independently of external references.

The core components of an IMU are accelerometers and gyroscopes, which detect linear acceleration along different axes and measure angular velocity around those axes, respectively. Accelerometers operate based on the principle of inertia, which describes an object's resistance to changes in motion (acceleration). Gyroscopes, however, detect changes in rotational orientation by relying on the principles of angular momentum and precession.

Inertial Measurement Unit Market Growth Factors

- Advancements in aerospace and defense sectors are driving the growth of the inertial measurement unit market.

- The modernization of military hardware will fuel market growth further in the future.

- A wider range of product adoption for virtual as well as augmented reality systems is also propelling the growth of the inertial measurement unit market.

- Rise in new smartphone sales and its shipment globally are also some of the major factors boosting the inertial measurement unit market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 27.39 Billion |

| Market Size in 2026 | USD 29.44 Billion |

| Market Size by 2035 | USD 56.00 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.41% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component, By Technology, By Platform, and By End-user, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advancement in military equipment technology

The continuous improvement of military equipment is a key factor driving the growth of the inertial measurement unit market, particularly in defense systems. Fiber optic IMUs are commonly used in unmanned aerial vehicles (UAVs) for autonomous navigation, allowing them to operate in adverse weather conditions. They are utilized for intelligence, surveillance, and reconnaissance (ISR) missions, as well as firefighting and bomb detection. The increasing use of virtual and augmented reality (V/AR) systems, along with the need for precise measurements of speed, orientation, and acceleration, also contributes to the market growth.

IMUs are being integrated as orientation sensors in upcoming smartphones, tablets, and gaming consoles. Other factors driving growth include technological advancements such as the development of microelectromechanical (MEMS)--based IMUs that can be integrated with the Internet of Things (IoT). R&D efforts are also expected to boost the inertial measurement unit market further.

- In September 2023, Honeywell and Civitanavi Systems launched a new inertial measurement unit for commercial and defense customers worldwide. The HG2800 family consists of low-noise, high-bandwidth, high-performance, tactical-grade inertial measurement units designed for pointing, stabilization, and short-duration navigation on commercial and military aircraft, among other applications.

Restraint

Challenges in the protection of IMU components

Protecting the internal components of MEMS IMU sensors in harsh mounting environments, which involve moisture, heat, and corrosive materials, is challenging. The development, commercialization, and packaging of micromachined gyroscopes are particularly difficult because they are sensitive to manufacturing and environmental variations. To ensure optimal performance without excessive cost, a durable MEMS sensing unit is required. Packaging these components is also complex due to the increased ruggedness of MEMS-packaged modules.

Opportunity

Rise in sales and shipments of smartphones globally

There's been a notable increase in the sales and shipments of smartphones worldwide. Demand for smartphones is particularly high in major markets like China, the U.S., Brazil, and Japan. In countries with large populations, smartphone usage is growing rapidly, which will continue to drive market growth shortly. Many smartphones now come equipped with inertial measurement units, which typically include a gyroscope, accelerometer, and magnetometer.

IMUs enable smartphones to measure human movement characteristics such as gait and tremors. The growing popularity of smartphones is fueling the demand for inertial measurement units. Additionally, regulations such as the International Traffic in Arms Regulations (ITAR) and the Export Administration Regulations play a significant role in governing defense-related applications, particularly in the United States.

- In August 2023, SparkFun launched a new inertial measurement unit (IMU) breadboard board, offering the sort of rotational accuracy needed for virtual and augmented reality (VR and AR) projects that don't give the user a bout of simulator sickness: the SparkFun VR Breakout BNO086.

Segment Insights

Component Insights

The accelerometer segment dominated the inertial measurement unit market in 2025. this is linked to the rising number of autonomous cars, rapid extension in space technologies, and increasing expenditure on the aviation sector in developing countries like China and India, which are helping to fuel market growth in the future.

The magnetometer segment has accounted for 21% revenue share in 2025 and is expected to grow at a notable rate over the forecast period. This is attributed to the use of magnetometers in various aviation equipment. Magnetometers measure the Earth's magnetic field to show orientation.

- In April 2024, A team of researchers at the Air Force Research Labs (AFRL) and the Massachusetts Institute of Technology (MIT) reported a successful demonstration of the capabilities of an aircraft outfitted with artificial intelligence-enhanced magnetic navigation, known as MagNav.

Technology Insights

The ring laser gyro segment held the largest share of the inertial measurement unit market in 2025. This is due to the increasing space program activities from developing countries of the Asian Pacific region, which will fuel the segment growth in the foreseeable future.

The MEMS segment is anticipated to grow at the highest CAGR over the projected period. This is linked to the growing use of miniaturized sensors in automotive applications and devices like wearables, etc. Moreover, MEMS components handle processing and sensing data while mechanical parts give physical feedback; these features make MEMS sensors reliable, cost-effective, and small.

Platform Insights

The space segment held the largest market share in 2025. Focusing on the use of inertial sensors in space-based systems such as satellite navigation. In spacecraft, the guidance, navigation, and control systems rely on inertial sensors to receive information about attitude and velocity. This data is crucial for translating steering inputs into commands for control surfaces, engine gimbal adjustments, and thruster firings on systems like the space shuttle.

The airborne segment is expected to grow with the highest CAGR in the inertial measurement unit market during the forecast period. With the increasing demand for global air travel and growing military investments in enhancing space-based capabilities, the airborne segment is expected to expand. Also, due to the rising demand in this market segment, air-based platforms are anticipated to experience the fastest growth.

- In January 2024, to redefine air travel, cargo transport, and advanced air mobility, the General Authority of Civil Aviation (GACA) of Saudi Arabia released the ‘Enabling Advanced Air Transport in the Kingdom' initiative. The initiative aims to revolutionize the Saudi aviation sector, positioning it as a leader in Advanced Air Mobility (AAM) in the Middle East through sustainable and state-of-the-art technologies.

End-use Insights

The aerospace and defense segment dominated the inertial measurement unit market in 2025. These devices are important for navigation guidance, control, and stability of UAVs and aircraft. The rise in demand for UAVs and aircraft fleets is expected to drive the growth of this segment shortly.

Regional Insights

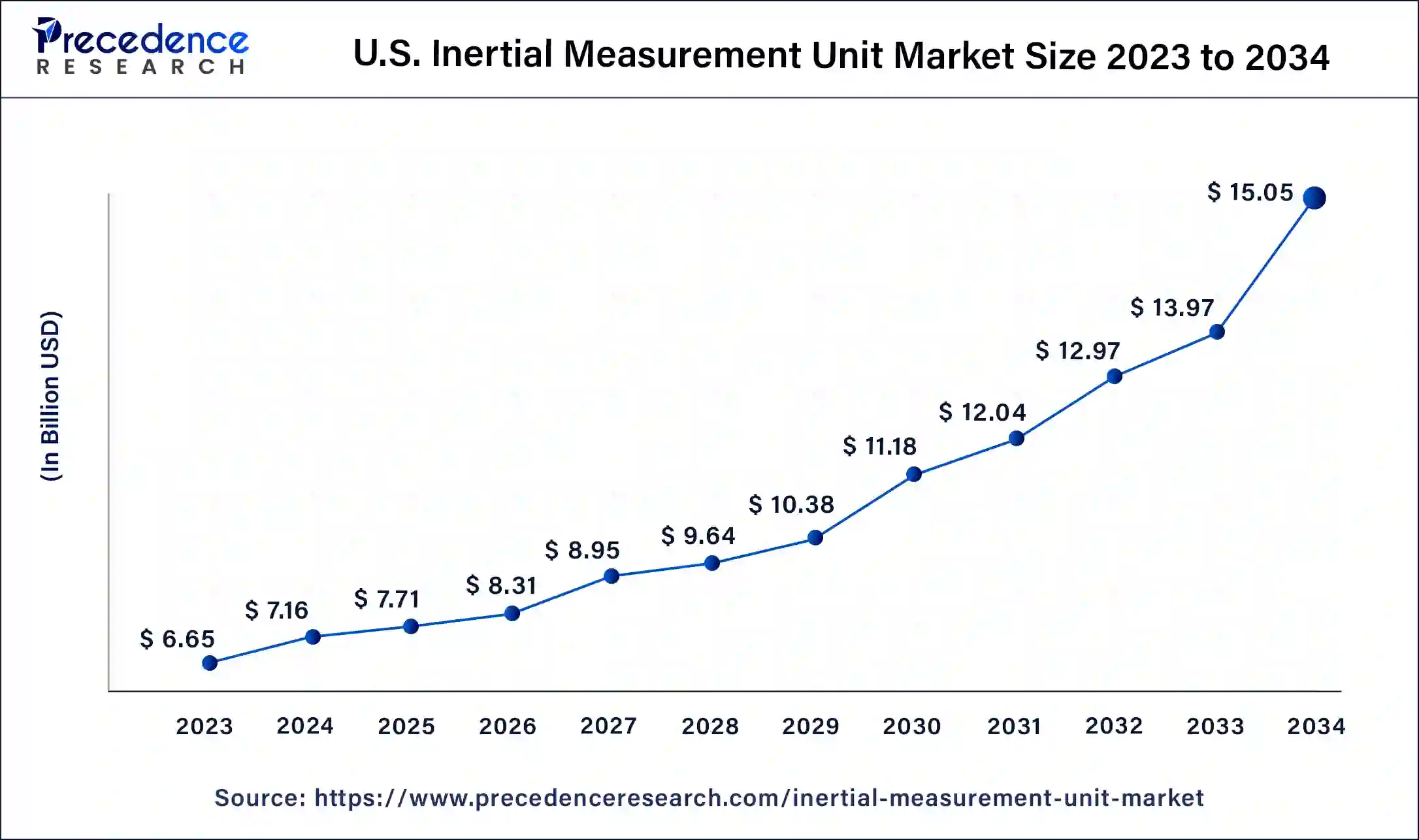

U.S. Inertial Measurement Unit Market Size and Growth 2026 to 2035

The U.S. inertial measurement unit market size was estimated at USD 7.71 billion in 2025 and is predicted to be worth around USD 16.08 billion by 2035, at a CAGR of 7.63% from 2026 to 2035.

North America dominated the inertial measurement unit market in 2025 and is at the forefront of adoptingaugmented reality (AR). Many AR applications are being developed for iOS and Android devices in this region. Several companies that produce smart glasses, such as VUZIX, Microsoft, and ODG, are based here. Smart glasses come with various wearable sensors.

The Vuzix Blade 3000 has built-in GPS and directional sensors, including a gyroscope, accelerometer, and hull sensors. Despite North America having a mature inertial measurement unit market, the demand for new types of wearables will stem from this region. The demand for inertial measurement units (IMUs) is expected to increase steadily during the forecast period.

Asia Pacific has captured a 22.3% revenue share in 2025 and is expected to experience the highest growth over the forecast period. Additionally, based on data from the OICA, China and Japan are projected to contribute a significant share of global car production over the forecast period. Both domestic and international companies have established large factories in these countries for both export and domestic consumption.

Furthermore, the demand for inertial navigation systems in Asia Pacific has seen a significant rise due to the increasing use of unmanned vehicles, such as autonomous underwater vehicles (AUVs), unmanned aerial vehicles (UAVs), and remotely operated vehicles (ROVs), in recent years across various civilian and defense applications.

- In July 2022, Honeywell and Hanwha Systems announced the signing of an MOU to partner on unmanned aerial systems (UAS) and urban air mobility (UAM) technology expansion in South Korea. Established in South Korea, Hanwha Systems delivers distinguished smart technologies in information infrastructure and defense electronics.

What are the Advancements in the Inertial Measurement Unit Market in Europe?

Europe is expected to witness a significant amount of growth throughout the forecast period. This growth is due to various factors like a strong emphasis on transportation safety, the development of autonomous vehicles, and the modernization of military capabilities. Additionally, the region benefits from a strong industrial automation sector, which further contributes to market growth. Countries like Germany, France, and the UK are leading players in the region.

Germany Inertial Measurement Unit Market Trends: Germany dominates the European IMU market due to its robust automotive, aerospace, and industrial sectors. The country is home to major automotive manufacturers like BMW, Daimler, and Volkswagen, which are at the forefront of developing autonomous driving technologies requiring advanced IMUs.

What are the Key Trends in the Inertial Measurement Unit Market in Latin America?

Latin America is set to witness substantial growth throughout the forecast period. This growth is due to the increasing adoption of autonomous vehicles, drones, and robotics in the region, which thus boosts the demand for high-precision IMUs. Additionally, rising defense budgets and the focus on modernizing military capabilities in the region further propel market growth. Brazil and Mexico are leading players in the market.

Brazil Inertial Measurement Unit Market Trends: The push towards electric vehicles and autonomous driving technologies drives the demand for advanced IMUs for navigation and stability. The increasing penetration of smartphones and other consumer electronics further fuels the region's market growth. Local partnerships and collaborations with international IMU suppliers are strengthening technological capabilities and supply chain resilience, helping to tailor solutions to domestic application needs.

How is the Middle East and Africa Region Growing in the Inertial Measurement Unit Market?

The Middle East and Africa are witnessing steady growth in the market. This growth is driven by increased regional military modernization programs and the high demand for advanced navigation solutions. Various companies are seen adopting innovation strategies and emphasizing industry-specific innovations. Strategic partnerships with OEMs and government agencies are also gaining traction, helping in securing long-term contracts, thus propelling the market even further.

Saudi Arabia Inertial Measurement Unit Market Trends: The proliferation of Industry 4.0 initiatives and IoT deployments in the region is helping in creating high demand for high-precision IMUs, especially in sectors like oil and gas, mining, and urban planning. Collaboration between global IMU manufacturers and local technology firms is fostering knowledge transfer and strengthening domestic capabilities in sensor development and integration.

Inertial Measurement Unit Market Companies

- Honeywell International Inc.

- Northrop Grumman Corporation

- Bosch Sensortec GmbH

- VectorNav Technologies, LLC

- STMicroelectronics N.V.

- Invensense, Inc.

- Safran Group

- Thales Group

- Trimble Navigation Ltd.

- Analog Devices, Inc.

- KVH Industries, Inc.

- Moog Inc.

- Epson Europe Electronics GmbH

- Gladiator Technologies, Inc.

- Silicon Sensing Systems Ltd.

- MEMSIC Inc.

- Sagem (Safran Electronics & Defense)

Recent Developments

- In January 2022,EMCORE Corporation received a continuing development award from a U.S. contractor for finalizing the design and creating a method for manufacturing high-end inertial measurement units for tactical grade pods.

- In May 2022,Emcore Corporation awarded new contracts for multistage space launch vehicle navigation grade and flight stabilization. The corporation finalized its purchase of L3 Harris Space and Navigation. The contract is part of the space launch vehicle Tri-Axial Inertial Measurement Unit (TAIMU) program.

- In July 2022,Honeywell Technologies Inc. and Civitanavi Systems announced a collaboration to develop a new IMU for aerospace customers. The new HG2800 inertial measurement units are low-cost, low-power precision pointing solutions with device stabilization.

- In November 2022, Collins Aerospace and China's Hainan Airlines signed a FlightSense contract to deliver Hainan Airlines' fleet of Boeing 787s with customizable support solutions to lessen repair time and costs. The contract with Hainan Airlines, which builds on a 30-year relationship between the two organizations, includes 185 aircraft on multi-platforms through 2025. Collins will assist in ensuring the availability of Hainan Airlines' maintenance, repair, and overhaul (MRO) supply chain management.

Segments Covered in the Report

By Component

- Accelerometers

- Gyroscopes

- Magnetometers

By Technology

- Fiber optics Gyro

- Mechanical Gyro

- Ring laser Gyro

- Mems

- Others (vibrating gyro, hemispherical resonator gyro)

By Platform

- Airborne

- Ground

- Maritime

- Space

By End-user

- Aerospace And Defense

- Consumer Electronics

- Marine

- Automotive

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting