What is the Smart Glass Market Size?

The global smart glass market size is calculated at USD 6.81 billion in 2025 and is predicted to increase from USD 7.53 billion in 2026 to approximately USD 18.07 billion by 2035, expanding at a CAGR of 10.25% from 2026 to 2035.

Market Highlights

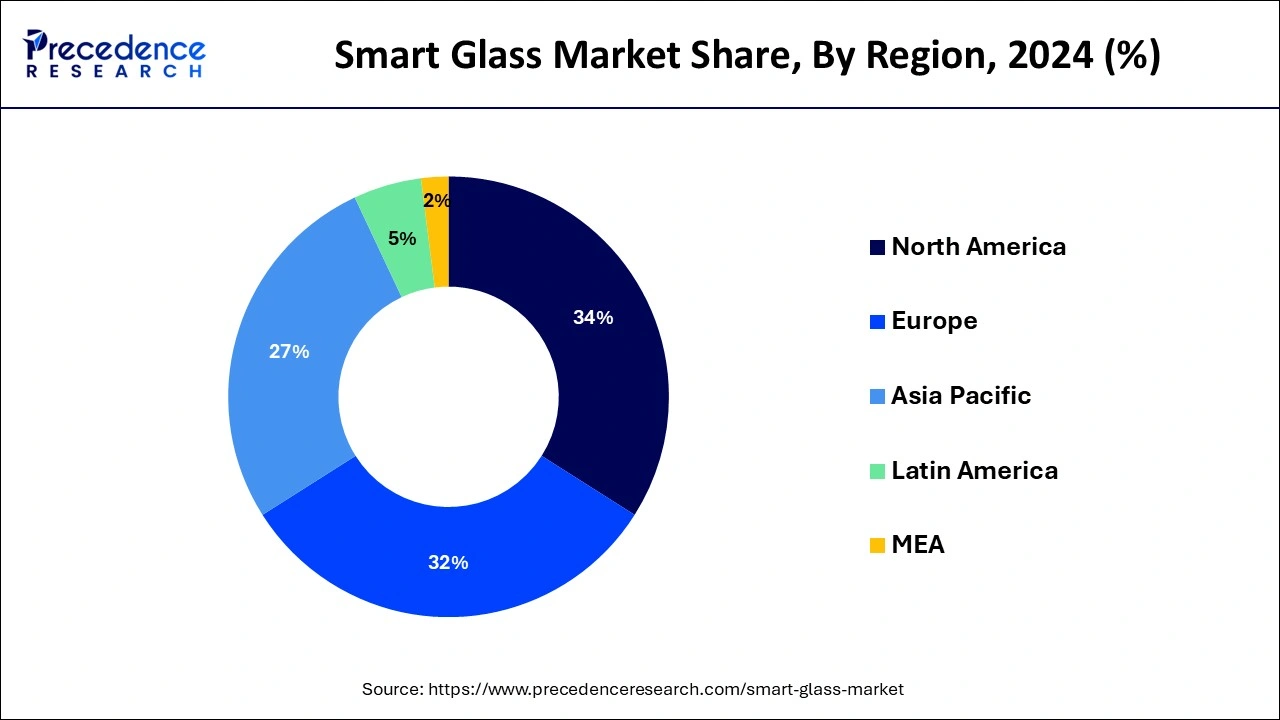

- North America region dominated the global market with the largest market share of 33.13% in 2025.

- The Europe region is growing at a CAGR of 10.25%.

- The suspended particle device (SPD) segment is registering a CAGR of 12.6% from 2026 to 2035.

- The transportation segment is expected to witness growth at a CAGR of 13.2% from 2026 to 2035.

- The construction segment is estimated to reach a CAGR of 12.3% from 2026 to 2035.

Market Size and Forecast

- Market Size in 2025: USD 6.81 Billion

- Market Size in 2026: USD 7.53 Billion

- Forecasted Market Size by 2035: USD 18.07 Billion

- CAGR (2026-2035): 10.25%

- Largest Market in 2025: North America

- Fastest Growing Market: Europe

What is the Smart Glass?

Smart Glass also known as switchable glass is an advanced technology-based glass that changes its light transmission properties. When voltage, light, or heat is introduced, smart glass undergoes a change in appearance and light transmission qualities. The expanding use in several applications, including architectural, automotive, aerospace, and marine, is fueling the expansion of the global market. The factors driving the market are technical breakthroughs in switchable glasses and architectural advances in the majority of buildings for the installation of smart windows. Switchable glass usage will also be aided by the government's rigorous regulations for retrofitting older buildings with eco-friendly and energy-efficient technology.

How does AI contribute to the growth of the smart glass market?

The adoption of Artificial Intelligence (AI) and Machine Learning (ML) is playing a transformative role in the smart glass market. The integration of AI is rising effectively with IoT devices to optimize functionality based on the conditions. AI algorithms are also increasing the adoption of smart glasses in various applications. Additionally, these systems require constant monitoring where AI plays a major role in predictive maintenance that reduces downtime. The crucial factor behind AI implementation also relies on the analysis of the future market trends which can help in optimizing particular businesses.

- For instance, In January 2025, CES 2025 showcased leading innovations in AI-powered robots, EVs, and smart glasses, with Chinese firms like Xreal and Rokid unveiling advanced augmented reality eyewear, signaling a growing global consumer electronics market driven by AI.

Smart Glass Market Growth Factors

- The expansion of the building and construction industry, where smart glass is commonly employed in windows, skylights, partitions, and doors to create adaptable lighting environments, has been accelerated by rising infrastructure investment and population increase.

- The growing focus on advancements in developing regions through smart city initiatives is the major factor that has been contributing towards the growth of the smart glass market.

- The adoption of advanced glass in the consumer electronics market is also increasing the market demand.

- The rapid growth in the manufacturing sector in the emerging economies is the major factor that has been helping in affordable manufacturing.

Smart Glass Market Outlook

- Overview Market: The world is quickly embracing the use of smart glass for buildings and vehicles. In order to meet the demands of modern construction and transportation for energy efficiency, comfort, and improved use of natural daylight, many building and vehicle manufacturers are looking for ways to control how much light and heat their products let through. Smart glass is a way to do this.

- Energy Efficiency / Energy Use: Smart glass can help reduce the energy consumed by buildings by controlling the amount of solar heat and light that is transmitted through windows. Many new building construction codes are designed to reduce energy consumption to at least 50% by using energy-efficient window designs.

- Government-Sponsored Energy Initiatives: Governments around the world are sponsoring various energy efficiency programs to encourage building owners to install advanced glazing materials to help meet the minimum energy requirements for commercial buildings and public buildings. For example, in India, the government has issued the energy conservation building code to encourage building owners to use advanced glazing, among other technologies.

- Sustainability and Urban Development: The rapid growth of urbanization and pressure to make new construction "green" has opened up an entirely new market for smart glass. Smart glass is considered a sustainable material and improves the overall sustainability of buildings, thereby reducing their carbon footprint.

- Technology and Innovation Trends: Smart glass technologies are constantly evolving, with many products being developed to apply the principles of smart glass to smart city infrastructure, commercial building projects, and other connected urban environments.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.81 Billion |

| Market Size in 2026 | USD 7.53 Billion |

| Market Size by 2035 |

USD 18.07Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.25% |

| Largest Market | North America |

| Fastest Growing Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Application, Control Mode, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing smart glass integration in automotive glass panels

The rising disposable incomes are leading the customers have insist on selecting premium amenities in their vehicles due to rising consumer buying power over the previous ten years. To differentiate their products from the competition, several multinational automakers are concentrating on incorporating contemporary ideas into their automobiles The use of switchable glass is one such design choice that has flourished in the car sector. In addition to windows, rear-view mirrors, windshields, sun visors, sunroofs, and panoramic view windows, they are used in glass panels for these items. These glass panels assist preserve temperature and privacy within the automobile in addition to controlling light transmission inside the vehicle chamber. These goods improve the comfort of the passengers and the energy economy of the vehicle thanks to these qualities.

Growing smart glass adoption in the construction industry

The use of smart glasses is increasing in buildings to develop smart facades, skylights, and smart windows, giving the structure a distinctive, dynamic aesthetic and allowing for control over the privacy within, particularly in office areas and hospital dividers. The need for intelligent construction materials is anticipated to rise as consumer expenditure rises in emerging nations, enabling customers to live elegantly. With the flip of a button, multifunctional rooms that are illuminated by smart glass respond to human demands and adapt to their surroundings. Additionally, it can insulate buildings from sound and heat, saving energy while offering architects and interior designers a 3D design option Additionally, this glass is used in various tourist attractions to design distinctive areas that draw visitors. For instance, the Eureka Tower in Melbourne includes a glass cubical space that extends 3 meters from the structure and is suspended 300 meters above the ground with people within. The glass stays opaque after it is inside the building's chamber.

Key Market Challenges

Cost of smart glass is a barrier to the adoption

The entire cost of smart glass is determined by factoring in the price of the glass itself, installation costs, power costs, and functional aspects like control latency, transparency variance, and dimming capability. When compared to regular glasses, these charges make this glass significantly more costly. Due to the use of rare chemicals and electrical systems, disposing of waste glass panels also requires specific treatment techniques, which raises the overall cost. These constraints make it difficult for switchable glass producers to list the advantages and alluring returns on investment that clients receive when adopting switchable glass. Despite the benefits of these spectacles, their expensive price is still the main barrier to their wider adoption.

Market Opportunities

A growing market trend is the use of SPD glass to create large windows in the aerospace industry - Demand has increased as a result of the aircraft industry's fast expansion. The adoption of bigger windows that would have greater utility and passenger control is being encouraged by aircraft makers. They are utilizing certain glasses, mostly SPD glass, for this purpose. These glasses provide the fundamental qualities needed to enhance the performance of the aircraft, including rapid and uniform reaction, great acoustic insulation, light management, and improved heat rejection when the aircraft is parked on the ramp. These features increase passenger comfort by reducing glare, protecting the vision, and enabling day lighting at the press of a button. As a result, the aerospace sector is seeing an increase in demand for these glasses since they have features that not only increase consumer happiness throughout the flight but also aid aerospace businesses in maintaining the energy efficiency of aircraft.

Increasing R&D activities - Rising R&D efforts have given rise to possible uses for smart glass across a range of end markets. Smart glass, for instance, may boost operational efficiency by 20 to 30% in solar-powered heating and cooling systems. Additionally, it is frequently used in fighter jets, airplanes, and cruise ships' interior barriers as a privacy glass. This is expected to result in a surge in smart glass sales across a number of end-use industries, opening up attractive market potential.

Segments Insights

Technology Insights

In 2025, the electrochromic glass market had a sizable share of more than 83.4%. This is partly attributable to the features of the device, including its high UV and IV ray blocking ratio, low operating voltage, and straightforward integration with big glass panels. Additionally, the electrochromic glass may be stained, colored, and made opaque to adjust how much light and heat it transmits depending on the environment. These glasses are widely used in medical facilities, educational facilities, business settings, and retail stores.

Due to the excellent stability of SPD against UV radiation, the Suspended Particle Device (SPD) smart glass category is anticipated to see the greatest CAGR of over 15.0% through 2030. These lenses can change from translucent to black in 1-3 seconds and provide fine and immediate light control. They also offer a remarkable optical quality that makes it easier to effectively manage sun glare.

Electronic gadgets frequently employ polymer dispersed liquid crystal (PDLC) glass, commonly referred to as switchable glass, magic glass, clever glass, or privacy glass. The technology is mostly utilised in businesses and residences to provide enough of light while maintaining privacy. It has applications in a number of fast-growing industries, including aviation, automobiles, ships, and architecture. The need for PDLC smart glass technology is being further fuelled by the rising predisposition toward "Green Energy" sources.

Application Insights

In 2025, the transportation application category held a sizable market share of around 49.6%. Aerial, vehicular, and maritime transportation are further subdivided into the transportation sector. The significant expansion in the automobile market can be attributed to luxury car manufacturers' increased use of smart glass. The market participants are being pushed by the increasing demand to broaden their product offerings in this niche in order to obtain a competitive advantage. For instance, the automotive giant BMW debuted its BMWi Vision Circular Show car in September 2021 at the IAA Auto Show. This vehicle was outfitted with a cutting-edge headlamp that was created utilizing the SPD LCG Technology created by Gauzy Ltd.

Commercial office buildings and corporate headquarters are where smart glass technology is most commonly used since it helps to significantly save expenses while increasing worker efficiency. In the approaching years, self-cleaning glasses, low-emissivity glasses, and solar control glasses are projected to emerge as popular options for the building industry. The expansion of the architectural sector is greatly influenced by the rising number of infrastructure projects, as well as restoration and renovation operations in residential and commercial areas.

Region Insights

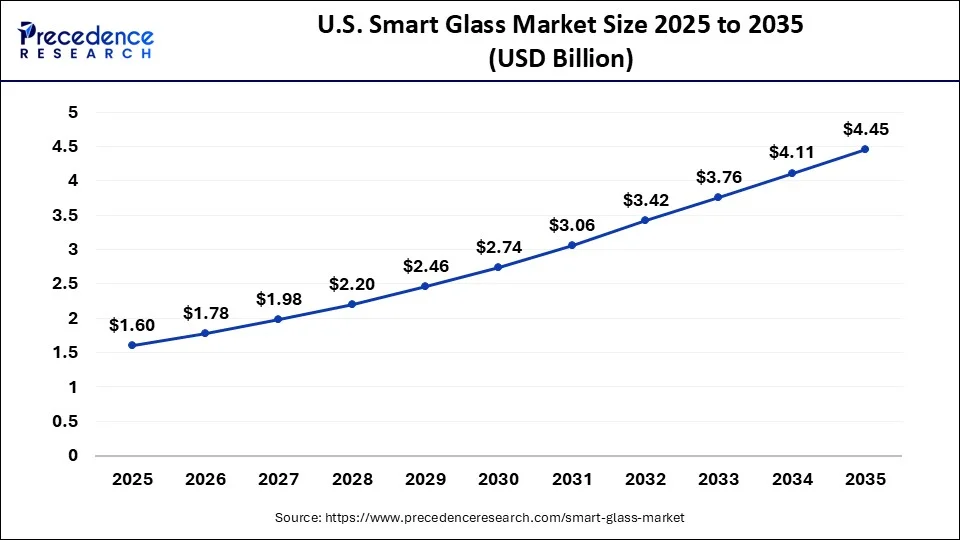

U.S. Smart Glass Market Size and Growth 2026 to 2035

The U.S. smart glass market size is exhibited at USD 1.60 billion in 2025 and is projected to be worth around USD 4.45 billion by 2035, growing at a CAGR of 10.77% from 2026 to 2035.

With a revenue share of more than 33.13%, North America dominated the global market for smart glass in 2024. This may be attributed to the availability of value-added goods like laminated glass as well as the implementation of energy-saving construction laws in the area. The area businesses are introducing items that meet customer demands.

The regional automotive industry is anticipated to see an increase in demand for smart glass due to the growing popularity of electric vehicles equipped with cutting-edge technology.

The U.S. smart glasses market is fueled by the rising use of augmented reality and virtual reality technologies. The need for hands-free wearable tech is increasing as both consumers and businesses adopt new uses in gaming, healthcare, and industry. Leading tech firms such as Google, Apple, and Microsoft are investing in smart glasses technology, leading to enhanced features and better user experiences. The nation's tech-savvy citizens are keen to adopt new devices that improve productivity and enjoyment, leading to an expanding customer base.

With industries and consumers placing greater emphasis on sustainable and innovative building materials, smart glass stands out as a crucial element, transforming the realm of architectural and glazing solutions in the nation, which is expected to drive the regional market during the projected timeframe. Apart from automotive uses, smart glass is being more commonly applied in transportation infrastructure. Smart glass in train stations and airports boosts passenger comfort, with shading choices and informational displays enhancing the travel experience.

Through 2034, Asia Pacific is expected to have the greatest CAGR of more than 12.4%,thanks to the region's exceptional development prospects in the transportation industry. Growing demand for luxury cars and rising disposable income are encouraging regional market growth. Additionally, it is predicted that increasing energy conservation awareness in the area would encourage the use of energy-efficient air conditioners and windows.

The Indian smart glass market has been emerging in recent years, indicating significant acceptance driven by the growth in energy-saving building options and heightened development of eco-friendly infrastructure. Top companies have adopted innovations in electrochromic and thermochromic technologies, broadening product uses. Cities such as Mumbai, Delhi, and Bengaluru lead the smart glass market in India. The prevalence of these areas arises from the dense presence of corporate headquarters, upscale housing developments, and high-end vehicles in city locales. Moreover, regulations encouraging energy conservation increase demand, as urban regions implement smart glass in commercial buildings to fulfill energy efficiency requirements.

- In April 2025, Meta Ray-Ban eyewear is set to officially debut in India shortly. These smart glasses powered by AI will allow users to engage in hands-free discussions with the voice assistant, enabling inquiries for instant answers, listening to music, retrieving information, and a variety of other hands-free activities.

What is Causing the Continued Growth of the Smart Glass Market in Europe?

Europe is currently one of the top-performing regions for the growth of smart glass, based on its strict environmental regulations and its strong mandate to reduce energy consumption by buildings. These buildings are seeing increased levels of renovation and have become the primary locations where smart glass will be installed to accommodate the increased demand for daylighting.

With automotive technology also advancing toward sustainability along with energy efficiency regulations providing support for the continued use of smart glass, the use of smart glass in both commercial & residential markets is also continuing to increase.

Germany Smart Glass Market Trends

Germany is Europe's leader for smart glass production usages in both energy-efficient buildings and premium automotive applications. Germany has a superior engineering expertise base, along with continued development and focus on sustainability & innovative uses of advanced materials that will support the use of smart glass in both the building & transportation industries.

How Middle East and Africa's Growing Smart Glass Market?

The Middle East and Africa region is seeing incremental growth in the market due to the increased number of luxury buildings and infrastructure projects. as a result of being in extreme climates, these areas have an increased need for solar control and energy efficiency. Over time, the establishment of smart cities, airports, and luxury commercial development will slowly positively affect the market.

The UAE Smart Glass Market Trends

The United Arab Emirates has emerged as a leader in smart glass production usage due to the growing establishment of its Smart Cities, iconic infrastructure, and Luxury Buildings. The UAE's focus on sustainability, innovative architecture, and high-quality construction projects will continue to further support its use of smart glass.

Rapid Urbanization Propels South America

South America is expected to grow significantly in the smart glass market during the forecast period, due to rapid urbanization. The expanding buildings, hospitals, and airports are also increasing the use of smart glass, where the growing sustainability trends and the demand for aesthetic smart glass are also increasing their use across various resorts and offices, which is promoting the market growth.

Brazil Smart Glass Market Trends

The expanding industries and infrastructure are increasing the demand for smart glass across Brazil. At the same time, the growing sustainability trends and focus on indoor comfort are also increasing its adoption rates. Furthermore, the growing vehicle production is also increasing its use, and the smart buildings are also increasing their utilization rates.

Value Chain Analysis of the Smart Glass Market

- Product Conceptualization and Design

The development of lightweight and aesthetic designs with advanced AI and AR components is involved in the product conceptualization and design of the smart glass.

Key players: Meta, Ray-Ban, Apple. - Raw Material Procurement

The raw material procurement for smart glass involves the sourcing of rare earth minerals, high-index optical polymers, and lithium-ion micro-batteries.

Key players: Corning Incorporated, TSMC, Luxottica. - Manufacturing and Assembly

The use of a high precision cleanroom environment and integrating micro electronics for the development of electrochromic and PDLC gazing units are involved in the manufacturing and assembly of smart glass.

Key players: Foxconn, Gauzy Ltd., Gentex Corporation. - Branding and Packaging

The branding and packaging of the smart glass include fashion-tech branding and the use of fibre-based and plastic-free materials.

Key players: Meta, Ray-Ban, Apple. - Retail Distribution (Online/Offline)

The integration of high traffic tech showcases and traditional optical channels ae involved in the retail distribution of the smart glass.

Key players: Meta, Ray-Ban, Apple. - Customer Support and Feedback Loop

The customer support and feedback loop for smart glass involves in-device AR troubleshooting and AI-powered remote diagnostics.

Key players: Apple, Vuzix, EssilorLuxottica. - End-of-Life Management

The end-of-life management for smart glass focuses on the circular economy and specialized e-waste recycling solutions.

Key players: Apple, Meta, Renewi.

Smart Glass Market Companies

- Corning Incorporated: The company provides raw materials and gorilla matte pro glass.

- Gauzy Ltd.: Polymer-dispersed liquid crystal and suspended particle devices are provided by the company.

- Gentex Corporation: The company developed various smart glasses for sunroofs and sun visors.

- Guardian Industries: Coated and high-performance float glass products are delivered by the company.

- Nippon Sheet Glass Co., Ltd.: The company offers a variety of architectural and automotive glasses.

Other Major Key Players

- AGC Inc.

- ChromoGenics

- Kinestral,Technologies, Inc.

- PPG Industries, Inc.

- RavenWindow

- Research Frontiers Inc.

- Saint-Gobain S.A.

- Showa Denko Materials Co., Ltd.

- Smartglass International Limited

- VELUX Group, View, Inc.

- Vision Systems

Recent Developments

- In January 2025, Gauzy Ltd. unveiled the latest smart glass technology at the Consumer Electronics Show (CES 2025) in Las Vegas. The company has created a suspended particle device (SPD), which gives the class a dark and neutral colored dim. The product is an improvement above the company's earlier work, transitioning quickly from clear to fully opaque and blocking more than 99% visible light. This glass also regulates temperature control and reduces energy consumption.

- In July 2024, eLstar Dynamics secured two million euros in Series A funding to advance the commercialization of its sustainable, energy-efficient adaptive glass solutions.

- In November 2024, Apple CEO announced the 'Atlas' study to collect employee feedback on smart glasses, focusing on advancing its AR/VR technology.

Segments Covered in the Report

By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Devices (SPD)

- Thermochromics

- Photochromic

- Others

By Application

- Architectural

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

By Control Mode

- Dimmers

- Switches

- Remote Control

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting