What is the Space-Based Network Market Size?

The global space-based network market size accounted for USD 10.41 billion in 2025 and is predicted to increase from USD 12.70 billion in 2026 to approximately USD 71.91 billion by 2035, expanding at a CAGR of 21.32% from 2026 to 2035. The market growth is attributed to rapid advancements in satellite technology and increasing global efforts to bridge connectivity gaps in underserved regions.

Space-Based Network Market Key Takeaways

- In terms of revenue, the space-based network market is valued at $10.41 billion in 2025.

- It is projected to reach $71.91 billion by 2035.

- The market is expected to grow at a CAGR of 21.32% from 2026 to 2035.

- North America dominated the space-based network market with the largest revenue share of 40% in 2025.

- Asia Pacific is expected to grow at the highest CAGR of 14.3% from 2026 to 2035.

- By orbit type, the low earth orbit segment held the major revenue share of 56% in 2025.

- By orbit type, the medium earth orbit segment is projected to grow at the fastest CAGR of 11.34% between 2026 and 2035.

- By component, the satellites segment contributed the biggest revenue share of 60% in 2025.

- By component, the ground stations segment is expected to expand at a significant CAGR of 12.3% during the forecast period from 2026 to 2035.

- By application, the broadband connectivity segment held the major revenue share of 46% in 2025.

- By application, the data communication segment is projected to expand at a significant CAGR of 11.93% over the projection period from 2026 to 2035.

- By end-use industry, the telecommunication segment led the global market with the largest revenue share of 41% in 2025.

- By end-user, the government and military segment is expected to grow at the fastest CAGR of 13.2% in the coming years from 2026 to 2035.

Market Overview

The rising demand for dependable, fast internet in many areas where land connections are not easily built is driving the growth of the space-based network market. Satellite networks make use of LEO, MEO, and GEO constellations to supply wide-area broadband and data communication services. Advanced technologies, including fast processors and advanced ground stations, are used by these networks to lessen latency. Space-based networks are vital, as the ITU reported in 2024 that over 2.6 billion world's population is still without internet access. NASA and ESA, along with other government groups, are also working on satellite design innovations to make networks more reliable and easier to use together.

Impact of Artificial Intelligence on the Space-Based Network Market

By advancing space-based networks, artificial intelligence (AI) enhances the way data, connections, and operations are handled. AI is included in satellite constellations to let companies handle bandwidth. This boosts the strength of links between satellites and guides traffic going through different nodes. Low latency is highly important when it comes to defense operations and remote sensing. Furthermore, by using AI, it becomes easier for operators to see any problems immediately and prevent issues that destroy or damage satellites.

Space-Based Network MarketGrowth Factors

- Rising Demand for IoT Connectivity: Expanding Internet of Things ecosystems are driving the need for pervasive satellite communication, boosting network expansion globally.

- Growing Adoption of 5G and 6G Technologies: Integration with next-generation mobile networks is propelling the demand for seamless satellite-terrestrial connectivity solutions.

- Increasing Investments in Space Infrastructure: Governments and private sectors are fueling satellite constellation deployments to enhance global broadband coverage.

- Advancements in AI and Onboard Processing: Improved satellite intelligence and data handling capabilities accelerate real-time communication and operational efficiency.

- Expanding Use of Satellite-Based Earth Observation: Growing applications in agriculture, disaster management, and environmental monitoring are supporting network growth.

- Rising Focus on Secure and Resilient Communications: Heightened cybersecurity concerns are driving innovation in encrypted and anti-jamming satellite networks.

- Boosting Cross-Border Regulatory Harmonization: International cooperation on spectrum allocation and standards is enabling smoother satellite network deployment worldwide.

Market Outlook

- Industry Growth Overview: The space-based networking industry is growing as more people want reliable communication backbones, defence-grade satellite networks, maritime connectivity, and remote industrial monitoring.

- Sustainable Trends: The development of green propulsion systems (environmentally friendly rocket engines), the usage of reusable launch vehicles, and the mitigation of "responsibly" produced orbital debris are emphasized by companies that manufacture satellites and provide launch services. Carbon-reducing ground stations and mission planning with "carbon-conscious" operations are changing the way that both commercial and government operators deploy their space-based networks.

- Global Expansion: Increased cross-border spectrum agreements (between countries) and increased use of multi-orbit satellite systems, as well as partnerships between telecommunication operators and aerospace companies, that are expected to continue to speed up the deployment of satellites internationally.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 71.91 Billion |

| Market Size in 2025 | USD 10.41 Billion |

| Market Size in 2026 | USD 12.70 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 21.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Orbit Type, Component, Application, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Does Rising Demand for Global Connectivity Drive the Growth of the Space-Based Network Market?

Increasing demand for global connectivity is expected to drive the market in the coming years. With the rising demand for internet access in remote areas, the need for space-based networking is rising. Since governments and businesses need strong, continuous communication in regions lacking infrastructure, space operators are launching satellites into LEO to satisfy this demand. ITU reports that around 32% of the people worldwide were not connected to the internet at the end of 2024, increasing the importance of orbital broadband expansion. The GSA reported in July 2024 that 62 companies in 45 countries were planning to use satellites, and 12 had already brought satellite service to the market. Satellite technology is being improved rapidly in areas including satellites connected to each other, in-orbit data processing, and dynamic network handling. Furthermore, this helps to make space an important basis for global digital transformation, thus further fuelling the market.(Source: https://gsacom.com),(Source:https://www.itu.int)

Restraint

Space Debris and Orbital Congestion Threaten Long-Term Reliability of Space Networks

The reliability of space-based networks is hampered due to space debris and orbital congestion. More satellites being launched into space worry experts about collisions that lead to debris harm. Space traffic control continues to develop with limited options for ensuring space vehicles are managed and safely removed from space. The lack of certainty makes people put off investments, which slows the building of large, thick satellite clusters. Furthermore, the initial costs associated with launching and maintaining satellites are substantial, hampering the growth of the market.

Opportunity

How are Satellite Miniaturization and Onboard AI Processing Transforming Space-Based Network Performance?

Spurring technological advancements in satellite miniaturization and onboard processing are likely to create favorable opportunities for the players competing in the market. Advances in making satellites and processors smaller, along with onboard calculation, raise network performance and make launches more economical. Being able to deal with data onboard means that the spacecraft no longer depends much on ground stations. This allows faster decision-making and data management at the edge of the network.

- In August 2024, ESA sent the Φsat-2 satellite powered by a multispectral camera and AI into space. In orbit, these satellite draws images of street maps and pick out anomalies in the sea, which cuts down on the amount of data sent to Earth, making it efficient. Furthermore, this capability of advanced satellite technology makes it easier to develop new space network technology, thus further driving the market in the coming years.(Source: https://www.esa.int)

Segment Insights

By Orbit Type Analysis

Why Did the LEO Segment Dominate the Space-Based Network Market in 2025?

The low earth orbit (LEO) segment dominated the space-based network market with the major share in 2025 due to their faster response time and lower installation cost than other orbits. Since a high-speed network is required for sharing videos and messages, these satellites are made to orbit at an altitude of approximately 500 to 2,000 km. SpaceX's Starlink and OneWeb added many satellites in LEO to improve coverage and help close the digital gap in rural places. Moreover, LEO networks are able to adjust their structure as user preferences and new technology change, thus further fueling their demand.

The medium earth orbit segment is projected to grow at the fastest CAGR, owing to their mix of wide coverage and quick signal delay. MEO satellites cover a larger area, as they float at altitudes of 8,000 to 20,000 kilometers above Earth. These platforms match demands for navigation, communication with businesses, and apps using hybrid satellite and ground stations. The European Space Agency (ESA) and new private companies help speed up MEO use by including advanced technology on their satellites to connect them with each other. Furthermore, UNOOSA has pointed out that fewer satellites in MEO systems lessen the risks of crowding, further driving the utilization of these types of satellites.

By Component Analysis

Why Did the Satellite Segment Lead the Space-Based Network Market in 2025?

The satellite segment held the largest share of the space-based network market in 2025 as they support global communication, navigation, and data transfers. Many space companies put thousands of satellites into orbit at LEO, MEO, and GEO to ensure the widespread availability of high-speed internet for remote parts of the globe. Since propulsion systems, onboard processing, and satellite miniaturization have advanced, satellites can now handle more data faster and with less delay.

The FCC handed out a large number of satellite licenses in 2024, aided by simple regulations that supported the use of satellites. Satellite manufacturers focused on making designs more effective, thereby keeping costs low for everyone to access. Advancements in AI help with onboard satellite systems, making network management more independent. Furthermore, the ISRO and JAXA increased the number of their satellite launches to improve connectivity throughout the world, thus further propelling the segment.

(Source:https://www.nasa.gov)

(Source: https://docs.fcc.gov)

The ground stations segment is expected to expand at a significant CAGR during the forecast period, owing to their key role in supporting the operation, data handling, and network overview of satellites. Improvements in antennas, software for networks, and automation allow ground stations to work better and in more flexible ways. Moreover, the enhanced capability of ground station arrays to successfully transfer big volumes of data boosts the segment in the coming years.

By Application Analysis

Why Is Broadband Connectivity Leading the Space-Based Network Market in 2025?

The broadband connectivity segment dominated the space-based network market in 2025. This is mainly due to the increased need for faster internet in urban, rural, and remote parts of the world. To meet the needs of the faster internet, mobile broadbands are gaining popularity. Better satellite throughput and lower latency made using streaming, gaming, and working from home more enjoyable. Due to the efforts of the FCC and ITU, processes for assigning spectrum and gaining regulatory approval were made faster, encouraging the growth of broadband satellites. Furthermore, the rapid growth of global networks shows that broadband is leading the field of space-based network market.

The data communication segment is projected to expand at a significant CAGR over the projection period, driven by higher demand for secure, stable, and effective links within the services sector. Industries such as maritime, aviation, defense, and energy, which often face poor or unsafe land-based connections, heavily rely on satellite networks for their critical data needs. Data is kept safer and transferred more efficiently due to stronger encryption and onboard computing. Additionally, the adoption of terminals and networking solutions by leading vendors is increasing due to a rising need for complex data communication.

By End-use Industry Analysis

Why Did Telecom Lead the Space-Based Network Market in 2025?

The telecommunication segment held the largest share of the space-based network market in 2025, due to the heightened need for international connectivity and sending data. Many telecommunications companies are expanding their satellite networks in LEO to fill coverage gaps for people living in urban, rural, and remote areas. Improvements in bandwidth and loss of latency provide a better experience for users with voice, video, and internet services. The telecommunication industry heavily uses space-based networks for global coverage, to reach remote areas, and for high-bandwidth applications.

SpaceX's Starlink and OneWeb were able to offer broadband services all over the world. Additionally, coordination with groups such as the Global Mobile Suppliers Association (GSA) and the European Space Agency (ESA) improved standards and boosted services' quality and dependability. In 2024, 3GPP released standards for non-terrestrial networks, facilitating better integration of satellite networks with today's 5G and future 6G systems.

(Source: https://www.3gpp.org)

The government & military segment is expected to grow at the fastest rate in the coming years. These organizations are heavily investing in space-based communication. Governments depend on satellite systems for better national security, enabling surveillance, reconnaissance, transfer of secure data, and leading command-and-control tasks.

Military organizations are stepping up efforts to create encrypted satellite communication platforms that defend themselves against hackers and interference. In 2024, teamwork by UNOOSA and agencies such as ISRO and JAXA, along with other nations, led to the development of safe and shared government satellite systems. Furthermore, the growing geopolitical situation necessitates the government and military organizations to adopt advanced space-based network technologies for better communications. (Source:https://www.isro.gov.in)

Regional Insights

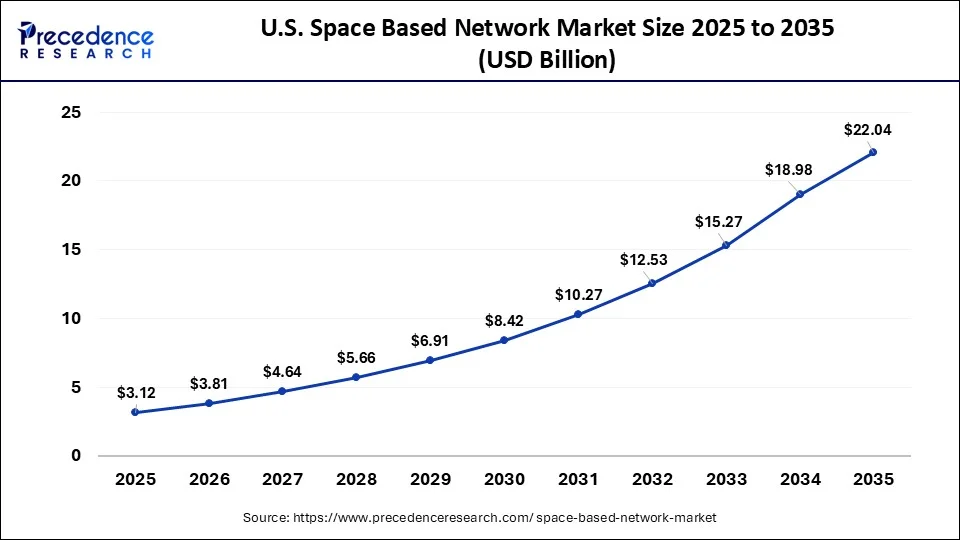

What is the How Big is the U.S. Space-Based Network Market Size?

The U.S. space-based network market size was exhibited at USD 3.12 billion in 2025 and is projected to be worth around USD 22.04 billion by 2035, growing at a CAGR of 21.59% from 2026 to 2035.

Why Did North America Lead the Space-Based Network Market in 2025?

North America led the space-based network market, capturing the largest share in 2025. This is mainly due to its high investments in launching and operating satellites. In this region, SpaceX, OneWeb, and Blue Origin are leading satellite operators, focusing on building huge Low Earth Orbit and Medium Earth Orbit constellations. This expands access to data and connectivity services across the region. Between 2023 and 2024, the Federal Communications Commission (FCC) made initiatives to manage and issue spectrum licenses, which promoted faster creation of satellite networks.

Satellite engineers progressed faster in miniaturizing satellites, handling operations aboard, and making communication systems more secure. North America is pioneering satellite networks with ground-based 5G and 6G. In 2024, the Space Development Agency (SDA) created new multi-orbit satellite plans that boost the network in this region. Furthermore, the widespread use of network-based satellite technology further facilitates the market in this region. (Source:https://docs.fcc.gov)

(Source: https://www.sda.mil)

Why Is Asia Pacific the Fastest-Growing Region in the Space-Based Network Market?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to greater government spending, more commercial space efforts, and more users of broadband in developing economies. The China National Space Administration (CNSA), the Indian Space Research Organisation (ISRO), the Japan Aerospace Exploration Agency (JAXA), and Australia's Space Agency have placed a strong emphasis on rapidly improving satellite capabilities in China, India, Japan, and Australia. The purpose is to include more satellites over each country to serve rural and remote regions, secure the country, assist with emergencies and improve digital access. Cross-border satellite use and collaboration over the spectrum are now possible due to updates in regulations and teamwork organizations, such as UNOOSA management. Moreover, the Asia Pacific is leading the way in satellite building and launching, boosting regional market growth.

Modernization of Defence and Integration of Synchronized Satellites in Europe

Europe's market for a network-based in space is being built with secure government communications systems, satellite-supported broadband services, and modernization efforts for regional defence. Due to advancements in security and encryption technologies, both telecom providers and aerospace manufacturers are working together on projects to provide higher levels of data encryption.

European aerospace agencies and associated regulatory groups are working to align regulations so that coordinated management of satellite orbits and the allocation of satellite spectrum can be achieved.

Germany Space-Based Network Market Trends

Germany is emerging as a major driver for growth in the region as a result of its substantial capacity to manufacture aerospace products as well as upgrades to its defence communications capabilities. The focus on using dual-purpose satellites is expected to provide commercial and military networks with a greater degree of integration.

Satellite Infrastructure Creates Bridges Between Connectivity Gaps within Latin America

Space-based networks are providing countries in Latin America with a way of overcoming barriers created by geography and providing broadband access to areas in rural and rainforest regions. Governments in the region have made e-learning, telemedicine, and emergency or disaster recovery communications systems a priority and are utilising satellite technology in the construction and implementation of these systems.

Brazil is distinguished within the region as a result of having established national satellite programs and utilising satellite technology to support growing applications associated with agricultural monitoring through agri-tech. The growth in public-private partnerships within Brazil has accelerated the deployment of high-capacity satellites.

Middle East & Africa (MEA): Strategic Satellite Investments for Digital Inclusion

Strategic satellite investments aplenty by Middle East and Africa (MEA) governments to increase national security, facilitate communications for oil and gas, and enhance cross-border digital trade corridors are prevalent throughout this region. With a relatively high demand for reliable connectivity in remote desert and offshore locations, growing interest is being experienced in satellite connections.

Countries with the highest growth rates in relation to the majority of regional countries include Saudi Arabia, where rapid progression is evidenced in the area of strategic space investments and smart/city communications projects.Furthermore, Saudi Arabia's comprehensive program of diversified digital economy initiatives will further strengthen satellite-enabled networking capabilities across the region.

Space-Based Network Market Companies

- Viasat, Inc.

- Telesat

- Swarm Technologies, Inc.

- Starlink

- ST Engineering iDirect, Inc.

- SES SA.

- OneWeb

- L3Harris Technologies, Inc.

- Intelsat

- Hughes Network Systems

- Gilat Satellite Networks

- Eutelsat Communications SA

- BridgeComm, Inc.

- AST SapceMobile

- Amazon

- Airbus SAS

Recent Developments

- In May 2025, China has initiated the first phase of its ambitious Three-Body Computing Constellation by successfully launching 12 advanced satellites equipped with AI-enabled, high-speed computing systems into orbit. The launch, conducted via a Long March 2D rocket from the Jiuquan Satellite Launch Centre, aims to establish the world's first space-based supercomputing network, according to Guangming Daily. Led by Zhejiang Lab, the constellation is designed to deliver real-time, in-orbit data processing at a groundbreaking rate of 1,000 peta operations per second (POPS), positioning China to surpass terrestrial supercomputing systems in both speed and global data accessibility.

(Source: https://www.business-standard.com) - In May 2025, Starlink received regulatory approval from the Department of Telecommunications (DoT) for satellite communication services and is now seeking expedited clearance from IN-SPACe to begin operations. Competitors such as Eutelsat OneWeb and Jio Satellite Communications previously secured their Global Mobile Personal Communication by Satellite (GMPCS) licenses in 2021 and 2022, respectively, but only obtained IN-SPACe approval by November 2023 and June 2024. Starlink's regulatory progress is expected to intensify the race for satellite-based internet services in one of the world's largest untapped connectivity markets.

(Source:https://www.business-standard.com) - In November 2024, AST SpaceMobile has signed new launch service agreements to support the deployment of its Block 2 satellite constellation, intended to provide direct-to-device space-based cellular broadband. The company targets high-demand markets including the United States, Europe, Japan, and U.S. government agencies, aiming to cover underserved and rural areas globally. Launches are scheduled between 2025 and 2026, using existing vehicles and Blue Origin's New Glenn rocket, with up to 60 satellites being placed in Low Earth Orbit (LEO) from Cape Canaveral Space Force Station.

(Source: https://www.businesswire.com) - In April 2025, United Launch Alliance (ULA) confirmed the successful launch and deployment of 27 satellites under its KA-01 mission for Amazon's Project Kuiper. Launched aboard an Atlas V rocket from Cape Canaveral Space Force Station on April 28, 2024, all satellites are now operational with activation sequences proceeding nominally. This milestone marks a key step in Amazon's mission to deliver low-latency, high-speed internet globally through its LEO satellite network, further intensifying competition in the satellite broadband ecosystem.

(Source: https://www.aboutamazon.in)

Segments Covered in the Report

By Orbit Type

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Orbit (GEO)

- Highly Elliptical Orbit (HEO)

By Component

- Satellites

- Ground Stations

- Transponders

- Antennas

- Routers & Switches

- Launch Vehicles

- Network Operations Centers (NOCs)

By Application

- Broadband Connectivity

- Data Communication

- Earth Observation

- Remote Sensing

- Navigation & GPS

- Broadcasting

- Surveillance & Reconnaissance

- Disaster Management

By End-Use Industry

- Telecommunication

- Government & Military

- Commercial Enterprises

- Aviation

- Maritime

- Oil & Gas

- Transportation & Logistics

- Media & Entertainment

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting