2D Barcode Reader Market Size and Forecast 2025 to 2034

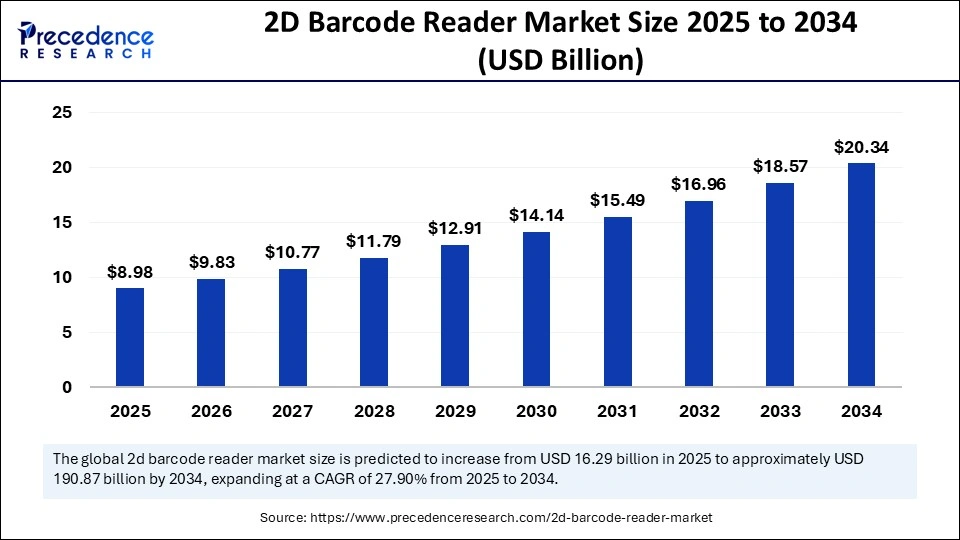

The global 2D barcode reader market size was estimated at USD 8.20 billion in 2024 and is predicted to increase from USD 8.98 billion in 2025 to approximately USD 20.34 billion by 2034, expanding at a CAGR of 9.51% from 2025 to 2034. The growth of the market is attributed to increasing demand for efficient inventory management and real-time data tracking solutions across various industries.

2D Barcode Reader Market Key Takeaways

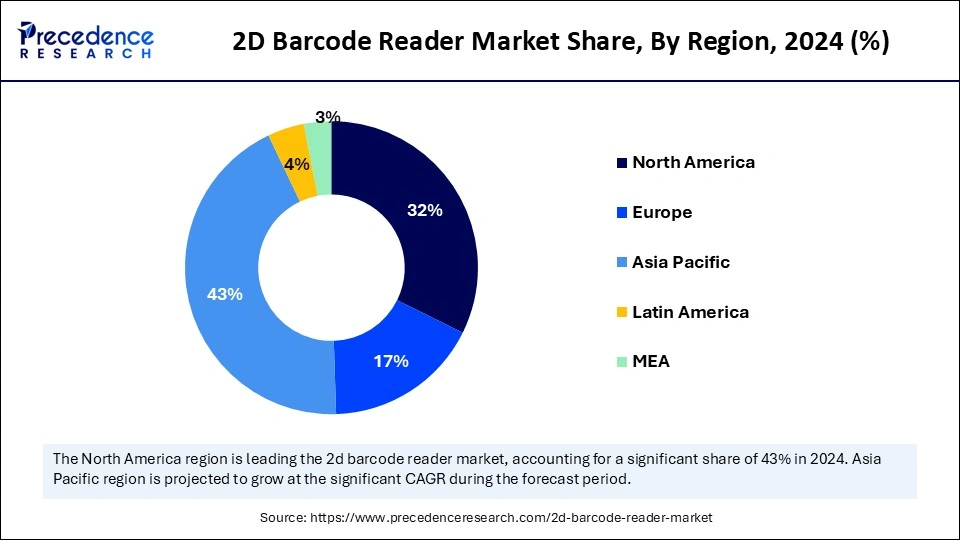

- Asia Pacific dominated the market with the largest share of 43% in 2024.

- Europe is expected to grow at a CAGR of 6% during the forecast period.

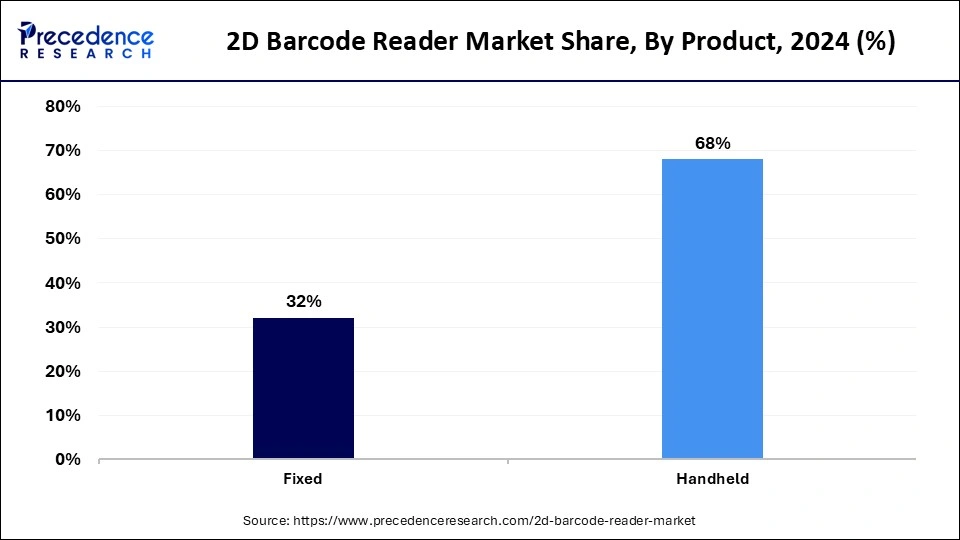

- By product, the handheld segment held the biggest market share of 68% in 2024.

- By product, the fixed segment is expected to grow at the fastest rate between 2025 and 2034.

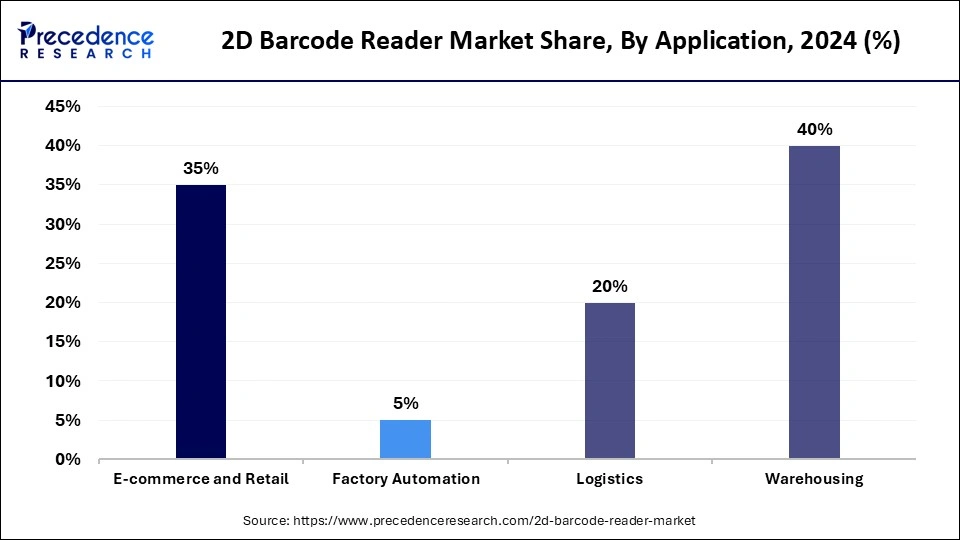

- By application, the warehousing segment accounted for the major market share of 40% in 2024.

- By application, the e-commerce and retail segment is projected to expand at a significant CAGR in the coming years.

Impact of Artificial Intelligence on the 2D Barcode Reader Market

Artificial intelligence (AI) algorithms enhance the speed and accuracy of 2D barcode readers. AI algorithms can improve barcode recognition accuracy, leading to more reliable data capture. This further provides on-the-spot barcode reading capabilities for badly printed, low contrast, and damaged barcodes. Moreover, the AI system allows 2D barcode readers to connect with automated systems to deliver automatic inventory tracking. AI-driven 2D barcode readers can analyze data in real-time, providing valuable insights into supply chain performance.

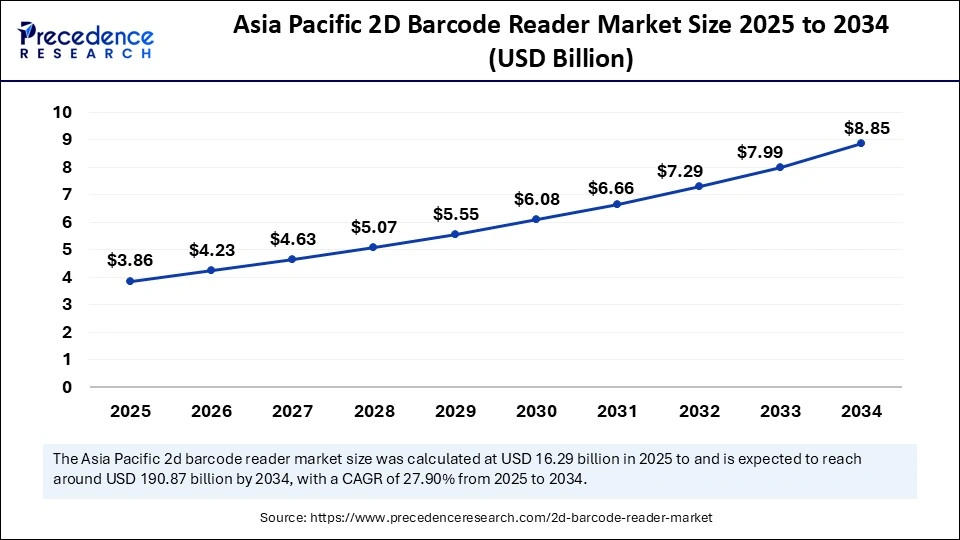

Asia Pacific 2D Barcode Reader Market Size and Growth 2025 to 2034

The Asia Pacific 2D barcode reader market size was evaluated at USD 3.53 billion in 2024 and is projected to be worth around USD 8.85 billion by 2034, growing at a CAGR of 9.62% from 2025 to 2034.

Asia Pacific dominated the 2D barcode reader market by capturing the largest share in 2024. This is mainly due to the rapid expansion of the e-commerce, logistics, and manufacturing industries, especially in emerging countries like India and China. There is a heightened adoption of barcode scanning technologies due to the growing concerns about supply chain visibility. With a strong emphasis on industrial automation, the adoption of 2D barcode readers has increased in industries like warehousing and logistics.

North America was the second-largest shareholder in 2024 and is expected to witness steady growth during the forecast period. The growth of the market in North America can be attributed to the rising automation in logistics and retail sectors, boosting the adoption of 2D barcode readers. The region boasts a well-established e-commerce industry, with a large number of online retailers operating. The rising online shopping and e-commerce sales are likely to support regional market growth.

The 2D barcode reader market in Europe is anticipated to grow at a significant rate during the forecast period. This is mainly due to the rising industrial automation and digitalization. There is a strong emphasis on supply chain optimization, which significantly boosts the adoption of 2D barcode readers. In addition, the growing e-commerce sector and the rising adoption of digital technologies in retail, logistics, and manufacturing operations contribute to market growth.

Market Overview

The 2D barcode reader market is witnessing rapid growth due to the increasing need for efficient inventory management and data-tracking solutions from industries like e-commerce and logistics. 2D barcode readers contribute significantly to enhancing operational efficiency. These barcodes assist industries, such as retail and manufacturing, with their objective of automation. The rising e-commerce activities worldwide further contribute to market growth. The Census Bureau of the Department of Commerce announced that the estimate of U.S. retail e-commerce sales for the fourth quarter of 2024 was USD 308.9 billion, an increase of 2.7% from the third quarter of 2024. Furthermore, the rising trend of online shopping is expected to boost the market's growth in the coming years.

2D Barcode Reader Market Growth Factors

- Advancements in Automation: The adoption of automated systems in industries such as manufacturing and logistics is anticipated to increase the use of 2D barcode readers for faster, more accurate data capture.

- Expanding Warehousing Capabilities: The growing need for optimized warehouse management systems is likely to accelerate the deployment of 2D barcode readers to enhance operational efficiency.

- Rising Demand for Real-Time Data Tracking: Increased reliance on real-time data for supply chain management is projected to boost the adoption of 2D barcode readers across various sectors.

- Integration of IoT in Supply Chains: The expansion of internet of things IoT technologies in logistics and retail operations is expected to create greater demand for 2D barcode readers to facilitate seamless data exchange.

- Growth of Industry 4.0: The ongoing shift toward smart manufacturing and connected devices is anticipated to spur the need for advanced barcode scanning systems.

- Enhancing Customer Experience: The push for better consumer experience in retail is likely to boost the use of 2D barcode readers in point-of-sale systems.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 20.34 Billion |

| Market Size in 2025 | USD 8.98 Billion |

| Market Size in 2024 | USD 8.20 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.51% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Expansion of the E-Commerce Industry

The rapid expansion of the e-commerce industry across emerging and developed economies is driving the growth of the 2D barcode reader market. Along with this, the trend of online shopping is rising. The fast-sorting operation of online retailers depends on accurate tracking identification through 2D barcode readers. They efficiently read shipping labels and product packaging. The uninterrupted handling process in logistics operations depends on their ability to decode both QR codes and interpret complex codes. These readers enable warehouses along with distribution centers to optimize their workflow and reduce errors for efficient delivery schedule compliance. The U.S. e-commerce industry generated USD 1,192.6 billion in sales in 2024, an increase of 8.1% from 2023.

Increasing Demand for Automated Data Capture

The increasing demand for automated data capture solutions is anticipated to drive the growth of the market. There is a high need for automated data collection technologies among different industries, which significantly boosts the widespread use of 2D barcode readers. These technologies deliver operational advantages by removing manual human errors and supporting operation automation. The global supply chain and retail industries are shifting toward 2D barcodes. The GS1 organization began Sunrise 2027 as a worldwide initiative, which aimed to introduce modern 2D barcodes with expanded supply chain data formats. By the end of 2027, retailers need to ensure their POS systems are equipped with scanners capable of reading both traditional barcodes and 2D barcodes. Additionally, advancements in barcode readers, which serve both time-sensitive operations and regulatory requirements, fuel the growth of the market.

Restraint

High Initial Costs

Implementing a 2D barcode reader system requires substantial investments in hardware and software, which hinders the growth of the 2D barcode reader market. This creates barriers for small enterprises to update their outdated systems. The overall ownership expenses are high due to requirements of hardware compatibility and software amalgamation. Furthermore, implementing 2D barcode readers with existing systems creates complexities and requires expertise, limiting the growth of the market.

Opportunity

Rising Adoption of Industry 4.0

The rising acceptance of industry 4.0 creates immense opportunities in the 2D barcode reader market. Industry 4.0 involves a range of technologies that support digital transformation and drive innovations in manufacturing and industrial processes. The growing investment in smart manufacturing technologies is projected to create immense opportunities for players competing in the market. 2D barcode readers play a key role in smart manufacturing, as they help to maintain connectivity between physical assets while offering real-time data about production lines. 2D barcode readers are used to monitor materials and other manufacturing assets. They enhance operational flow while cutting down maintenance periods and operational inefficiencies, making them essential for manufacturing system smartification.

Product Insights

The handheld segment dominated the 2D barcode reader market with the largest share in 2024. The dominance of the segment is mainly attributed to the increased adoption of handheld 2D barcode readers across multiple industries due to their versatility and ease of use. The handheld format proves beneficial in rapidly changing sites, including retail facilities, warehouses, and logistics centers. These devices offer high portability for inventory management and order fulfillment operations. Handheld 2D barcode devices have gained widespread acceptance because of upgraded battery systems and scanning solutions for flexibility in all operational contexts.

The fixed segment is expected to grow at the fastest rate in the upcoming period. The segment growth can be attributed to the increasing adoption of fixed 2D barcode readers in large-scale manufacturing sites. These readers deliver automated high-speed scanning procedures while eliminating manual errors. These readers can seamlessly integrate into automated systems. Moreover, the rising emphasis on industrial automation is expected to boost the demand for fixed barcode readers in the coming years.

Application Insights

The warehousing segment held the largest share of the 2D barcode reader market in 2024. This is mainly due to the essential role of 2D barcode readers in assisting businesses with inventory management and supply chain functions. These readers play a key role in streamlining order fulfillment and inventory management, further enhancing supply chain operations. Furthermore, 2D barcode readers implemented in warehousing operations drive operational efficiency while boosting accuracy rates.

The e-commerce & retail segment is projected to expand at a significant rate in the coming years. This is mainly due to the rising e-commerce and retail operations worldwide. Faster inventory management with precise order fulfilment processes has increased as a result of the online shopping boom. This creates demand for 2D barcode readers, which help maintain seamless product tracking until delivery points.

2D Barcode Reader Market Companies

- Zebra Technologies Corp.

- Zebex Industries Inc.

- Wasp Barcode Technologies

- Unitech Electronics Co., Ltd.

- SICK AG

- Scandit

- Sato Holdings Corp.

- Omron Microscan Systems, Inc.

- Marson Technology Co., Ltd.

- Keyence Corp.

- Juniper Systems Inc.

- JADAK - A Novanta Company

- Honeywell International, Inc.

- General Data Company, Inc.

- Denso Wave Inc.

- Datalogic S.p.A.

- Cognex Corp.

- Casio Computer Co., Ltd.

Recent Developments

- In February 2025, Newland AIDC, a global leader in data capture innovation, expanded its product offerings in Indonesia's various industries and manufacturing sectors by launching AI-powered barcode scanners, wearables, barcode printers, and scanner guns. The NVH220 AI Barcode Scanner is suitable for various industries requiring powerful scanning machines, such as manufacturing, logistics, and warehousing. It is available in both wired and wireless options.

- In October 2023, Cognex Corporation introduced the DataMan 380 series of fixed-mount, image-based barcode readers. The DataMan 380 features a CMOS sensor with up to 5320 x 3032 resolution (16.13 MPixel) and shutter speeds ranging from 15 μs (minimum exposure) to 200 ms (maximum exposure). Equipped with C-mount high-speed liquid lenses, the reader offers one opto-isolated acquisition trigger input and up to three general-purpose inputs when connected to the Breakout cable. Designed for machine vision applications in logistics and manufacturing, these readers feature AI-accelerated decoding to process both 1D and 2D codes, enhancing throughput during robotic pick-and-place tasks, pallet scanning, and tire barcode reading.

- In February 2024, Azenta Life Sciences unveiled the Ziath Handheld 2 tube reader, a portable device designed for efficient and accurate reading of 2D barcoded sample tubes. The Handheld 2 enables users to operate it with one hand while leaving the other free for tube handling. Pre-loaded software ensures instant startup, allowing users to read tube codes, edit tube contents, and check off items from preloaded "pick lists" when retrieving tubes from freezers. The device's large icons on the screen facilitate easy method selection, even when wearing protective gloves.

Segments Covered in the Report

By Product

- Fixed

- Handheld

By Application

- E-commerce & Retail

- Factory Automation

- Logistics

- Warehousing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting