Aerospace Coating Market Size and Forecast 2025 to 2034

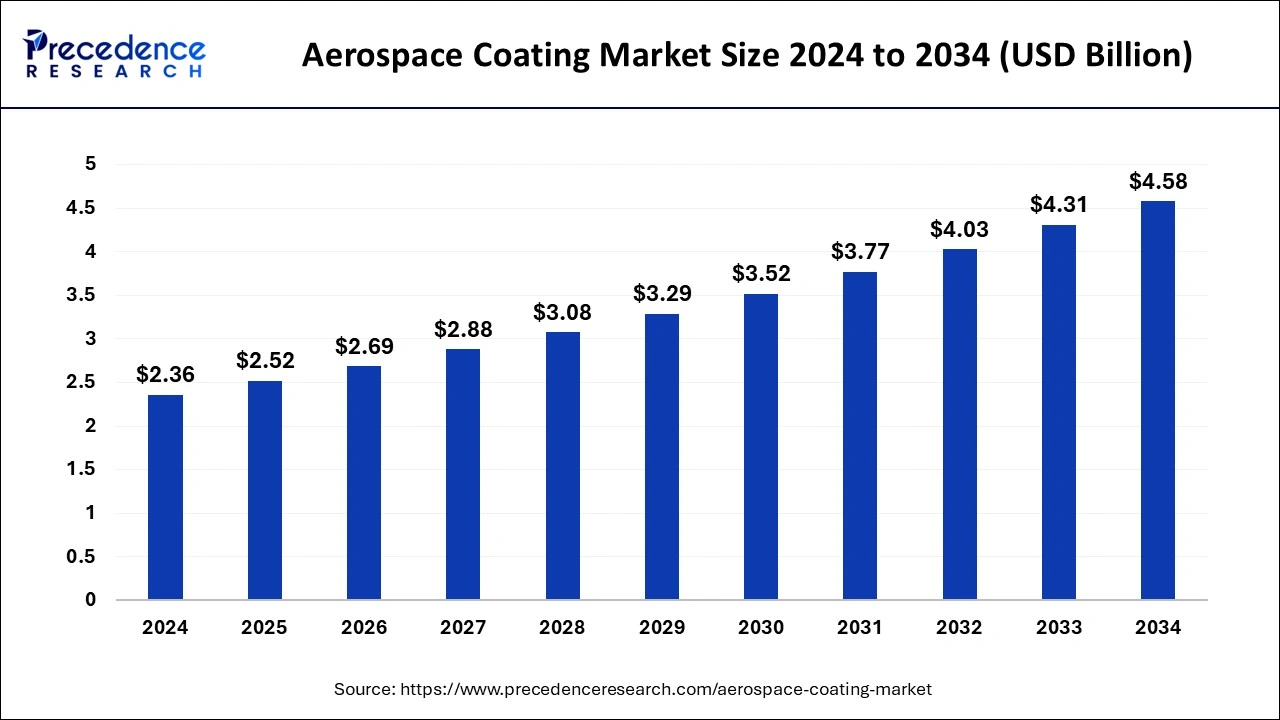

The global aerospace coating market size was estimated at USD 2.36 billion in 2024 and is predicted to increase from USD 2.52 billion in 2025 to approximately USD 4.58 billion by 2034, expanding at a CAGR of 6.86% from 2025 to 2034. Airline mergers are of significant interest to aerospace coatings manufacturers, which is expected to fuel the market's growth during the forecast period.

Aerospace Coating Market Key Takeaways

- The global aerospace coating Market market was valued at USD 2.36 billion in 2024.

- It is projected to reach USD 4.58 billion by 2034.

- The market is expected to grow at a CAGR of 6.86% from 2025 to 2034.

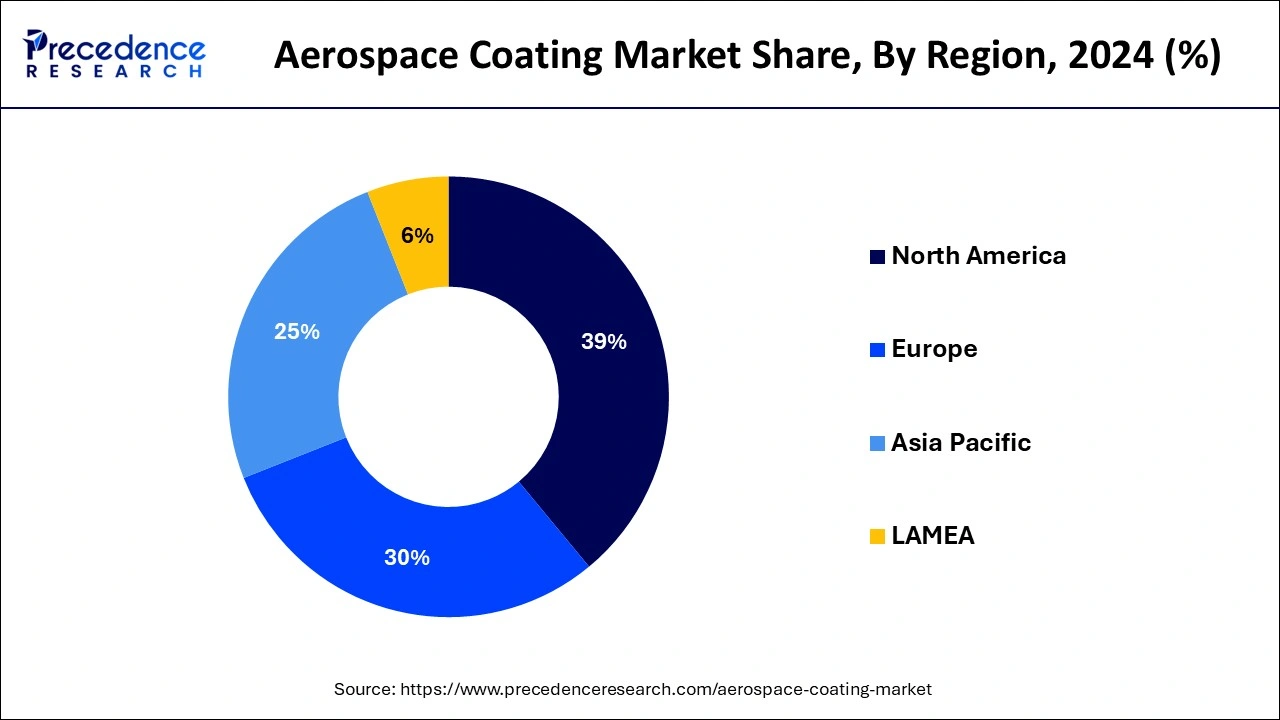

- North America dominated the global market with the largest market share of 39% in 2024.

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By resin, the polyurethane resins segment dominated the market in 2024.

- By resin, the epoxy resin segment is predicted to experience the fastest growth over the forecast period.

- By product, the solvent-based coating segment dominated the market in 2024.

- By product, the powder coating segment is anticipated to experience the highest growth during the projected period.

- By end use, in 2023, the commercial segment dominated the market globally.

- By end use, the military segment is ready to witness significant growth during the forecast period.

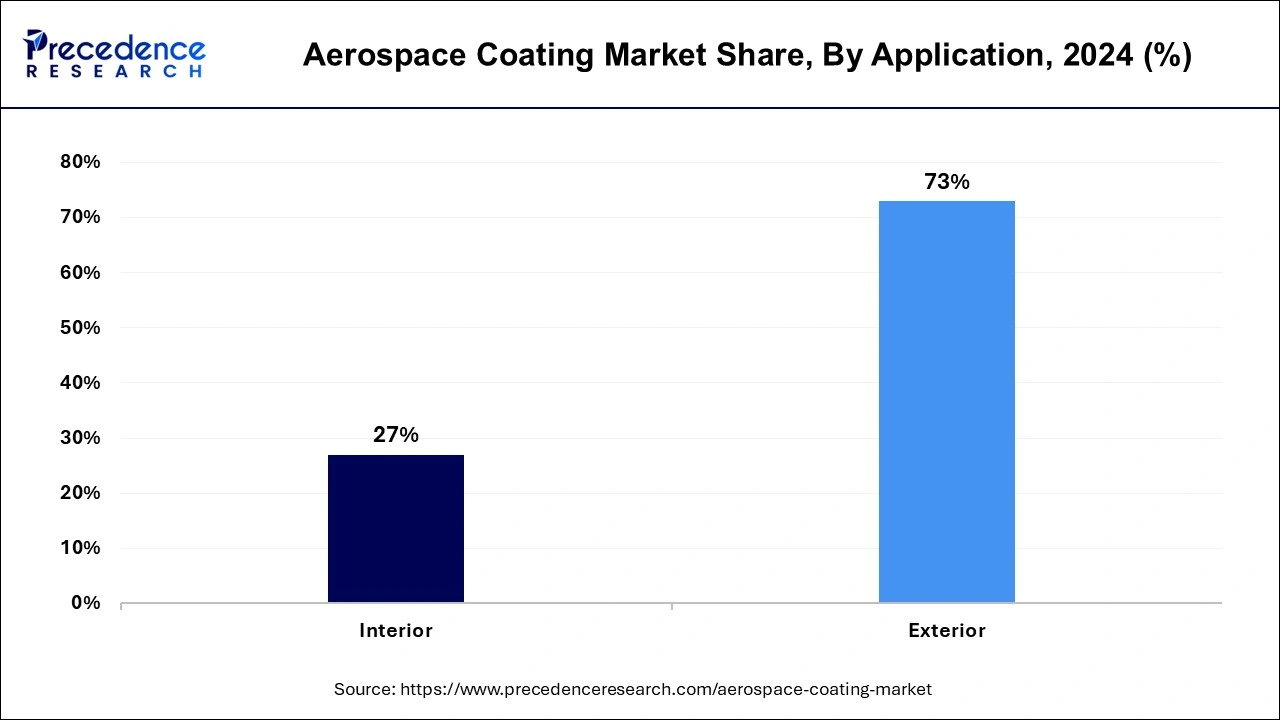

- By application, the exterior coatings segment has held the largest market share of 73% in 2024.

- By application, the interior segment is the fastest growing during the studied period.

U.S.Aerospace Coating Market Size and Growth 2025 to 2034

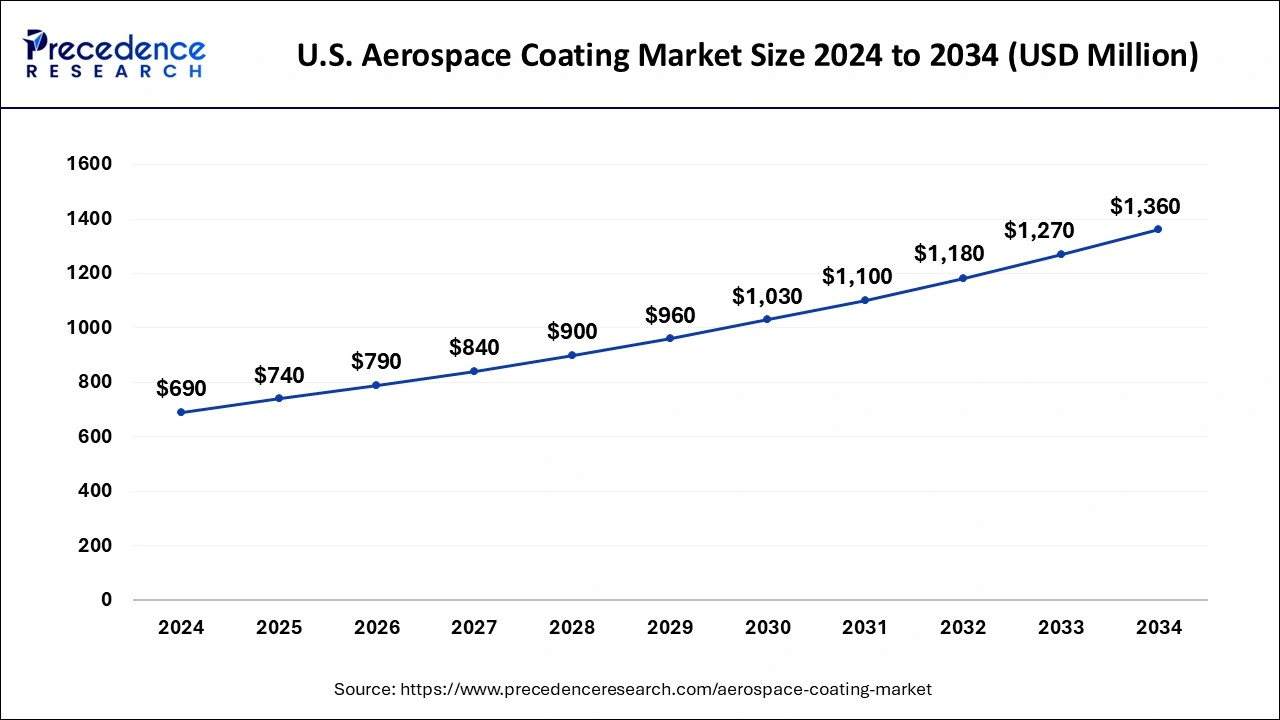

The U.S. aerospace coating market size was estimated at USD 690 million in 2024 and is predicted to surpass around USD 1,360 million by 2034 with a notable CAGR of 7.02% from 2025 to 2034.

North America dominated the aerospace coating market in 2024. The expanding commercial aviation sector in countries like the United States and Canada is driving an increase in the use of aerospace coatings in this region. The United States, with its sizable aviation market and one of the largest fleets globally, stands out as a significant consumer. Government backing further supports the rising demand for aerospace coatings in North America. Furthermore, the growth of the aviation industry in this region is fueling market expansion. Products like polyurethane aerospace coatings, which have lower VOC content and may contain hydroxyapatite (HAp), are preferred here due to stringent regulatory standards imposed by government agencies.

Asia Pacific is expected to grow at the fastest rate during the forecast period. The Asia Pacific aerospace coating market is anticipated to experience significant growth over the forecast period. This can be attributed to the rapid pace of industrialization and urban development, which has led to an increase in air travel and the demand for aerospace coatings. Specifically, the Chinese and Indian aerospace coating markets are projected to witness significant expansion within the region.

- In December 2023, DuPont announced that Coryor Surface Treatment Company Ltd. and Nippon Paint Taiwan have introduced a series of new offerings, including printed Tedlar PVF solutions and PVF coating in the Taipei Building Show, the largest building materials exhibition in Taiwan.

Market Overview

Aircraft endure significant environmental strain, leading to metal surface deterioration, and need frequent maintenance and repair. Aerospace coatings provide robust protection against corrosion from solar radiation, fog, and other adverse weather elements. Moreover, they contribute to weight reduction in aircraft, thereby lowering CO2 emissions. The burgeoning aviation sector in emerging markets like China and India is driving the demand for the aerospace coating market as the number of aircraft increases.

To align with environmental regulations, manufacturers are focusing on developing primer coatings with reduced volatile organic compound (VOC) emissions. These coatings are essential for safeguarding and minimizing in-flight wing drag and aircraft exteriors, enhancing durability, preventing surface icing, and facilitating waste removal through vacuum-suction systems.

Aerospace Coating Market Growth Factors

- Growth in the aerospace industry can drive the demand for the aerospace coating market in upcoming years.

- Increasing military expenditure on new military aircraft development can boost the growth of the market.

- Technological advancements and innovations in coating technology, such as eco-friendly coatings, can fuel the aerospace coating market's growth during the forecast period.

- Tight government regulations on the aerospace industry's use of eco-friendly coatings are propelling the growth of the aerospace coating market.

- Rising demand for fuel-efficient aircraft can create demand for aerospace coating shortly.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.86% |

| Market Size in 2025 | USD 2.52 Billion |

| Market Size by 2034 | USD 4.58 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Resin, By Product, By End-user, By Industry Category, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The growing air passenger traffic

The aerospace coating market is experiencing notable growth, attributed largely to the increasing number of air passengers worldwide. This surge in air travel has led to a growing demand for commercial aircraft, prompting an upsurge in commercial aircraft production. The expansion of the aircraft manufacturing sector has a direct correlation with the significant growth of the market. Emerging economies, in particular, present substantial opportunities for aerospace coatings, given the rising aircraft sales and production in these regions.

The global aircraft fleet has expanded considerably, fueled by heightened deliveries from prominent manufacturers, which can further drive the growth of the aerospace coating market. Additionally, as more aircraft are put into service, there is an expected rapid increase in the demand for maintenance, repair, and overhaul (MRO) services for various aircraft components and systems.

- In September 2023, ST Engineering's Commercial Aerospace business expanded its MRO capacity in Singapore with a new airframe maintenance facility at Singapore Changi Airport. Groundbreaking for the new facility was held today at its location next to the Changi Airfreight Centre in Changi Creek, in the presence of industry and government partners.

Restraint

Environmental factors

A significant portion of challenges that occur in the aerospace coating market arise from the diverse environmental conditions and exposure to elements such as wind, temperature variations, rain, sunlight, humidity, and oxygen. Despite advancements, certain coatings, particularly those used in marine, aerospace, automotive, and medical applications, still face difficulties in combating corrosion.

In aerospace, the movement of structural joints in aircraft can lead to deformation and elongation of the coating system, posing a significant challenge in maintaining the integrity of the aircraft's structural components. Identifying and addressing these coating challenges is important to improving substrate performance in terms of appearance, moisture resistance, wear resistance adhesion, and other key factors. Despite efforts to overcome these challenges, the growth of the aerospace coating market is expected to be hindered over the forecast period.

Opportunity

Nano-coatings technologies

A significant trend driving market growth is the increased adoption of nano-coatings, which are ultra-thin films applied at the nanoscale on aerospace components. These coatings offer various benefits, such as improved water and ice protection, corrosion resistance, antifouling properties, and antimicrobial capabilities. They also reduce friction, enable self-cleaning, and improve thermal management and resistance to heat and radiation. With a focus on enhancing energy efficiency by reducing aircraft weight, nanotechnology has gained prominence in aircraft manufacturing and component production.

Nanoparticle powders, particularly ceramics and plastics, are utilized in coatings for aircraft engines to provide enhanced protection. Nanoceramic coatings play a crucial role in safeguarding aircraft and engines from high temperatures. These advancements in aerospace coatings are anticipated to create market opportunities and significant growth throughout the forecast period.

- In September 2023, Satys Aerospace signed a new agreement with the Mohammed Bin Rashid Aerospace Hub (MBRAH) to build a new paint hangar at Dubai South - Al Maktoum International Airport (DWC).

Resin Insight

The polyurethane resins segment dominated the aerospace coating market in 2024. This coating offers exceptional durability, chemical resistance, significant weight reduction, and environmental friendliness. Moreover, it meets the market's need for easier application and faster resin healing. Epoxy emerges as the most rapidly expanding category within the expected timeframe.

- In March 2024, Sun Chemical showcased its full range of pigments, polymers, and additives for the coatings industry during the American Coatings Show 2024 (April 30–May 2, 2024) in Indianapolis, Ind. Visitors of booth #746 during the show were also introduced to new pigments from Sun Chemical's Paliocrom aluminum effects line, newly launched waterborne resins, efficient driers, and additives, and high-performance polyurethane all compatible with an extensive range of coatings designed to meet customers''' needs while furthering sustainable initiatives.

The epoxy resin segment has grown the fastest over the forecast period. Epoxy resin, a type of reactive polymer with epoxide groups, exhibits remarkable versatility and toughness, making it suitable for various applications. Its key attributes include resistance to voltage, water absorption, strength, heat, and chemicals, as well as properties like coefficient, thermal conductivity, elongation, shrinkage, and induced rate. Compared to other resin types, epoxy resin offers superior mechanical strength, thermal stability, and chemical resistance. The thriving aerospace sector is driving demand for epoxy resin in the aerospace coating market.

Product Insight

Solvent-based coating dominated the aerospace coating market in 2024. The solvent-based type, favored for its resilience in challenging weather conditions, remains the primary choice within the aerospace sector. However, stringent regulations on volatile organic compound (VOC) emissions imposed by governments worldwide are expected to impede the growth of this specific product sub-segment shortly.

Powder coating segment is anticipated to experience the highest growth during the projected period. In recent years, powder coatings have experienced a surge in demand owing to their ease of application and eco-friendly attributes. These coatings are administered as dry powder and subsequently cured using heat. While they boast impressive durability and environmental advantages, their application needs specialized equipment.

- In April 2023, AkzoNobel launched a superdurable Interpon D2000 powder coating for architects and designers in the North American market that can give aluminum surfaces the beautiful natural look and texture of stone without any of the inconvenience or cost associated with using the actual material.

End user Insight

The commercial segment dominated the aerospace coating market. The increasing desire for air travel among passengers in 2024, driven by the expanding tourism sector and more affordable travel options, is resulting in a notable increase in the global fleet of commercial aircraft. Additionally, the rising trade activities, particularly in nations like China and India, are fueling the demand for air cargo services.

The military segment is ready to witness significant growth during the forecast period. This category encompasses the air forces of various nations involving military aircraft that have stringent coating requirements. These coatings must exhibit resilience against elevated temperatures and radiation while meeting the rigorous demands of military operations.

Application Insight

Exterior coatings dominated the aerospace coating market in 2024. Applying coatings to the exterior of aircraft is crucial for improving their performance and safeguarding them against the extreme temperatures and weather conditions encountered at high altitudes. Moreover, these coatings serve to combat corrosion, preserving the structural integrity of the aircraft.

The interior segment is the fastest growing during the studied period. Rapidly developing economies like India, Brazil, and ASEAN nations are expected to drive the demand for aerospace coatings used in interior applications due to a significant surge in air travel. The growing middle-class population's higher disposable income has fueled a notable increase in the number of people traveling by air in these regions in recent years.

Aerospace Coating Market Companies

- Akzo Nobel N.V.

- BASF SE

- Hardide plc.

- Henkel AG & Co. KGaA

- Hentzen Coatings

- IHI Ionbond AG

- Mankiewicz Group

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Zircotec

Recent Developments

- In December 2023, DuPont, a renowned multinational chemical company, announced the launch of new coatings at the Taipei Building Show in Taiwan. Tedlar PVF solutions and PVF coatings were launched for interior aircraft applications and other applications.

- In July 2022, PPG partnered with UK airline brand and design consultancy Aerobrand to provide airline customers with a unique service, integrating paint supply with livery design.

- In July 2022, Akzo Nobel announced a total of EUR 15 million (USD 17.7 million) investment in the company's aerospace coatings facility in Pamiers, which Mapaero acquired in 2019. Production capacity is expected to be increased by 50%.

Segments Covered in the Report

By Resin

- Polyurethane

- Epoxy

- Others

By Product

- Liquid

- Solvent-based

- Water-based

- Powder

By End-user

- Commercial

- Military

- Others

By Industry Category

- Oem

- Mro

By Application

- Exterior

- Interior

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting