What is Hydroxyapatite Market Size?

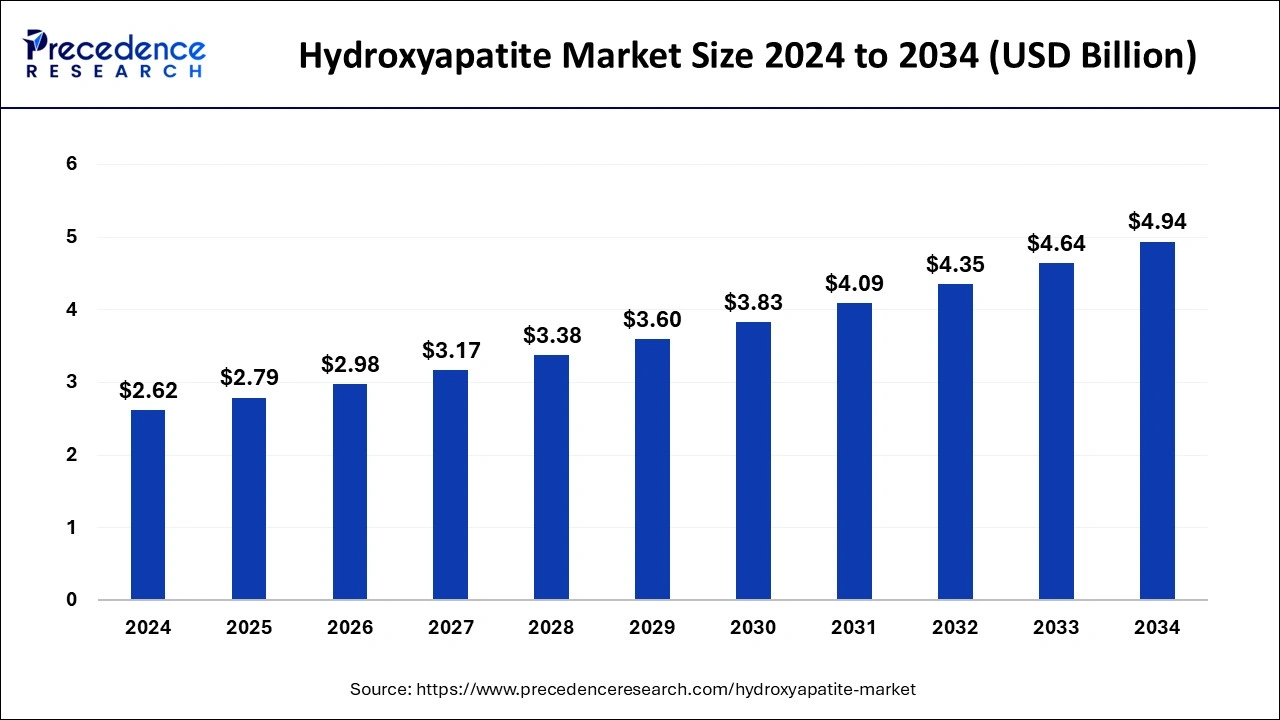

The global hydroxyapatite market size accounted for USD 2.79 billion in 2025 and is expected to exceed around USD 4.94 billion by 2034, growing at a CAGR of 6.54% from 2025 to 2034. The hydroxyapatite market growth is attributed to the increasing demand for biocompatible materials in healthcare applications, particularly in orthopedics, dental care, and regenerative medicine.

Market Highligts

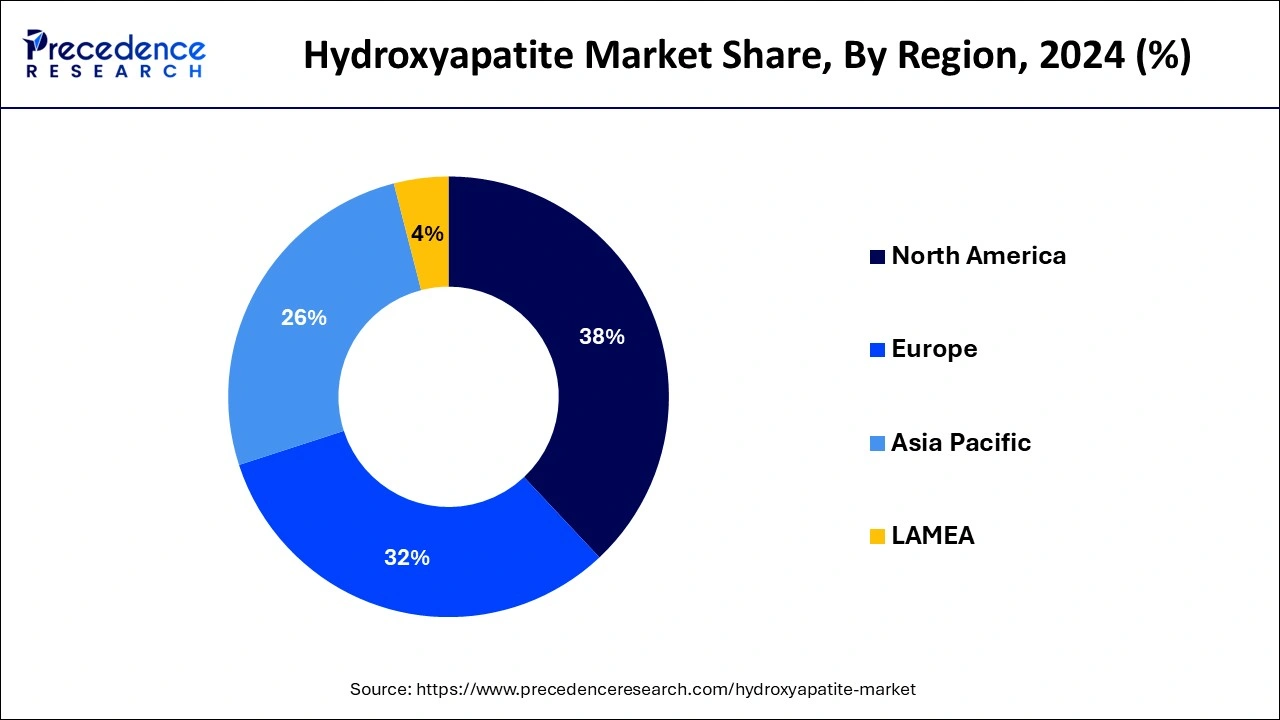

- North America dominated the hydroxyapatite market with the largest market share of 38% in 2024.

- Asia Pacific is projected to host the fastest-growing market in the coming years.

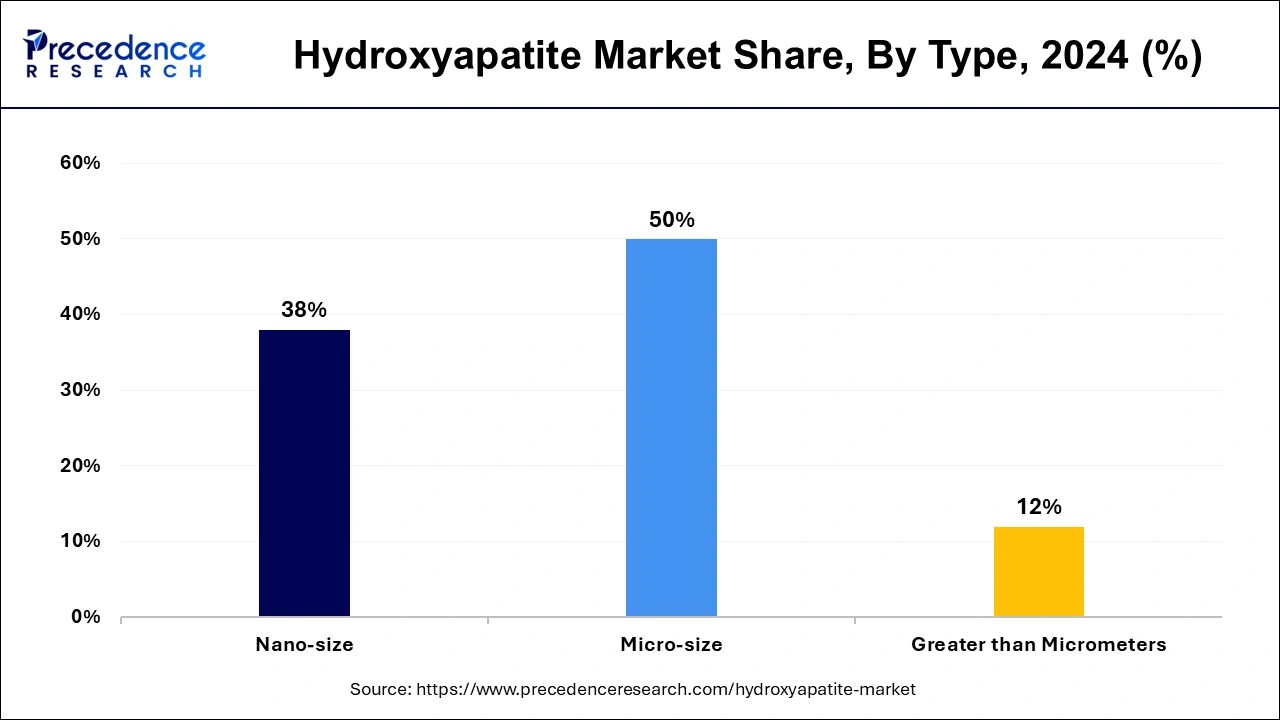

- By type, the micro-sized segment held the biggest market share of 50% in 2024.

- By type, the nano-size segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the orthopedic segment accounted for a considerable share in 2024.

- By application, the dental care segment is anticipated to grow with the highest CAGR during the studied years.

Market Overview

The rising use of bioactive ceramics in applications to the medical field, especially in orthopedic and dental care is driving the use of the hydroxyapatite market. One of the uses of hydroxyapatite is in bone grafts, coating implants, and dental implantation, as it is biocompatible with human bone tissue. These factors are the aging population globally and the increased incidence of disorders relating to bones, which enhance the consumption of hydroxyapatite-based products.

- The WHO states that musculoskeletal conditions are among the leading contributors to disability globally, with approximately 1.71 billion persons in 2022.

Impact of Artificial Intelligence (AI) on the Hydroxyapatite Market

Artificial Intelligence affects industries by introducing revolutions with features to advanced materials through the precise demand of estimate, the smart supply chain, and improving materials through the development of new technologies. In the hydroxyapatite market, AI supports optimizing processes linked with manufacturing that occur with less waste, fewer rejections, and more adherence to the customers' demand. Superior analytical tools are used to process large volumes of data for the purpose of making forecasts for the market and finding applications of the new utilization of the technology in the process. Furthermore, by enabling more knowledgeable processes and decision-making, artificial intelligence increases the efficiency and dynamism of markets.

Hydroxyapatite Market Growth Factors

- The growing prevalence of osteoporosis and other bone-related disorders is driving demand for hydroxyapatite-based solutions.

- The increasing need for advanced surgical implants, especially in emerging markets, is contributing to market expansion.

- The rising preference for minimally invasive surgical procedures is boosting the adoption of hydroxyapatite in medical applications.

- The continuous expansion of the global healthcare sector, particularly in developing economies, is enhancing market opportunities.

- Advancements in biocompatible and biomaterial technologies are spurring innovation and application in the hydroxyapatite market.

- Significant investments in research and development for regenerative medicine are fostering new applications for hydroxyapatite.

- The growing demand for hydroxyapatite in drug delivery systems and tissue engineering is opening new avenues for market growth.

Market Outlook

- Market Growth Overview: The Hydroxyapatite market is expected to grow significantly between 2025 and 2034, driven by the rising orthopedic and dental demand, and advancements in biomaterials, particularly nanostructured hydroxyapatite, are expanding its application beyond traditional implants into areas like tissue engineering and drug delivery systems.

- Sustainability Trends: Sustainability trends involve waste valorization and natural sourcing, green chemistry manufacturing, and eco-friendly dental care alternatives.

- Major Investors: Major investors in the market include The Vanguard Group, Inc., BlackRock, Inc., State Street Corporation, and F-Prime Capital.

Startup Economy: The startup economy is focused on biomimetic and functionalized materials, integration with advanced manufacturing, and consumer oral care brands.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.79 Billion |

| Market Size in 2026 | USD 2.98 Billion |

| Market Size by 2034 | USD 4.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for biocompatible materials in healthcare

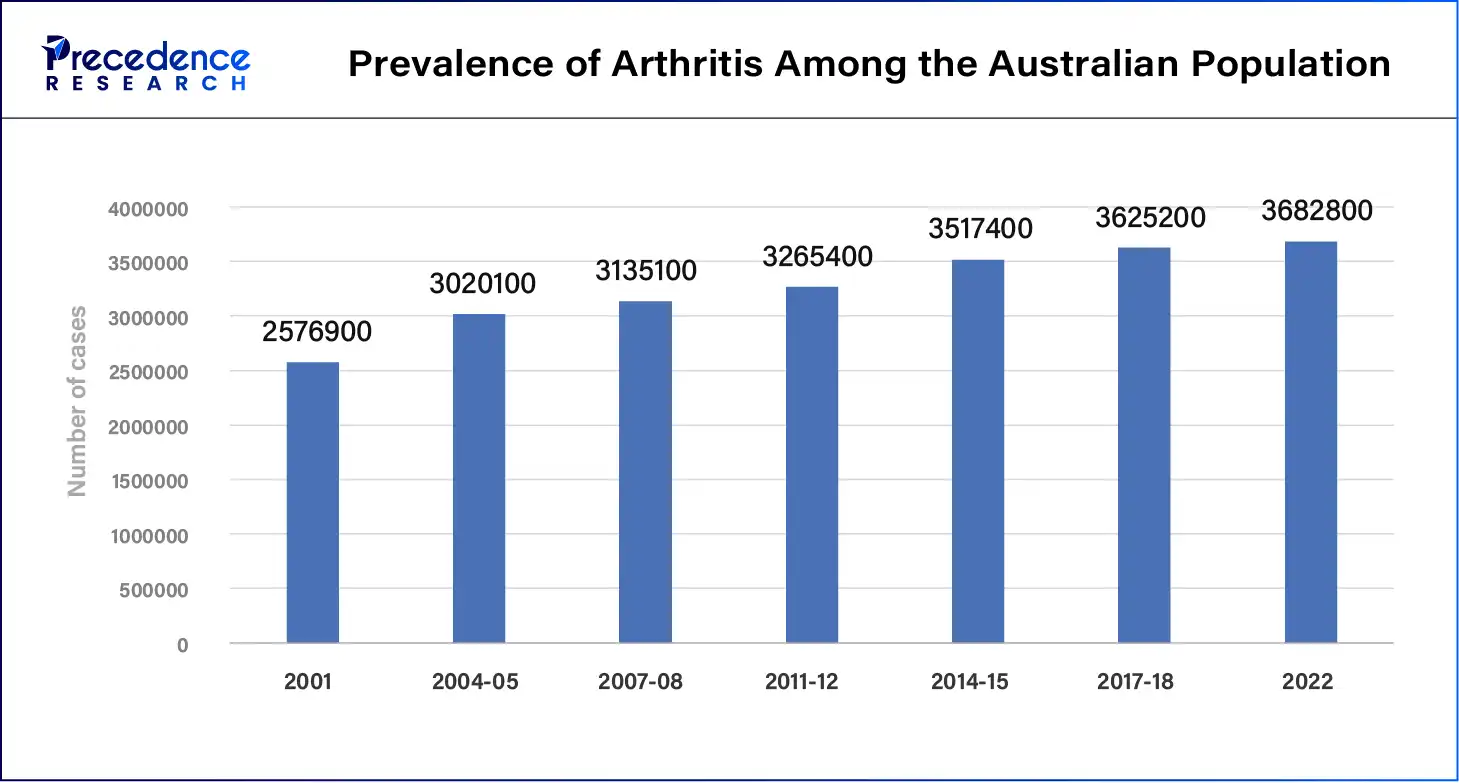

Increasing demand for biocompatible materials in healthcare is anticipated to drive the hydroxyapatite market in the coming years. Surgeons and medical researchers prefer hydroxyapatite for its nature as a biocompatible substance, which has a chemical composition closely resembling human bone mineral. Hydroxyapatite is normally used in orthopedic implants, dental fillers, and bone grafts. This increasing number of patients makes the use of hydroxyapatite in reconstructive surgeries and joint replacement more popular. Elevated incidence of osteoporosis and arthritis, especially in aged individuals, fuels global demand.

- According to the International Osteoporosis Foundation (IOF), the 2023 report results in more than 8.9 million fractures each year worldwide, making bone analogy essential and thus fuelling the market.

- According to the 2022 American Joint Replacement Registry Annual Report by the NIH, data from more than 2.8 million hip and knee procedures across over 1,250 institutions from all 50 states and the District of Columbia were included.

Restraint

Volatility in raw material prices

Volatility in raw material prices is anticipated to hinder the hydroxyapatite market. Some of the challenges that manufacturers face owing to the nature of demand include pricing strategies; some of the cost factors include fluctuations in the cost of raw materials like calcium and phosphate compounds. Such fluctuations owe their existence to conditions such as disruption in the supply chain, conflicts of national interest, and variations in the demand for related products. Manufacturers who import raw materials experience an extra cost in the form of currency exchange rate vagaries, which is indicative of extra pressure on cost control and realizations.

Opportunity

Spurring investments in emerging economies

Spurring investments in emerging economies are likely to create immense opportunities for the hydroxyapatite market growth, especially in Asia Pacific and Latin America. Governments and private organizations in these regions are improving healthcare facilities and encouraging the domestic production of medical and dental instruments. Moreover, technological adoption policies in biomedical applications drive the penetration of hydroxyapatite into new emerging markets.

- According to the World Bank 2024 report, health investments in East Asia and the Pacific are targeted at human capital development and economic development.

Segment Insights

Type Insights

The micro-sized segment held the largest share of the hydroxyapatite market in 2024. Micro-hydroxyapatite particles, with a size range of 1 to 100 micrometers, have the proper mechanical strength and biocompatibility properties required for orthopedic implants. Due to its favorable mechanical properties and high durability, micro-hydroxyapatite is preferred in these applications, and due to compatibility with natural bone, the authors assert that the use of micro-hydroxyapatite in bone tissue helps patient recovery. Moreover, developments in the fields of sintering and powder metallurgy manufacturing have made micro-hydroxyapatite affordable.

The nano-sized segment is observed to be the fastest growing in the hydroxyapatite market during the predicted timeframe owing to its emerging features in biomedical uses. According to multiple researches, nano-hydroxyapatite is more biocompatible faster than other hydroxyapatite. In the bulk density test, the surface area of nano-sized hydroxyapatite appears to be between fifty-two one hundred and two m²/g. This feature is observed to increase the material's performance in terms of bone regeneration and dental implant applications.

- NIH 2023 report also showed that the nano-hydroxyapatite has a large surface area, which has resulted in an increased rate of osteointegration. The experimental work done indicates an up to 30 % increase in bone formation on the implant surface.

Application Insights

The orthopedic segment accounted for a considerable share of the hydroxyapatite market in 2024 due to its application in bone grafts, coating of implants, and bone filler. In such applications, hydroxyapatite is preferred on the basis of its bio-compatibility since it has properties resembling the natural bone and thus heals faster and is least likely to be rejected by the body. The increase in the aging population across the world and the increase in the incidence of bone-related diseases.

- As stated in the 2024 WHO report, musculoskeletal conditions are the leading cause of disability globally, with low back pain ranking as the primary cause of disability in 160 countries, highlighting the significant demand for orthopedic products.

The dental care segment is anticipated to grow with the highest CAGR in the hydroxyapatite market during the studied years, owing to its ability to restructure the surface of enamel with a strengthening effect on teeth. These factors are attributed to the rise in the consciousness of oral health and the burgeoning of cosmetic dentistry procedures. Additionally, a survey from the 2023 report reveals that approximately 5 million dental implants are placed annually in the U.S., driving the demand for hydroxyapatite-based dental care solutions.

Regional Insights

U.S. Hydroxyapatite Market Size and Growth 2025 to 2034

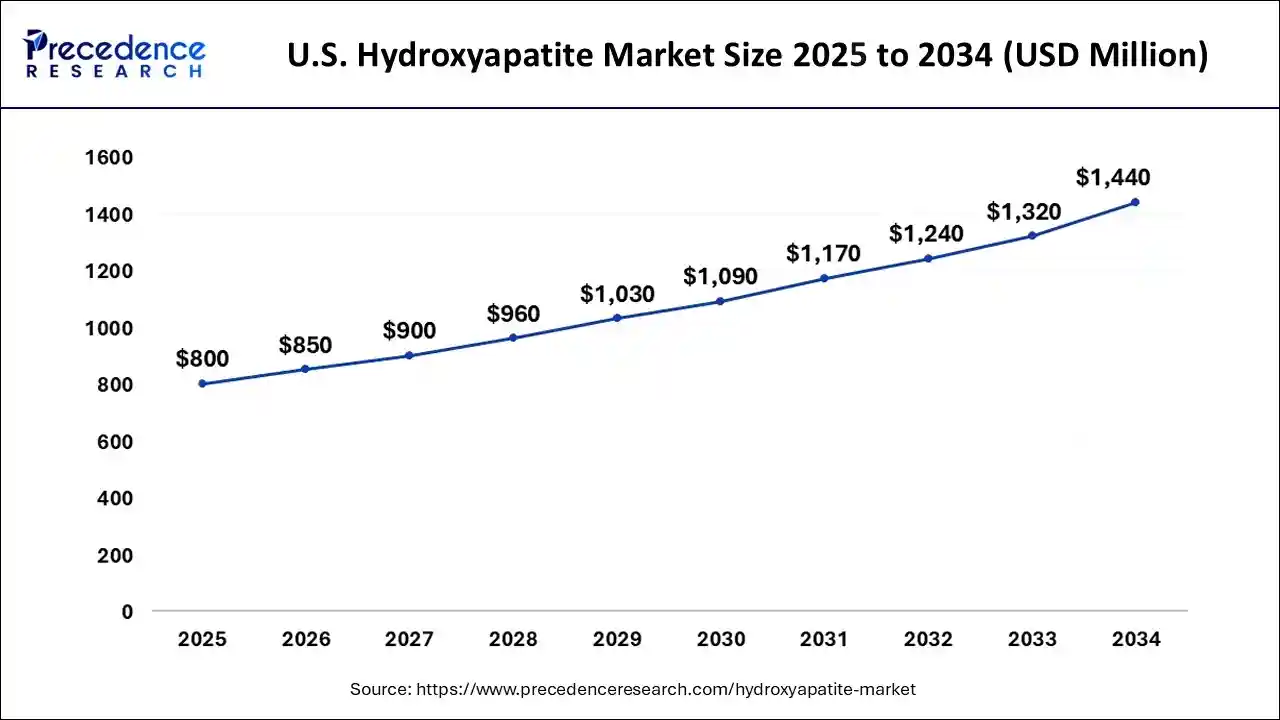

The U.S. hydroxyapatite market size is exhibited at USD 800 million in 2025 and is projected to be worth around USD 1.44 million by 2034, growing at a CAGR of 6.74% from 2025 to 2034.

North America held the largest share of the hydroxyapatite market in 2024 due to advanced healthcare facilities, high healthcare consumption, and emphasis on research and development in the medical fraternity. The United States is expected to have the most compounded annual growth rate in the use of advanced biomaterials for orthopedic and dental applications owing to the already developed medical device industry in the country.

- According to the CDC 2024 report, musculoskeletal disorders are among the leading disability types in the United States, emphasizing the need for adequate treatments and products such as hydroxyapatite.

Asia Pacific is projected to host the fastest-growing hydroxyapatite market in the coming years, owing to the region's growing healthcare industry, the growing population of elderly people, and rising cases of bone disease. The increasing need for orthopedic or dental treatments across emerging economies such as China and India has also fostered the growth of the market.

- The World Health Organization's 2024 report estimates that the Western Pacific Region has 427 million people and South-East Asia has 369 million people affected by musculoskeletal conditions, leading to a high demand for products containing hydroxyapatite.

U.S. Hydroxyapatite Trends:

U.S. widespread use of hydroxyapatite as a coating for implants to enhance osseointegration, and its increasing use in fluoride-free oral care products for enamel remineralization. The rapid growth of nano-hydroxyapatite and advancements in 3D printing for customized scaffolds underscore the market's technological innovation.

- In April 2024, Sangi Co., Ltd. introduced a remineralizing toothpaste using medical hydroxyapatite, inspired by the original NASA technology, and this product was recognized by the U.S. Space Technology Hall of Fame.

India Hydroxyapatite Market Trends:

India's rapid expansion of the nano-sized hydroxyapatite segment, which is increasingly utilized in advanced bone grafts, implant coatings, and remineralizing oral care products. This growth is further propelled by government initiatives like "Make in India" that support domestic manufacturing and research in medical devices, despite challenges related to high production costs for high-purity synthetic options.

Hydroxyapatite Market Value Chain Analysis:

- Raw Material Sourcing and Synthesis

This initial stage involves obtaining the base calcium and phosphate sources needed to synthesize high-purity hydroxyapatite, often through precipitation methods.

Key Players: Sigma-Aldrich, Berkeley Advanced Biomaterials and Plasma Biotal. - Manufacturing and Processing (Powder to Product)

In this stage, the base hydroxyapatite powder is processed into various forms suitable for specific applications, such as coatings, granules, scaffolds, pastes, or incorporated into other materials like polymers and ceramics. - Key Players: Plasma Biotal and Medicoat, and Sangi Co., Ltd.

- Product Development and Regulatory Approval

This stage is crucial for bringing products to market, particularly in highly regulated industries like medicine and dentistry. Value is added through R&D, clinical trials, and navigating complex regulatory pathways (e.g., FDA 510(k) clearance in the U.S.).

Key Players: HAPPE Spine, Stryker Corporation and Zimmer Biomet. - Distribution and Supply Chain

This stage involves the logistics, storage, and delivery of finished products to hospitals, dental clinics, research labs, and retail consumers.

Key Players: Henry Schein

Hydroxyapatite Market Companies

- APS Materials, Inc.: This company primarily contributes to the market through its expertise in plasma spray coating technology, applying high-quality hydroxyapatite coatings to metallic implants to enhance osseointegration and device longevity.

- Berkeley Advanced Biomaterials: A key supplier of raw materials, they provide high-purity hydroxyapatite powders and custom forms to medical device manufacturers and researchers, facilitating innovation in various biomedical applications.

- Bioceramics: This company specializes in the development and production of calcium phosphate-based bioceramics, offering a range of products including synthetic bone grafts and dental fillers utilizing hydroxyapatite.

- CAM Bioceramics: A leading independent supplier, CAM Bioceramics focuses on the large-scale production of high-quality calcium phosphate materials, including hydroxyapatite, serving medical device partners and contributing to consistent raw material supply globally.

- FLUIDINOVA: This company is a major innovator in the nano-hydroxyapatite segment, utilizing proprietary technology to produce stable aqueous colloidal suspensions used as active ingredients in medical devices and oral care products.

- Granulab (M) Sdn Bhd: This Malaysian firm contributes to the Asia-Pacific market by focusing on the production of synthetic bone graft substitutes, including hydroxyapatite granules, addressing regional demand for orthopedic biomaterials.

- Merz Biomaterials: Part of Merz Pharma, this company provides specialized biomaterial solutions, including calcium hydroxyapatite fillers used in aesthetic medicine and dermatology, expanding the market application beyond orthopedics and dentistry.

- Sangi Co., Ltd.H: As a pioneer in the nano-hydroxyapatite dental application, Sangi has been crucial in developing and commercializing remineralizing toothpastes, establishing the efficacy and safety of fluoride-free oral care solutions.

- SigmaGraft: This company develops and supplies a variety of bone regeneration products, including synthetic bone graft materials utilizing hydroxyapatite, contributing to solutions for both orthopedic and dental surgical procedures.

- SofSera Corporation: Focusing on innovative biomaterials, SofSera contributes to the market through research and development of novel hydroxyapatite-based composites and coatings designed for enhanced performance in clinical applications.

- Taihei Chemical Industrial Co. Ltd.: A Japanese chemical company, Taihei is a reliable supplier of high-purity hydroxyapatite raw powder, supporting the manufacturing processes of medical device companies and dental product producers primarily in the Asian market.

- Zimmer Biomet: One of the world's largest medical device companies, Zimmer Biomet integrates hydroxyapatite into its vast portfolio of orthopedic and dental implants, leveraging its significant market reach to drive consumption in clinical settings globally.

Latest Announcements by Industry Leaders

- October 2023 – Superior Polymers

- Director of Business – Bob Fruge

- Announcement - Superior Polymers, an innovator in advanced materials for medical applications, has announced the launch of Magnolia Trinity PEEK, a composite material that integrates three clinically proven biomaterials. Bob Fruge, Director of Business Development at Superior Polymers, said, "Integrating these materials in a single application is unprecedented and provides new opportunities for the use of implantable materials like hydroxyapatite. This novel composite material enhances the potential for improved bone regeneration and integration in orthopedic and dental implants, ultimately improving patient outcomes."

Recent Developments

- In February 2024, Sangi Co., Ltd.'s remineralizing toothpaste was inducted into the U.S. Space Technology Hall of Fame. Inspired by NASA technology, the toothpaste contains Medical Hydroxyapatite, an ingredient known for preventing tooth decay.

- In May 2023, HAPPE Spine, a medical device company specializing in innovative materials for orthopedic implants, announced that its INTEGRATE-C Interbody Fusion System received 510(k) clearance from the FDA. Powered by the HAPPE platform, INTEGRATE-C is the first interbody fusion cage fully integrated with porosity and hydroxyapatite to promote superior healing.

Segments Covered in the Report

By Type

- Nano-Size

- Micro-Size

- Greater Than Micrometers

By Application

- Orthopedic

- Dental Care

- Plastic Surgery

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting