Agricultural Robots and Drones Market Size and Forecast 2025 to 2034

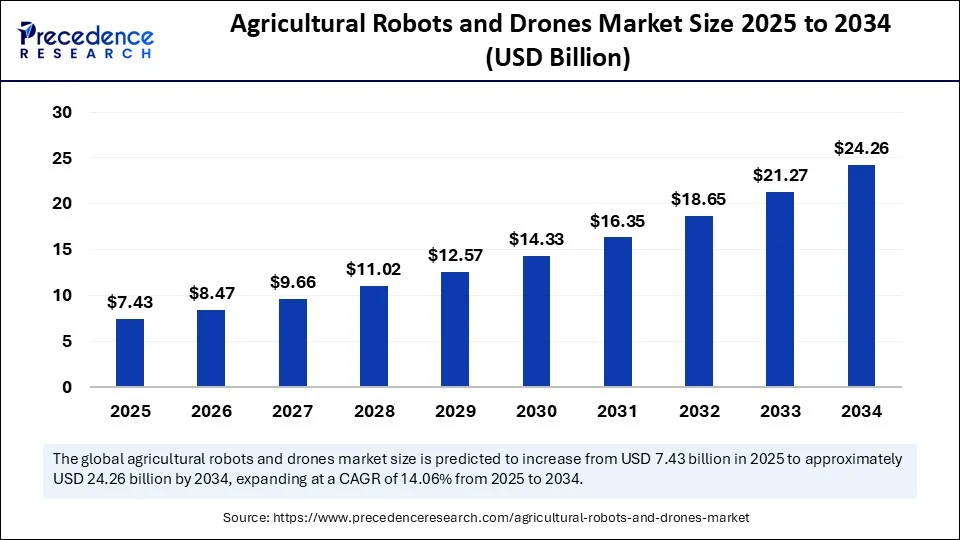

The global agricultural robots and drones market size was calculated at USD 6.51 billion in 2024 and is predicted to increase from USD 7.43 billion in 2025 to approximately USD 24.26 billion by 2034, expanding at a CAGR of 14.06% from 2025 to 2034. The market growth is attributed to the rising adoption of autonomous technologies aimed at improving agricultural productivity, sustainability, and labor efficiency.

Agricultural Robots and Drones Market Key Takeaways

- In terms of revenue, the global agricultural robots and drones market was valued at USD 6.51 billion in 2024.

- It is projected to reach USD 24.26 billion by 2034.

- The market is expected to grow at a CAGR of 14.06 % from 2025 to 2034.

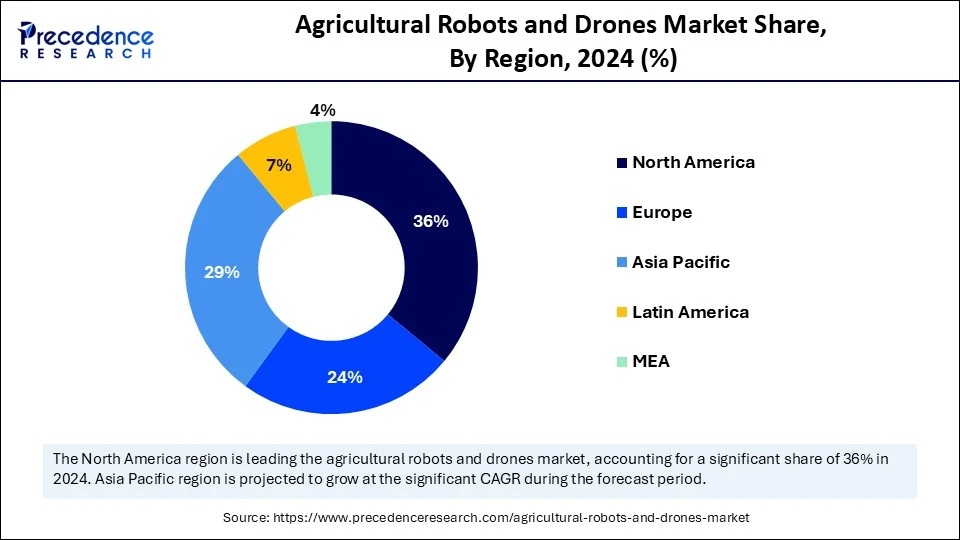

- North America dominated the global agricultural robots and drones market with the largest share of 36% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By product type, the drones (UAVs) segment held the major market share in 2024.

- By product type, the weeding and spraying robots segment is projected to grow at the fastest CAGR between 2025 and 2034.

- By component, the hardware segment contributed the biggest market share in 2024.

- By component, the software segment is expanding at a significant CAGR between 2025 and 2034.

- By application, the crop monitoring and analysis segment led the market in 2024.

- By application, the livestock monitoring segment is expected to grow at a significant CAGR over the projected period.

- By farm type, the field crops segment captured the largest market share in 2024.

- By farm type, the specialty crops segment is expected to grow at a notable CAGR from 2025 to 2034.

- By mobility type, the aerial robots segment held the major market share in 2024.

- By mobility type, the hybrid systems segment is projected to grow at a CAGR in between 2025 and 2034.

- By end use, the large commercial farms segment accounted for highest market share in 2024.

- By end use, the small and family farms segment is projected to grow at a CAGR in between 2025 and 2034.

Impact of Artificial Intelligence on the Agricultural Robots and Drones Market

Artificial intelligence is considered a key factor in enhancing the functionalities of agricultural robots and drones, making them indispensable in next-generation farming. Drones analyze multispectral data to measure plant health, alert pest places early, and control robotic devices to act using custom treatments. Additionally, these smart automation further address both the labor shortage and the increase in operational efficiency, leading to economic and environmentally friendly farming.

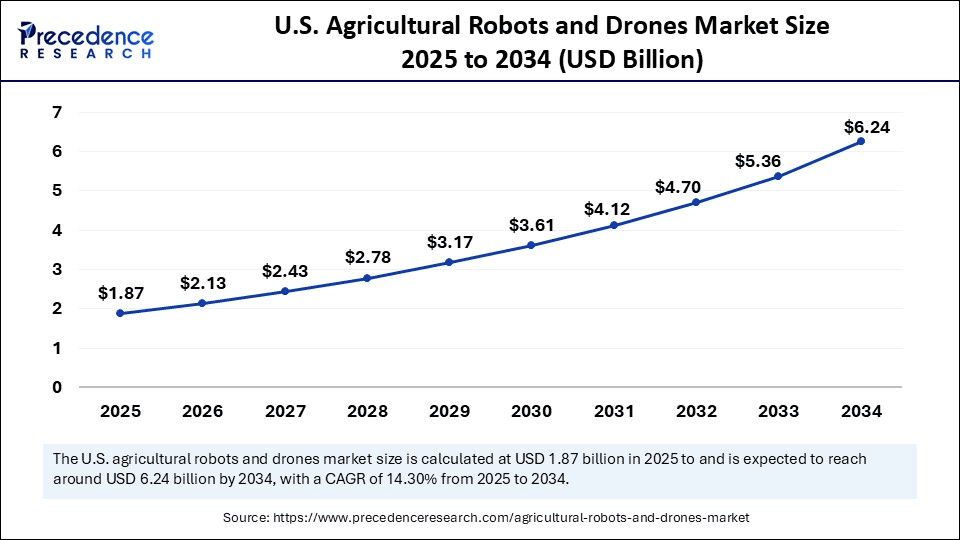

U.S. Agricultural Robots and Drones Market Size and Growth 2025 to 2034

The U.S. agricultural robots and drones market size was exhibited at USD 1.64 billion in 2024 and is projected to be worth around USD 6.24 billion by 2034, growing at a CAGR of 14.30% from 2025 to 2034.

What Made North America the Dominant Region in 2024?

North America led the agricultural robots and drones market, capturing the largest revenue share in 2024 due to well-developed farm infrastructure and the adoption of precision farming techniques in both the U.S. and Canada. The high labor rates and large-scale farming enterprises have driven the introduction of automated systems to perform agronomic activities. Major market players, including Deere & Company, Trimble Inc., and Blue River Technology, have rolled out production and pilots geographically throughout the Midwestern states, focusing on row crop production such as corn and soybeans.

In a bid to facilitate region-wide adoption of the technology as part of the North American Climate-Smart Agriculture Partnership. The Agricultural Research Service (ARS) collaborated with Climate Corporation to enhance predictive tools of robotic plantations during climate-based planting windows. Moreover, the regulatory and technological ecosystems surrounding robotics in farming environments are driving the market in this region.

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period, driven by rising demand for food security and investment in agri-tech innovations. Other nations, including China, India, Japan, and Australia, are rapidly incorporating autonomous solutions to overcome labor shortages in rural sectors and enhance output in smallholder farms.

DJI and XAG, Chinese companies, presented the Chinese-localized model of the drones that considered the narrow, uneven geometrical patterns of Asian farms. In 2024, the National Bank of Agriculture and Rural Development (NABARD) partnered with agri-tech firms in India to provide subsidized robotic machinery under digital agriculture plans to smallholder farmers. Additionally, the regional deployments supported by public and private efforts are expected to fuel growth in the coming years.

(Source: https://www.nabard.org)

Market Overview

The Agricultural Robots and Drones Market encompasses autonomous, semi-autonomous, and remotely operated machines and aerial systems used in farming, horticulture, and agribusiness operations. These technologies help automate tasks such as planting, spraying, harvesting, soil analysis, crop monitoring, and livestock management, enabling precision agriculture, reducing labor costs, and increasing productivity. Drones (UAVs) provide high-resolution imaging, multispectral analysis, and real-time monitoring, while robots perform physical tasks with minimal human intervention.

The increasing demand for precision farming, labor shortages, and a growing call for sustainable agricultural production are driving the proliferation of agricultural robots and drones on farms worldwide. Large U.S. farms have mounted drones or autonomous machines to address the shortage of seasonal employment. The Food and Agriculture Organization (FAO) initiated several agri-drone programs in 2024 in Asia, including countries such as India and Vietnam, to assist smallholders with precision pesticide delivery and pest monitoring. Furthermore, catalyzing investments in agri-technology research and development, especially through products of public-private cooperation and institutional grants, are also expected to fuel the market.

Agricultural Robots and Drones Market Growth Factors

- Rising Demand for Climate-Resilient Farming: Shifting weather patterns and climate risks are fuelling the adoption of automated systems that optimize inputs and enhance crop resilience.

- Growing Emphasis on Food Traceability and Quality:Consumer awareness and stricter food safety standards are boosting the use of robotic systems for real-time monitoring and transparent supply chains.

- Expansion of Government-Led Smart Farming Programs: National digital agriculture missions and subsidies are driving the integration of robotics and drones into mainstream agricultural practices.

- Increasing Pressure to Reduce Input Waste:Rising costs of fertilizers, pesticides, and water are boosting demand for precision robots that minimize over-application and environmental harm.

- Surging Use of Data-Driven Decision Support Tools: The integration of robotics with cloud platforms and analytics is fueling better forecasting, planning, and real-time farm adjustments.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 24.26 Billion |

| Market Size in 2025 | USD 7.43 Billion |

| Market Size in 2024 | USD 6.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.06% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Component, Application, Farm Type, Mobility Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is the Increasing Adoption of Precision Agriculture Technologies Accelerating Growth in the Agricultural Robots and Drones Market?

Increasing adoption of precision agriculture technologies is expected to accelerate market expansion. The farmers are adopting high-end robotics and drones loaded with GPS, computer visualization, and analytical capabilities to sharpen in accuracy of planting, fertilizing, and administering pesticides. Such technologies enable real-time monitoring of the field, minimize input waste, and allocate resources in the most effective way. It is the trend in site-specific crop management that creates a need for autonomous systems that bring data-dense insights and perform their work with minimum errors.

- According to the USDA, in 2024, more than three-quarters of large-scale farms in the U.S. are adopting precision agriculture tools used on their farms, with a greater focus on drone-based field analysis and autonomous ground vehicles.

Precision agriculture enhances yield consistency and also promotes sustainable agricultural behavior, which is adjusted to the current regulations and the environmental requirements. This demand is actively being met by manufacturers who have incorporated AI and sensor-based automation into robotic platforms. Major players, such as John Deere and Trimble Inc., released their new AI-controlled farming equipment at the end of 2024, providing virtually flawless precision in the agricultural field. Furthermore, increasing the application of robotics in farming operations by conducting training and subsidizing the process through government support will further boost market growth.

(Source: https://www.ers.usda.gov)

Restraint

High Initial Investment in Autonomous Equipment Limits Adoption Among Small and Medium-Sized Farms

High initial investment in autonomous farming equipment is anticipated to hinder the market. The cost of buying, maintaining, and incorporating them into conventional farming activities is substantial in terms of initial investments. These investments, in many instances, appear infeasible in places where agricultural income is erratic and seasonal, unless aided by outside assistance or subsidies. The uncertainty in the timeline of returns on investments and the financial risk makes the smaller to hesitate in their shift, thus further fueling the market.

Opportunity

Rising Investment in Agri-Tech Innovation

Spurring investment in agri-tech innovation is likely to create immense opportunities for the players competing in the market. Incentivizing the research and development of agri-tech is expected to accelerate the commercialization of goods and services. R&D investment leads to innovations in sensor tech, machine learning models, and robotics hardware. This creates systems able to adapt to environmentally variable conditions and new patterns in agriculture. European DG AGRI awarded new grants on the Horizon Europe program to fund work on developing robots in 2024 to help manage crops precisely on Mediterranean and Eastern European farms. Furthermore, the growing availability of platforms that are compatible with multi-crop that work effectively in both row and specialty crops further boosts the market growth.

- In October 2024, India witnessed the launch of AG365H, the country's first DGCA Type Certified medium-category agricultural drone. The unveiling took place at the Amaravati Drone Summit, led by Andhra Pradesh Chief Minister N. Chandrababu Naidu. Civil Aviation Minister K. Ram Mohan Naidu also participated in the official inauguration.

(Source: https://marutdrones.com)

Product Type Insights

Why Are Drones Leading the Agricultural Robots and Drones Market?

The drones segment continues to dominate the market due to their versatility in applications. UAVs were utilized more by farmers in monitoring crops in flight, farm mapping, crop health assessment, and crop yield predictions. These drones were capable of high-resolution (multispectral and thermal) imagery. Furthermore, this enables the collection of accurate information on crop stress, nutrient deficiencies, and irrigation patterns, thereby creating a growing demand.

The weeding and spraying robots segment is expected to grow at the fastest rate in the coming years, owing to the increasing demand for resource-efficient and targeted operations in the fields. AI and machine vision enable robots to identify weeds and apply herbicides or pesticides with precision. Further reducing chemical application and minimizing its environmental impact.

These measures align with global market efforts to limit the release of agrochemicals and enhance soil health. It suggests that precision sprayers have helped reduce chemical input by 25%, especially in row crops such as corn, soybeans, and sugar beets, according to the 2024 report provided by the FAO. Moreover, companies such as Blue River Technology and Bosch BASF Smart Farming have developed technological advancements that utilize AI, further facilitating the segment in the coming years.

Component Insights

What Made Hardware the Dominant Segment in the Agricultural Robots and Drones Market?

The hardware segment held the largest revenue share in the agricultural robots and drones market in 2024.This is primarily due to the high utilization of physical components, including drones, robotic arms, GPS modules, cameras, sensors, and autonomous vehicles. Farmers have invested significantly in installing modern and advanced robotic systems on traditional machinery to enhance field management for seeding, spraying, and harvesting.

Sales of integrated hardware platforms were facilitated by the popularization of drone fleets for crop monitoring and by the increased use of ground-based robots on vast farms. Commercial farms in the U.S. have spent more on agricultural autonomous machines and other associated hardware. Furthermore, the government pilot schemes in Japan and Southeast Asia to roll out next-generation drone fleets in rice and sugarcane fields further fuel the hardware segment.

The software segment is expected to grow at the fastest rate in the coming years, as there is a rising level of dependence on AI, machine learning, data analytics, and cloud-based farm management systems. The use of software in decision-making translates data captured by drones and robotic systems to maximize real-time monitoring of conditions in the fields. The report on Agri-Digitalization 2024 by the FAO emphasized the importance of intelligent software platforms, which are expected to bring higher accuracy, particularly in climate-sensitive areas, thereby further facilitating the segment in the coming years.

Application Insights

Why Did the Crop Monitoring & Analysis Segment Dominate the Market in 2024?

The crop monitoring & analysis segment dominated the agricultural robots and drones market in 2024 due to the critical need for accuracy in crop health tracking, forecasts of the harvested crops, and instantaneous diagnostics. Farmers embraced AI-enabled imaging devices and autonomous drones to capture high-frequency aerial and ground-level data. This helps detect nutrient stress, pest infestations, and disease outbreaks faster than ever before.

The integration of high-resolution data into farm management systems enabled users to undertake zone-specific interventions for productive and sustainable yield practices. The DG AGRI of the European Commission piloted projects in Spain and Italy in 2024, using UAV-based analytics to aid precision olive and grape production. Additionally, the increase in the application of near-infrared and multispectral sensors to diagnose row crops, particularly in the enhancement of crop vigor mapping, further facilitates the segment.

(Source: https://ecpa2025.upc.edu)

The livestock monitoring segment is expected to expand at the fastest rate in the coming years, owing to growing concerns about animal health, biosecurity, and workforce issues in large-scale animal production. Furthermore, livestock monitoring stands out as one of the areas to experience strategic growth in the extractive stage of agri-automation, thus fuelling the demand for agricultural drones and robotics technology.

Farm Type Insights

How Does the Field Crops Segment Dominate the Agricultural Robots and Drones Market in 2024?

The field crops segment held the largest revenue share in the market in 2024, facilitated by large-scale usage of automation in farm production of grain, cereal, oilseed, and legume crops. They commonly occupy large swaths of land, which is why they are well-suited for high-performance robotic technologies. This assists in the work of automated planting and aerial sprayers and crop monitoring through remote control.

The International Food Policy Research Institute (IFPRI) also confirmed increased investments in robotic applications in Sub-Saharan Africa to sustain wheat productivity. Additionally, the adaptability of robotic products and their ability to cater to monoculture agricultural trends will contribute to the growth of this segment in the coming years.

The specialty crops segment is expected to grow at the fastest CAGR in the coming years, owing to the increased demand for automated crop-wise, specifically in labor-intensive settings. Such farms are sometimes a matter of care, fine spacing, and specific maintenance, which makes robotics that perform tasks, such as selective harvesting, canopy management, and pest scouting, more valuable accordingly. Additionally, these developments also fuel faster adoption in specialty crop farms, where precision, care, and labor-saving measures are key contributors to profitability and sustainability.

Mobility Type Insights

What Factors Position Aerial Robots as the Dominant Force in the Market?

The aerial robots (drones) segment dominated the agricultural robots and drones market with the largest share in 2024. This is mainly due to their effectiveness in collecting a large volume of data, production, and monitoring of crops in all types of farms. Multispectral, hyperspectral, and thermal sensors installed in drones have helped farmers analyze the health of their crops. These technologies identify stress areas and conduct maintenance and field management that require less effort and less human involvement.

The widespread use of aerial robots remains the leading deployment of remote sensing in agricultural applications worldwide, especially in North America, China, and Australia. The National Agricultural Statistics Service (NASS) of the USDA documented a 42% rise in drone application for irrigation scheduling in corn and soybean fields in 2024. Furthermore, the use of drones regionally in Southeast Asia was funded by the CGIAR Excellence in Agronomy Initiative, further propelling the segment.

The hybrid systems segment is expected to grow at the highest CAGR during the projection period. The UAV surveillance system is typically combined with ground robots that perform intervention services, such as spraying, weeding, and harvesting. Hybrid robots coordinate scouting and action without any lag time between the occurrence of the problem and action. Moreover, the hybrid deployments enhanced work efficiency with high-value crops, such as strawberries, tomatoes, and wine grapes, thereby fueling their demand.

End User Insights

How Does the Large Commercial Farms Segment Dominate the Agricultural Robots and Drones Market in 2024?

Large commercial farms segment held the largest revenue share in the market in 2024, driven by high financial potential, large-scale automation, and the dire need to make labor efficient in large farm holdings. These farms have adopted robotics to automate the processes of planting, monitoring crops, spraying, and harvesting, making them more productive and profitable as the cost of inputs increases. Furthermore, the capacity to scale robotic systems to expanses of thousands of acres was an invitation to be considered very seriously by commercial farms dealing with monocultures.

Small & family farms segment is expected to grow at the fastest rate in the coming years, owing to the growing affordability and availability of agri-drones and compact robotic systems. Agri-tech start-ups and governments are investing in scalable automation tools. Further enabling smallholders to deal with labor crunch, variable weather conditions, and the need to maximize yields. Additionally, governmental funds for training and funding opportunities for drones in small farms' work further boost the market.

Agricultural Robots and Drones Market Companies

- John Deere

- DJI

- AGCO Corporation (Fendt, Massey Ferguson)

- Trimble Inc.

- Kubota Corporation

- Yamaha Motor Co., Ltd.

- Blue River Technology (John Deere)

- Naïo Technologies

- ecoRobotix SA

- AgEagle Aerial Systems

- PrecisionHawk

- CNH Industrial (Raven Industries)

- Agrobot

- Octinion (RoboJob)

- XAG Co., Ltd.

- Delaval Inc. (Milking Robotics)

- Small Robot Company

- SwarmFarm Robotics

- Taranis

- Skyx (Autonomous Sprayers)

Recent Development

- On October 2024, UAV startup Amber Wings launched its DGCA-certified agricultural drone Vihaa, developed by an IIT Madras incubator. Designed to revolutionize farming operations across India, Vihaa is capable of performing spraying tasks up to seven times faster than manual methods, helping farmers save valuable time and resources. The drone offers an efficient solution for applying fertilizers, pesticides, and other treatments with greater precision.

(Source:https://www.mavdrones.com)

- In November 2024, Marut Drones introduced the AG365H, a DGCA Type Certified medium-category agricultural drone, at the Amaravati Drone Summit. Designed for diverse farming applications including pesticide spraying, fertilizer broadcasting, and fish feeding, the AG365H was praised by Andhra Pradesh Chief Minister N. Chandrababu Naidu and Civil Aviation Minister K. Ram Mohan Naidu. The launch marks a significant step toward modernizing and sustainably transforming India's agricultural practices.

(Source: https://www.financialexpress.com)

- In June 2025, Garuda Aerospace announced the establishment of a dedicated Agri-Drone manufacturing center on the outskirts of Chennai, focused on developing 33 components and 7 critical subsystems for agricultural UAVs. This initiative strengthens India's drone manufacturing ecosystem and aligns with the government's ‘Atmanirbhar Bharat' mission to boost domestic technology production and reduce reliance on imports.

(Source: https://themachinemaker.com)

Latest Announcement by Industry Leader

- In June 2025, Garuda Aerospace has officially launched its state-of-the-art Agri-Drone Indigenization Facility in Chennai, marking a significant step in advancing India's domestic drone manufacturing capabilities. The event was inaugurated by Shri Kamlesh Paswan, Hon'ble Union Minister of State for Rural Development, who also unveiled 300 Centres of Excellence (CoEs) and Garuda's DGCA-approved Train the Trainer (TTT) skilling program. Commending Garuda's founder and CEO, Agnishwar Jayaprakash, the Minister highlighted the company's contribution to rural development and employment generation. “Agnishwar has always been like a younger brother to me, but today I was truly proud to witness the incredible work he is doing as CEO of Garuda Aerospace,” said Shri Paswan. He praised the company for employing over 140 individuals and emphasized the impact of the Drone Didi initiative, which has empowered women who had never stepped outside their homes to now confidently operate drones. Jayaprakash stated that the launhsignifies the achievement of three major milestones aligned with the national goal. “In 2022, our Hon'ble Prime Minister Modi ji envisioned the production of one lakh Made-in-India drones by 2026. So far, we have delivered 4,000 drones, and we are confident of reaching that target in the next two years,” he added.

(Source: https://news.agropages.com)

Segments covered in the report

By Product Type

- Drones (UAVs)

- Fixed-wing

- Rotary-wing

- Hybrid VTOL

- Autonomous Tractors & Harvesters

- Milking Robots

- Weeding & Spraying Robots

- Planting & Seeding Robots

- Robotic Grippers & Arms

- Livestock Monitoring Robots

By Component

- Hardware

- Sensors (LIDAR, multispectral, thermal, cameras)

- GPS/GNSS Modules

- Actuators & Controllers

- Frames and Mobility Platforms

- Software

- AI/ML for crop recognition, yield mapping

- Farm Management Systems

- Real-time Decision Support Tools

- Services

- Drone-as-a-Service (DaaS)

- Predictive Maintenance

- Data Processing & Analytics

By Application

- Crop Monitoring & Analysis

- Soil & Field Mapping

- Planting & Seeding

- Harvesting & Picking

- Weed & Pest Control

- Irrigation Management

- Livestock Monitoring

By Farm Type

- Field Crops

- Horticulture

- Dairy Farms

- Greenhouses

- Specialty Crops (e.g., vineyards, floriculture)

By Mobility Type

- Aerial Robots (Drones)

- Ground Robots

- Wheeled

- Tracked

- Hybrid Systems

By End-User

- Large Commercial Farms

- Medium Farms

- Small & Family Farms

By region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting