What is Digital Agriculture Market Size?

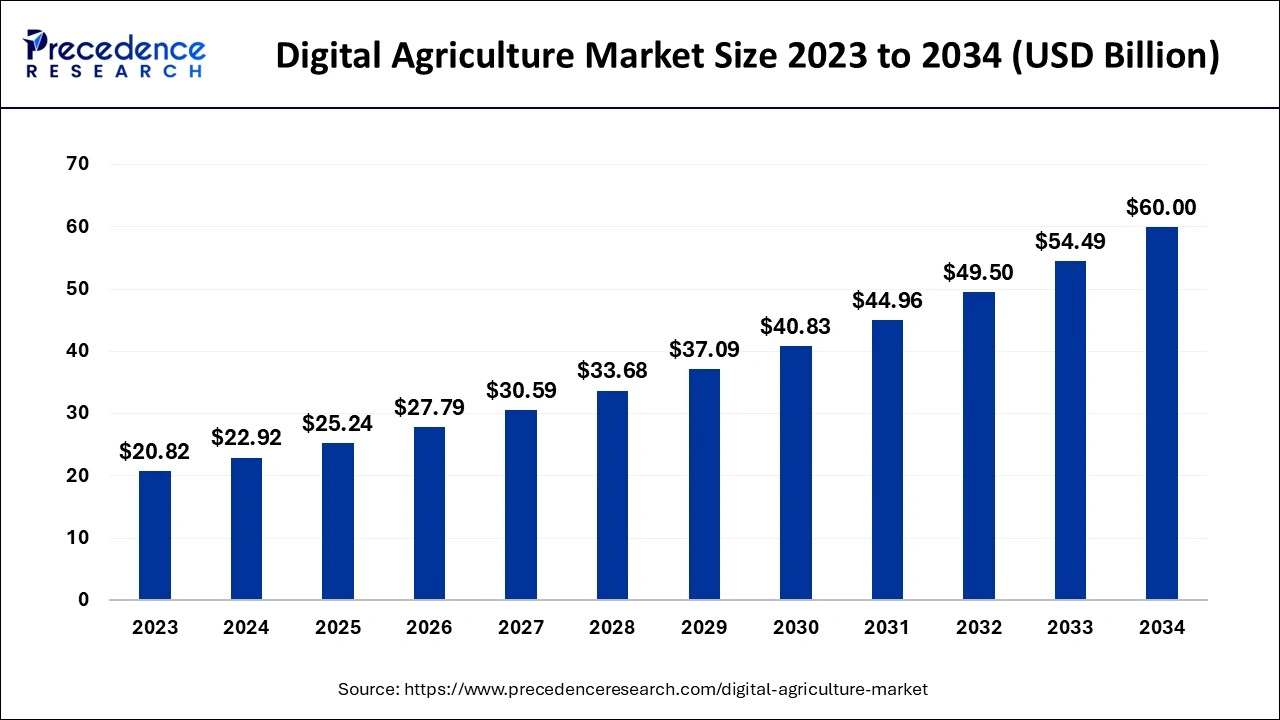

The global digital agriculture market size is estimated at USD 25.24 billion in 2025 and is anticipated to reach around USD 27.79 billion by 2026 and is precdicated to reach USD 60 Billion by 2034, expanding at a CAGR of 10.10% from 2025 to 2034.

Market Highlights

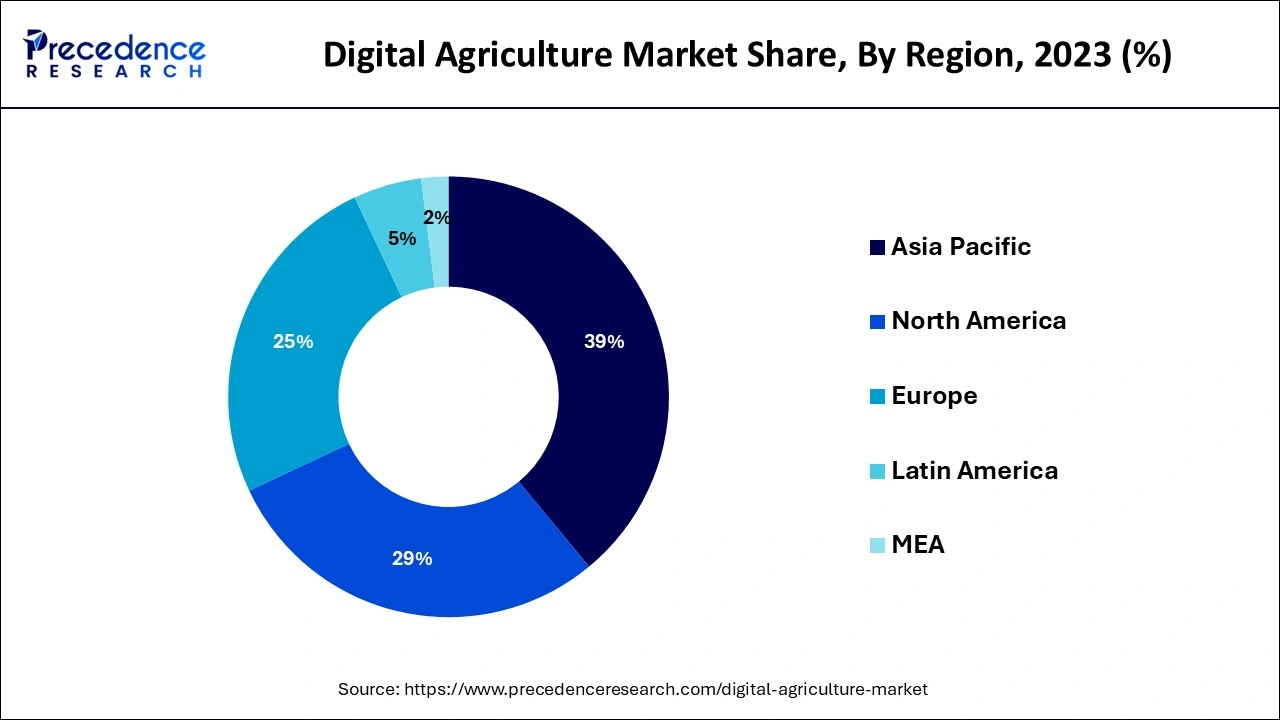

- Asia Pacific dominated digital agriculture market in 2024.

- By product, the perishable segment led the market during the forecast period 2025 to 2034.

- By business, the B2B segment led the market during the forecast period 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 25.24 Billion

- Market Size in 2026: USD 27.79 Billion

- Forecasted Market Size by 2034: USD 60 Billion

- CAGR (2025-2034): 10.10%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What is the impact of AI in the digital agriculture market?

A transformation is occurring in digital agriculture, in which Artificial Intelligence enables data-driven smart decision-making. Crop protection and yield results are improved when farmers are helped by AI to anticipate hazards like weather shifts or insect outbreaks. AI-enabled precision farming maximises the use of pesticides, fertilisers, and water, lowering expenses and enhancing sustainability. The automated processes make the manual operations easier, with robots, tractors, and drones as examples. AI sensors monitor crop and livestock health, thereby minimizing injuries. Supply chains benefit through market prediction and efficient logistics. All these advances contribute towards long-term food security, less environmental impact, and productivity gains.

What is digital agriculture?

There is growing pressure on farmers to produce more food and animal feed by using lesser chemicals. The increasing population is making it more difficult to feed the growing population. There's an increase in the strain on agricultural production. The use of Internet of Things solutions combined with precision agricultural softwares will help the agricultural sector. There is an increasing use of agricultural tools that are digital which help in tracking the progress of the crops with the help of sensors that record the condition of the soil and the temperature in the fields.

Farmers are using these applications to analyze the climate for the growth of various crops. Like all the other sectors farming is also making use of digital platforms post pandemic. There's an increase in the investments and innovations for the digital agriculture. Increasing dependency on the digitization is helping in the betterment of the lives of various farmers across the world.

Digital Agriculture Market Growth Factors

- With the rising global population and growing demand for food security, there is a need for digital agriculture solutions.

- There is a market demand being fueled as farmers are becoming increasingly aware of precision farming and resource optimization.

- Supporting government policies are in place to encourage farmers to take up advanced agricultural tech.

- The existence of advisory services and farm management platforms ensures that farmers lessen their problems during digital tool adoption.

- Technologies in agricultural software, sensors, and connectivity provide service for the productivity, sustainability, and profitability of the whole agri-sector.

Digital Agriculture Market Outlook

- Industry Growth Overview: From 2025 to 2030, the digital agriculture industry is expected to grow at a rapid pace, fueled by the adoption of AI, IoT, and remote sensing in precision agriculture. Most growth will occur in data-driven crop management and farm automation in North America, Europe, and the Asia-Pacific region.

- Sustainability Trends: Sustainability is the central focus of digital agriculture. Rapidly expanding smart irrigation, carbon tracking, and precision input management to reduce input waste is being explored by many participants. Advanced agriculture companies, such as Deere & Company and Trimble, are developing geo-analytics tools to assist farmers in reaching carbon-neutral production goals and ongoing environmental policy compliance.

- Global Expansion: The global expansion of prominent agritech players is particularly directed toward developing regions that have a solid potential for digitization (for example, Africa and Southeast Asia). For instance, CNH Industrial recently introduced a range of digital platforms for emerging markets with the goal of fostering productivity from smallholders engaged in sustainable agricultural practices.

- Key Investors: Venture capital and private equity firms are heavily investing in agri-data platforms and automation startups due to strong growth prospects. Moreover, many investors are funding technologies that improve farm profitability and promote climate-resilient agriculture.

- Startup Ecosystem: The digital agriculture startup scene is thriving, with innovators focusing on AI-based crop analytics, drone surveillance, and soil health platforms. Startups like CropX (Israel) and AgNext (India) are gaining traction for delivering scalable, real-time agricultural intelligence solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 25.24 Billion |

| Market Size in 2024 | USD 27.79 Billion |

| Market Size by 2034 | USD 60 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.10% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments Covered | Business Channel, Product Type, Component Type, Deployment, Infrastructure, Type, Company Type, Designation, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Product Type Insights

The perishable segment is expected to dominate the marketplace during the forecast period. Dairy products, vegetables, meat, fresh fruits, seafood and poultry are all the perishable foods in the digital agricultural marketplace.

Business Channels Insights

The B2B segment is expected to have the largest market share during the forecast period in the digital agricultural market. B2B commerce operates between companies instead of the end user and the company. There are various tools and services like software tools, data analysis, value added services for logistics which are offered to the farmers. All these services in the B2B segment help the farmers to improve their crop productivity and cultivation

Regional Insights

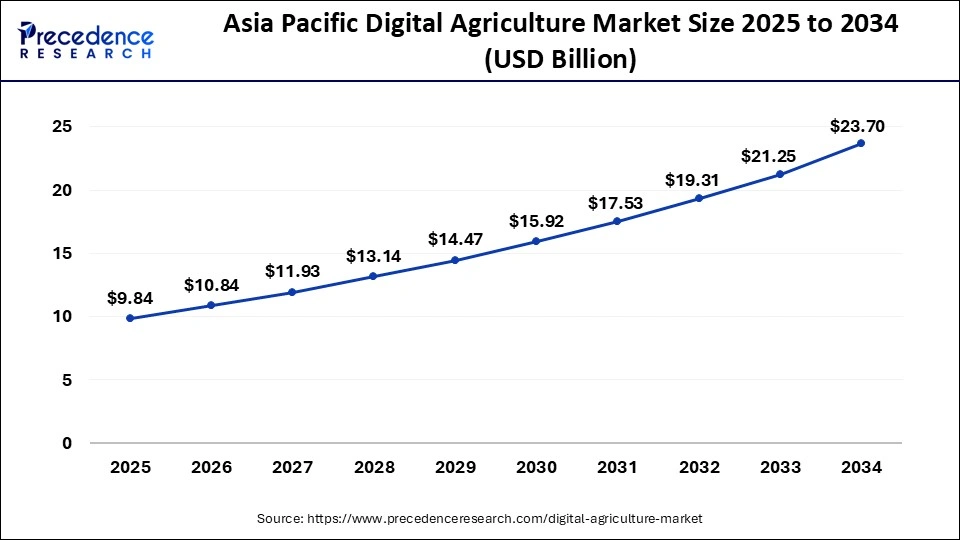

Asia Pacific Digital Agriculture Market Size and Growth 2025 to 2034

The Asia Pacific digital agriculture market size is evaluated at USD 9.84 billion in 2025 and is predicted to be worth around USD 23.70 billion by 2034, rising at a CAGR of 10.23% from 2025 to 2034.

The Asia Pacific region is expected to dominate the global digital agricultural market during the forecast period. The Chinese agricultural sector has undergone a great revolution with respect to the adoption of smart farming practices. With the availability of Internet of Things cellular devices use of sensor-based technologies like gear tooth sensor-based irrigation and fertilizer equipment the market is expected to grow. There is an increased rate of mechanization andsmart agriculturalpractices are adopted by the farmers.

China has contributed well in the agricultural science and technology progress. The rate of mechanization in crop harvesting and crop cultivation has rose exponentially in China. India is an agricultural country and it is traditionally dependent on rain and the climate changes. Due to these reasons the farmers are extremely vulnerable to crop loss in India. An increase in the use ofartificial intelligencein the agricultural field will help in reducing the uncertainties and the risk in the agricultural activities in India.

What made North America grow at the fastest rate in the digital agriculture market?

The North America region is expected to show the fastest growth in the digital agriculture market due to technology use, specifically precision farming, as well as robust investment into agri-tech. Growth opportunities existed in AI farm management solutions, autonomous machinery, and sustainable farming solutions.

U.S. Digital Agriculture Market Trends

The US dominated the North American digital agriculture market due to investment in farm automation, AI crop analytics, and sensor-based irrigation systems. This level of investment with large-scale farms plus government support contributed to the adoption of smart agriculture technologies.

Europe - Sustainability Fuels the Fields

Europe experienced steady growth in the digital agriculture market due to smart farming, precision agriculture, and sustainability initiatives with strong government support for agricultural solutions. Growth opportunities were present in AI solutions for crop management, sensor-based irrigation, and monitoring carbon footprints for farms.

Germany Digital Agriculture Market Trends

Germany led the European digital agriculture market due to advanced farm automation, AI monitoring of crops, and precision irrigation systems. The research infrastructure in the country, combined with government subsidies for agricultural solutions, allowed for the adoption of digital agriculture to occur at a quicker pace than in other regions in Europe.

Latin America - Cultivating Growth through Tech

Latin America grew at a considerable rate in the digital agriculture market due to the facilitation of agri-tech adoption, the availability of vast arable lands, and increasing private investment. Furthermore, there are opportunities in remote sensing, precision farming, and farm analytics to help smallholder farmers.

Brazil Digital Agriculture Market Trends

Brazil led the Latin American digital agriculture market due to its advanced precision agriculture, drone monitoring, and AI-based crop forecasting. Moreover, the country's strong agricultural exports have driven digital agriculture investment.

Middle East & Africa - Innovation Blooms in the Desert

In the Middle East & Africa, agri-tech investment growth has been seen through increased investment in smart irrigation, digital monitoring systems for farms, and other sustainable practices for farmers. Moreover, Opportunities existed in water-efficient technologies to enable precision agriculture in arid areas.

UAE Digital Agriculture Market Trends

In the UAE, smart farming projects have been led by the government, such as vertical farms and IoT-based Agri-tech systems, with a specific focus on agricultural solutions in desert farming.

Value Chain Analysis

- Procurement:Procurement of digital agriculture thus refers to using technology and digital platforms to carry out purchasing and trading of agricultural inputs (seeds, fertilizers) and outputs (farm produce).

Key players: John Deere, Trimble Inc. - Operations:Utilizing IoT, AI, and robotic technologies, these digital agricultural operations aim to increase productivity and sustain it. Key players: Deere & Company, IBM, and Microsoft

- Technology Development:Digital agriculture technology development may be viewed as the integration of digital tools and platforms for the sake of efficiency, sustainability, and productivity in farming.

Key players: AGCO Corporation, Bayer AG - Marketing and Sales:Marketing and Sales covers promoting agricultural products, services, and technologies, and selling them through online channels and digital tools, as opposed to traditional ones.

Key players: IBM and Cisco - Regulatory landscape:The regulatory landscape of digital agriculture is fragmented and evolving, which also attempts to address thorny issues around data ownership, privacy, security, and market power.

Key players: Food and Agriculture Organization of the United Nations, Digital Agriculture Association

Key Players in Digital Agriculture Market & Their Offerings:

- AGCO Corporation: Offers a portfolio of precision agriculture technologies, including the PTx Trimble platform, to help farmers with guidance, planting, and farm management.

- Microsoft Corporation: Provides cloud-based platforms like Azure FarmBeats and tools such as Azure Data Manager for Agriculture to enable agritech companies and farmers to manage and analyze farm data using AI and machine learning.

- HummingBird Technologies: Uses remote sensing imagery from drones and satellites combined with AI to provide analytics and insights on crop health, disease detection, and yield prediction.

- IBM Corporation: Offers the IBM Watson Decision Platform for Agriculture, which leverages AI to provide farmers with weather forecasts, soil moisture information, and other insights for improved crop management.

- Gamaya SA: Specializes in AI-driven solutions for large-scale crop production, particularly sugarcane and soybeans, using remote sensing to optimize harvesting and increase yields.

- DTN: Provides agricultural intelligence through its DTN Ag Hub and MyDTN platforms, which offer real-time weather data, market updates, and other agronomic information to help with decision-making.

- Taranis: Delivers a precision agriculture intelligence platform that uses high-resolution imagery from drones, planes, and satellites, along with AI, to provide "leaf-level" insights for crop monitoring and targeted interventions.

- Farmers Edge: A digital agriculture company offering a platform that combines connected field sensors, AI, and big data analytics to provide a range of hardware, software, and services.

- Eurofins: Specializes in providing laboratory analysis of soil, water, and plants, with a digital component that integrates this data into growers' dashboards to help optimize cultivation and nutrition.

- Agriwebb: Offers livestock business management software that helps ranchers manage their operations, track animal performance, and use data to increase profitability and productivity.

- Climate Corporation: Provides the Climate FieldView platform, which is an agronomic tool that uses data from equipment to help farmers with seed prescription, crop monitoring, and yield analysis.

Recent Developments

- In August 2025, the Indian government approved the Digital Agriculture Mission (DAM) in September 2024, marking a significant step towards a modern, data-driven, and farmer-centric agricultural ecosystem.

- In May 2025, the United Nations Food and Agriculture Organization (FAO) is launching a Digital Agriculture Innovation Bootcamp to empower youth-led agripreneurs in driving digital transformation in the agrifood sector.

Segments Covered in the Report

By Business Channel

- B2B

- B2C

By Product Type

- Perishables

- Non perishables

- Raw materials

- Others

By Component Type

- Hardware

- Software

- Devices

By Deployment

- Cloud

- On-Premise

- Hybrid

By Infrastructure

- Sensing & Monitoring

- Sensors

- Cameras

- Communication Technology

- Short Range

- Medium Range

- Long Range

- Cloud and Data Processing

- Telematics/Positioning

- GPS/GNSS

- GIS

By Type

- Crop Monitoring

- Artificial Intelligence

- Precision Farming

By Company Type

- Tier 1-55%

- Tier 2-20%

- Tier 3-25%

By Designation

- C-Level Executives-40%

- Directors -35%

- Others-25%

By Application

- Field Mapping

- Livestock Monitoring

- Greenhouse Farming

- Crop Scouting

- Weather Tracking

- Drone Analytics

- Financial Management

- Farm Inventory Management

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting