Synthetic Aperture Radar Market Size and Forecast 2025 to 2034

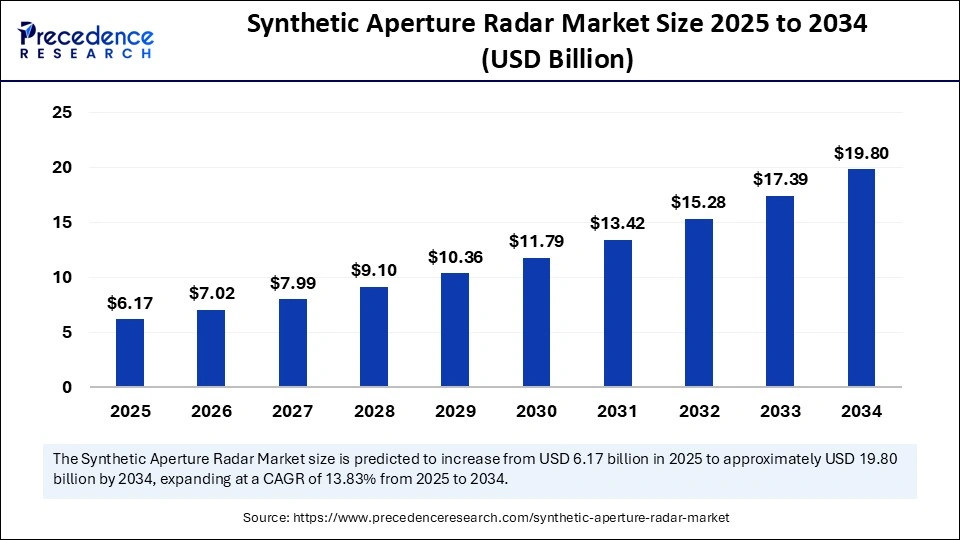

The global synthetic aperture radar market size accounted for USD 5.42 billion in 2024 and is predicted to increase from USD 6.17 billion in 2025 to approximately USD 19.80 billion by 2034, expanding at a CAGR of 13.83% from 2025 to 2034. The demand for improved surveillance and reconnaissance capabilities in military applications has increased, driving the global synthetic aperture radar market. Rising geopolitical instability and security concerns are fostering market growth.

Synthetic Aperture Radar MarketKey Takeaways

- In terms of revenue, the synthetic aperture radar market is valued at $6.17 billion in 2025.

- It is projected to reach $19.80 billion by 2034.

- The market is expected to grow at a CAGR of 13.83% from 2025 to 2034.

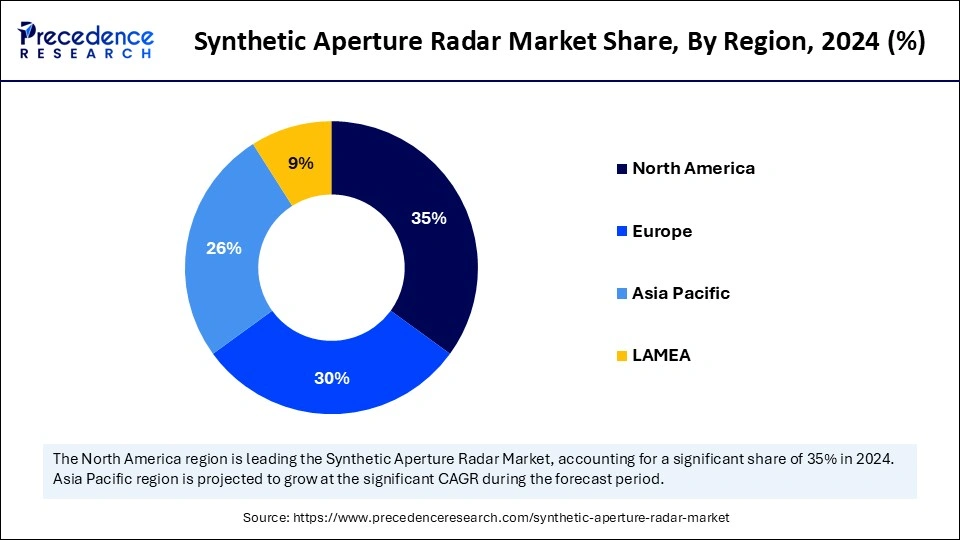

- North America generated the highest revenue of 35% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 20245 to 2034.

- By component, the receivers segment held the major market revenue share of 39% in 2024.

- By component, the transmitter segment will grow at a CAGR between 2025 and 2034.

- By platform, the airborne segment accounted for the largest market revenue in 2024.

- By platform, the ground segment will grow at a CAGR between 2025 and 2034.

- By frequency band, the X band segment contributed the biggest market revenue in 2024.

- By frequency band, the VHF/UHF band segment is expected to expand at a significant CAGR between 2025 and 2034.

- By mode, the single segment dominated the market in 2024.

- By mode, the multimode segment is expected to grow at a significant CAGR during the forecast period.

- By application, the defence segment contributed the largest market revenue in 2024.

- By application, the natural resource exploration segment is expected to grow at a significant CAGR between 2025 and 2034.

What is the Impact of AI on Synthetic Aperture Radar (SAR)?

Artificial intelligence is revolutionizing the overall synthetic aperture radar technology by enhancing image composition, despeckling, optical-to-SAR, and multi-view image generation applications. AI helps to provide clear and accurate images by removing noise and distortions in SAR images. AI is enabling synthetic aperture radar technologies to overcome their image challenges by enabling improved image quality and resolution. AI integration for a synthetic aperture radar system can be trained to automatically detect, classify, and track objects of interest in images. Additionally, the advanced anomaly detection and real-time data analysis provided by AI integration can improve the capabilities of the synthetic aperture radar system in detecting and analysis of potential threats and environmental changes. AI is being highly implemented with synthetic aperture radar systems for remote sensing, environmental monitoring, and military surveillance.

- In February 2025, companies like ICEYE, the global leader in Synthetic Aperture Radar (SAR) satellite operations for high-fidelity Earth Observation, and SATIM, a world-leading provider of AI-based solutions for Automatic Target Recognition (ATR) on SAR imagery, entered into a partnership for joint development of new, AI-powered SAR imagery analysis products

(Source: https://www.iceye.com)

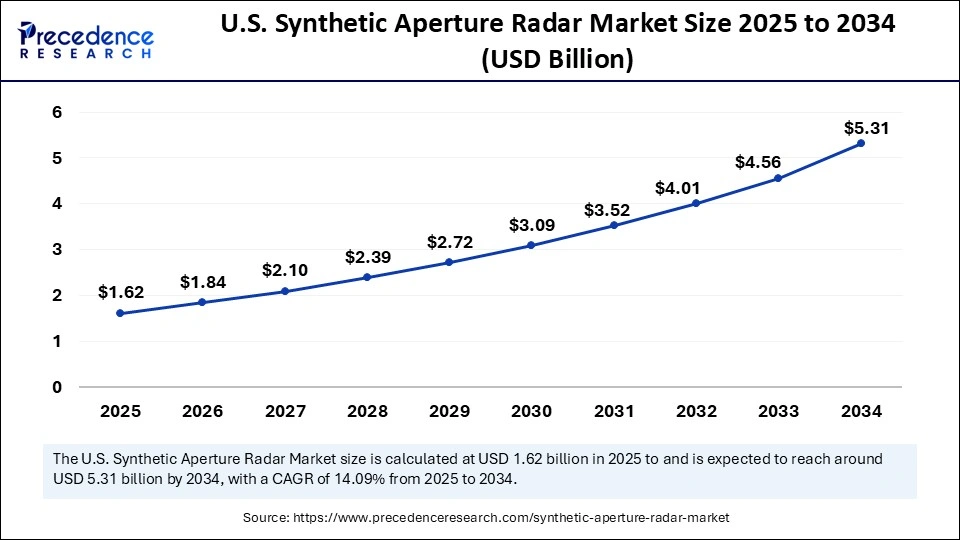

U.S. Synthetic Aperture Radar Market Size and Growth 2025 to 2034

The U.S. synthetic aperture radar market size was exhibited at USD 1.42 billion in 2024 and is projected to be worth around USD 5.31 billion by 2034, growing at a CAGR of 14.09% from 2025 to 2034.

North America is the World's Largest Synthetic Aperture Radar Market

North America dominated the market with the largest revenue share of 35% in 2024, driven by the region's well-established defence sector and strong investments in advanced radar technology and defence. Government funding for defence and earth observation initiatives, shaping market growth. Additionally, the presence of key market players, including Raytheon Technologies, Lockheed Martin, and Northrop Grumman, brings cutting-edge approaches in technology advancements. In recent years, North America has witnessed spectacular growth in advancements of airborne synthetic aperture radar technology.

United States Synthetic Aperture Radar Market Trends:

The U.S. is a major player in the regional market, driven by growth due to robust defense investments and the presence of key market vendors. The U.S. is focusing on advancing its space program. The country's military is heavily dependent on SAR for surveillance, intelligence gathering, and various defense applications, driving the necessity of innovations and developments of cutting-edge synthetic aperture radar technologies.

- In March 2025, Synspective Inc., a provider of Synthetic Aperture Radar (SAR) satellite data and analytics solutions, opened Synspective USA HD, Inc., a holding company, and Synspective USA, Inc., an operating company in the USA. The expansion is aimed at bringing milestone approaches in advanced satellite technology and data-driven insights for clients of North America and Latin America, the world's largest space-related market.

(Source:https://synspective.com)

Asia Pacific Synthetic Aperture Radar Market & Trends

Asia Pacific is the fastest-growing region in the global market, driven by increased demand for defence applications and earth observation. Asia is investing heavily in the advancement of the radar systems, including dual-band SAR and MIMO-SAR systems, to enhance image quality and overall performance of radar. Asia is witnessing growth in the requirement for border surveillance, maritime security, and other intelligence activities, fostering regional focus toward advancements of the synthetic aperture radar system.

With countries like China, Japan, India and South Korea, and their heavy investments in technological advancements, the Asian market is expected to witness steady growth over the forecast period.

China & India Synthetic Aperture Radar Market Trends:

China is dominating the regional market with robust investments in satellite technology and defense applications. Government initiatives in enhancing national security, resource management, and disaster response, contributing to the rising investments. To advance remote sensing fields like urban mapping and disaster monitoring, China has implemented various innovations.

For instance, in April 2025, the Aerospace Information Research Institute of the Chinese Academy of Sciences (AIRCAS) unveiled a Breakthrough in "Microwave Vision", a theoretical methodology for synthetic aperture radar (SAR) 3D imaging. The innovations have enabled achievements in higher-precision, lower-cost, and more robust 3D imaging.

(Source:http://english.aircas.ac.cn)

India is holding sustainable market growth with ongoing improvements in synthetic aperture radar capabilities by the Indian Space Research Organization (ISRO). India is witnessing a surge in agriculture monitoring, border surveillance, disaster management, and urban mapping, bolstering investments in satellite technology advancements, including synthetic aperture radar. With government support for private and start-up organizations in technology, the country is expected to lead the market over the forecast period.

- In May 2024, GalaxEye tested its Synthetic Aperture Radar (SAR) technology on a subscale High Altitude Pseudo-Satellite (HAPS) successfully, which was developed by the National Aerospace Laboratories (NAL). The test demonstrates India's first time using a private framework to achieve a feat on a HAPS platform.

(Source:https://www.thehindu.com)

Robust Investments in Technology: To Boost Europe's Synthetic Aperture Radar Market

Europe is a significant player in the global synthetic aperture radar market, growth driven by regions' strong investments in technology for national security, environmental tracking, and border monitoring. Existence for well-established initiatives like the European Space Agency's Sentinel Satellites shapes market conditions. The L-band synthetic aperture radar system segment is leading the European market, driven by high adoption of the band for various applications due to its ability to penetrate vegetation and clouds.

Ongoing collaborations between private and public sectors are bringing novel innovations, developments, and deployments of synthetic aperture radar systems in Europe. Major key players like Thales Group and their developments of novel software and hardware for airborne SAR systems and efforts in advanced algorithms integration bring significant opportunities for the emerging market.

The PIDSO's SAR-AESA-X is popular for various surveillance and reconnaissance missions due to its high resolution and flexibility in different operating modes. Additionally, Lockheed Martin's AN/APY-12 airborne radar is highly viable for export to various European countries, deployed for surveillance and reconnaissance missions. This radar is popular for transmitting airborne processed images and moving target detections to ground stations in real-time.

Countries like Germany, France, and the UK are significant players in the regional market, driving growth due to countries' strong investments in the advancement of SAR technology, defense R&D spending, which contributes to the advancement of SAR technology in those countries. Germany leads the largest portion of the regional market, with countries high focus on defense monitoring and surveillance applications.

- In April 2025, mission “VV26”, Arianespace launched the European Space Agency's (ESA) Earth Explorer Biomass satellite from Europe's Spaceport in French Guiana. The mission is the world's leading research mission, which places its passenger on board a Vega C launcher.

(Source:https://www.arianespace.com)

Which Factors Fostering Growth of the Synthetic Aperture Radar Market?

- Defense and Security: The adoption of cutting-edge synthetic aperture radar systems is high in defense and security operations, ensuring improvements in surveillance and reconnaissance capabilities.

- Growth in Research & Commercial Applications: The growing research and commercial applications, like infrastructure monitoring, urban planning and mapping, resource management, agriculture observations, and environmental studies, are increasing the demand for the synthetic aperture radar market.

- Disaster Management: The use of synthetic aperture radar systems is high in disaster management applications, providing critical information in disaster conditions like flood management, wildfire tracking, and damage assessments.

- Technological Advancements: Technological advancements in synthetic aperture radar, with enhanced resolutions, integration of cutting-edge technologies, and data processing abilities, are fostering innovations and developments of advanced synthetic aperture radar systems.

- Emerging Applications: The adoption of synthetic aperture radar systems is witnessing rapid growth for emerging applications, including agriculture (crop mapping and phenology tracking), forestry, and infrastructure monitoring.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 19.80 Billion |

| Market Size in 2025 | USD 6.17 Billion |

| Market Size in 2024 | USD 5.42 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.83% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Platform, Frequency Band, Mode, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Earth observation and surveillance capabilities

The increased demand for high-resolution Earth observation and surveillance capabilities, driving the global synthetic aperture radar market. The adoption of the synthetic aperture radar system is high in applications of earth observations, defense & security, and disaster management. The technology provides high-resolution imaging for environmental monitoring, agriculture surveillance, and disaster management, in any kind of weather and lighting conditions.

Military and defense operations like tactical planning and border security also rely on synthetic aperture radar systems for improved surveillance and reconnaissance capabilities. Additionally, the extreme use of technology for flood mapping, damage assessments, and wildfire tracking fosters their importance in disaster management applications. The Earth observation and surveillance operations have led to a demand for real-time data, making the synthetic aperture radar system essential.

Restraint

High Upfront Cost

The high initial cost associated with research & development, testing, launching, and maintenance is the major restraint for the global synthetic aperture radar market. The system needs cutting-edge technology integrations and materials. The data processing and analysis of synthetic aperture radar data is time-consuming and increase the cost. The system is complex, requires specialized expertise and cutting-edge components, increased cost. Additionally, the cost of launching synthetic aperture radar satellites in orbit hampers innovations and developments. However, government support and funding for R&D can help to overcome this cost burden.

Opportunity

Environmental Monitoring and Climate Studies

The rising adoption of synthetic aperture radar systems for environmental monitoring and climate study applications is holding significant growth opportunities for the market over the forecast period. The system helps to provide information for understanding and managing environmental changes, disaster management, and climate-related issues. Climate-related issues like glacier movements, ocean currents, and sea-level rise drive the need for synthetic aperture radar technology, enabling researchers and scientists to study climate and predict changes.

The rising application of crop health monitoring, developments, and growth for efficient agriculture practices, fostering market growth. Additionally, the synthetic aperture radar system is ideal for environmental changes monitoring, overviews, and tracking of deforestation, contributing to innovative approaches for technological advancements, including improved resolutions, technology integration, and data processing.

Component Insights

Which Component Segment Dominated the Synthetic Aperture Radar Market in 2024?

In 2024, the receivers segment dominated the market by holding more than 39% of revenue share, due to its crucial role for SAR's active imaging function. A synthetic aperture radar system uses receivers to send signals and identify scattered waves for creating images. Integration of the receiver helps to enhance image precision. The adoption of synthetic aperture radar (SAR) receivers is high among applications like environmental monitoring, defense, and disaster management.

The transmitter segment is the second-largest segment, leading the market, driven by developments of digital-to-analog converters and high-power amplifiers. Transmitters enable the synthetic aperture radar system to generate microwave signals transmitted toward targeted areas. The rising use of solid-state transmitters in synthetic aperture radar systems, especially for military/defence, earth mapping, and infrastructure monitoring applications, is fostering segment growth.

Platform Insights

What Made the Airborne Platform Segment Dominate the Synthetic Aperture Radar Market?

The airborne segment dominated the market in 2024, due to its versatility, flexibility, and real-time imaging capabilities. Airborne synthetic aperture radar systems enable flexible and real-time imaging with higher resolutions. The airborne synthetic aperture radar systems are ideal for tactical applications, including military surveillance, environmental monitoring, and infrastructure safety. The growing adoption of unmanned aerial vehicles (UAVs) with synthetic aperture radar systems is fostering the segment's growth. Additionally, ongoing developments of synthetic aperture radar systems with advanced miniaturized sensors, enhanced data fusion, and integration of AI technology are improving airborne system capabilities.

The ground segment is expected to grow fastest over the forecast period. The segment is experiencing growth mainly due to its cost-effectiveness. Ground-based synthetic aperture radars are affordable than airborne or satellite-based platforms. Applications like environmental monitoring, disaster response, and defense drive the adoption of ground-based platforms due to their high flexibility, higher-resolution images, and continuous monitoring. The segment is well-known for high-precision surveillance for long-term monitoring of critical assets, infrastructure, and natural hazards.

Frequency Band Insights

The X band segment holds the largest market revenue in 2024, due to its high adoption in military and defense operations. X-band synthetic aperture radar technology ensures capturing small details and provides ideal use in remote sensing, urban planning, and infrastructure monitoring. The high-resolution imaging capability of the segments makes them ideal for these applications. The diverse applications like infrastructure monitoring, defense, and environmental monitoring, and increased demand for high-resolution imaging in them are fostering the segment growth.

The VHF/UHF band segment is experiencing significant growth due to its wide use in military & defense applications. The VHF/UHF bands allowed effective land force communications and airborne deployments. Ongoing developments of satellite constellations integrated with VHF/UHF bands near-real-time coverage and persistent monitoring, an emerging market for the segment to grow.

Mode Insights

What made Single Mode Segment contribute the Largest Revenue in the Synthetic Aperture Radar Market?

The single segment contributed the largest market revenue in 2024, due to its reference of stripmap mode and wide area coverage for applications like land use mapping, crop monitoring, disaster response, security monitoring, and environmental monitoring. The segment is widely used in urban infrastructure for applications like monitoring urban development, traffic patterns, and infrastructure integrity. The high-resolution imaging and cost-effective capabilities make single-mode synthetic aperture radars a suitable choice for various applications.

The multimode segment is the second-largest segment, leading the market. The segment is growing due to its compatibility and flexibility, making it ideal for switching between different modes depending on applications. The multimode synthetic aperture radar system can switch between Stripmap, Spotlight, and ScanSAR within a single system. The versatile nature of segments drives their adoption in various applications, including defense, environmental monitoring, intelligence, and disaster response.

Application Insights

Which Application Segment Dominated the Synthetic Aperture Radar Market in 2024?

In 2024, the defence segment dominated the market, due to all-weather capabilities, high-resolution images, surveillance & reconnaissance, and improved situational awareness needs in the defence. Synthetic aperture radar systems enable high-resolution images without being bothered by weather or lighting conditions. Growing geopolitical tension has increased the need for advanced surveillance, reconnaissance, and intelligence, driving the adoption of cutting-edge synthetic aperture radar technologies.

The natural resource exploration segment is growing significantly, driven by increased use of synthetic aperture radar systems in applications like environmental monitoring, agriculture surveillance, resource management, and disaster management, driven by high-resolution imaging, unaffected by weather or lighting conditions provided by the synthetic aperture radars.

The system can gather real-time data and analyze regardless of weather, making it the ideal tool for mapping and monitoring natural resources. The demand for synthetic aperture radar systems has increased for urban planning, infrastructure development, and natural resource management, contributing to the segment's growth.

Synthetic Aperture Radar Market: A Transformative Growth

The global synthetic aperture radar market is witnessing transformative growth, driven by various factors, including increased use in environmental, commercial, logistics, and geopolitical applications. Government investments in research & development are playing a crucial role in market growth. The defence and intelligence operations need an advanced synthetic aperture radar system for monitoring contested borders, identifying movement across remote terrain, and tracking vessel activity beyond the reach of traditional sensors.

The growing commercial segment, including, use of synthetic aperture radar flood monitoring for safe and maritime logistics, and crop yield monitoring, is fostering innovative approaches in technology advancements. Additionally, humanitarian settings, including damage assessments and delivery in cloud-covered or rural areas, emerging adoption rate of the system. The rising demand for high-resolution radar imaging, accurate monitoring, scalable delivery platforms, and real-time data analysis, in various applications, is recolonizing the importance of synthetic aperture radar systems worldwide.

Latest Innovative Approaches in Synthetic Aperture Radar Technology- 2025

NASA and the Indian Space Research Organisation (ISRO) are planning to launch the NISAR (NASA-ISRO Synthetic Aperture Radar) satellite mission in June 2025, from the Satish Dhawan Space Centre in India. The first mission to carry both L-band and S-band radar, NISAR is scheduled to scan Earth's land and ice surfaces twice every 12 days, including its ecosystems, ice masses, and geological processes.

(Source:https://science.nasa.gov)

The Asia-Pacific Conference on Synthetic Aperture Radar (APSAR), an international conference devoted to SAR technology development and applications, and co-sponsored by the Institute of Electronics, Information and Communication Engineers (IEICE), Japan, and the IEEE Geosciences and Remote Sensing Society (GRSS), will be held in October 2025, Matsue, Shimane, Japan. The event theme will be “SAR Technology and Applications for Sustainability.”

(Source:https://www.spaceagenda.com)

Capella Space is likely to unveil its Spotlight Ultra and Colorized Sub-aperture Images, with its latest imaging modes, including sub-daily revisit rates and global coverage, in 2025, with the aim of bringing new standards in resolution and fidelity.

(Source:https://www.capellaspace.com)

Synthetic Aperture Radar MarketCompanies

- Lockheed Martin Corporation

- Northrop Grumman

- AIRBUS

- Thales

- General Atomics

- SDT Space & Defence Technologies Inc.

- BAE Systems

- L3Harris Technologies, Inc.

- Maxar Technologies

- IMSAR LLC

- Metasensing

Recent Developments

- In March 2025, the Mohammed Bin Rashid Space Centre (MBRSC) and its partner, the Republic of Korea's Satrec Initiative, launched the Etihad-SAT satellite on a SpaceX Falcon 9 rocket from the Vandenberg Air Force Base in California, USA. (Source:https://qazinform.com)

- In February 2025, Sisir Radar, a pioneering DeepTech startup specializing in cutting-edge radar technology, developed the world's highest-resolution L-band Synthetic Aperture Radar (SAR) under the leadership of Dr. Tapan Misra, former Director of the Space Applications Centre (SAC), ISRO, and the Physical Research Laboratory (PRL). The development is bringing novel standards for remote sensing and radar imaging.

(Source:https://syntheticapertureradar.com)

Segment Covered in the Report

By Component

- Receiver

- Transmitter

- Antenna

By Platform

- Ground

- Airborne

By Frequency Band

- X Band

- L Band

- C Band

- S Band

- K, Ku, Ka Band

- VHF/UHF Band

- Others

By Mode

- Single

- Multi

By Application

- Defense

- Commercial

- Public Safety

- Environmental Monitoring

- Natural Resource Exploration

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting