What is the Positive Material Identification (PMI) Market Size?

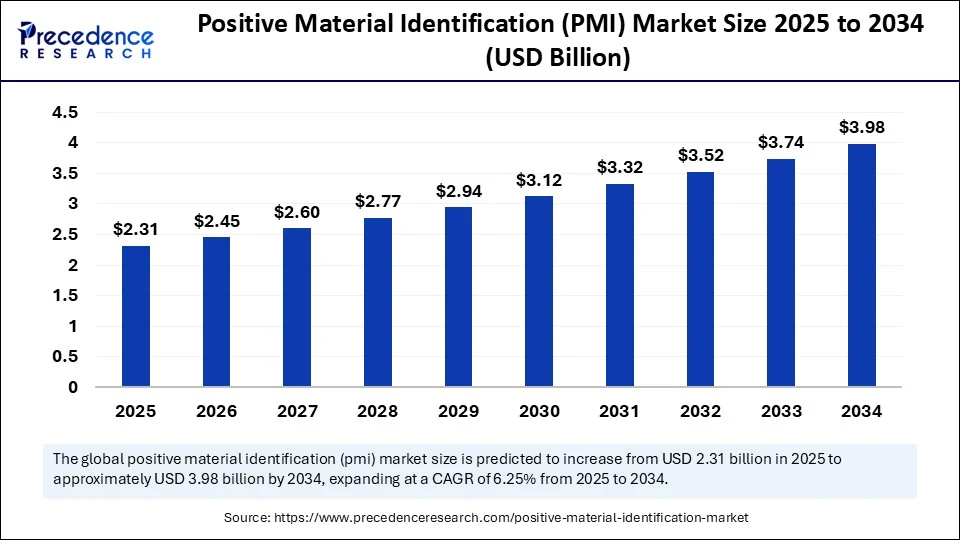

The global positive material identification (PMI) market size is calculated at USD 2.31 billion in 2025 and is predicted to increase from USD 2.45 billion in 2026 to approximately USD 3.98 billion by 2034, expanding at a CAGR of 6.25% from 2025 to 2034. The growth of the market is attributed to stringent regulations regarding material safety and compliance. Moreover, the rising demand for enhanced quality control solutions is expected to boost the growth of the market during the forecast period.

Positive Material Identification (PMI) MarketKey Takeaways

- In terms of revenue, the global positive material identification (PMI) market was valued at USD 2.17 billion in 2024.

- It is projected to reach USD 3.98 billion by 2034.

- The market is expected to grow at a CAGR of 6.25% from 2025 to 2034.

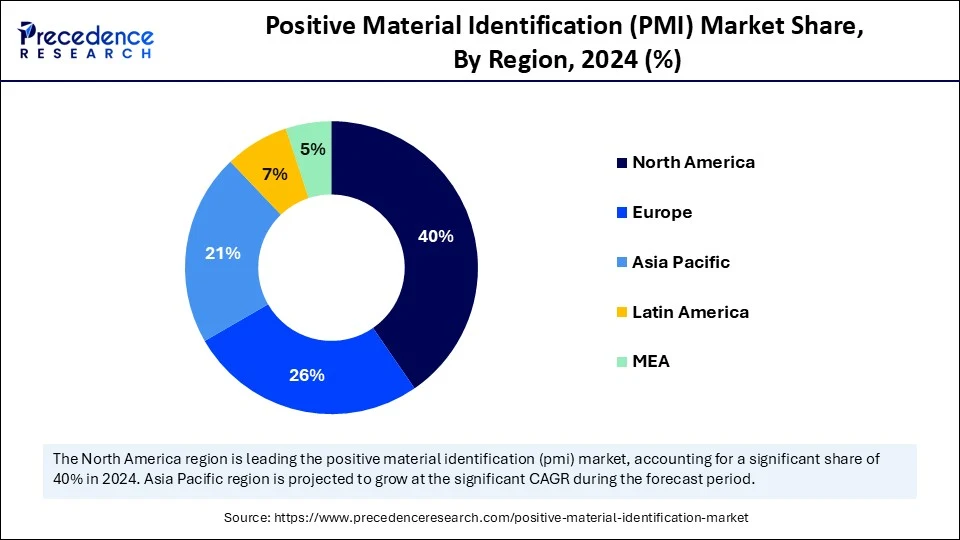

- North America dominated the largest market share of 40% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By technique, the x-ray fluorescence (XRF) segment held the biggest market share in 2024.

- By technique, the laser-induced breakdown spectroscopy (LIBS) segment is expected to grow at the highest CAGR between 2025 and 2034.

- By offering, the equipment segment held the largest market share in 2024.

- By offering, the services segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By form factor, the handheld/portable segment generated the highest market share in 2024.

- By form factor, the fixed/benchtop segment is expected to grow at a notable CAGR between 2025 and 2034.

- By end-use industry, the oil and gas segment accounted for significant market share in 2024.

- By end-use industry, the pharmaceuticals segment?is expected to grow at a remarkable CAGR between 2025 and 2034.

Artificial Intelligence: The Next Growth Catalyst in Positive Material Identification (PMI)

Artificial Intelligence (AI) is revolutionizing the market for positive material identification by making material analysis faster, more accurate, and predictive. AI-powered algorithms are now being integrated into PMI systems to automatically interpret spectral data from XRF (X-ray fluorescence) and LIBS (Laser-Induced Breakdown Spectroscopy) analyzers, reducing human error and analysis time. These systems can learn from thousands of data points, improving their ability to detect trace elements, inconsistencies, or contamination in real-time. In the future, AI could also support automated robotic PMI inspections in production lines, mines, or hazardous environments, minimizing human exposure and improving consistency. Overall, AI is making PMI more intelligent, scalable, and aligned with Industry 4.0 standards, transforming it from a manual quality checkpoint into a smart manufacturing tool.

Strategic Overview of the Global Positive Material Identification (PMI) Industry

Positive material identification (PMI) refers to a non-destructive testing (NDT) method used to determine the chemical composition of materials, primarily metals and alloys, ensuring they meet the required specifications. PMI is widely employed in industries where material verification is critical, such as oil and gas, aerospace, manufacturing, power generation, and pharmaceuticals. PMI enhances quality control, safety compliance, and traceability in supply chains.

The positive material identification (PMI) market is steadily expanding as industries demand greater accuracy, traceability, and quality assurance. PMI is increasingly being integrated into quality control processes to prevent costly failures and maintain compliance with global safety standards. Applications span across sectors such as petrochemicals, automotive, metallurgy, and aerospace, where even minor material discrepancies can have serious consequences. Advancements in portable analyzers and non-destructive testing (NDT) are enhancing on-site inspection capabilities. The shift toward automated and real-time material verification solutions is also driving growth. As industries move toward zero-defect manufacturing and predictive maintenance, the PMI becomes a non-negotiable element in quality frameworks.

Positive Material Identification (PMI) MarketGrowth Factors

- Growing adoption of handheld XRF and LIBS analyzers for quick and accurate field inspections.

- Rising emphasis on regulatory compliance in high-risk industries such as nuclear, aviation, and oil & gas.

- Integration of PMI with Internet of Things and data logging systems for real-time material traceability.

- Increasing demand for non-destructive testing (NDT) methods across industries.

- Surge in aftermarket and third-party inspection services, especially in emerging economies.

- Movement toward cloud-based data management for storing and sharing PMI reports across supply chains.

Market Outlook

- Market Growth Overview: The Positive Material Identification (PMI) market is expected to grow significantly between 2025 and 2034, driven by innovation I analytical techniques, integration with Industry 4.0 and AI, and expanding application industries.

- Sustainability Trends: Sustainability trends involve energy efficiency in device operation, waste reduction and e-waste management, and eco-friendly manufacturing and materials.

- Major Investors: Major investors in the market include Thermo Fisher Scientific Inc., Ametek Inc., Bruker Corporation, Olympus Corporation, and Hitachi High-Tech Analytical Science.

- Startup Economy: The startup economy is focused on AI for data analysis and automation, novel sensors and hardware miniaturisation, and service-based models.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.98 Billion |

| Market Size in 2025 | USD 2.31 Billion |

| Market Size in 2024 | USD 2.17 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.25% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technique, Offering, Form Factor, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Stringent Quality Regulations

The need for strict adherence to quality and safety regulations is a primary driver of the positive material identification (PMI) market. Industries such as petrochemicals, power generation, and aerospace operate under high-risk conditions, making accurate material identification essential to avoid catastrophic failures. PMI ensures that the right materials are used in construction and manufacturing processes, minimizing the risk of breakdowns and enhancing product reliability. Regulatory bodies worldwide mandate material traceability, reinforcing the demand for reliable positive material identification (PMI) market technologies.

Additionally, the rising complexity of supply chains has made in-house and third-party verification of raw materials increasingly important. As quality control becomes more stringent, the adoption of PMI increases across sectors. PMI also helps with quality control by confirming that materials meet the required specification, reducing defects, and improving product reliability.

Restraint

High Cost and Skill Gaps Slow Adoption

Despite strong potential, the positive material identification (PMI) market faces notable challenges. The high initial costs of advanced equipment, particularly XRF and LIBS analyzers, can deter small- and mid-sized enterprises from investing. Additionally, training requirements for operating these technologies and interpreting results can be a barrier in regions with a limited technical workforce. Some companies also hesitate to adopt PMI due to concerns over equipment calibration, maintenance, and certification. In low-volume applications, manual verification methods are still preferred due to their lower cost. Moreover, limited awareness of the benefits of PMI restricts widespread adoption. Addressing these issues is essential to unlock the market's full potential.

Opportunity

Smart Technologies Unlock New Applications

The evolution of PMI instruments into smarter, more compact, and connected devices is opening new avenues of growth. Integration of PMI instruments with AI, cloud platforms, and wireless data sharing allows companies to monitor material data across multiple sites in real-time. Sectors like renewable energy, biomedical devices, and 3D printing are emerging as new users of positive material identification solutions to validate the integrity of advanced materials. There is also a growing need for mobile, rugged analyzers that can operate in harsh field conditions, such as offshore rigs or remote mines. SMEs and contract manufacturers are also entering the PMI ecosystem to meet global supplier qualification standards. These trends present companies in the PMI space with ample opportunities to diversify their offerings and enter previously untapped markets.

Technique Insights

Why Did the X-ray Fluorescence (XRF) Segment Dominate the Positive Material Identification (PMI) Market in 2024?

The X-ray fluorescence (XRF) segment dominated the market with the largest share in 2024 due to its speed, accuracy, and non-destructive nature. It is widely preferred for identifying metal alloys and verifying elemental composition across a broad range of industries. XRF devices are user-friendly and require minimal sample preparation, making them ideal for both field and lab use. Their effectiveness in detecting heavy metals and trace elements strengthens their relevance in quality assurance. XRF analyzers are also cost-efficient for long-term use, which appeals to both large enterprises and smaller firms. As compliance requirements grow, XRF remains the cornerstone technology for material verification.

The laser-induced breakdown spectroscopy (LIBS) segment is expected to grow at the fastest CAGR during the forecast period due to its rapid, real-time material analysis capabilities. LIBS enables surface-level and depth profiling with minimal sample destruction, making it suitable for high-precision applications. Its ability to detect light elements like lithium, aluminum, and beryllium gives it an edge where XRF falls short. Portable LIBS devices are gaining traction in industries like aerospace and battery manufacturing. Technological advancements are making LIBS more compact and affordable, facilitating wider adoption. As advanced materials emerge, LIBS is becoming a go-to tool for modern material testing needs.

Offering Insights

How Does the Equipment Segment Dominate the Market in 2024?

The equipment segment dominated the positive material identification (PMI) market in 2024 due to the increased demand for handheld, benchtop, and integrated testing systems. Companies heavily rely on these tools to carry out accurate, on-site, and real-time analysis of materials. XRF and LIBS analyzers are leading the pack in terms of installations and upgrades. Technological advances have made the equipment more user-friendly, compact, and data-integrated. Industries with high-risk operations prioritize owning in-house positive material identification devices for operational efficiency and safety assurance. As the backbone of the positive material identification process, the equipment segment is expected to continue seeing consistent growth in the near future.

The services segment is expected to grow at the fastest rate in the upcoming period, driven by companies seeking flexible, third-party inspection solutions. Outsourced testing enables businesses to access expert-level analysis without incurring the high costs associated with owning specialized equipment. This model is particularly popular in emerging markets and among small to medium-sized enterprises. Field testing, mobile labs, and rental services are expanding to meet client needs for compliance and traceability. Regulatory audits and global supply chains are prompting more companies to validate materials externally. As operational outsourcing expands, positive material identification services are becoming a crucial component of the quality assurance ecosystem.

Form Factor Insights

What Made Handheld/Portable the Dominant Segment in the Positive Material Identification (PMI) Market in 2024?

The handheld/portable segment dominated the market while holding the largest share in 2024 and is expected to continue its growth trajectory in the coming years, driven by its convenience and growing field-based applications. Technicians can easily carry handheld PMI devices to factories, construction sites, or pipelines for instant material verification. Their rugged design, fast analysis time, and wireless data transfer capabilities add to their appeal. These tools are especially useful in the oil & gas, aerospace, and metal recycling industries. With improvements in battery life and user interface, portable analyzers are replacing traditional lab testing in many cases. They represent the future of mobile, efficient quality control.

The fixed/benchtop segment is expected to grow at a notable rate over the projection period, driven by the need for high-volume, high-accuracy lab testing. These systems provide more stable conditions and enhanced precision, making them ideal for R&D and certified labs. As quality standards rise, many industries are investing in dedicated inspection stations. Benchtop systems also enable deeper elemental analysis, particularly when combined with AI-driven software. They are gaining popularity in the pharmaceutical, electronics, and specialty metals sectors. With increasing automation, benchtop positive material identification solutions are becoming central to in-house testing strategies.

End-User Insights

How Does the Oil & Gas Segment Lead the Market?

The oil & gas segment dominated the positive material identification (PMI) market in 2024, due to the increased need for material verification in high-risk environments. Pipelines, pressure vessels, and structural components must meet strict standards to prevent leaks or failures. Positive material identification ensures alloy grades and corrosion-resistant materials are correctly identified before use. Regular inspection of existing infrastructure also drives recurring demand. Given the industry's emphasis on safety and regulation, portable positive material identification tools are standard equipment. With ongoing exploration and refinery development, oil & gas will remain the top end-user segment.

The pharmaceuticals segment is expected to grow at the fastest rate in the market during the forecast period, as it emphasizes strict material validation for safety and compliance. Positive material identification is used to confirm the quality of stainless-steel equipment, components, and raw materials in the pharmaceutical industry. Regulatory bodies, such as the FDA, demand high traceability, prompting companies to implement in-house or third-party positive material identification checks. With increasing reliance on stainless and specialty alloys, positive material identification helps maintain product integrity and prevent contamination. Handheld analyzers are being deployed in cleanrooms and production lines for spot checks. As quality standards tighten, the pharmaceutical sector's reliance on positive material identification increases.

Regional Insights

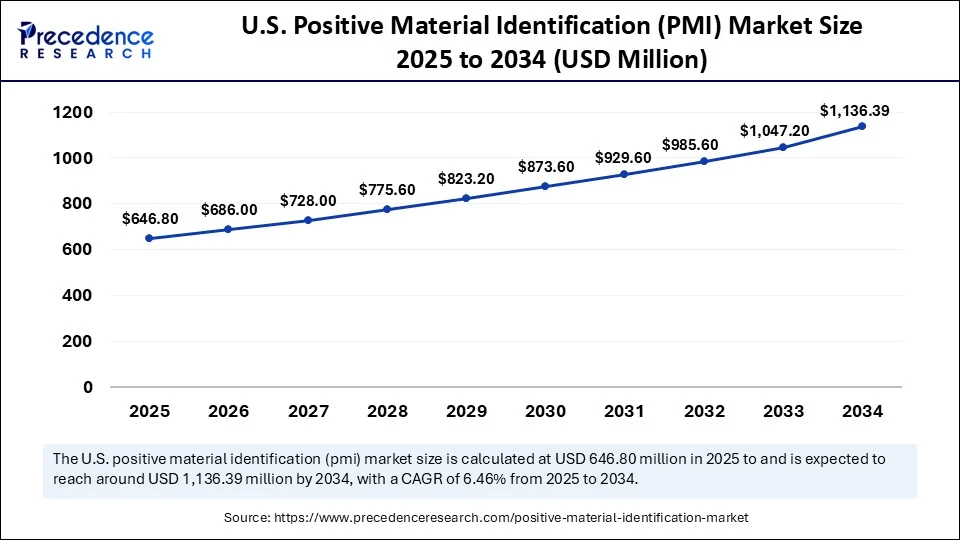

U.S. Positive Material Identification (PMI) Market Size and Growth 2025 to 2034

The U.S. positive material identification (PMI) market size is exhibited at USD 646.80 million in 2025 and is projected to be worth around USD 1,136.39 million by 2034, growing at a CAGR of 6.46% from 2025 to 2034.

North America: U.S. Positive Material Identification (PMI) Market Trends

North America dominated the market by holding the largest share in 2024 due to its highly regulated industrial environment and early adoption of advanced technologies. It has stringent material validation requirements in sectors like aerospace, defense, oil & gas, and nuclear energy. Major positive material identification device manufacturers and testing service providers are headquartered in the region, supporting innovation and accessibility. The presence of a skilled workforce and established infrastructure also accelerates market maturity. North American companies are increasingly integrating positive material identification into digital quality control systems for traceability and audit readiness. As ESG and safety compliance gain prominence, the regional demand for precise material verification remains strong.

The U.S. is a major contributor to the regional market growth, driven by its highly regulated industries such as aerospace, defense, and oil & gas. Stringent compliance standards from organizations such as OSHA, ASME, and the FDA drive demand for accurate material verification. U.S.-based manufacturers are early adopters of advanced technologies, such as handheld XRF and AI-integrated PMI tools. The country also has a strong network of third-party inspection services and certified labs offering PMI solutions. Continuous innovation and a skilled workforce further strengthen the U.S. position as a global leader in the positive material identification (PMI) market.

Asia Pacific: China Positive Material Identification (PMI) Market Trends

Asia Pacific is expected to grow at the fastest CAGR during the forecast period, driven by rapid industrialization, infrastructure expansion, and export-focused manufacturing. Countries such as China, India, Japan, and South Korea are investing heavily in petrochemical plants, automotive production, and large-scale infrastructure, where PMI is crucial. The growing presence of international manufacturing standards in the region is boosting the need for material traceability and compliance. Additionally, government initiatives aimed at enhancing industrial safety and reducing counterfeiting are supporting the adoption of PMI solutions. The rising focus on material safety and quality is boosting the adoption of PMI instruments.

China is emerging as a key player, supported by massive investments in construction, shipbuilding, and heavy manufacturing. As the country tightens its industrial quality and safety standards, PMI is becoming increasingly important across supply chains. The rise of Chinese OEMs exporting to global markets has accelerated the need for internationally accepted material verification practices. Local production of PMI equipment is also growing, making devices more affordable and accessible. With strong government support and increasing awareness about material quality, China is poised to become a dominant player in the positive material identification (PMI) market.

Value Chain Analysis of the Positive Material Identification (PMI) Market

- Research & Development (R&D) and Design

This initial stage focuses on innovating core analytical technologies like X-ray Fluorescence (XRF) and Optical Emission Spectrometry (OES), and developing new advanced methods such as Laser-Induced Breakdown Spectroscopy (LIBS).

Key Players: Thermo Fisher Scientific Inc., Olympus Corporation, Bruker Corporation, Hitachi High-Technologies - Corporation, AMETEK Inc.

Component Manufacturing & Assembly

This stage involves sourcing high-quality electronic components, specialised detectors, X-ray tubes, and optical systems, followed by the assembly of these parts into robust, reliable analytical instruments (both portable and benchtop).

Key Players: Thermo Fisher Scientific Inc., Olympus Corporation, Bruker Corporation, Hitachi High-Technologies - Corporation, Shimadzu Corporation.

Distribution & Sales

Products are distributed globally through a network of direct sales teams, specialised equipment distributors, and channel partners to reach various end-user industries such as oil & gas, aerospace, and automotive manufacturing.

Key Players: OEMs' direct sales forces, authorised regional distributors, and online marketplaces. - Equipment Operation & Services

Post-sale activities include providing on-site inspection services, calibration, maintenance, repairs, and operator training.

Key Players: SGS, Bureau Veritas, Intertek Group PLC, TUV Rheinland, Element Materials Technology, Applus+, and specialised local NDT service providers. - End-User Application

This final stage is where the PMI equipment and services are actually utilised in critical applications to verify material composition, ensure safety compliance, and prevent material mix-ups or component failures.

Key Players: Oil & Gas refineries, aerospace manufacturers, automotive production lines, power generation plants, scrap metal recyclers.

Top Companies in the Positive Material Identification (PMI) Market & Their Offerings:

- Thermo Fisher Scientific: Thermo Fisher is a major provider of handheld X-ray Fluorescence (XRF) analysers and other spectroscopic instruments used for Positive Material Identification (PMI).

- Hitachi High-Tech Analytical Science: Hitachi High-Tech offers a range of PMI instruments, including handheld XRF and Optical Emission Spectrometry (OES) devices, for precise material verification and testing. They contribute by providing fast, accurate elemental analysis solutions for demanding industrial environments.

- Bruker Corporation: Bruker provides advanced analytical instruments, including handheld XRF and OES systems, that are used extensively for PMI applications in metal production and scrap recycling. Their focus on high performance and precision supports critical quality control and safety compliance in various industries.

- Olympus Corporation: Olympus (now EVIDENT) is a significant player with a strong portfolio of handheld XRF and Laser-Induced Breakdown Spectroscopy (LIBS) analysers used for non-destructive PMI testing. They contribute by delivering portable, robust solutions for material chemistry confirmation in the field and in laboratories.

- Ametek Inc. (SPECTRO): SPECTRO, an AMETEK company, is a leading provider of OES and XRF spectrometers that are widely used for highly accurate PMI. They contribute by delivering laboratory-grade analysis capabilities in field-ready equipment.

- Oxford Instruments: Oxford Instruments offers a range of high-performance X-ray and optical tools for material characterisation, including handheld XRF analysers used for PMI. Their contributions focus on providing precise, fast, and reliable material analysis solutions.

- Rigaku Corporation: Rigaku specialises in X-ray analysis technology, providing XRF and other analytical instruments for various industrial applications, including PMI. They contribute innovative and reliable solutions for elemental analysis in material verification.

- Elvatech Ltd.: Elvatech develops and manufactures portable and desktop XRF analysers that are used for elemental analysis and PMI in industries like scrap metal sorting and jewellery assessment. They contribute by providing compact and efficient testing devices.

- SciAps Inc.: SciAps is an innovator in handheld LIBS and XRF analysers, offering some of the fastest and smallest devices for in-field material identification. They contribute by making advanced, high-speed analysis accessible in rugged, portable formats.

- Nexxis: Nexxis is an Australian company providing advanced robotic inspection equipment and non-destructive testing (NDT) services, including solutions that integrate PMI technology. They contribute by enabling safer and more efficient inspections in difficult-to-access industrial environments.

- SGS S.A.: SGS is a global leader in inspection, verification, testing, and certification services, offering extensive third-party PMI services to industries like oil & gas and power generation. They contribute by ensuring regulatory compliance and material integrity through independent testing services.

- Bureau Veritas: Bureau Veritas is a global testing, inspection, and certification services provider that offers comprehensive PMI and NDT services to ensure material quality and safety in critical infrastructure. They contribute by verifying compliance and reducing operational risks for clients worldwide.

- Element Materials Technology: Element provides a wide range of materials testing, inspection, and certification services, including specialised PMI testing for aerospace, oil & gas, and other vital industries. They contribute to material integrity and safety through their expert analysis and testing capabilities.

- Applus+ Laboratories: Applus+ provides testing, inspection, and certification services, including advanced NDT and PMI, for various industries. They contribute by offering reliable material verification solutions that ensure quality control and safety compliance.

- TUV SUD: TUV SUD is a leading certification, testing, auditing, and advisory services firm that offers NDT and PMI services to ensure the safety and reliability of industrial components and systems. They contribute by verifying compliance with international standards and minimising material failure risks.

- Intertek Group: Intertek is a global quality assurance provider offering NDT and PMI services to confirm material composition in industries like power generation and petrochemicals. They contribute by ensuring material quality and compliance with required specifications.

- TSI Incorporated: TSI specialises in measurement instruments for aerosols, air flow, and other applications, including instruments that may have indirect relevance to material processing quality control.

Metrohm: Metrohm is a global leader in analytical chemistry, providing instruments for chemical analysis, some of which might be used in laboratory settings for detailed material analysis relevant to quality control. - Positive ID Lab: This likely refers to specialised laboratories or services offering PMI testing, rather than a single major manufacturer. They contribute by providing expert, in-depth material identification services for industries requiring rigorous analysis.

- AXT Pty Ltd: AXT is a leading supplier of high-tech scientific equipment in Australia, including instruments from major brands like Bruker and Olympus that are used for PMI applications.

Positive Material Identification Market Companies

- Thermo Fisher Scientific

- Hitachi High-Tech Analytical Science

- Bruker Corporation

- Olympus Corporation

- Ametek Inc. (SPECTRO)

- Oxford Instruments

- Rigaku Corporation

- Elvatech Ltd.

- SciAps Inc.

- Nexxis

- SGS S.A.

- Bureau Veritas

- Element Materials Technology

- Applus+ Laboratories

- TUV SUD

- Intertek Group

- TSI Incorporated

- Metrohm

- Positive ID Lab

- AXT Pty Ltd

Recent Development

- In January 2025, Evident launched its next-generation Vanta Element handheld XRF analyzer series built for fast, accurate alloy identification in scrap sorting, metal manufacturing, and precious metals testing. Available in two affordable models, the new series offers enhanced comfort, speed, and ease of use to increase confidence in every alloy analysis.

(Source: https://ims.evidentscientific.com)

Segments Covered in the Report

By Technique

- X-ray Fluorescence (XRF)

- Optical Emission Spectroscopy (OES)

- Laser-induced breakdown spectroscopy (LIBS)

By Offering

- Equipment

- Portable/Handheld Analyzers

- Benchtop Analyzers

- Software

- services

- Onsite PMI Services

- Third-party Laboratory Testing

By Form Factor

- Handheld/Portable

- Fixed/Benchtop

By End Use

- Oil & Gas

- Aerospace & Defense

- Metals & Mining

- Automotive

- Power Generation

- Pharmaceuticals

- Scrap & Recycling

- Construction

- Manufacturing/Industrial Fabrication

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting