What is the Automated Material Handling Equipment Market Size?

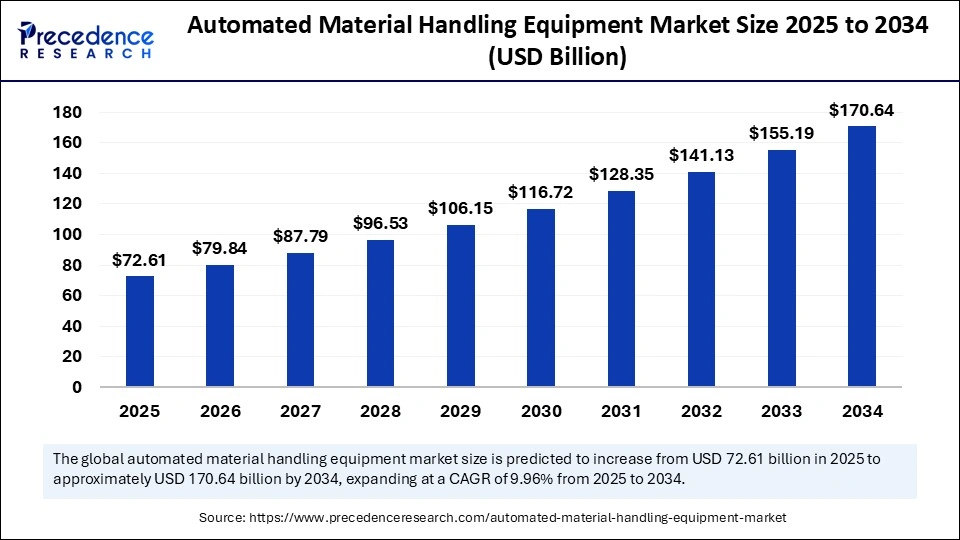

The global automated material handling equipment market size accounted for USD 72.61 billion in 2025 and is predicted to increase from USD 79.84 billion in 2026 to approximately USD 185.16 billion by 2035, expanding at a CAGR of 9.81% from 2026 to 2035. The growth of the market is driven by the rising demand for industrial automation. Moreover, the Industry 4.0 evolution is fostering the adoption of automated solutions, boosting the market's growth.

Automated Material Handling Equipment MarketKey Takeaways

- In terms of revenue, the automated material handling equipment market is valued at $72.61 billion in 2025.

- It is projected to reach $185.16 billion by 2035.

- The market is expected to grow at a CAGR of 9.81% from 2026 to 2035.

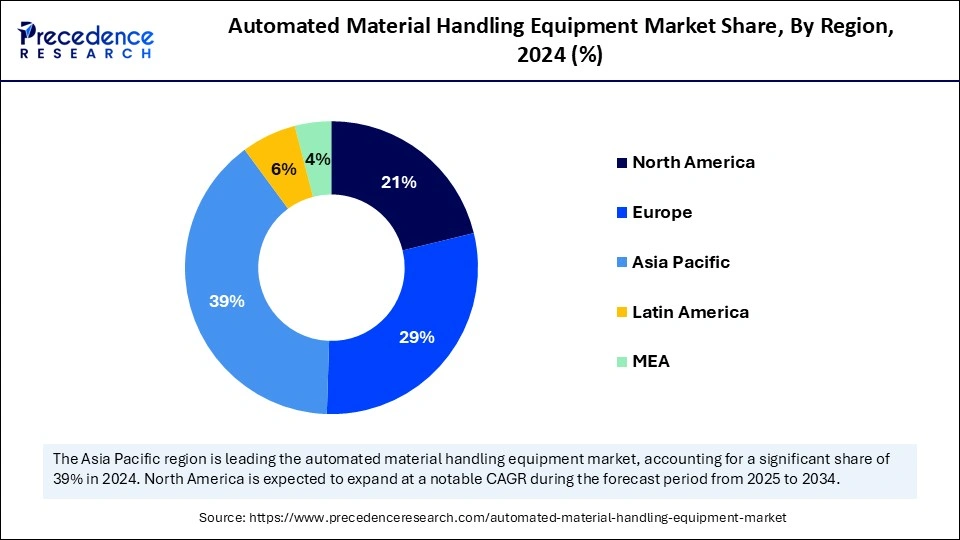

- Asia Pacific dominated the automate material handling equipment market by holding more than 39% of revenue share in 2025.

- North America is projected to grow at a notable CAGR of 11.5% from 2026 to 2035.

- By product, the robots segment held the major revenue share of 23% in 2025.

- By product, the warehouse management system segment is projected to grow at a significant CAGR between 2026 and 2035.

- By system, the unit load material handling segment contributed the biggest market share in 2025.

- By system, the bulk load material handling segment is expected to expand at a significant CAGR from 2026 to 2035.

- By vertical, the e-commerce segment dominated the market in 2025.

Market Overview

The automated material handling equipment market is witnessing rapid growth, driven by the rising demand for automation in various industries, including healthcare, warehouse, logistics, manufacturing, and e-commerce. Industries are focusing on adopting automated equipment to enhance efficiency, streamline production, and meet safety regulations. For instance, businesses are focusing on warehouse safety to comply with safety regulations, such as New OSHA compliance requirements, by adopting AI-driven safety monitoring solutions. Updating workplace safety regulations require the adoption of advanced automated solutions to enhance labor safety and productivity, including automated material handling equipment solutions. Additionally, labor shortages are encouraging businesses to invest in automated equipment to reduce reliance on manual labor and provide safe work environments. Government initiatives like Industry 4.0 are contributing to the adoption of automated solutions in material handling operations.

Companies' Investments in Material Handling Equipment - 2025

- According to the Modern Materials Handling survey report published in 2025, 64% of companies are investing in automation solutions and 32% in technology, including warehouse management systems (WMS) and enterprise resource planning (ERP). A Significant portion of companies have increased their spending on material handling solutions by 20% compared to FY 2024.

- Over the next two to three years, the investment is expected to rise by 35% for materials handling equipment.

- 30% of companies are projected to buy materials-handling equipment by the end of 2025, with a plan to spend around USD 402,000 on materials-handling equipment.

(Source: https://www.mmh.com)

How is AI Impacting the Automated Material Handling Equipment Market?

Artificial Intelligence is transforming the market for automated material handling equipment with advanced process optimization, smarter picking strategies, and operational resilience in various settings. AI helps in maintaining equipment in changing as well as difficult environments. AI also enables the automation navigation of material handling equipment, helps to reduce labor costs, and enhances efficiency. AI capabilities are being extended with dynamic decision-making, real-time monitoring, and smart resource deployment, enhancing speed, precision, accuracy, and efficiency in automated material handling equipment. AI also helps develop a connected and intelligent ecosystem for automated material-handling equipment. It optimizes the movement of materials, reduces bottlenecks, and improves throughput.

What are the Major Factors Supporting the Growth of the Automated Material Handling Equipment Market?

- Demand for Automation: The demand for automation has increased in industries to enhance efficiency and reduce labor costs. Automated material handling equipment allows streamlined processes and more efficient material flow true a distribution channel.

- Expanding E-commerce Platforms: The e-commerce platforms have expanded significantly, enabling access to efficient and precise products and contributing to higher adoption of automated material handling equipment.

- Industry 4.0: Governments worldwide are supporting the Industry 4.0 initiatives and smart manufacturing, creating opportunities for the integration of automated material handling equipment.

- Lean Manufacturing: Industries are aligning automated material handling equipment with lean manufacturing to enhance process optimization and minimize inventory and waste.

- Sustainability and Green Technology: The surge in the integration of eco-friendly practices with material handling equipment, including Electric Forklifts, Solar-Powered Conveyors, and Recyclable Materials, to enhance the brand's eco-conscious image and comply with regulatory requirements, fostering a shift toward automated material handling equipment.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 185.16 Billion |

| Market Size in 2025 | USD 72.61 Billion |

| Market Size in 2026 | USD 79.84 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.81% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, System,Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Lean Manufacturing and Just-In-Time (JIT) Practices

The rising demand for lean manufacturing and just-in-time (JIT) practices is the major factor driving the growth of the worldwide automated material handling equipment market. Lean manufacturing helps to reduce waste, streamline operations, and offer continuous improvements in the process. On the other hand, just-in-time (JIT) practices reduce inventory levels and enable receiving materials just in time for production. These philosophies benefit automated material handling equipment by reducing waste, improving productivity, improving accuracy and responsiveness, and reducing labor costs.

Restraint

High Initial Investment

Automated vehicles, conveyor systems, and robotics require high upfront investments. Automated material handling equipment needs to be set up and integrated with advanced systems. Additionally, the need for specialized training and maintenance processes of these solutions escalates operational costs. The significant upfront cost for equipment and installation limits the adoption of automated material handling equipment, especially across small and medium-sized enterprises.

Opportunity

Autonomous Mobile Robots (AMRs)

Autonomous Mobile Robots (AMRs) hold a dynamic future for global automated material handling equipment. Autonomous mobile robots optimize material transport, reduce labor costs, and enhance productivity, flexibility, adaptability, scalability, and workplace safety. Robotics technology enables flexible and scalable material handling solutions. Autonomous mobile robots (AMRs) further help to improve efficiency and productivity in manufacturing and production environments. The ability of autonomous mobile robots to enhance accuracy in order fulfillment and other logistic operations ensures their dynamic position in various industries, including e-commerce, manufacturing, healthcare, and pharmaceuticals.

Segment Insights

Product Insights

The robots segment dominated the automated material handling equipment market with the largest revenue share of 23% in 2025. This is mainly due to the increased adoption of robotic material handling equipment in various industries like manufacturing, warehouses, packaging, and logistics. Robots, including articulated robots, SCARA robots, and Delta robots, are largely being used in high-speed picking, packaging, assembly, inspection, and material handling. Mobile robots and collaborative robots have gained popularity for their flexibility and agility in material handling operations. The ability of robots to perform hazardous operations, with improved workplace safety and reduced human accidents, drives the demand for robotic material handling solutions in industries.

The warehouse management system segment is projected to grow at a significant CAGR in the coming years. The warehouse management system improves the efficiency and productivity of automated material-handling equipment. This system can offer real-time tracking and management, help to provide high-speed response, and enhance customer experience. The warehouse management system automates the material handling process and minimizes human intervention, making warehousing digitalizing. The warehouse management system connects various components of automated material handling equipment, enabling seamless integration and automation operations.

System Insights

The unit load material handling segment held the largest share of the automated material handling equipment market in 2025. Unit load material handling, such as palletizing and depalletizing, automates the loading and unloading process, which helps to improve efficiency and reduces labor costs. This system transports pallets and containers through warehouses, streamlining material flow. The expanded e-commerce platform is driving demand for unit load material handling systems for handling goods. It enhances accuracy and order fulfillment.

The bulk load material handling segment is expected to expand at a significant rate in the upcoming period. The bulk load material handling systems include conveyors, automated guided vehicles (AGVs), and robotic solutions. The system streamlines material flow, improves manufacturing productivity and efficiency, and enhances accuracy in distribution. The adoption of bulk load material handling systems is high among e-commerce, logistics, manufacturing, and production sectors to enhance material handling to optimize the production process.

Vertical Insights

The e-commerce segment held the largest share of the automated material handling equipment market in 2025 and is expected to expand at a steady growth rate during the forecast period due to increased demand for automated material handling equipment in e-commerce companies. The expansion of e-commerce platforms is driving the adoption of automated material handling equipment for managing their warehouses and fulfilling orders. E-commerce operations require high-speed and efficient solutions, driving the need for automated material handling equipment to enhance overall operations and accuracy. E-commerce companies need efficient logistics and supply chain management, leading to an increased need for automated material handling equipment, including robots, conveyors, and sortation systems, to streamline operations and enhance efficiency. The expanding e-commerce platform and its commitment to improving customer experiences are fostering segment growth.

- In March 2025, a global leader in sustainable paper-based packaging automation solutions for e-commerce and industrial supply chains, Ranpak Holdings Corp., showcased its novel range of packaging and material handling solutions, including Print'it!, PaperWrap, and Rabot at ProMat 2025.(Source: https://www.businesswire.com)

Regional Insights

What is the Asia Pacific Automated Material Handling Equipment Market Size?

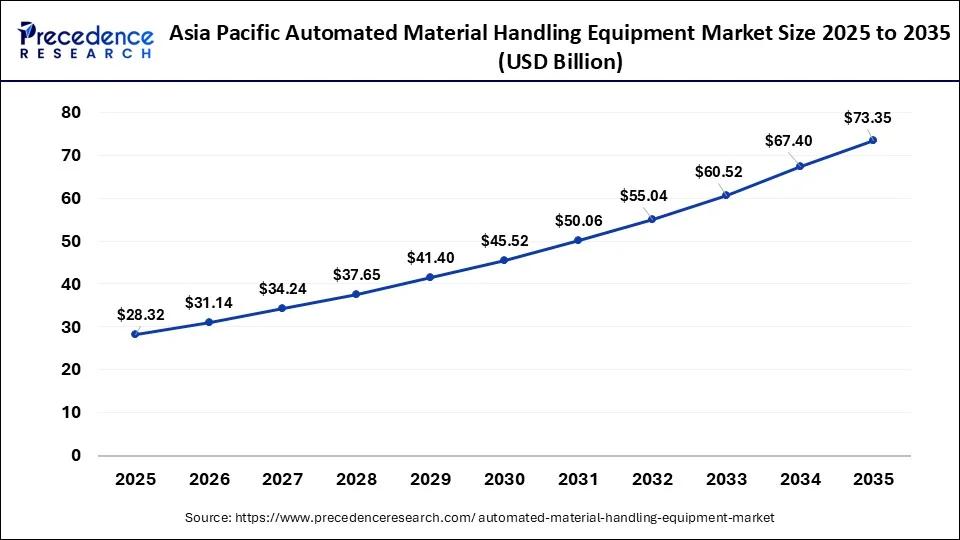

Asia Pacific automated material handling equipment market size was exhibited at USD 28.32 billion in 2025 and is projected to be worth around USD 73.35 billion by 2035, growing at a CAGR of 9.98% from 2026 to 2035.

Asia's Stronghold on the Market

Asia Pacific accounted for the highest market share of 39% in 2025, driven by its large manufacturing capability. The region is the hub of manufacturing, boosting the need for automation solutions. There is heightened adoption of automation solutions across industries to improve efficiency, reduce labor costs, and enhance safety standards. Automated storage and retrieval system (AS/RS) systems have become critical to supply chain functions, and regional companies have increased demand for reliable after-sales support, including system upgradation, quick access to spare parts, and timely servicing, contributing to innovation and development of advanced automation solutions. Additionally, the rise of e-commerce boosted the adoption of automated material-handling equipment in the region.

China Automated Material Handling Equipment Market Trends

China is a major player in the regional market, owing to the country's strong focus on automation and robotics. China's large manufacturing and production sector for automobiles, logistics, healthcare, and pharmaceuticals are driving the adoption of automation. Additionally, government support and investments in smart technologies and the adoption of Industry 4.0 foster market growth.

India On Way to Lead the Asian Automated Material Handling Equipment Market in the Upcoming Period

India is a significant player in the regional market, witnessing notable growth due to government initiatives and support for industrial automation and strategies for collaborative approaches among key companies. Companies are investing heavily in automated solutions to enhance efficiency, streamline operations, and reduce labor costs. Additionally, the rapid expansion of the e-commerce industry is boosting the need for advanced solutions to meet order fulfillment requirements.

- In February 2025, a global leader in power management and a provider of IoT-based smart green technologies, Delta, launched its novel D-Bot series of Collaborative Robots (Cobots) in the Indian market. These robots have up to 30 kg payload capabilities and a speed of 200 degrees per second. They are designed to empower industries with smarter, more efficient production processes, such as electronics assembly, packaging, materials handling, and even welding.(Source: https://www.eletimes.com)

Industrial Expansion Fostering the Adoption of Automated Material Handling Equipment in North America

North America is expanding at a remarkable CAGR of 11.5% during the forecast period from 2026 to 2035, driven by increased industrialization. North America is home to some of the major key players. The well-established infrastructure, such as transportation networks and logistics, fosters industrial advancements. The region is focusing on expanding its manufacturing sector. The expanding e-commerce platforms are further contributing to the demand for automated material handling equipment for efficient operations.

The U.S. is leading the regional market due to its strong focus on technological innovation. The well-established manufacturing and logistics industry of the U.S. is fostering the adoption of cutting-edge solutions to streamline their operations, reduce labor costs, and comply with regulatory workplace standards. There is a high rate of adoption of automated technology and robots for material handling, supporting the growth of the market.

Europe's Growing Automated Material Handling Equipment Industry

Europe is anticipated to witness notable growth in the forecast period, mainly due to region-wide adoption of Industry 4.0 initiatives. This, in turn, drives the demand for automated material handling equipment. Europe is witnessing significant growth in the e-commerce industry. The region has an advanced manufacturing sector, supporting the market's growth. Rising investment in innovative technologies and stringent regulations for workplace and labor safety are fostering regional market growth. Countries like Germany, the UK, France, and Italy have robust logistics and manufacturing sectors, creating the need for automated material handling equipment.

Germany Automated Material Handling Equipment Market Trends: The region's growth is fueled by a strong emphasis on sustainability and efficiency, driven by regulatory frameworks that promote green technologies. Various initiatives to enhance logistics efficiency and reduce carbon footprints are underway, encouraging investments in automated solutions. Integration with Industry 4.0 technologies such as IoT, AI, and real-time data analytics is enabling predictive maintenance and optimized material flow.

Latin America's Growing Automated Material Handling Equipment Industry

Latin America is expected to witness substantial growth in the market, driven by increasing industrialization, rapid urbanization efforts, and a rising demand for efficient supply chain solutions. Countries like Brazil and Mexico are leading players as they are supported by government initiatives aimed at enhancing manufacturing capabilities and logistics efficiency.

Brazil Automated Material Handling Equipment Market Trends: The country is witnessing a high demand for robotics and automated systems, particularly in sectors like e-commerce and manufacturing. As companies strive to optimize their operations, the region is set to become a crucial hub in the upcoming years.

MEA's Growing Automated Material Handling Equipment Industry

The Middle East and Africa are expected to witness steady growth in the upcoming years. This growth and development is driven by increasing investments in infrastructure and logistics and a rising demand for efficiency in supply chain operations. Governments in the region are seen increasingly promoting automation in order to enhance productivity and boost competition, thus leading to market expansion. Countries like the UAE and South Africa are leading players.

Saudi Arabia Automated Material Handling Equipment Market Trends: The country's market landscape has a mix of both local and international players, all of whom are exploring opportunities in this emerging market. As the region continues to invest in technology and infrastructure, the potential for automated material handling solutions is expected to grow even more.

Automated Material Handling Equipment Market Companies

- Honeywell International Inc.

- Daifuku Co., Ltd.

- Toyota Material Handling International

- KION GROUP AG

- Schaefer Systems International, Inc.

- Hyster-Yale Materials Handling, Inc.

- JBT

- Jungheinrich AG

- Hanwha Group

- KUKA AG

Recent Developments

- In May 2025, a global systems integrator and consulting firm, Reply, received recognition for the sixth consecutive year as a Visionary in the 2025 Gartner Magic Quadrant for Warehouse Management Systems (WMS). The company is well known for its advanced, AI-powered warehouse management solutions. (Source: https://via.ritzau.dk)

- In March 2025, the Material Handling Equipment (MHE) Vision was launched by Gather AI. This AI-driven MHE camera system is designed to advance real-time material handling visibility and warehouse efficiency. (Source: https://www.sdcexec.com)

- In March 2025, a pallet-moving autonomous mobile robot (AMR) was unveiled by Ocado Intelligent Automation (OIA), part of Ocado Group, at ProMat 2025. The robotic system navigates warehouses to automate several warehouse workflows, like cross-docking, bulk-item picking, putaway, and pallet movement.(Source:https://www.therobotreport.com)

Segment Covered in the Report

By Product

- Robots

- Automated Storage and Retrieval System (AS/RS)

- Unit Load

- Mid & Mini Load

- Vertical Lift Module (VLM)

- Carousel

- Shuttle

- Conveyor Systems

- Sortation Systems

- Cranes

- Warehouse Management System (WMS)

- Collaborative Robots

- Autonomous Mobile Robots (AMR)

- Goods-to-Person Picking Robots

- Self-driving Forklifts

- Autonomous Inventory Robots

- Unmanned Aerial Vehicles

- Automated Guided Vehicle (AGV)

- Tow Vehicle

- Unit Load Carrier

- Pallet Truck

- Forklift Truck

- Hybrid Vehicles

- Others

By System

- Unit Load Material Handling

- Bulk Load Material Handling

By Vertical

- Automotive

- Semiconductor & Electronics

- E-commerce

- Healthcare

- Metals & Heavy Machinery

- Food & Beverages

- Chemicals

- 3PL

- Aviation

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting