What is Automated Test Equipment Market Size?

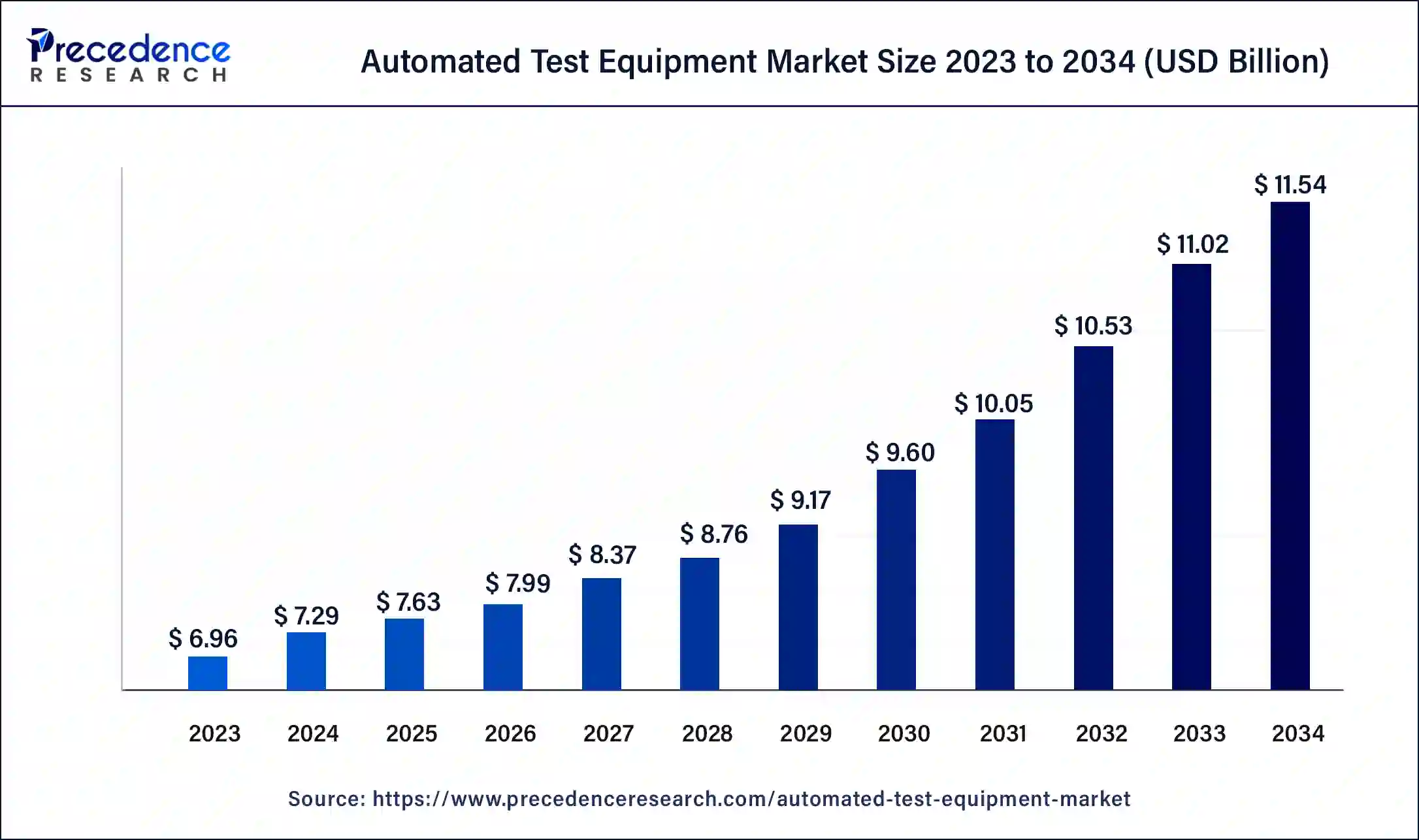

The global automated test equipment market size is calculated at USD 7.63 billion in 2025 and is predicted to increase from USD 7.99 billion in 2026 to approximately USD 12.04 billion by 2035, expanding at a CAGR of 4.67% from 2026 to 2035.The automated test equipment market is driven by the rising complexity of semiconductor devices.

Market Highlights

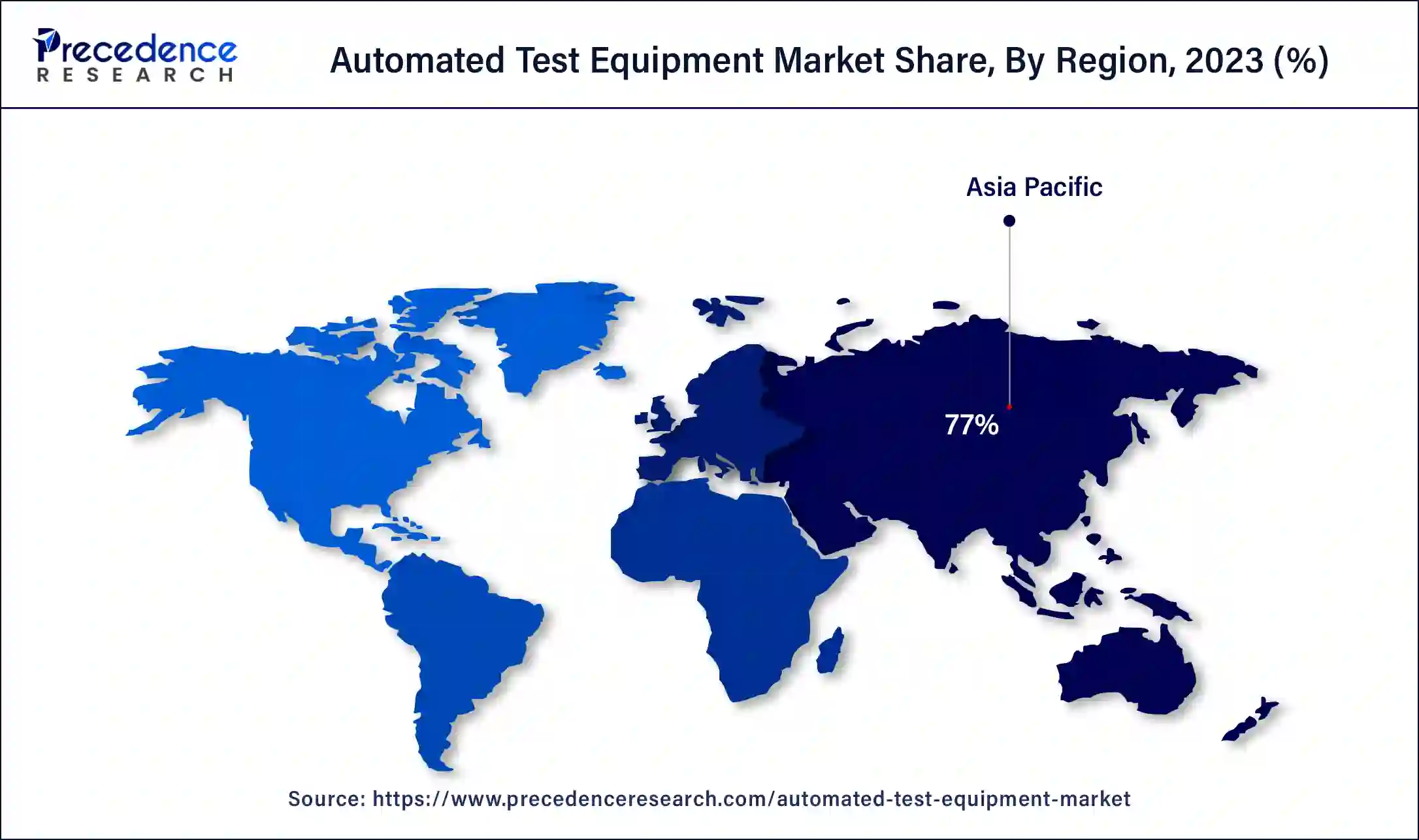

- Asia Pacific led the global market with the largest market share of 77% in 2025.

- By Product, the non-memory ATE segment has held the largest revenue share of 67% in 2025.

- By End Use, the IT and telecommunication segment has held the highest market share of 50% in 2025.

Artificial Intelligence: The Next Growth Catalyst in Automated Test Equipment

Artificial intelligence has revolutionized automation testing by enhancing efficiency, accuracy, and speed. By leveraging machine learning, natural language processing, and data analytics, AI tools can streamline the testing process, decrease human error, as well as adapt to changes in software development. With regular tool usage, the training data accumulates, which improves the accuracy along with effectiveness of the machine learning models. This continuous feedback loop permits the AI system to learn and adapt and also refines capabilities over time.

Technological Advancement

Technological advancements in the automated test equipment market feature 5G, next-gen wireless technologies, industry 4.0, and software-centric ATE platforms. Software-centric ATE platforms improve testing capacity, supporting companies' productivity. Industry 4.0 and smart manufacturing techniques are adopted to analyze the need for an ATE system to achieve efficient production and product quality. 5G and next-gen wireless technologies promote infrastructure and communication devices highly driven for ATE systems. The modular and flexible ATE system helps in adapting to the ATE system, identifying testing requirements, and developing a low-cost, effective strategy.

Advances in semiconductor manufacturing exemplify the intricacy of electronic systems, which is escalating the demand for advanced ATE solutions. The valuable investment of technology in various markets, such as automotive, aerospace, and defense, is contributing to the automated test equipment market indirectly. The innovation and development enhance and favor other sectors as well. AI and machine learning are popular technologies igniting the market. The technology helps to analyze data and predict maintenance.

Automated Test Equipment Market Growth Factors

The rapid growth of the automotive and semiconductor industry is expected to drive the market growth. The surge in demand for high quality consumer electronics products will contribute positively towards the market growth. The semiconductor companies deploy the automated test equipment in order to amplify the performance capability, speed of operation and to reduce the cost of production of the semiconductor devices. These attributes are expected to drive the growth of the automated test equipment market.

The rise in demand for the System on chip devices will fuel the market growth. Also, the increase in electronics components in the automobiles and the rapid increase in demand for the electric vehicles in the market is anticipated to boost the market. Furthermore, with the enhancement of technology integrated with the design complexity of the electronic components that needs essential testing are the factors that will positively impact the growth of the automated test equipment market.

The rise in demand for the implementation of 5G technology across the world is the major factor in the telecom industry that is expected to drive the market growth. On 27th April 2021, Marvin Test Solutions, Inc. a provider of innovative test solutions for military, aerospace, and manufacturing organizations announced that, its product TS-900e-5G production test system for 5G mm wave semiconductor devices is extensively used by the semiconductor manufacturers. The extensive use of these solutions is due to the attribute that it enables manufacturers to meet high-throughput production demands for mm Wave semiconductor devices. TS-900e-5G is ideal for both wafer probing and package test with support for most popular production automation and handling tools. Moreover, the advancements in the semiconductor manufacturing processes along with the expansion of the wireless networks across the globe will significantly impact the growth of the automated test equipment market.

The rise in demand for the automated test equipment's across diverse industry verticals such as consumer electronics, IT and telecommunications, defense, automotive, healthcare and others is expected to foster the market growth rate. It also helped in reducing the producing cost and the time utilized in the manufacture of the devices. It helps in checking the performance of the electronic devices and this helps in preventing a faulty device from entering into the market. All these factors are estimated to fuel the growth of the automated test equipment market.

The presence of favorable Government policies for the development of semiconductor devices, and the heavy investments made by the Government of the developing nation such as China, India, Taiwan and others to produce advanced semiconductor manufacturing plants is estimated to drive the growth of the automated test equipment market.

- The surge in demand for high-quality consumer electronics products will contribute positively to market growth.

- Semiconductor companies deploy automated test equipment to amplify the performance capability, speed of operation, and reduce the cost of production of the semiconductor devices. These attributes are expected to drive the growth of the automated test equipment market.

- The rise in demand for the System on Chip devices will fuel market growth. Also, the increase in electronics components in automobiles and the rapid increase in demand for electric vehicles in the market are anticipated to boost the market.

- Furthermore, with the enhancement of technology, the design complexity of the electronic components requires essential testing.

- The rise in demand for the implementation of 5G technology across the world is a major factor in the telecom industry that is expected to drive market growth.

- Moreover, the advancements in the semiconductor manufacturing processes, along with the expansion of the wireless networks across the globe, will significantly impact the growth of the automated test equipment market.

- The rise in demand for automated test equipment across diverse industry verticals such as consumer electronics, IT and telecommunications, defense, automotive, healthcare, and others is expected to foster the market growth rate.

- The presence of favorable Government policies for the development of semiconductor devices, and the heavy investments made by the Government of developing nations such as China, India, Taiwan, and others to produce advanced semiconductor manufacturing plants are estimated to drive the growth of the automated test equipment market.

Automated Test Equipment Market Trends

- Technological advancement, with the growing adoption of electronic equipment, drives the growth of the market.

- Integration of AI and machine learning helps reduce labor costs, which is a growing trend in the market.

- Government initiatives and policies for smart technology and automated industries fuel the growth of the market.

- Increasing manufacturing sectors for automated equipment to improve precision and accuracy, which results in the growth of the market.

Market Outlook

- Market Growth Overview: The automated test equipment market is expected to grow significantly between 2025 and 2034, driven by the rising complexity of semiconductor devices, demand from automotive and EV applications for testing specialized components.

- Sustainability Trends: Sustainability trends involve energy efficiency and decarbonization, waste minimization and circular economy, and smart manufacturing and data analytics.

- Major Investors: Major investors in the market include Clearlake Capital, Thoma Bravo, Advent International, Iconiq Capital, PeakSpan Capital, and Accel.

- Startup Economy: The startup economy is focused on software-centric and cloud-based testing, AI and machine learning integration, and specialized and niche solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.63 Billion |

| Market Size in 2026 | USD 7.99 Billion |

| Market Size by 2035 | USD 12.04 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.67% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Largest Market | APAC |

| Fastest Growing Market | North America |

| Segments Covered | Product, End User, and Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Market Dynamics

Drivers

How is the growth in consumer electronics the driving force for the automated test equipment market?

The rapid growth of the consumer electronics market, driven by increasing need for smartphones, wearables, tablets, and other connected devices, is a primary catalyst for the automated test equipment market. Automated test equipment plays a crucial role in achieving this by enabling thorough and accurate testing of electronic components. As consumer electronics become more standard, the semiconductor elements within them become more complex and integrated. This necessitates developed automated test equipment systems capable of handling the raised complexity and volume of testing.

Restraint

How are high costs associated with testers and testing components a restraint for the automated test equipment market?

High costs associated with automated test equipment and its components, such as testers and handlers, significantly restrain the market's growth by limiting adoption, mainly among smaller companies as well as price-sensitive sectors. The testers and supporting elements can be very expensive, with some handlers expensive more than the memory tester itself. Operating along with maintaining automated test equipment systems needs specialized knowledge, and the lack of skilled personnel can hamper market expansion.

Opportunity

Why does the rise of advanced technologies like 5G, IoT, and AI act as an opportunity for the automated test equipment market?

The rise of 5G, IoT, and AI technologies is driving significant growth in the automated test equipment market due to the raised complexity and volume of devices demanding testing, the need for faster testing cycles, and the requirement for higher accuracy and reliability. The increased usage of sophisticated semiconductor elements in these technologies also drives the need for automated test equipment, as its importance for ensuring performance along with reliability in demanding environments.

Segment Insights

Product Insights

Based on the Product, the market is divided Non-Memory ATE, Memory ATE and Discrete ATE. In the product segment, the non-memory automated test equipment's is expected to dominate the market with a market share of more than 67% in terms of revenue in 2024. The market dynamics is significantly changed with the innovation of internet of things(IoT) devices and autonomous vehicles. The demand for the automated test equipment's has been increased in the defense and aerospace sectors for developing defect free devices. These attributes act as the drivers of the market.

The non-memory ATE segment dominated the automated test equipment market in 2024. This supremacy is largely due to the rising complexity of integrated circuits (ICs) and the vital role of logic and mixed-signal semiconductors in numerous industries. This segment is important for testing logic along with mixed-signal semiconductors, which are important components in numerous applications, including automotive systems, telecommunications, as well as industrial automation.

Also, the complexities involved in the manufacturing of the semiconductor chips require a robust testing process that can be ensured by the use of automated test equipment's. Therefore, the rise in demand for the semiconductor chips in the market is anticipated to drive the growth of the automated test equipment market.

The memory ATE segment is the fastest growing in the automated test equipment market during the forecast period. The memory ATE segment's rapid expansion is closely associated to the expansion of hyperscale data centers, the acceptance of AI and machine learning, and the proliferation of memory-intensive devices such as smartphones. Memory ATE systems are specifically programmed to test the reliability, functionality, and efficiency of memory chips as well as storage devices.

End UseInsights

Based on the end use, the IT and telecommunication segment accounts for the largest market share contributing more than 50% of the global revenue in 2024. The increasing penetration of semiconductors in the manufacture of IT system components and the telecom equipment will contribute significantly towards the growth of the automated test equipment market. The rise in complexity and performance level of the semiconductor devices used in the electronics products along with the enhancement of semiconductor device technology is anticipated to fuel the market growth.

In the aerospace and defense sector, the electronic devices used should be of high quality as any defect may lead to serious accidents and therefore the manufacturing of the electronic devices for the aerospace and defense sector, must be tested thoroughly with the help of automated test equipments and this attribute is estimated to fuel the market growth.

Furthermore, the increase demand for the consumer electronics products is estimated to drive the market growth. Also, with the surge in demand for the electric vehicles in the automotive industry has positively impacted the growth of the market.

Regional Insights

Asia Pacific Automated Test Equipment Market Size and Growth 2025 to 2034

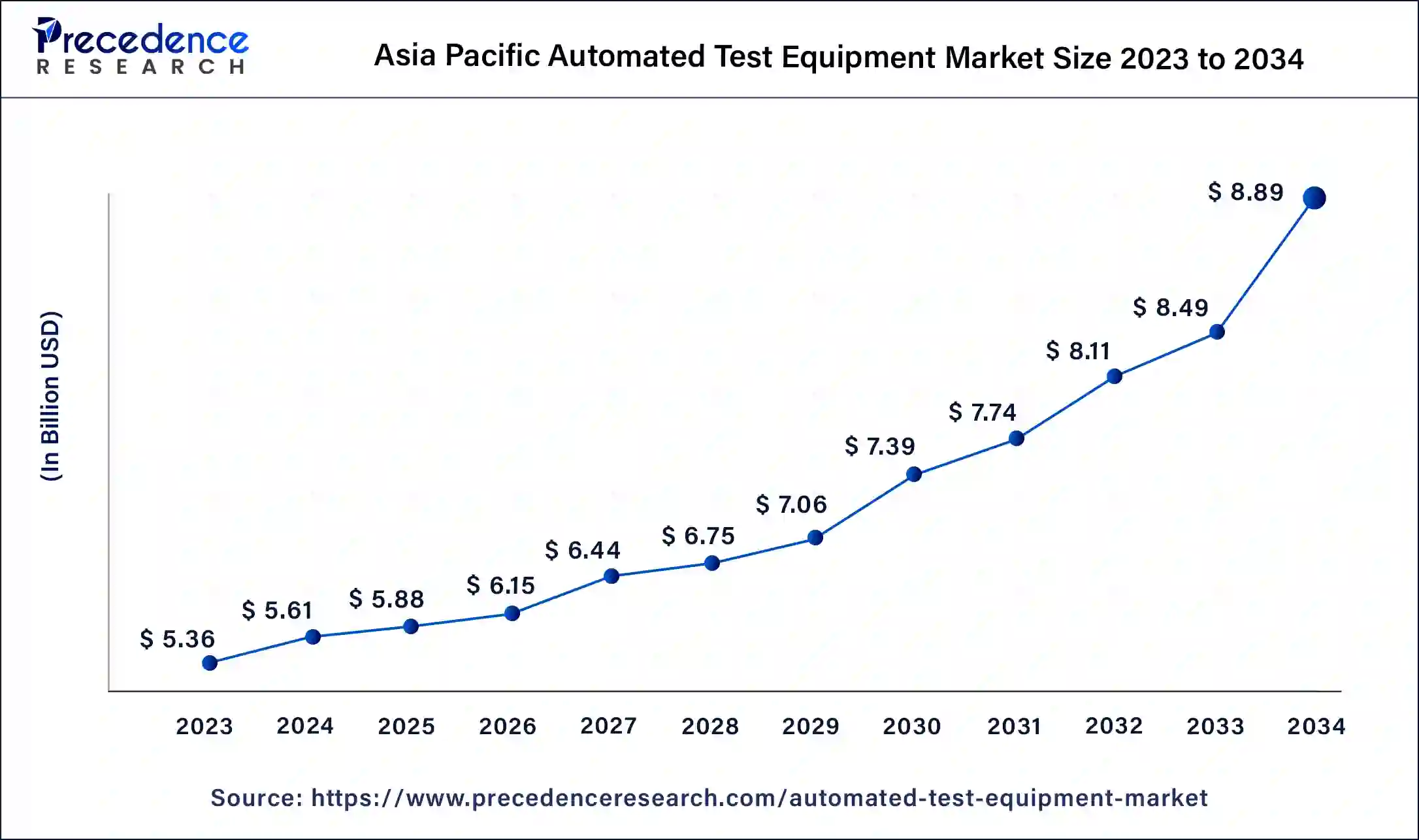

The Asia Pacific automated test equipment market size is exhibited at USD 5.88 billion in 2025 and is projected to be worth around USD 9.28 billion by 2035, growing at a CAGR of 4.67% from 2026 to 2035.

Asia Pacific: India Automated Test Equipment Market Trends

The Asia Pacific region is estimated to dominate the market with the contribution of more than 77% of revenue share in 2023 owing to the presence of major market players in the region. China and Taiwan in this region will dominate the market share. Some of the future technologies that are adapted by the major market players in this region includes faster mixed-signal testers, fine-pitch probe cards, Adaptive testing, advanced Design-For-Test (DFT), design standards and others. Additionally, the supportive Government policieswith the provision of incentives and tax benefits offered by the Government of the developing nations such as India and China for the establishment of the fabrication plants will fuel the market growth. Such establishments of the fabrication plants will facilitate the production of semiconductor equipment's including assembly, packaging, and automated test equipment and these factors are anticipated to drive the growth of the automated test equipment market in the Asia Pacific region.

- Currently, Asia Pacific is dominating the automated test equipment market. The region is known for its popularity of high-tech brands in the semiconductor, electronics, and automotive industries. The rising demand for automation and advancement is exceeding the choices of innovation.

India has seen a significant growth in the market; the growth is driven by increasing demand for automated technology in operations and processes, which helps reduce manual labor and improve efficiency which making it a cost-effective solution for the market, which drives the growth of the market. Rapid shift towards urbanization and consumer demand for electronics, with a growing population, drives the growth in the country. The growth in the semiconductor and high-tech brands sector fuels the demand. Demand for advanced technology in sectors like automotive, aerospace, and defence helps and supports the growth of the market in the country and helps in expansion.

North America: U.S. Automated Test Equipment Market Trends

North America is also expected to witness a remarkable growth in the upcoming yearsowing to the increase in adoption of automated test equipments in the aerospace and defense sector.

The U.S. has seen a significant growth in the automated test equipment market, the growth is seen due to rising consumer demand for electronics like smartphones, connected devices, ensuring quality and reliability, and the rising use and adoption of semiconductor technology due to increasing complexity drives the growth in the country. Government initiatives for advancement boost the demand and market growth. Integration of AI and machine learning in the system helps predict and monitor maintenance and data analysis by improving accuracy. Major players like Aemulus Corporation, Chroma ATE Inc., VIAVI Solutions Inc., and Astronics Corporation play a crucial role in the growth of the market in the country.

Value Chain Analysis of the Automated Test Equipment Market

- Components and Material Supply

This foundational stage involves sourcing the electronic components, materials, and mechanical parts necessary to build the sophisticated ATE systems.

Key Players: Intel, Samsung - Equipment Manufacturing and Assembly

This core stage involves the design, engineering, and assembly of the ATE systems, including the hardware and the complex mechanical structures.

Key Players: Teradyne Inc. and Advantest Corporation, and Cohu, Inc. - Software and Systems Integration

This stage focuses on the development of the sophisticated software that controls the ATE hardware, manages test routines, analyzes data, and integrates with factory automation systems.

Key Players: National Instruments (NI) - Distribution and Sales

The distribution stage involves getting the complex ATE systems to the end-users, often requiring specialized logistics and direct sales teams due to the technical nature and high value of the equipment.

Key Players: Teradyne and Advantest - End-User Applications and Services

The final stage is the application of the ATE by end-users across various industries, including semiconductor manufacturing, automotive electronics, consumer electronics, and medical devices.

Key Players: TSMC, Samsung Electronics, and Intel

Top Companies in the Automated Test Equipment Market & Their Offerings:

- Aemulus Holdings Bhd (“Aemulus”): Aemulus designs and develops a wide range of automated test equipment, primarily serving the semiconductor industry with a focus on testing radio frequency (RF) and mixed-signal components crucial for connectivity devices.

- Chroma ATE Inc.:Chroma is a leading global supplier of precision test and measurement instrumentation, automated test systems, and smart manufacturing systems across a variety of industries.

- Aeroflex Inc.(a subsidiary of Cobham plc, now part of Advent International): Aeroflex, before its acquisitions, was known for its high-performance test and measurement equipment used in the aerospace, defense, and communications industries.

- Astronics Corporation: Astronics develops and manufactures advanced technologies for the aerospace and defense industries, including specialized automated test systems for aircraft maintenance and system validation. Their ATE ensures the reliability and performance of critical avionics and in-flight entertainment systems.

- Advantest Corporation: Advantest is a dominant global producer of automated test equipment, particularly for the semiconductor industry, offering solutions for testing a wide variety of integrated circuits, memory chips, and system-on-chips (SoCs).

- LTX-Credence Corporation(now part of Xcerra Corporation, which was acquired by Cohu, Inc.): LTX-Credence was a major supplier of ATE for the semiconductor industry, focusing on test solutions for mixed-signal, RF, and digital devices.

- Teradyne Inc.: Teradyne is a world leader in automated test equipment for semiconductor testing, industrial robotics, and other electronic testing applications.

- Star Technologies Inc.: (Information limited, potentially a niche or smaller firm) This company likely contributes to the ATE market through specialized components or niche test solutions for specific electronic testing requirements.

- Tesec Corporation: Tesec is a Japanese manufacturer of ATE, specializing in test solutions for discrete semiconductors, memory devices, and integrated circuits. They provide reliable and high-throughput test equipment to major semiconductor manufacturers, particularly in the Asian market.

- Roos Instruments, Inc.: Roos Instruments specializes in high-performance ATE and test services for demanding RF and mixed-signal applications, including wireless communication components and high-frequency devices.

- Marvin Test Solutions Inc.: Marvin Test Solutions provides a broad range of test solutions for the aerospace, defense, and manufacturing industries, including military aviation test systems and PXI-based test equipment.

- Danaher Corporation:Danaher is a diversified science and technology conglomerate and is not a direct ATE manufacturer; however, its operating companies like Fluke, Tektronix (now part of Fortive, a Danaher spin-off), and Hach provide essential test and measurement tools and analytical instruments that support the broader electronics and quality control industries.

Recent Developments

- In February 2025, U.S.-based automated test equipment supplier Teradyne entered a strategic partnership with German semiconductor manufacturer Infineon Technologies to advance power semiconductor testing. (Source - https://chargedevs.com)

- In February 2025, Chroma ATE developed comprehensive semiconductor testing solutions, strategically positioning for the 2025 global market. George Chang, president of Chroma ATE's semiconductor test business unit, highlighted in his opening speech that Chroma has been engaged in the semiconductor sector for over 20 years. (Source - https://www.digitimes.com)

- In December 2024, Japanese semiconductor testing equipment firm Advantest announced its latest testing solutions for advanced applications such as high-end memory, 5G, AI, and high-performance computing (HPC). (Source - https://www.digitimes.com)

Segments Covered in the Report

By Product

- Non-Memory ATE

- Memory ATE

- Discrete ATE

By End User

- Automotive

- Consumer

- Aerospace & Defence

- IT & Telecommunications

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting