What is the Test and Measurement Equipment Market Size?

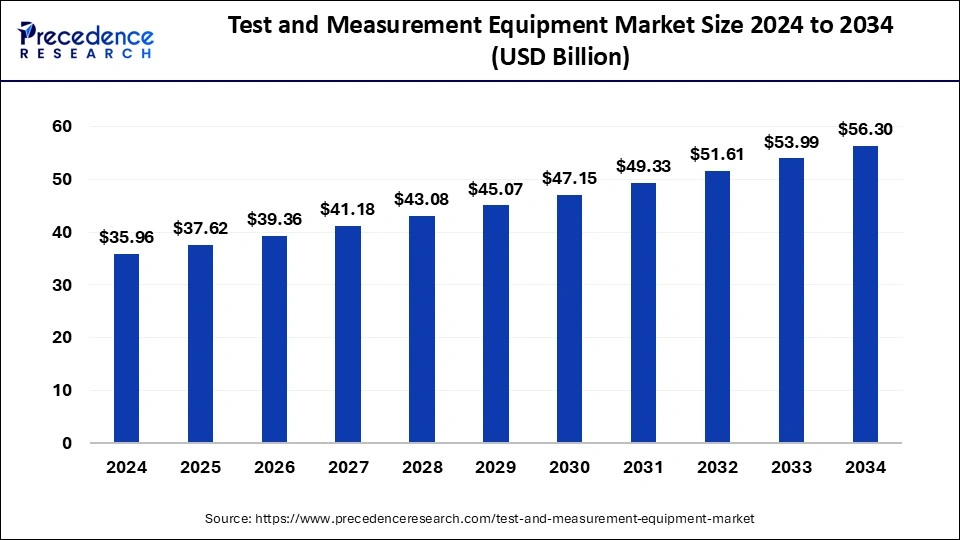

The global test and measurement equipment market size is calculated at USD 37.62 billion in 2025 and is predicted to increase from USD 39.36 billion in 2026 to approximately USD 58.66 billion by 2035, expanding at a CAGR of 4.54% from 2026 to 2035.

Test and Measurement Equipment Market Key Takeaways

- The global test and measurement equipment market was valued at USD 37.62 billion in 2025.

- It is projected to reach USD 58.66 billion by 2035.

- The market is expected to grow at a CAGR of 4.54% from 2026 to 2035.

- The North America test and measurement equipment market size reached USD 37.62 billion in 2025 and is expected to expand around USD 58.66 billion by 2035, at a CAGR of 4.54% from 2026 to 2035.

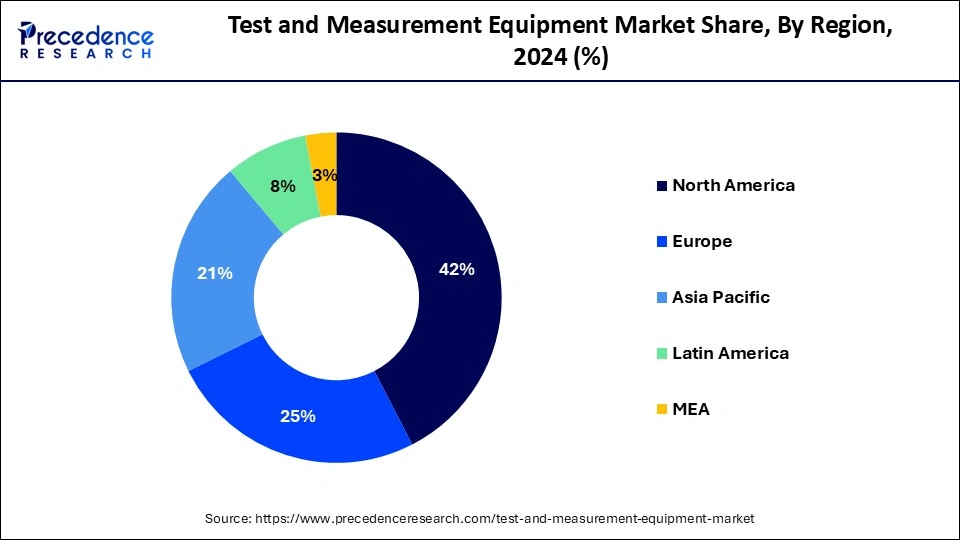

- North America dominated the test and measurement equipment market with the largest revenue share of 42% in 2024.

- Asia Pacific is projected as the fastest-growing region during the forecast period.

- By product, the general-purpose test equipment segment dominated the market and is expected to remain dominant during the forecast period.

- By service type, the calibration services segment dominated the market in 2025.

- By vertical, the healthcare segment held the largest share of the market in 2025.

What is Test and Measurement Equipment?

Tests and measurements are important functions in testing industries' operations and manufacturing processes. It is used in a wide range of industrial applications like automotive, healthcare, consumer electronics, manufacturing, research labs, and others. Tests and measurements are essential in the electronic industry for utilizing quality control, product testing, and debugging of electronic components, PCBs (printed circuit boards), and electronic devices. There are different types of test and measurement equipment available, such as electronic industry, ohmmeters, voltmeters, capacitance meters, ammeters, digital pattern generators, frequency counters, oscilloscopes, and EMF meters. Some of the test and measurement equipment are used to produce signals and help in measuring the object being tested. There are several tests available to test the mechanical properties of products, such as friction, compression, impact, hardness, fatigue, torsion, fatigue, and others. The rising industrialization is driving the growth of the test and measurement equipment market.

Artificial Intelligence: The Next Growth Catalyst in Test and Measurement Equipment

AI is transforming the test and measurement equipment industry by shifting traditional hardware-centric approaches towards intelligent, software-defined, and autonomous testing solutions. By embedding machine learning algorithms, modern instruments can analyze vast amounts of data in real time, enabling faster pattern recognition, anomaly detection, and higher accuracy in product validation.

The integration of AI facilitates predictive maintenance by analyzing usage patterns to forecast equipment failures, significantly reducing downtime and lowering maintenance costs.

Test and Measurement Equipment Market Growth Factors

- The rising implementation of test and measurement equipment in various end-use industries like automotive, consumer electronics, healthcare, aviation, and others are driving the growth of the market.

- The increasing use of test and measurement equipment in testing medical diagnostic equipment to improve diagnostics testing and treatment processes drives the demand for test and measurement equipment.

- The integration of advancements in technologies like IoT, artificial intelligence, modular instrumentations, and complex technologies in the test and measurement equipment that contribute to the growth of the test and measurement equipment market.

- The increasing investment in research and development activities in the expansion of technologies and software upgradation for higher flexibility, functionality, and cost efficiency in technologies that drive the growth of the market.

- The rising expenditure on industrial development and the integration of IoT, 5G technologies, big data analytics, and other industries are further propelling the growth of the test and measurement equipment market.

Test and Measurement Equipment Market Outlook

The test and measurement equipment market is expected to grow significantly between 2025 and 2034, driven by the growing industrial infrastructure, increased focus on productive maintenance and minimizing downtime, and rapid adoption of 5G, internet of things, and AI requires sophisticated testing for complex electronic systems.

Major investors in the market include Keysight Technologies, Rohde & Schwarz, Fortive Corporation (Fluke/Tektronix), National Instruments (NI), and Teledyne Technologies.

Various startup brands are engaged in developing high-quality testing and measurement solutions across the world. The prominent startup companies dealing in measurement equipment consist of CALYPSO instruments, Polar Signals, STPI SMART Lab, and some others.

Sustainability trends involve green technology support, energy-efficient design, and the use of eco-friendly materials.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 58.66 Billion |

| Market Size in 2025 | USD 37.62 Billion |

| Market Size in 2026 | USD 39.36 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.54% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Service Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand from several industrial uses

The rising demand for test and measurement equipment from various end-use industries like automotive, healthcare, IT, telecommunications, electronics, aerospace and defense, and others increases efficiency in workflow and improves productivity and effectiveness. It helps in validating all electronic and electric devices in a wide range of industries. Test and measurement equipment plays an important role in the automotive industry; under the manufacturing and testing of driverless vehicles, connected cars, and autonomous driving cars, there is an increase in demand for test and measurement equipment for testing and optimizing the performance of the vehicles.

The demand for other testing, such as RF testing, is required to test wireless communication standards like Wi-Fi in traditional automotive applications and Long-Term Evolution (LTE). Test and measurement equipment is responsible for every standard testing in the automobile, including automotive radar, infotainment systems, collision avoidance, target simulation, and the new Wi-Fi standard 802.11p. Thus, the rising demand for the automotive industry worldwide is highly contributing to the growth of the test and measurement equipment market.

Restraint

Stringent regulations

The handling of a number of regulations in a wide range of industries and the diverse quality and safety standards of industries like healthcare, pharmaceuticals, food and beverages, and chemicals are limiting the expansion of the test and measurement equipment market. Additionally, the higher cost of the test and measurement equipment is restraining the demand growth of the product, and major industries like electronics, aerospace and defense, automotive, and others industries are preferably choosing the test and measurement equipment on a rental basis, which limits the buying of test and measurement equipment are restraining the growth of the test and measurement equipment market.

Opportunity

Integration of modern technologies

The advancements and integration of the technologies in the test and measurement equipment are driving the opportunity for growth in the market. The test and measurement equipment has seen substantial growth in the industrial expansion of big data analytics, Internet of Things (IoT), and 5G technologies. Technological integration, like power applications, high-speed digital standards, and the evolution of software-as-a-service (SaaS), new software models, and cloud licensing, is driving the expansion of the test and measurement. The rising intervention of the market leader in technology and the ongoing research and development activities on the upgrade of software and product launches drive the growth opportunity in the test and measurement equipment market.

Segment Insights

Form Insights

The immunosuppressors segment contributed the highest share of the scleroderma therapeutics market in 2025. The immunosuppressors segment is leading the market due to its high demand for managing systemic scleroderma by suppressing the overactive immune response. Immunosuppressors help to reduce inflammation and fibrosis. Ongoing innovations in biologics and small-molecule immunosuppressors are the key reasons behind the expanding growth of the segment. Due to the ability to drive control over manifestations of scleroderma, like lung fibrosis and renal involvement, healthcare providers have increased the adoption of immunosuppressors in recent years. With the growing prevalence of scleroderma and the need for effective therapies in reducing disease progression, the segment is expected to continue dominating the market. Moreover, growing regulatory support and investments are driving the segment's success.

In October 2025, the FDA of an amendment to its IND application gave clearance to Adicet Bio's ADI-100, which is an investigational allogeneic CAR-engineered gamma delta T-cell therapy, recently being evaluated in a phase 1 clinical trial (NCT06375993) for lupus nephritis (LN) for patients with IIM and SPS into the trial.

On the other hand, the endothelin receptor antagonist segment is expected to grow at a significant CAGR in the scleroderma therapeutics market during the forecast period. The growth of the segment is anticipated due to its growing adoption in healthcare due to its ability to block the actions of endothelin, a potent blood vessel constrictor, which develops the scleroderma condition. The receptor also effectively manages pulmonary arterial hypertension (PAH), a common complication of scleroderma. The endothelin receptor antagonist is being highlighted due to its ability to improve patients' exercise capacity and reduce the slow progression of disease in patients who are suffering from PAH. The adoption of some endothelin receptor antagonists like Bosentan, Ambrisentan, and Macitentan is high. With the growing need for the management of PAH and other complications of scleroderma, the adoption of segments is expected to boost in the forecast period.

Technology Insights

The systemic scleroderma segment held the dominant share of the scleroderma therapeutics market in 2025. The segment growth is attributed to higher prevalence and greater severity of systemic scleroderma. The increased awareness and advanced diagnosis are driving the growth of the segment. Moreover, an aging population is contributing to the expansion. Systemic scleroderma improves morbidity and mortality by directly affecting inner organs like lungs and kidneys. The growing investments of pharmaceutical companies in the development of innovative treatments for systemic scleroderma.

In March 2024, Cabaletta Bio received the FDA-granted Orphan Drug Designation (ODD) for its CABA-201, an investigational therapy for scleroderma. CABA-201 is being developed as a treatment for autoimmune diseases, and it is a CD19-CAR T cell therapy.

In November 2024, the Scleroderma Research Foundation (SRF) published a peer-reviewed article on CONQUEST, a highly innovative platform clinical study that accelerates the development of new therapies for systemic sclerosis. CONQUEST focuses on early, active systemic sclerosis with interstitial lung disease (SSc-ILD), a serious complication that is the leading cause of death in scleroderma.

However, the localized scleroderma segment is anticipated to grow at the highest CAGR in the scleroderma therapeutics market during the forecast period. Localized scleroderma has properties of limited skin involvement. Localized scleroderma can mostly be treated by utilizing topical medications and phototherapy. Continuous innovations in the development of novel treatments for localized scleroderma, like biologics and small molecules, are fueling the segment expansion. Additionally, the ability of localized scleroderma to be cured by using systemic immunosuppressive therapy drives cutting-edge research in the treatments.

Product Insights

The healthcare segment dominated the test and measurement equipment market with the largest share in 2025. The growth of the segment is attributed to the rising implementation of tests and measurements in the healthcare sector to improve patient and treatment outcomes. Testing and measurement are used to simplify complex and efficient diagnostics to help with the treatment. It also helps in the testing of preventive vaccines and medications. The continuous research on the development and launch of the latest medical devices, personal emergency reporting systems, and patient monitoring systems drives the demand for testing and measurement in the healthcare industry. Additionally, the rising investment in the development of the healthcare industry is further driving the demand for test and measurement equipment in the segment. The automotive and transportation segment is expecting significant growth in the market during the forecast period. The growth of the segment is owing to the rising demand for the automotive industry by the population due to the rising disposable income and the rising tendency to have their own transportation system, which is driving the growth of the automotive and transportation industry. Test and measurement equipment plays an important role in the automotive industry; it is used in every stage of automobile manufacturing, from development to production, quality checking and assurance, safety testing, conformity, workshops, and recycling. Furthermore, the rising advancements in automotive technologies, integration of smart features, and rising competition in the automobile industry are collectively contributing to the expansion of the test and measurement equipment market.

Regional Insights

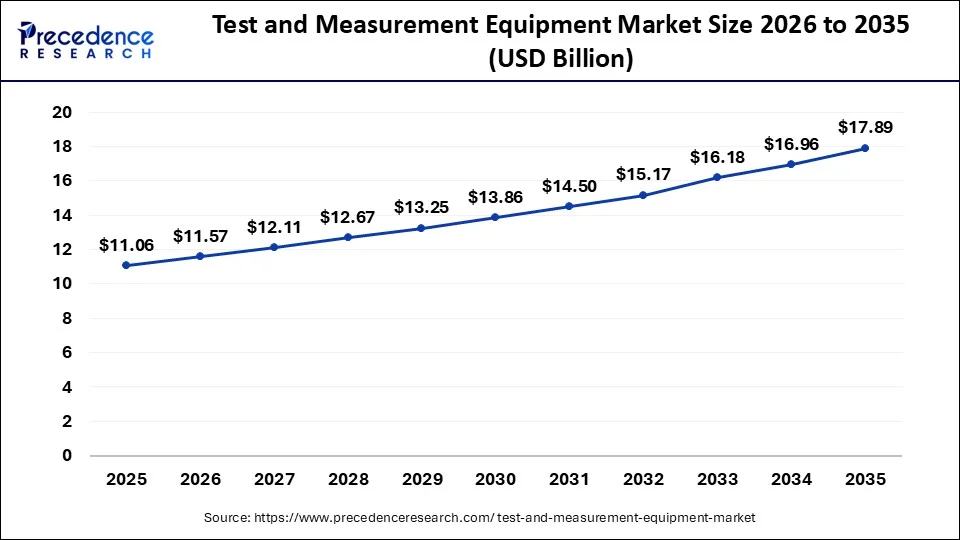

The U.S. test and measurement equipment market size is exhibited at USD 11.06 billion in 2025 and is projected to be worth around USD 17.89 billion by 2035, growing at a CAGR of 4.93% from 2026 to 2035.

North America dominated with the largest share of the market in 2025. The growth of the market is attributed to the availability of well-developed industrial infrastructure such as automotive, electronics,aerospace, and defense, as well as other industries that are contributing to the demand for test and measurement equipment for testing the mechanical properties of industrial devices or components. The rising investment in the infrastructural development of the electronic industry is driving the growth of the test and measurement equipment market. The ongoing research on the development and innovations of electronic products is further driving the expansion of the test and measurement equipment market.

U.S. Test and Measurement Equipment Market Trends

In North America, the U.S. dominated the market owing to the increasing miniaturization and complexity of electronic devices, especially with the surge of IoT, 5G, and AI, which necessitates sophisticated testing to ensure compliance and functionality. Also, rising focus onpredictive maintenance across industries is boosting demand for innovative testing equipment.

Asia Pacific is expecting significant growth during the forecast period. The growth of the market in the region is attributed to the rising regional countries' population and the rising demand for industrialization in the region, which drives the demand for testing and optimizing the process of industries that will positively influence the growth of the market. The rising economic growth in the countries driving the expansion of industries like healthcare, automotive, electronics, telecommunication, aviation, and others are further driving the demand for the test and measurement process, which will drive the growth of the market. Additionally, the rising research and development activities for the expansion of technologies drive the growth of the market in the region.

China Test and Measurement Equipment Market Trends

In Asia Pacific, China dominated the market by holding the largest market share, due to technological advancements, rapid industrialization, and supportive government policies, coupled with the rising emphasis on safety and quality. Additionally, the shift towards industrial automation, likesmart manufacturing and robotics, needs reliable and precise testing and measurement solutions.

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be credited to the growing adoption of high-speed networks and 5G infrastructure across major countries in Europe. Furthermore, the adoption of Industry 4.0 needs advanced measurement and test solutions for data-driven decisions and real-time monitoring, which will impact positive market expansion soon.

Germany Test and Measurement Equipment Market Trends

Germany's Test & Measurement (T&M) sector is defined by the high-precision requirements of Industry 4.0 and the rapid scaling of EV infrastructure. The market is shifting from standalone hardware toward integrated software-and-service ecosystems that facilitate real-time predictive maintenance and 5G network optimization.

Latin America held a considerable share of the industry. The growing demand for high-quality measurement equipment from the automotive sector in several nations, including Brazil, Argentina, Peru, and some others, has driven the market expansion. Additionally, numerous government initiatives aimed at mandating advanced testing equipment in the manufacturing industry are expected to drive the growth of the test and measurement equipment market in this region.

The Middle East and Africa held a notable share of the market. The rising sales of GPTE in numerous countries, including the UAE, Saudi Arabia, South Africa, Qatar, and some others, has driven the market expansion. Also, partnerships among market players and tech providers to develop high-quality testing equipment are expected to boost the growth of the test and measurement equipment market in this region.

Value Chain Analysis of the Test and Measurement Equipment Market

- Research & Development (R&D) and Design

This stage involves designing sophisticated, high-precision instruments and developing proprietary software for data acquisition, analytics, and automation.

Key Players: Keysight Technologies, Rohde & Schwarz, National Instruments (NI), Advantest Corporation, and Anritsu Corporation. - Component Sourcing and Manufacturing

This involves sourcing specialized electronic components, sensors, signal processors, and calibration components to produce hardware components such as oscilloscopes, multimeters, and spectrum analyzers.

Key Players: Teledyne Technologies, Fortive Corporation, Advantest Corporation, RIGOL Technologies, Good Will Instrument Co. (GW Instek). - Distribution and Logistics

This stage encompasses global distribution networks that deliver specialized equipment to diverse industries such as aerospace, automotive, and telecommunications.

Key Players: Keysight Technologies, Rohde & Schwarz, Advantest, and various regional distributors/channel partners.

Test and Measurement Equipment Market Companies

Yokogawa Electric is a Japanese company founded in 1915 that provides industrial automation, control systems, and test and measurement solutions to a wide range of industries. The company's offerings include process control systems like DCS and SCADA, field instruments such as pressure transmitters and flow meters, and a variety of engineering and consulting services.

Rohde & Schwarz is a German technology group headquartered in Munich, focusing on three main divisions: Test & Measurement, Technology Systems, and Networks & Cybersecurity. The company develops, produces, and markets products and solutions for industrial, regulatory, and government customers, aiming to foster technological and digital sovereignty.

Anritsu is a Japanese multinational corporation that develops, manufactures, and sells telecommunications and electronic measurement solutions, as well as quality assurance systems. The company's business segments include Test and Measurement, Product Quality Assurance (PQA), Environmental Measurement, and Sensing and Devices.

Advantest is a Japanese company that is a leading global manufacturer of automatic test equipment (ATE) for the semiconductor industry. Advantest is headquartered in Tokyo and provides systems for testing a wide range of semiconductors, including SoC, memory, and RF test systems, and serves companies in the communications and consumer electronics industries.

EXFO is a Canadian company that develops and supplies a wide range of test, monitoring, and analytics solutions for telecommunications networks, including fiber, 5G, and cloud infrastructure. This company provides intelligent hardware, software, and services to customers like service providers and webscale companies to help them transform and manage their networks.

OWON Technology is a Chinese Electronic Manufacturing Service (EMS) provider and Original Design Manufacturer (ODM) that specializes in IoT and smart home solutions, as well as test equipment and electronic displays. It offers a wide range of services from product research and development to manufacturing for customized and standardized products.

GW Instek, or Good Will Instrument Co., Ltd, is a Taiwanese manufacturer of electronic test and measurement instruments founded in 1975. The company is a leading global provider of affordable and reliable equipment for a wide range of industries, with a product portfolio that includes oscilloscopes, spectrum analyzers, signal sources, and power supplies.

Other Major Key Players

- ADLINK Technology (Taiwan)

- RIGOL Technologies (China)

- Saluki (Taiwan)

- IKM Instrutek (Norway)

- Uni-Trend Technology (China)

- Mextech Technologies (India)

Recent Developments in the Test and Measurement Equipment Industry

- In November 2025, Rohde & Schwarz launched NGT3600. NGT3600 is a new test and measurement equipment that finds applications in numerous industries.

(Source: www.manufacturingtodayindia.com) - In September 2025, GW Instek launched GPP-1000. GPP-1000 is a measurement equipment for designing a wide range of applications.(Source: www.gwinstek.com)

- In April 2025, Bosch launched a new range of testing equipment. This testing equipment is designed for the electric professionals in different parts of the world.

(Source: www.bosch-presse.de)

Segments Covered in the Report

By Product

- GPTE

- MTE

By Service Type

- Calibration Services

- Repair/After-sales Services

By Vertical

- Automotive and Transportation

- Aerospace and Defense

- IT and Telecommunication

- Education and Government

- Industrial

- Healthcare

- Semiconductor and Electronics

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting