What is RF Test Equipment Market Size?

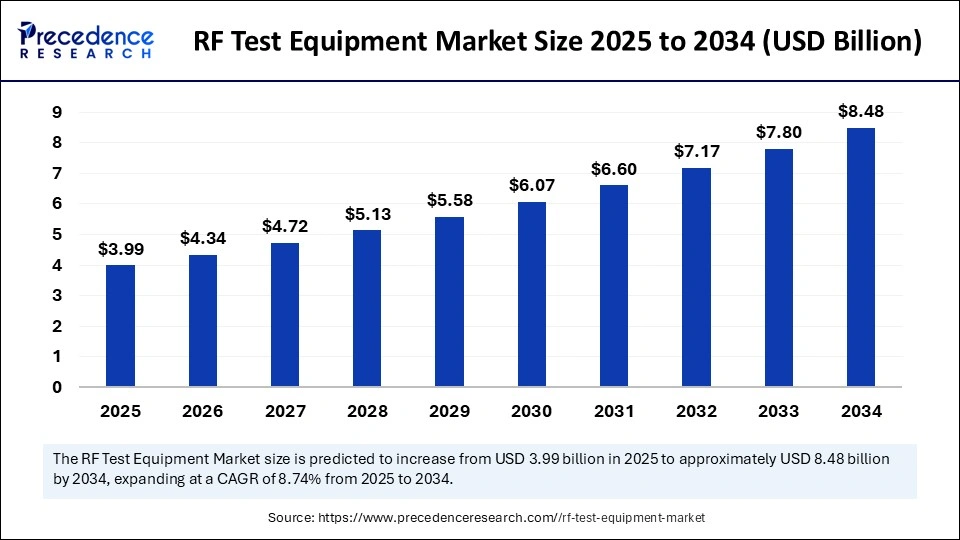

The global RF test equipment market size accounted for USD 3.99 billion in 2025 and is predicted to increase from USD 4.34 billion in 2026 to approximately USD 9.12 billion by 2035, expanding at a CAGR of 8.62% from 2026 to 2035. The increasing adoption of 5G technologies and the high demand for connected devices are boosting the growth of the market.

Market Highlights

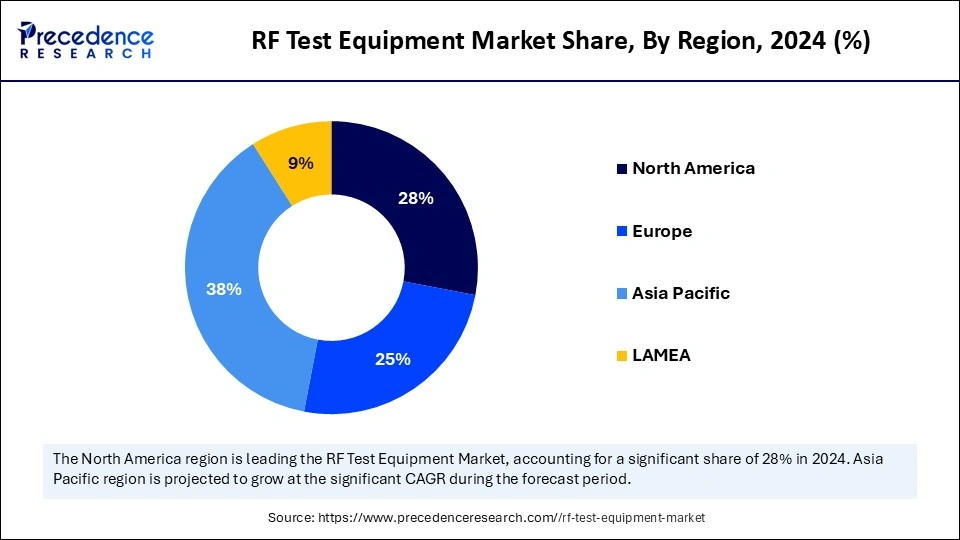

- Asia-Pacific generated the major revenue share of 38% in 2025.

- North America is expected to expand at the fastest CAGR between 2026 to 2035.

- By equipment type, the oscilloscopes segment held the largest revenue share of 28% in 2025.

- By equipment type, the spectrum analyzers segment is growing at a CAGR of 9.83% between 2026 to 2035

- By frequency range, the 1GHz–6GHz segment held the largest revenue share of 31% in 2025.

- By frequency range, the more than 20 GHz segment is poised to grow at a significant CAGR of 10.1% between 2026 to 2035

- By form factor, the benchtop segment contributed the highest revenue share of 48% in 2025.

- By form factor, the modular segment is expanding at a notable CAGR of 10% between 2026 to 2035

- By end-use, the telecommunications segment held the major revenue share of 32% in 2025.

- By end-use, the aerospace & defense segment is expected to grow at a CAGR of 10% between 2026 to 2035

Market Overview

RF test equipment is becoming increasingly vital in today's high-speed, hyper-connected world. RF test equipment plays a pivotal role in validating the performance and reliability of wireless communication systems. As the world leans into 5G, IoT, and autonomous technologies, the demand for sophisticated RF testing tools is growing exponentially across sectors such as telecom, aerospace, automotive, and defense. With the rapid expansion of wireless communication technologies, particularly 5G, IoT, Wi-Fi 6, and satellite networks, the need for advanced testing tools that can ensure signal integrity, compliance, and performance is more critical than ever. RF testing devices are designed to generate, detect, and analyze radio frequency signals, making them indispensable in the research, design, validation, and maintenance of RF-enabled systems.

Industries such as telecommunications, automotive, and healthcare are relying heavily on these instruments to validate their communication protocols and ensure seamless operation of device conditions. A major factor fueling market growth is the global rollout of 5G infrastructure , which demands precise and high-frequency testing capabilities, often up to millimeter-wave bands. The shift from traditional hardware-centric tools to software -defined and modular platforms is also reshaping the landscape, allowing companies to customize solutions, improve scalability, and reduce testing time and cost. In addition, government and standardization bodies around the world are enforcing strict electromagnetic compatibility and radio compliance standards, thereby accelerating the demand for certified, accurate, and flexible RF testing equipment.

Is AI Supercharging the RF Test Equipment Landscape?

Artificial intelligence is revolutionizing RF testing by introducing automated signal analysis, predictive diagnostics, and intelligent calibration. Through machine learning algorithms, AI-enhanced RF test equipment can now detect anomalies more quickly, enhance accuracy, and minimize human error in complex signal environments. This not only speeds up testing processes but also enables real-time adaptability in rapidly evolving network conditions, making AI an indispensable driver of next-generation RF testing efficiency.

What are the Major Trends in the RF Test Equipment Market?

- 5G Development: The global rollout of 5G networks is dramatically increasing demand for RF test equipment capable of high-frequency, low-latency, and massive bandwidth testing. Vendors are focusing on devices that can support sub-6 GHz and millimeter-wave frequencies for both R&D and production testing environments.

- AI-Powered Testing: Artificial Intelligence is increasingly being integrated into RF testing systems to automate signal analysis, pattern recognition, and fault detection. This trend enhances testing speed and accuracy and reduces manual intervention, especially in complex environments like IoT ecosystems and Smart Cities.

- Software-Defined Solutions: Traditional bulky hardware is being replaced by modular, software-configurable platforms, allowing greater flexibility, scalability, and ease of updates. These systems are also enabling remote and cloud-based test execution, which is particularly beneficial for distributed teams.

- Growing Demand from Aerospace and Defense: RF test equipment is witnessing a surge in usage across aerospace, military, and satellite communication sectors, where precision, security, and compliance are paramount. Complex radar systems and mission-critical communication devices demand high-performance testing for frequency stability and signal purity.

- Automotive Electronics and EVs Fueling: The increasing use of radar , infotainment systems, V2X communication, and wireless charging in modern vehicles, especially electric and autonomous ones, is creating new application avenues for RF testing tools in automotive design and manufacturing.

- IoT and Smart Devices Proliferation: As billions of devices connect wirelessly through various RF bands, the need for interference management, network optimization, and protocol compliance is becoming essential. RF test equipment is now a cornerstone in ensuring seamless operation in smart homes , factories, and cities.

- Regulatory and Compliance Pressure: National and international bodies like FCC, ETSI, and ITU are tightening radio frequency regulations, compelling industries to adopt precise and standardized testing protocols. This trend is fueling demand for certified, accurate, and lab-compliant testing tools.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.99 Billion |

| Market Size in 2026 | USD 4.34 Billion |

| Market Size by 2035 | USD 9.12 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.62% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Equipment Type, Frequency Range, Form Factor, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is Wireless Innovation Driving the Demand for RF Testing?

The relentless evolution of wireless technology, especially the deployment of 5G, Wi-Fi 6, and IoT, has made RF test equipment indispensable. These tools ensure optimal performance and signal integrity across countless high-frequency applications. Telecommunications companies, device manufacturers, and infrastructure developers increasingly rely on precise RF testing for tasks ranging from spectrum analysis to network performance validation. In addition, the growing integration of RF components in automotive electronics , defense systems, and medical devices is further boosting the demand for RF test equipment. This expansion into diverse verticals is significantly propelling market growth.

Restraint

What are the Major Factors Hampering the Growth of the RF Test Equipment Market?

The high costs associated with RF test equipment create barriers for small and mid-sized businesses. Advanced systems that test mm-wave frequencies (used in 5G and beyond) are often expensive to procure and maintain, requiring skilled professionals and controlled lab environments. Smaller organizations may struggle with capital investment and talent acquisition, which limits adoption. Additionally, technological advancements can make obsolete quickly, leading to shorter product life cycles and concerns around ROI, particularly for mid-scale enterprises and R&D labs with limited budgets.

Opportunity

Where Lies the Next Big Wave of Growth?

The most promising opportunity in the RF test equipment market lies in the emergence of advanced wireless networks such as 6G, Low Earth Orbit (LEO) satellite communications, and private 5G networks for industrial use. With smart manufacturing and digital transformation gaining momentum, enterprises are investing in RF solutions to ensure seamless machine-to-machine communication. Moreover, the rise of modular, portable, and AI-integrated test systems presents a lucrative opportunity to cater to start-ups, SMEs, and field engineers who require cost-effective, flexible, and intelligent testing alternatives. Expansion in Asia-Pacific and Latin America, where infrastructure upgrades are ongoing, also offers significant untapped potential.

Segment Insights

Equipment Type Insights

How Oscilloscope Segment Dominated the Market in 2025?

The oscilloscopes segment dominated the RF test equipment market with the largest revenue share of 28% in 2025. Oscilloscopes have long served as foundational tools in the RF testing ecosystem. Their ability to visually capture, measure, and interpret electrical signals over time makes them indispensable for engineers working on complex RF systems. From diagnosing anomalies to evaluating signal behavior, oscilloscopes are central to ensuring accurate and stable high-frequency transmission. The segment's dominance is further reinforced by the versatility of oscilloscopes. They are used in research labs, communication network testing, electronic component validation, and industrial manufacturing. As devices continue to integrate multiple RF functionalities (e.g., 5G modules, Wi-Fi 6E chips), oscilloscopes remain vital for real-time debugging, timing analysis, and waveform monitoring.

On the other hand, the spectrum analyzers segment is expected to grow at the highest CAGR of 10% in the upcoming period due to increasing complexity in the RF environment. These devices enable the visualization of signal frequencies, helping users identify and isolate noise, interference, and spectral occupancy. With the global rollout of 5G, the proliferation of IoT devices, and the rise in defense applications, spectrum analyzers have become essential in evaluating channel performance, verifying spectral emissions, and ensuring compliance with regulatory standards. The demand is also fueled by the adoption of real-time spectrum analysis (RTSA), enabling users to detect intermittent signals and improve response times in mission-critical systems.

Frequency Insights

Why did the 1GHz-6GHz Segment Dominate the RF Test Equipment Market in 2025?

The 1GHz–6GHz segment dominated the market by holding more than 31% of revenue share in 2025 due to its extensive applicability in wireless systems. This frequency band supports mainstream technologies such as LTE, Wi-Fi, Bluetooth, and initial 5G deployments, offering a balance between coverage range and data speed. Test equipment tuned for this spectrum is crucial for developing, validating, and optimizing RF modules in consumer electronics, telecom infrastructure, and automotive applications. Due to ongoing upgrades in telecom and connected devices, this band remains the most tested and utilized in RF testing protocols globally.

Meanwhile, the more than 20 GHz segment is growing at a significant CAGR of 10.1% during the forecast period. The demand for test equipment operating above 20GHz is rising sharply due to the adoption of millimeter wave technologies in 5G advanced, satellite broadband, military radar, and autonomous vehicles. These frequencies allow for high-speed, low-latency communications but also introduce complex propagation challenges. Consequently, test equipment supporting the 20GHz range is required for precise phase noise analysis, channel modelling, and antenna testing. With R&D efforts intensifying in aerospace, next-gen cellular networks, and LEO satellite constellations, this segment is positioned for aggressive growth.

Form Factor Insights

What Made Benchtop the Dominant Segment in 2025?

The benchtop segment dominated the RF test equipment market with the major revenue share of 48% in 2025 due to its robust performance, reliability, and advanced analytical capabilities. Benchtop RF test equipment offers full-featured solutions with intuitive interfaces, large displays, and comprehensive diagnostic tools, making them ideal for both development and production environments. They are widely used in telecom, automotive, medical devices, and aerospace laboratories, where stability and accuracy are non-negotiable. The ability to integrate seamlessly into test benches with other high-precision instruments further solidifies their relevance in comprehensive RF validation setups.

On the other hand, the modular segment is expected to expand at a solid CAGR of 10% during the projection period. Modular format is rapidly gaining traction due to its scalability, flexibility, and cost-efficiency. Ideal for dynamic testing environments and evolving product lines, modular systems allow users to configure RF test setups based on specific requirements. This is particularly useful in automated test environments, start-up R&D labs, and manufacturing test lines, where adaptability and compact size are crucial. With the emergence of PXI-based RF test systems and the shift toward software-defined instruments, modular RF test solutions are becoming the preferred choice for organizations seeking agility and innovation.

End-Use Insights

Why is Telecommunications Segment Dominating the RF Test Equipment Market?

The telecommunications segment dominated the market with highest revenue share of 32% in 2025. This is mainly due to the increased deployment of 4G and 5G networks. The telecommunications industry remains the primary end-user of RF test equipment. With the deployment of 5G, LTE-Advanced, and upcoming 6G networks, telecom providers require meticulous RF testing to ensure network stability, coverage, and throughput. Base station components, mobile devices, antennas, and small cells must undergo comprehensive signal integrity tests. Moreover, network optimization, spectrum re-farming, and interference mitigation demand continuous testing support. RF test tools in telecom not only support product validation but also play a vital role in certification, compliance, and maintenance testing throughout the network lifecycle.

The aerospace & defense segment is expected to grow at the highest CAGR of 10% over the studied period. RF test equipment is increasingly vital in aerospace and defense applications where accuracy, resilience, and high-frequency performance are critical. Whether it is radar system development, satellite communication, or electronic warfare testing, these sectors demand ultra-precise and reliable RF validation tools. The segment is growing due to increased defense budgets, technological advancements, and rising investments in space exploration, surveillance, and avionics. In these environments, RF testing supports mission-critical operations and helps meet stringent military-grade standards, further fueling demand.

Regional Insights

Asia Pacific RF Test Equipment Market Size and Growth 2026 to 2035

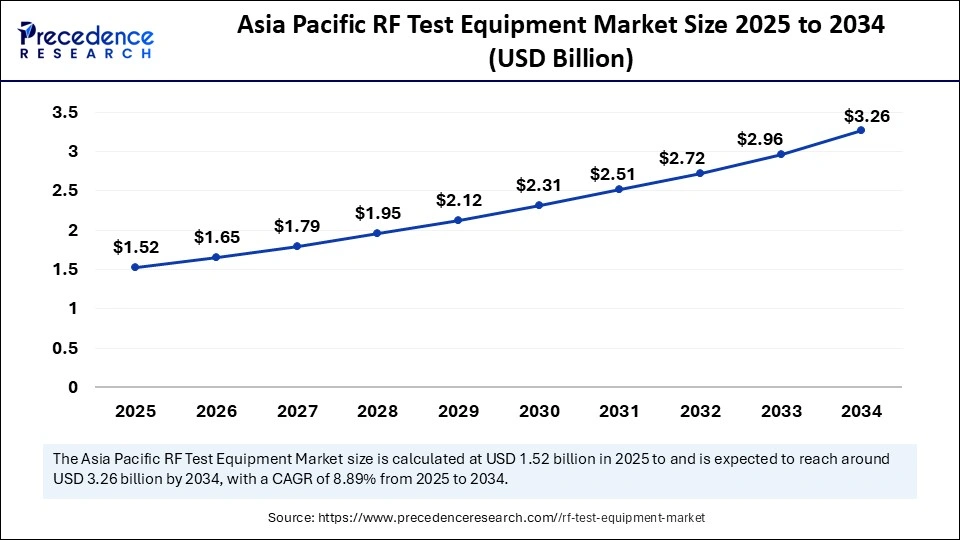

Asia Pacific RF test equipment market size is exhibited at USD 1.52 billion in 2025 and is projected to be worth around USD 3.52 billion by 2035, growing at a CAGR of 8.76% from 2026 to 2035.

Which region dominated the RF test equipment market in 2025?

Asia-Pacific dominated the RF test equipment market in 2025, owing to the rising manufacturing of electronic devices, rapid 5G expansion, and rising investments in automotive and smart device production. Countries like China, South Korea, India, and Japan are becoming major RF innovation hotspots, not just in consumption but also in design and test equipment production. The proliferation of smartphones, IoT devices, smart infrastructure, and connected vehicles has created an urgent need for robust RF testing throughout the development and deployment cycles. Additionally, government-led initiatives focused on digital transformation and industrial automation, like Smart Cities and Industry 4.0 in India and China, are further stimulating market growth.

What sets Asia-Pacific apart is its combination of low manufacturing costs and high R&D intensity, allowing both multinational giants and local tech companies to scale testing operations. Educational institutions and engineering hubs in the region are also increasingly collaborating with industrial players for real-world RF experimentation, adding to the demand for compact, modular, and AI-integrated testing solutions.

How is North America Growing in the RF Test Equipment Market?

North America is expected to grow at the fastest CAGR during the forecast period. This is mainly due to its booming technological ecosystem, rapid adoption of innovative technologies, and robust telecom and aerospace sectors. The presence of leading industry players, high usage of 5G networks, and intensive R&D activities in defense electronics, satellite systems, and autonomous driving contribute significantly to the region's stronghold.

United States RF Test Equipment Market Analysis:

The RF test equipment market in the United States expands, fueled by a well-established telecom sector and widespread 5G and IoT rollouts. The market features sophisticated, automated testing systems crafted for precision and efficiency. In contrast to other areas, the USA prioritizes integration with cloud-based solutions and software analytics. Significant R&D funding and a robust presence of top test equipment producers foster innovation. The need for testing in aerospace, defense, and automotive wireless systems expands the range of applications. Increasing emphasis on cybersecurity and data integrity influences product development priorities.

The United States has long been a hub for semiconductor testing, wireless communication innovation, and government-funded aerospace research. Government contracts, defense projects, and commercial telecom rollouts demand constant RF testing, ranging from antenna validation to spectrum monitoring.

Additionally, the proliferation of high-end benchtop and modular testing setups in North American research labs and OEM manufacturing units reflects the region's emphasis on precision, quality assurance, and performance benchmarking. Moreover, the integration of AI and machine learning for automated test analytics and predictive diagnostics is gaining traction in North American facilities, further amplifying the region's growth in the market.

How Is Europe Quietly Making Big Waves in the RF Test Equipment Market?

Europe is considered to be a significantly growing area. Europe is making significant strides in RF innovation and specialized testing applications, particularly in the fields of automotive electronics, satellite communication , healthcare technology, and renewable energy systems. With strong regulatory frameworks and a deep focus on safety, sustainability, and signal integrity, European businesses are investing heavily in RF testing solutions. The region's leadership in electric vehicle (EV) adoption, especially with integration of V2X (Vehicle-to-Everything) communications, boosts the demand for RF test setups that ensure low latency, accurate communication, and electromagnetic compliance.

Europe is also a key contributor to international telecom standardization, and its companies are involved in 6G R&D and aerospace innovations. This has created opportunities for developing cutting-edge, software -defined, and modular RF testing systems that cater to niche, high-precision use cases. The region's notable growth is underpinned by its strategic investment in research hubs, test labs, and cross-border technology collaborations, helping it steadily rise in the RF testing arena.

India RF Test Equipment Market Analysis:

The rollout of 5G in India significantly propels the RF test equipment market, with telecom operators and network providers making substantial investments in sophisticated testing solutions. According to reports, 5G services had been launched in all states and union territories of India by October 2024. The swift growth of IoT devices in India is creating a demand for sophisticated RF testing equipment to guarantee uninterrupted connectivity, dependability, and adherence to regulations. An industry report states the expected quantity of IoT devices in India. Developments in semiconductor technology, growing telecom infrastructure, and the widespread use of smart devices in different sectors are key factors boosting the India RF test equipment market share.

UK RF Test Equipment Market Analysis:

The market for radio frequency testing equipment in the UK is growing due to multiple influences. Telecommunications infrastructure and automotive electronics investments are crucial factors, along with investments in aerospace and defense. The UK's emphasis on developing wireless technologies and compliance with strict regulatory standards also influences market dynamics. Additionally, research and development initiatives foster innovation in radio frequency testing solutions, while the need for test automation and efficiency propels technological progress.

Booming Market of Middle East and Africa:

The RF Test Sets Market in the Middle East and Africa is gaining substantial traction driven by the swift expansion of wireless communication technologies and the rollout of 5G infrastructure in the area. The growing need for RF testing equipment is influenced by telecom operators and network service providers seeking to guarantee excellent signal quality and adherence to international standards. The growing implementation of sophisticated mobile networks, IoT-connected devices, and the expanding frequency spectrum for communication purposes are driving the demand for RF test sets in both commercial and industrial markets.

UAE RF Test Equipment Market Analysis:

The RF test equipment market in the UAE is seeing remarkable growth, fueled by substantial investments in technology and infrastructure, especially in telecommunications as well as aerospace and defense. The growth of 5G networks, the rise of IoT devices, and the growing intricacy of wireless technologies drive the need for more sophisticated testing tools. Significant global companies, like Keysight Technologies, participate in this market, bolstering the UAE's position as a technological hub in the region.

Value Chain Analysis

- Raw Materials and Components: Source and supply of the necessary base materials like RF semiconductors, substrates, connectors, and components to ensure the highest performance, quality, and reliability possible in RF test gear.

Key Players: Skyworks Solutions, Qorvo, Broadcom, Infineon Technologies, Murata Manufacturing - R&D and Product Development: The Engineering team develops innovative RF architecture, measurement algorithms, and user interface designs that provide improved sensitivities, bandwidth accuracy, and allow compliance with the latest standards.

Key Players: Keysight Technologies, Rohde & Schwarz, Anritsu, National Instruments (NI) - Manufacturing and Assembly: This phase consists of Board fabrication, RF shield fabrication, Board precision assembly, and instrument Calibration. This ensures that each instrument is stable and has the right frequency coverage and environmental tolerance.

Key Players: Flex Ltd., Jabil Inc., Sanmina Corporation, Pegatron, Celestica - Distribution and Channel Partnerships:Distributing manufactured products to the market through authorized distributors, VARs, and System Integrators provides customers with demonstration equipment, financing options, and initial support.

Key Players: Arrow Electronics, Avnet, Future Electronics, WPG Holdings, Rutronik - Sales, Integration, and Custom Solutions: Technical Sales, System Integrators, and their engineering teams can develop, customize, and deploy innovative RF test solutions to meet the needs of telecom carriers, semiconductor fabrication plants, and defense organizations, and to provide additional software and automation to these solutions.

Key Players: Accenture, Deloitte, NI Value-Added Resellers, Keysight System Integrators, Rohde & Schwarz Solutions Group

Top Companies in the RF Test Equipment Market & Their Offerings

- Anritsu: Provides high-end wireless communication testers and portable analyzers essential for 5G/6G mobile device and infrastructure verification.

- B&K Precision Corporation:Offers accessible, general-purpose RF tools like spectrum analyzers and field strength meters for education and repair.

- Chroma ATE:Specializes in high-volume automated test equipment (ATE) for semiconductor chips and wireless power components.

- Cobham Limited: Focuses on specialized radio test sets for critical communications in the aerospace, defense, and public safety sectors.

- EXFO: Delivers RF-over-CPRI and fiber-based wireless test solutions used to optimize and troubleshoot cellular network fronthaul.

- Fortive (via Tektronix): Supplies real-time spectrum analyzers and wide-bandwidth oscilloscopes for high-speed digital and wideband RF signal analysis.

- Giga-Tronics: Manufactures advanced microwave signal generators and hardware for electronic warfare and radar simulation.

- Goodwill Instruments (GW Instek): Produces cost-effective, benchtop RF instruments like signal sources and spectrum analyzers for manufacturing and training.

- Keysight Technologies: Leads the industry with a massive portfolio of premium signal analyzers, generators, and software for end-to-end wireless design.

- National Instruments (NI): Utilizes a modular PXI hardware approach and LabVIEW software for highly customizable, automated production testing.

- Rohde & Schwarz: Renowned for high-precision, low-noise signal generators and analyzers used in satellite, aerospace, and high-end wireless research.

- Teledyne Technologies: Offers high-speed digitizers, microwave components, and environmental stress test systems for military and space applications.

- Viavi Solutions: Focuses on field-portable instruments for base station maintenance, signal interference hunting, and network performance validation.

- Yokogawa Electric: Provides precision power meters and optical analyzers that support high-speed RF communication and power electronics testing.

Recent Developments

- In February 2025, Keysight Technologies expanded its radio frequency (RF) and microwave instrument portfolio with six new analog signal generators, two vector signal generators, eight RF synthesizers, and three signal source analyzers. These new solutions provide RF engineers with compact tools, in single channel and multi-channel platforms, for component and device characterization at frequencies up to 54 GHz. RF synthesizers enable engineers to routinely test components, devices, and systems in areas such as radar and defense electronics, wireless communication systems, and consumer electronics.

(Source: https://www.keysight.com ) - In November 2024, Advantest Corporation launched the Wave Scale RF20ex instrument for the V93000 EXA Scale platform. It enables customers to test virtually any type of radio frequency (RF) device using a single instrument.(Source: https://www.advantest.com )

Segments Covered in the Report

By Equipment Type

- Oscilloscopes

- Signal Generators

- Spectrum Analyzers

- Network Analyzers

- Power Meters

- Others

By Frequency Range

- Less than 1 GHz

- 1 GHz-6 GHz

- 7 GHz-20 GHz

- More than 20 GHz

By Form Factor

- Bench Top

- Portable

- Modular

- Rackmount

By End-use

- Telecommunications

- Aerospace & Defense

- Electronics Manufacturing

- Automotive

- Medical Devices

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting