What is the Display Material Market Size?

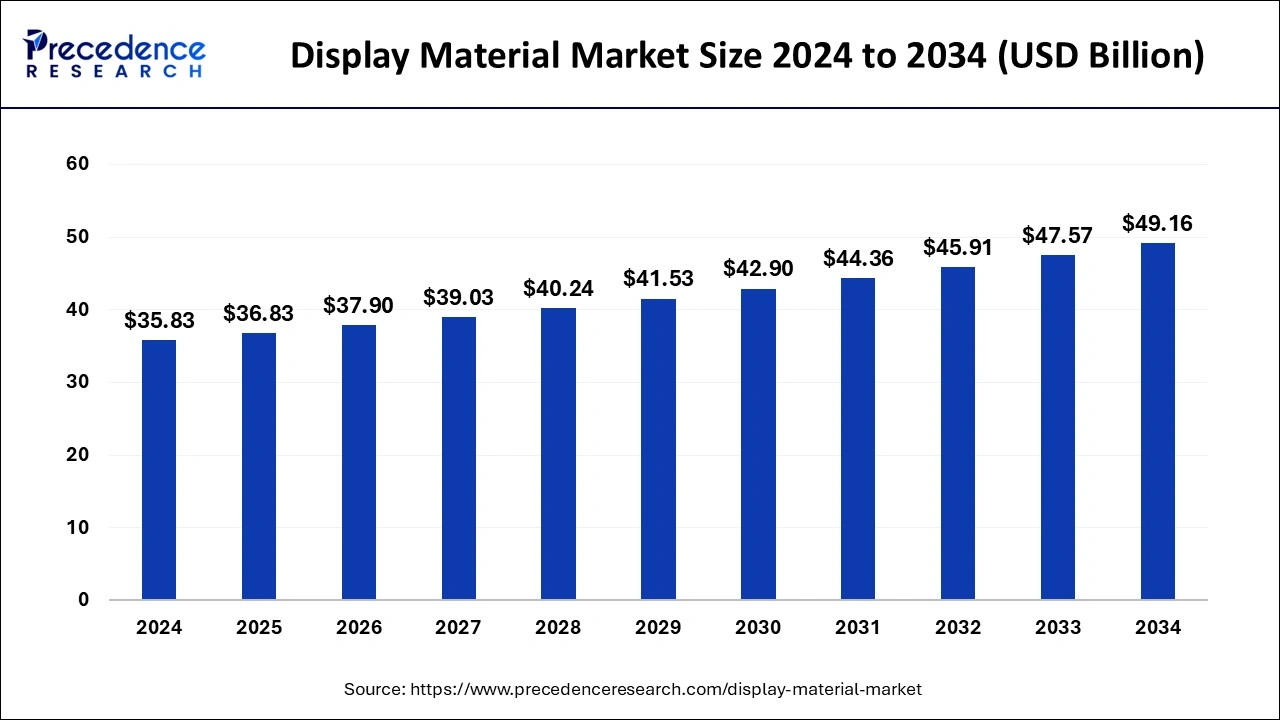

The global display material market size is calculated at USD 36.83 billion in 2025 and is predicted to increase from USD 37.90 billion in 2026 to approximately USD 50.80 billion by 2035, expanding at a CAGR of 3.27% from 2026 to 2035.

Display Material Market Key Takeaways

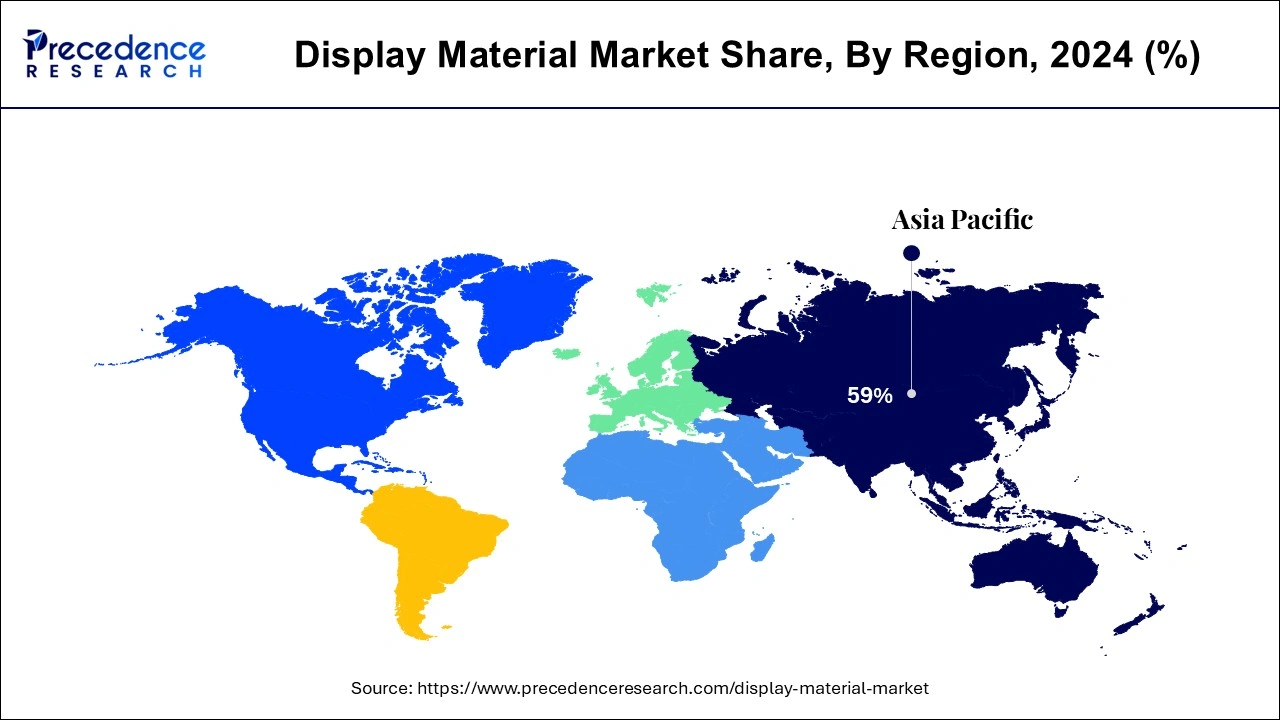

- Asia Pacific led the global market with the highest market share in 2025.

- By Technology, the LCD segment has held the largest market share in 2025.

- By Component, the polarizer segment captured the biggest revenue share in 2025.

- By Application, the television segment is estimated to hold the highest market share in 2025.

Market Overview

Display material is an aspect which is mainly used on display cell phones, digital cameras, media players, and televisions. Among the crucial display components are film, glass, backlights, ICs, and some organic materials that are flexible and used to manufacture displays. Different technologies, such as OLED, LCD, IPS, AMOLED, and others, are used to create displays.

The advancement of electronic display technology is made possible by several materials and methods. Plastics are ideal for point-of-purchase displays because they are inexpensive, have excellent aesthetic qualities, and are simple to manufacture.

Plastic is sturdy and lightweight, and wide varieties may be easily customized with painting and printing. When using showcases made of plastics like acrylic, high-impact polystyrene, polycarbonate, and expanded PVC, customers have a rich shopping experience. These materials are available in various colors and textures and can be made with basic woodworking tools.

Many plastic sheet materials can be produced on strip heaters and thermoformed, and they can be swiftly glued together using solvent cement blocks and adhesives. Polycarbonate, special acrylic, and PETG materials designed to transmit and diffuse LED light can create stunning backlit displays.

As long as there is a need for high-end consumer electronics, specifically TV applications, and as long as the umbrella ecosystem is accepted, the market for display materials will keep growing. The growing size and resolution of TV displays are driving the growth of the display material market. Therefore, it is likely that the growing adoption of OLED display technology and its expanding applications will fuel rising demand for the market of display material in the years to come.

In OLED technology, a light-emitting diode's light-emitting layer is an organic substance, and organic molecules typically release light in reaction to an electric current. The extraordinary rapid expansion of quantum dot OLED and LCD will also likely increase demand for display materials in the future.

Throughout the projection, it is also expected to positively affect the display materials market. Despite several motivating elements, the display material market will likely decrease and have a variable growth rate because of the IP protection and exclusivity of advanced and emerging display materials.

The high power consumption of IPS displays, which leads to crisper screens and faster battery drain, is hurting the display material market. The high manufacturing costs and higher engineering complexity that make it difficult to be installed in consumer devices like entry-level tablets and budget smartphones are two major factors restraining the global market for display material.

The display material market will grow over the next years due to the continued demand from OLED display panel manufacturers for thin substrate sheets of exceptionally high quality.

Display Material Market Growth Factors

The increasing demand for LCDs from various end-use sectors, including automotive, consumer electronics, and healthcare, is expected to drive robust growth in the global market for display material during the forecast period. The growing use of OLED technology in televisions and smartphones is also anticipated to fuel industry expansion. Additionally, over the upcoming years, it is projected that the rising demand for environmentally friendly and energy-efficient display materials will open up new prospects for market participants.

The growing popularity of smartphones and tablets, Advances in display technology, such as the development of flexible and foldable displays, The increasing popularity of smart TVs, which use internet-connected display panels, The increasing adoption of advanced driver assistance systems (ADAS) and infotainment systems in vehicles.

The rise in popularity of gaming, the increasing use of virtual and augmented reality technology, the adoption of IoT devices, like smart home devices and wearables, and the increase in e-commerce and online learning due to the COVID-19 pandemic is driving demand for display materials.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2025 | USD 36.83 Billion |

| Global Market Size in 2026 | USD 37.90 Billion |

| Global Market Size by 2035 | USD 50.80 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.27% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Component, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Technology Insights

The market is divided into OLED and LCD segments based on technology. Due to the growing use of OLED screens in smart wearables and smartphones, the LCD category commands a sizable portion of the market. Making an LCD panel requires more layers, materials, or components.

A colour filter layer, liquid crystal, and a backlight unit are also used in LCDs, which are not necessary for OLED displays, thereby accelerating the growth of the Market for Display Materials. Two layers of polarizers and substrates are used in LCDs instead of just one layer of each plate in OLED.

Component Insights

The market is divided into polarizers, substrates, colour filter layers, liquid crystals, backlighting units, and others based on the component. Due to industry leaders' rising investments in enhancing these materials for greater energy efficiency and extended lifespan, the Polarizer category maintains a sizable market share. These reasons are driving the display material market growth.

Application Insights

By Application, the market is divided into television, smartphones and tablets, signage and large-format displays, and smart wearables. Due to the rising display materials consumption used in LCD panels for TVs, the television industry owns a sizable portion of the market.

The majority of the display material demand comes from smartphones and tablets. Shipments of OLED panels for TV applications are increasing exponentially, driven by LG, which is accelerating the expansion of the market for display material.

Regional Insights

What is the Asia Pacific Display Material Market Size?

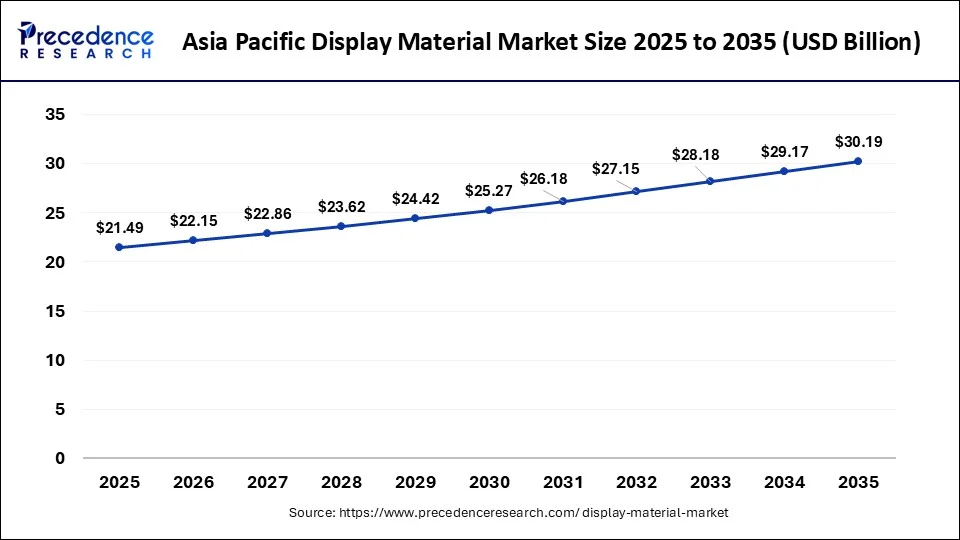

The Asia Pacific display material market size was evaluated at USD 21.49 billion in 2025 and is projected to be worth around USD 30.19 billion by 2035, growing at a CAGR of 3.46% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Display Material Market?

Asia Pacific dominated the display material market with the largest share in 2025 due to rapid industrialization, strong growth in consumer electronics, and expanding advertising and retail sectors across countries like China, Japan, South Korea, and India. The region benefits from large-scale manufacturing capabilities, lower production costs, and the presence of major display panel manufacturers, which support high-volume supply. Additionally, rising urbanization, increasing disposable incomes, and growing demand for digital signage and advanced display technologies further strengthened Asia Pacific's market leadership.

India Display Material Market Analysis

The market in India is expanding due to the rising demand in consumer electronics, strategic government support, industrial and commercial expansion, and supply chain diversification. Strong government initiatives such as “Make in India,” along with rising investments in domestic manufacturing and infrastructure, are boosting local production of display materials. For instance, in January 2026, the government of India cleared the Electronics Component Manufacturing Scheme (ECMS) proposals with the investment of Rs. 418.63 billion.

What Makes North America the Fastest-Growing Region in the Market?

North America is expected to grow at the fastest rate in the market during the studied period, owing to the adoption of advanced technologies, rising demand for automotive displays, and the rise of AR/VR and wearables. The presence of leading market players, high R&D investments, and well-established infrastructure support faster commercialization and scalability. Additionally, favorable regulatory frameworks, high consumer purchasing power, and increasing use of next-generation products are accelerating market growth in the region.

- In July 2024, the U.S. Department of Commerce's National Institute of Standards and Technology (NIST) announced a funding opportunity for an AI-focused manufacturing USA institute.

U.S. Display Material Market Analysis

The market in the U.S. is growing due to a combination of strong policy incentives, increased domestic manufacturing, and a clear shift toward sustainability across industries. Regulatory changes and the rapid digital transformation of the automotive sector are driving demand for advanced display materials used in infotainment systems, dashboards, and digital interfaces.

How is the Opportunistic Rise of Europe in the Display Material Market?

Europe is expected to expand at a notable rate in the market, driven by its strong focus on sustainability, advanced manufacturing, and technological innovation. The region's stringent environmental regulations are accelerating the adoption of energy-efficient and recyclable display materials, while investments in smart manufacturing, automotive digitalization, and Industry 4.0 are boosting demand for advanced displays. Additionally, Europe's growing use of digital signage in retail, transportation, and public infrastructure, supported by strong R&D capabilities and government-backed innovation programs, is creating new growth opportunities across the market.

What Potentiates the Display Material Market Within Latin America?

The market in Latin America is being potentiated by rapid urbanization, expanding retail and advertising sectors, and increasing adoption of digital signage across commercial spaces. Growing investments in infrastructure, smart transportation, and public information systems are driving demand for durable and cost-effective display materials. Additionally, rising consumer electronics penetration, improving manufacturing capabilities, and supportive government initiatives in countries such as Brazil and Argentina are further accelerating market growth across the region.

What Opportunities Exist in the Middle East & Africa for the Display Material Market?

The Middle East & Africa (MEA) presents significant opportunities for the market due to large-scale infrastructure development, smart city projects, and rapid expansion of retail and commercial spaces. Growing investments in digital signage for transportation hubs, hospitality, healthcare, and public information systems are driving demand for advanced and durable display materials. Additionally, increasing adoption of consumer electronics, rising urban populations, and government-led digital transformation initiatives across countries such as the UAE, Saudi Arabia, and South Africa are creating strong growth prospects for the market.

Value Chain Analysis

- Raw Material Procurement: This stage involves the sourcing and processing of essential raw materials such as glass substrates, polymers, metals, and specialty chemicals used in display materials.

Key Players: Shin-Etsu Chemical, SUMCO Corporation, GlobalWafers Co., Ltd., Siltronic AG, SK Siltron. - Distribution:Finished display products and materials are distributed through global supply chains involving logistics providers, wholesalers, and OEM networks.

Key Players: WPG Holdings, WT Microelectronics, Arrow Electronics, Avnet, Digi-Key & Mouser Electronics. - Lifecycle Support and Recycling:This stage encompasses collection, logistics, preliminary sorting, safe disassembly, material recovery, and refinement.

Key Players: Samsung Display & Samsung Electronics, LG Display & LG Electronics, Umicore, Sims Limited, Electronic Recyclers International, TES, Stena Recycling, Attero Recycling.

Display Material Market Companies

- AGC Inc.

- DIC Corporation

- Corning Incorporated

- DuPont and Dow

- Idemitsu Kosan Co, Ltd

- Hodogaya Chemical Co., Ltd

- JSR Corporation

- NITTO DENKO CORPORATION

- LG Chem

- SAMSUNG SDI CO., LTD.

Key Developments

- In January 2026, Titan Intech announced the launch of UltraLED Displays, a premium LED display brand designed to strengthen India's domestic display technology capabilities. The initiative marks the company's strategic transition from assembly-focused operations to the development and ownership of core LED display technologies.

(Source: https://www.constructionworld.in ) - In November 2025, TSK Corporation announced a strategic collaboration with Samsung Display Co., Ltd. to jointly undertake the full-scale development of advanced blue OLED display materials. The partnership aims to enhance material performance and efficiency, supporting next-generation OLED displays and strengthening innovation in the global display materials market.

(Source: https://www.ledinside.com ) - In Apr 2021, Samsung was thrilled to be a partner in important material innovation projects with Corning, QD Display, OLED, and flexible displays.

- In Apr 2021, a long-term deal for a new OLED Technology License and Material Purchase Agreements was signed by Universal Display Corporation, a global leader in designing and producing innovative display panels, and LG Display Co., Ltd., which enables energy-efficient lighting and displays with its Universal PHOLED technology and materials.

Segment Covered in the Report

By Technology

- OLED

- LCD

By Component

- Substrate

- Polarizer

- Liquid Crystals

- Colour Filter Layer

- Backlighting Unit

- Others

By Application

- Smartphone & Tablet

- Television

- Smart Wearables

- Signage/Large Format Display

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting