What is the Commercial Display Market Size?

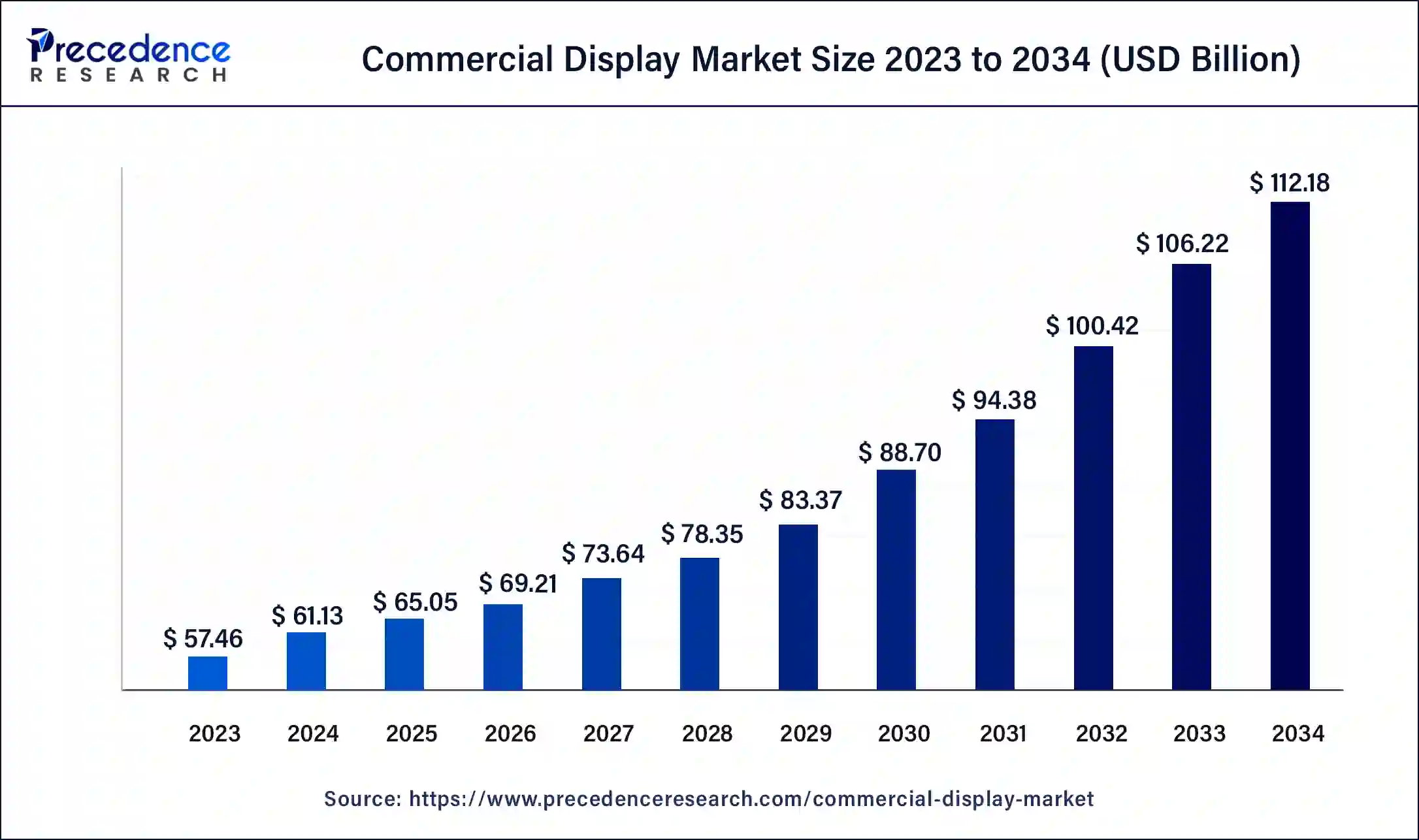

The global commercial display market size is valued at USD 65.05 billion in 2025 and is predicted to increase from USD 69.21 billion in 2026 to approximately USD 112.18 billion by 2034, expanding at a CAGR of 6.26% from 2025 to 2034.

Commercial Display Market Key Takeaways

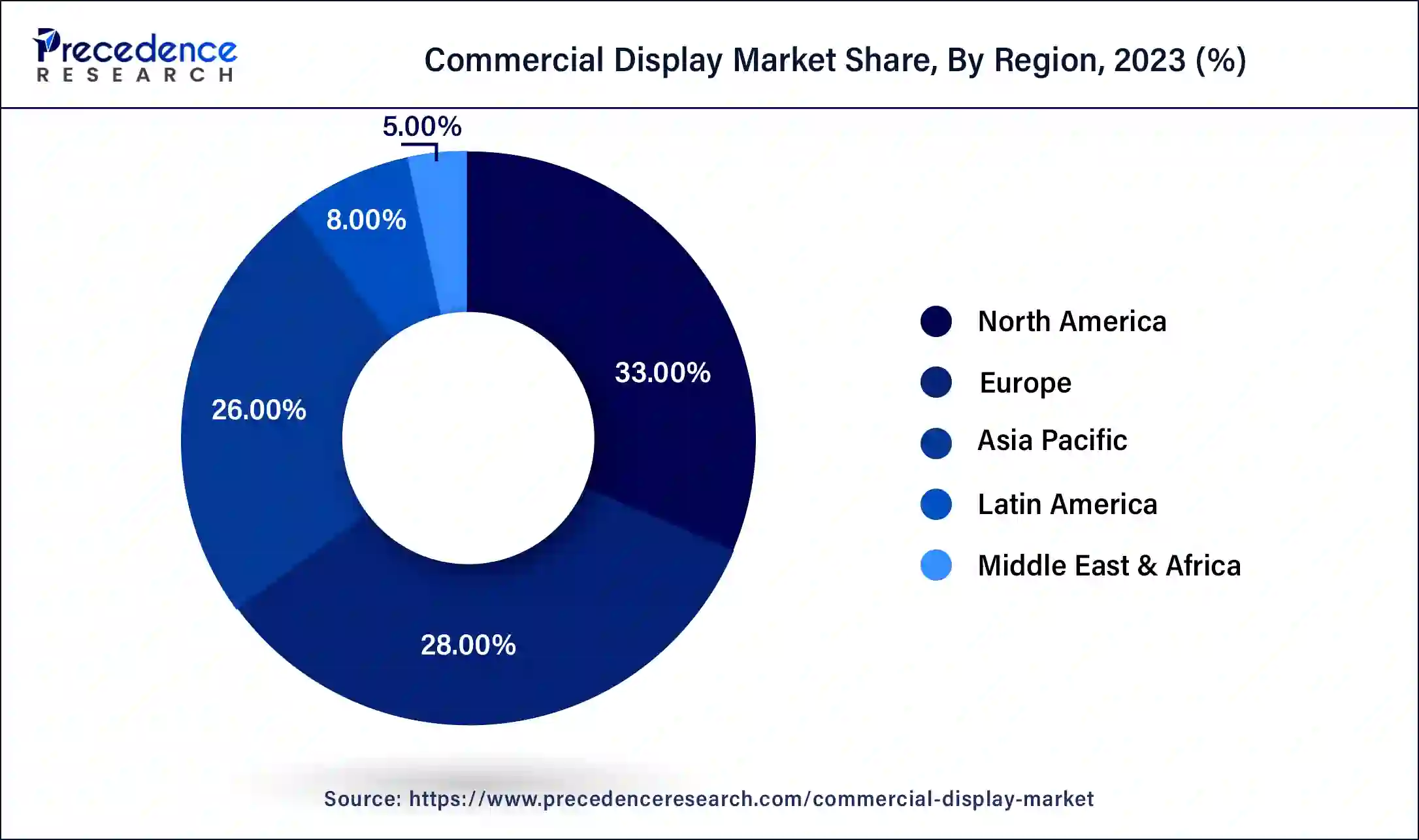

- North America e moisture-curing adhesive market in 2024.

- By product, the digital signage segment dominated the market in 2024.

- By display type, the passenger vehicles segment dominated the market in 2024.

- By display type, the curved panel segment is anticipated to grow significantly in the market during the forecast period.

- By component, the hardware segment led the global market in 2024.

- By component, the software segment is estimated to grow rapidly in the market during the fastest period.

- By technology, the LCD segment dominated the market in 2024.

- By application, the retail segment led the global market in 2024.

- By application, the hospitality segment is estimated to grow rapidly in the market during the fastest period.

Market Size and Forecast

- Market Size in 2025: USD 65.05 Billion

- Market Size in 2026: USD 69.21 Billion

- Forecasted Market Size by 2034: USD 112.18 Billion

- CAGR (2025-2034): 6.26%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Commercial Display Market Growth Factors

The increasing demand for the digital signage across the healthcare and transportation sectors is expected to drive the growth of the global commercial display market. Rapid industrialization and rapid urbanization, rising government expenditure on the development of infrastructure, and changing lifestyle of the consumers is fostering the growth of the commercial display market across the globe. Furthermore, the rising adoption of digital technologies by the market players for the advertisement of products and services for making a strong impact on the customers mind is major driving force propelling the demand for the commercial displays. Moreover, rising integration of technologies such as AI and machine learning in the commercial displays is fueling the market growth across the globe. The introduction of 4K and 8K displays is ramping up the production of ultra-HD advertising content, which is significantly contributing towards the market growth. Further, the energy efficiency factor is becoming an important aspect of the sustainable business, hence the demand for the energy efficient commercial displays is rising rapidly across the globe.

Further, the increasing demand for the commercial displays across wide range of sectors such as retail, entertainment, hospitality, corporate, banking, and education is driving the growth of the commercial display market. Technological advancements in the development of software in order to increase target audience engagement tracking and engagement, and management of content has fostered the market growth.

Commercial Display Market Outlook

- Industry Growth Overview: The commercial display market is witnessing significant growth, driven by the widespread adoption of digital signage, interactive flat screens, and video walls across retail, transportation, corporate, and educational sectors. Rising demand for real-time, data-driven advertising via digital-out-of-home (DOOH) displays is further accelerating revenue growth, while immersive, highly visual interfaces are becoming essential in hospitality and education.

- Technological Advancements: The commercial display ecosystem is also transforming with innovations in micro-LED, OLED, and transparent display technologies, offering improved brightness, contrast, and flexibility. Manufacturers such as Samsung Display, LG Display, BOE Technology Group, and Sony Corporation are focusing heavily on pixel miniaturization and adaptive HDR. The development of edge-computing video walls and 8K resolution is expected to revolutionize control centers, broadcasting, and entertainment facilities by providing the highest quality images and automation.

- Sustainability & Energy Efficiency: Environmental considerations are increasingly shaping product development. Companies, including Panasonic and Sharp, are designing recyclable, energy-efficient, and low-carbon display solutions with modular repairability, aligning with EU and U.S. energy standards and lifecycle sustainability expectations.

- Investment & Startup Ecosystem: Private equity and institutional investors are targeting integrated hardware-software platforms that combine displays, analytics, and content management. Startups such as NoviSign, Yodeck, and Raydiant are pioneering cloud-native digital signage solutions, enabling real-time content updates, advanced analytics, and accelerated innovation cycles across the global market.

Report Scope of the Commercial Display Market

| Report Coverage | Details |

| Market Size by 2034 | USD 112.18 Billion |

| Market Size in 2026 | USD 69.21 Billion |

| Market Size in 2025 | USD 65.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.26% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Display Type, Component,Technology,Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product Insights

Based on the product, the digital signage segment accounted largest revenue share in 2024 and is expected to remain its dominance in near future. This is attributed to the increased adoption of digital signage in the retail sector like supermarkets and shopping malls across the globe. The rising number of commercial complexes like shopping malls and rising penetration of supermarkets in the developing regions is expected to further drive the growth of this segment. The segment is also estimated to be the fastest-growing segment during the forecast period. The rising adoption of the micro and mini-LED in the commercial grade TVs is expected to drive the growth of this segment in the forthcoming years.

Display Type Insights

Based on the display type, the flat panel segment dominated the global commercial display market in 2024, in terms of revenue. This is due to the extensive utilization of the flat panels by the end-use sectors in the past years. Moreover, low cost and easy availability are the major factors that resulted in the huge adoption of this panel. The immense popularity of the digital posters, video walls, TVs and monitors has significantly contributed towards the growth of this segment in the past.

On the other hand, curved panel is estimated to be the most opportunistic segment during the forecast period. Curved panels are now being widely adopted in the TVs, monitors, and smartphones. The increasing adoption of curved panels across the various end-use sectors is expected to drive the growth of this segment in the upcoming years.

Component Insights

Based on the component, the hardware segment dominated the global commercial display market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is due to the availability of high cost hardware and wider range of hardware components such as displays, cables, accessories, and other equipment.

On the other hand, the software is estimated to be the fastest-growing segment during the forecast period. This is mainly due to the rising technological advancements and upgradations in the software in order to develop effective software that can efficiently manage contents in the commercial displays.

Technology Insights

Based on the technology, the LCD segment accounted highest revenue share in 2024. The LCD has been widely accepted technology across the globe in the past few decades, which led to its dominance in the market. The banking and corporate sectors extensively uses the LCD technologies. Further, the low cost of production associated with the LCDs is a significant driver of the segment.

On the other hand, the LED segment is expected to be the fastest-growing segment during the forecast period. This can be attributed to the technological advancements and rising popularity of the QLEDs and OLEDs is fueling the growth of the segment. These LED technologies are known for its energy efficiency. Moreover, the emergence of micro and mini-LED is expected to further drive the market in the foreseeable future.

Application Insights

Based on the application, the retail segment hit largest market share in 2024. This can be attributed to the increased adoption of the commercial displays in the retail sectors like shopping malls, supermarkets, and hypermarkets. The huge number of footfall in the shopping malls and other retail units makes it a huge segment for the application of the commercial displays.

On the other hand, the hospitality is estimated to be the most opportunistic segment during the forecast period. This is attributed to the rising penetration of quick service restaurants, motels, bars, and cafes across the globe. The restaurants, cafes, and bars requires huge number of display units to display their offers and menus. Hence, the rising number of such foodservice units is boosting the growth of this segment.

Regional Analysis

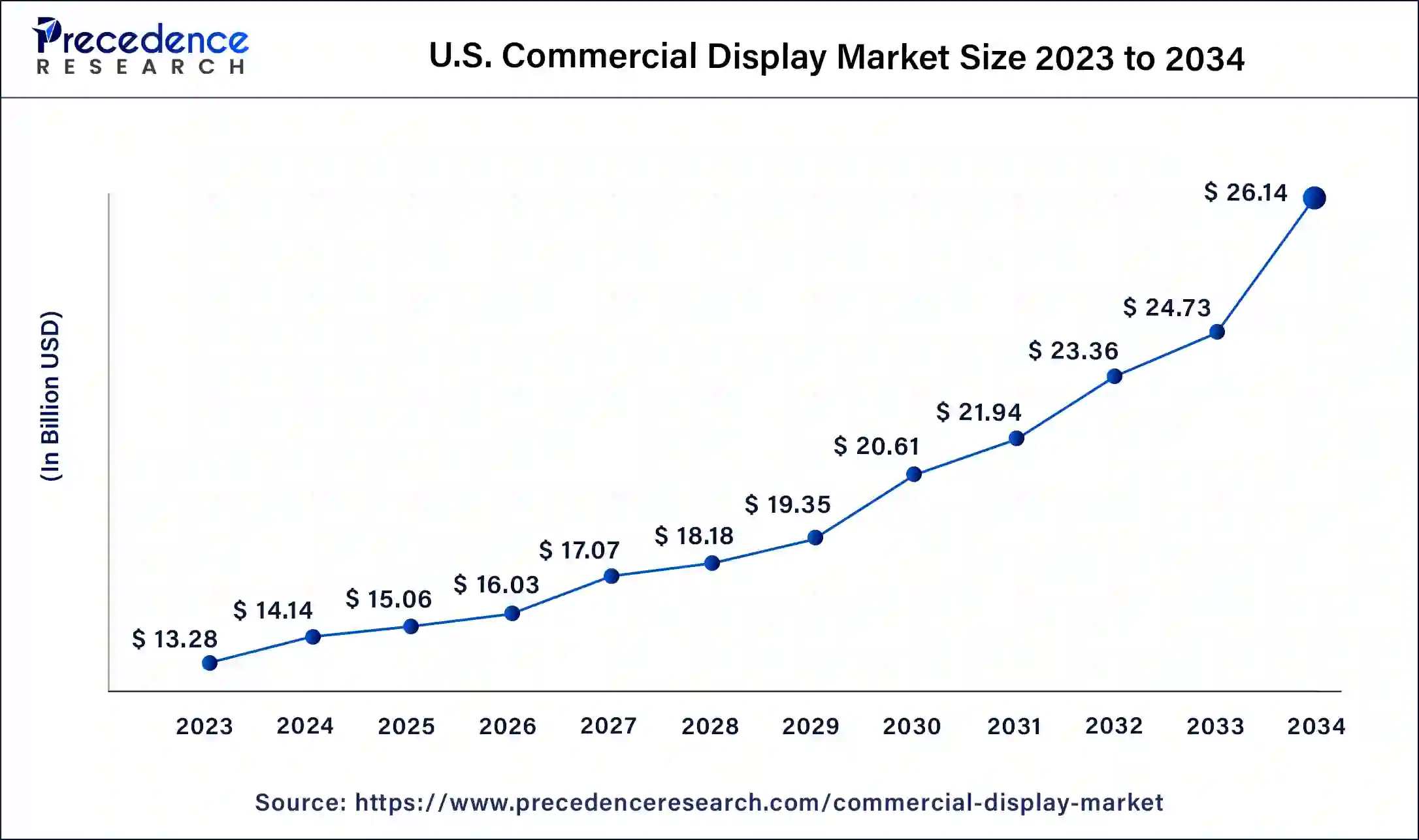

U.S. Commercial Display Market Size and Growth 2025 to 2034

The U.S. commercial display market is calculated at USD 15.06 billion in 2024 and is projected to be worth USD 26.14 billion by 2034, at a CAGR of 6.34% between 2025 to 2034.

North America dominated the global commercial display market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. North America is characterized by the increased penetration of supermarkets/hypermarket, hotels, restaurants, shopping malls, and other commercial units that has significantly contributed towards the growth of the global commercial display market. Further, increased adoption rate of the digital technologies for the advertisement and promotional activities of products and service in North America has led towards the dominance of this region in the global market.

U.S. Commercial Display

The U.S. dominates the North American commercial display market, capturing a significant share. Large-format LED and LCD systems are widely adopted across corporate offices, retail chains, and airlines. Supported by leading companies such as Samsung Electronics America, LG Electronics USA, and Planar Systems, the U.S. continues to drive global innovation in commercial display technology and versatile applications.

Asia Pacific is estimated to be the most opportunistic segment during the forecast period. The rapid industrialization and rapid urbanization coupled with the rising penetration of numerous commercial units in the region is expected to boost the adoption of the commercial displays in the region in the forthcoming years.

China: The Inheritor of Display Production

China led the Asia Pacific commercial display market, driven by strong adoption in transportation, retail, and government sectors. Future growth is expected from micro-LED technologies as the country accelerates ultra-high-definition and energy-efficient display adoption. Government initiatives, including the Digital China project and Smart City Development Plans, are further promoting intelligent display systems across public infrastructure.

Germany: Vision the Future of Visual Communication

Europe is expected to grow significantly in the commercial display market during the forecast period. Europe is experiencing a rise in digitalization across various fields. This, in turn, increases the use of commercial displays at various places for promoting or advertising various information. Its use is increasing in airports, hotels, as well as hospitals for delivering various important information. Furthermore, the utilization of various technological advancements enhances the features of these commercial displays. At the same time, the use of AI is advancing the display systems. This further leads to increasing collaboration between various companies due to increasing use as well as demand. Moreover, this is also supported by the government investments. Thus, all these factors enhance the market growth.

Germany: Vision the Future of Visual Communication

Germany dominates the European commercial display market, driven by high demand from auto showrooms, manufacturing plants, and commercial infrastructures. The country's technological expertise and robust manufacturing ecosystem have enabled advanced display integration across industrial and commercial sectors. During the forecast period, the OLED segment is expected to lead the market, driven by rising demand for energy-efficient, high-contrast, and flexible display solutions.

How is the Opportunistic Rise of Latin America in the Commercial Display Market?

Latin America is experiencing an opportunistic rise in the market, driven by the rising demand for wall displays, particularly across transport systems, shopping malls, and sports arenas. The digital signage segment is expected to drive further growth as regional businesses adopt dynamic, networked displays to engage customers and enhance brand differentiation. The expansion of entertainment and sports culture in major cities is also fueling demand for large-format LED screens and interactive kiosks. Brazil is leading the market due to the rising installation of displays it the retail sector, stadiums, and transport hubs. Major cities like São Paulo and Rio de Janeiro are focusing on DOOH advertising and public engagement platforms, reflecting a broader shift toward visual communication.

What Factors Boost the Growth of the Market in the Middle East and Africa?

The market in the Middle East & Africa is growing, driven by rising adoption of indoor displays in hospitality, retail, and corporate sectors. The UAE and Saudi Arabia captured the highest revenues, fueled by digital transformation initiatives in tourism and rapid infrastructure development under Vision 2030. Collaborations between global players such as LG, Samsung, and Barco and local integrators are strengthening supply chains and technical capabilities in emerging urban centers. The UK is leading the market due to the rising installation of indoor displays in luxury retail as well as hospitality and corporate settings.

Commercial Display Market – Value Chain Analysis

- Raw Material Sourcing

The foundation of commercial display production begins with sourcing critical materials such as glass substrates, rare earth elements, indium tin oxide (ITO), LEDs, semiconductors, and optical films. These materials are vital for constructing high-performance LCD, OLED, and micro-LED panels.- Key Players: Corning Incorporated, Nippon Electric Glass, Asahi Glass Co. (AGC Inc.), 3M Company, Merck KGaA.

- Key Players: Corning Incorporated, Nippon Electric Glass, Asahi Glass Co. (AGC Inc.), 3M Company, Merck KGaA.

- Component Fabrication

Raw materials are processed into essential display components including backlight units, polarizers, color filters, driver ICs, and touch sensors. This stage focuses on converting base materials into functional display components that define image quality and durability.- Key Players: Nitto Denko Corporation, Sumitomo Chemical Co. Ltd., Toppan Printing Co. Ltd., Renesas Electronics Corporation, Rohm Semiconductor.

- Key Players: Nitto Denko Corporation, Sumitomo Chemical Co. Ltd., Toppan Printing Co. Ltd., Renesas Electronics Corporation, Rohm Semiconductor.

- Panel Manufacturing

Display panels (LCD, OLED, micro-LED) are fabricated using precision deposition and encapsulation processes. This is the core stage of the value chain, where pixel arrays are formed, and panels are integrated with backplanes to achieve high brightness, resolution, and energy efficiency.- Key Players: Samsung Display, LG Display, BOE Technology Group, AU Optronics, Sharp Corporation.

- Key Players: Samsung Display, LG Display, BOE Technology Group, AU Optronics, Sharp Corporation.

- System Integration & Module Assembly

Panels are integrated with hardware components such as controllers, processors, and connectivity modules to form complete commercial display systems. Integration includes calibration, housing, and testing to ensure durability and performance across diverse use cases like signage, video walls, and kiosks.- Key Players: Panasonic Corporation, Sony Corporation, NEC Corporation, Barco NV, Leyard Optoelectronic.

- Key Players: Panasonic Corporation, Sony Corporation, NEC Corporation, Barco NV, Leyard Optoelectronic.

- Distribution & OEM Partnerships

Fully assembled display systems are distributed to OEMs, resellers, and commercial customers for deployment in retail, hospitality, corporate, education, and transportation sectors. Vendors often collaborate with AV integrators and IT solution providers to deliver customized display ecosystems.- Key Players: Samsung Electronics, LG Electronics, Dell Technologies, Philips (TPV Technology), ViewSonic Corporation.

- Key Players: Samsung Electronics, LG Electronics, Dell Technologies, Philips (TPV Technology), ViewSonic Corporation.

- Aftermarket Services & Support

The final phase includes installation, maintenance, calibration, software upgrades, and lifecycle management to optimize performance and extend product lifespan. Cloud-based content management and remote monitoring have become crucial differentiators at this stage.- Key Players: Cisco Systems, Microsoft Corporation, BrightSign LLC, Scala (STRATACACHE),

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

Commercial Display Market Companies

- Samsung Electronics Co., Ltd. (South Korea): A global leader in commercial display solutions, Samsung offers a wide portfolio including digital signage, LED walls, video walls, interactive displays, and outdoor signage systems designed for retail, corporate, and transportation sectors.

- LG Display Co., Ltd. (South Korea): LG is a dominant player in OLED and LCD technologies, supplying commercial-grade displays for hotels, retail spaces, healthcare, and corporate environments with advanced 4K/8K and transparent OLED solutions.

- BOE Technology Group Co., Ltd. (China): One of the world's largest display manufacturers, BOE provides high-end LCD, OLED, and flexible displays for commercial use in education, digital signage, and public information systems.

- Sharp Corporation (Japan): Sharp offers a wide range of commercial display panels, including 4K Ultra-HD and interactive touchscreen displays, targeted at classrooms, conference rooms, and public displays.

- AU Optronics Corp. (Taiwan): AUO produces advanced display technologies such as energy-efficient LCDs, mini-LED, and OLED panels designed for retail signage, industrial, and transportation sectors.

- Sony Corporation (Japan): Sony's professional display division focuses on high-brightness 4K HDR and micro-LED displays used in broadcasting, control rooms, entertainment venues, and corporate communications.

- Panasonic Corporation (Japan): Panasonic delivers durable and energy-efficient digital signage solutions, video walls, and transparent displays for retail, education, and hospitality applications.

- Leyard Optoelectronic Co., Ltd. (China): A pioneer in LED and visualization technologies, Leyard offers fine-pitch LED displays, immersive visualization systems, and architectural LED screens for advertising and command centers.

- Barco NV (Belgium): Barco specializes in large-format visualization and projection systems, video walls, and LED displays for corporate, healthcare, and entertainment applications.

- NEC Corporation (Japan): NEC provides comprehensive digital signage and display systems integrating LCD, LED, and projection technologies for smart retail, education, and public infrastructure projects.

- ViewSonic Corporation (USA): ViewSonic offers commercial-grade LED and interactive displays, particularly targeting education, enterprise, and hybrid work environments.

Recent developments

- In May 2025, MateBook Fold ULTIMATE DESIGN, which is HUAWEI's first HarmonyOS 5-powered laptop with a foldable OLED screen in China, was introduced. It has a dual-layer OLED flexible display with the 18-inch screen when unfolded and 13-inch screen when folded, which makes it the world's largest commercial foldable screen PC.

- In May 2025, the JXT480272T016-ZBB03, a 4.3, which is IPS model developed by Inelco Hunter, was recently introduced. It consists of a crisp resolution of 480(RGB) × 272 dots, it also delivers a full viewing angle, a normally black LCD type, 450cd/m² brightness, and transmissive, which enhances the image quality and readability across various lighting conditions.

- In May 2025, a collaboration between AUO Display Plus and Nanolumens was announced to develop and provide display solutions for global markets. The expertise in engineering, along with the merging of creative LED displays with AUO Display Plus's capabilities in microLED, will be provided by this collaboration.

(Source: https://www.fonearena.com)

(Source: https://www.electropages.com)

(Source: https://www.avinteractive.com)

Segments Covered in the Report

By Product

- Digital Signage

- Display TVs

- Display Monitor

By Display Type

- Curved Panel

- Flat Panel

- Others

By Component

- Software

- Hardware

- Services

By Technology

- LCD

- LED

- Others

By Application

- Hospitality

- Entertainment

- Retail

- Corporate

- Stadiums & Playgrounds

- Healthcare

- Education

- Banking

- Transportation

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting