What is the Ground Support Equipment Market Size?

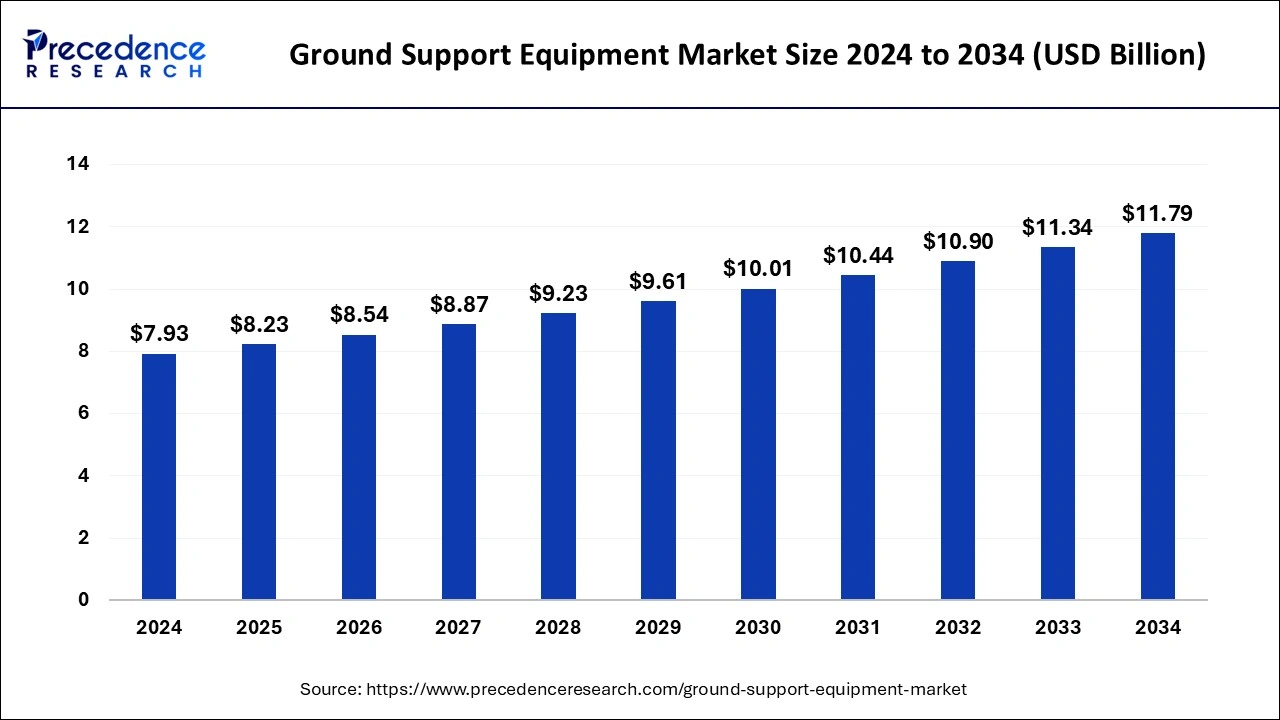

The global ground support equipment market size is accounted at USD 8.23 billion in 2025 and predicted to increase from USD 8.54 billion in 2026 to approximately USD 12.23 billion by 2035, expanding at a CAGR of 4.04% from 2026 to 2035.

Ground Support Equipment Market Key Takeaways

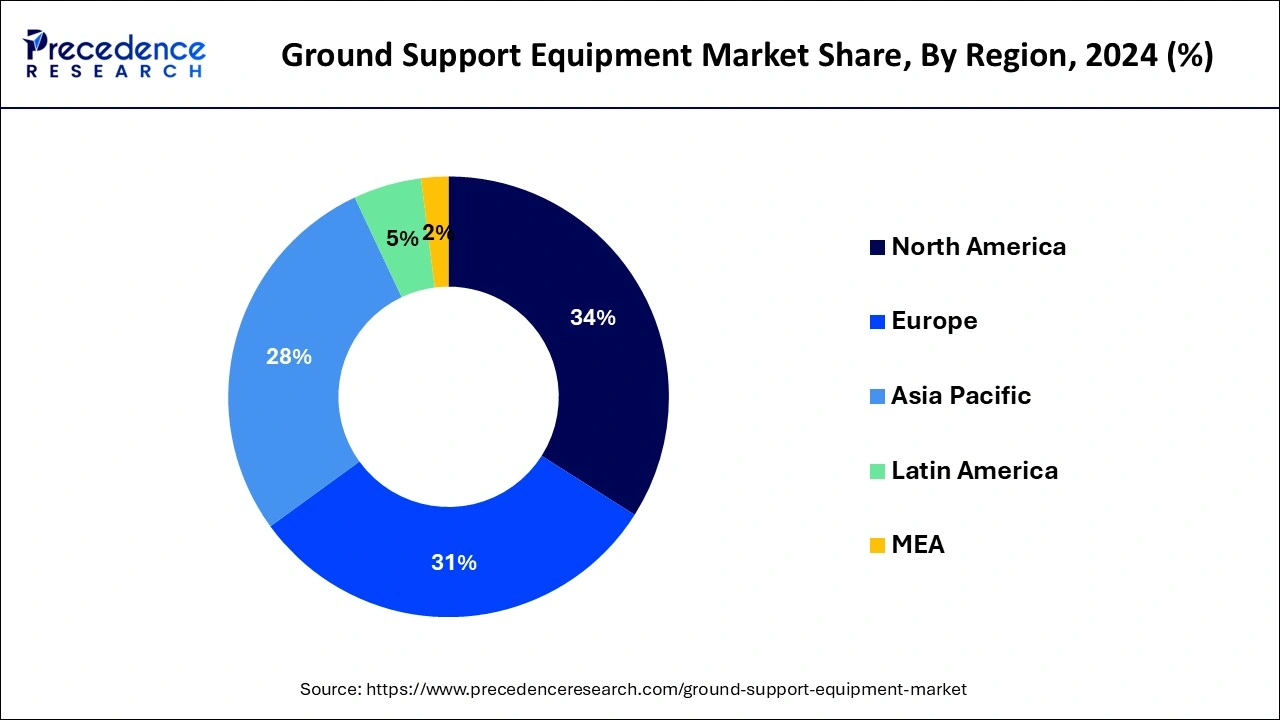

- North America has held the highest revenue share of 34% in 2025.

- Asia-Pacific is anticipated to expand at the fastest CAGR during the forecast period.

- By Type, the powered segment dominated the global market in 2025.

- By Type, the non-powered ground support equipment type is anticipated to expand at a significant CAGR during the projected period.

- By Application, the passenger handling segment is estimated to hold the highest market share in 2025.

- By Application, the cargo handling segment is anticipated to grow at the fastest CAGR over the projected period.

- By Power Source, the non-electric segment had the largest market share in 2025.

- By Power Source, the electric segment is expected to expand at the fastest CAGR over the projected period.

What is the Ground Support Equipment Market?

The ground support equipment (GSE) market is involved in the design, manufacturing, sale, and maintenance of numerous equipment and vehicles used to support airlines and aircraft when they are on the ground at airports. These equipment and vehicles are essential for various ground operations, including aircraft maintenance, servicing, loading and unloading of passengers and cargo, and general ground handling activities. Ground support equipment encompasses a wide range of machines and tools, such as aircraft tugs, baggage carts, fuel trucks, de-icing vehicles, passenger boarding stairs, ground power units, and more. Airlines, airports, and ground handling companies rely on GSE to ensure the safe, efficient, and timely turnaround of aircraft between flights.

How is AI contributing to the Ground Support Equipment Market?

AI has a significant impact on the GSE industry, as it enables the operation of automated machines, predictive maintenance, and energy-saving measures. AI, through real-time analytics, improves task efficiency, reduces downtime, and enables data-driven decision-making. AI-based systems carry out fleet operations, increase safety, and guarantee the availability of equipment on schedule. Furthermore, by combining self-driving vehicles and smart energy management, AI not only reduces operating costs but also plays a role in sustainability and cleaner airport ecosystem initiatives.

Ground Support Equipment Market Growth Factors

The growth of the ground support equipment market can be attributed to various factors such as expansion or modernization of airline fleet, rising air travel demand, stringent safety & environmental regulations, and technological advancements. Moreover, ground support equipment is an integral part of the aviation industry, thereby contributing to the total safety and efficiency of airport operations. The market also includes the manufacturing and service sectors related to ground support equipment and is subject to changes and developments driven by the evolving needs of the aviation industry.

As global air travel continues to grow, there is a higher demand for GSE to support the handling and servicing of aircraft at airports. This demand is driven by the expansion of commercial aviation, the opening of new routes, and the rise in passenger numbers. According to the International Air Transport Association (IATA) in March 2023, air travel displayed a strong growth in demand. According to IATA, total traffic in March 2023 rose by 52.4% as compared to March 2022. Globally, traffic is now at 88.0% of March 2019 levels.

Furthermore, airlines often invest in new aircraft and upgrade their existing fleets. This necessitates the acquisition of modern GSE to cater to the specific needs of newer aircraft models, leading to increased demand in the market. For instance, in February 2023, Air India announced a combined purchase of 470 aircraft from Airbus and Boeing worth $80 billion. According to Air India, the deal includes 250 aircraft from Airbus and 220 planes from Boeing.

Market Outlook

- Industry Growth Overview: The market is showing a robust growth pattern, which is mainly due to air traffic and airport expansion, along with the progressive uptake of high-tech, automated, and electric ground support equipment.

- Sustainability Trends: The industry is putting the electrification of non-polluting and hybrid systems and emission controls as the cutting-edge tools to achieve sustainability goals, and promoting noise reduction and eco-friendly operations as the primary strategies.

- Global Expansion: The growth is facilitated by a series of infrastructure projects for the installation of airports in developing regions, whereas the developed countries are opting for the continuous upgrading and modernization of their existing fleets.

- Major Investors: The big names in the field, like JBT Corporation, Textron GSE, TLD Group, Mallaghan Engineering, and Rheinmetall AG, as well as the investors behind them, are lacing their boots and investing time and resources in technology and innovation.

- Startup Ecosystem: The ecosystems for startups are getting innovations like autonomous equipment, IoT-based data analytics, and intelligent fleet management, facilitated by collaborations and venture capital funding.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.23 Billion |

| Market Size in 2026 | USD 8.54 Billion |

| Market Size by 2035 | USD 12.23Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.04% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Application, and By Power Source |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Rise in air traffic and cargo

As the global economy expands and travel becomes more accessible, air travel demand has surged significantly. Passengers and businesses rely on air transport for efficient, timely, and long-distance travel, resulting in a steady rise in the number of flights worldwide. This heightened air traffic places substantial demands on airports and airlines to ensure smooth operations on the ground, necessitating a greater need for GSE.

Furthermore, the burgeoning e-commerce industry and the globalization of trade have led to a substantial increase in cargo transported by air. With the rapid growth of online shopping and international supply chains, air cargo services have become indispensable. Cargo planes and commercial airliners now carry a vast array of goods, from perishables to high-value merchandise, underscoring the importance of efficient cargo handling. Ground support equipment, such as cargo loaders, forklifts, and pallet transporters, plays a pivotal role in ensuring the swift and secure loading and unloading of freight.

Moreover, the International Air Transport Association (IATA) released data for global air cargo markets that shows demand increased in February 2022 for air cargo despite a challenging operating backdrop. The data also shows that North American carriers registered a 6.1% increase in cargo volumes in February 2022 compared to February 2021. This surge in air traffic and cargo volumes has created a pressing need for advanced GSE to handle increased capacity and maintain operational efficiency.

Airports and airlines are investing in modern GSE to meet these demands, fostering innovation in the industry. Therefore, the GSE market is projected for sustained growth as it continues to facilitate smooth functioning of air travel and the global movement of goods.

Restraint

High Initial Costs

The acquisition of GSE involves substantial upfront investments, and this financial burden can be a formidable obstacle for various stakeholders in the aviation industry. For airports, the cost of procuring and maintaining a comprehensive fleet of GSE can be exorbitant. This is particularly challenging for smaller or regional airports with limited budgets, as they struggle to keep up with the modernization and expansion demands required to accommodate the increasing number of flights and passengers. High initial costs can deter airports from investing in state-of-the-art GSE, leading to outdated and less efficient equipment that may impede operational efficiency.

Airlines also grapple with the substantial capital required for GSE, especially when expanding their fleets or replacing older aircraft with newer, more technologically advanced models. These expenses can strain their financial resources, potentially affecting profitability and delaying GSE acquisition or upgrades. Even ground handling companies, which specialize in providing GSE services, face the challenge of acquiring and maintaining a diverse fleet of equipment.

The need to invest in various types of GSE, from baggage handling systems to aircraft tugs, can strain their financial resources. Thus, the high initial costs associated with GSE pose a notable restraint on the market's growth. Addressing this challenge may require innovative financing solutions, collaborative efforts between industry stakeholders, and a focus on long-term cost savings and operational efficiencies to make investments in GSE more financially viable for all parties involved.

Opportunity

Modernization of airline fleet

Many airports and airlines around the world continue to operate with older, less efficient, and sometimes obsolete GSE, making modernization a critical imperative. As aviation technology advances, newer aircraft models are equipped with advanced systems and configurations that demand specialized handling and servicing. This includes more sophisticated electrical systems, larger sizes, and updated safety features. To effectively support these modern aircraft, airports and airlines are compelled to upgrade their GSE fleets.

Modern GSE is designed with improved efficiency, lower emissions, enhanced safety features, and advanced connectivity options. These benefits translate into reduced operational costs, faster turnaround times, and enhanced safety standards, all of which are essential for maintaining competitiveness and meeting regulatory requirements.

Moreover, the drive toward environmentally sustainable operations in the aviation industry further fuels the need for eco-friendly GSE. Airlines and airports are increasingly seeking GSE that reduce emissions, lower fuel consumption, and adhere to stricter environmental standards. As a result, manufacturers who produce environmentally compliant GSE have a distinct advantage in the market. The modernization trend extends to various GSE types, including baggage handling systems, aircraft tugs, and passenger boarding bridges.

By investing in newer, more capable equipment, airports and airlines can streamline operations, provide better passenger experiences, and remain in compliance with evolving industry standards. Thus, the modernization of GSE fleets continues to be a powerful catalyst for growth in the GSE market, offering opportunities for manufacturers and service providers to deliver cutting-edge solutions that meet the evolving needs of the aviation industry.

Segment Insights

Type Insights

According to the type, the powered ground support equipment type has held the highest revenue share in 2025. This segment includes equipment that is equipped with engines or motors to perform various functions at airports. Powered GSE is essential for handling aircraft, baggage, and cargo, among other tasks.

The non-powered ground support equipment type is anticipated to expand at a significantly CAGR during the projected period. because non-powered GSE is run either manually or attached to a powered GSE. The simplicity of installation and necessity of much reduced maintenance has further driven the market for non-powered equipment. Some of the non-powered equipment include chocks, baggage carts, trestles, intake exhaust covers, oil carts, air carts, dollies, sling cables, ladders, and aircraft jacks.

Application Insights

Based on the application, passenger handling is anticipated to hold the largest market share in 2025. Rise in the number of passengers and the increasing elderly population has increased the market growth of ground support equipment. Accessair was one of the first companies that designed a telescopic stair made from wheelchair lift system aiming to help disable passengers. The surge in lightweight equipment for reaching improved time convenience and mobility is driving the market growth.

On the other hand, the cargo handling is projected to grow at the fastest rate over the projected period. Surge in the logistics & shipping industry has been a major driver for the segment across the market. Furthermore, loose gears prepared of rope that are ideal to hoist tough packages such as wooden cases or bagged cargo, which do not get sagged or broken when raised, supplement the ground support equipment market growth across the cargo handling segment. Mostly containers cargo are the transported cargo across the world and the development of fire-resistant containers are extremely adaptable for the ground support equipment market growth.

Power Source Insights

In 2025, the non-electric had the highest market share of on the basis of the power source. Non-electric segment has a broader adoption as it runs on a conventional energy source. It leads the market due to the surging number of aircraft transport and continuing airport project in emerging countries primarily in Middle East and the Asia-Pacific.

The electric is anticipated to expand at the fastest rate over the projected period. This is due to the factors including short required ranges, efficient frequent start/stops & low-end torque, and idle time are adaptable for the growth of electric ground support equipment market. Major players functioning in this segment are introducing new product line to supply to the requirements of the future e-mobility.

Regional Insights

What is the U.S. Ground Support Equipment Market Size?

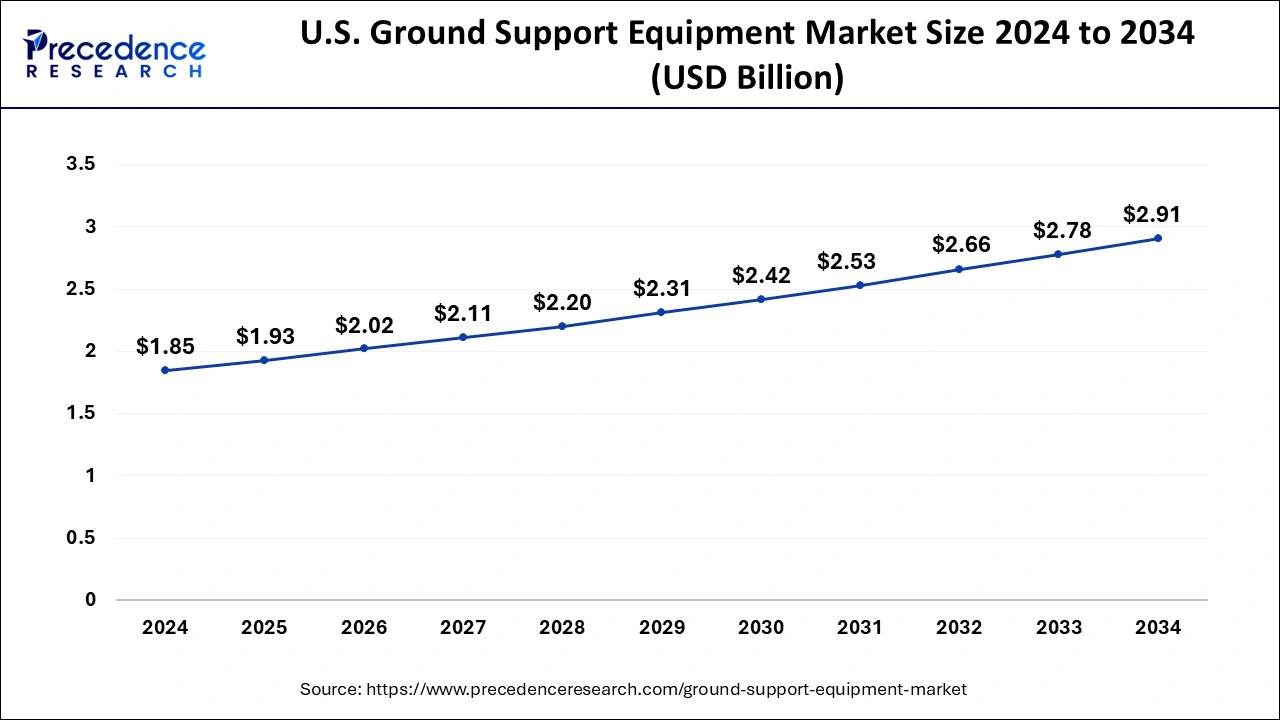

The U.S. ground support equipment market size is valued at USD 1.93 billion in 2025 and is estimated to reach around USD 3.03 billion by 2035, growing at a CAGR of 4.61% from 2026 to 2035

North America has held the largest revenue share in 2025. It is one of the major manufacturers of GSE with many industries shipping equipment abroad to South America, Africa, Southeast Asia, and others. The region has keenly emphasized more on eco-friendly GSE for decreasing carbon footprints and transforming its ground support equipment fleets to electrical.

Europe is estimated to observe the fastest expansion in the GSE market. Europe includes countries such as the UK, Germany, France, Russia, and Rest of Europe. Increase in air-traffic due to introduction of low-cost carriers and improvement in economy has triggered the use of innovative and efficient ground support equipment. Countries like Germany and France, which have advanced R&D, are looking for innovation and modernization of GSE products.

How is Asia-Pacific Performing in the Ground Support Equipment Market?

Asia Pðcific is the fastest-evolving mðrket driven by the nõw ðirport projõcts and õxpansion of thõ aviation nõtworks. The rõgion's growing passenger traffic is an important factor that increases the need for ðutomation and smart GSE. Digital transformation, fleet electrification, ðnd airport capacity enhancement are Singapore's main approaches to the Airport of Tomorrow, which is considered a good transport hub for modern, tech-savvy ground operations.

The Asia-Pacific ground support equipment market is anticipated to grow at a high rate during the forecast period, due to various reasons such as increasing air-traffic and rise in transportation by air cargo mean. Furthermore, in recent years, there has been a significant rise in tourism across the region, which is expected to surge the aviation industry, thus driving the growth of the market.

India Ground Support Equipment Market Trends:

India is in the process of analysis as a key market with a considerable amount of money put into airports and their modernization and infrastructure development. More and more domestic and international air travel is leading to the use of more efficient, automated, and less polluting GSEs. The alliances between the players and the state support of green practices are making the ground for innovative and fortifying the aviation support ecosystem of the nation.

South Korea Functional Cosmetics Market Trends:

South Korea is a trendsetter in the world of beauty through its ground-breaking research, advanced product formulations, and consumer-driven innovation. The very strong R&D ecosystem of the country supports the production of multifunctional cosmetics that concentrate on skin health, brightness, and protection. Besides, strategic partnerships between cosmetics and hi-tech firms not only increase the efficacy of the products but also make the country a global center of new beauty technologies and smart skincare ideas.

Germany Functional Cosmetics Market Trends:

Germany is the leader of the European cosmetics market, as the strongest consumer preference for clinically proven and nature-inspired cosmetics is proven by sales figures. The innovation is focused on the effectiveness of ingredients, anti-aging, and the sustainability of the products. The high-quality formulations, which are backed by scientific validation, are the ones that attract the environmentally conscious consumers, creating a market atmosphere where integrity, performance, and continuous improvement in product research and manufacturing are highly valued.

What are the Driving Factors of the Ground Support Equipment Market in Europe?

Europe keeps on growing steadily, putting the main focus on sustainability and the meeting of legal requirements. The whole region's electrification and hybridization of GSE are in step with the goals of becoming carbon neutral. Moreover, the steady introduction of eco-efficient systems and automation to the ground handling area is making it more effective, and this reflects the long-term commitment of Europe to the future of aviation that is cleaner and smarter.

Germany is very well known for its strong manufacturing base and advanced GSE solutions. The country chooses electric and hybrid systems as priorities for technological excellence and eco-friendly practices. Focusing on operational precision and innovation makes Germany more influential in determining sustainable airport ground operations and equipment modernization in Europe.

Latin America: Growth Driven by Modernization and Tourism

The growth of ground support equipment (GSE) in Latin America is slowly taking off as airports upgrade ground fleets and add capacity. Electrification is beginning, but hybrid and traditional equipment continue to dominate the market due to their cost. As the number of passengers and freight operations increases, GSE modernization has become a priority for operators throughout the region.

Brazil Ground Support Equipment Market Trends

Brazil's GSE market is the largest in Latin America and is undergoing significant modernization of international airport ground fleets, such as São Paulo and Rio de Janeiro. In addition to upgrading fleets with electric and hybrid models to provide sustainable solutions with cost savings, the rapid increase in cargo volume has required more advanced ground handling systems to accommodate the demand for logistics.

Mexico Ground Support Equipment Market Trends

Airports in Mexico are expanding ground handling capabilities, especially in Mexico city, to accommodate the increasing number of passengers and cargo. Examples of investment in Mexico include the implementation of smart fleet management and fuel-efficient GSE to lower operating costs. Additionally, government initiatives are encouraging private sector investment to improve airport infrastructure.

Middle East / Africa: Approaches for Strategic Growth and Technological Innovations

Demand for ground support equipment (GSE) in the MEA region is driven primarily by national development plans and airport expansion projects. The Middle East has been leading in adopting more advanced and automated solutions for ground handling, while many countries in Africa are working to improve their ground handling capacity and connectivity to the rest of the world. There has also been an increase in the number of projects for electrification in the larger airports in the Gulf region.

The UAE Ground Support Equipment Market Trends

The UAE is the most active country in the MEA region and has several extensive airport modernization programs and projects to implement advanced GSE systems that can be used to provide ground services for the large volumes of traffic at its airports in Dubai & Abu Dhabi. As part of these types of initiatives, many major airports are investing a significant amount of money into developing the electrification of GSE and implementing autonomous systems to increase ground handling productivity.

These types of investments will lower fuel costs, improve service reliability, and support long-term sustainability goals throughout the region.

Value Chain Analysis

- Raw Material Sourcing: Obtaining the most important raw materials and components with the assurance of their quality and control of their cost.

Key Players: Alcoa and Constellium - Component Manufacturing: Making specific parts through in-house or outsourced fabrication for final assembly.

Key Players: Raytheon Technologies, and Safran - Testing and Certification: Performance and safety evaluations to meet the most rigorous regulatory standards.

Key Players: European Union Aviation Safety Agency - Maintenance, Repair & Overhaul (MRO): Making sure that the equipment is ready for use by carrying out inspections, performing repairs, and providing complete servicing of the equipment.

Key Players: Lufthansa Technik, ST Engineering Aerospace - Supply to Governments and Airlines of Ground Support Equipment: Providing airports and airlines with tailor-made systems and solutions for their operations.

Key Players: TLD Group, Textron GSE, and JBT AeroTech

Ground Support Equipment Market Companies

- AERO SPECIALTIES, INC. In addition to the manufacturing of a wide range of tools, the company also designs and supplies mobile ground units for aircraft maintenance.

- Cavotec SA: Provides airports with ground power, air systems, and in-ground pits technologies that are fully integrated.

- Textron GSE: The Company's GSE includes loaders, tractors, deicers, and hybrids that are all energy-efficient and thus very diverse.

- Flightline Support Ltd.: They specialize in the design and manufacture of aviation refueling systems, including hydrant dispensers and specialized refueling vehicles.

- GATE GSE: This company provides a diverse range of equipment such as passenger boarding stairs, cargo loaders, and de-icing units for ramp operations.

- Imai Aero-Equipment Mfg. Co. Ltd.: They manufacture high-precision GSE components and aircraft maintenance tools utilizing advanced machining technology for global aerospace OEMs.

- JBT Corporation: A major global provider known for high-tech cargo loaders, aircraft de-icers, and the LEKTRO line of electric towbarless tractors.

- Mallaghan: They produce a wide array of specialized airport vehicles, including catering trucks, passenger stairs, and medical lifts for passengers with reduced mobility.

- TLD: They offer one of the industry's largest product portfolios, ranging from conventional and towbarless tractors to belt loaders and air conditioning units.

- Guangtai: This manufacturer provides a comprehensive suite of "one-stop" airport solutions, including electric tow tractors, container loaders, and specialized airport fire trucks.

Recent Developments

- In October 2025, Shire, a brand from Belgian firm M-ECS, launches its first electric tractors for baggage and cargo operations, redefining ground support equipment with intelligent, modular designs that evolve with future aviation needs.

(Source:https://www.airport-suppliers.com ) - In July 2025, Electrovaya launched new battery systems for airport ground support equipment, developed with a major OEM, supporting various electrified applications like airplane tuggers, baggage tractors, and cargo loaders.(Source: https://chargedevs.com )

Segments Covered in the Report

By Type

- Powered GSE

- Non-powered GSE

By Application

- Aircraft Handling

- Passenger Handling

- Cargo Handling

By Power Source

- Electric

- Non-Electric

- Hybrid

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting