Connected Aircraft Market Size and Forecast 2025 to 2034

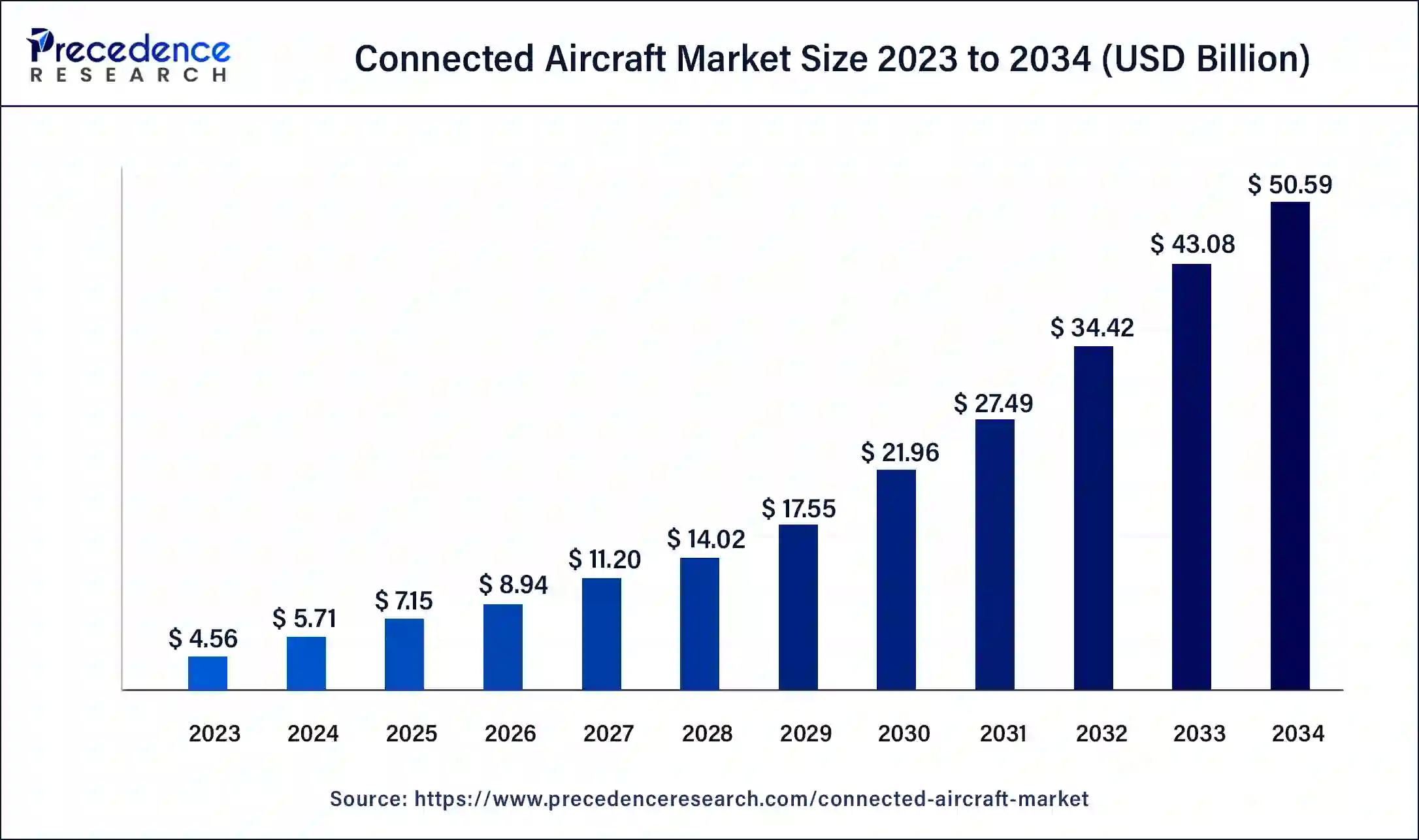

The global connected aircraft market size was estimated at USD 5.71 billion in 2024 and is anticipated to reach around USD 50.59 billion by 2034, growing at a CAGR of 24.38% from 2025 to 2034. The increase in demand for advanced technologies, including fast wi-fi connectivity and the integration of IoT in connected aircraft, increases the growth of the connectedaircraft market.

Connected Aircraft Market Key Takeaways

- The global connected aircraft market was valued at USD 5.71 billion in 2024.

- It is projected to reach USD 50.59 billion by 2034.

- The connected aircraft market is expected to grow at a CAGR of 24.38% from 2025 to 2034.

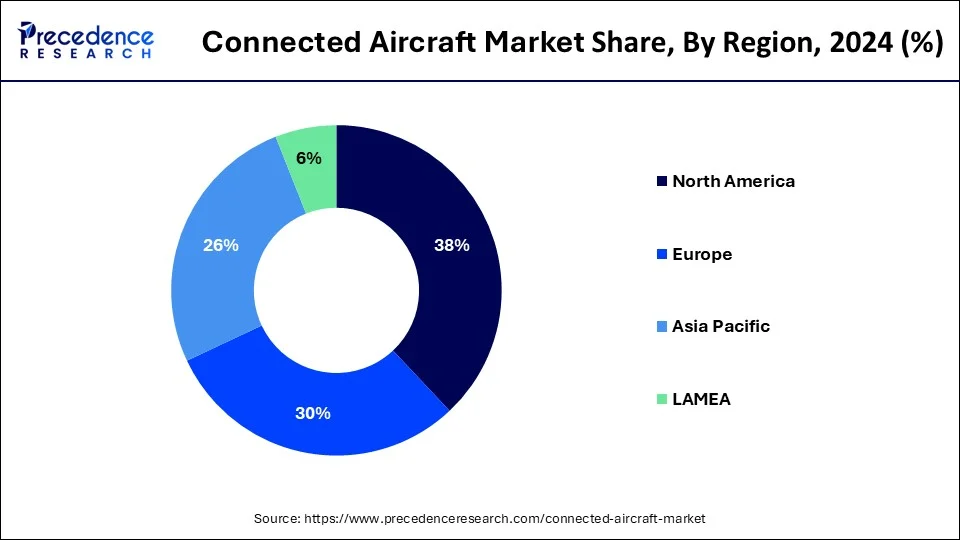

- North America dominated the market with the largest market share of 38% in 2024.

- Asia Pacific is expected to witness the fastest growth between 2025 to 2034.

- By type, the systems segment dominated the market in 2024.

- By type, the solutions segment is expected to grow continuously in the forecast period.

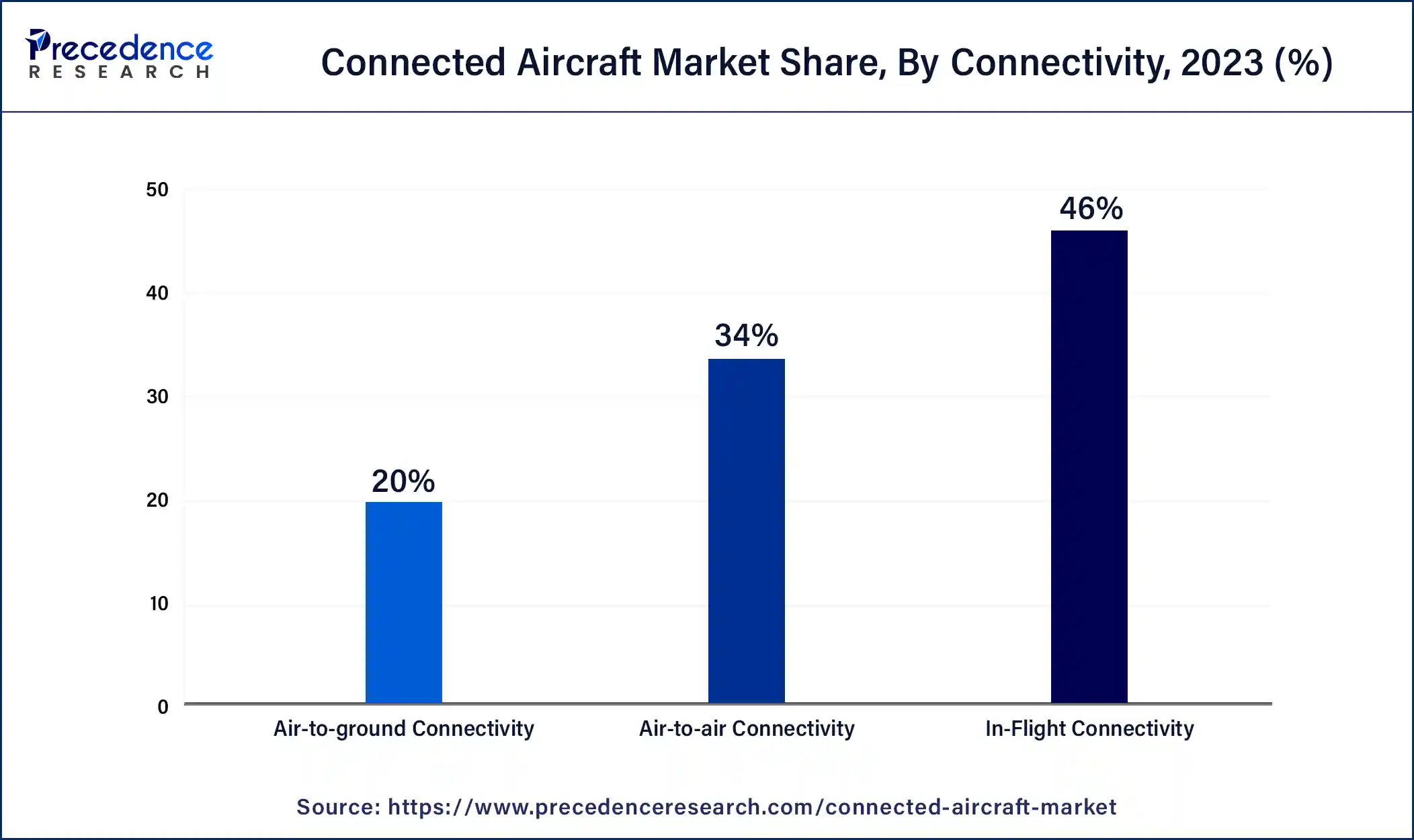

- By connectivity, the in-flight connectivity segment has held the largest market share of 46% in 2024.

- By connectivity, the air-to-ground connectivity segment is projected to grow at a fast pace during the forecast period.

- By frequency, the Ka-band segment dominated the market in 2024.

- By frequency, the L-band segment is the fastest-growing segment during the forecast period.

- By application, the commercial segment dominated the market in 2024.

- By application, the military segment is the fastest-growing segment.

U.S. Connected Aircraft Market Size and Growth 2025 to 2034

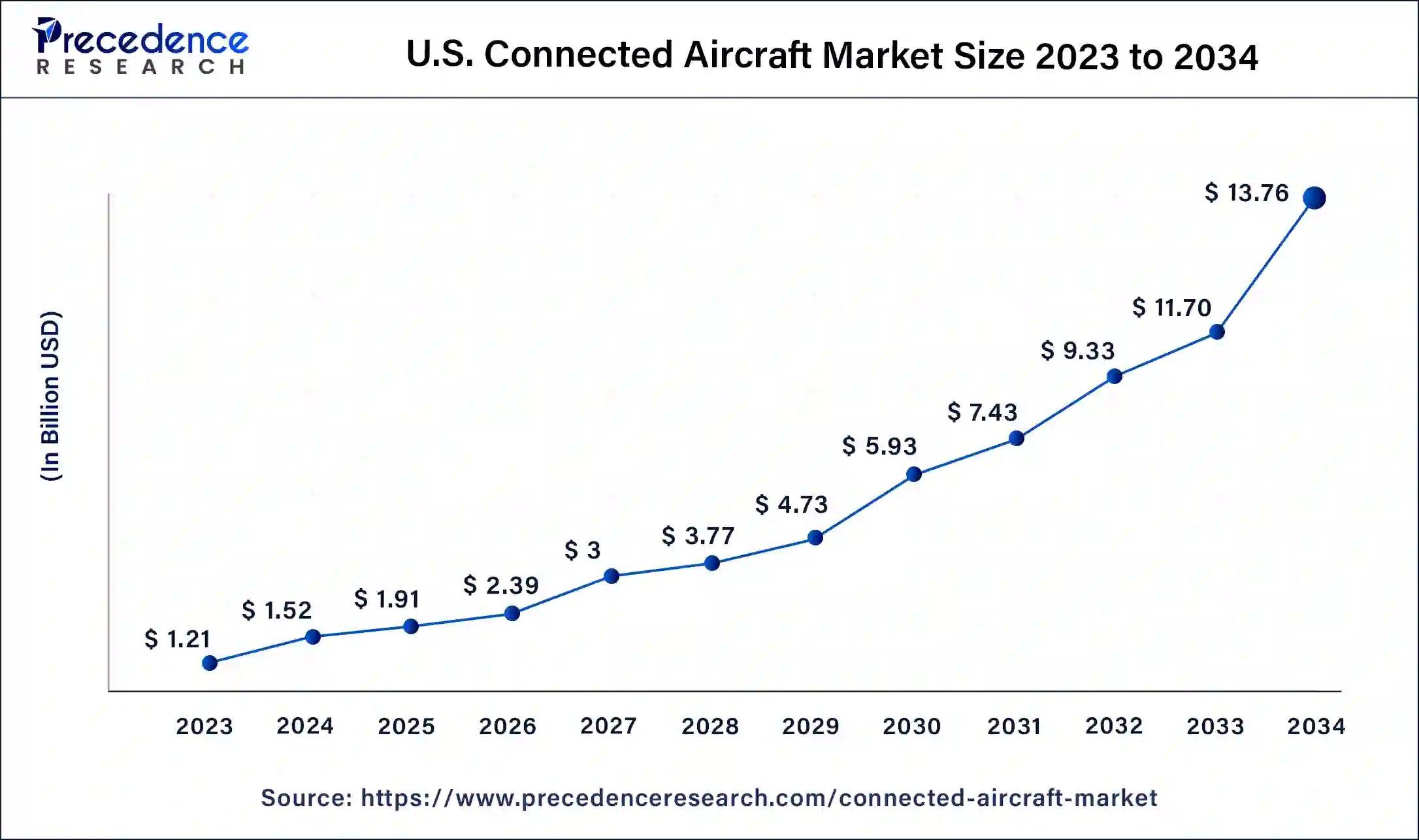

The U.S. connected aircraft market size reached at USD 1.52 billion in 2024 and is expected to be worth around USD 13.76 billion by 2034 at a CAGR of 24.65% from 2025 to 2034.

North America dominated the connected aircraft market in 2024 and is expected to maintain its dominance over the forecast period. North America has the biggest and most developed aviation market in the world. Airlines operating in the region are trying to focus more on investing in connection solutions to meet the demand and improve the customer experience. Also, the presence of a significant number of commercial airlines, business aviation operators, and aircraft manufacturers expands the growth of the market. People traveling in this region have high expectations for in-flight internet and digital facilities. The increase in the number of airlines in the region that offer in-flight Wi-Fi, streaming services, and other conditions is expanding the usage of connected aircraft technologies.

Asia Pacific is expected to witness the fastest growth between 2025 and 2034. The growth of the region is attributed to companies with advanced technologies, avionics providers, and aircraft manufacturers that are actively developing and enhancing services in aircraft systems. Moreover, the region is setting the standard for the adoption of connected aircraft technology. Vietnam, Indonesia, and India are the main regions that are investing in expanding the aviation infrastructure, and as a result, the region is rapidly increasing demand for advanced aircraft systems. Additionally, advancements in data analytics, the Internet of Things, satellite communication, and wireless technologies provide an opportunity for expanding the market growth in the region.

- In March 2024, the Madhya Pradesh chief minister launched aircraft services to promote tourist destinations in the region. The Tourism Board of MP has collaborated with Jet Serve Aviation to promote air services in tourist destinations within the state. Jet Serve Aviation is also exploring connectivity options and trying to establish the required infrastructure, such as booking portals.

Market Overview

Connected aircraft (CA) is a comprehensive term that consists of the Internet of Things (IoT), in-flight entertainment, Wi-Fi accessibility, sensors, air-to-air flight connectivity, and air-to-ground connectivity in aircraft systems. In simple words, the integration of advanced technologies in aircraft is referred to as connected aircraft. The concept of this system is to maintain and expand growth in order to meet the demand for information exchange between aircraft and relevant aviation stakeholders. The main aim of the connected aircraft market is to improve airline or operator operations through efficient and sustainable approaches and also fulfill the needs of the people.

The strong desire for inflight connectivity is rapidly increasing, and new developments are continuously being announced. In addition, providing internet connectivity for entertainment and other purposes in airlines improves the overall services and traveling experience. Further, collaboration with market players and the launching of advanced technologies are essential for the growth of the connected aircraft market. The Federal Aviation Administration (FAA) is planning for system-to-system communications. This aims to provide the full connection of aircraft from the ground and helps enable new types of aircraft, operators, and operation procedures.

The huge amounts of data gathered by connected aircraft help in fleet management operations for optimal performance by contributing profits in areas such as engineering and scheduling with more safety and reliability. Meanwhile, connected aircraft ensure higher standards of safety and management in airspace systems because of better information and communications available in real time. Also, this system faces some challenges, such as concerns regarding data and privacy, and high maintenance costs hamper the market. To avoid these challenges and expand growth, these challenges need to be addressed. All these factors increase the demand for connectivity systems globally and further boost the connected aircraft market.

Connected Aircraft Market Growth Factors

- Connected aircraft technology helps to improve airline or operator operations by efficient and sustainable approaches and also fulfills the needs of the passenger for connectivity purposes, which enhances the connected aircraft market.

- The strong desire for having inflight connectivity is rapidly increasing and continuously announcing new developments that boost the connected aircraft market.

- Connected technology expands the connected aircraft market, which ensures higher standards of safety and management in airspace systems because of better information and communications available in real-time.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 24.38% |

| Market Size in 2024 | USD 5.71 Billion |

| Market Size in 2025 | USD 7.15 Billion |

| Market Size by 2034 | USD 50.59 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Connectivity, Frequency, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand for high-speed connectivity services in flights

The growing demand for in-flight Wi-Fi services among passengers in airlines increases the growth of the market. The airline sector is also trying to make investments in connectivity technologies to enhance the passenger experience. This offers passengers more entertainment options during the flight. Along with this, passengers are also able to access high-speed internet and streaming services. With the utilization of linked aircraft technologies, airlines are reducing costs and improving operational efficiency. These technologies help in lowering operating costs and increasing resources. Connected aircraft systems also help in weather monitoring, real-time data transfer, and aircraft tracking for safety and security purposes. Further, these technologies increase usage in airlines and expand the growth of the connected aircraft market.

Restraint

Increase in problems associated with cyber threats in aircraft industries

Cyber-attacks can impact the aviation industry in several ways. Generally, the exposure to IoT and connected technologies has increased cyber-attacks, which results in a large number of flight delays and issues such as attacks by terrorists. The lack of standard security components and systems can increase the risk of more cyber-attacks. These rising cases of cyber-attacks in the aviation sector are analyzed to hamper the growth of the connected aircraft market in the forecast period.

Opportunity

Integration of the Internet of Things in aircraft

Integration of the Internet of Things (IoT) in aircraft results in improving predictive maintenance, minimizing downtime, and reducing operational costs. Companies like Boeing and Airbus are trying to focus more on investments in IoT technologies. Predictive maintenance has become a standard practice that ensures operations are efficient. This advanced trend offers comprehensive solutions to the airline sector, which ensures the optimization of aircraft performance and safety with cost-effective approaches.

- In March 2024, OnAsset Intelligence announced the launch of the world's first dedicated aircraft IoT Gateway. This presents airlines with a more appropriate solution for monitoring, maintaining, and optimizing aircraft systems. This leads to improved efficient operations, reduced downtime, and expanded safety and security, with multiple benefits.

Type Insights

The systems segment dominated the market in 2024. The system segment includes different systems, such as satellite communication, data management, etc. The growth of this segment is attributed to the increasing use of satellite systems and data management systems. The use of satellites in the aviation industry complements navigation potential and helps in communication, which is often referred to as SATCOM. Along with this, it also helps in air traffic management as communication between aircraft and air traffic control with the help of satellite is an innovative concept. All these factors increase the demand for aircraft systems globally and hence expand growth in the connected aircraft market.

Along with this, the solutions segment is expected to grow continuously in the forecast period. The solution segment consists of a fuel management system, flight management system, crew connectivity system, traveler connectivity system, aircraft monitoring and safety system, etc. The increased demand for these systems globally is expected to boost the growth of the connected aircraft market.

Connectivity Insights

The segment of in-flight connectivity dominated the market in 2024. This growth is attributed to the increasing demand for in-flight connectivity technologies that provide passengers with high-speed internet, streaming services, and other digital conveniences while traveling on a flight. These technologies include satellite communication systems, air-to-ground networks, wireless access points, and onboard routers. Moreover, aircraft connectivity also monitors aircraft health systems, performance, and errors in real-time. Sensors, diagnostic tools, health management systems, and predictive maintenance software provide real-time monitoring, which helps optimize fleet safety and reduce downtime by resolving maintenance issues. The demand for in-flight connectivity is rapidly increasing as travelers expect connectivity and entertainment alternatives while traveling, just like they do while on the ground. Therefore, it is essential to provide air travelers with internet connectivity and digital entertainment options. All these factors contribute to the expansion of the connected aircraft market.

The air-to-ground connectivity segment is projected to grow at a fast pace during the forecast period. The passage of communication or data between an aircraft and a ground station, which helps in controlling air traffic or operating an aircraft agency, increases the demand for more usage of air-to-ground connections. All these factors increase the growth of the connected aircraft market.

Frequency Insights

The Ka-band segment dominated the market in 2024. The data transfer rates of satellite communication technology by Ka-band are significantly higher than those of traditional Ku-band systems. The growth of this segment is due to fast internet connections, lower latency, and better performance for in-flight connectivity services. It effectively meets the growing demand for better internet access and multimedia streaming from passengers during flights. The higher bandwidth capacity of Ka-band than Ku-band satellites makes it appropriate for in-flight usage. As a result, airlines are able to offer high-speed internet connectivity to a large number of passengers on board aircraft. Additionally, multiple passengers can avail of connectivity facilities simultaneously.

The L-band segment is the fastest-growing segment during the forecast period. L-band signals have longer wavelengths, so they are able to penetrate through the Earth's atmosphere and are used for GPS units, which makes them suitable for both terrestrial and satellite communication. Moreover, satellite communication is also important for mobile communication, navigation systems, etc. Hence, the growth of the connected aircraft market is continuously increasing.

Application Insights

The commercial segment was the dominant market. Regular and business travelers demand advanced connectivity options to have a seamless internet and digital amenities experience on flights. Airlines are investing in linked aircraft technologies to meet customer demand and distinguish themselves in a competitive field. Wi-Fi connections, streaming services, email, and social media access during flights are essential in enhancing the overall travel experience. Linked aircraft technologies also aid airlines in improving fleet management, reducing costs, and enhancing operational performance. Predictive maintenance, real-time aircraft system monitoring, and data analytics all contribute to the efficient use of fuel and maintenance of other protocols.

The military segment is the fastest-growing segment. The growth of this segment is due to an increase in demand for aircraft connectivity in military services for performing surveillance and other operations. This significantly boosts the growth in the connected aircraft market.

Connected Aircraft Market Companies

- Honeywell

- Gogo

- Panasonic Avionics

- Inmarsat

- Global Eagle Entertainment

- BAE Systems PLC

- Panasonic Avionics Corporation

- Zodiac Aerospace

- Thales Group

- Burrana Inc.

- Viasat SpA

- Cobham PLC.

- Rockwell Collins, Inc.

- Kontron S&T AG

Recent Developments

- In October 2023, Qatar Airways announced a partnership with Starlink to offer high-speed free Wi-Fi on flights. The Wi-Fi can reach up to 350 megabits per second, which can be used for different purposes such as gaming, VPN access, sports streaming, and other high-demand activities.

- In February 2022,Aegean, a Greece airline, introduced a novel high-speed broadband service in flight, which is powered by the European Aviation Network (EAN). These EAN-connected aircraft have access to different wi-fi packages and also include a free 10-minute trial for browsing the internet, accessing email, messaging, and other social media applications.

Segments Covered in the Report

By Type

- System

- Solutions

By Connectivity

- In-Flight Connectivity

- Air-to-air Connectivity

- Air-to-ground Connectivity

By Frequency

- Ka-band

- Ku-band

- L-band

By Application

- Commercial

- Narrow Body

- Widebody

- Business Jet

- General Aviation Aircraft

- Military

- Fighter Aircraft

- Military Transport Aircraft

- Military Helicopter

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting