What is the Aviation Fuel Market Size?

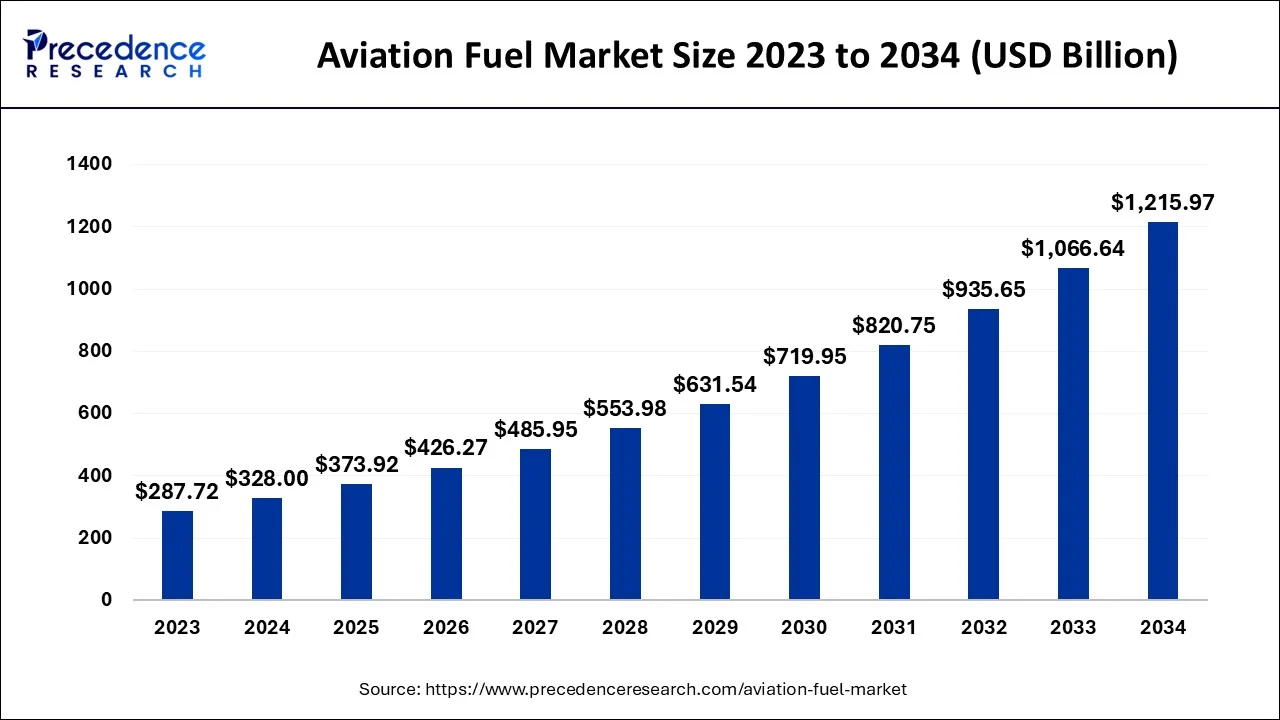

The global aviation fuel market size is calculated at USD 373.92 billion in 2025 and is predicted to increase from USD 426.27 billion in 2026 to approximately USD 1,215.97 billion by 2034, growing at a CAGR of 14% from 2025 to 2034.

Market Highlights

- North America held the highest revenue share of the global market in 2025.

- By Fuel Type, the conventional fuel segment held the biggest market share in 2025.

- By End User, the commercial aircraft segment had the largest revenue share in 2025.

Market Size and Forecast

- Market Size in 2025: USD 373.92 Billion

- Market Size in 2026: USD 426.27 Billion

- Forecasted Market Size by 2034: USD 1,215.97 Billion

- CAGR (2025-2034): 14%

- Largest Market in 2024: North America

Market Overview

Aviation fuel is used for powering aircraft and various types of aviation fuels are the by-products of crude oil. The aviation fuel market is majorly driven by the rising trend of air travel and the expanding aviation sector in various developing nations. The development of the latest aviation biofuels and the increasing requirement for low-cost carriers are also anticipated to create notable opportunities for all the market players during the study period. Factors such as stringent environmental regulations along with fluctuating crude oil prices can hinder the aviation fuel market growth to a certain extent.

Increasing investment in the aviation sector, rising disposable income, and the growing tourism industry are some of the latest factors that are supporting the aviation fuel market substantially.

In an effort to developsustainable aviation fuel, United Airlines and 5 corporate partners announced to invest $100 million in February 2025. GE Aerospace, Air Canada, Boeing, JPMorgan Chase, and Honeywell are the 5 corporate partners which would help in the development of sustainable aviation fuel.

As per the data from the U.S. Bureau of Economics, personal income increased by $1.97 trillion (10.5%) and Disposable Personal Income (DPI) grew by $2.13 trillion in April 2020. With rising income levels and expanding tourism sector, the number of air travelers is increasing rapidly across various nations of the world.

In 2022, Dubai received around 14.36 million international overnight visitors. This number is a 97% year-on-year (Y-o-Y) increase as compared to 7.28 million tourist arrivals in 2021. According to the World Tourism Organization, a specialized agency of the United Nations (UN), tourist arrivals in Maldives in January 2021 stood at 92,103. This count rose to 99,397 by 3rd February 2021. The growing count of tourists is creating promising scope for the aviation industry.

As per our research, the global sustainable aviation fuel market was valued at $433.26 million in 2022 and is predicted to account for $14,842.13 million by 2032. The global sustainable aviation fuel market will grow at a compounded annual growth rate (CAGR) of 42.39% from 2025 to 2034. Thus, considering such a high compounded annual growth rate for the sustainable aviation fuel market, the aviation fuel market is also expected to grow exponentially.

Aviation Fuel Market Outlook

- Industry Growth Overview: Between 2024 and 2034, the aviation fuel market is expected to grow significantly as global passenger traffic exceeds pre-pandemic levels. Supported by rising disposable incomes, increased tourism, and the expansion of low-cost airlines, the revival of international flights, especially in Asia-Pacific and the Middle East, is boosting the volume of jet fuel used by commercial and cargo fleets. Additionally, the high volume of air freight driven by e-commerce and globalized logistics is expected to sustain strong fuel demand.

- Sustainability Trends: Sustainability has become the key force shaping the aviation fuel industry, as governments, regulators, and industry leaders move toward achieving carbon neutrality. Sustainable Aviation Fuel (SAF) is rapidly transitioning from pilot projects to large-scale production. Companies like Neste, TotalEnergies, and Shell are launching large-scale SAF production facilities. Policies such as the ReFuelEU Aviation initiative by the EU, the SAF Grand Challenge in the U.S., and the Corrosiva initiative by ICAO are promoting renewable jet fuel blending targets and the use of carbon credits.

- Global Expansion: The market is growing worldwide as aviation fuel producers seek to comply with strict fuel regulations in different regions. Asia-Pacific remains the main growth area, with countries like India, China, and Indonesia expanding their airport networks and increasing capacity to meet the growing demand for aviation fuel. Government policies that promote energy independence and standardize fuel quality along international flight routes support these global growth efforts.

- Major Investors: The aviation fuel market is seeing increased participation from institutional investors and sovereign wealth funds attracted to the sector's shift toward cleaner, high-value fuel solutions. Companies like BlackRock, Brookfield Renewable Partners, and Temasek Holdings are investing billions in SAF production and refinery modernization efforts. Venture capital is increasingly focused on investments in SAF technology startups and carbon reduction platforms, with a particular emphasis on scalable and cost-effective solutions. Additionally, investor confidence in the long-term profitability of the aviation fuel sector continues to grow.

- Startup Ecosystem:The dynamic ecosystem of startups and technology innovators is reshaping the aviation fuel landscape through breakthroughs in renewable fuel production and emission reduction. Firms such as LanzaJet (USA), SkyNRG (Netherlands), and Aemetis (USA) are building commercial-scale plants using waste feedstocks and alcohol-to-jet technologies to generate sustainable aviation fuels. Praj Industries (India) and Euglena (Japan) are the first to develop biofuel and microalgae-based SAF processes, which have low carbon intensity. They are forging offtake deals and collaborative R&D with major airlines, including United, KLM, and ANA.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 373.92 Billion |

| Market Size in 2026 | USD 426.27 Billion |

| Market Size by 2034 | USD 1,215.97 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 14% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fuel Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

In order to enhance the development of aviation fuel, aviation fuel companies can consider expansion, collaboration, partnership, acquisition, and joint ventures. Furthermore, constantly evolving aviation engine technology can make the existing technology obsolete very soon. This can further intensify the industry rivalry among the prominent market players.

Since the count of aviation fuel providers (suppliers) is less in comparison to the count of buyers, the bargaining power of suppliers is relatively higher as compared to the bargaining power of buyers. Due to promising profit margins, the threat of new entrants in the aviation fuel market is considered to be moderate.

As per the U.S. Department of Energy (DOE), air travel accounts for nearly 175 million metric tons of CO2 emissions or about 2.6% of domestic Greenhouse gas (GHG) emissions each year in the United States. According to Environmental Protection Agency (EPA), large business jets and commercial airplanes contribute around 10% of US transportation emissions and account for almost 3% of the country's total greenhouse gas (GHG) production. Thus, such high contributions of harmful emissions hinder market growth to some extent.

The use of aircraft is highly growing across logistics applications. Airlines transport over 52 million metric tons of goods each year. According to International Air Transport Association (IATA), approximately 90% of cargo in international trade is shipped via sea route, and only around 0.5% is transported by air. But this transport by air cargo translates to around 35% of world trade by value or nearly $6 trillion in value. With an increasing demand for international products, the need for a safe and efficient air service is anticipated to rise enormously in the near future.

Our aviation fuel report includes an in-depth analysis of the recent market scenario. The report covers various key factors such as the competitive landscape, key players, the latest trends, and regional analysis. The analytical research on the COVID-19 impact helps in understanding the effects on the supply and demand side. The segmental analysis offers a clear overview of various types of aviation fuels.

Segments Insights

Fuel Type Insights

Based on fuel type, the global aviation fuel market is segmented into conventional fuel and sustainable fuel. The conventional fuel segment held the largest market share in 2025. The sustainable fuel segment is expected to grow with the highest compounded annual growth rate (CAGR) during the study period.

Sustainable aviation fuel (SAF) is a type of biofuel that can be used for powering aircraft. Sustainable aviation fuel features similar properties to conventional fuel but with lesser carbon emissions. With advanced technologies and suitable feedstock for the production of sustainable aviation fuel, the carbon footprint can be reduced dramatically.

Owing to the characteristics such as safety, reliability, and low carbon emissions, the bio-jet fuel type is predicted to provide lucrative scope during the study period. In October 2022, Honeywell announced an innovative technology to process ethanol-to-jet fuel (ETJ). This latest technology allows fuel producers to convert sugar-based, cellulosic, or corn-based ethanol into SAF.

End User Insights

Based on end-user, the global aviation fuel market is segmented into commercial aircraft, private aircraft, and military aircraft. The commercial aircraft segment had the highest revenue share in 2022. The commercial aircraft segment is estimated to grow with the highest compounded annual growth rate (CAGR) during the forecast period till 2032. Increasing international air traffic is majorly contributing to the growth of the commercial aircraft segment.

According to the Australian Bureau of Statistics, the average equivalised disposable household income for FY 2017–18 accounted for $1,094 per week. For 2019-20, this amount increased to $1,124 per week. Thus, rising spending power and high living standards are augmenting the growth of the private aircraft segment substantially. Various defense forces are expanding their fleet of aircraft over past few years. As of December 2022, Dassault Aviation's Rafale-M emerged as the top contender for the Indian Navy's significant contract of 27 fighters.

Regional Insights

What Made North America the Dominant Region in the Aviation Fuel Market?

North America dominated the aviation fuel market with the largest share in 2024 due to its well-established aviation infrastructure, including a large fleet of commercial and private aircraft, and a robust network of airports and fueling stations. The U.S., as the largest market within the region, plays a pivotal role, supported by major airlines, cargo carriers, and military demand, ensuring a consistent and growing need for aviation fuel.

Furthermore, the region's leadership in technological advancements, regulatory frameworks, and sustainability initiatives, such as the development of sustainable aviation fuel (SAF), strengthens its position in the global market. The U.S. government's support through policies like the Renewable Fuel Standard (RFS) and various public-private partnerships aimed at reducing aviation emissions is also helping to drive the growth of cleaner fuel alternatives in the region.

U.S. Aviation Fuel Market Analysis

The U.S. leads North America's aviation fuel market due to its extensive airport network, advanced refinery infrastructure, and steady domestic air traffic growth. The frequency of flights among major hubs, including Atlanta, Dallas, and Chicago, remains high, thus driving significant jet fuel consumption. The increase in air cargo traffic and the growth of low-cost carrier networks likely support the U.S. leadership in regional aviation fuel market.

What Potentiates the Growth of the European Aviation Fuel Market?

The market in Europe is set to grow at a rapid pace, driven by stringent regulatory mandates on sustainable aviation fuel (SAF) blending and emissions accounting in key EU countries. Major hubs like Frankfurt and Amsterdam benefit from efficient portside logistics and onland storage, optimizing cross-border fuel transportation. Public funding and green bond financing are expected to lower the capital costs of SAF projects, enabling faster implementation and commercialization across the region. This regulatory push and financial support are key to accelerating Europe's shift towards a more sustainable aviation fuel ecosystem.

Germany Aviation Fuel Market Analysis

Germany's aviation fuel market is expected to grow steadily, supported by Frankfurt Airport's global connectivity and strong logistics integration with nearby refining centers. The EU sustainability targets that the government has undertaken are already estimated to boost local SAF blending requirements and lead to significant investments in renewable jet fuel facilities. Germany is a key player in Europe's transition to sustainable fuels, thanks to its combination of technological capability, regulatory support, and the density of its aviation industry.

How is the Opportunistic Rise of Asia Pacific in the Aviation Fuel Market?

Asia Pacific's aviation fuel market is poised for robust growth, driven by the rebound in passenger demand and the expansion of new airport capacity in major metropolitan hubs. As regional carriers increase procurement, significant investment is expected in the long-term development of SAF feedstock and logistics infrastructure. State-owned refiners, airlines, and technology startups are likely to collaborate closely to accelerate the commercialization of low-carbon aviation fuels, fostering innovation and industrial cooperation to meet growing demand for sustainable aviation.

China Aviation Fuel Market Analysis

China is expected to remain the dominant player in the Asia-Pacific aviation fuel market, driven by the continued expansion of its civil aviation infrastructure and robust growth in domestic and international air routes. State-owned refiners like Sinopec and PetroChina are scaling up jet fuel refining capacity to meet surging airline demand and support increased exports. With a strong focus on energy self-sufficiency and long-term decarbonization goals, China's strategic initiatives are set to solidify its leadership in the region by 2030.

What Factors Support the Growth of the Latin American Aviation Fuel Market?

The market in Latin America is driven by expanding intra-regional connectivity and growing air freight volumes, fueled by commodity exports and the rise of e-commerce. Regional airlines are prioritizing local supply security, leading to decisions that boost local refining capacity. Additionally, cross-border regulatory harmonization is anticipated to facilitate broader access to Sustainable Aviation Fuel (SAF), enhancing market growth and off-take opportunities across the region.

Brazil Aviation Fuel Market Analysis

Brazil's aviation fuel market is projected to grow rapidly, driven by high air travel demand across domestic and regional routes and abundant access to bio-based feedstocks. The alcohol-to-jet processes offer the country a good platform to develop SAF, given that it has established ethanol and sugarcane industries. The increased passenger flows in Sao Paulo, Rio de Janeiro, and Brasilia are projected to uphold the demand for jet fuel until the decade.

What Opportunities Exist in the Middle East and Africa?

The Middle East and Africa (MEA) offer significant growth opportunities for the aviation fuel market, driven by rapidly increasing transit traffic at major Gulf airports and expanding airline interconnection across Africa. This growing connectivity encourages investment in reliable jet fuel supply routes, regional logistics, and storage infrastructure, while public policy measures and international partnerships are expected to foster collaboration and support global sustainability goals.

UAE Aviation Fuel Market Analysis

The UAE is set to lead the Middle East and Africa aviation fuel market, bolstered by its well-developed airport infrastructure and strategic location as a major global transit hub. With ADNOC driving large-scale refining and expanding sustainable aviation fuel (SAF) production, coupled with the high passenger volumes at Dubai International and Abu Dhabi airports, the UAE's fuel throughput is expected to remain substantial and continue to support regional growth in the aviation sector.

Aviation Fuel Market – Value Chain Analysis

1. Crude Oil Exploration & Extraction

The aviation fuel value chain begins with the exploration, extraction, and production of crude oil, which serves as the primary feedstock for jet fuel. Major oil fields and offshore reserves supply the raw material essential for refining aviation-grade fuels.

- Key Players: ExxonMobil, Chevron Corporation, Saudi Aramco, Abu Dhabi National Oil Company (ADNOC), BP

2. Refining & Jet Fuel Production

Crude oil is refined through complex processes such as distillation, hydrocracking, and desulfurization to produce aviation turbine fuel (ATF or Jet A/Jet A-1). Refineries focus on meeting strict ASTM and DEF STAN fuel quality standards for energy efficiency and emission performance.

- Key Players: Shell Plc, TotalEnergies SE, Valero Energy Corporation, Indian Oil Corporation Limited, Bharat Petroleum Corporation Limited

3. Storage, Blending & Quality Control

Produced jet fuel is stored in specialized tanks and undergoes quality assurance testing, blending (including Sustainable Aviation Fuel or SAF), and certification before transport. This stage ensures compliance with international safety and environmental specifications.

- Key Players: Neste, World Fuel Services, Vitol Aviation, BP Aviation, Chevron Global Aviation

4. Distribution & Logistics

Aviation fuel is transported via pipelines, tankers, and airport refueling systems to ensure reliable delivery to airlines and airports. Efficient supply chain logistics are critical for minimizing downtime and maintaining fuel availability at global hubs.

- Key Players: ExxonMobil Aviation, Shell Aviation, TotalEnergies Aviation, Indian Oil Aviation, Viva Energy Group

5. End-Use Consumption (Airlines & Operators)

Airlines, cargo carriers, and defense aviation sectors consume aviation fuel for operations. Increasingly, they collaborate with suppliers on SAF integration and carbon offset initiatives to meet global net-zero goals.

- Key Players: Emirates, Lufthansa, Delta Air Lines, Air India, Qantas

Aviation Fuel Market Companies

- Exxon Mobil: A leading global supplier of jet fuel, ExxonMobil provides high-performance aviation fuels and lubricants optimized for commercial, military, and general aviation sectors.

- Chevron Corporation: Chevron delivers reliable aviation fuels and advanced additives, supporting airlines and airports with efficient fuel logistics and sustainability initiatives.

- Shell Plc (UK/Netherlands): Shell Aviation offers a global network of jet fuel supply, technical support, and sustainable aviation fuel (SAF) solutions to reduce industry carbon emissions.

- Indian Oil Corporation Limited (India): India's largest fuel supplier, IOCL provides aviation turbine fuel (ATF) across major airports with growing investments in SAF and cleaner energy alternatives.

- TotalEnergies SE (France): TotalEnergies focuses on sustainable aviation fuel production and distribution, supplying conventional and renewable jet fuels to global airline partners.

- Valero Energy Corporation (U.S.): Valero is a top U.S. refiner producing premium jet fuels and is expanding into sustainable aviation fuel manufacturing through renewable diesel platforms.

- Essar Oil (UK) Limited: Essar supplies aviation fuels refined at the Stanlow refinery, with increasing focus on decarbonizing jet fuel through low-carbon hydrogen and biofuel initiatives.

- Bharat Petroleum Corporation Limited (India): BPCL provides aviation turbine fuel to domestic and international carriers, emphasizing infrastructure expansion and SAF readiness.

- Viva Energy Group (Australia): Viva Energy refines and markets aviation fuels across Australia, partnering with airlines to advance biofuel adoption and emission reduction.

- Abu Dhabi National Oil Company (ADNOC) (UAE): ADNOC is a major global supplier of jet fuel, advancing its aviation energy portfolio with sustainable aviation fuel and low-carbon technology investments.

- Neste (Finland): Neste is the world's leading producer of sustainable aviation fuel, supplying renewable jet fuels that significantly reduce lifecycle greenhouse gas emissions.

Recent Developments

- In March 2022,TotalEnergies' Normandy platform began the production of sustainable aviation fuel1 (SAF) successfully. This Normandy site complements the bio-jet fuel production capacities of the Oudalle plant (Seine-Maritime) and the La Mède biorefinery (Bouches-du-Rhône). TotalEnergies has also announced to produce sustainable aviation fuel at its Grandpuits zero-crude platform from 2024.

- In January 2023,State Oil firm Abu Dhabi National Oil Company (ADNOC), United Arab Emirates renewable energy company Masdar, and a major oil company BP (BP.L) decided to carry out a joint study on the production of sustainable aviation fuel (SAF) in the United Arab Emirates (UAE). This joint feasibility study would leverage the capabilities of all the involved partners for evaluating the commercial as well as technical viability of such a project. In case the results of this joint study are positive, the mentioned companies will plan to develop a commercial scale production capacity in Abu Dhabi.

Segments Covered in the Report

By Fuel Type

- Conventional Fuel

- Sustainable Fuel

By End User

- Commercial Aircraft

- Private Aircraft

- Military Aircraft

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting