What is the Sustainable Aviation Fuel Market Size?

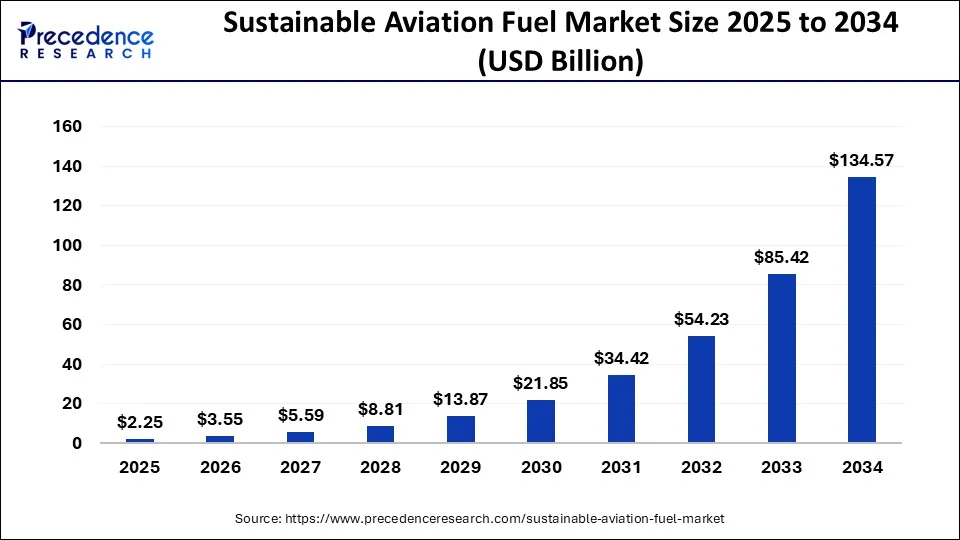

The global sustainable aviation fuel market size is calculated at USD 2.25 billion in 2025 and is predicted to increase from USD 3.55 billion in 2026 to approximately USD 171.75 billion by 2035, expanding at a CAGR of 54.27% from 2026 to 2035.

Market Highlights

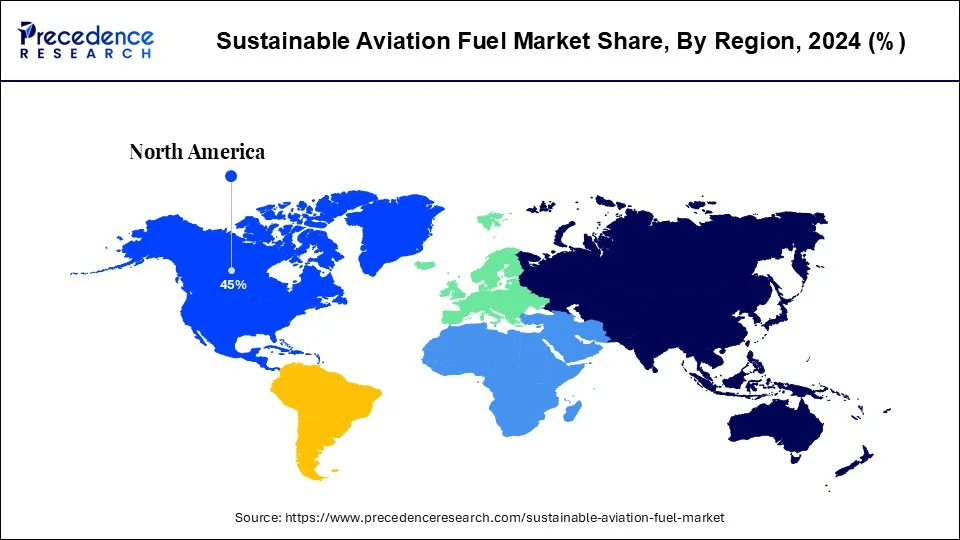

- North America generated maximum market share in 2025.

- Asia-Pacific will reach at a CAGR of 60.1% from 2026-2035.

- The biofuel type segment has captured the major share in 2024 which was 57%.

- The Fischer Tropsch Synthetic Paraffinic Kerosene (FT-SPK) technology segment dominated the market in 2025.

- The military aviation technology aircraft type segment dominated the market in 2025.

- The 30% to 50% biofuel blending capacity segment dominated the market in 2025.

Market Size and Forecast

- Market Size in 2025: USD 2.25 Billion

- Market Size in 2026: USD 3.55 Billion

- Forecasted Market Size by 2035: USD 171.75Billion

- CAGR (2026-2035): 54.2%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

Market Overview

- In the coming years, market growth is expected to be driven by the increased usage of sustainable fuel, especially in the aviation market. The use of sustainable aviation fuel (SAF) aids in reducing CO2 emissions. It is expected that the implementation of sustainable fuels will increase as various governments push for sustainable development in multiple industries.

- New opportunities in the worldwide industry are expected to grow as investment opportunities in sustainable energy increase, and strict energy policies are implemented. To boost their profitability, top SAF manufacturers are changing from crude oil manufacturing to the generation of renewable fuels. Companies also invest in carbon jet fuels in order to expand their industry share.

- High-quality, environmentally friendly aviation fuels contribute significantly to low CO2 emissions. The level of emission from sustainable jet fuel transportation, combustion, production, and distribution is approximately 75% lesser than those of fossil jet fuel. SAF technology is used in a variety of ways by oil and gas refineries. Using renewable fuel decreases hazardous particle and sulfur emissions by 90% as well as 100%, respectively.

- As stated in the report, liquid biofuels are presently the most innovative alternative to traditional petroleum-based fuels, owing to their higher energy content as well as lower life cycle carbon benefits, given the aviation firm's focus on lowering carbon emissions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.25 Billion |

| Market Size in 2026 | USD 3.55 Billion |

| Market Size by 2035 | USD 171.75 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 54.2% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Fuel Type, Technology, Biofuel Blending Capacity, Aircraft Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

There is an increasing need to reduce GNG production in the aviation sector.

The rising number of air travelers is connected to a rise in emissions of carbon dioxide in the aviation sector. The carbon capture technique is being actively adopted by governments around the world in an attempt to cut CO2 emissions. Increased SAF utilization decreases carbon dioxide emissions in the aviation business, driving the worldwide market.

To accomplish net zero emissions, the aircraft industry must reduce emissions by approximately 65% by 2050. SAF reduces carbon dioxide emissions by approximately 80% over the value chain of the fuel, especially in comparison to jet fuel, based on the renewable raw material used, method of production, and distribution network to the aircraft.

Increased airline passenger traffic combined with rising disposable income

Most passengers worldwide choose to travel by air over traditional modes of transport like road and sea because it is the safest and fastest means of transportation, with very few canceled flights. This allows airline travel to be more dependable than other transportation methods and provides a more comfortable trip.

Despite the high cost, customers prefer air travel due to increased disposable income and shorter travel times. Furthermore, according to data published by the International Civil Aviation Organization (ICAO), airlines carried 4.3 billion passengers. Moreover, the percentage of airline travelers is anticipated to exceed 10 billion by 2040, entailing the requirement for more airplanes to transport travelers from point A to point B.

Restraints

Inadequate feedstock as well as refinery availability to meet up SAF future requirements

Raw materials for alternative aviation fuels such as synthetic fuels, e-fuels, and bio-jet fuels include non-biological and biological resources such as sugar crops, oil crops, waste oil, algae, and so on. The insufficient raw material supply needed for the production of sustainable aviation fuels may bring the market to a halt.

Furthermore, the lack of refineries, which play an important role in properly utilizing these feedstocks, contributes to the overall procedure of SAF manufacturing. Furthermore, the scarcity of fuel imposes an obstacle to the fuel's blending capacity, resulting in less efficiency.

Opportunities

SAF's drop-in capability boosts its demand to decrease its carbon footprint

SAF is a fully exchangeable drop-in fuel after blending with petroleum-based fuel. Depending on the methods, technological frameworks, and feedstocks employed in production, these fuels may also be referred to as alternative jet fuels, synthetic fuels, e-fuels, green fuels, renewable jet fuels, or conventional bio-jet fuels.

Fuels use is not handled differently than existing petroleum fuels, and aviation fuel storage, as well as hydrant systems, are used and save money on development costs. Significant efforts to reuse infrastructure and equipment, as well as co-processing with specific other streams, are potentially being used to reduce capital costs. Drop-in fuel is considered to be similar to traditional jet fuel and is used in existing infrastructure and engines without modification.

Segments Insights

Fuel Type Insights

On the basis of fuel type, the biofuel sector held the maximum share of the worldwide industry in 2024 and is expected to maintain its supremacy throughout the projected period. The majority of the raw materials used in the production of biofuels are common natural biomass, such as animal manure, charcoal, and fuelwood. These fuels also match the operation of petroleum-based jet fuels while emitting only a trace amount of carbon dioxide.

The increased use of biofuels is expected to drive the global market. This increase is attributed to the increasing focus of governments around the world on tackling the alarming levels of greenhouse gas caused by the aviation industry.

The growing need to develop renewable aviation fuels is propelling the growth of the aviation fuel market's power-to-liquid (PtL) segment. PtL is generated by integrating hydrogen, which is able to separate from water (it's the "H" in H2O), with carbon derived from the environment or industrial effluents gas in a process known as electrolysis. When using energy from renewable sources like solar and wind energy, PtL produces higher area-related yields than biofuels.

The amount of water required for PtL output is also significantly less than that needed for biofuel production. As a result, PtL is viewed as a critical technology for enabling a fully renewable, sustainable, post-fossil fuel source of aviation in the long term while preventing potential risks as well as adverse side effects associated with the energized use of cultured biomass or in land use.

Technology Insights

With the largest market share and the highest market revenue, the Fischer Tropsch Synthetic Paraffinic Kerosene (FT-SPK) sector dominated the market in 2024. Coal, natural gas, or biomass feedstocks have been gasified into syngas of hydrogen and carbon monoxide in the FTSPK process. In the FT reactor, this syngas is enzymatically transformed into a liquid hydrocarbon fuel mixing component. The raw material used in the kerosene process includes wood waste, municipal solid waste, and grass.

Furthermore, by 2030, the hydro-processed fatty acid esters and fatty acids synthetic paraffinic kerosene (HEFA-SPK) sector dominates the market because it produces the majority of commercially available biofuels. The HEFA-SPK sector uses vegetable oil, which is initially oxygenated and then hydrogenated to decompose the lipids compounds into hydrocarbons.

These fatty compounds undergo refinement to produce a variety of liquids that combine further. The increasing adoption of HEFA-SPK technology has a positive impact on the outlook for the Sustainable Aviation Fuel Market.

Aircraft Type Insights

Business and general aviation, military aviation, unmanned aerial vehicle, and commercial aviation are the aircraft type segments. Military aviation dominated the market in 2024. Military aviation involves both transport and fight aircraft, as well as fixed-wing aircraft, rotary-wing aircraft (RWA), and unmanned aerial vehicles (UAV). This increase is owing to a rise in the defense budget and numerous government plans toward using sustainable aviation fuel.

According to Vision 2030, the Saudi government intends to increase local army equipment expenditure to 50% by 2030 in order to boost local manufacturing. Furthermore, under the "Make in India" proposal, India intends to contribute approximately 64% of its defense budget (about USD 8 billion) to domestic manufacturers.

Furthermore, due to the rising number of passengers traveling by commercial and aircraft flights, the commercial aviation segment is expected to lead the market by 2030. Commercial aircraft are an essential component of the global aviation system, contributing to long-term improvements in economic, social, and environmental conditions.

Furthermore, as aerospace technology advances, the use of lightweight carbon materials in manufacturing, as well as the growing adoption of fuel-efficient airplanes, propel the worldwide commercial aircraft sector.

Biofuel Blending Capacity Insights

The biofuel blending capacity is classified as less than 30%, 30% to 50%, and above 50%. In 2024, the 30% to 50% segment dominated the market. The drop-in capability, moderate blend capacity, supply logistics transportation, as well as aircraft fleet allows for lower overall costs while meeting commercial and military aviation capacity demands.

Furthermore, increasing research and development in innovation pathways aids in improving the blending potential of sustainable energy aviation fuel with conventional aviation fuel.

Regional Insights

What is the U.S. Sustainable Aviation Fuel Market Size?

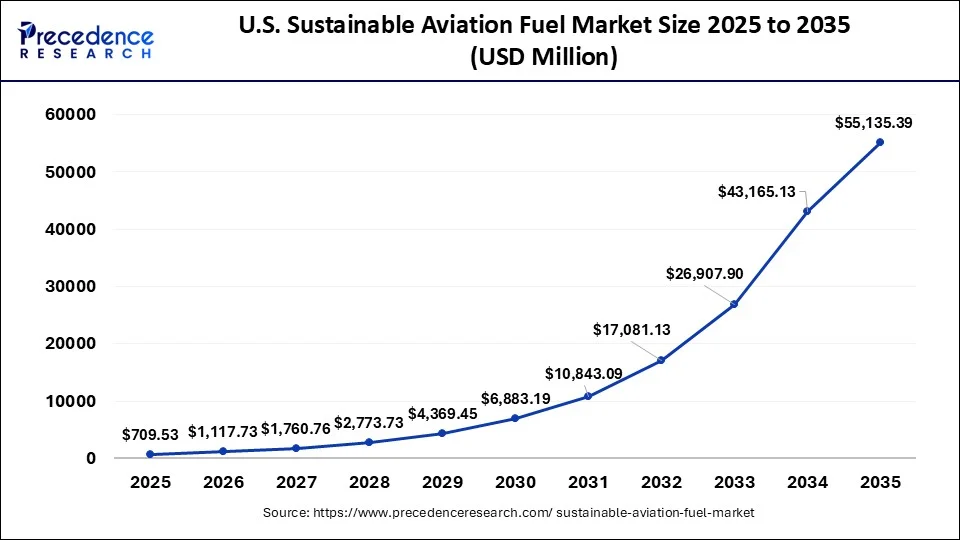

The U.S. sustainable aviation fuel market size is valued at USD 709.53 million in 2025 and is expected to reach USD 55,136.39 million by 2035, growing at a CAGR of 54.54% from 2026 to 2035.

How is the Massive Transition of North in the Sustainable Aviation Fuel Market in 2025?

North America was the major market for worldwide sustainable aviation fuel. Due to increased air traffic and passengers, North America leads the market for sustainable aviation fuel. Additionally, the accelerated adoption of advanced techniques and initiatives by the government to encourage the use of sustainable aviation fuels contribute to the region's market growth.

U.S. Market Analysis

The U.S. leads the North American sustainable aviation fuel market, supported by strong policy incentives, abundant biofuel feedstock, and major airline SAF off-take agreements. Federal programs and airport-based blending facilities enable rapid production scaling, positioning the country as a global hub for SAF innovation and commercialization.

How did Asia Pacific Reach Fastest Growth in the Sustainable Aviation Fuel Market?

Furthermore, the Asia-Pacific is predicted to grow at the fastest rate of more than 60.1% during the forecast timeframe. This expansion is due to the proliferation of low-cost airlines and the rapid advancement of infrastructure in emerging economies. Furthermore, rising public and private spending on developing aviation facilities in developing economies will aid market growth over the projected period.

China Market Analysis

China is leading the Asia Pacific market, with wider state-run biofuel programs coupled with vast biomass availability and pilot SAF flights operated by domestic airlines. Government-targeted carbon neutrality goals for aviation, together with refinery-scale production capacities, make China a regional anchor for SAF development and future exports.

India Sustainable Aviation Fuel Market Analysis

India is experiencing a rapid growth in the market due to heavy investments in domestic production infrastructure, decarbonization efforts, and regulatory mandates. Government policies, including incentives, blending mandates, and collaborations with private players, are supporting the development and commercialization of SAF production facilities. Research suggests that the number of domestic passengers in India's aviation sector has grown rapidly from around 50 million in 2010 to approximately 230 million in 2024.

What Opportunities Exist in the Middle East & Africa for the Sustainable Aviation Fuel Market?

The Middle East & Africa (MEA) presents immense opportunities for the market, driven by the region's focus to expand the SAF production capabilities, as both airlines and governmental entities search for means to reduce carbon emissions over the long-term. Additionally, various countries within this area are identifying local sources for SAF production, such as solar energy, waste products from cities, and the creation of synthetic fuels. The establishment of aviation hubs and national sustainability visions also supports pilot SAF projects, although large-scale SAF production has not yet commenced within this region.

UAE Market Trends

The UAE leads the market within the Middle East & Africa through national sustainability initiatives, airline SAF trial programs, and direct government investment in synthetic fuel research. With robust aviation infrastructure and strong partnerships with leading SAF technology providers, the UAE is well-positioned to become a regional hub for SAF innovation and commercialization in the near future.

How is the Opportunistic Rise of Europe in the Sustainable Aviation Fuel Market?

Europe is expected to grow at a significant rate in the market, driven by several factors, including stringent aviation emission regulations, mandated blending targets, and airlines' long-term sustainability plans. The region emphasizes waste-based and synthetic fuels, aligning with circular economy objectives. Clear and enforceable regulations are enabling investments in refineries, while airports are increasingly integrating SAF into their routine fuel supply chains, supporting broader adoption across the aviation sector.

Germany Market Trends

Germany dominates the European sustainable aviation fuel market through extensive research on power-to-liquid fuels, strong regulatory enforcement, and corporate commitments to reducing carbon emissions. Government and utility-led innovation programs support industrial-scale pilot projects, fostering technological advancements in SAF. These efforts position Germany as a key leader in developing the technologies necessary to enable sustainable aviation capacity across Europe.

South America

How is the Pivotal Growth of the Sustainable Aviation Fuel Market within South America?

South America is expected to experience significant growth during the forecast period, driven by strategic international partnerships, global collaborations, and robust regulatory and policy support. Technological advancements in bio-refining and policy support, including subsidies and incentives, are helping to scale production and improve cost efficiency. In October 2024, Avalon BioEnergy Uruguay S.A. launched an agriculture-sustainable aviation fuel project of $380 million in Latin America, driven by Uruguay Govt.

MEA

- In December 2025, Egypt signed a production license agreement with Honeywell UOP to launch the first sustainable aviation fuel project.

Value Chain Analysis

- Resource Extraction: This stage consists of primary feedstock extraction methods, including waste fats, oils, and greases, agricultural and forestry residues, municipal solid waste, and direct carbon & industrial off-gases.

Key Players: Neste, World Energy, Gevo, Inc., Fulcrum BioEnergy, Alder Renewables, Diamond Green Diesel, TotalEnergies, Praj Industries. - Grid Maintenance and Monitoring: This stage includes digital monitoring, tracking, infrastructure and grid maintenance, and regulatory compliance monitoring.

Key Players: Honeywell, Neste, LanzaJet, Topsoe A/S, Gevo, AiDash, Heimdall Power, SkyNRG. - Regulatory Compliance and Energy Trading: This stage encompasses mandatory blending, reporting requirements, credit trading systems, revenue support, and price stability.

Key Players: STX Group, Shell Aviation, SkyNRG, Future Energy Global, Airbus, Neste, World Energy, BP Plc, TotalEnergies.

Sustainable Aviation Fuel Market Companies

- Northwest Advanced Biofuels, LLC.

- Red Rock Biofuels

- Fulcrum BioEnergy, Inc.

- Aemetis, Inc.

- TotalEnergies SE

- OMV Aktiengesellschaft

- Neste Oyj

- SKYNRG

- Gevo Inc.

- Eni SPA

- Avfuel Corporation

- SG Preston Company

- Sundrop Fuels Inc.

- Ballard Power Systems

- Velocys

- ZeroAvia, Inc.

Recent Developments

- In May 2025, Wheels Up Experience Inc. launched a new Sustainable Aviation Fuel (SAF) program, allowing charter customers to book flights and support aviation decarbonization by opting into SAF contributions, aiming to set an industry standard.

(Source: https://www.prnewswire.com ) - In October 2025, India plans a pilot project to supply sustainable aviation fuel (SAF) at Delhi's Indira Gandhi International Airport, marking a step toward greener aviation infrastructure and reducing carbon emissions.

(Source: https://www.chinimandi.com ) - The European Commission published a bundle of legislative proposals termed "Fit for 55" in July 2021. The ReFuelEU proposal, which aims to increase SAF production and uptake, is one component of the package.

- Cepsa approved a contract with Iberia and Iberia Express in January 2022 for the advancement and large manufacture of sustainable aviation fuel. The deal calls for SAF to be produced using recycled oils, waste, as well as plant-based second-generation bio feedstock.

- In partnership with DHL Express, Neste Company revealed the most significant SAF deals ever in March 2022. This agreement is Neste's most visible SAF and one of the aviation industry's most crucial sustainable aviation fuel contracts. This collaboration will enhance Neste's existing web by providing global connectivity.

- In May 2021, the United States Congress initiated the Sustainable Skies Act, which aims to increase incentives for the use of SAF.

- The 77th IATA Annual General Meeting in Boston adopted a resolution for the worldwide aviation industry to accomplish net-zero carbon dioxide emissions by 2050. The above commitment aligned with the Paris Agreement's aim to limit global warming to 1.5°C. One possible scenario is that SAF will lessen 65% of this.

- Aramco has become an organizational partner of Aston Martin Racing (AMR) for the 2022 Formula 1 season, ushering in a new collaboration in motorsports.

- In 2020, ASTM approved two major specialized SAF certifications, bringing the total number of approved technical SAF production pathways to seven.

Segments Covered in theReport

By Fuel Type

- Biofuel

- Power-to-Liquid

- Gas-to-Liquid

By Technology

- HEFA-SPK

- FT-SPK

- HFS-SIP

- ATJ-SPK

By Aircraft Type

- Fixed Wings

- Rotorcraft

- Others

By Biofuel Blending Capacity

- Above 50%

- 30% to 50%

- Below 30%

By Aircraft Type

- Commercial

- Regional Transport Aircraft

- Military Aviation

- Business & General Aviation

- Unmanned Aerial Vehicles

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content