What is the Aircraft Actuators Market Size?

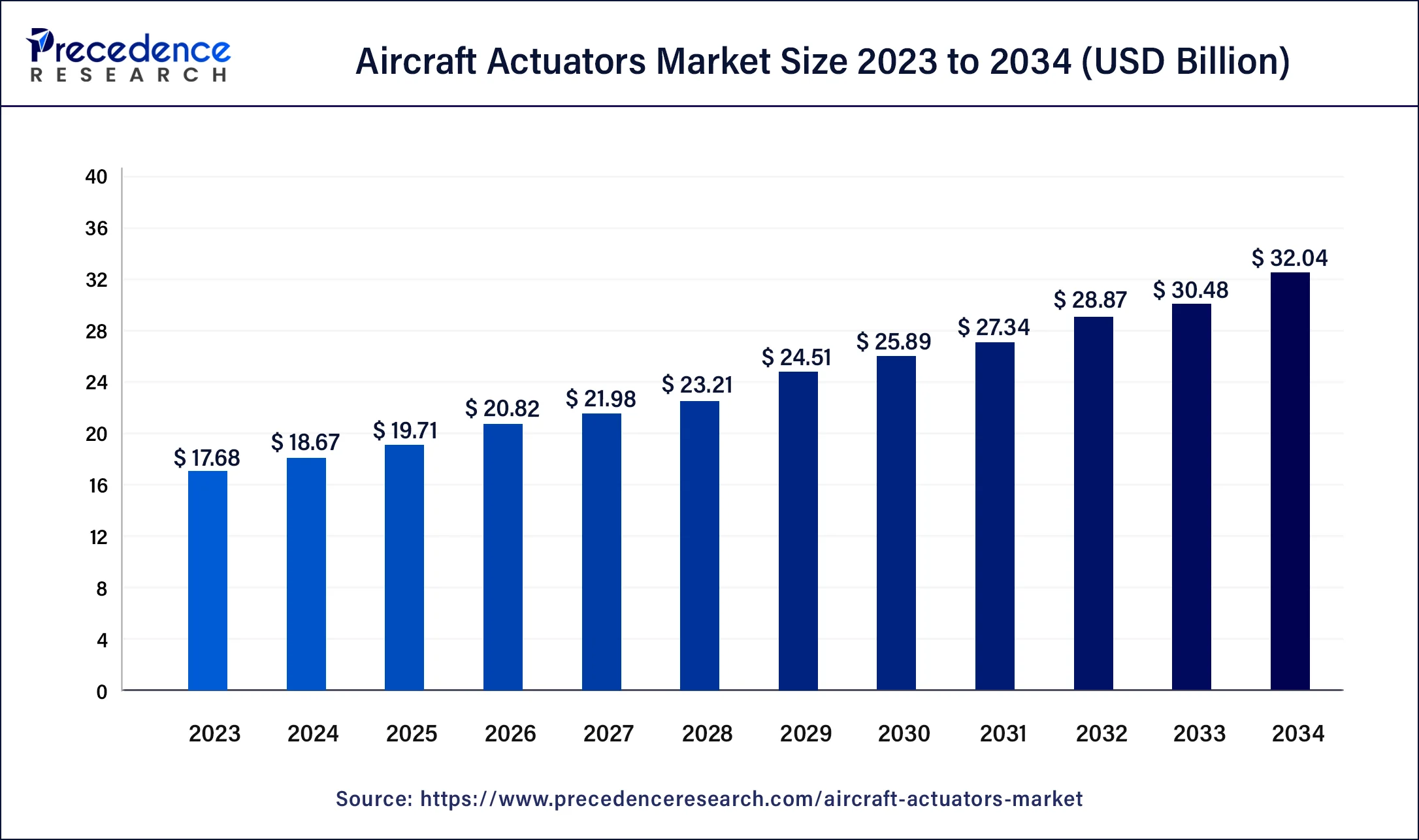

The global aircraft actuators market size is estimated at USD 19.71 billion in 2025 and is predicted to increase from USD 20.82billion in 2026 to approximately USD 32.04 billion by 2034, expanding at a CAGR of 5.55% from 2025 to 2034.

Aircraft Actuators Market Key Takeaways

- In terms of revenue, the aircraft actuatorsmarket is valued at $19.71 billion in 2025.

- It is projected to reach $32.04 billion by 2034.

- The aircraft actuatorsmarket is expected to grow at a CAGR of 5.55% from 2025 to 2034.

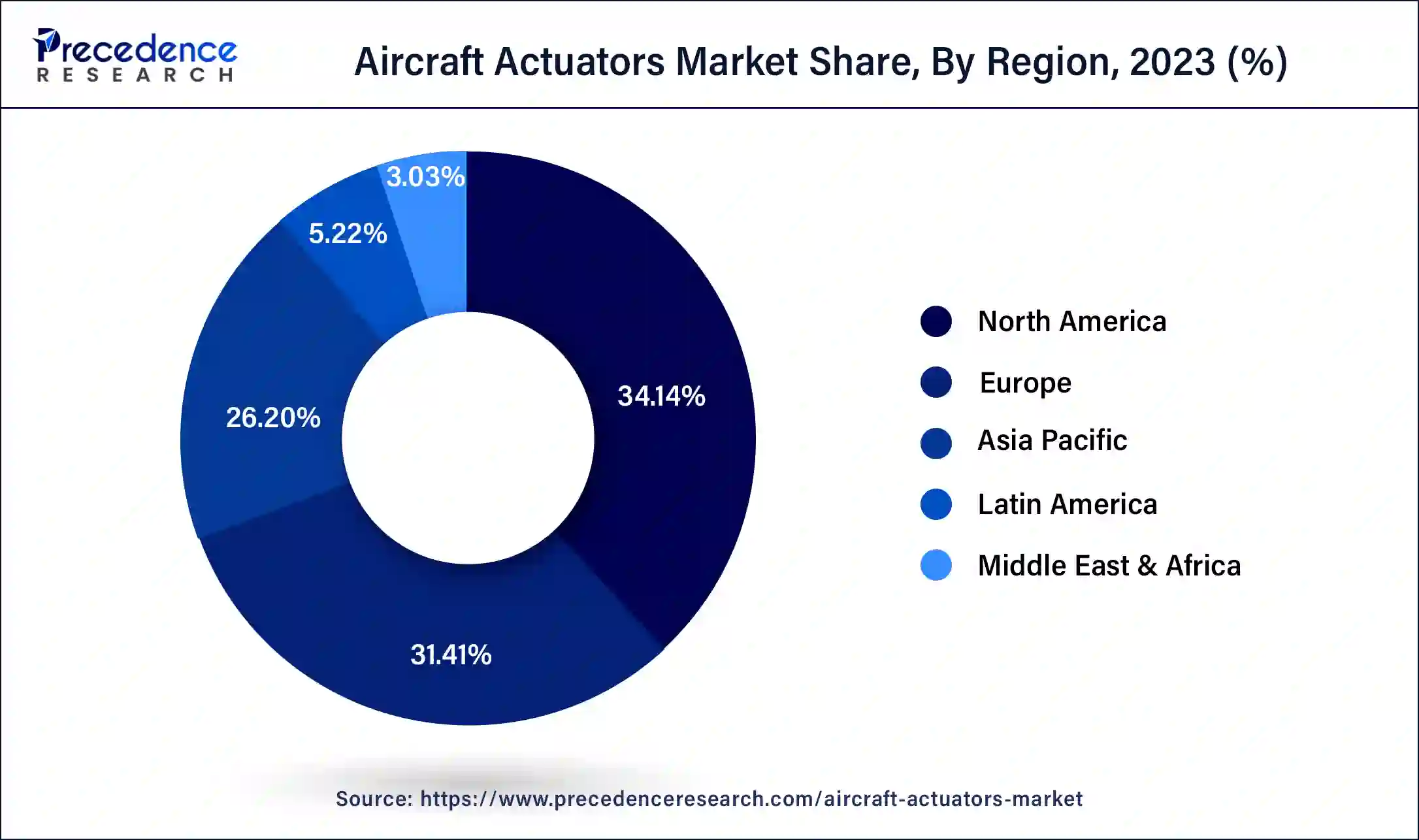

- North America generated more than 34.14% of the revenue share in 2024.

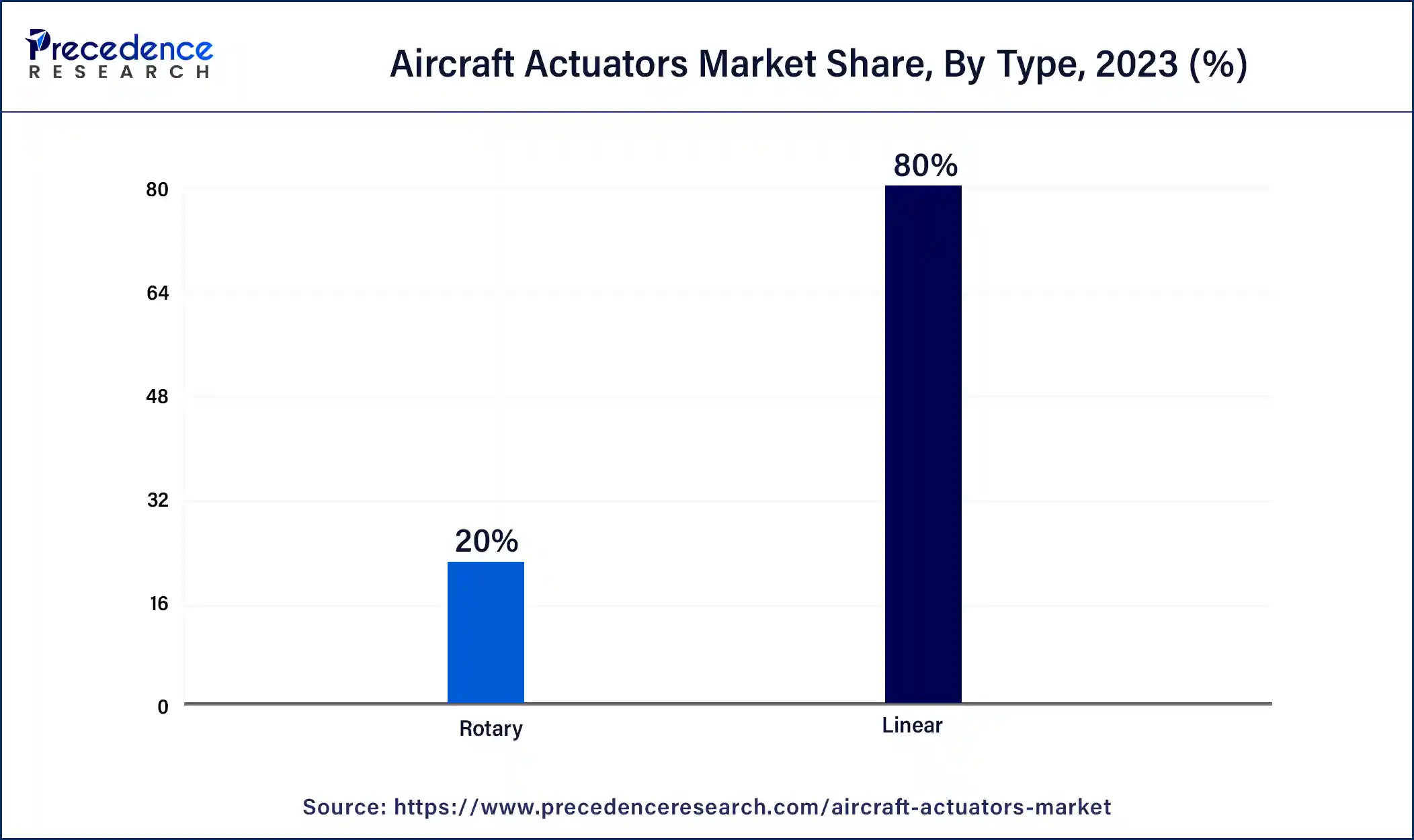

- By Type, the linear segment captured more than 80% of revenue share in 2024.

- By System, the hydraulic actuator segment led the global market in 2024.

Market Overview

On an aircraft, actuators carry out a variety of crucial tasks, including adjusting various flight control surfaces, including flaps, rudder, slats, and spoilers, ailerons, extending and retracting landing gear, positioning engine inlet guide vanes and thrust reversers, and closing and opening cargo or weapon bay doors, among others. Strong vibrations, extreme heat, and extreme cold can all be handled by aircraft actuators. Pneumatic and hydraulic actuators have historically been used extensively in aeroplanes, however, due to the increased requirement for fuel efficiency, electric actuator adoption is rapidly rising.

During the forecast period, factors such as an increase in commercial aviation operations and a rise in demand from emerging markets are anticipated to propel the development of the global aircraft actuators market. However, during the forecast period, high aircraft actuator costs, leakage problems, and maintenance issues are anticipated to restrain the industry's expansion. Additionally, it is anticipated that in the near future, the market will benefit from an increase in air travel activity and air traffic as well as an increase in demand for electric actuators.

In the aviation industry's shift towards more electric aircraft (MEA), the aircraft actuator market is undergoing a transformation. Electric actuators are more efficient than hydraulic actuators around 80% compared to hydraulic so electric actuators are being deployed as replacements for traditional hydraulic and pneumatic types. The replacement of actuator efficiencies translates to an increase in fuel efficiencies as well as lower maintenance costs and environmental impacts. Parker Aerospace's involvement with the all-electric Alice commuter aircraft highlights the use of electric actuators in airline operations, including emerging advances on electromotive actuators for better performance. As airlines and manufacturers continue to seek innovative designs for sustainability as well as operational efficiency in a rapidly changing environment, expect an increasing demand for electric actuators, signaling a prime opportunity in aerospace.

Aircraft Actuators Market Outlook

- Industry Growth Overview: Between 2024 and 2034, the aircraft actuators market is expected to grow steadily as global air travel recovers, aircraft production increases, and defense modernization efforts intensify. The demand for actuators in both the commercial and military sectors is driven by the gradual replacement of old-generation aircraft with new, fuel-efficient planes. A major trend is the shift toward electromechanical actuation systems that save weight and use less power. The market is driven by ongoing investments in automation, system stability, and next-generation flight controls within the aviation industry.

- Technological Innovation: The aircraft industry is undergoing a paradigm shift toward electric designs, with actuators playing a central role in this technological revolution by replacing traditional hydraulic systems. Electromechanical and electrohydraulic actuators enable precise movement control, reducing dependence on centralized hydraulics, while modular actuator designs are gaining traction for their ease of integration, cost-effectiveness, and scalability for OEMs.

- Sustainability Trends and Focus on Enhancing Efficiency: The aviation industry is under growing pressure to reduce emissions and meet global carbon-reduction targets, prompting actuator manufacturers to develop systems that minimize hydraulic fluid consumption, reduce leakage, and improve energy efficiency. Companies like Honeywell International, Eaton Corporation, and others are leading the way by incorporating lightweight materials such as titanium and advanced composites to reduce actuator mass while maintaining strength and reliability, and by integrating sustainability goals with digital control technologies, positioning the actuator segment as a critical enabler of next-generation sustainable aviation.

- Global Expansion: The aircraft actuators market is becoming geographically diversified as major manufacturers expand production and engineering capabilities closer to OEM hubs, particularly in China, Japan, and India, where local assembly and testing facilities are on the rise. New MRO (Maintenance, Repair, and Overhaul) hubs in regions such as the Middle East and Latin America are also gaining significance due to the growth in airline fleets and regional air mobility investments, prompting global suppliers to establish local centers to mitigate supply chain vulnerabilities and meet offset requirements.

- Investment and Strategic Interest: Investor confidence in the aircraft actuators industry remains strong, driven by its mission-critical role, substantial aftermarket revenue potential, and high technical barriers to entry. Companies like TransDigm Group are strengthening their actuator portfolios through strategic acquisitions, while OEMs and actuator manufacturers are collaborating on the development of integrated actuation and avionics systems for next-generation aircraft designs, including eVTOLs and hybrid-electric aircraft.

- Innovation and Startup Ecosystem: The aircraft actuator ecosystem is experiencing a wave of innovation from startups and emerging engineering firms redefining actuation technologies for next-generation mobility. Companies like ElectraFly (U.S.), AeroTorque Systems (Germany), and SkyDrive Technologies (Japan) are leading the development of compact, high-efficiency electric actuators for UAVs, eVTOLs, and lightweight aircraft, attracting venture capital attention due to their focus on miniaturization, additive manufacturing, and AI-assisted control algorithms.

Aircraft Actuators Market Growth Factors

The global market for actuators is expanding as a result of rising demand for both commercial and military aircraft. With a combined share of more than half of the global aircraft fleet, APAC and Europe are the two largest aircraft owners. The number of aircraft fleets is growing as a result of the increase in air passenger traffic. In commercial and defence aircraft, electric actuators offer a practical and affordable replacement for hydraulic and pneumatic actuator systems. They offer accurate control, quick response times, and assistance in enhancing aircraft performance. Aside from offering high reliability and low lifecycle costs, the use of electric actuators in commercial and defence aircraft also lessens the workload on maintenance staff. Therefore, it is anticipated that during the forecast period, there will be an increase in demand for electric actuators due to the rising demand for commercial and defense aircraft.

One of the main reasons propelling the market's expansion is rapid industrialization. Actuators are now used much more frequently thanks to technical developments in the automotive sector, such as the advent of advanced driver assistance systems (ADAS). Another significant growth-inducing aspect is the expanding trend of automation across numerous industries.

The adoption of the Internet of Things (IoT) has made it possible to automate actuators, which has increased productivity and decreased downtime in manufacturing and industrial units. They offer excellent control and precision, as well as less noise production and fuel loss. Additionally, the demand for the product is being driven by the growing number of aircraft carriers that have actuators on each wing to maintain effective flight at low airspeeds.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 18.67 Billion |

| Market Size in 2025 | USD 19.71 Billion |

| Market Size by 2034 | USD 32.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.55% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By System, By Aircraft Type, and By End-User Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver:

Growing adoption of more electric aircraft

The development of more electric aircraft (MEA) is receiving more attention, which has prompted aircraft OEMs to work with suppliers to design and create new electric-intensive aircraft architecture more quickly. In the aviation sector, the MEA idea plays a crucial role as an enabler and offers enormous possibilities for lighter aircraft, more fuel-efficient engines, lower operating costs due to lower maintenance expenses, and higher aircraft reliability. While hydraulic, pneumatic, and mechanical power sources currently power non-propulsive systems, the MEA concept offers a motivation to use electricity in these conventional systems.

Additionally, electrical actuators are more efficient (around 80%) than their hydraulic counterparts because they use a more effective motor, which eliminates the problem of heating and reduces the possibility of component damage. The usage of electrical actuation systems is safer and more environmentally friendly than that of conventional actuators, which use hydraulic fluids that, when heated to high temperatures, can burn the skin and contaminate or infect people. As a result, there is a growing need for electrical actuation solutions, which in turn is driving the market for aviation actuators.

Restraints:

Faulty and loosely insulated electric actuators and their malfunction risks

During the anticipated period, the global actuator market share will experience difficult growth. Electric actuators are designed to work and sustain their performance across a range of temperatures. To prevent leaks, these goods must be stored properly with the appropriate insulation. The health of workers and other nearby electric actuators may be negatively impacted by gas leaks caused by defective or inadequately insulated electric actuators. Suffocation or asphyxiation can result from argon inhalation. Eye stinging, vomiting, dizziness, rapid breathing, ecstasy, headache, excessive salivation, prickling in the nose and throat, and fainting are some of the possible side effects. Issues with compliance with the authorities may result from this. Therefore, their demand during the projected time frame may be impacted by defective and poorly fitting electric actuators.

Opportunities:

Ongoing digitalization and adoption of IOT

The networking of physical objects with the use of devices, such as sensors and actuators, allowing the transfer of information within the network, is known as the Internet of Things (IoT). The use of IoT in aviation provides numerous opportunities to improve automation and operational effectiveness across a range of aircraft activities. IoT makes it possible to combine numerous actuators with different capabilities into a network so that they may communicate with one another and carry out a variety of tasks that would otherwise be impossible for each type of actuator to carry out on its own. During the forecast period, analytics is anticipated to have a significant impact on aircraft design, production, and maintenance.

IoT technology is currently being used in aeroplane engines by Pratt & Whitney (a United Technologies Group company) to increase their effectiveness. However, IoT can be applied to electrical appliances (like actuators) to make it simple for them to talk to each other and move in unison. The growing application scope of actuators in IoT for these applications is anticipated to drive up demand for actuators throughout the projected period because IoT offers aviation applications the chance to improve automation in these areas.

Impact of COVID-19:

To stop the COVID-19 virus from spreading, governments everywhere imposed stringent lockdowns and mandated social seclusion. Consequently, many businesses started work-from-home programmes as a preventative measure. As a result, there was a dramatic drop in demand for travel on a global scale, which had an impact on the market for aeroplane actuators. In February 2022, air traffic grew 115.9% year over year, according to IATA estimates, but it was only 54.5% of pre-pandemic levels (February 2019 level), a gauge of worldwide passenger demand.

Additionally, a rise in vaccination rates and fewer travel restrictions in many areas are fueling the recovery of international air travel. RPKs increased by 256.8% YoY in February but are still only 40.4% higher than in February 2018 before the outbreak. The surge in air travel following the epidemic has given aviation actuator firms tremendous prospects in recent years. Plans to reopen are expected to provide the aircraft sector with a boost, which would open up new growth potential for the market for aircraft actuators.

Segment Insights

Type Insights

The market is divided into linear and rotary actuators according to type. Due to its accuracy and controllability, the linear actuator market sector was expected to be the largest one. During the forecast period, the linear actuator segment is expected to grow at the fastest rate.

The market is expected to expand more quickly due to the increase in demand for electro-mechanical linear actuators, such as ball screw actuators in aeroplanes. The market's expansion is anticipated to be significantly influenced by the rotary actuator segment. The market for aircraft actuators is expected to expand due to the increased use of servo motors in flight control systems.

System Insights

The hydraulic, electromechanical, pneumatic, electric, and electro hydrostatic segments of the market. According to estimates, the hydraulic actuator sector dominated the market. Because it has advantages like integrated redundancy in case of failure, overload protection, and a free-floating control surface that is frequently used in conventional aircraft, the hydraulic actuator is becoming more and more popular, which is boosting the market's expansion. Electromechanical actuators (EMA) combine electrical and mechanical components. Due to its accuracy and effectiveness, the EMA segment is anticipated to experience significant market growth over the course of the forecast period. EMAs are mostly employed in seat actuation systems for aircraft. Due to the rising trend of more electric aircraft to reduce costs and fuel consumption, the electric actuator market is anticipated to develop at the fastest rate throughout the projection period.

End-user Type Insights

The flight control system, power generation, fuel management system & gearbox system, landing gear & braking system, firing or weapon control system and aircraft health monitoring system are the systems by which the aircraft actuator market is divided. The market's largest segment was anticipated to be the power generation and gearbox system and flight control system. Due to the benefits of lightweight aircraft and better reliability and efficiency, the market will grow as EMAs and EHAs are increasingly being used in surface control systems. During the forecast period, the passenger comfort segment is anticipated to grow at the fastest rate. Due to the rise in demand for comfort, safety, and luxury associated with air travel, there is a greater need for passenger comfort.

Aircraft Type Insights

The fixed-wing and rotary-wing segments of the aviation actuator market. Due to rising demand for aircraft across a number of industries, including commercial, military, and general aviation, the fixed-wing category was anticipated to be the largest part of the market. Commercial, business, military, general aviation, and fixed-wing UAVs are further categories under the fixed-wing category. The commercial aircraft market sector was anticipated to hold the biggest market share in. The primary element boosting the expansion of this market is the increase in air travel.

Due to the increasing demand for helicopters for various military purposes, including surveillance, emergency services, and transport, the rotary-wing category is anticipated to experience the quickest growth during the projection period.

Regional Insights

U.S. Aircraft Actuators Market Size and Growth 2025 to 2034

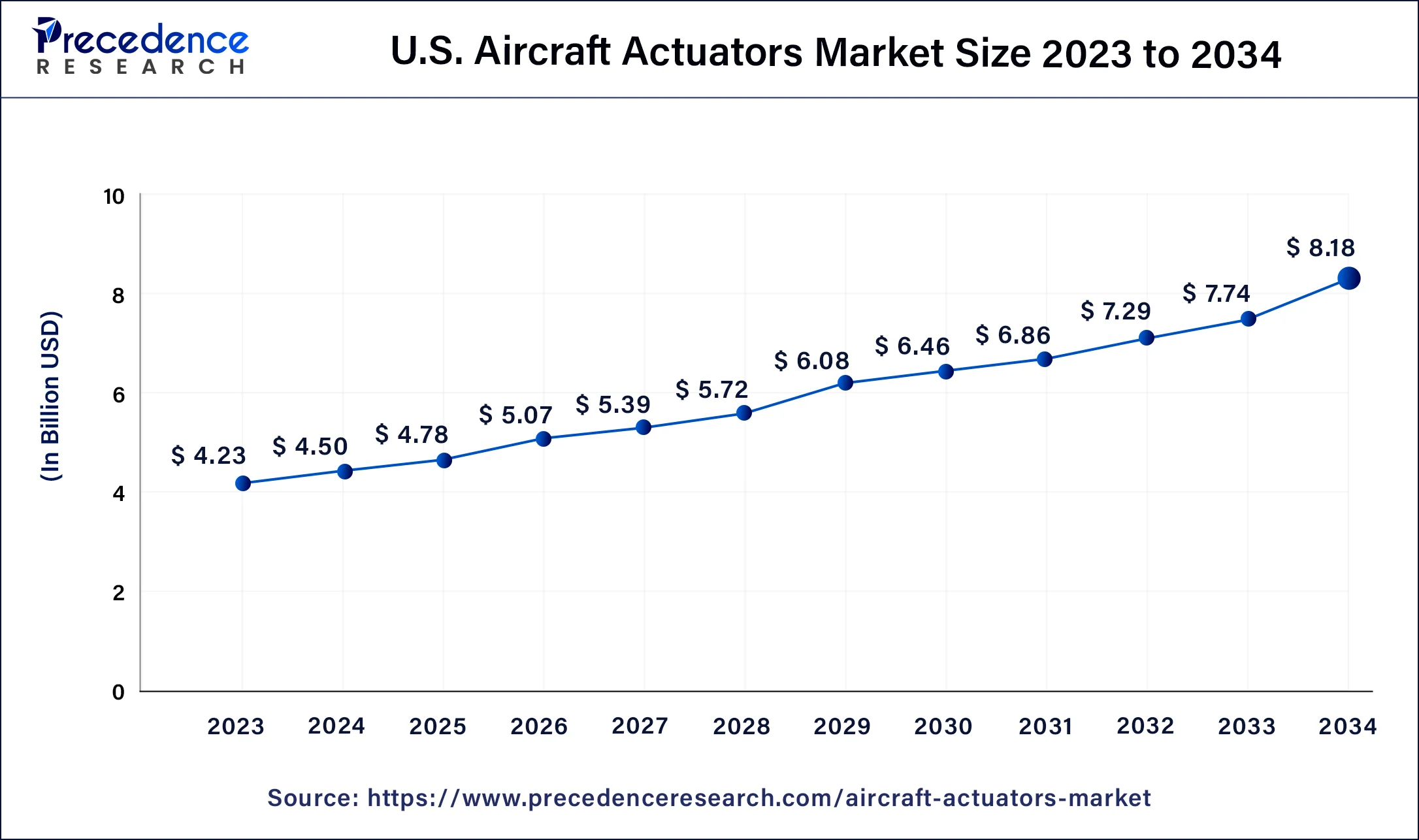

The U.S. aircraft actuators market size was estimated at USD 4.78 billion in 2025 and is predicted to be worth around USD 8.18 billion by 2034, at a CAGR of 6.16% from 2025 to 2034.

Aviation actuator sales are predicted to be dominated by North America, followed by Europe and Asia-Pacific. Due to the increased adoption of updated safety rules by major American airlines, including United Airlines, Inc., the market in North America is anticipated to expand during the projected period. Lightweight systems in actuators are anticipated to drive the expansion of the market, and producers of aircraft actuators in developed nations like the U.S. are investing in the R&D of more electric aircraft.

The U.S. is a major contributor to the market in North America, bolstered by its advanced aerospace manufacturing capabilities and robust commercial aviation platforms. Major OEMs like Boeing, Lockheed Martin, and Northrop Grumman drive domestic demand through high-volume aircraft production and fleet renewals, while ongoing investments in programs like the F-35, B-21 Raider, and advanced UAV systems have accelerated the development of precise, lightweight actuator technologies

What Makes Europe a Significantly Growing Region in the Aircraft Actuators Market?

Europe is experiencing significant expansion in the aircraft actuators market, driven by Airbus's large production footprint, a strong aerospace supply base, and EU-funded R&D initiatives focused on efficiency and certification excellence. The region's technical expertise and strict EASA certification standards have not only reinforced short-term barriers but also favored local vendors, supporting premium aftermarket pricing, with the latest Airbus production strategies and EU research initiatives further strengthening this trend.

Germany stands as a crucial market, driven by a robust engineering ecosystem and strong partnerships with major players like Airbus, Lufthansa Technik, and MTU Aero Engines. The country's high production levels, commitment to quality, and focus on automation, robotics, and sustainability in manufacturing have solidified its position as a reliable supplier in the European aircraft supply chain, ensuring its continued leadership in the regional market.

What Makes Asia Pacific the Fastest-Growing Region?

Asia Pacific is expected to grow at the fastest CAGR in the aircraft actuators market, fueled by rapid fleet expansion, increasing OEM activity (including COMAC), and rising passenger demand across China, India, and Southeast Asia. The regional sourcing of actuators and related subsystems is expected to grow alongside local manufacturing expansion and government-supported strategies for aerospace industrialization. Regional airlines are expanding their fleet of aircraft to launch new routes and handle the increased passenger traffic in the commercial aviation sector, as passenger volume is recovering to pre-pandemic levels.

What Potentiates the Growth of the Aircraft Actuators Market in Latin America?

The market in Latin America is primarily driven by regional fleet renewals and the activities of local OEMs and business jet manufacturers, with Brazil and Mexico being key hubs for MRO (Maintenance, Repair, and Overhaul) services. The growth of domestic carriers and an increasing number of LCCs (Low-Cost Carriers) has fueled demand for short- to medium-haul fleets, driving the need for regular actuator assemblies and supporting the expansion of the MRO sector in the region.

Brazil is the aerospace hub of Latin America, driven by Embraer's global leadership in regional and business jet manufacturing, along with its advanced capabilities in aerostructures and systems integration. This has resulted in consistent demand for actuators in flight control systems and braking systems, with the growing air passenger traffic in South America and ongoing fleet modernization programs further fueling the demand for aftermarket services in the region.

How is the Opportunistic Rise of the Middle East & Africa in the Market?

The Middle East and Africa (MEA) region presents significant opportunities in the aircraft actuators market, driven by the expansion of hub carrier fleets and substantial investments in MRO infrastructure, which have created strong demand for high-cycle actuator spares and overhaul services. Government support for aviation clusters has further encouraged regional sourcing, positioning the Middle East as a key hub for aftermarket services and heavy-check operations in the aerospace sector.

The UAE is emerging as a regional powerhouse for aerospace components and MRO services, driven by strong investments from Emirates, Etihad Airways, and Dubai Aerospace Enterprise. The growing airport infrastructure and increasing demand for predictive maintenance continue to drive the expansion of the market in the region.

Aircraft Actuators Market – Value Chain Analysis

1. Raw Material Procurement

The value chain begins with sourcing critical materials such as aluminum alloys, titanium, high-strength steels, and advanced composites, as well as electronic components and sensors essential to actuator assemblies.

- Key Players: Arconic Corporation, Allegheny Technologies Incorporated (ATI), Hexcel Corporation, Toray Industries, Inc.

2. Component Fabrication

Raw materials are processed into precision-engineered actuator components such as gears, motors, spindles, valves, and housing units, often incorporating smart sensors for feedback and control.

- Key Players: SKF Group, Schaeffler Technologies AG, Thomson Industries, NSK Ltd.

3. Actuator Design & System Integration

Manufacturers design electromechanical, electrohydraulic, and pneumatic actuators tailored for aircraft applications, such as flight control, landing gear, engine systems, and cabin mechanisms, and integrate them with avionics and power systems.

- Key Players: Moog Inc., Collins Aerospace, Parker Hannifin Corp, Eaton Corporation, Honeywell International Inc.

4. Assembly & Testing

Fully assembled actuator systems undergo rigorous testing for reliability, endurance, vibration, and environmental resilience to meet FAA and EASA certification standards.

- Key Players: Curtiss-Wright Corporation, Meggitt Plc., Woodward, Inc., TransDigm Group Inc.

5. OEM Integration & Aircraft Manufacturing

Validated actuators are supplied to aircraft OEMs and Tier-1 integrators for installation in commercial, business, and defense aircraft platforms.

- Key Players: Boeing, Airbus, Lockheed Martin, Embraer, Dassault Aviation.

6. Aftermarket Support & MRO Services

The final stage includes maintenance, repair, and overhaul (MRO) operations, system upgrades, and predictive performance analytics to extend actuator lifecycle and enhance aircraft reliability.

- Key Players: Lufthansa Technik, Collins Aerospace (Aftermarket Division), AAR Corp., ST Engineering Aerospace.

Aircraft Actuators Market Companies

- Collins Aerospace (U.S.) – A global leader in aerospace and defense systems, Collins Aerospace delivers advanced electromechanical and hydraulic actuators for flight control, landing gear, and engine applications.

- Eaton (U.S.) – Eaton provides highly reliable hydraulic and electrohydraulic actuator systems used in both commercial and military aircraft for precise motion and power control.

- Curtiss-Wright (U.S.) – Known for its rugged aerospace technologies, Curtiss-Wright designs and manufactures flight control actuation systems and components optimized for high performance and safety-critical operations.

- Honeywell International Inc. (U.S.) – Honeywell develops intelligent aerospace actuation and control systems that enhance flight efficiency, reliability, and energy optimization across modern aircraft platforms.

- Meggitt Plc. (UK) – Meggitt specializes in high-performance aerospace actuation, braking, and thermal management systems used in civil, military, and business aviation.

- Moog Inc. (U.S.) – A pioneer in motion control, Moog supplies precision electromechanical, electrohydraulic, and servo actuation systems for aircraft flight control and engine applications worldwide.

- NOOK Industries, Inc. (U.S.) – NOOK Industries produces custom linear motion and mechanical actuation solutions, supporting aircraft landing gear, control surfaces, and industrial aerospace systems.

- Parker Hannifin Corp. (U.S.) – Parker Hannifin offers advanced fluid power and motion control technologies, providing robust actuator systems that enhance efficiency and reliability in aircraft operations.

- TransDigm Group Inc. (U.S.) – TransDigm designs and supplies specialised, proprietary aerospace components, including linear and rotary actuators used in flight control and landing systems.

- Woodward, Inc. (U.S.) – Woodward delivers high-precision electromechanical actuation and control systems for engine management, flight surfaces, and power optimisation in commercial and defence aircraft.

Leaders Announcements

- In May 2025, Power management company Eaton (market cap: USD 120.84 billion) announced an USD 18.5 million expansion of its Orchard Park, New York, facility. This investment aims to meet the increasing demand for aerospace mission systems solutions. Orchard Park facility employs over 450 individuals and is responsible for producing critical technologies such as oxygen and actuation systems for defense, commercial aerospace, and space customers.

- In April 2025, RTX's Collins Aerospace joins the Digital Alliance for Aviation to expand predictive maintenance and health monitoring solutions. Focused on advancing aviation through collaboration, data transparency, and digital transformation, the Digital Alliance will benefit from Collins' proven track record of deploying predictive maintenance analytics for Airbus and non-Airbus platforms and systems to optimize operations.

- In July 2024, Vertical Aerospace (Vertical), a global aerospace and technology company that is pioneering zero-emission aviation, unveiled its next-generation full-scale VX4 prototype, the only electric take-off and landing vehicle (eVTOL) designed, built, and assembled in the UK.

- In April 2023, Stirling Dynamics & Hanwha Aerospace developed actuators for Vertical's VX4 eVTOL. The advanced electro-mechanical actuator (EMA) solution removes the need for hydraulic or pneumatic systems on the aircraft, helping to optimize the VX4's performance

Recent Developments

- In July 2022,Vertical Aerospace, a manufacturer of electric vertical takeoff and landing aircraft based in the United Kingdom, and Hanwha Aerospace Co. Ltd., a South Korean aerospace industrial company, established a joint development programme to design, test, produce, and supply electromechanical actuators for Vertical's VX4 electric aircraft. The goal of this programme is to promote the advancement of electrically powered, zero-emission aircraft technology.

- In January 2022,Moog supplied electromechanical actuators for the DARPA Gremlins unmanned aircraft's launch motion control. Three Gremlins were successfully flown using the Gremlins demonstration system in four separate sorties totalling 6.7 hours of flight time, including the 1.4-hour aerial recovery mission. The company's involvement in this programme demonstrates Moog's proficiency in designing and supplying high-performance electromechanical systems for the aerospace sector.

- A new range of electro-hydrostatic actuators (EHA) for the nose landing gear of various aircraft platforms used by Safran SA was introduced in July 2022.

- The development of a new line of electromechanical actuators specifically suited for urban air mobility (UAM) was announced by Honeywell International Inc. in January 2020.

Segment Covered in the Report:

By Type

- Linear

- Rotary

By System

- Hydraulic Actuators

- Electrical Actuators

- Pneumatic Actuators

- Mechanical Actuators

By Aircraft Type

- Fixed wing

- Rotary

By End User Type

- Commercial Aircraft

- Military Aircraft

- General Aviation Aircraft

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting