Aircraft Gearbox Market Size and Forecast 2025 to 2034

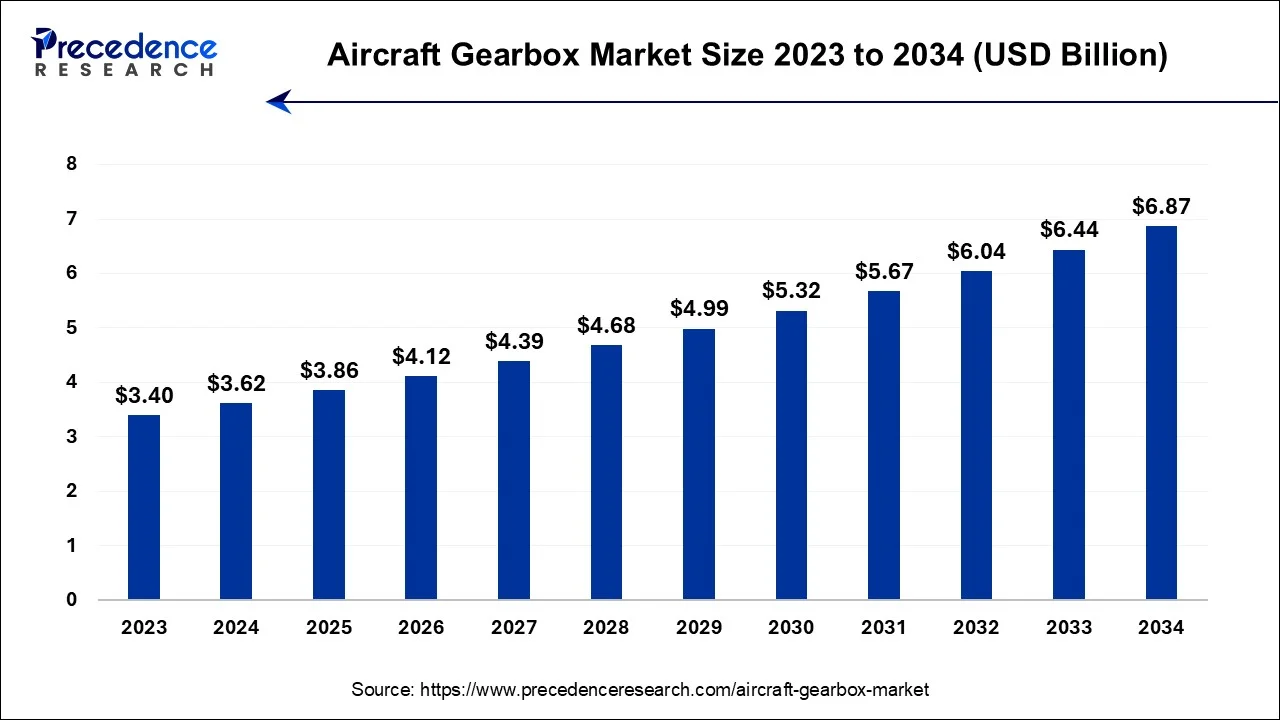

The global aircraft gearbox market size was estimated at USD 3.62 billion in 2024 and is anticipated to reach around USD 6.87 billion by 2034, growing at a healthy CAGR of 6.60% between 2025 and 2034.

Aircraft Gearbox Market Key Takeaways

- In terms of revenue, the aircraft gearbox market is valued at $3.86 billion in 2025.

- It is projected to reach $6.87 billion by 2034.

- The aircraft gearbox market is expected to grow at a CAGR of 6.60% from 2025 to 2034.

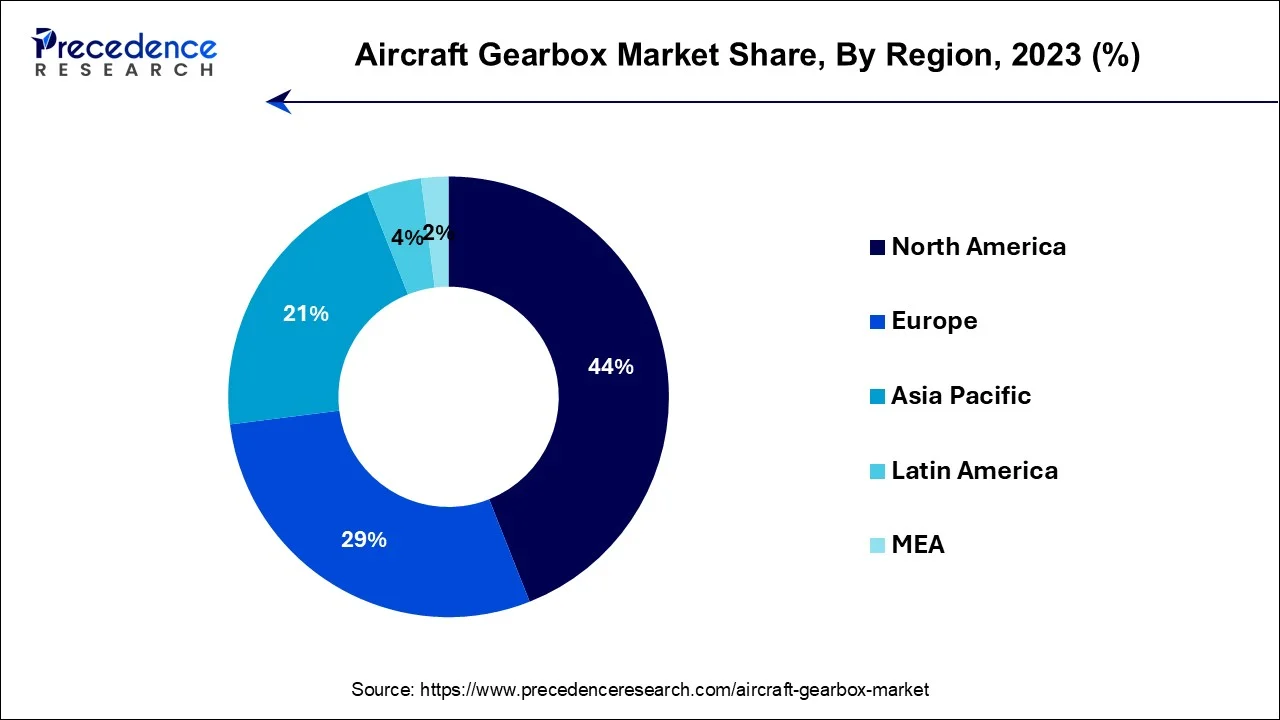

- North America contributed more than 44% of revenue share in 2024.

- The Asia-Pacific region is estimated to expand the fastest CAGR between 2025 and 2034.

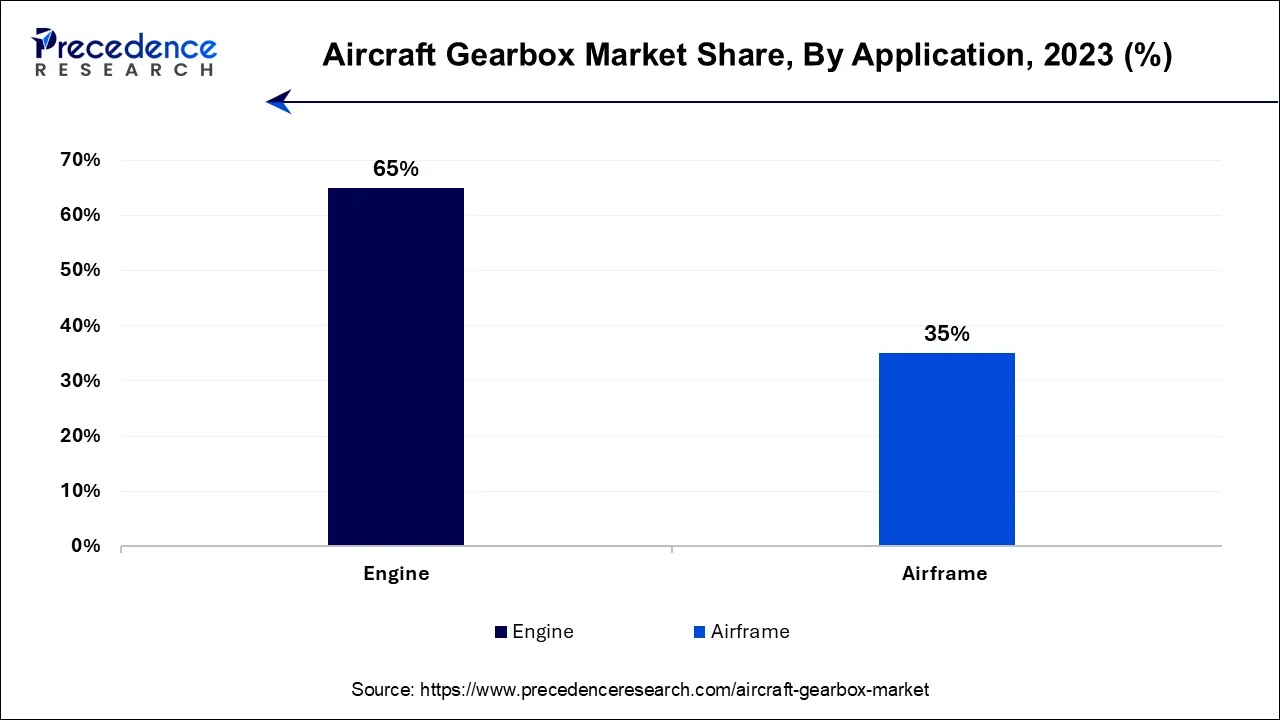

- By Application, the engine segment has held the largest market share of 65% in 2024.

- By Application, the airframe segment is anticipated to grow at a remarkable CAGR of 6.9% between 2025 and 2034.

- By Component, the gear segment generated over 45% of revenue share in 2024.

- By Component, the bearing segment is expected to expand at the fastest CAGR over the projected period.

- By End Use, the commercial aircraft segment generated over 40% of revenue share in 2024.

- By End Use, the helicopters segment is expected to expand at the fastest CAGR over the projected period.

- By Sales Channel, the OEM segment generated over 63% of revenue share in 2024.

- By Sales Channel, the aftermarket segment is expected to expand at the fastest CAGR over the projected period.

U.S. Aircraft Gearbox Market Size and Growth 2025 to 2034

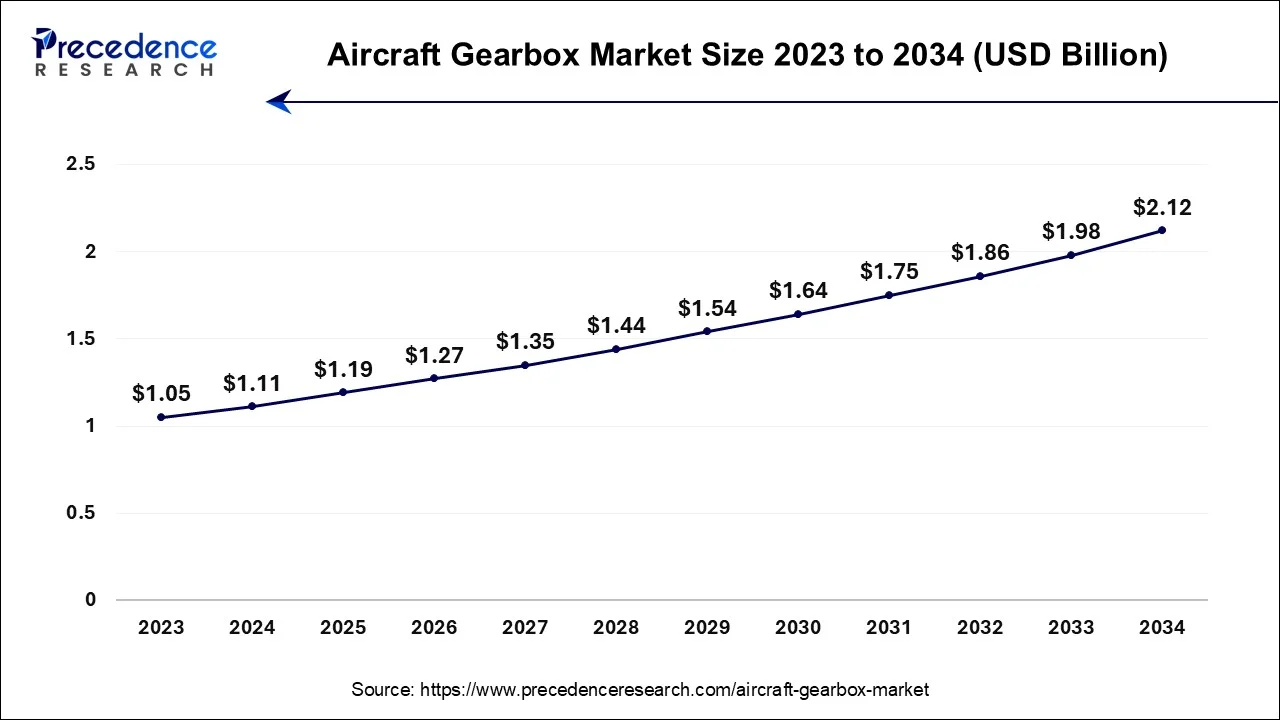

The U.S. aircraft gearbox market size accounted at USD 1.11 billion in 2024 and is expected to be worth around USD 2.12 billion by 2034, at a CAGR of 6.68% from 2025 to 2034.

North America has held the largest revenue share 44% in 2024. North America commands a substantial share in the aircraft gearbox market due to several key factors. The region boasts a strong presence of leading aerospace manufacturers and operators, driving a consistent demand for aircraft gearboxes. North America's technologically advanced aerospace industry emphasizes innovation and performance, leading to frequent upgrades and replacements of gearbox components. Moreover, the region's robust military aviation sector and investments in defence further contribute to the market's growth. The presence of well-established aviation regulations and safety standards bolsters the demand for certified gearboxes, solidifying North America's major share in the global aircraft gearbox market.

Europe is observed to grow at a considerable growth rate in the upcoming period, propelled by innovations in aerospace technology and a strong focus on fuel efficiency and reduced emissions. The region's dedication to sustainable aviation is driving an increased need for lightweight and high-performing gearboxes. Partnerships between major aerospace firms and research organizations are stimulating advancements in gearbox design and production. Moreover, Europe's well-established aviation infrastructure and the presence of leading aircraft manufacturers are bolstering market growth. The rise of electric and hybrid propulsion systems in aviation further accelerates the demand for sophisticated gearbox solutions in the region.

Germany

Germany plays a crucial role in Europe's aircraft gearbox industry, capitalizing on its exceptional engineering skills and vibrant aerospace sector. The nation hosts major industry stakeholders focused on creating cutting-edge gearbox technologies. Germany's commitment to research and development, along with governmental backing for sustainable aviation initiatives, places it at the leading edge of gearbox innovation. The country's strategic investments are aimed at improving aircraft performance while minimizing environmental impact.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific holds significant growth in the aircraft gearbox market due to its dynamic aviation sector. The region experiences robust growth in commercial and military aviation, driven by expanding economies, increasing passenger traffic, and defense investments. As a result, aircraft procurement and fleet expansion are on the rise, necessitating a greater demand for aircraft gearboxes. Furthermore, Asia-Pacific's emergence as a manufacturing hub for aircraft and components, combined with a growing focus on technological advancements, positions the region as a key contributor to the aircraft gearbox market's growth and development.

Market Overview

- An aircraft gearbox stands as an indispensable mechanical apparatus at the core of an aircraft's propulsion system. Its primary purpose lies in the orchestration of power transmission from the engine to the propeller or rotor, a pivotal function that ensures the aircraft's optimal performance and, most critically, its operational safety. Serving as the vital intermediary, this gearbox adeptly bridges the divide between the engine's high-speed rotation and the propeller or rotor's requirement for a slower and precise rotational motion, making it an essential cog in the propulsion process.

- These gearboxes are meticulously crafted with an exacting degree of precision, constructed from top-tier materials and equipped with advanced lubrication and cooling mechanisms, assuring their seamless operation amidst the challenging conditions of flight. Their utility extends to a wide array of aircraft, encompassing fixed-wing airplanes and helicopters alike.

- Given their paramount importance in aviation, aircraft gearboxes are subjected to stringent quality control procedures, comprehensive inspection protocols, and exacting maintenance standards to preserve the aircraft's airworthiness and safety standards. The significance of these gearboxes cannot be overstated, as any malfunction or breakdown could result in grave consequences, underlining the critical nature of their reliability in the realm of aviation.

Aircraft Gearbox Market Growth Factors

- Increasing demand for fuel-efficient aircraft is driving the aircraft gearbox market, as these gearboxes play a vital role in optimizing engine performance.

- The growth of the aircraft gearbox and the expansion of regional air travel are propelling the demand for new aircraft, boosting the aircraft gearbox market.

- Technological advancements in gearbox materials and designs are enhancing their durability, efficiency, and reliability, further stimulating market growth.

- Emerging markets in Asia-Pacific and Latin America are witnessing a surge in aircraft procurement, contributing to the expanding aircraft gearbox market.

- The rising need for the replacement and maintenance of aging aircraft gearboxes is generating a significant aftermarket for these components.

- The growing preference for electric and hybrid-electric propulsion systems in aircraft is creating opportunities for innovative gearbox solutions.

- Increasing defence budgets in various countries are leading to investments in military aircraft, bolstering the aircraft gearbox market.

- Advancements in additive manufacturing and 3D printing technologies are revolutionizing the production of lightweight and high-strength gearbox components.

- Stringent environmental regulations are pushing the aircraft gearbox to adopt more fuel-efficient and environmentally friendly aircraft, boosting the demand for advanced gearboxes.

- The expansion of low-cost carriers and the need for cost-effective aircraft solutions are driving the market for economically priced gearboxes.

- The incorporation of more electric systems in modern aircraft, including electric propulsion, necessitates advanced gearbox designs and technologies.

- Collaborations between aircraft manufacturers and gearbox suppliers are fostering innovation and product development in the market.

- Research and development efforts to reduce gearbox weight and improve power transmission efficiency are advancing market growth.

- The growth of urban air mobility (UAM) and electric vertical takeoff and landing (eVTOL) aircraft is creating new opportunities for gearbox manufacturers.

- Increasing investments in unmanned aerial vehicles (UAVs) and drones are driving demand for specialized, lightweight gearboxes.

- The adoption of predictive maintenance and condition monitoring technologies is enhancing the longevity of aircraft gearboxes and driving market growth.

- The emphasis on noise reduction in aircraft is leading to the development of quieter gearbox solutions for commercial and military applications.

- Rising concerns about safety and reliability are prompting aircraft operators to invest in high-quality, certified gearboxes.

- Global efforts to reduce greenhouse gas emissions are spurring research into gearbox technologies that can help achieve greener aviation.

- The increasing focus on aircraft electrification and sustainable aviation fuels is expected to create additional opportunities for innovative gearbox solutions in the future.

- General Electric annual revenue for 2022 was $76.555B, a 3.18% increase from 2021. General Electric's annual revenue for 2021 was $74.196B, a 2.16% decline from 2020. General Electric's annual revenue for 2020 was $75.833B, a 15.95% decline from 2019.

Major Key Trends in Aircraft Gearbox Market

- Electrification of Aircraft Systems: The transition to electric and hybrid propulsion requires the creation of specialized gearboxes that can efficiently handle power distribution in these advanced aircraft designs.

- Adoption of Advanced Lightweight Materials: Producers are increasingly utilizing materials such as titanium alloys and composites for gearbox manufacturing to decrease weight, boost performance, and enhance fuel efficiency in contemporary aircraft.

- Incorporation of Predictive Maintenance Technologies: Integrating sensors and IoT technologies within gearboxes allows for real-time monitoring, facilitating predictive maintenance and reducing the likelihood of unexpected failures and downtime.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.60% |

| Market Size in 2024 | USD 3.62 Billion |

| Market Size in 2025 | USD 3.86 Billion |

| Market Size by 2034 | USD 6.87 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Component, End Use, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Growth in aircraft gearbox

The aircraft gearbox market is seeing substantial growth, thanks to the expanding aircraft gearbox. This growth is influenced by several key factors. One of the main drivers is the increasing demand for air travel. With a growing global population and a burgeoning middle-class demographic, airlines are expanding their fleets. When airlines acquire new aircraft or modernize their existing ones, they require advanced and efficient gearboxes to optimize engine performance and ensure safety.

Furthermore, this growth isn't limited to commercial aviation. Military, cargo, and specialized aviation sectors are also on the rise, each with its specific gearbox requirements to meet operational demands. In response to these needs, the aircraft gearbox market is experiencing ongoing development and competition. This collaborative effort results in the advancement of gearbox technologies and materials, providing more reliable and efficient solutions for both current and future aircraft, ultimately contributing to the industry's growth and innovation.

Restraints

Costly development

The costly development of aircraft gearboxes stands as a significant restraint on the growth of the aircraft gearbox market. The design, research, and manufacturing processes required to create advanced and reliable gearboxes demand substantial financial investments. This financial barrier can deter new entrants to the market, limiting competition and innovation. Moreover, stringent aviation safety regulations mandate rigorous certification procedures for aircraft gearbox components, driving up the costs and extending development timelines. These regulations are essential to ensure safety but can impede market growth due to increased expenses and time constraints.

The substantial upfront expenses and prolonged development cycles can discourage manufacturers from pursuing aircraft gearbox projects. Furthermore, it can lead to higher prices for aircraft operators, affecting the overall affordability of aircraft and potentially hampering market demand. Overcoming these cost-related challenges requires industry stakeholders to balance safety standards with cost-effective solutions, encouraging the development of innovative yet financially viable gearbox technologies.

Opportunities

Rising demand for electric propulsion

The rising demand for electric propulsion in aircraft is creating significant opportunities in the aircraft gearbox market. Electric and hybrid-electric propulsion systems are gaining prominence as the aircraft gearbox strives to reduce emissions and enhance energy efficiency. This transition requires specialized gearboxes tailored to the unique characteristics of electric motors and power distribution systems. Opportunities in this context include the development of lightweight, high-torque gearboxes capable of efficiently transmitting power from electric motors to propellers or rotors. These gearboxes need to meet stringent performance and safety standards while also contributing to the overall weight reduction goals of electric aircraft.

In addition, the adoption of electric propulsion technology offers opportunities for gearboxes designed with enhanced integration of advanced sensors and diagnostics. This facilitates real-time monitoring and predictive maintenance, which can improve the longevity and reliability of gearbox components. As electric aircraft gain traction, manufacturers in the aircraft gearbox market have the chance to position themselves as leaders in this transformative field, offering innovative solutions that align with the aircraft gearbox's sustainability goals. This shift represents a compelling opportunity for companies to innovate, develop, and supply cutting-edge gearboxes for the evolving aviation landscape.

Application Insights

According to the engine, facial aesthetic products has held 65% revenue share in 2024. The engine segment holds a major share in the aircraft gearbox market due to its pivotal role in aircraft propulsion. Aircraft engines operate at high speeds, necessitating the use of gearboxes to transmit power to the propellers or rotors at optimal speeds for efficient thrust. Gearboxes in this segment must handle extreme forces and stresses. The consistent demand for new engines and engine upgrades in the aircraft gearbox, along with the ongoing maintenance requirements of existing engines, ensures a steady and substantial market share for gearbox manufacturers serving this critical component of the aircraft.

The airframe segment is anticipated to expand at a significant CAGR of 6.9% during the projected period. The airframe segment holds a major growth in the aircraft gearbox market primarily because gearboxes play a critical role in various aircraft systems beyond propulsion. They are instrumental in controlling functions like landing gear retraction, flap and slat deployment, and other airframe-related mechanisms. These components ensure smooth and precise operation, contributing to flight safety and operational efficiency. As airframes are central to an aircraft's structural and functional integrity, the demand for reliable and high-performance gearboxes remains consistently high, bolstering the airframe segment's prominence in the aircraft gearbox market.

Component Insights

In 2024, the gear segment had the highest market share of 45% on the basis of the raw material. The gear segment holds a significant share in the aircraft gearbox market due to its fundamental role in power transmission and engine optimization. Gears are critical components that ensure the proper rotation and torque transfer between the engine and propeller/rotor. They must meet stringent safety and reliability standards. With the growing demand for fuel-efficient aircraft and innovative propulsion systems, gear technology has become pivotal. The need for lightweight, durable, and high-performance gear solutions has led to substantial investments and advancements in this segment, cementing its dominant position in the aircraft gearbox market.

The bearing segment is anticipated to expand fastest over the projected period. The bearing segment holds a major growth in the aircraft gearbox market due to its critical role in ensuring the smooth and reliable operation of gearboxes. Bearings reduce friction and facilitate the movement of rotating components, thereby enhancing efficiency and durability. Given the rigorous demands and safety requirements of the aircraft gearbox, high-quality, precision-engineered bearings are essential. As a result, aircraft gearbox manufacturers prioritize bearings to meet stringent performance and safety standards, contributing to their significant market share as a vital component in the aviation propulsion system.

End Use Insights

In 2024, the commercial aircraft segment had the highest market share of 40% on the basis of the end use. The commercial aircraft segment holds a major share in the aircraft gearbox market primarily due to the steady growth of the global aircraft gearbox. The increasing demand for air travel, driven by population growth and economic expansion, results in a continuous need for new and modern commercial aircraft. Gearboxes play a pivotal role in optimizing engine performance, ensuring safety, and meeting stringent regulations. The sheer volume of commercial aircraft in operation, combined with the ongoing need for replacements and upgrades, makes this segment a dominant force, contributing significantly to the overall market share in the aircraft gearbox industry.

The helicopters segment is anticipated to expand fastest over the projected period. The helicopter segment holds substantial growth in the aircraft gearbox market due to several factors. Helicopters rely on complex gearbox systems to control the main rotor's speed and manage power distribution. This critical role in helicopter propulsion leads to a consistent demand for specialized gearboxes. Additionally, the military and civilian applications of helicopters contribute to a diverse market for gearbox solutions. As helicopters are employed in various missions, including defence, medical evacuation, and transport, their gearbox requirements span a wide spectrum, making this segment a major contributor to the aircraft gearbox market.

Sales Channel Insights

In 2024, the OEM segment had the highest market share of 63% on the basis of the sales channel. The Original Equipment Manufacturer (OEM) segment holds a significant share in the aircraft gearbox market due to its strategic role in the supply chain. OEMs are directly involved in the design and production of aircraft, allowing them to integrate gearboxes seamlessly. Their ability to offer customized solutions, ensure compliance with safety standards, and provide comprehensive support makes them preferred partners for aircraft manufacturers. Additionally, long-term contracts with OEMs and their strong reputation for reliability contribute to their dominant market position, as airlines and operators seek trusted sources for critical components like aircraft gearboxes.

The aftermarket segment is anticipated to expand fastest over the projected period. The aftermarket segment holds significant growth in the aircraft gearbox market due to several factors. Aircraft gearboxes, being critical components, require periodic maintenance, repair, and replacement to ensure safety and optimal performance. Aging aircraft fleets and the need for upgrades contribute to a steady demand for aftermarket gearbox solutions. Additionally, stringent regulatory requirements often prompt operators to invest in certified aftermarket gearboxes. This consistent need for maintenance and replacement, driven by safety and regulatory compliance, solidifies the aftermarket segment's dominance in the market, making it a major revenue contributor for gearbox manufacturers.

Aircraft Gearbox Market Companies

- United Technologies Corporation

- Safran S.A.

- GE Aviation

- Honeywell International Inc.

- Rolls-Royce Holdings PLC

- Northrop Grumman Corporation

- Parker Hannifin Corporation

- Woodward, Inc.

- Liebherr Group

- SKF Group

- Moog Inc.

- Curtiss-Wright Corporation

- Aero Gear, Inc.

- ZF Friedrichshafen AG

- AMETEK Inc.

Recent Developments

- In October 2024, The French aerospace firm Safran announced its plans to invest over USD 1.11 billion to grow its engine maintenance network, aiming to increase in-house maintenance capability fourfold by 2028. This expansion is in response to rising demand for LEAP engine services and includes enhancing advanced gearbox maintenance capabilities.

- In March 2023, Airbus Helicopters introduced an improved main gearbox (eMGB) for the H225 model, extending the overhaul period from 1,000 to 2,000 hours. This enhancement is aimed at boosting safety and minimizing maintenance needs, reflecting the company's commitment to progress in gearbox technology.

- In March 2023, Regal Rexnord Corporation completed its acquisition of Altra Industrial Motion Corp., enhancing its offerings in power transmission components, including aircraft gearboxes. This strategic acquisition strengthens Regal Rexnord's position within the aerospace industry and expands its ability to provide advanced gearbox solutions.

- In September 2021, Air Travel inked a 12-year agreement with CFM International, a collaboration between GE Aviation and Safran, to secure the seamless operation of its upcoming A320neo aircraft. This deal, valued at USD 992 million, encompasses the procurement of spare LEAP-1A engines.

- In February 2021,Philadelphia Gear, a subsidiary of The Timken Company, forged a contract with Newport News Shipbuilding to supply main reduction gears (MRGs) for the forthcoming USS Doris Miller aircraft carrier.

- In October 2020,Triumph Group entered into an arrangement to provide 30 brand-new spare high-speed gearboxes over five years to Linmarr Associates, a distributor for the Defense Logistics Agency serving the US Air Force. These gearboxes are an integral part of Triumph Group's landing gear door actuation system for the Lockheed C-5 Galaxy aircraft.

Segments Covered in the Report

By Application

- Engine

- Airframe

By Component

- Gear

- Housing

- Bearing

- Others

By End Use

- Commercial Aircraft

- Military Aircraft

- Helicopters

By Sales Channel

- OEM

- Aftermarket

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting