Aircraft Paint Market Size and Forecast 2025 to 2034

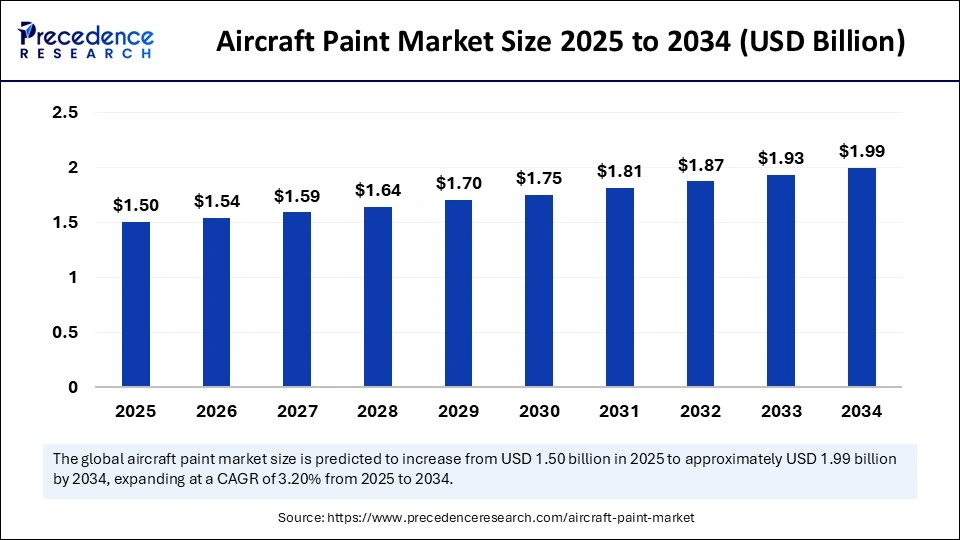

The global aircraft paint market size accounted for USD 1.45 billion in 2024 and is predicted to increase from USD 1.50 billion in 2025 to approximately USD 1.99 billion by 2034, expanding at a CAGR of 3.20% from 2025 to 2034. The growth of the market is attributed to the increasing demand for high-performance coatings that reduce drag and improve aerodynamic performance.

Aircraft Paint Market Key Takeaways

- In terms of revenue, the aircraft paint market is valued at $1.50 billion in 2025.

- It is projected to reach $1.99 billion by 2034.

- The market is expected to grow at a CAGR of 3.20% from 2025 to 2034.

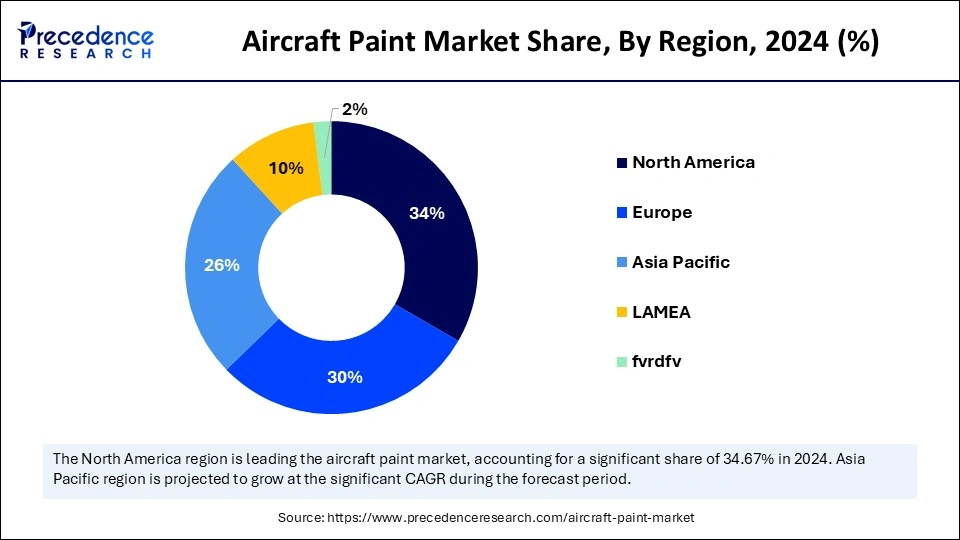

- North America dominated the aircraft paint market with the largest share of 34% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By type, the epoxy segment held the largest share of the market in 2024.

- By type, the enamel segment is expected to grow at the fastest rate in the coming years.

- By application, the interior segment dominated the market with the largest share in 2024.

- By application, the exterior segment is projected to grow at the fastest rate during the forecast period.

- By aircraft type, the narrow body segment held the largest share of the market in 2024.

- By aircraft type, the regional jets segment is anticipated to witness significant growth between 2025 and 2034.

- By end user, the commercial aircraft segment dominated the market in 2024.

- By end user, the military aircraft segment is projected to grow at a significant rate in the market during the forecast period.

How is AI Improving the Automotive Coatings' Efficiency and Quality?

AI is optimizing the paint application process, which greatly improves the effectiveness and quality of aircraft coatings. Large volumes of data from multiple production stages can be analyzed by AI-driven systems, which can then find patterns that improve coating efficiency. AI algorithms can forecast the ideal paint thickness needed for various surfaces, cutting down on waste and guaranteeing uniform application. AI can also automatically regulate environmental parameters like humidity and temperature, guaranteeing that the coatings meet the highest standards. This lowers material consumption and leads to quicker production times, fewer flaws, and better paint quality.

By utilizing machine learning models to identify paintwork flaws, AI also improves the quality control stage. Artificial intelligence (AI)-driven computer vision systems can frequently detect flaws in painted surfaces, including bubbles, scratches, and unevenness, more accurately than human inspectors. By enabling real-time corrections, this lessens the need for pricey touch-ups or rework. AI will further transform the automotive coatings industry as it develops and can be integrated with robotic painting systems, resulting in more cost-effective operations and consistently higher-quality finishes.

U.S. Aircraft Paint Market Size and Growth 2025 to 2034

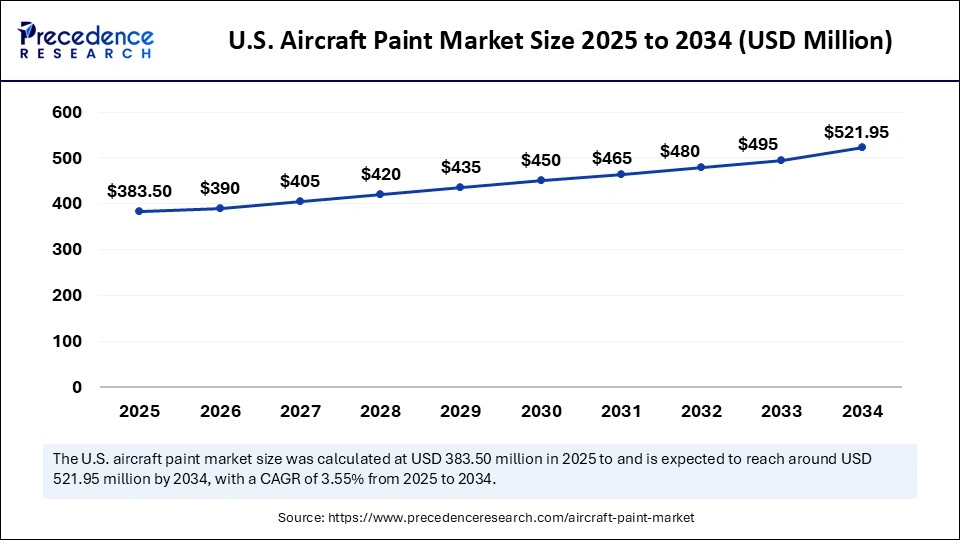

The U.S. aircraft paint market size was exhibited at USD 367.50 million in 2024 and is projected to be worth around USD 520.95 million by 2034, growing at a CAGR of 3.55% from 2025 to 2034.

North America dominated the aircraft paint market in 2024. With emphasis on technological developments in aerospace manufacturing, the military and aerospace sectors are demanding coatings with improved performance and corrosion resistance. Another important factor driving the need for novel coatings for military aircraft and unmanned aerial vehicles (UAVs) is North America's substantial defense budget.

Manufacturers and MRO providers are investing in environmentally friendly paint systems that satisfy corporate sustainability objectives and regulatory requirements. Coatings that are free of hazardous materials and low in volatile organic compounds (VOCs) are becoming more and more popular due to the region's strict environmental regulations. As a result, the paint industry is creating innovative technologies such as self-healing coatings and sophisticated anti-corrosion layers.

Aisa Pacific is observed to grow at the fastest rate in the aircraft paint market. The dominance is mainly due to the substantial rise in air travel and the expanding number of military and commercial aircraft. Nations such as China, Japan, and Singapore have developed into major hubs for international aviation. To meet air travel demands, regional airlines have made significant investments in fleet expansion and maintenance and repair (MRO) activities. Increased investments in advanced coating, especially those aimed at lowering fuel consumption and maintenance costs, are another result of this quick expansion.

Several nations have increased their production of narrow- and wide-body aircraft, which call for premium coatings for both practical and aesthetic reasons. There is a high demand for low-VOC and high-durability coatings by airlines and MRO providers. The need for coatings that enhance an aircraft's aerodynamic qualities is also rising as airlines prioritize fuel economy to lower operating expenses.

Europe is observed to grow at a considerable growth rate in the upcoming period. The growth of the aircraft paint market in Europe can be attributed to the rising demand for high-performance coatings. The region is home to some of the leading aircraft manufacturers in the world. There is a strong emphasis on lowering carbon emissions and increasing fuel efficiency. European military services and airlines are spending money on cutting-edge coatings that offer improved durability against environmental factors. The emphasis on sustainable aviation is one of the main factors propelling the demand for eco-friendly paints. Additionally, the development of lightweight, low-drag coatings is being driven by the need for coatings that enhance the aerodynamic qualities of aircraft, particularly for new-generation jets and unmanned aerial vehicles.

Market Overview

The aircraft paint market is experiencing steady growth, driven by the growing need for lightweight materials and fuel-efficient coatings that improve aircraft performance and lower operating costs. Advanced paint technologies like epoxy-based systems and polyurethane, which provide better corrosion protection, durability, and UV resistance, are being adopted by airlines and OEMs more frequently. Increased repainting cycles and MRO (Maintenance Repair and Overhaul) activities are also being caused by the growth of commercial and military fleets globally as well as increasing air traffic.

Environmental safety regulations are promoting the creation of eco-friendly and low VOC coatings, which is further stimulating innovation in the industry. Branding requirements and the growing trend of aircraft refurbishment are also driving the demand for premium, visually appealing paint solutions. The market for aircraft paint is anticipated to grow over the forecast years as aerospace manufacturers concentrate on increasing aircraft lifespan and efficiency.

Aircraft Paint Market Growth Factors

- Expansion of Commercial Aviation: The global rise in air passenger traffic is leading to an increase in aircraft production and fleet expansion, driving the demand for both OEM and MRO aircraft painting services.

- Increasing Aircraft Maintenance & Refurbishment: Aging aircraft fleets and stringent safety regulations boost the need for repainting and maintenance activities, particularly in the aftermarket sector.

- Advancements in Paint Technology: Innovations such as nano-coating, chrome-free primers, and lightweight, fuel-efficient paints are gaining popularity due to their performance benefits and regulatory compliance

- Environmental Regulations: Stringent environmental norms are pushing manufacturers to develop low-VOC and water-based coatings, opening new market opportunities.

- Defense Sector Modernization: Military aircraft upgrades and stealth technology enhancements are also contributing to the demand for specialized coastings with radar-absorbing and corrosion-resistant properties.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1.99 Billion |

| Market Size in 2025 | USD 1.50 Billion |

| Market Size in 2024 | USD 1.45 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.20% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Aircraft Type, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increased Air Travel Demand

Airline fleets around the world are growing rapidly because of increased air travel demand, particularly in developing regions like Asia Pacific, where economic growth is boosting the number of middle-class people. Airlines need to make investments in fleet expansion and maintenance as more people fly. Initial paint jobs are needed for new aircraft while touch-ups, frequent repainting, and the addition of branding components are needed for fleets that are already in place. The need for aircraft painting services will increase globally as a result of the ongoing increase in air travel volumes, which will necessitate painting more aircraft for maintenance aesthetics and brand identification.

The growing popularity of low-cost carriers also increases the demand for airlines that typically have larger fleets and provide more short-term services, which causes the outside of the aircraft to deteriorate more. Additionally, repainting older aircraft is essential as airlines look to update their fleets with the newest models. The market for aircraft paint is still heavily influenced by modernization and fleet expansion trends as airlines seek to prolong the life of their aircraft and maintain their new-looking appearance.

Aerospace Industry's Growth

The rapid expansion of the aerospace industry is driving the growth of the aircraft paint market. The demand for aircraft paints is rising as a result of the enormous expansion of the global aerospace industry, which includes both the military and commercial aviation sectors. As new airlines join the market and more nations build their aviation infrastructure, the commercial aviation industry expands. To meet the demand for aircraft, manufacturers such as Boeing and Airbus are increasing production, necessitating extensive painting operations to guarantee that every aircraft is visually appealing, shielded from environmental harm, and consistent with the airline's branding strategy.

Specialized coatings are also in high demand due to the expanding military industry. Coating for military aircraft must be functional and long-lasting, able to endure harsh environments like high speeds, chemical exposure, and wear from combat. They must also be aesthetically pleasing. More military aircraft are being built because of rising defense spending worldwide, raising the need for functional coating like radar-absorbing paints for stealth aircraft. The expansion of the commercial and defense aerospace sector guarantees the aircraft paint market consistent growth.

Restraints

Stringent Environmental Regulations

Stringent environmental regulations hinder the growth of the aircraft paint market. Regulatory bodies, such as the European Commission for Aviation Health and Safety (AHS) and the EPA, have imposed strict regulations on releasing hazardous air pollutants and volatile organic compounds. Manufacturers must invest in creating water-based, low-VOC, or biodegradable paints to comply with these regulations. Time to market may be slowed, and product development expenses may be raised as a result of these regulations. Moreover, business operations may be further impacted by fines or limitations on product usage resulting from non-compliance. The requirement for continuous innovation to satisfy changing standards introduces another level of difficulty.

High Repainting Cost

Depending on size and design complexity, repainting an aircraft can cost hundreds of thousands of dollars. The aircraft must be grounded during the procedure, sometimes for more than a week, which can result in lost operational time and revenue, particularly for commercial airlines. Post-painting inspections, curing time, and surface preparation all require substantial time. These exorbitant expenses render frequent repainting unfeasible for many carriers. This restricts the adoption of new paint technologies and deters design modifications.

Opportunity

Technological Advancements and Sustainability Trends

Technological advancements create immense opportunities in the aircraft paint market. High-performance aircraft paints and coatings infused with nanotechnology or fluoropolymers are increasingly preferred over conventional coatings. These cutting-edge materials and lightweight formulations are intended to provide increased fuel efficiency, resilience to severe weather, and exceptional durability. In addition, the aviation industry is increasingly focusing on sustainable practices, boosting the need for eco-friendly paints.

- In May 2024, PPG Industries launched a new line of low VOC water-based aerospace coatings designed to meet and exceed emerging environmental standards. This product line addresses the increasing demand for eco-friendly solutions in the aviation sector.

Type Insights

The epoxy segment dominated the aircraft paint market with the largest share in 2024 because of its exceptional durability and resistance to corrosion. Epoxy paints and coatings are frequently used as primers because they provide a solid foundation that sticks well to a variety of substrates, such as composite materials and aluminum. Epoxy coatings are essential for shielding airplanes from extreme weather conditions like high humidity, salty air, and temperature swings. They are essential in both military and commercial applications due to their long service life and superior resistance to wear and fuel spills. Furthermore, the need for sophisticated epoxy systems that can bond well and offer long-term protection is further supported by the expanding use of lightweight composite materials in aircraft manufacturing.

The enamel segment is expected to grow at the fastest rate in the coming years because of its enhanced appearance, quick curing time, and versatility in application. Modern enamel coatings are now being developed for increased durability, making them appropriate for exterior branding and interior decorative elements. In addition to enhancing the aircraft's aesthetic appeal, their high-gloss finish and exceptional color retention assist airlines in upholding their brand image. Furthermore, enamel coatings' quick drying times allow for more efficient maintenance and repainting schedules, which minimizes aircraft downtime. Additionally, enamel coatings are made with eco-friendly solvents and UV stabilizers, aligning with worldwide trends toward low emissions and sustainability.

Application Insights

The interior segment dominated the aircraft paint market with the largest share in 2024. This is mainly due to the increased need for cabin renovations, significantly boosting the need for high-performance paints and coatings that provide durability, aesthetic appeal, and safety compliance. Airlines prioritize interior coatings for spaces subjected to frequent wear abrasion and cleaning agents such as seats, overhead bins, sidewalls, and restrooms. Airlines are investing in high-end finishes that improve comfort, lighten aircraft, and adhere to flammability regulations as the passenger experience becomes a crucial differentiator.

The exterior segment is projected to grow at the fastest rate during the forecast period, driven by the growing need for aerodynamic coatings that enhance aircraft performance and fuel economy. New-generation coatings are being developed to improve UV protection, decrease drag and lengthen maintenance intervals. Lightweight, environmentally friendly exterior paints are in high demand as airlines update their fleets and embrace sustainability objectives. These coatings also aid in branding by providing weather-resistant finishes and high-visibility colors. The rising focus on aircraft maintenance to enhance operational efficiency supports segmental growth.

Aircraft Type Insights

The narrow body segment held the largest share of the aircraft paint market in 2024. This is mainly due to the increased need for narrow-body aircraft for short- and medium-distance routes. The increased focus on fleet modernization boosted the demand for aircraft paints for narrow-body aircraft. Because of their high turnaround times, low operating costs, and suitability for both domestic and regional connectivity, these aircraft are highly preferred and contribute to increased repaint cycles and branding updates. The increasing number of narrow-body aircraft, particularly in developing nations, sustain the steady growth of the segment in the coming years.

- In January 2025, Sherwin-Williams Aerospace Coatings introduced a low-VOC exterior coating aimed at improving the repainting turnaround for narrow-body fleet operators under strict environmental compliance.

The regional jets segment is anticipated to witness significant growth in the upcoming period. This growth of the segment is mainly attributed to the growing need for connectivity between underserved regions and smaller cities. Airlines are spending money on regional aircraft like Mitsubishi SpaceJets and Embraer E-Jets to accommodate the growing demand for short-haul travel while preserving fuel efficiency. Because of the more demanding and varied environments in which they operate, these aircraft need coatings that resist repeated takeoff landings and environmental wear. The demand for sophisticated, lightweight, and high-performance paint systems for regional jets is increasing due to increased fleet modernization.

End User Insights

The commercial aircraft segment dominated the aircraft paint market with the largest share in 2024. This is mainly due to the increased modernization of aging fleets and air travel demand. Commercial aircraft require frequent maintenance and repainting to ensure operational efficiency. Special coatings are also being developed to guard against thermal, biological, and chemical threats. High-tech coating is becoming more and more necessary for commercial aircraft due to a strong emphasis on performance.

The military aircraft segment is projected to grow at a significant rate in the market during the forecast period. This is mainly due to the modernization of military aircraft and increased global defense spending. Governments of various nations are spending money on cutting-edge coatings. Furthermore, unique coatings are being created to defend against harsh environmental conditions. High-performance coatings are becoming more important for fighter jets, drones, and helicopters as militaries place an increasing emphasis on survivability.

- In April 2025, AkzoNobel Defense introduced an infrared-suppressive coating to reduce aircraft visibility in thermal imaging, targeted for unmanned aerial vehicles (UAVs).

Aircraft Paint Market Companies

- IHI Ionbond AG

- Hentzen Coatings Inc

- DuPont

- Akzo Nobel NV

- PPG Industries Inc

- BASF SE

- Masco

- Mankiewicz Gebr & Co

- Kansai Paint Co Ltd

- Mapaero Coatings

Latest Announcement By Industry Leader

- In May 2024, Sherwin-Williams launched a UV-curing aerospace coating that reduces drying time, allowing for faster turnaround times. John G. Morikis, President and CEO of Sherwin-Williams, stated, "This new UV-curing technology is a game-changer, drastically reducing downtime and improving the efficiency of MRO operations, which is crucial in today's fast-paced aviation industry."

Recent Developments

- In October 2024, Airbourne Colors opened a £6.5 million aircraft painting facility equipped with advanced technologies to expedite the repairing process. The facility's capabilities aim to reduce aircraft downtimes and associated costs for airlines.

- In March 2024, BASF Coatings introduced biodegradable paint formulations aimed at reducing the environmental footprint of aircraft coatings. The new product line is a step towards sustainability, helping airlines comply with increasingly strict environmental regulations. The biodegradable nature of the paint allows for easier disposable and less harmful waste, a growing concern in the aviation sector. The introduction of these coatings reflects BAFS' commitment to producing eco-friendly solutions while maintaining high-performance standards for the aviation industry.

- In January 2024, AkzoNobel launched a range of eco-friendly, water-based aircraft coatings that meet low VOC standards. This initiative aligns with growing environmental regulations and caters to airlines looking to adopt sustainable practices. The coatings are designed to deliver superior durability while minimizing traditional solvent-based paints. AkzoNobel's efforts position the company as a leader in sustainability within the aerospace sector, as it addresses both performance and compliance with stringent environmental laws.

Segments Covered in the Report

By Type

- Enamel

- Epoxy

By Application

- Interior

- Exterior

By Aircraft Type

- Narrow Body

- Widebody

- Regional Jets

By End User

- Military Aircraft

- Commercial Aircraft

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting