Alternative Data Market Size and Forecast 2026 to 2035

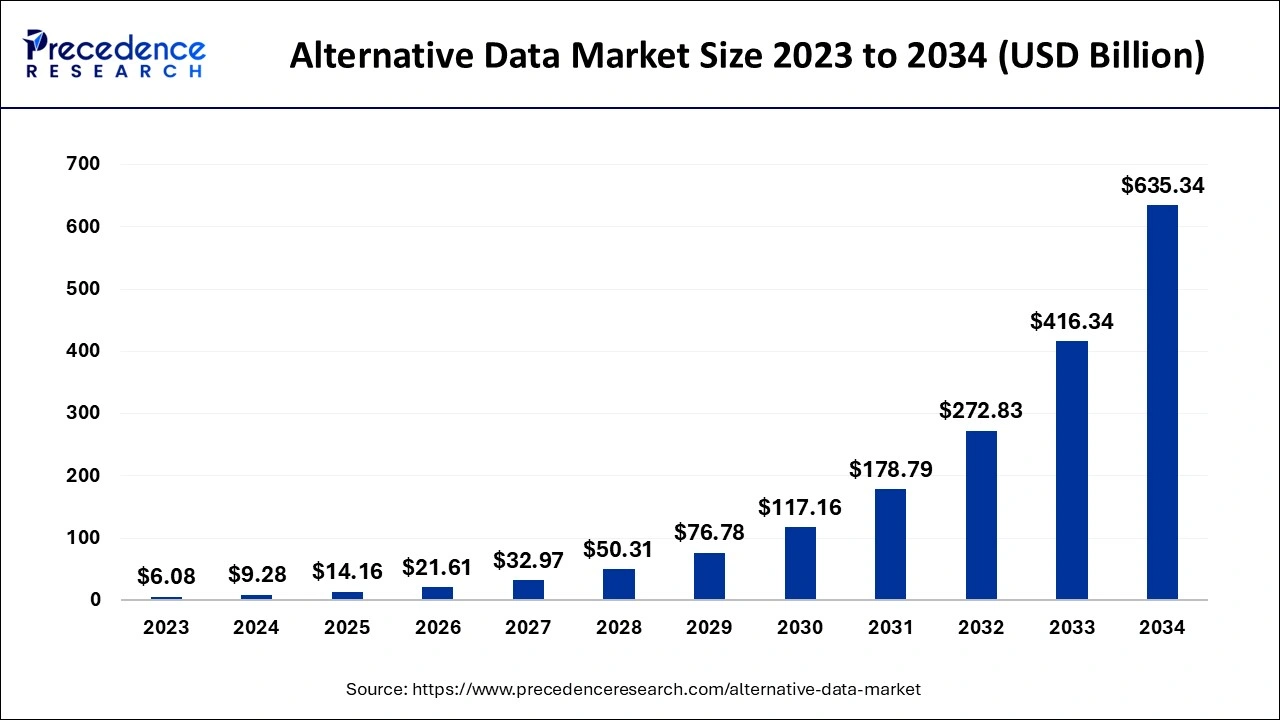

The global alternative data market size is valued at USD 14.16 billion in 2025 and is predicted to increase from USD 21.61 billion in 2026 to approximately USD 854.34 billion by 2035, expanding at a CAGR of 50.68% from 2026 to 2035.

Alternative Data Market Key Takeaways

- By end user, the hedge fund operators segment has generated a revenue share of over 71% in 2025.

- The retail companies segment is growing at the highest CAGR between 2026 to 2035.

- By industry, the BFSI segment exhibited a 16% revenue share in 2025.

- The retail industry segment is growing at a CAGR of 56.5% between 2026 to 2035.

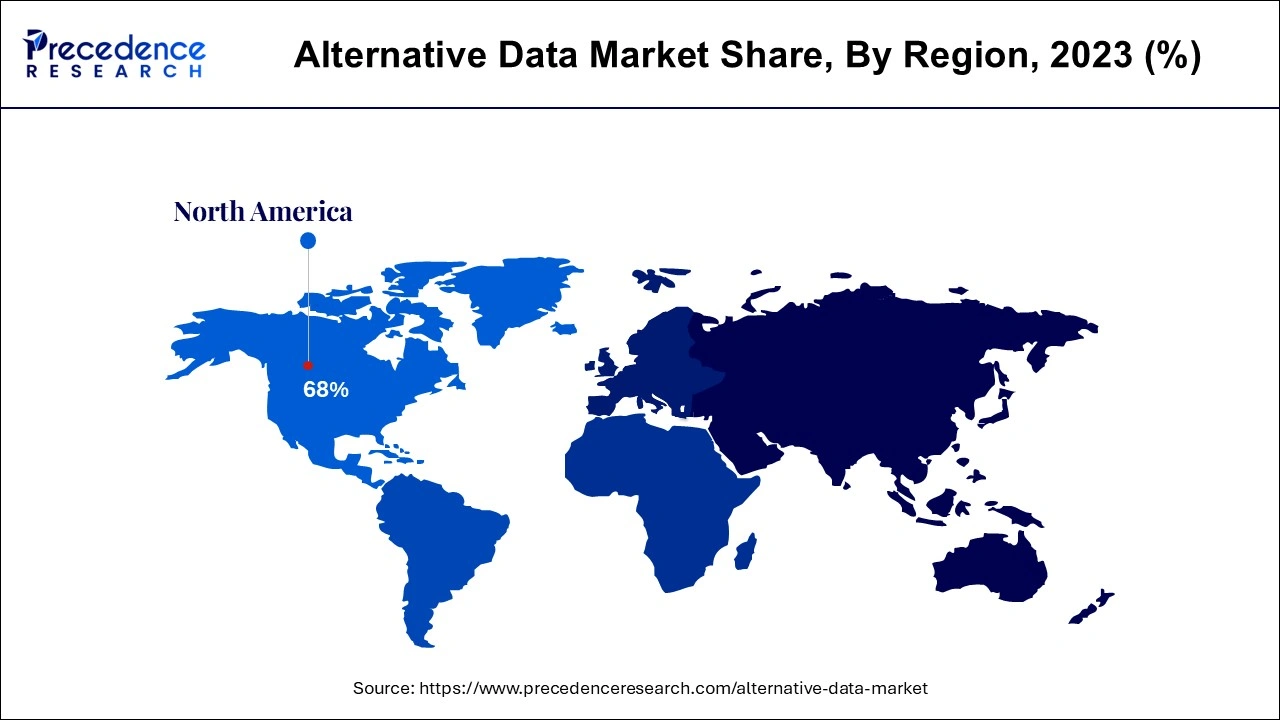

- North America region accounted highest revenue share of over 68% in 2025.

Strategic Overview of the Global Alternative Data Industry

Information acquired from non-conventional sources is known as alternative data. Analysis of alternative data can yield insights that go beyond what can be learned from an industry's standard data sources. Investors employ non-traditional data sets known as "alternative data" to inform their investment strategy. Credit card transaction data, IoT sensor data, satellite images, mobile device data, product reviews, site traffic, weather data, app usage, and ESG (environmental, social, and corporate governance) data are a few examples of alternative data sets.

Some alternative data suppliers also keep tabs on congressional trade, government contracts, and business jet travel. The need for alternative data is anticipated to increase as hedge funds place more emphasis on generating alpha. Hedge funds, private equity funds, mutual funds, unit trusts, life insurance companies, pension funds, and other BFSI institutions' asset managers have a strong preference for using alternative data to provide predictive insights. Additionally, it is anticipated that the usage of alternative data for risk management procedures will propel market expansion.

Artificial Intelligence: The Next Growth Catalyst in Alternative Data

AI is fundamentally reshaping the alternative data industry by enhancing the entire data lifecycle from collection to analysis. AI algorithms are crucial for processing vast volumes of unstructured data, such as satellite imagery, social media feeds, and geolocation data, converting raw noise into actionable investment signals that were previously inaccessible or too complex for human analysis.

Furthermore, AI is utilized to validate data quality, identify biases, and detect subtle patterns or anomalies, thereby improving the reliability and depth of market insights derived from this non-traditional information.

Alternative Data Market Growth Factors

Alternative data is undiscovered information that isn't found in conventional sources like SEC filings, financial statements, news announcements, and management presentations. It is compiled from a variety of sources, including social media, financial transactions, web traffic, public records, mobile devices, sensors, e-commerce websites, satellites, and more. When specialized analytics are applied to this assembled set, previously undiscovered insights are produced that are then used by investors to assess investment opportunities. The buy-side organizations, including private equity funds, hedge funds, mutual funds, pension funds, unit trusts, and life insurance companies, are actively using this new information to develop investment models to outperform the market because it is a key differentiator that contributes to alpha, market outperformance.

Alternative data, which was initially adopted by algorithmic or quantitative traders looking for signals, has extended throughout the institutional investment community and into the corporate sector. The COVID-19 problem marks a new stage for alternative data as well as an unprecedented challenge for corporations and governments.

- The businesses are evaluating changes in customer behavior patterns connected to purchases and interests during the coronavirus epidemic using alternative data gathered from social media, wearables, applications, mobile phones, and other IoT-based devices.

- Fundamental asset managers have increased their demand for alternative data as they look for fresh signals and sources of alpha for selecting stocks in the COVID economy.

- Both buy-side and sell-side organizations are interested in learning more about alternative data because of the behavioral changes brought on by the global epidemic.

Market Outlook

- Market Growth Overview: The alternative data market is expected to grow significantly between 2025 and 2034, driven by intense demand from hedge funds and investment institutions to generate "alpha" (excess returns) using unique insights not available from traditional sources, AI and machine learning advancements, and expansion beyond financial services.

- Sustainability Trends: Sustainability trends involve ethical data sourcing and privacy compliance, data processing efficiency, and transparency and traceability.

- Major Investors: Major investors in the market include Vanguard, BlackRock, State Street, T. Rowe Price, Goldman Sachs, Citi Ventures, and JPMorgan.

- Startup Economy: The startup economy is focused on analytics and signal generation, data sourcing and collection, and compliance and data governance.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 14.16 Billion |

| Market Size by 2035 | USD 854.34 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 50.68% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Data Type, Industry, End User, and Geography |

Market Trends

- Launch of next-generation platforms: A significant development in the alternative data sector is the introduction of next-generation platforms. Major alternative data industry players are concentrating on launching next-generation platforms to provide researchers, analysts, and enterprises with fresh and pertinent insights.

- Rise in number of players: A increasing number of firms are providing systems that can mine data from satellite images, social media sentiment, and IoT device data.

Market Dynamics

Drivers in the Alternative Data Market

- Data obtaining: The regulatory environment around the acquisition of data, its application, and its dissemination has caused data sourcing to continuously change. All kinds of data must be collected scientifically and in accordance with privacy standards, according to laws like the GDPR and California Consumer Privacy Act (CCPA). The element significantly contributed to the alternative data market's growth dynamics. The adoption of alternative data analysis tools for credit card transaction data has increased demand. The enormous attractiveness of data in anticipating sales and predicting economic signals that may influence future purchase intentions is a key consumer proposition driving the increase in demand. Hedge fund managers' investment has increased as a result, increasing the revenue potential of those in the alternative data market.

- Rising demand from hedge funds: Market growth is anticipated to be greatly accelerated by the increasing demand from hedge funds. Today, more than half of hedge fund managers use it to generate outperformance and assist risk management procedures in order to obtain a competitive advantage. The market revenue from selling alternative data to hedge funds is greatly boosted by the work of more than 400 businesses. When we talk about alternative data, we mean the undiscovered information that is not contained in the conventional sources. It is compiled from a variety of sources, including social media, e-commerce websites, public records, web traffic, mobile devices, sensors, satellites, and more.

- Expansion of expenditures in smart city projects: The alternative data industry is expected to benefit from the rising development of spending on smart city projects across many nations. In order to efficiently manage and operate municipal services including water supply, law enforcement, and transportation systems, smart cities leverage information and communication technology.

Challenges in the IoT microcontroller market

- Data Interpretation- For enterprises, data interpretation could provide a challenge. When there are so many sources available, it might be challenging to differentiate between them and assess each source's quality in order to choose the best one. Any manipulation of this data may result in erroneous choices and substantial harm to the company.

- Lack of data accuracy- It entails understanding the information's sources, the limitations on its use, and the ethical and proper preservation practices. There is a tremendous amount of data generated, and the legitimacy of alternative data may contain incorrect information, which would hamper the market for alternative data.

Data Type Insights

The credit and debit card transactions segment is the market leader and is anticipated to contribute the most to the alternative data market in terms of data type. This substantial share can be attributed to the fact that there are various sources of credit card transaction data available and that investors have a high demand for this kind of data. This sector is also expected to develop at the fastest rate throughout the projected year because to the improved capabilities of the data providers, which include identifying client expenditure based on gender, age, seller, area, and other characteristics. The businesses are combining transaction data with various sorts of data to uncover hidden consumer spending trends, enabling investors to fund successful businesses.

Duringthe projected period, it is anticipated that the social and sentiment data and mobile application usage categories would have significant increase. The increase is linked to the retail industry's growing need for smartphone usage. It is used by retail organizations to examine customer behavior in e-commerce applications. Additionally, merchants are leveraging sentiment data from social media websites more and more to identify consumer interests across diverse groups and geographies. The geolocation from satellite photos is also becoming more and more popular to assess the customer store visits on specific days and times, consequently structuring the operational plans for managing the businesses. Even though these sources are less accurate than transaction data, businesses are figuring out how to connect the connections and gain insights.

Industry Insights

The Banking, Financial Services, and Insurance (BFSI) sector dominates the market for alternative data by industry. The expansion can be linked to the rise in demand for intelligent data from different BFSI enterprises. These animals aggressively employ the sources' occult predicting abilities to raise their alpha. During the forecast period, the retail industry segment is expected to display a sizable CAGR. Energy, real estate, construction, transportation, and logistics are some of the industries with the fastest growth.

Regional Insights

U.S. Alternative Data Market Size and Growth 2026 to 2035

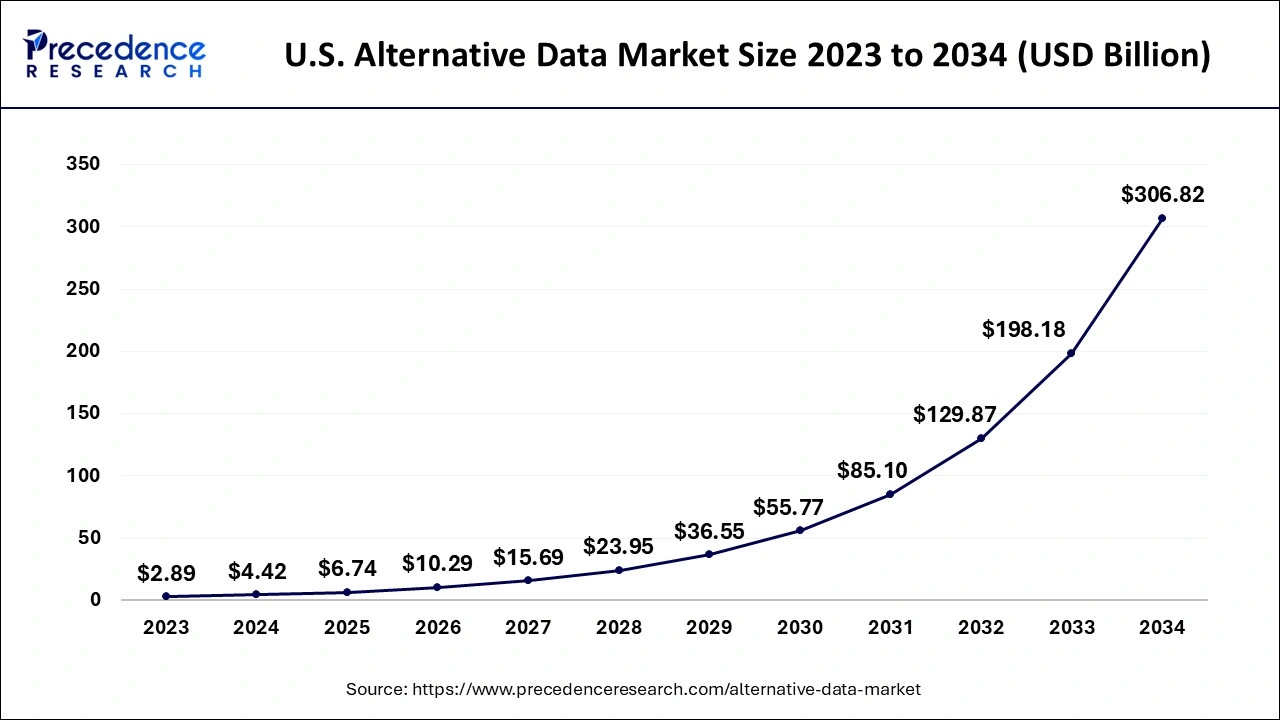

The U.S. alternative data market size is evaluated at USD 6.74 billion in 2025 and is predicted to be worth around USD 388.57 billion by 2035, rising at a CAGR of 50.00% from 2026 to 2035.

During the projected period, North America is expected to maintain its prominent position in the alternative data market. Advan, Eagle Alpha, M Science, and UBS Evidence Lab are just a few of the several market players that are credited with the region's sizable market share. The nation's early acceptance of alternative data from a number of industrial verticals also contributes to its substantial market dominance. Currently, more than 70% of American asset managers favor incorporating alternative data in their investment process. The rise of the regional market is also expected to be fueled by business alliances and purchases from Nasdaq and S&P Global Platts. These elements are elevating it above other regions.

Due to the sizeable alternative Assets under Management (AUM), the market for alternative data in Europe has a sizable revenue share and was anticipated to expand. These assets are mainly spread out among several classes, including real estate, private equity, hedge funds, and natural resources. Asset management firms are using alternative data more and more to develop successful alpha-generating methods.

Over the projected period, Asia Pacific is anticipated to rank among the regional markets with the quickest growth. This is because alternative data use cases in the BFSI, retail, automotive, and telecommunications industries are growing. The growth of the regional market is anticipated to be boosted by the usage of alternative data for investments and risk assessment, particularly from businesses in rising markets like China and India.

U.S. Alternative Data Market Trends

The U.S. financial services sector, which leverages data from sources like credit card transactions to gain a trading advantage. The integration of advanced AI and machine learning is crucial for analyzing the vast volumes of unstructured information and extracting meaningful insights. The shift to cloud-based platforms and the diversification of data types, such as geolocation records, are democratizing access and expanding applications beyond finance.

Germany Alternative Data Market Trends

Germany's stringent EU regulatory framework fosters a strong emphasis on data privacy and compliance. This mature B2B market sees robust adoption of alternative data in industrial and healthcare sectors as part of "Industry 4.0" strategies. Companies highly value data security and control, leveraging AI for data analytics while navigating clear, though demanding, data sharing regulations.

China Alternative Data Market Trends

China's market is driven by strong demand for diverse data types to fuel national AI development goals. This market operates within a complex and strict regulatory framework, including laws like PIPL and the Data Security Law. While finance is a core application, the use of data is rapidly expanding into the retail and e-commerce sectors, leveraging unique opportunities for potential data collaboration between private enterprises and state entities.

Value Chain Analysis of the Alternative Data Market

- Data Sourcing and Collection

This initial stage involves identifying, accessing, and collecting massive volumes of raw, unstructured data from diverse sources like satellite imagery, social media feeds, sensor data (IoT), and web traffic.

Key Players: Maxar Technologies, social media platforms (X/Twitter, Reddit), and data aggregators like Earnest Analytics - Data Aggregation and Curation

Once collected, raw data is aggregated, cleaned, standardized, and stored in formats suitable for analysis.

Key Players: YipitData, Palantir Technologies, and exchange-owned platforms like Nasdaq Data Link. - Data Analysis and Signal Generation

This critical stage involves applying advanced analytics, machine learning (ML), and artificial intelligence (AI) algorithms to the processed data to extract meaningful patterns, trends, and predictive signals (alpha).

Key Players: Two Sigma or Renaissance Technologies, or by analytical software providers like Google Cloud or AWS - Distribution and Delivery

This involves delivering the generated insights, raw data feeds, or analytical tools to end-users through various channels, typically via APIs, cloud platforms, or subscription services.

Key Players: Bloomberg Terminal, cloud service providers like Microsoft Azure and AWS

Top Companies in the Alternative Data Market & Their Offerings:

- Advan Research Corporation

Advan specializes in geospatial alternative data, using satellite imagery and geolocation data to track real-time economic activity, such as vehicle and foot traffic at commercial locations. - Preqin Ltd.

Preqin is a leading provider of data and intelligence for the alternative assets market, offering comprehensive information on private equity, hedge funds, and real estate. They provide crucial insights into investor activity and fund performance metrics not found in traditional sources. - 7Park Data Inc.

7Park Data specializes in extracting insights from a variety of unstructured data sources, particularly from apps and other digital platforms. They help clients understand consumer behavior, market share shifts, and competitive landscapes with high-quality, actionable data sets. - Convergence Inc.

Convergence focuses on data about the asset management industry itself, providing intelligence on fund flows, service providers, and operational data. - UBS Evidence Lab

The UBS Evidence Lab is an internal research unit of UBS that generates proprietary, non-traditional data and insights for its investment banking clients. They conduct primary research and data analysis on a vast array of topics to provide an informational edge. - YipitData

YipitData is a major data aggregation and analysis platform that provides alternative data insights to institutional investors and corporations. They specialize in web data collection and offer clean, curated datasets ready for immediate analysis. - Dataminr Inc.

Dataminr uses AI to detect high-impact events and emerging risks in real-time from public social media and news data. They provide crucial early warning signals for financial market risks and geopolitical events. - M Science LLC

M Science is a data-driven research and analytics firm that provides actionable insights for financial institutions and corporations. They leverage a range of alternative data sets, including e-commerce and transaction data, to generate predictive signals. - Eagle Alpha Ltd.

Eagle Alpha is a leading provider of solutions for alpha generation from alternative data, acting as a one-stop shop for data sourcing, due diligence, and education. They connect data buyers (like hedge funds) with data vendors. - Geotab Inc.

Geotab is a leader in connected transportation and fleet management, providing a massive source of high-frequency and granular data on commercial vehicle movement. This geolocation data is valuable for logistics and supply chain analysis. - Jumpshot

Jumpshot is now defunct, but when operational, it specialized in data that tracked the full consumer journey online. Their data offered a unique view of digital behavior and market share for e-commerce companies. - JWN Energy

JWN Energy (now part of Daily Oil Bulletin) provides data and intelligence on the Canadian energy sector, offering insights into oil and gas production, infrastructure projects, and market dynamics. - RavenPack International SL

RavenPack is a leading provider of news and social media analytics, using natural language processing (NLP) to turn unstructured text data into structured, real-time insights. They help clients monitor sentiment and manage risk across global markets. - The Earnest Research Company

Earnest Research uses data from credit and debit card transactions to provide insights into consumer spending habits and company performance. Their granular transaction data is highly valued by investors for predicting retail and restaurant sales. - Thinknum Inc.

Thinknum provides a platform for tracking data from the public web, such as job listings, pricing data, and social media metrics, for investment analysis. They provide a simple, scalable way to collect alternative data for competitive intelligence. - Talkingdata

Talkingdata is a major mobile data intelligence platform based in China, providing extensive app usage and behavior data for a massive user base.

Alternative Data Market Companies

- Advan Research Corporation

- Preqin Ltd.

- 7Park Data Inc.

- Convergence Inc.

- UBS Evidence Lab

- YipitData

- Dataminr Inc.

- M Science LLC

- Eagle Alpha Ltd.

- Geotab Inc.

- Jumpshot

- JWN Energy

- Ravenpack International SL

- The Earnest Research Company

- Thinknum Inc.

- Talkingdata

Key Market Developments

- The Financial Terminal infrastructure has undergone considerable improvements, according to Advan Research Corporation, the top provider of geolocation data to the financial sector. Advan is enabling a larger and more varied range of investors to use geolocation data to guide their decision-making by adding hundreds of additional companies to its coverage. In January 2021, Advan added 300,000 locations, 540 new businesses, and 44 new index categories, giving it a total coverage of 2,790 businesses and 310 industries.

Segments covered in the Report

By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting