What is the Amplifier Market Size?

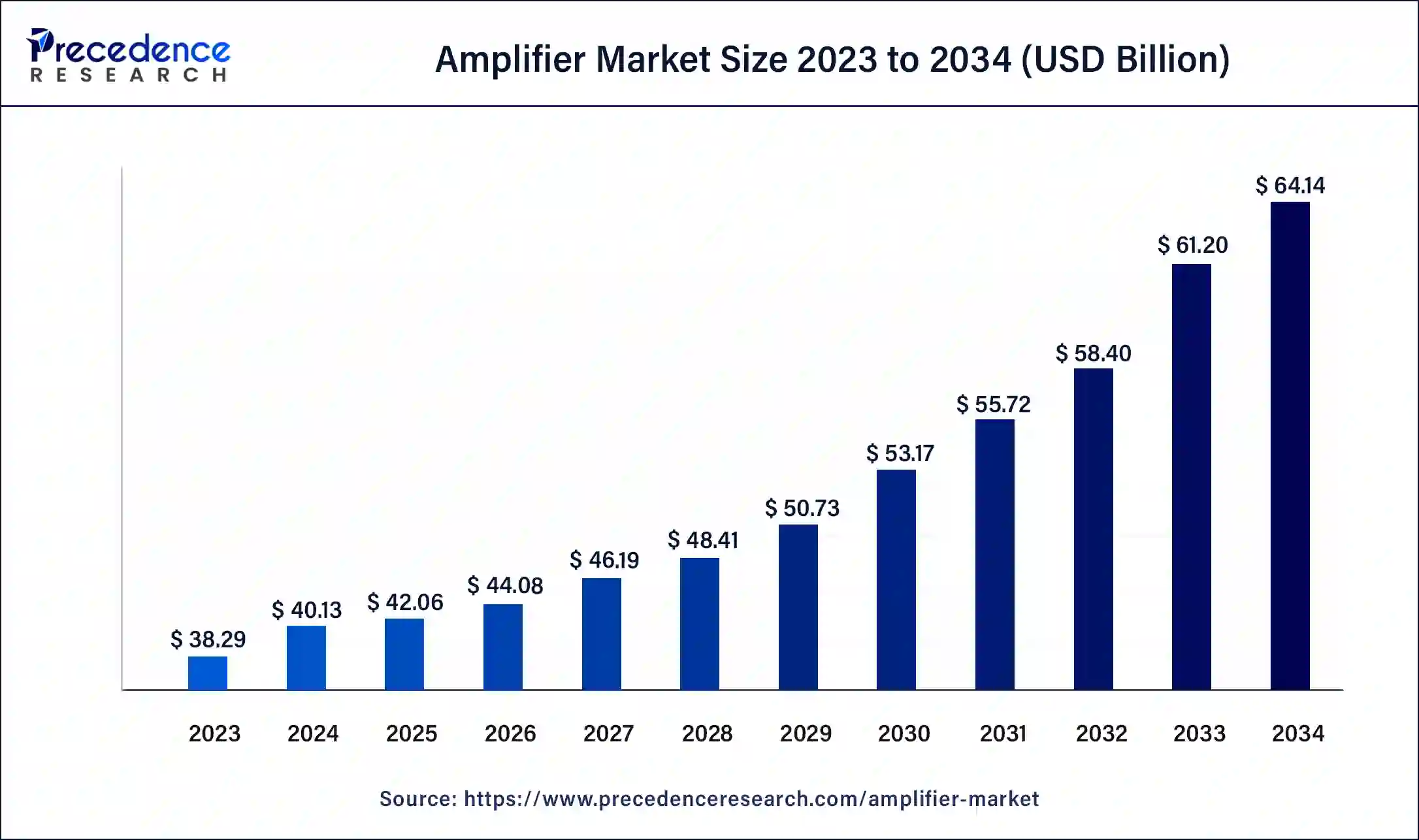

The global amplifier market size is accounted at USD 42.06 billion in 2025 and predicted to increase from USD 44.08 billion in 2026 to approximately USD 66.99 billion by 2035, representing a CAGR of 4.76% from 2026 to 2035.

Amplifier Market Key Takeaways

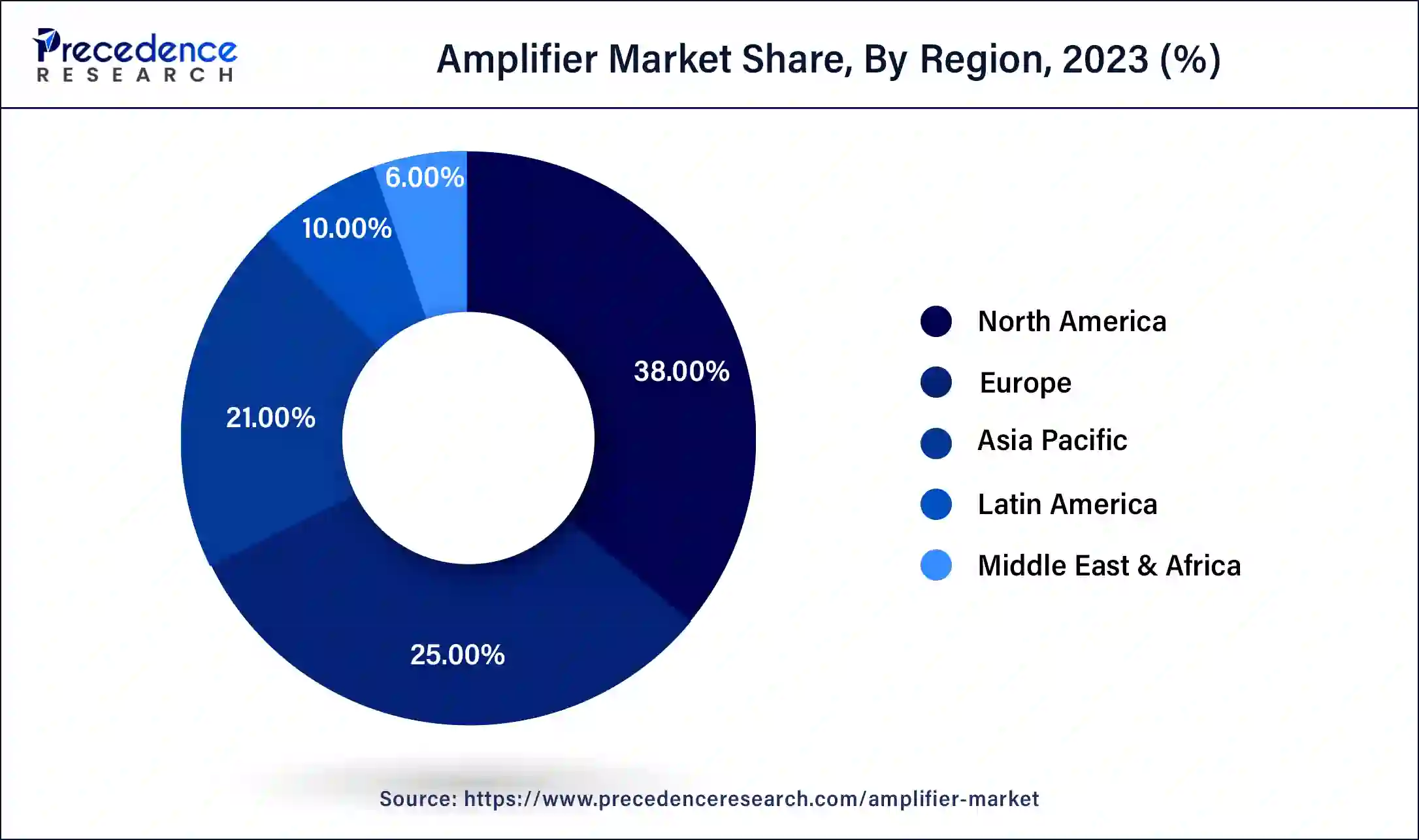

- North America contributed more than 38% of the revenue share in 2025.

- Asia-Pacific region is estimated to expand the fastest CAGR between 2026 and 2035.

- By type, the voltage amplifier segment has held the largest market share of 43% in 2025.

- By type, the power amplifier segment is anticipated to grow at a remarkable CAGR of 7.1% between 2026 and 2035.

- By phase, the inverting amplifier segment generated over 68% of revenue share in 2025.

- By phase, the non-inverting amplifier segment is expected to expand at the fastest CAGR over the projected period.

- By coupling method, the resistive-capacitive coupling amplifier segment had the largest market share of 39% in 2025.

- By coupling method, the inductive-capacitive coupling Amplifier segment is expected to expand at the fastest CAGR over the projected period.

- By product type, the audio frequency amplifier segment generated over 41% of revenue share in 2025.

- By product type, the intermediate Frequency amplifier segment is expected to expand at the fastest CAGR over the projected period.

- By industry vertical, the consumer electronics segment generated over 45% of revenue share in 2025.

- By industry vertical, the automotive segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The amplifier market is characterized by the production and distribution of devices that enhance the amplitude of electrical signals, catering to a diverse range of applications. The market growth is propelled by increasing demand for audio and video amplification in consumer electronics, automotive, and communication sectors. Technological advancements, the rising popularity of wireless audio systems, and the integration of amplifiers in smart devices contribute to market expansion.

The global amplifier market demonstrates steady growth, driven by innovations, an expanding consumer electronics market, and the constant evolution of audio and communication technologies. Moreover, the emergence of advanced amplifier technologies like Class D amplifiers, coupled with the growing trend of home entertainment systems, further fuels market progression, creating new avenues for growth.

Amplifier Market Growth Factors

- Technological Advancements: Continuous technological innovations, especially in Class D amplifiers, are contributing to the market's expansion.

- Increasing Demand for Home Entertainment Systems: The rising trend of home entertainment systems is a significant driver, creating a robust demand for amplifiers in the consumer electronics sector.

- Growing Automotive Industry: The automotive sector's expansion, particularly in premium and luxury vehicles, is boosting the demand for amplifiers in car audio systems.

- Live Music Events and Concerts: The resurgence of live music events and concerts is driving the demand for amplifiers in the professional audio industry.

- Wireless Audio Systems: The increasing preference for wireless audio systems is fueling the adoption of amplifiers with advanced connectivity options.

- Rising Disposable Income: With the increase in disposable income, consumers are investing in high-quality audio systems, positively impacting the amplifier market.

- Class D Amplifiers: The market is witnessing a shift towards Class D amplifiers due to their energy efficiency and compact size.

- Integration of Advanced Features: Amplifiers are increasingly incorporating advanced features like wireless connectivity, multi-room audio, and smart capabilities.

- Focus on Eco-friendly Solutions: Manufacturers are emphasizing eco-friendly amplifier designs, aligning with the growing environmental consciousness.

- Customization in Amplifier Design: There is an opportunity for manufacturers to provide customizable amplifier solutions to cater to diverse consumer preferences.

- Expansion in Emerging Markets: The untapped potential in emerging markets presents opportunities for companies to expand their footprint and tap into growing consumer bases.

- Collaborations for Technological Innovation: Partnerships and collaborations for technological innovation can drive product development and enhance market competitiveness.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 42.06 Billion |

| Market Size in 2026 | USD 44.08 Billion |

| Market Size by 2035 | USD 66.99 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.76% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Phase, By Coupling Method, By Product Type, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand for home entertainment systems and growing automotive industry

The increasing demand for home entertainment systems has become a pivotal factor in driving the amplifier market. As consumers seek enhanced audio experiences for their home setups, amplifiers play a crucial role in delivering high-quality sound. With the rising trend of home theaters, soundbars, and immersive audio solutions, amplifiers have witnessed a significant uptick in demand. Homeowners are investing in amplifiers that can complement advanced audio systems, providing clear and powerful sound for movies, music, and gaming. This trend is particularly pronounced as people spend more time at home, emphasizing the importance of a premium audio experience.

Simultaneously, the growing automotive industry is contributing substantially to the increased demand for amplifiers. As automotive manufacturers focus on enhancing in-car entertainment and audio systems, amplifiers play a vital role in delivering superior sound quality within vehicles. Premium and luxury vehicles, in particular, are incorporating advanced audio technologies, creating a market niche for high-performance amplifiers. The intersection of automotive innovation and audio excellence is propelling the amplifier market forward, as consumers increasingly prioritize a sophisticated and immersive audio experience while on the road.

Restraint

Cost constraints and competitive market dynamics

The amplifier market faces challenges related to cost constraints, especially in price-sensitive consumer segments. The production of high-quality amplifiers often involves sophisticated technologies and premium components, leading to elevated manufacturing costs. Consumers, particularly in economically sensitive regions, may be reluctant to invest in expensive audio systems, impacting the overall market demand. Additionally, intense competition among manufacturers to offer cost-effective solutions further exerts pressure on profit margins, limiting the ability to invest in research and development for advanced amplifier technologies.

The market is highly competitive, with numerous players vying for market share. This competition often leads to price wars and a focus on cost reduction strategies to gain a competitive edge. As companies strive to offer affordable amplifiers without compromising quality, they face challenges in achieving profitability. Intense rivalry can limit the pricing flexibility for manufacturers, and the emphasis on cost-cutting measures may hinder investments in innovation, impacting the introduction of new and advanced amplifier technologies. This competitive environment creates a challenging landscape for sustained growth and can impede the overall market demand for amplifiers.

Opportunity

Customization in amplifier design and class D amplifiers

Customization plays a pivotal role in surging the demand for amplifiers in the market. Consumers today seek audio solutions that align with their unique preferences, whether it's for home entertainment, professional audio setups, or automotive audio systems. The ability to customize amplifier designs allows manufacturers to cater to diverse needs, offering features like specific power outputs, connectivity options, and aesthetic choices. Customization not only enhances the user experience but also addresses specific requirements, making the amplifiers more versatile across various applications. Manufacturers that prioritize and excel in customization are likely to attract a broader consumer base, driving demand and fostering brand loyalty in the competitive amplifier market.

The rise of Class D amplifiers significantly contributes to the growing demand in the market. Class D amplifiers are known for their high efficiency and compact size, making them ideal for applications where space and power consumption are critical factors. With advancements in semiconductor technology, Class D amplifiers deliver robust performance with reduced heat dissipation. As energy-efficient solutions, they align with the increasing emphasis on eco-friendly and sustainable products. The adoption of Class D amplifiers, especially in audio systems for vehicles and portable devices, reflects a market preference for cutting-edge technology that meets performance expectations while addressing the need for energy efficiency.

Type Insights

According to the type, the voltage amplifier segment has held a 43% revenue share in 2025. Voltage amplifiers increase the amplitude of an input signal while preserving its waveform. In the amplifier market, voltage amplifiers are integral to various applications, such as audio systems and signal-processing equipment. Trends indicate a shift towards low-noise and high-gain voltage amplifiers, catering to the demand for enhanced signal fidelity, critical in applications like high-quality audio reproduction and precise instrumentation.

The power amplifier segment is anticipated to expand at a significant CAGR of 7.1% during the projected period. Power amplifiers boost the amplitude of signals to drive speakers or other output devices. In the amplifier market, trends involve the integration of Class D power amplifiers known for their efficiency. The industry also sees a surge in demand for power-efficient amplifiers tailored for energy-conscious applications like mobile devices and portable audio systems.

Phase Insights

Based on the phase, the inverting amplifier segment held the largest share of 68% in 2025. Inverting amplifiers are a key component in audio signal processing, providing an inverted output relative to the input. A trend in the amplifier market involves enhancing the precision and noise reduction of inverting amplifiers. Manufacturers focus on improving the signal-to-noise ratio and minimizing distortions, ensuring that inverting amplifiers maintain high fidelity in audio reproduction, a crucial factor in the pursuit of superior sound quality.

On the other hand, the non-inverting amplifier segment is projected to grow at the fastest rate over the projected period. Non-inverting amplifiers amplify the input signal without inverting its phase, preserving the original signal's integrity. A trend in the market is the integration of advanced semiconductor technologies to enhance the performance of non-inverting amplifiers.

This includes optimizing bandwidth, reducing distortion, and improving the overall efficiency of these amplifiers. The trend reflects the industry's commitment to providing amplification solutions that meet the evolving demands of high-quality audio reproduction in various applications.

Coupling Method Insights

In2025, the resistive-capacitive coupling amplifier segment had the highest market share of 39% based on the coupling method. A resistive-capacitive coupling amplifier employs a combination of resistors and capacitors to transfer AC signals between amplifier stages. This coupling method allows for the transmission of signals while blocking DC components, ensuring proper biasing. In the amplifier market, the trend towards resistive-capacitive coupling lies in its ability to maintain signal integrity, reduce distortion, and enhance the overall performance of audio amplifiers.

The Inductive-capacitive coupling amplifier segment is anticipated to expand at the fastest rate over the projected period. Inductive-capacitive coupling in amplifiers involves the use of inductors and capacitors to pass AC signals while blocking DC components. This coupling method is valued for its ability to maintain signal fidelity and facilitate impedance matching. In the amplifier market, the trend towards inductive-capacitive coupling amplifiers is driven by their effectiveness in audio applications, contributing to clearer and more accurate signal reproduction. As audio systems demand higher performance, these coupling methods play a crucial role in meeting the evolving requirements of the amplifier market.

Product Type Insights

Based on the product type, audio frequency amplifier segment held the largest market share of 41% in2025. Audio frequency amplifiers are designed to amplify signals in the audio frequency range, typically from a few hertz to several kilohertz. The trend in this segment involves the integration of advanced features like low distortion, high signal-to-noise ratio, and compact designs, catering to the demand for premium audio experiences in various applications.

On the other hand, the intermediate frequency amplifier segment is projected to grow at the fastest rate over the projected period. Intermediate Frequency (IF) Amplifiers are vital components in communication systems, amplifying signals at intermediate frequencies. In the amplifier market, trends in IF amplifiers revolve around achieving higher bandwidth, improved selectivity, and enhanced linearity. Advancements in semiconductor technology contribute to the development of IF amplifiers with better performance parameters, meeting the requirements of modern communication systems and radio-frequency applications.

Industry Vertical Insights

Based on the industry vertical, the consumer electronics segment is anticipated to hold the largest market share of 45% in2025. In the consumer electronics sector, amplifiers are crucial components in audio systems, smartphones, smart speakers, and home theater setups. The trend in this vertical revolves around miniaturization, high power efficiency, and wireless connectivity. Manufacturers focus on creating compact yet powerful amplifiers with features like Bluetooth connectivity, catering to the demand for seamless and high-quality audio experiences in modern electronic devices.

On the other hand, the automotive segment is projected to grow at the fastest rate over the projected period. The automotive industry demands amplifiers for in-car entertainment and advanced driver assistance systems (ADAS). The trend here is toward integrated solutions that support connectivity options, surround sound, and efficient power management. As vehicles become more technologically advanced, amplifiers are evolving to enhance the in-cabin audio experience and support emerging applications like electric vehicle sound design, where amplifiers play a crucial role in creating a harmonious driving experience.

Regional Insights

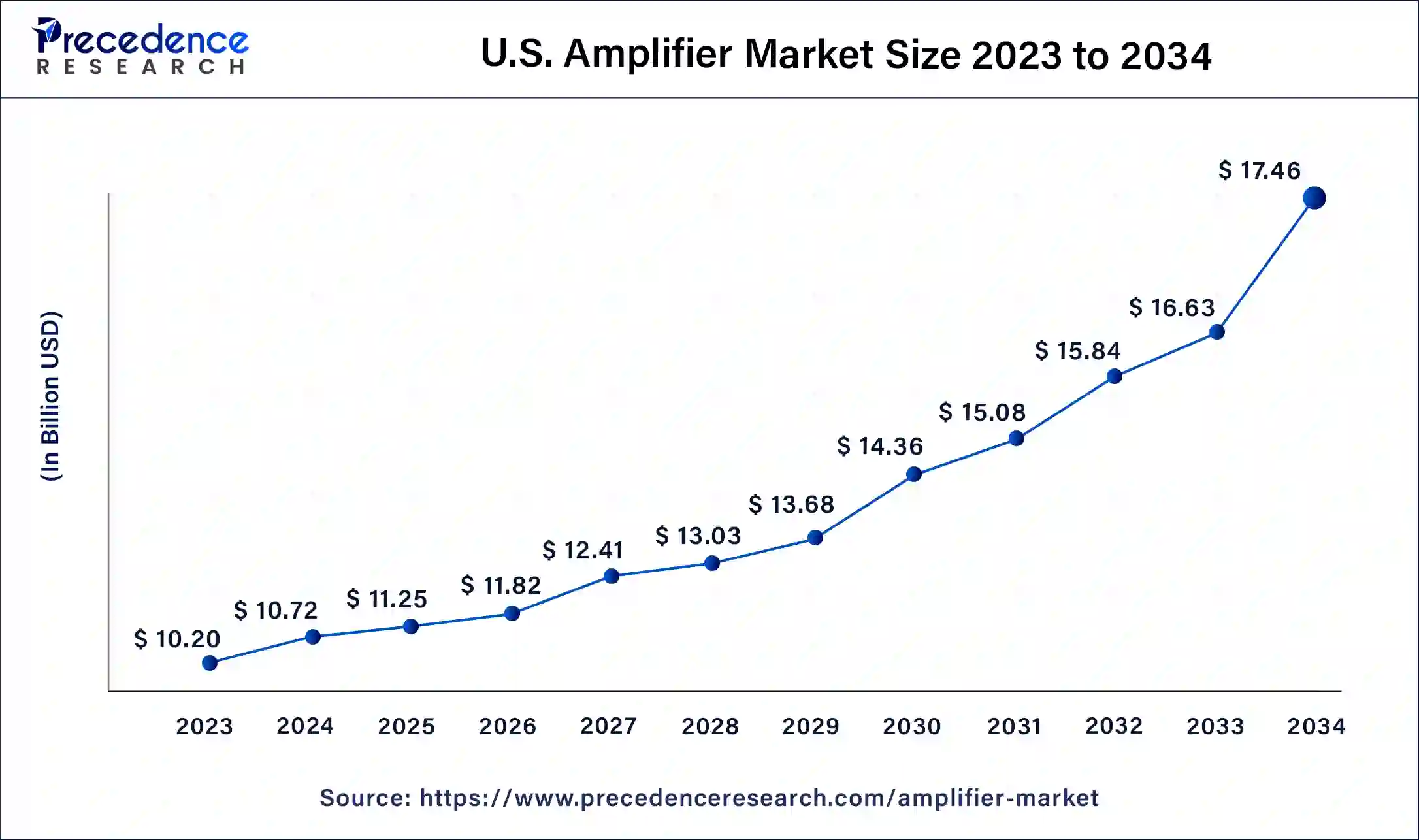

U.S. Amplifier Market Size and Growth 2026 to 2035

The U.S. amplifier market size is estimated at USD 11.25 billion in 2025 and is predicted to be worth around USD 18.26 billion by 2035, at a CAGR of 5% from 2026 to 2035.

North America has held the largest revenue share of 38% in 2025. The North American amplifier market is witnessing a surge in demand, driven by the increasing adoption of advanced audio solutions in sectors like home entertainment, automotive, and professional audio. The region's focus on technological innovation and the presence of key players contribute to a dynamic market landscape. Emerging trends include a growing preference for high-performance amplifiers with smart integrations for home automation and immersive audio experiences.

U.S. Market Trends

The U.S. is the major contributor to the North American amplifier market, driven by rising consumer demand for high-fidelity audio in smart homes, professional setups, and premium automotive systems. This is fueling innovation in compact, efficient, and wireless solutions, including Bluetooth and Wi-Fi integration, along with AI/voice control features. The trend towards integrating amplification, processing, and connectivity into single chips is also driving the development of more compact and feature-rich devices.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific amplifier market is experiencing robust growth, propelled by rising disposable incomes, urbanization, and a burgeoning entertainment industry. Countries like China and India are key contributors, with a growing consumer base seeking enhanced audio experiences. The market trend in the region encompasses a transition towards compact, energy-efficient amplifiers, aligning with the demand for portable audio solutions and the integration of amplification technology in a variety of electronic devices.

India Market Trends

The amplifier market in India is growing due to rapid urbanization, rising disposable incomes, and the widespread adoption of smartphones and IoT. There is a rapid growth in consumer electronics, automotive audio, and 5G infrastructure, where high-performance, compact amplifiers like Class-D are in demand. Class-D amplifiers' energy efficiency, compact size, and low heat generation make them ideal for automotive, portable, and smart home applications.

What Makes Europe a Notably Growing Region in the Amplifier Market?

Europe is expected to grow at a notable rate during the projection period due to the increasing demand for high-quality audio systems across consumer electronics, automotive, and professional audio sectors. Germany is a major player in the European market due to a strong adoption of smart home technologies, an emphasis on energy-efficient amplifiers, and the rising demand from the automotive and manufacturing sectors. Additionally, the region's emphasis on sustainability and premium audio experiences drives the need for high-performance, low-power amplifiers, particularly in portable and automotive applications.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is experiencing opportunistic growth in the amplifier market, driven by industrial growth, telecom upgrades (5G, 4G), and consumer demand for advanced GaN, RF, and audio amps. Government initiatives aimed at modernizing existing communication systems also boost the demand for specialized RF amplifiers. Additionally, advancements in mobile and 5G infrastructure further boost the need for compact and efficient amplifier solutions, creating significant growth opportunities in Latin America.

What Drives the Market in the Middle East & Africa?

The amplifier market in the Middle East & Africa (MEA) is being driven by rising investments in smart city developments, along with entertainment complexes, driving the need for professional audio systems. Saudi Arabia is leading the market, as consumers in the country are looking for premium, high-quality, and wireless audio systems, creating the need for sophisticated amplifiers. Additionally, infrastructure development, particularly in smart cities and 5G networks, is fueling the need for advanced, compact, and energy-efficient amplifiers.

Value Chain Analysis

- Raw Material Sourcing

This stage involves sourcing raw materials such as semiconductors, capacitors, resistors, and inductors, which are critical in the manufacturing of amplifiers.

Key Players: TDK Corporation, Murata Manufacturing Co., Ltd. - Component Manufacturing

This stage involves manufacturing amplifier parts such as operational amplifiers (Op-Amps), transistors, and digital-to-analog converters (DACs).

Key Players: Texas Instruments, Analog Devices, Inc. - Distribution to End-Users

This stage plays an essential role in ensuring the components and finished amplifiers reach manufacturers, retailers, and end-users.

Key Players: Arrow Electronics, Digi-Key Electronics

Value Chain Analysis of Amplifier Market

- Raw Material Procurement (Silicon Wafers, Gases)

It depends heavily on semiconductor technology, is a meticulous, multi-stage process aimed on achieving extreme purity to guarantee reliable device performance. The process includes sourcing and refining basic materials such as quartz sand into high-purity silicon wafers and obtaining a variety of specialty gases. - Wafer Fabrication (Front-end)

It serves as the foundation for amplifiers and few integrated circuits (ICs). The front-end process transforms a raw wafer into a functional circuit through a precise, multi-step sequence of adding and modifying material layers. - Photolithography and Etching

It involves those used in amplifiers (audio, RF, etc.). They permit the creation of microscopically small along with precise circuit patterns, like transistors, resistors, and interconnections, on a silicon wafer. Photolithography allows the cost-effective, high-volume production of identical amplifier ICs on a single silicon wafer, which is vital for the consumer electronics market.

Amplifier Market Companies

- Texas Instruments Incorporated

- STMicroelectronics N.V.

- Analog Devices, Inc.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Qualcomm Technologies, Inc.

- Cirrus Logic, Inc.

- Renesas Electronics Corporation

- Toshiba Corporation

- Yamaha Corporation

- Qorvo, Inc.

- ESS Technology, Inc.

- Silicon Labs

- Maxim Integrated

- ON Semiconductor Corporation

Recent Developments

- In 2020, Infineon Technologies, a leading German semiconductor manufacturer, innovated with its Raspberry Pi Audio amplifier HAT, delivering high-definition audio with significant power output in a compact form. Designed for compatibility with Raspberry Pi Zero W, Raspberry Pi 3, and 4, this self-contained board offers power-efficient performance, meeting the demand for enhanced audio experiences in diverse applications.

- In October 2025, Qorvo, a leading global manufacturer of connectivity and power solutions, started the QPA9510, a compact RF power amplifier which delivers wideband coverage from 100 to 1000 MHz with industry-leading efficiency.

- In September 2025, Yamaha declared the launch of two new premium headphones, the YH-4000 and even YH-C3000, expanding its high-end headphone lineup with models which deliver extraordinary sound and comfort.

Segments Covered in the Report

By Type

- Voltage Amplifier

- Current Amplifier

- Power Amplifier

By Phase

- Inverting Amplifier

- Non-inverting Amplifier

By Coupling Method

- Resistive-Capacitive Coupling Amplifier

- Inductive-Capacitive Coupling Amplifier

- Transformed Coupling Amplifier

- Direct Coupling Amplifier

By Product Type

- Audio Frequency Amplifier

- Intermediate Frequency Amplifier

- Radio Frequency Amplifier

- Ultrasonic Amplifier

- Wideband Amplifier

- Direct Coupled Amplifier

- Video Amplifier

- Buffer Amplifier

- Operational Amplifier

- Transistor Amplifier

By Industry Vertical

- Consumer Electronics

- Industrial

- Telecommunication

- Automotive

- Healthcare

- Aerospace Defense

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content