What is Anti-Biofilm Agents Market Size?

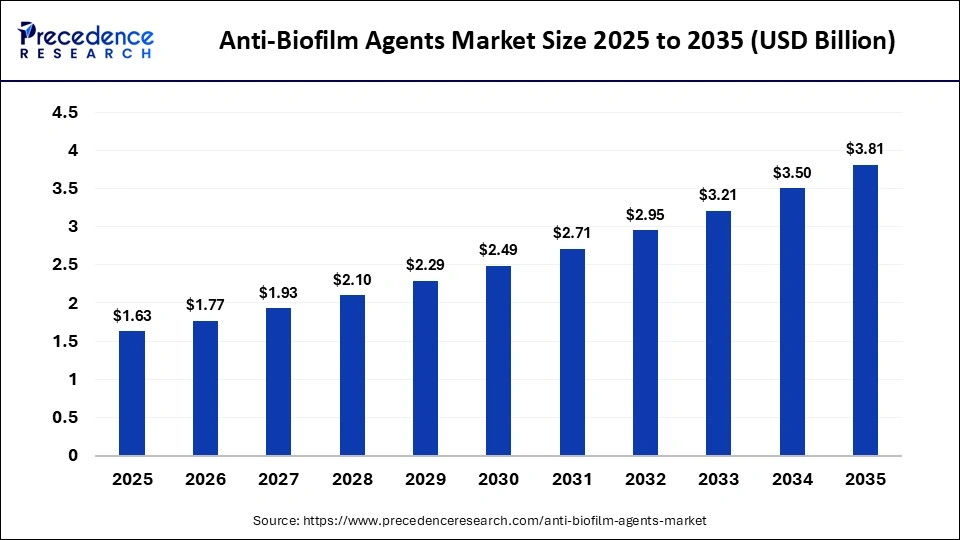

The global anti-biofilm agents market size was calculated at USD 1.63 billion in 2025 and is predicted to increase from USD 1.77 billion in 2026 to approximately USD 3.81 billion by 2035, expanding at a CAGR of 8.85% from 2026 to 2035. The market is driven by increasing antimicrobial resistance and the prevalence of hospital-acquired infections.

Market Highlights

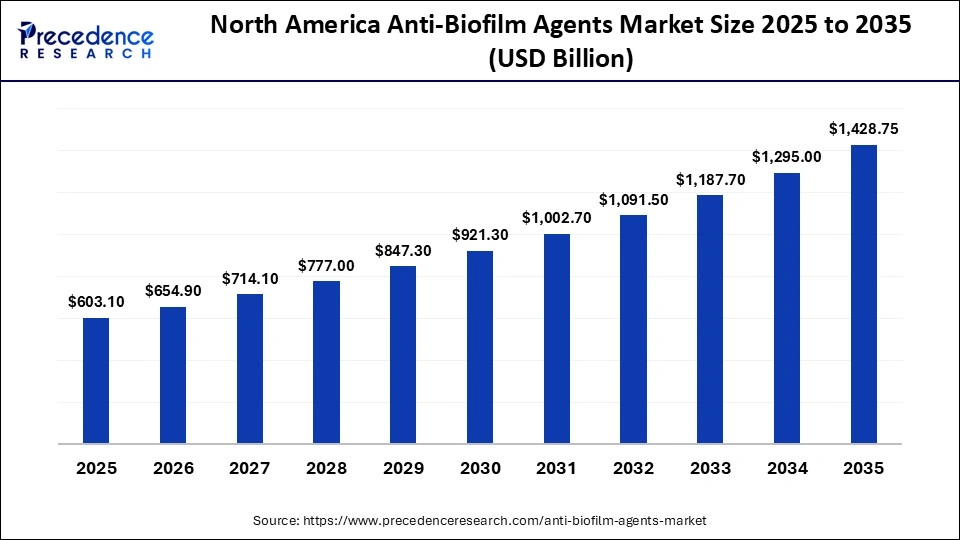

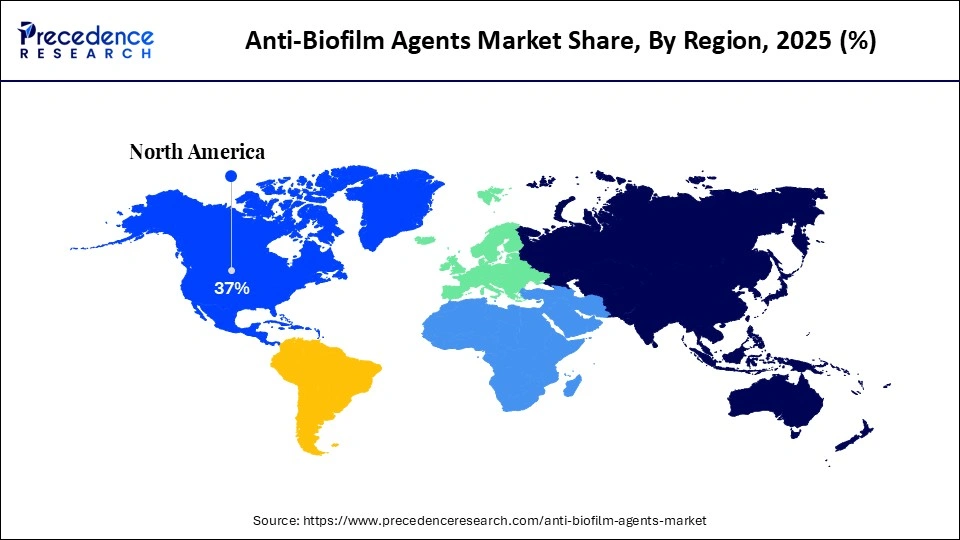

- North America dominated the market in 2025 with the largest market share of 37%.

- By region, Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the dressings segment held a dominant position in the market with a major share in 2025.

- By product, the ointments/gels segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By molecule, the silver segment held the largest market share in 2025.

- By molecule, the honey segment is expected to grow with the highest CAGR in the market during the studied years.

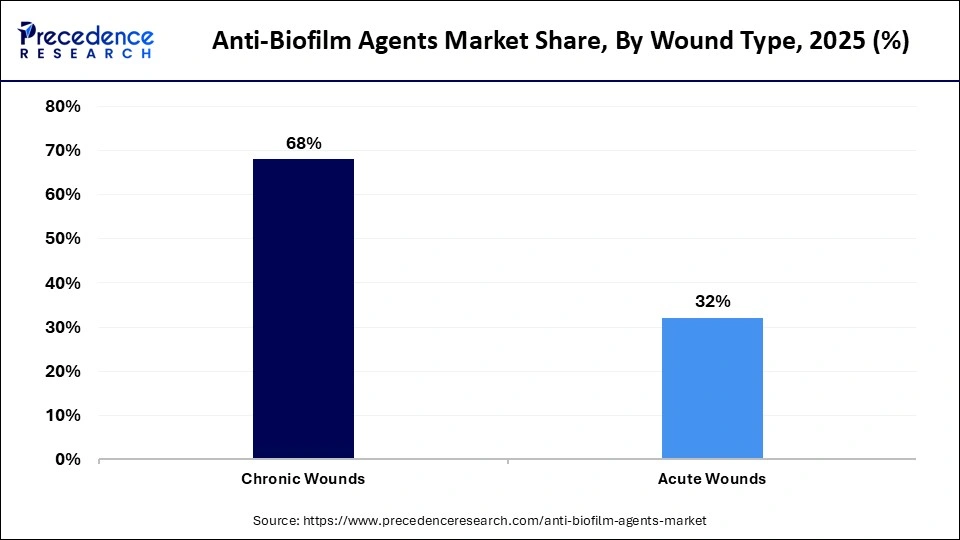

- By wound type, the chronic wounds segment led the market in 2025.

- By wound type, the acute wounds segment is expected to expand rapidly in the market in the coming years.

- By end-user, the hospitals segment registered dominance in the global market in 2025.

- By end-user, the home care settings segment is expected to witness the fastest growth over the forecast period.

Market Overview

The anti-biofilm agents market is experiencing robust growth because of the increased clinical burden of biofilm-related infections and chronic wounds. Biofilms are known to make any antimicrobial therapy less effective and thus the treatment of infections more complicated and expensive. The rising cases of acute and chronic wounds, such as diabetic foot ulcers, pressure ulcers, and arterial ulcers, have increased the number of patients who have biofilm formation.

The growing prevalence of chronic and complex wounds has heightened the demand for advanced wound care products capable of preventing and disrupting biofilms. Market growth is further fueled by technological innovations in antimicrobial formulations, enzymatic therapies, and combination treatments that enhance healing outcomes. Additionally, supportive reimbursement policies, rising healthcare expenditures, and an aging population, who are particularly prone to chronic wounds, are further driving the expansion of the market.

Anti-Biofilm Agents Market Trends

- The rising prevalence of chronic and non-healing wounds is increasing the demand for agents that improve infection control and accelerate healing in hospitals and long-term care facilities.

- Growing concerns over antimicrobial resistance are encouraging the adoption of non-antibiotic anti-biofilm solutions, including enzyme, surfactant, and novel antimicrobial-based preparations.

- Technological advancements, such as biofilm-disrupting dressings and combination therapies, are enhancing treatment effectiveness and market penetration.

- The rising use of anti-biofilm agents in medical devices like catheters and implants is also reducing device-associated infections, further supporting growth.

- Expansion of healthcare infrastructure and modern wound care facilities in emerging economies is increasing product availability and accelerating market adoption.

- There is a strong focus on research, clinical validation, and regulatory approvals, which is driving innovation and broadening the therapeutic applications of anti-biofilm products worldwide.

How is AI Integration Impacting the Anti-Biofilm Agents Market?

Artificial intelligence -assisted data analytics are increasingly being applied in the anti-biofilm agents market to better understand the complex behavior, interactions, and resistance patterns of biofilms, helping researchers identify more effective anti-biofilm compounds. AI also supports formulation optimization, modeling how agents penetrate and degrade biofilm matrices for maximum effectiveness. In clinical practice, AI-powered imaging and diagnostic technologies allow for earlier detection of biofilms in wounds and medical devices, enabling more timely and precise treatment decisions. Additionally, AI helps personalize wound care by analyzing patient data, wound characteristics, and treatment responses, guiding clinicians to prescribe the most suitable anti-biofilm therapies for each individual.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.63 Billion |

| Market Size in 2026 | USD 1.77 Billion |

| Market Size by 2035 | USD 3.81 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.85% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Delivery Type, Freight Type, Vehicle Type, Location, Industry Vertical, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Insights

Why Did the Dressings Segment Dominate the Anti-Biofilm Agents Market?

The dressings segment dominated the anti-biofilm agents market with a major share in 2025. This is because dressing products are the best option since they are used to offer optimal moist environments, reduce the number of microbes in the wound, and enhance faster healing. These products form a protective layer against external contaminants, as well as preventing and disrupting the formation of biofilm at the wound site. Due to the rising number of chronic wounds, advanced dressings have been increasingly employed in the chronic treatment of wounds, including diabetic foot ulcers and pressure ulcers. Integrated dressings with antimicrobial agents such as silver and honey, and those that are endorsed by the regulatory bodies, also add to their effectiveness.

The ointments/gels segment is expected to grow at the fastest CAGR in the market between 2026 and 2035 due to the rising demand for flexible and targeted wound care products. Such products are used especially on acute wounds, surgery sites, and irregular wound surfaces, where the accuracy of application is needed. The increasing incidence of acute wounds, such as burns, traumas, and post-operative wounds, is boosting the demand for topical anti-biofilm formulations. Product effectiveness and adoption are being enhanced by innovations in the technology of formulations, including sustained-release antimicrobials and biofilm-penetrating compounds.

Molecule Insights

What Made Silver the Leading Segment in the Anti-Biofilm Agents Market?

The silver segment led the anti-biofilm agents market in 2025, thanks to its well-established broad-spectrum antimicrobial properties and effectiveness against biofilm-forming pathogens. Silver-based agents have been shown to reduce bacterial load, disrupt biofilm structures, and accelerate wound healing, making them a popular choice in advanced wound care products. Their long-standing clinical acceptance and consistent performance in healthcare settings further reinforce their market dominance. Additionally, the availability of diverse silver-based formulations tailored to different wound types supports their widespread adoption.

The honey segment is expected to grow at the highest CAGR between 2026 and 2035 due to the increasing demand for natural and biocompatible wound care products. Honey has high biofilm-inhibitory, antimicrobial, and membrane-disruption properties, making it highly effective for treating infected and chronic wounds. Increasing concerns about antimicrobial resistance and the side effects of synthetic agents are accelerating the shift toward natural alternatives. Moreover, clinical trials demonstrating honey's ability to promote healing with minimal tissue irritation have further boosted its acceptance in medical practice.

Wound Type Insights

Why Did the Chronic Wounds Segment Lead the Anti-Biofilm Agents Market?

The chronic wounds segment led the global market with a major revenue share in 2025. This dominance is primarily driven by the high prevalence of chronic conditions such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers. The biofilm-forming nature of these wounds makes them particularly prone to infections and slower healing, increasing the need for targeted interventions. Healthcare providers are increasingly incorporating anti-biofilm agents into evidence-based wound care protocols to improve healing outcomes. Additionally, ongoing research into advanced formulations, using both natural and synthetic molecules, is driving product innovation and expanding treatment options.

The acute wounds segment is expected to witness the fastest growth in the market over the forecast period due to the increasing number of cases of burns, surgical wounds, and traumatic injuries. Acute wounds are increasingly associated with biofilm formation, particularly in cases of delayed healing or infection. Growing awareness among clinicians about the importance of early biofilm prevention is boosting the adoption of anti-biofilm agents in acute wound care. Additionally, the increasing number of surgical procedures worldwide and clinical trials validating the effectiveness of these agents are further driving market growth.

End-User Insights

How Does Hospitals Segment Dominate the Anti-Biofilm Agents Market?

The hospitals segment led the global anti-biofilm agents market with the largest share in 2025 due to the high prevalence of acute infections, chronic wounds, and post-surgical complications associated with biofilm formation. Hospitals serve as primary treatment centers for patients with complex wounds, including diabetic foot ulcers, pressure ulcers, and other challenging conditions. The segment's dominance is supported by advanced wound care facilities, skilled healthcare professionals, and access to a wide range of anti-biofilm agents. Additionally, growing investments in healthcare infrastructure and the implementation of standardized wound care protocols are further strengthening the leadership of hospitals in the market.

The home care settings segment is expected to expand at a significant CAGR in the coming years. The growth of the segment is driven by the rising popularity of home-based wound management, particularly among elderly and chronic patients. The demand for easy-to-use, effective anti-biofilm products is increasing, supported by favorable reimbursement policies in developed regions. Technological advancements have enabled the development of patient-friendly dressings, gels, and ointments that can be administered by patients or caregivers. This growth is further fueled by shorter hospital stays, rising healthcare costs, and the expansion of home healthcare services, along with increasing awareness of effective wound care in non-hospital settings.

Regional Insights

How Big is the North America Anti-Biofilm Agents Market Size?

The North America anti-biofilm agents market size is estimated at USD 603.10 billion in 2025 and is projected to reach approximately USD 1,428.75 billion by 2035, with a 9.01% CAGR from 2026 to 2035.

What Made North America the Lead Region in the Anti-Biofilm Agents Market?

North America dominated the global anti-biofilm agents market with the largest share in 2025. This is mainly due to its advanced healthcare infrastructure, high awareness levels, and widespread adoption of innovative wound care solutions. The region faces a significant incidence of acute and chronic wounds, driven by an aging population and a high prevalence of diabetes, which increases the risk of biofilm formation and related complications. Growing awareness among healthcare professionals about the benefits of anti-biofilm products in preventing infections and promoting faster wound healing is further supporting market growth. Additionally, increased healthcare spending enables hospitals and clinics to invest in advanced wound care products, including dressings, gels, and topical formulations.

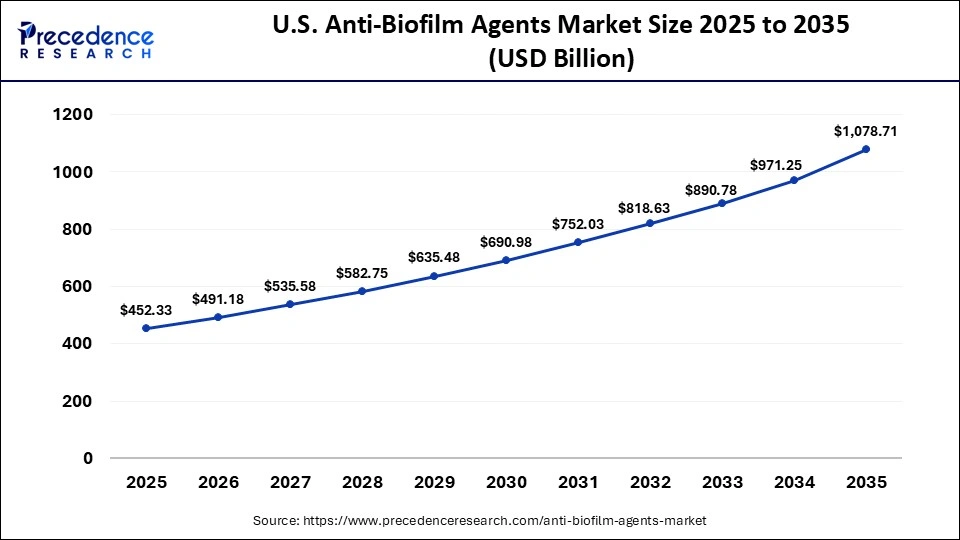

What is the Size of the U.S. Anti-Biofilm Agents Market?

The U.S. anti-biofilm agents market size is calculated at USD 452.33 billion in 2025 and is expected to reach nearly USD 1,078.71 billion in 2035, accelerating at a strong CAGR of 9.08% between 2026 to 2035.

U.S. Market Analysis

The anti-biofilm agents market is growing in the U.S. due to several key factors. First, there is a high prevalence of chronic and acute wounds, including diabetic foot ulcers, pressure ulcers, and surgical wounds, which are prone to biofilm formation and slow healing. Second, the advanced healthcare infrastructure and high awareness among clinicians drive the adoption of effective anti-biofilm treatments to prevent infections and improve patient outcomes. Additionally, the aging population and increasing incidence of diabetes create a growing patient pool in need of specialized wound care solutions.

How is the Opportunistic Rise of Asia Pacific in the Anti-Biofilm Agents Market?

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to rising cases of acute and chronic wounds and rising complications caused by biofilm formation. Rapid urbanization, increased healthcare spending, and expanding medical infrastructure are improving access to advanced wound care solutions in emerging economies. Ongoing research to identify effective anti-biofilm compounds is fueling product innovation and clinical adoption. Additionally, healthcare manufacturers are strategically expanding into countries such as China, India, and Southeast Asia to meet the growing demand.

China Market Analysis

China is a major contributor to the Asia Pacific anti-biofilm agents market. The country's rapid urbanization, expanding healthcare infrastructure, and increasing healthcare expenditure are driving access to advanced wound care solutions. Additionally, the rising prevalence of acute and chronic wounds, along with complications related to biofilm formation, is fueling demand. Ongoing research and development in biofilm-targeting therapies, coupled with strategic expansions by healthcare product manufacturers, further support China's leading role in the regional market.

Who are the Major Players in the Global Anti-Biofilm Agents?

The major players in the on-demand trucking market are Convatec Inc. (U.K.), Smith+Nephew (U.K.), Coloplast A/S (Denmark), Solventum (U.S.), Mölnlycke AB (Sweden), URGO MEDICAL (France), and Imbed Biosciences (U.S.)

Recent Developments

- In March 2025, Imbed Biosciences received an FDA Investigational New Drug (IND) to start clinical trials on its Silver-Gallium Synthetic Antimicrobial Matrix. The bioresorbable ultra-thin matrix will form the basis of preventing biofilm formation and healing chronic and acute wounds.(Source:https://imbedbio.com)

- In February 2024, Smith + Nephew partnere with the U.S. Army Institute of Surgical Research to enhance its advanced wound management division. The partnership is concerned with collaborative research and development projects to improve wound care solutions. (Source:https://members.lifesciencespa.org)

Segments Covered in the Report

By Product

- Dressings

- Ointments / Gels

- Powders

By Molecule

- Silver

- Iodine

- Honey

- Others

By Wound Type

- Chronic Wounds

- Acute Wounds

By End User

- Hospitals

- Wound Clinics

- Home Care Settings

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting