What is the Womens Health Market Size?

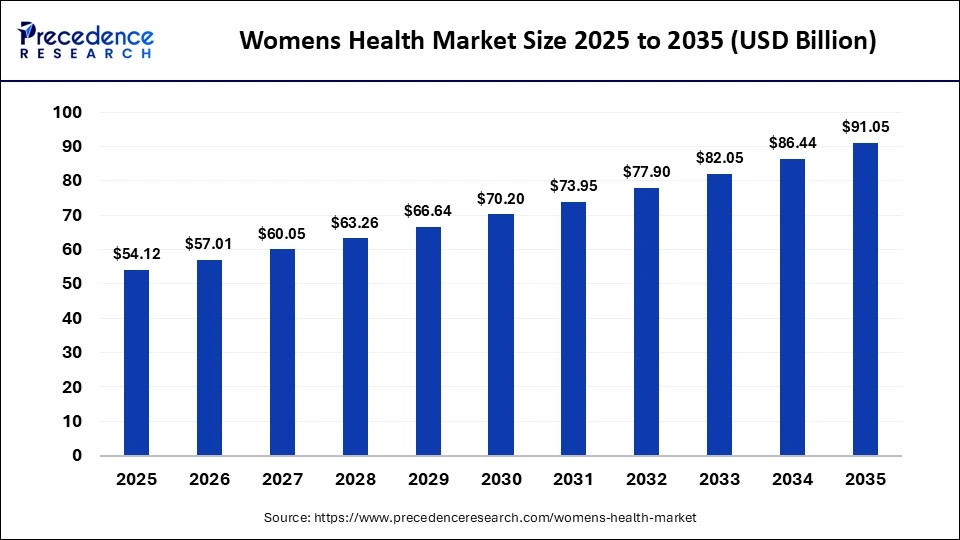

The global womens health market size accounted for USD 54.12 billion in 2025 and is predicted to increase from USD 57.01 billion in 2026 to approximately USD 91.05 billion by 2035, expanding at a CAGR of 5.34% from 2026 to 2035. The market is driven by increasing awareness, advancements in medical technologies, and rising demand for specialized healthcare solutions addressing female-specific health issues.

Market Highlights

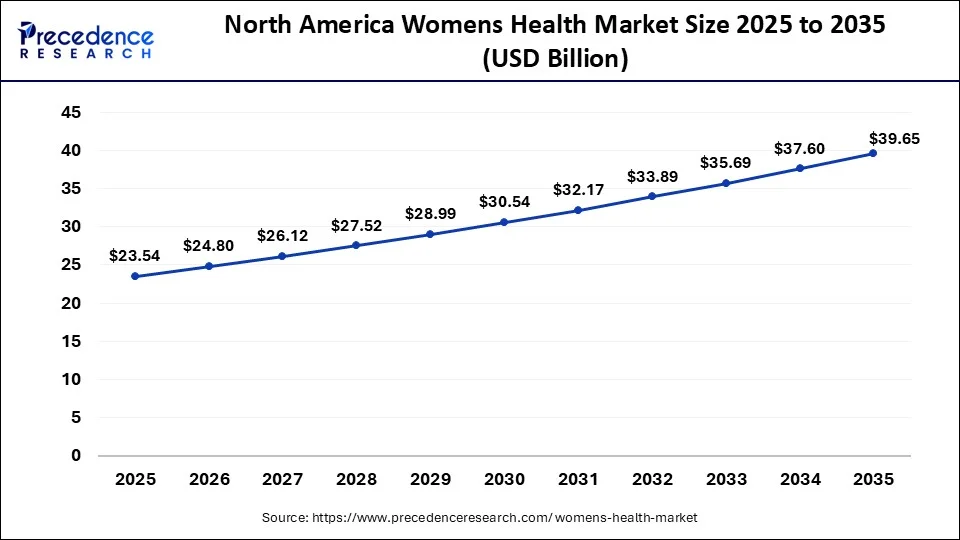

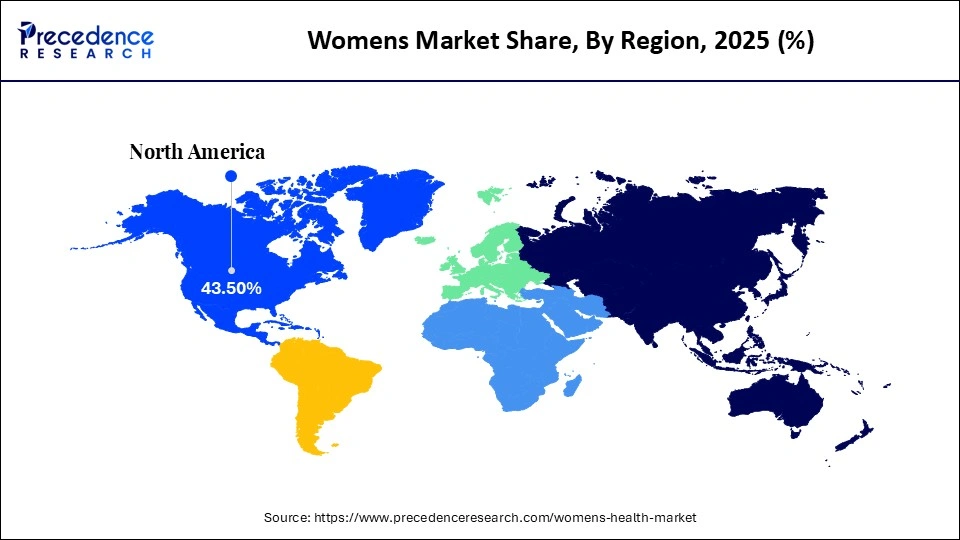

- North America dominated the market with the largest market share of 43.50% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035.

- By application, the contraceptives segment led the market while holding the largest share in 2025.

- By application, the menopause segment is growing at the fastest CAGR between 2026 and 2035.

- By drug class, the hormonal therapies segment contributed the largest market share in 2025.

- By drug class, the pain and symptom management segment is growing at a significant CAGR from 2026 to 2035.

- By age, the below 50 years segment dominated the market in 2025.

- By age, the 50 years & above segment is poised to grow at a CAGR between 2026 and 2035.

What is the Womens Health Market

The womens health market is evolving from focusing mainly on reproductive care to a comprehensive, lifecycle-based healthcare system that includes menstrual health, fertility, pregnancy, menopause, cancer, mental health, and chronic disease management. Healthcare providers and innovators are increasingly recognizing that women's physiology requires different diagnostic, therapeutic, and preventive approaches. Digitally enabled care, specialty clinics, and home-based solutions are making access and usage of services easier, especially for working women and those in less developed areas.

Preventive care and early diagnostics are becoming core concepts of the healthcare system, which helps reduce costs and improve quality of life. The market is supported by policies and employer health programs aimed at enhancing womens wellness outcomes. Overall, womens health is becoming a healthcare priority that is moving to the center of the system rather than remaining a niche segment.

How is AI contributing to the Women's Health Industry?

AI has a profound impact on women's health in such a way that it improves the early detection of cancers, predicts the risks of pregnancies, and customizes the treatments. It supports the doctors by incorporating imaging, wearables, genetic studies, and behavioral data, and at the same time reduces the probability of misdiagnosis, allows intervening proactively, increasing telehealth access, and provides women with timely and data-driven health insights while emphasizing the need for unbiased datasets.

Key Technological Shifts in the Womens Health Market?

Technologies are transforming the women's health market by enabling personalized and accessible care through innovations like AI-powered symptom management, telemedicine, and health monitoring apps, which allow women to manage their health remotely and conveniently. Wearable devices and connected diagnostics provide continuous monitoring of critical health parameters like hormonal cycles, fertility, and pregnancy, while precision medicine facilitates the development of targeted therapies for conditions like endometriosis, breast cancer, and hormonal imbalances, improving treatment outcomes. Additionally, home-based diagnostic kits and data analytics support early detection, reduce clinic dependency, and enhance clinical decision-making through real-time insights and longitudinal health data.

Key Market Trends

- Holistic and Preventive Care: Holistic and preventive care is reshaping womens healthcare by emphasizing overall well-being and proactive measures, leading to a rise in demand for wellness-focused products and services.

- Home Testing: The growing acceptance of at-home testing and virtual care is empowering women to manage their health more independently, reducing barriers to healthcare access and driving demand for home-based diagnostic solutions.

- Cultural Normalization: As cultural conversations around womens health become more normalized, the stigma around certain conditions decreases, leading to earlier diagnoses, increased treatment demand, and greater market growth in womens health services and products.

Statistics of the Womens Health Market:

- Over 230 million girls and women have experienced female genital mutilation all over the world.

- Female genital mutilation is practiced in over 30 countries in Africa, the Middle East, and parts of Asia.

- The majority of the cases occur from infancy through adolescence before the long-term health consequences are noticed.

- US$ 1.4 billion is the annual cost of treatments for health complications related to female genital mutilation.

Womens Health Market Outlook

- Industry Outlook: The womens health market is expected to grow at a rapid pace from 2026 to 2035, driven by increasing awareness of female-specific health issues and rising demand for personalized healthcare solutions. Advancements in womens healthcare technologies, higher healthcare expenditure, and the growing prevalence of conditions such as breast cancer, osteoporosis, and reproductive health disorders also drive the market growth.

- Global Expansion: The market is growing worldwide due to increasing awareness of gender-specific health issues, greater focus on personalized treatments, and advancements in healthcare technologies tailored to womens needs. In emerging regions, there are significant opportunities driven by expanding healthcare access, rising disposable incomes, and improved healthcare infrastructure, which are increasing demand for women's health services and products. Emerging economies like India, China, and countries in South America are witnessing a rapid uptake of womens health services as urbanization, higher education levels, and workforce participation reshape healthcare priorities.

- Major Investment: Major investors in the market include pharmaceutical companies, venture capital firms, and private equity groups, such as Pfizer, Johnson & Johnson, and Blackstone. These investors contribute by funding research and development of innovative treatments, medical devices, and health technologies tailored to women's needs, as well as supporting startups and initiatives focused on improving women's healthcare access and outcomes globally.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 54.12 Billion |

| Market Size in 2026 | USD 57.01 Billion |

| Market Size by 2035 | USD 91.05 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.34% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, Drug Class, Age, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Application Insights

What Made Contraceptives the Dominant Segment in the Womens Health Market?

The contraceptives segment dominated the market with the largest share in 2025. This is mainly due to its central role in family planning and reproductive health management. Long-acting reversible contraceptives and oral contraceptives are in high demand, driven by population control and maternal health programs. Additionally, innovations in safety, hormonal balance, and ease of use have contributed to increasing consumer acceptance, ensuring a consistent demand for contraceptives across diverse markets.

The menopause segment is expected to grow at the fastest CAGR in the coming years due to the increasing awareness of menopause symptoms and a rising elderly female population, leading more women to seek medical advice and treatments. As average life expectancy increases, women are more focused on managing menopause symptoms for better quality of life and long-term health, driving demand for both pharmacological and non-pharmacological solutions. Additionally, advancements in personalized and low-risk treatments have enhanced treatment confidence, further fueling growth in this segment.

Drug Class Insights

Why Did the Hormonal Therapies Segment Lead the Womens Health Market?

The hormonal therapies segment led the market in 2025, thanks to their proven effectiveness in managing reproductive health conditions. They also form the basis for contraception, fertility treatments, and hormonal imbalance disorders, making them the most common options. Their continued dominance is largely due to strong clinical validation and longstanding familiarity among physicians. Patients tend to stick with these treatments because more formulations and delivery methods are available. Ongoing efforts to improve these therapies and eliminate the risks of side effects also ensure the long-term growth of the segment.

The pain and symptom management segment is expected to grow at the fastest rate in the coming years due to the increasing availability of non-hormonal pain relief options and targeted therapies for conditions such as dysmenorrhea, endometriosis, and menopause-associated discomfort. The rise in chronic gynecological conditions and greater patient awareness have led to higher demand for pain management solutions that offer improved efficacy and fewer side effects. Additionally, combination therapies and innovative drug classes are enhancing symptom relief, contributing to a shift toward more holistic and personalized care.

Age Insights

How Does the Below 50 Years Segment Dominate the Womens Health Market?

The below 50 years segment dominated the market in 2025 due to the high prevalence of reproductive health concerns, including fertility issues, menstrual disorders, and contraceptive needs, which are particularly relevant to women in this age group. Additionally, this segment sees strong demand for preventive care, health screenings, and lifestyle management, as women focus on maintaining their health and managing chronic conditions such as polycystic ovary syndrome (PCOS) and endometriosis. The rise in awareness about women's health, combined with a growing inclination toward early diagnosis and preventive treatments, further drives segmental growth.

The 50 years & above segment is expected to grow at the fastest CAGR during the projection period. This is primarily due to the increasing focus on menopause management, osteoporosis prevention, and chronic disease management as women live longer and experience more health challenges related to aging. With a rising elderly female population, there is a growing demand for specialized treatments addressing conditions like heart disease, diabetes, and cancer, which become more prevalent in post-menopausal years. Additionally, advancements in personalized medicine, preventive care, and health monitoring technologies have enhanced womens ability to manage their health post-reproductive years, driving growth in this segment.

Regional Insights

How Big is the North America Womens Health Market Size?

The North America womens health market size is estimated at USD 23.54 billion in 2025 and is projected to reach approximately USD 39.65 billion by 2035, with a 5.35% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Market?

North America dominated the womens health market, capturing the largest share in 2025. This is mainly due to the high expenditure on health, strong awareness of women's health conditions, and early adoption of advanced medical technologies. The region benefits from a well-balanced ecosystem of pharmaceutical companies, medical device manufacturers, and digital health innovators who all focus on female health needs. Favorable reimbursement frameworks and insurance coverage support access to diagnostics, therapeutics, and preventive care. Innovation continues in areas such as reproductive health, oncology, and hormonal therapies, helping maintain the market's leadership to a large extent.

What is the Size of the U.S. Womens Health Market?

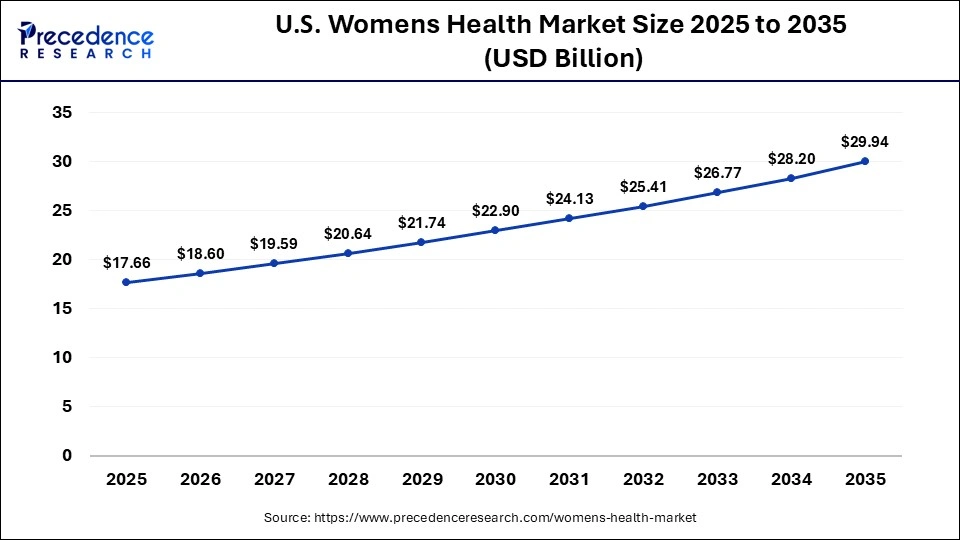

The U.S. womens health market size is calculated at USD 17.66 billion in 2025 and is expected to reach nearly USD 29.94 billion in 2035, accelerating at a strong CAGR of 5.42% between 2026 and 2035.

U.S. Womens Health Market Analysis

The U.S. leads the market in North America due to its strong R&D infrastructure, large patient base, and presence of major industry players. There is high adoption of digital womens health platforms and personalized medicine solutions. Canada engages the public through robust public healthcare systems and a growing emphasis on preventive womens healthcare. Investments in maternal health, menopause management, and chronic disease monitoring continue to rise. Government-backed health programs promote early diagnosis and long-term care. These combined factors make North America the most advanced and influential market for womens health.

What Makes Asia Pacific the Fastest-Growing Region in the Womens Health Market?

Asia Pacific is expected to grow at the fastest rate in the upcoming period. This growth is sustained by the large female population and the improving healthcare access for women. With rising disposable incomes and ongoing urbanization, there is an ever-growing demand for quality womens health services. Governments around the region are prioritizing maternal health, reproductive care, and cancer screening initiatives. Private healthcare providers in the region are also improving service availability, contributing to market growth. Moreover, a rising women workforce and awareness of women's health issues are supporting market expansion across the region.

China is a major player in the market due to the expanding healthcare infrastructure and the focus on womens wellness programs. India is a significant contributor to the market through diagnostic programs and government-led maternal health initiatives. Japan is more focused on womens health issues related to aging and advanced medical technologies. South Korea has a very strong adoption of aesthetic and dermatology-related womens health devices. Southeast Asian countries are emerging markets with healthcare investments on the rise. Together, these countries form the foundation of the region's gradual growth.

Why is Europe Considered a Notably Growing Region in the Market?

Europe is expected to grow at a notable rate over the projection period. This is mainly due to the increasing focus on preventive healthcare as well as the aging female population. The rising awareness of diseases like breast cancer, osteoporosis, and reproductive disorders is boosting the demand for diagnostics and treatment solutions. Strict regulatory focus on safety and quality not only supports innovation but also maintains patient trust. This region also greatly benefits from research collaborations, public-private partnerships, and a well-established healthcare system.

Germany and the UK are leading contributors to Europe's womens health market due to their advanced healthcare infrastructures and high adoption of innovative therapies. France supports growth through strong public healthcare funding and women-focused screening programs, while the Nordic countries emphasize preventive care and digital integration, driving demand for monitoring solutions. Southern European countries are seeing gradual market uptake, fueled by policy reforms and awareness campaigns, and Eastern Europe holds untapped potential as its healthcare systems undergo modernization, with various national strategies collectively propelling Europe's rapid market expansion.

What Potentiates the Womens Health Market within South America?

The market in South America is driven by the growing awareness of womens health issues. There is increasing focus on preventive care as well as early diagnosis. Private healthcare facilities are expanding throughout the region, offering access to specialized womens services. Economic growth in key countries is one of the factors making advanced treatments more affordable.

Brazil stands out in Latin America due to its large population and continually improving healthcare infrastructure, which boosts demand for womens health services. Mexico shows strong growth through advancements in urban healthcare and ongoing public health initiatives that enhance access to care. Argentina contributes with its growing emphasis on reproductive and maternal health services, while Chile and Colombia benefit from improvements in insurance coverage and increased private sector participation, driving further growth in the region's womens health market.

What Opportunities Exist in the Middle East & Africa?

The Middle East & Africa (MEA) presents significant opportunities in the womens health market, supported by improving healthcare infrastructure as well as the increasing awareness of womens health needs. Governments around the region are prioritizing maternal health, fertility treatments, and the management of chronic diseases, driving investment in womens health. The expansion of private hospitals and specialty clinics is making quality care more accessible, while the rise in medical tourism in countries like Saudi Arabia and the UAE is boosting demand for women-centric treatments.

Saudi Arabia and the UAE are leading contributors to the Middle East & Africa womens health market, thanks to substantial investments in healthcare infrastructure and services. South Africa, with its advanced healthcare system, plays a pivotal role in Sub-Saharan Africa, while other African nations are making gradual progress with the support of international aid and public health programs. The growing demand in urban centers across the region is fueling market expansion.

Value Chain Analysis of the Womens Health Market

- R&D: Discovering and developing crazy new compounds that will address contraception, menopause, fertility, and unmet women's health needs.

Key Players: Bayer AG, AbbVie Inc., Pfizer Inc., Organon & Co., Theramex - Clinical Trials and Regulatory Approvals: Judging the safety and efficacy through human studies while complying with strict regulatory authorization requirements.

Key Players: IQVIA, ICON plc, Syneos Health, Parexel, Labcorp - Formulation and Final Dosage Preparation: Active ingredients are transformed into stable pills, injectables, and patches with ensured quality and consistency.

Key Players: Sun Pharmaceutical Industries Ltd., Cipla Ltd., Dr. Reddy's Laboratories, Lupin Limited - Packaging and Serialization: Products are protected with compliant packaging, traceability codes, and the first line of anti-counterfeiting safety mechanisms.

Key Players: PCI Pharma Services, Amcor, Catalent, WestRock - Women's Health Distribution to Hospitals, Pharmacies: Managing complex logistics for the timely delivery of products to doctors, pharmacies, and patients worldwide.

Key Players: McKesson Corporation, AmerisourceBergen (Cencora), Cardinal Health

Top Companies Operating in the Market

- AbbVie, Inc.: It offers innovative treatments in areas like hormonal therapies and reproductive health, with a focus on addressing infertility and endometriosis.

- Bayer AG: It plays a key role in the market through its extensive portfolio of contraceptives and hormonal therapies, alongside its efforts in womens health research for conditions like menopause and osteoporosis.

- Organon & Co.: It provides a wide range of medications for family planning, fertility treatments, and womens health conditions, with a focus on empowering women's health through accessible care.

- Pfizer, Inc.: It contributes by developing innovative therapies for breast cancer, fertility treatments, and hormonal therapies, with a strong emphasis on women's oncology and reproductive health solutions.

Other Major Companies

- Theramex

- Agile Therapeutics

- Amgen, Inc.

- Apothecus Pharmaceutical Corp.

- Blairex Laboratories, Inc.

- Ferring

Recent Developments

- In December 2025, Sprout Pharmaceuticals announced the FDA approval of Addyi (flibanserin 100 mg) for treating Hypoactive Sexual Desire Disorder (HSDD) in women under 65. This milestone addresses a significant gap in care for postmenopausal women with low sexual desire and marks the FDA's first approval for such a treatment.(Source: https://www.prnewswire.com)

- In August 2025, Health-tracking ring maker Oura released two new products aimed at aiding women during important life stages. Pregnancy Insights provides "individualized and contextualized tracking" of physiological changes, educational content, and daily tools to help women navigate each stage of pregnancy. Perimenopause Check-In enables users to record their symptoms and recognize their effects.(Source: https://www.mobihealthnews.com)

Segments Covered in the Report

By Application

- Hormonal Infertility

- Contraceptives

- Postmenopausal Osteoporosis

- Endometriosis & Uterine Fibroids

- Menopause

- Polycystic Ovary Syndrome (PCOS)

By Drug Class

- Hormonal Therapies

- Bone Health Agents

- Fertility Agents

- GnRH Modulators

- Pain and Symptom Management

- Metabolic Agents

- Others

By Age

- 50 Years & Above

- Postmenopausal Osteoporosis

- Endometriosis & Uterine Fibroids

- Menopause

- Others

- Below 50 Years

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content