What is the Women's Health Therapeutics Market Size?

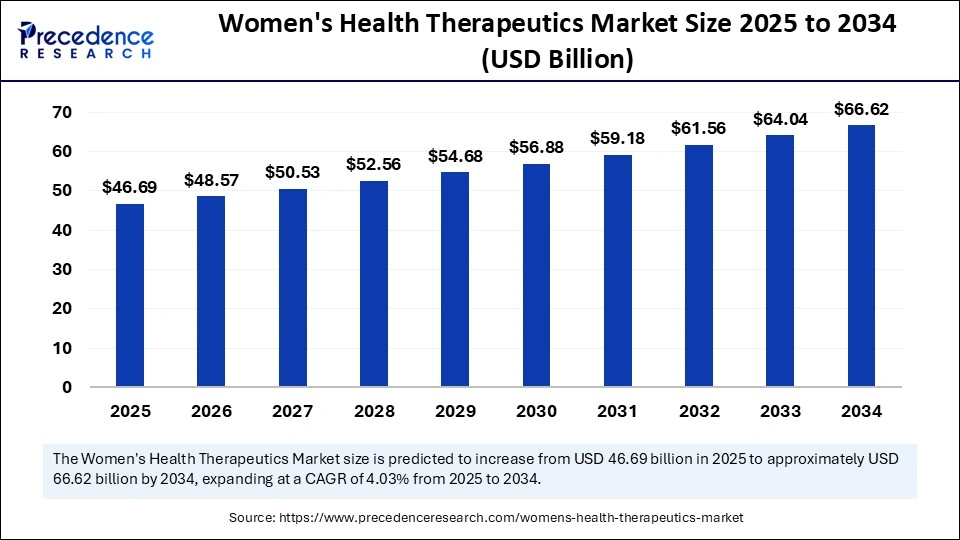

The global women's health therapeutics market size is accounted at USD 46.69 billion in 2025 and is predicted to increase from USD 48.57 billion in 2026 to approximately USD 66.62 billion by 2034, expanding at a CAGR of 4.03% from 2025 to 2034. The increasing awareness of women's health conditions and the common occurrence of conditions such as endometriosis, osteoporosis, and menopause-related ailments are driving the growth of the market. Moreover, the rising demand for customized treatments and governmental efforts to enhance women's healthcare access contribute to market growth.

Women's Health Therapeutics MarketKey Takeaways

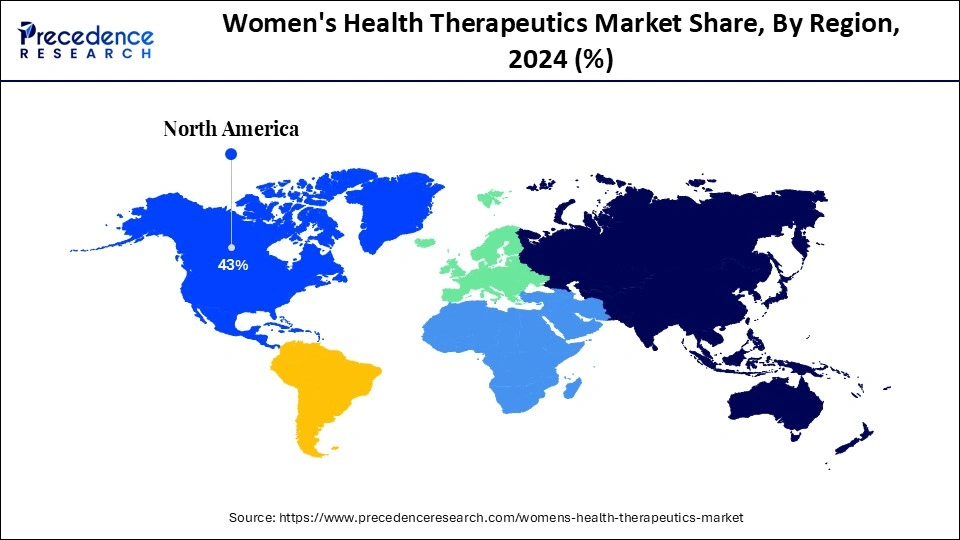

- North America dominated the global market with the largest market share of 44% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By application, the contraceptives segment contributed the biggest market share of 36% 2024.

- By application, the endometriosis & uterine fibroids segment is expected to expand at a CAGR of 7.64% in the coming years.

- By age, the 50 years and above segment captured the highest market share in 2024.

- By age, the working class and minors segment is expected to grow at the fastest CAGR during the predicted timeframe.

- By drug, the Prolia segment held a significant share of 17% in 2024.

- By drug, the Minastrin 24 Fe segment is expected to grow at the fastest CAGR in the upcoming period.

- By distribution channel, the hospital pharmacies segment captured the biggest revenue share of 48% in 2024.

- By distribution channel, the online pharmacies segment is expected to grow at the fastest CAGR of 4.6% during the projection period.

Strategic Overview of the Global Women's Health Therapeutics Industry

The women's health therapeutics market represents a segment of healthcare dedicated to creating medical treatments and therapies addressing specific health concerns for women, including reproductive health, menopause, hormonal imbalances, gynecological conditions, and hormone-related cancers. This market encompasses hormone treatments, contraceptive methods, biologics, and tailored medical solutions that target issues such as reproductive health disorders, menopause symptoms, osteoporosis, gynecological cancers, endometriosis, polycystic ovary syndrome (PCOS), and urinary tract infections (UTIs). The market is witnessing substantial growth due to heightened awareness, progress in drug development, and the rising development of hormonal and non-hormonal therapies and targeted biologics.

How is Artificial Intelligence Revolutionizing the Women's Health Therapeutics Market?

Artificial Intelligence is transforming the market for women's health therapeutics by enhancing diagnostics, tailoring treatments, and improving access to healthcare. AI assists in predicting risks, facilitating early assessments, and minimizing missed diagnoses. It enables tailored treatments, assists doctors in clinical decision-making, and enhances maternal health with real-time monitoring tools. AI also enables telemedicine , broadens healthcare access, and enhances research by diversifying trial participants and recognizing gender-specific disease development.

- In February 2025, the National Health Service (NHS) of the UK initiated an important AI trial aimed at improving breast cancer detection, possibly increasing the efficiency of radiologists twofold and boosting early detection rates by evaluating mammograms against large image databases.

Market Outlook

- Market Growth Overview: The Women's Health Therapeutics market is expected to grow significantly between 2025 and 2034, driven by the growing global awareness and advocacy for women's health issues, from reproductive health to chronic conditions demand for advanced therapeutic solutions. Rising geriatric population, innovation in precision medicine, targeted drug development, and digital health platforms.

- Sustainability Trends:Sustainability trends involve gender equity and inclusivity in research & development, broader access to care, and sustainable manufacturing and supply chains.

- Major Investors: Major investors in the market include Pfizer Inc., Bayer AG. Merck & Co., Inc., AbbVie Inc., F. Hoffmann-La Roche Ltd., and Eli Lilly and Company.

- Startup Economy: The startup economy is focused on technology-driven innovation, focusing on underserved areas, and the expansion of digital and telehealth solutions.

Women's Health Therapeutics MarketGrowth Factors

- Increasing Prevalence of Women's Health Disorders: The increase in women's health issues, such as osteoporosis, endometriosis, gynecological cancers, and PCOS, is boosting the need for targeted therapies, while chronic ailments like breast cancer, cervical cancer, and uterine fibroids are also becoming more prominent.

- Increasing Health Awareness: The promotion of women's health concerns is driving the demand for innovative treatment options, encompassing menopause, reproductive issues, and hormonal irregularities. Government and non-profit entities are fostering awareness, resulting in more diagnoses and treatments.

- Aging Population and Menopause: The rising number of older women and their menopausal health requirements are boosting the need for hormone replacement treatments and osteoporosis medications, along with greater use of birth control pills, IUDs, and emergency contraceptives due to improved awareness and availability.

- Increasing Demand for Personalized Medicine: Personalized medicine is becoming increasingly popular, concentrating on unique hormonal or genomic profiles, like targeted therapies for hormone receptor-positive cancers or fibroids, by utilizing selective progesterone receptor modulators.

- Drug Development: Innovations in drug development, such as non-hormonal contraceptives, biologics , and precision medicine , have enhanced patient outcomes. Long-lasting contraceptives, hormonal patches, and vaginal rings improve patient adherence and treatment effectiveness.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 66.62 Billion |

| Market Size in 2026 | USD 48.57 Billion |

| Market Size in 2025 | USD 46.69 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.03% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Age, Drug, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Cases of Women's Health Conditions and Technological Advancements

The rising number of cases of women's health conditions is a major factor driving the growth of the women's health therapeutics market. As more women experience conditions like infertility, menopause, PCOS, endometriosis, and breast cancer , the need for effective therapeutics increases. This, in turn, encourages government and pharmaceutical organizations to invest in R&D for developing novel therapeutics. In addition, advancements in diagnostic technologies are facilitating early disease detection. Innovations in medical devices and diagnostic tools further improve healthcare for women's conditions. The rising approval for new drugs further fuels the growth of the market.

- In October 2024, the U.S. FDA approved Iterum Therapeutics' application for Orlynvah, an oral antibiotic, for the treatment of uncomplicated urinary tract infections in adult women.

Restraint

Insufficient Funding for R&D and

The women's health therapeutics market encounters several challenges. One such challenge stems from insufficient funding for research and development. Historically, conditions affecting women's health have received inadequate funding and research attention, resulting in a limited understanding and fewer novel treatments. In the U.S., funding from the federal government for women's health issues is considerably less than that for men, leading to poorer health results. This limitation is apparent in the development of drugs for issues such as endometriosis and uterine fibroids. The pipeline for new medications in women's health is still limited. Moreover, the lack of reimbursement policies for women's health therapies hampers the growth of the market.

Opportunity

Development of Novel Therapies and the Rise of Digital Tools

The rising development of novel therapies to address health issues associated with menopause creates immense opportunities in the market. Innovations in drug development are opening up new avenues for novel therapeutics. The development of novel therapies for menopause symptoms is anticipated to rise because of heightened awareness and the occurrence of this health condition. With the rising of digital tools, such as wearable devices, it is possible to monitor women's health conditions, improving patient outcomes. Improvements in medical technology and rising demand for personalized medicine further propel the growth of the market.

Regional Insights

Application Insights

Why did the Contraceptives Segment Dominate the Market in 2024?

The contraceptives segment dominated the women's health therapeutics market with the largest revenue share of 44% in 2024 because of heightened awareness and focus on family planning, progress in contraceptive technologies, and increased demand for simple and efficient methods. Major elements driving this supremacy encompass worldwide efforts advocating for family planning, innovations such as non-hormonal contraceptives and long-acting reversible methods, plus the accessibility of over-the-counter (OTC) contraceptives and online sales platforms. Government policies and subsidies have enhanced the availability of contraceptives, making them cheaper and more accessible. In general, the contraceptives category has emerged as the leading application in the women's health therapeutics market.

- In March 2025, the Australian government launched new contraceptive alternatives, such as the progesterone-only Slinda, in the Public Benefit System (PBS), with the goal of saving more than USD 250 each year and enhancing women's health services.

The endometriosis & uterine fibroids segment is expected to grow at a solid CAGR of 7.64% during the forecast period. because of heightened awareness of these conditions, increased diagnostic rates, and the high prevalence of these conditions. Endometriosis impacts approximately 10% of women of reproductive age worldwide, and uterine fibroids are prevalent in women of reproductive age. Major factors driving the growth of the segment include enhanced diagnostic methods, progress in treatments such as hormonal and non-hormonal therapies, and less invasive surgical options. The increasing prevalence of endometriosis and uterine fibroids, influenced by lifestyle choices and genetic factors, further support market expansion.

Age Insights

How Does the 50 Years and Above Segment Dominate the Women's Health Therapeutics Market?

The 50 years and above segment dominated the market with the largest share in 2024 due to an increase in menopausal and postmenopausal health concerns. Individuals in this age category encounter symptoms such as osteoporosis, hormonal disruptions, and a heightened susceptibility to chronic illnesses. The dominance of this segment is reinforced by the aging female demographic, improvements in healthcare technology, and increased awareness of preventive strategies. The increasing recognition of women's specific health requirements and the creation of advanced treatments, especially hormone replacement therapies, have broadened choices for alleviating menopausal symptoms and enhancing their quality of life.

The working class and minors segment is expected to grow at the fastest CAGR during the predicted timeframe, driven by heightened awareness of reproductive health concerns such as PCOS and infertility. Access to healthcare services and information is enhanced, supported by digital platforms and government efforts. Improvements in birth control methods and fertility therapies, such as Phexxi and OUI, are catering to the needs of this demographic. Government programs and educational initiatives foster this trend, establishing a conducive atmosphere for implementing therapeutics among different age groups. The increasing awareness of reproductive health among younger women is likely to drive segmental growth.

Drug Insights

What Made Prolia the Dominant Segment in the Market?

The prolia segment dominated the women's health therapeutics market with the largest share of 17% in 2024 because of its crucial role in treating and preventing osteoporosis in postmenopausal women. Prolia has proven effective in reducing bone loss and fracturing risk. Prolia targets the RANK ligand, a protein involved in bone resorption, which decreases bone loss and fracture risk. Its biennial injection schedule promotes patient compliance and makes it more accessible. Extensive clinical trials have shown that Prolia has superior efficacy in raising bone mineral density and lowering fracture risk among postmenopausal women. Overall, the success of Prolia in the women's health therapeutics market is due to its efficacy, convenience, and good clinical evidence.

- In March 2024, Sandoz received FDA approval for its biosimilars Wyost and Jubbonti, marking them as the first FDA-endorsed substitutes for Prolia. Jubbonti is tailored for postmenopausal women at high risk for osteoporosis, which may lower expenses for patients.

The Minastrin 24 Fe segment is expected to grow at the fastest CAGR in the upcoming period because of its convenient dosing regimen, low risk of side effects, and easy availability through multiple distribution pathways. By blending low-dose estrogen with progestin, it reduces side effects and aids in regulating menstrual issues, making it a favored option for hormonal birth control. It regulates menstrual cycles and prevents pregnancy. The rising demand for efficient contraceptives supports segmental growth.

Distribution Channel

Why Did the Hospital Pharmacies Segment Dominate the Market?

The hospital pharmacies segment dominated the women's health therapeutics market with a major share of 44% in 2024. Hospital pharmacies provide access to innovative treatments and tailored therapies. They manage significant quantities of prescriptions for conditions such as endometriosis, PCOS, and osteoporosis while ensuring adherence to regulatory standards. Hospitals possess the necessary resources to manage regulatory obligations and maintain safety standards, enabling patients to obtain timely consultations, personalized treatment plans, and the commencement of therapies. Their advanced medical infrastructure and innovative diagnostic tools enable effective management of women's health issues.

The online pharmacies segment is expected to grow at the fastest CAGR 4.6% in the upcoming years because of their convenience, easy access, and affordability. They provide an extensive selection of therapeutics, such as contraceptives and hormonal treatments, along with comprehensive product details. The increasing popularity of digital healthcare and telemedicine services is propelling the expansion of online pharmacies and broadening healthcare access to distant and underserved regions. They provide competitive rates, promotions, and extensive information, allowing women to make informed purchases and seek advice from healthcare providers online. In addition, these pharmacies provide easy doorstep delivery, reducing the need to physically visit pharmacies and attracting a large consumer base.

Regional Insights

U.S. Women's Health Therapeutics Market Size and Growth 2025 to 2034

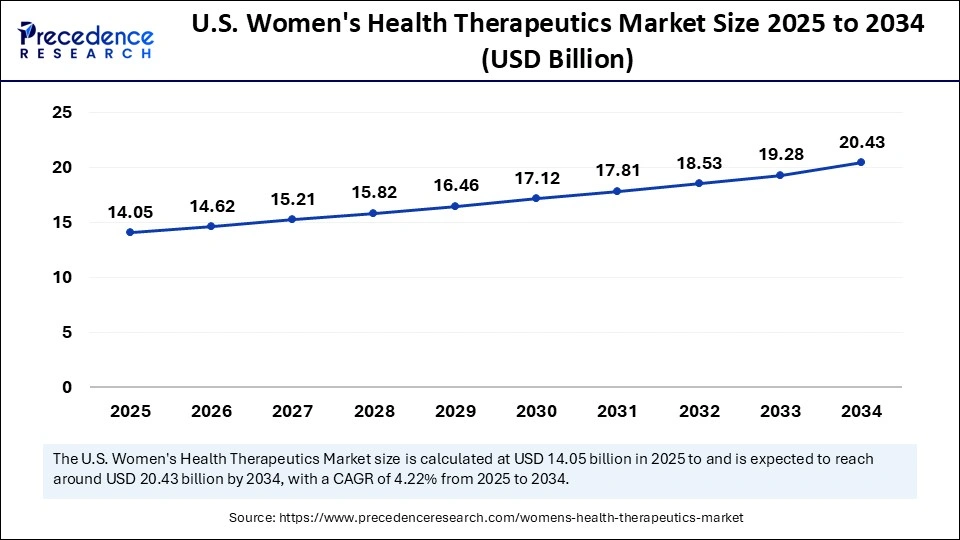

The U.S. women's health therapeutics market size is exhibited at USD 14.05 billion in 2025 and is projected to be worth around USD 20.43 billion by 2034, growing at a CAGR of 4.22% from 2025 to 2034.

What Factors Contribute to North America's Dominance in the Market?

North America dominated the women's health therapeutics market by holding the largest revenue share of 44% in 2024 because of its robust healthcare system and access to advanced treatments for women's health concerns. Major companies in the region, such as Pfizer Inc. and Merck & Co., Inc., dedicated significant resources to research and development, leading to the development of new drugs. There is a high occurrence of women's health issues, such as endometriosis, osteoporosis, and breast cancer, prompting the need for effective therapeutics.

The U.S. Women's Health Therapeutics Market Trends

The U.S. is a major player in the market because of increased healthcare awareness, significant expenditures, large pharmaceutical firms such as Pfizer and Merck & Co., and government-backed initiatives. Healthcare organizations in the U.S. are improving access to cutting-edge therapies. Moreover, the rising development of groundbreaking treatments supports market expansion. The widespread occurrence of health issues such as menopause, hormonal infertility, endometriosis, and PCOS emphasizes the necessity for interventions. Public awareness and government-supported family planning services strengthen the leadership of the U.S. in this market.

What are the Major Factors Driving the Growth of the Market Within Asia Pacific?

Asia Pacific is expected to be the fastest-growing region during the forecast period, driven by factors like rising awareness of women's health and increasing healthcare expenditure. The rising adoption of digital tools to enhance healthcare delivery supports market growth. The prevalence of PCOS and endometriosis is rising in the region. Governments around the region are making efforts to spread awareness about women's health, contributing to market expansion. Digital health tools such as telemedicine and mobile health apps are enhancing access to women's healthcare, especially in rural regions.

India Women's Healthcare Therapeutics Market Trends

India is emerging as a major player in the Asia Pacific women's health market. This is mainly due to the increase in awareness of women's health and government investments in novel drug development. The rate of chronic issues such as PCOS, dysmenorrhea, and osteoporosis is rising, necessitating specific therapies. The Indian government is making efforts to improve women's healthcare via programs such as PMSMA and the Ayushman Bharat Scheme. The rising burden of breast cancer further supports market growth.

What Opportunities Exit in the Women's Health Therapeutics Market Within Europe?

Europe is considered to be a significantly growing area. The rising number of cases of women's health issues is a major factor driving the growth of the market. The region's sophisticated healthcare system and strong emphasis on research and innovation in healthcare contribute to market growth. Europe has initiated initiatives such as EU4Health, intending to bolster healthcare systems and enhance health outcomes. The emphasis on individualized medicine and alternative treatments is increasing, resulting in the creation of customized therapies for women's health conditions. Leading pharmaceutical firms such as Bayer AG and GlaxoSmithKline are investing in research and development, supporting regional market growth.

Germany Women's Health Therapeutics Trends

Germany's integration and reimbursement of digital therapeutics within the formal healthcare system. Growing awareness of addressing gender data gaps in medical research. The constant surge in chronic conditions, lifestyle-related diseases, and gynecological disorders in women is a key market driver, increasing the demand for effective therapeutic interventions.

Women's Health Therapeutics Market Value Chain Analysis

Research and Development (R&D) & Clinical Trials

This foundational stage involves the discovery of new therapeutic molecules, understanding disease mechanisms specific to women, and conducting rigorous preclinical and clinical trials to ensure safety and efficacy.

- Key Players: Pfizer Inc., Merck & Co., Inc., Bayer AG, TherapeuticsMD, Inc., Myovant Sciences, Inc. (now part of Sumitomo Pharma), Organon & Co.

Manufacturing and Production

This stage involves the large-scale production, synthesis, and formulation of approved therapeutic drugs, including active pharmaceutical ingredients (APIs), excipients, and final dosage forms (pills, injections, patches).

- Key Players: Pfizer Inc., Merck & Co., Inc., Bayer AG, Cipla Ltd., Teva Pharmaceutical Industries Ltd. (generic manufacturers), large contract manufacturing organizations (CMOs).

Distribution and Logistics

This stage encompasses the entire supply chain management process, from warehousing the finished therapeutics to their distribution to hospitals, pharmacies, and clinics globally.

- Key Players: McKesson Corporation, Cardinal Health, Inc., AmerisourceBergen Corporation, various regional pharmaceutical distributors, specialized logistics providers.

Marketing, Sales, and Market Access

This stage involves promoting the therapeutics to healthcare professionals and patients, managing sales efforts, and navigating complex market access and reimbursement landscapes with insurers and government health bodies.

- Key Players: Pfizer Inc., Merck & Co., Inc., Bayer AG, Organon & Co., Theramex, various advertising and PR agencies specializing in healthcare.

Women's Health Therapeutics Market Companies

- Bayer AG : Bayer is a significant global player with a strong focus on women's healthcare, offering a wide portfolio of products including various contraceptives and hormone therapies.

- Pfizer, Inc .: Pfizer contributes to the women's health market through a range of therapeutics, notably in areas like menopause management and breast cancer treatment. Their extensive R&D pipeline and global reach help address diverse medical needs for women worldwide.

- Cipla Inc:Cipla is an Indian pharmaceutical company that provides affordable generic medicines in the women's health space, including contraceptives and fertility drugs, increasing accessibility to essential therapeutics in various markets.

- Orchid Pharma.: Orchid Pharma focuses on active pharmaceutical ingredients (APIs) and formulations, contributing to the women's health market with products related to gynecology and critical care medicines.

- Sun Pharmaceutical Industries Ltd.:Sun Pharma provides a variety of generic and branded formulations for women's health conditions, including therapies for menstrual disorders, PCOD, and menopause, offering cost-effective solutions in the Indian and global markets.

- Teva Pharmaceutical: Teva is a leading generic drug manufacturer that plays a key role by providing a wide array of cost-effective generic women's health therapeutics, including contraceptives and hormone replacement therapies.

- F. Hoffmann-La Roche Ltd.:Roche focuses on developing highly specialized and innovative therapies, particularly in women's cancer treatments like breast and ovarian cancer, driving advancements in precision medicine within this market segment.

- AbbVie: AbbVie has a strong presence in the women's health market with therapeutics for conditions such as endometriosis and uterine fibroids, focusing on innovative treatments for chronic, underserved gynecological disorders.

- Axena Health: Axena Health is a company specializing in digital therapeutics for women's health, offering prescription software (Loona) for treating urinary incontinence, representing the growing trend of integrating digital solutions with traditional medical treatments.

Recent Developments

- In April 2025, Bayer intends to introduce elinzanetant, a hormone-free therapy for menopause symptoms, showcasing its dedication to women's health.

- In March 2025, the FDA granted approval to Blujepa, an antibiotic created by GSK, for the treatment of uncomplicated urinary tract infections in women aged 12 and older, tackling issues related to antibiotic-resistant bacteria. The medication is scheduled to be released in the U.S. during the second half of 2025.

- In March 2025, the UK-based femtech firm Elvie, recognized for its wireless breast pumps, was purchased by its US rival Willow due to financial difficulties and ongoing patent disputes. The merger seeks to unite resources and enhance women's health product selections.

- In March 2024, Opill, a progestin-only contraceptive pill, became the first oral contraceptive available over-the-counter in the U.S., representing a major advancement in women's reproductive health.

- In May 2023, the FDA approved fezolinetant, branded as Veozah, as the first neurokinin three receptor antagonist to treat moderate to severe vasomotor symptoms (VMS) linked to menopause, providing a non-hormonal treatment alternative.

Segments Covered in the Report

By Application

- Hormonal Infertility

- Contraceptives

- Postmenopausal Osteoporosis

- Endometriosis and Uterine Fibroids

- Menopause

- Polycystic Ovary Syndrome (PCOS)

By Age

- 50 Years and Above

- Working class and minors

By Drug

- ACTONEL

- YAZ, Yasmin, Yasminelle

- FORTEO

- Minastrin 24 Fe

- Mirena

- NuvaRing

- ORTHO TRI-CY LO

- Premarin

- Prolia

- Reclast/Aclasta

- XGEVA

- Zometa

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting