What is Canada Womens Health Market Size?

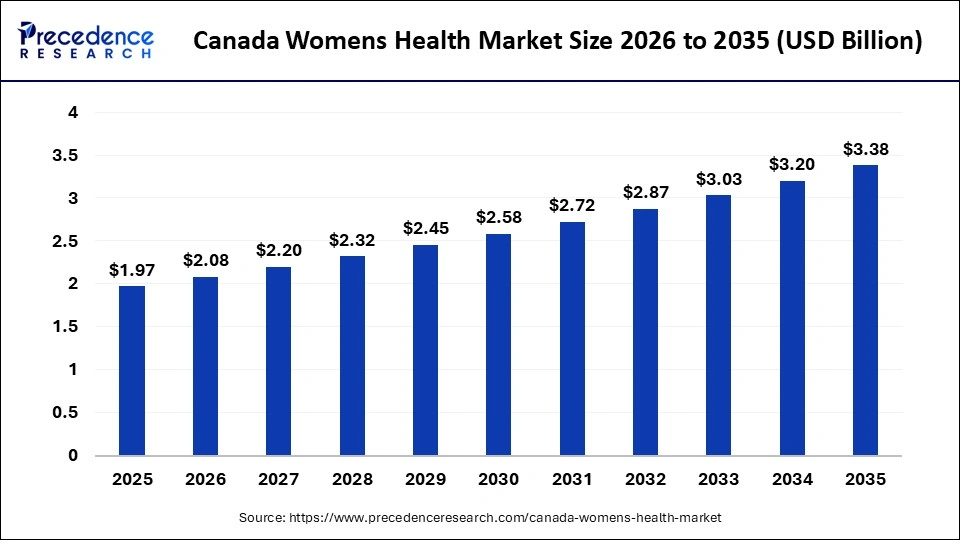

The canada womens health market size is calculated at USD 1.97 billion in 2025 and is predicted to increase from USD 2.08 billion in 2026 to approximately USD 3.38 billion by 2035, expanding at a CAGR of 5.52% from 2026 to 2035. The market is experiencing rapid growth to bridge the gap between women's deteriorating health and its adverse effects on the country's GDP, to increase awareness of proactive healthcare solutions, and to grow the FemTech domain in Canada.

Market Highlights

- By application/condition, the postmenopausal osteoporosis segment held the largest market share in 2025

- By application/condition, the menopause segment is set to grow at the highest CAGR from 2026 to 2035.

- By product/drug class, the hormonal therapies segment contributed the highest market share in 2025.

- By product/drug class, the digital therapeutics segment is expected to expand at a strong CAGR from 2026 to 2035.

- By care settings/channels, the hospitals/specialty clinics segment accounted for the major market share in 2025.

- By care settings/channels, the online pharmacies & digital health platforms segment is growing at a healthy CAGR from 2026 to 2035.

Canada Women's Health Market- Evolving Healthcare Approach of Women

The Canada women's health market covers products, services, and technologies addressing women's sexual and reproductive health, fertility, menopausal care, bone health, gynaecological disorders such as endometriosis, uterine fibroids, and PCOS, contraceptives, and related diagnostics, devices, and digital or fintech solutions. It further includes prescription drugs such as hormonal therapies, fertility agents, and bone health agents, as well as devices, diagnostics, clinic services for fertility, IVF, and gynaecology, and consumer fintech and digital health offerings targeted at female health needs. This landscape reflects a broad shift in the region toward improving access to specialized care, strengthening preventive health systems, and supporting long-term well-being for women across different age groups.

The evolving landscape of women's healthcare products in Canada is driven by increasing demand for targeted therapeutic options, rising awareness of chronic gynaecological conditions, and the growing recognition of gender specific health needs within clinical practice. Canadian healthcare providers increasingly diagnose conditions such as endometriosis and PCOS earlier due to improved screening tools and updated clinical guidance. This encourages wider use of advanced diagnostics and minimally invasive devices that support faster detection and more personalized treatment pathways. Investments in fertility clinics and IVF infrastructure across major provinces also reflect demographic and societal changes, as more women plan pregnancies later in life and seek medically supported fertility options.

AI Shifts in Canada's Women's Health Market

The incorporation of cutting-edge technologies like artificial intelligence into healthcare companies-primarily dedicated to offering women's health-related solutions in Canada, is majorly transforming Canada women's healthcare landscape. Leading femtech companies like Eli Health, Future Fertility, COSM Medical Corp, HerSay, and many others are offering solutions and innovative products related to women's health that are powered by AI.

For example, Eli Health is a leading Canadian femtech company that offers an AI-powered smart device, engineered to analyze saliva samples of women that present a hormone profile at home, precisely assisting women to follow their reproductive health via an AI-based mobile application accompanied by the smart device.

Women are becoming more comfortable detecting early signs of diseases by using AI-powered products like the SELF Menopause testing kit, regulated by Health Canada. AI-based apps and direct-to-consumer platforms for disease detection, reproductive health tracking, along with remote health consulting, are key drivers of the femtech business of Canada, impacting the growth of Canada women's health market positively.

Canada Women's Health Market Outlook

Canada's women's health market is significantly growing due to several leading factors like the increasing awareness about women's health issues and precaution against them, the increasing rate of geriatric population, increasing disposable income, along with government initiatives and healthcare policies. Additionally, as technologies are evolving, many tech leaders are integrating them with the healthcare products while offering different therapies like osteoporosis drugs, hormonal contraceptive therapies, and many others, fueling the market's growth.

The market is undergoing substantial changes, along with significant sustainability trends that have been witnessed by the Canada women's health market, which includes the increasing feminine hygiene products with eco-friendly materials and organic nature, which fuels the higher production of feminine products with biodegradable and plastic-free alternatives. Reusable hygiene products like menstrual cups, cloth pads, and many other products are gaining popularity in Canada

The major investors in the Canada women's health market encompass venture capital firms, corporate investments and non-profit organizations. Venture capital firms include Flow Capital, cross-border impact venture, TELUS pollinator fund for good, and pioneer funds that are heavily influencing the market's expansion by investing in women's healthcare products, along with innovation. Also, as mandated by the Canada Health Act , federal and provincial governments offer significant funding through the publicly funded healthcare system.

The startup ecosystem in Canada women's health market is significantly growing due to the national health strategy of Canada to fill the gap of women's health that causes a decline of GDP, as per the sources, 1 in 10 woman leaves their career annually due to the unmanaged menopause issues, cost the Canadian economy nearly 3.5 billion loss every year. Thus, many startups are merging to support women's health in a critical year of their lifetime, which includes Eli, Tiina Fertility, Fem Therapeutics, Loom Women Plus Health, and others.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.97 Billion |

| Market Size in 2026 | USD 2.08 Billion |

| Market Size by 2035 | USD 3.38 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.52% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Building Type/End-User, Building Systems Focus |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

By Application/Condition Insights

Postmenopausal Osteoporosis: The postmenopausal osteoporosis segment held the largest market share in 2025, due to the increasing prevalence of chronic health burden, an ageing population of women, along with the well-developed and innovative treatments that are specially curated for women's health to bridge the gap between the country's health offerings and the declining health of women in Canada. The prevalence of reduced bone density among older women continues to rise as demographic trends shift and life expectancy increases, which elevates the need for early risk identification and long-term management. This condition often progresses without symptoms until fractures occur, which places a significant burden on primary care networks, orthopedic services, and rehabilitation facilities.

Canadian health systems emphasize routine bone density screening for women above specific age thresholds, which increases detection rates and drives demand for pharmacological interventions and monitoring tools. Clinicians rely on bisphosphonates, selective estrogen receptor modulators, and newer biologic agents that target bone resorption pathways, which aligns with updated treatment guidance. These therapies support sustained demand because they require ongoing administration and structured follow-up.

Menopause: The menopause segment is growing steadily in Canada. More women are seeking structured medical support as symptoms become harder to manage with general wellness products. Clinics now see higher demand for treatment plans that address vasomotor symptoms, sleep issues, cognitive changes, and metabolic shifts. This creates consistent activity across pharmaceutical, diagnostic, and digital health channels.

Therapy selection has become more personalized. Clinicians assess symptom severity, family history, and individual risk factors before recommending treatment. Hormone therapy remains a central option because it offers reliable relief for hot flashes and night sweats. Newer transdermal patches and lower dose formulations have improved safety profiles, which encourage adoption. Non-hormonal medications are also used widely, especially for women who cannot receive hormone therapy. Digital tools play a growing role in this segment. Many women use mobile applications to track symptoms, monitor therapy effects, and receive lifestyle guidance. Clinics integrate this information into follow-up visits.

By Product/Drug class Insights

Hormonal Therapies: The hormonal therapies segment held the largest market share in 2025. The segment is dominating due to the increasing prevalence of menopause related symptoms that can be managed effectively with structured hormonal treatments. Many women in Canada experience sleep disturbances, mood swings, night sweats, and other vasomotor symptoms during the menopausal transition. These symptoms often disrupt daily functioning and push women to seek formal medical care instead of relying on over-the-counter remedies. As a result, demand for evidence-based hormone options continues to rise.

Clinicians across Canada follow strong clinical guidelines for prescribing hormonal therapy. These guidelines emphasize personalized dosing, safety monitoring, and risk evaluation. Hormonal treatments also support broader women's health needs. They help manage postmenopausal osteoporosis by stabilizing bone density, and they play a significant role in reducing pain and inflammation linked to endometriosis.

Femtech / Digital Therapeutics: The digital therapeutics segment is expected to witness the fastest CAGR during the forecast years. The segment is expanding due to rising awareness of gender specific health needs and growing interest in technologies that deliver tailored support. Canadian women increasingly use digital tools for condition tracking, remote consultations, hormonal monitoring, and cycle management. These platforms offer continuous guidance and help women engage with the healthcare system more proactively.

Government initiatives that promote virtual care adoption also strengthen this segment. Many health authorities in Canada encourage digital platforms that support mental health, chronic condition management, and preventive care. Women's health applications fit naturally into this framework. They provide structured programs for menopause support, fertility planning, pelvic health therapy, and symptom monitoring for PCOS or endometriosis.

By Care Settings/Channels Insights

Hospital / Specialist Clinics: The hospitals and specialty clinics segment held the largest market share in 2025. The segment is dominating because these facilities provide structured, specialized care supported by trained healthcare professionals and dependable clinical infrastructure. Women rely on these centres for conditions that require detailed evaluation, precise diagnostics, and ongoing medical supervision. This includes reproductive health services, chronic gynaecological disorder management, and complex hormonal guidance that cannot be addressed through general outpatient settings.

Hospitals and specialty clinics also deliver critical services such as breast cancer and ovarian cancer screenings, mammography, ultrasound diagnostics, and prenatal testing. These procedures demand advanced imaging systems, laboratory support, and specialist interpretation, which positions hospitals as essential hubs for women's health. Government funding strengthens this segment further. Provincial health programs regularly support hospital-based screening initiatives, maternal health services, and chronic disease management pathways. Specialty clinics frequently collaborate with private R&D labs, which allows them to participate in early-stage trials, biomarker studies, and new therapeutic evaluations.

Online Pharmacies and Digital Health Platforms: The online pharmacies and digital health platforms segment is expected to witness the fastest CAGR during the foreseeable period of 2025 to 2034. The segment is expanding quickly as Canadian women shift toward convenient, technology-supported healthcare models. Online pharmacies allow easy ordering of hormonal therapies, contraceptives, supplements, and chronic disease medications without the delays often associated with in-person visits. This convenience is especially important for women managing long-term conditions or living in regions with limited specialist access.

Digital health platforms strengthen this growth. Many incorporate AI-driven tools, symptom trackers, and data analytics that help users monitor changes in reproductive cycles, menopause patterns, pelvic health symptoms, and fertility indicators.

Country-level Analysis

Ontario and Quebec lead the Canada women's health market due to their large populations, dense healthcare networks, and strong concentration of specialized clinical services. These provinces host the highest number of fertility centres, gynaecology clinics, menopause programs, and diagnostic facilities in the country. This creates consistent demand for prescription therapies, imaging services, and digital health offerings targeted at women's health needs.

Ontario benefits from a broad hospital system and a large academic research base. Major centres in Toronto, Ottawa, and Hamilton support advanced programs in reproductive medicine, oncology, endocrinology, and pelvic health. This ecosystem attracts investment from device manufacturers, pharmaceutical companies, and digital health firms that focus on women's health innovation. The presence of large teaching hospitals also accelerates the adoption of updated clinical guidelines, which increases the use of specialized diagnostics and treatments.

Quebec shows similar strengths. Montreal and Quebec City house highly developed reproductive and gynaecological care networks. These centres provide IVF, minimally invasive gynaecological procedures, menopause care, and chronic condition management for disorders such as endometriosis and PCOS. Quebec's structured provincial health programs encourage routine screening and early intervention, which drives the use of diagnostics, hormonal therapies, and long-term condition management tools. Both provinces carry a significant share of Canada's ageing female population. This increases demand for services related to menopause, bone health, chronic disease prevention, and cardiovascular risk management.

Value Chain Analysis of Canada Women's Health Market

It's an initial stage where programs have been carried out on women's health care and prevention.

Key Players- Canada healthcare bodies, private healthcare organizations, Shoppers Drug Mart, and Rexall.

This stage involves medical consulting, lab work, and Imaging to detect health issues.

Key players- Quest Diagnostics, GE Healthcare, Syantra Health, Abbott Labs.

This stage involves treatment and care with medication, surgery, and therapy after a confirmed disease diagnosis.

Key Players- AstraZeneca, Laborie Medical, Bayer AG, and Merck &Co

Companies in Canada Women's Health Market

- AbbVie Inc.

- Bayer AG

- Merck & Co., Inc. (MSD)

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd.

- Ferring Pharmaceuticals

- Amgen Inc.

- Acerus Pharmaceuticals

- Laborie Medical Technologies

- FemTherapeutics Inc.

- Eli (Eli Health)

- Hyivy Health

- Products by Women

- CCRM Fertility (CCRM Canada)

- CReATe Fertility Centre

- Olive Fertility Centre

- NewLife / TRIO / IVF Canada

- McKesson Canada

- Hologic

- CooperSurgical

- Karl Storz

- Femtech Canada

Recent Developments

- In June 2025, Manulife Canada announced its partnership with Maven clinic, a globally largest virtual clinic developed especially for women's health, along with their family. It includes fertility guidance, family planning, maternity care, newborn babies, pediatrics, and menopause.(Source: https://www.manulife.com)

- In August 2025, Shoppers Foundation, for women's health is announced its support through an investment of $1.75 million via its community grants program, aiming to help uplift women's health across Canada.

Segments Covered in the Report

By Application / Condition

- Postmenopausal Osteoporosis

- Endometriosis & Uterine Fibroids

- Hormonal Infertility (Fertility treatments / IVF services)

- Contraceptives (prescription & OTC)

- Menopause (Fastest Growing application segment

- Polycystic Ovary Syndrome (PCOS)

By Product / Drug Class

- Hormonal Therapies (HRT, Contraceptive Hormones)

- Bone-Health Agents

- Fertility Agents & Assisted-Reproduction Products (Stimulation Drugs, Hormones, Adjuncts)

- Pain & Symptom Management (for Endometriosis/Fibroids)

- Diagnostics & Imaging (Pelvic Imaging, Bone Density Scans)

- Fintech / Digital Therapeutics (Symptom Tracking, Telehealth For Fertility/Menopause)

By Care Setting / Channel

- Hospital / Specialist Clinics (Fertility Clinics, Gynaecology Clinics)

- Retail Pharmacies (Prescription & OTC Contraceptives, HRT)

- Online Pharmacies & Digital Health Platforms

Get a Sample

Get a Sample

Table Of Content

Table Of Content