What is the Canada Plasma Fractionation Market Size?

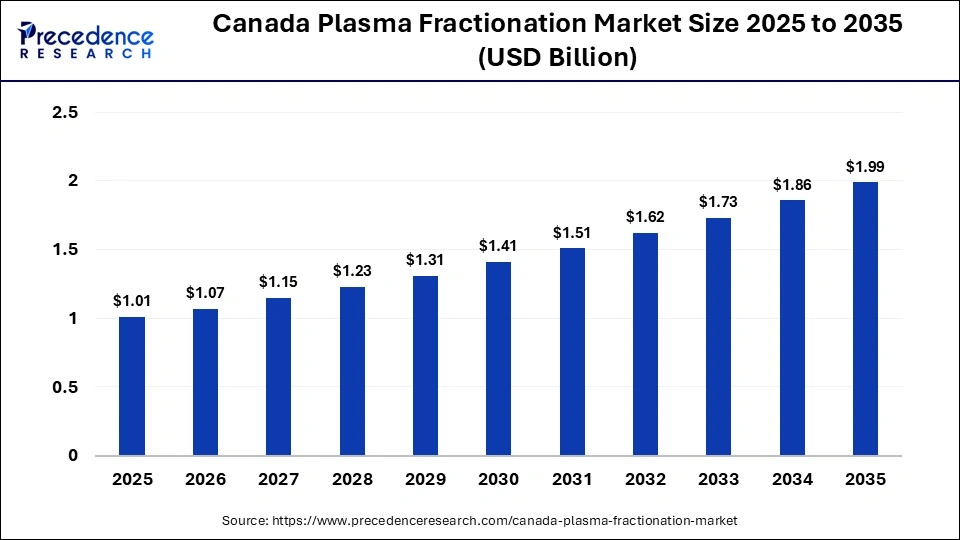

The Canada plasma fractionation market size was calculated at USD 1.01 billion in 2025 and is predicted to increase from USD 1.07 billion in 2026 to approximately USD 1.99 billion by 2035, expanding at a CAGR of 7.02% from 2026 to 2035. The Canada plasma fractionation market is driven by growing demand for plasma-derived therapies and expanding domestic plasma collection and processing capacity.

Market Highlights

- By product, the immunoglobulin segment held the largest share in 2025.

- By product, the albumin segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By application, the immunology & neurology segment dominated the market with a considerable share in 2025.

- By application, the pulmonology segment is expected to grow at the highest CAGR in the market during the studied period.

- By end user, the hospitals & clinics segment led the market in 2025.

- By end user, the clinical research laboratories segment is expected to expand rapidly in the market in the coming years.

Market Overview

Plasma fractionation is a complex biotechnology process that separates human blood plasma into key components such as clotting factors, albumin, immunoglobulins, and fibrinogen, along with enzymes and antibodies. These plasma-derived products are vital for treating chronic and life-threatening conditions, including immune deficiencies, hemophilia, coagulation disorders, and genetic diseases. The Canada plasma fractionation market is experiencing steady growth, driven by the rising prevalence of these chronic and rare disorders and the increasing demand for plasma-based therapies.

Rising awareness of the benefits of plasma-derived therapies, advances in fractionation technology, and expanding plasma collection infrastructure are also driving market growth. Moreover, government initiatives to promote domestic plasma collection, improve healthcare access, and increase R&D in plasma therapeutics are further fueling the expansion of the market.

Advancing Plasma Therapies: How Technologies are Transforming the Canada Plasma Fractionation Market?

The market is undergoing a significant transformation due to advanced technologies. The adoption of AI has been influencing the market by improving efficiency, safety, and accuracy in plasma collection, processing, and therapeutic development. AI-driven process control systems monitor parameters such as temperature, pH, and protein separation in real time, enhancing product purification and minimizing errors. Advanced analytics enable predictive maintenance of critical equipment, reducing downtime and operational costs. Additionally, AI-based quality control systems detect impurities and deviations during manufacturing, ensuring high-quality products that meet regulatory standards.

Canada Plasma Fractionation Market Trends

- The rising incidence of autoimmune disease and immune deficiencies is increasing the consumption of immunoglobulin therapies, which in turn creates a stable demand for plasma fractionation products in Canada.

- Investments in domestic plasma collection facilities and mobile donation units are enhancing supply and production of plasma-derived therapeutics.

- Advances in automated, high-yield fractionation methods are improving product purity, efficiency, and safety, accelerating market acceptance.

- Government policies promoting domestic plasma collection, stringent safety standards, and reimbursement programs are expanding industry growth and patient access to plasma therapies.

- Rising research investment supports new product development, novel formulations, and evidence generation for expanded therapeutic use.

- Government efforts to improve reimbursement coverage and regulatory pathways are making plasma‑derived medicines more accessible to patients.

- Growing adoption of convenient formulations such as subcutaneous immunoglobulin (SCIG) that support at‑home administration and enhance compliance also contributes to the market.

- Expansion of hospitals and specialty clinics with the capacity to administer complex plasma therapies supports market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.01Billion |

| Market Size in 2026 | USD 1.07 Billion |

| Market Size by 2035 | USD 1.99Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.02% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and End User |

Segment Insights

Product Insights

What Made Immunoglobulin the Dominant Segment in the Canada Plasma Fractionation Market?

The immunoglobulin segment dominated the market with the largest share in 2025. This is mainly due to its widespread clinical adoption and established therapeutic significance. Immunoglobulins are widely used to treat immunodeficiencies, autoimmune disorders, and chronic inflammatory diseases, available as intravenous (IVIG) and subcutaneous (SCIG) formulations. IVIG is suited for acute or severe cases due to rapid administration, while SCIG allows convenient at-home use for long-term management, improving patient compliance. Strong physician trust, clinical evidence, and inclusion in treatment guidelines have strengthened the segment's growth. Additionally, rising awareness of immune-related diseases and supportive reimbursement policies in Canada have expanded patient access, sustaining demand.

The albumin segment is expected to grow at the fastest CAGR in the market between 2026 and 2035. This is because albumin is an important plasma protein that is commonly used to treat hypovolemia, shock, burns, and complications caused by liver diseases. The segmental growth is also driven by rising critical care cases, increased hospital-based treatments, and expanding use of albumin in surgeries and therapeutic procedures. Advances in fractionation technology have improved the safety, availability, and efficacy of albumin, while growing clinician awareness of its role in fluid resuscitation and supportive therapies is further boosting adoption.

Application Insights

Why Did the Immunology & Neurology Segment Lead the Canada Plasma Fractionation Market?

The immunology & neurology segment led the market with the largest share in 2025. This is mainly due to the high demand for immunoglobulin therapies in treating a broad range of conditions, including primary immunodeficiency, chronic inflammatory demyelinating polyneuropathy, and other autoimmune neuropathies. Strong clinical evidence, inclusion in treatment guidelines, and physician familiarity have reinforced its dominance. Growing awareness among patients and healthcare providers, along with expanded reimbursement coverage, has further supported adoption. Hospitals and specialty clinics continue to focus on plasma-based therapies for these conditions, ensuring steady and sustained demand.

The pulmonology segment is expected to grow at the fastest rate in the upcoming period. The growth of the segment is driven by the rising use of plasma-derived therapies for respiratory conditions such as COPD, severe asthma, and other lung diseases, where immunoglobulins help prevent infections and reduce inflammation. Rising prevalence of respiratory disorders, increasing hospitalization rates, and greater awareness among pulmonologists are boosting adoption. Advances in plasma fractionation technology, improved access to therapies, and expanded coverage under Canadian healthcare programs are further supporting growth. The healthcare system's focus on specialized pulmonary care and prevention of complications also contributes to the rising demand.

End User Insights

How Does the Hospitals & Clinics Lead the Canada Plasma Fractionation Market?

The hospitals & clinics segment registered its dominance in the market by capturing the largest share in 2025. This is because these facilities are the primary centers for administering plasma-derived therapies such as immunoglobulins and albumin for immunodeficiencies, autoimmune, neurological, and critical care conditions. These facilities often have infrastructure, trained medical practitioners, and systems that are required to administer intravenous or subcutaneous therapy safely.

Their well-established supply chains, strong relationships with plasma product manufacturers, and effective stock management ensure constant treatment availability. Their dominance is further reinforced by the need for regular plasma-based therapies, which leads to frequent patient visits. Safety, accessibility, and reliability make these centers the preferred end-user for administering plasma-derived treatments.

The clinical research laboratories segment is expected to grow at the fastest rate in the market over the forecast period. This is because of their critical role in developing new plasma-derived therapies, conducting clinical trials, and advancing research in immunology, neurology, pulmonology, and other therapeutic areas. The segment growth is also driven by rising R&D investment, the focus on personalized medicine, and supportive regulatory environments. Increasing studies on new applications of plasma proteins, including immunoglobulins and albumin, are boosting demand for specialized lab services. Pharmaceutical companies and academic institutions increasingly rely on these laboratories to develop drugs, test safety, optimize formulations, and enhance plasma fractionation technologies, ensuring higher purity, safety, and efficacy.

Country-Level Analysis

The Canada plasma fractionation market is highly consolidated, dominated by major players such as CSL Behring LLC, Grifols S.A., and Octapharma AG. These companies hold significant market share due to substantial investments in R&D, advanced manufacturing capabilities, and robust operational infrastructure. Strategic initiatives, including the launch of new plasma collection centers, portfolio expansion, and partnerships, strengthen their presence in Canada. Their focus on innovation and quality ensures a steady supply of critical plasma-derived therapies, including immunoglobulins, clotting factors, albumin, and enzyme-based treatments, which are essential for managing chronic and rare diseases.

Other companies, such as Takeda Pharmaceutical Company Limited and LFB, are also making significant inroads in the Canadian plasma fractionation market. They focus on launching new products, increasing awareness of plasma therapies, and forming strategic alliances to capture emerging opportunities. The growing prevalence of immune system and coagulation disorders is driving higher demand, creating opportunities for these players to expand their presence in the market.

Who are the Major Players in the Canada Plasma Fractionation Market?

The major players in the canada plasma fractionation market include CSL Behring LLC, Octapharma AG, Grifols S.A, Takeda Pharmaceutical Company Limited, Kedrion Biopharma,LFB Group, Biotest AG, Bio Products Laboratory, Green Cross Corporation (GC Biopharma), Hema‑Quebec (plasma collection and fractionation), Intas Pharmaceuticals

Recent Developments

- In March 2025, Takeda Canada announced that Health Canada expanded HyQvia's approval for chronic inflammatory demyelinating polyneuropathy (CIDP) in adults, allowing its use as maintenance therapy after IVIG stabilization to prevent relapse of neuromuscular disability. HyQvia is the only subcutaneous immunoglobulin for CIDP in Canada that can be infused once every 24 weeks and, with proper training, can be self-administered or given by a healthcare professional, eliminating the need for hospital or clinic visits.(Source:https://www.takeda.com)

- In January 2025, Takeda Canada Inc. stated that Hema-Quebec will pay HyQvia to treat the immunodeficiencies in adult and pediatric patients aged two years. The reimbursement promotes increased access to therapy and eliminates financial burdens on patients who are obliged to receive plasma-derived immunoglobulin therapies.(Source: https://www.takeda.com)

- In June 2023, Grifols announced an agreement with Canadian Plasma Resources (CPR), giving it rights to plasma donated at CPR centers, with plans to acquire these centers by the end of 2025. Separately, Grifols expanded its presence in Canada by opening its first center in Winnipeg in 2022, developing a second in Edmonton, and planning up to five additional centers, including in Ontario, as an agent of Canadian Blood Services. The Alberta and Ontario centers were expected to become operational in 2024.(Source: https://www.grifols.com)

Segments Covered in the Report

By Product

- Albumin

- Immunoglobulin

- Intravenous Immunoglobulin

- Subcutaneous Immunoglobulin

- Coagulation Factors

- Factor IX

- Factor VIII

- Prothrombin Complex Concentrates

- Fibrinogen Concentrates

- Others

- Protease Inhibitors

- Others

By Application

- Immunology & Neurology

- Hematology

- Critical Care

- Pulmonology

- Others

By End User

- Hospitals & Clinics

- Clinical Research Laboratories

- Others

Get a Sample

Get a Sample

Table Of Content

Table Of Content