What is the Plasma Fractionation Market Size?

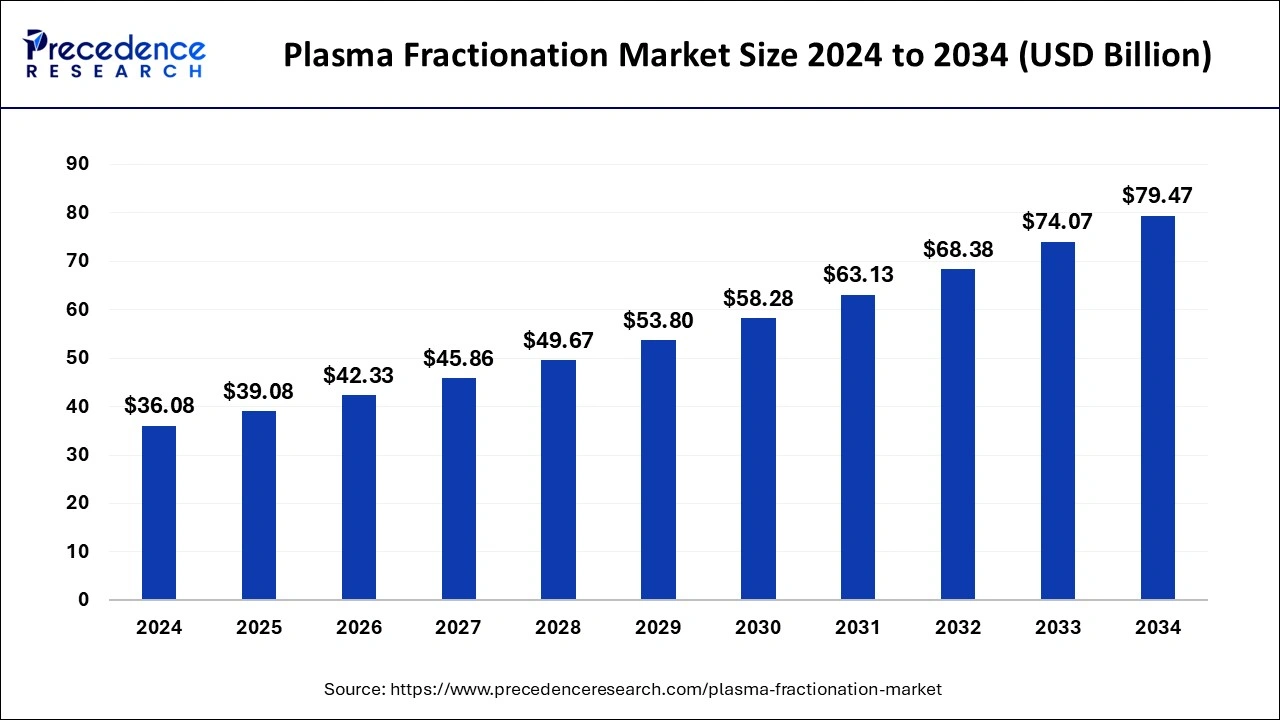

The global plasma fractionation market size is accounted at USD 33.53 billion in 2025 and predicted to increase from USD 35.82 billion in 2026 to approximately USD 66.18 billion by 2035, representing a CAGR of 7.04% from 2026 to 2035.

The growing prevalence of genetic diseases across the world is driving the growth of the plasma fractionation market.

Plasma Fractionation Market Key Takeaways

- The global plasma fractionation market was valued at USD 33.53 billion in 2025.

- It is projected to reach USD 66.18 billion by 2035.

- The market is expected to grow at a CAGR of 7.04% from 2026 to 2035.

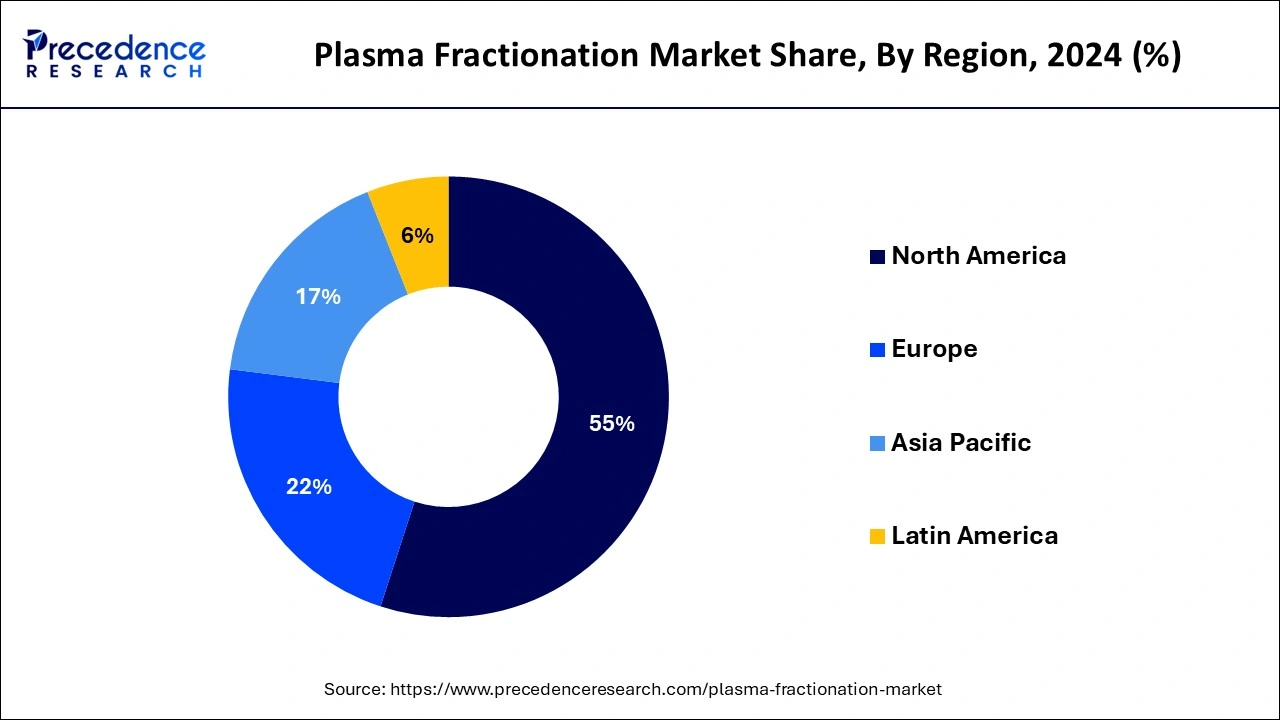

- North America led the market with the largest revenue share of 46.1% in 2025.

- Asia Pacific is expected to witness the fastest rate of growth in the market during the forecast period.

- By method, the centrifugation segment has contributed more than 35% of revenue share in 2025.

- By method, the chromatography will grow rapidly during the forecast period.

- By product, the immunoglobins segment dominated the market in 2025.

- By product, the coagulation factors segment is projected to witness the fastest growth during the forecast period.

- By application, the neurology segment dominated the market in 2025.

- By application, the oncology segment will grow at a considerable rate in the market during the forecast period.

- By end use, the hospitals & clinics segment has held a major revenue share of 52% in 2025.

- By end use, the clinical research segment is projected to grow rapidly in the market during the forecast period.

Artificial Intelligence: The Next Growth Catalyst in Plasma Fractionation

The technique of plasma fractionation relies heavily on innovation. Here comes artificial intelligence (AI), which is transforming the process of plasma fractionation. Businesses may improve processes, save operating costs, and minimize human mistakes by using AI and automation in plasma fractionation. Additionally, AI is enabling the enhancement of plasma product production and purity, which will improve patient outcomes. Additionally, AI is assisting businesses in overcoming some of the drawbacks of conventional fractionation techniques by making it easier to isolate a variety of previously challenging-to-extract plasma components. In order to keep plasma components safe and efficient over time, this technical advancement also helps with their long-term storage.

Market Overview

The plasma fractionation industry has experienced rapid developments due to advancements in healthcare sectors. Plasma fractionation is a down-streaming method that deals with separating different components of blood plasma. This process is used to convert human plasma into medicines and therapies for the treatment of different diseases. It uses various separation processes such as depth filtration, precipitation, centrifugation, and chromatography. The application of plasma fractionation has increased rapidly in various domains such as neurology, immunology, hematology, and some others due to the higher efficacy of plasma therapies than conventional medicines.

This plasma fractionation market is fragmented, with the presence of small and large market players. These market players are actively engaged in research and development activities related to plasma fractionation. Some of the most prominent market players include Boccard, Grifols, S.A., Hemarus Therapeutics Limited, ADMA Biologics, Bio Products Laboratory Ltd., Intas Pharmaceuticals Limited, LFB S.A., Merck Group, Octapharma AG, PlasmaGen BioSciences Pvt. Ltd., SK Plasma Co. Ltd, Virchow Biotech Private Limited and some others.

- In March 2024, ADMA Biologics announced that the United States Food and Drug Administration (FDA) approved the Asceniv and Bivigam plasma therapies. These therapies will be manufactured in an FDA-licensed plasma fractionation facility in Boca Raton, Florida, U.S.

Plasma Fractionation Market Growth Factors

- The growing demand for plasma-derived medicinal products (PDMPs) has boosted the plasma fractionation market growth.

- The rising awareness related to the diagnosis and treatment of auto-immune diseases has also driven the growth of the plasma fractionation market.

- The technological advancements in medical sciences have also boosted the market growth.

- The rise in the geriatric population suffering from rare diseases has increased the demand for plasma fractionation.

- The growing application of plasma fractionation in therapeutic use is driving the growth of the plasma fractionation market.

- The increasing prevalence of heart diseases and alpha-1 antitrypsin deficiency (AATD) has also fostered the market growth.

- The Government initiatives related to the development of healthcare infrastructure propel the growth of the plasma fractionation market.

Market Outlook

- Market Growth Overview: The plasma fractionation market is expected to grow significantly between 2025 and 2034, driven by the increasing incidence of primary immunodeficiency, expansion of collection centers, and increased surgeries, grow demand for plasma components.

- Sustainability Trends: Sustainability trends involve waste and energy reduction, greener production practices, and solvent recovery and treatments.

- Major Investors: Major investors in the market include CSL Limited, Grifols S.A., Takeda Pharmaceutical Company, and Octapharma AG.

- Startup Economy: The startup economy is focused on significant capital investment, securing raw material supply, and established competition.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 33.53 Billion |

| Market Size by 2035 | USD 66.18 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.04% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Method, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing incidences of von willebrand's disease

The rising prevalence of Von Willebrand's disease has increased the demand for plasma therapy. Plasma therapies are found to be highly effective for treating Von Willebrand's disease as they help in blood clots in different parts of the human body. This, in turn, drives the growth of the plasma fractionation market. Also, several plasma-based therapies are approved by government organizations for the treatment of Von Willebrand's disease.

- According to a study conducted by Centres for Disease Control and Prevention (CDC), Von Willebrand disease (VWD) occurs in the same frequency among men and women; around 1% of the overall population of the world suffers from this genetic disorder.

Restraints

High cost and unavailability of high-quality plasma

There have been several developments in the plasma fractionation industry in recent times. The research and development activities related to plasma-based products come with a high cost. Also, the availability of suitable plasma is very low, and plasma companies import plasma from different parts of the world, which is very costly. Thus, higher costs associated with plasma product manufacturing are expected to restrain the growth of the plasma fractionation market.

Opportunity

Rising investments to develop plasma fractionation

The plasma therapy industry has grown rapidly in recent times due to the rising number of rare diseases across the world. Several plasma therapy companies have started focussing on enhancing their plasma fractionation and collection capabilities. Also, some plasma product companies have started adopting strategies such as business expansions, acquisitions, and the inauguration of R&D facilities related to plasma therapeutics. Thus, growing investment related to plasma fractionation is expected to create ample growth opportunities for the plasma fractionation market players.

Method Insights

The centrifugation segment led the plasma fractionation market in 2025. The growth of this segment is driven by the growing application of this method for the extraction of cells from plasma. Moreover, centrifugation methods can facilitate the separation of red blood cells and white blood cells from one another or from platelets. Thus, the rising application of centrifugation for different applications boosts the growth of the market.

The chromatography will grow rapidly during the forecast period. The growth of this segment can be attributed to the growing application of chromatographic purification in the removal of plasma viruses, along with the rising use of industrial chromatography for plasma fractionation. Also, the rise in research and development activities related to the extraction of pure plasma along with albumin production has further driven the market growth. Moreover, the presence of High-performance liquid chromatography (HPLC) equipment companies such as Agilent Technologies. Welch Materials, Waters Corporation, Thermo Fisher Scientific, Waters Corporation, ArgusEye, Shimadzu Corporation, and PerkinElmer, Inc. also drive the market growth.

- In April 2024, Waters Corporation launched the ‘iS Bio HPLC System'. This HPLC system comes with MaxPeak High-Performance Surface (HPS) Technology that helps QC analysts of biopharma companies to derive pure products from any sample.

Product Insights

The immunoglobins segment dominated the plasma fractionation market in 2025. This segment is mainly driven by the rise in the number of patients suffering from melanoma and prostate cancer around the world. Also, several research and developments related to the innovation of immunoglobulin therapies, along with the rising application of immunoglobin in neurological disorders, are driving the market growth. Moreover, the presence of immunoglobins companies such as CSL Behring, Kedrion S.p.A., Takeda, Octapharma, Baxter International Inc., Biotest AG, and some others boosts the market growth.

- In January 2024, Takeda announced that the U.S. Food and Drug Administration (FDA) had approved Gammagard Liquid. It is an intravenous immunoglobulin (IVIG) therapy that can help to treat impairment and neuromuscular disability in adults.

The coagulation factors segment is projected to witness the fastest growth in the plasma fractionation market during the forecast period. The growth of this segment is mainly due to the growing application of plasma coagulation for stopping blood losses during endoscopy and treatment of gastrointestinal diseases. Moreover, the growing cases of sickle cell anemia have increased the demand for plasma coagulation, thereby driving the growth of the market.

- According to a recent study by the Centers for Disease Control and Prevention (CDCP), in May 2024, more than 100,000 people suffered from Sickle cell disease (SCD) in the United States in 2023.

Application Insights

The neurology segment dominated the plasma fractionation market in 2025. This segment is generally driven by the rise in the number of nerve patients across the world. Plasma-based medications are found to be highly effective against nervous disorders, which in turn boosts the market growth. Also, the research and advancements related to neurological sciences, along with the rising adoption of plasma therapies for the treatment of nerve problems, accelerate the growth of the market.

- According to the World Health Organisation (WHO), more than 3 billion people around the world suffer from neurological disorders.

The oncology segment will grow at a considerable rate in the plasma fractionation market during the forecast period. The growth of this segment is generally driven by the rise in government initiatives towards cancer along with the growing application of plasma therapies for treating cancer. Moreover, the growing prevalence of cancer around the world also drives the market growth. Also, the growing adoption of plasma-assisted cancer immunotherapy and the use of cold atmospheric plasma (CAP) for treating cancer patients has also boosted the growth of the market.

End-use Insights

The hospitals & clinics segment held the largest share of the plasma fractionation market in 2025. The growth of this segment is generally driven by the growing number of hospitals and clinics across the world. Also, growing advancements in hospital infrastructure for the treatment of auto-immune diseases drive the growth of the market. Moreover, the availability of experienced doctors in clinical settings has also increased the demand for plasma therapies for the treatment of cancer, heart diseases, and some others, thereby driving the market growth.

The clinical research segment is projected to grow rapidly in the plasma fractionation market during the forecast period. The growth of this segment can be attributed to the rising adoption of plasma therapy for the treatment of rare diseases. Moreover, rising research and development activities for the production of plasma-based therapeutics also drive the growth of the market.

Regional Insights

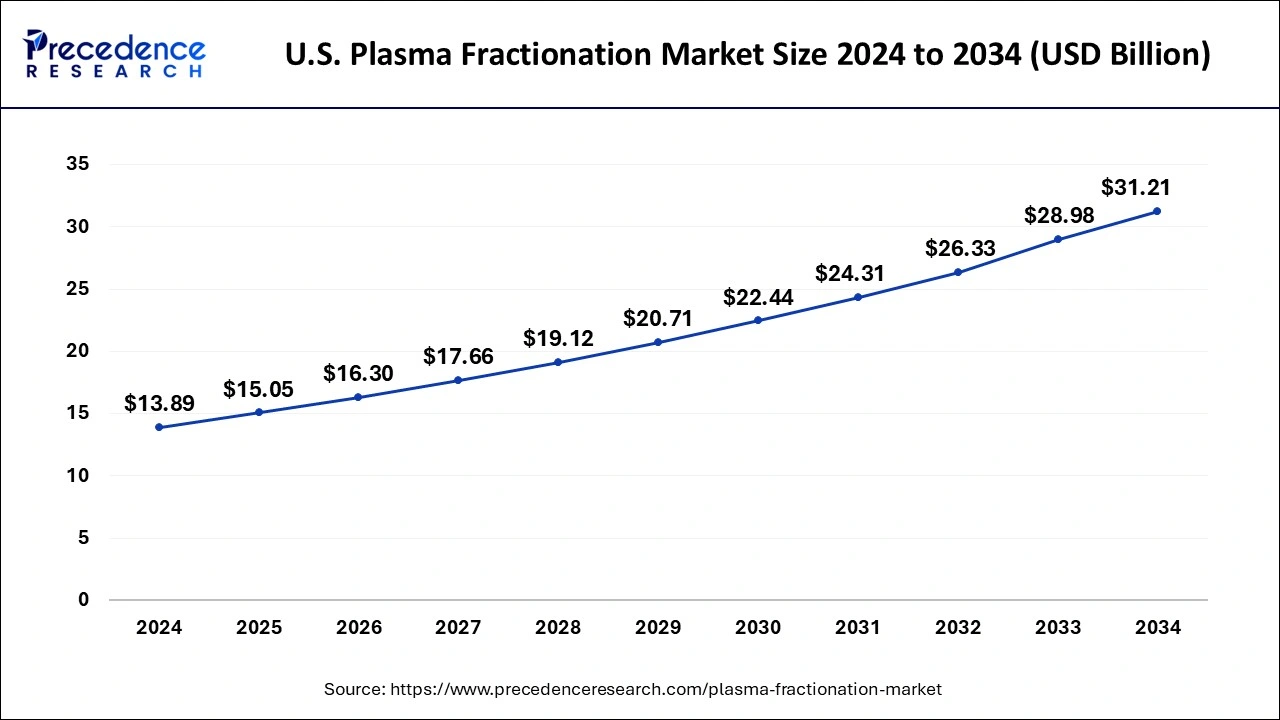

U.S. Plasma Fractionation Market Size and Growth 2026 to 2035

The U.S. plasma fractionation market size is estimated at USD 15.60 billion in 2025 and is predicted to be worth around USD 28.6 billion by 2035, with a CAGR of 6.25% from 2026 to 2035.

North America led the global plasma fractionation market in 2025. The growth of this region is mainly driven by the growing number of plasma research institutes along with a rising number of startup companies related to plasma medicines. Moreover, the growing cases of rare diseases in countries such as Canada and the U.S. have also increased the demand for plasma medicines, thereby driving the market growth of the market. In addition, the growing prevalence of nerve and bone-related issues has also increased the demand for plasma therapies, which, in turn, drives the market growth. Also, the presence of plasma companies such as Baxter, LFB Plasma, Pall Corporation, ADMA Biologics, Inc., and some others also drives the market growth.

- According to a study conducted by the National Institutes of Health (NIH), the number of rare diseases reached 7000 among the people of the U.S. It also stated that 1 in every ten people in the U.S. suffered from rare diseases.

- According to the International Osteoporosis Foundation, there are around 300,000 hip fractures in the U.S. every year, out of which 25% die due to such fractures.

U.S. Plasma Fractionation Market Trends

The U.S. is experiencing a rising global prevalence of primary immunodeficiency disorders and an aging demographic requiring chronic care solutions. The market is capitalizing on improved collection logistics and advanced fractionation technologies that enhance both the volume and quality of plasma-derived products.

Asia Pacific is expected to witness the fastest rate of growth in the plasma fractionation market during the forecast period. The growth of this region is mainly driven by scientific developments and advancements in the healthcare sector in countries such as India, Japan, and China. Also, the rising initiatives from the public and private sectors for research & development related to plasma therapeutics have also boosted the market growth. Moreover, an increase in government initiatives aimed at opening plasma centers also fosters market growth. Furthermore, the presence of biopharma companies such as Grifols, Octapharma, Sanquin, CSL, Eden Biologics, and some others is also driving the growth of the market.

China Plasma Fractionation Market Trends

China's growth is driven by growing demand for treating immune deficiencies, neurological disorders, and autoimmune conditions, rising domestic plasma supply, and reducing reliance on imports, although a gap still exists, and rising prevalence of rare diseases, neurological disorders, respiratory diseases, and an aging population are major growth catalysts.

How did Europe experience notable growth in the Plasma Fractionation Market?

Europe's high incidence of immunodeficiency, respiratory, and bleeding disorders in an aging population, rising emphasis on plasma donation and strategic expansion of plasma collection centers, and advanced infrastructure and regulations. An agency that enhances product safety and market confidence. Technological advancements in fractionation processes and increasing investments in new facilities are improving production efficiency and capacity across key countries such as Germany, France, and the UK.

The UK Plasma Fractionation Market Trends

The UK's escalating clinical demand for immunoglobulins and albumin in aging populations. Heavy R&D investment is currently broadening the therapeutic scope of plasma proteins, enabling new treatments for complex autoimmune and neurological conditions.

Value Chain Analysis of the Plasma Fractionation Market

- Plasma Collection

This initial stage involves collecting human plasma from voluntary or paid donors through a process called plasmapheresis or as a byproduct of whole blood donation.

Key Players: CSL Plasma, BioLife Plasma Services, and Grifols. - Fractionation and Purification

In this stage, the pooled plasma is separated into specific protein fractions, primarily using variations of the cold ethanol fractionation (Cohn) process, often integrated with modern chromatography and filtration techniques.

Key Players: CSL Behring, Grifols, Takeda Pharmaceutical Co. Ltd., and Octapharma AG. - Distribution and Sales

The finished products are then distributed globally to hospitals, clinics, and other healthcare providers to treat a wide range of diseases, including immune deficiencies and bleeding disorders.

Key Players: CSL Behring, Grifols, and Takeda

Top Companies in the Plasma Fractionation Market & Their Offerings:

- Grifols S.A. is a major global producer of plasma-derived medicines, utilizing a vertically integrated model to collect plasma, manufacture essential therapies like albumin and immunoglobulins, and distribute them worldwide.

- CSL Limited contributes significantly to the market as one of the largest manufacturers of plasma protein biotherapies globally, with its CSL Behring subsidiary providing a broad portfolio of products for patients with rare and serious diseases.

- Takeda Pharmaceutical Company Limited operates a large plasma-derived therapies business, leveraging its extensive R&D capabilities and global reach to deliver critical treatments for neurological, immunological, and bleeding disorders.

- Octapharma AG is a large, independent plasma fractionator that focuses on developing and producing high-purity human protein products from both source plasma and human cell lines to treat life-threatening conditions.

- Kedrion S.p.A. contributes to the plasma market through its commitment to maximizing the use of blood plasma to produce therapies that improve the quality of life for patients with various disorders, operating facilities in both the U.S. and Europe.

- LFB S.A. specializes in developing, manufacturing, and marketing plasma-derived products and new-generation recombinant proteins, supplying the French market and expanding its international presence with a focus on innovative therapies.

Plasma Fractionation Market Companies

- Grifols S.A.

- CSL Limited

- Takeda Pharmaceutical Company Limited

- Octapharma AG

- Kedrion S.p.A

- LFB S.A.

- Biotest AG

- Sanquin

- Bio Products Laboratory Ltd.

- Intas Pharmaceuticals Ltd

Recent Developments

- In December 2023, GC Biopharma announced that the Indonesian government approved the construction of a plasma fractionation plant in Jababeka Industrial Estate. This plant is expected to be operational in 2027 and will produce around 4000000 liters of plasma for medicinal use.

- In March 2023, CSL Limited opened a new plasma fractionation facility in Marburg, Germany. This manufacturing plant cost around 470 million USD and was opened with the aim of using human-donated plasma in useful medicines.

- In October 2025, Grifols' subsidiary Biotest AG launched Yimmugo, an innovative intravenous immunoglobulin therapy for primary immunodeficiencies, in the U.S. market. It expands access to treatment for people living with immunodeficiencies. (https://www.grifols.com)

Segments Covered in the Report

By Product

- Albumin

- Immunoglobulins

- Intravenous Immunoglobulins

- Subcutaneous Immunoglobulins

- Others

- Coagulation Factors

- Factor viii

- Factor ix

- Von Willebrand Factor

- Prothrombin Complex Concentrates

- Fibrinogen Concentrates

- Others

- Protease Inhibitors

- Others

By Method

- Centrifugation

- Depth Filtration

- Chromatography

- Others

By Application

- Neurology

- Hematology

- Oncology

- Immunology

- Pulmonology

- Others

By End-use

- Hospitals & Clinics

- Clinical Research

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting