Plasma Therapeutics Market Size and Forecast 2025 to 2034

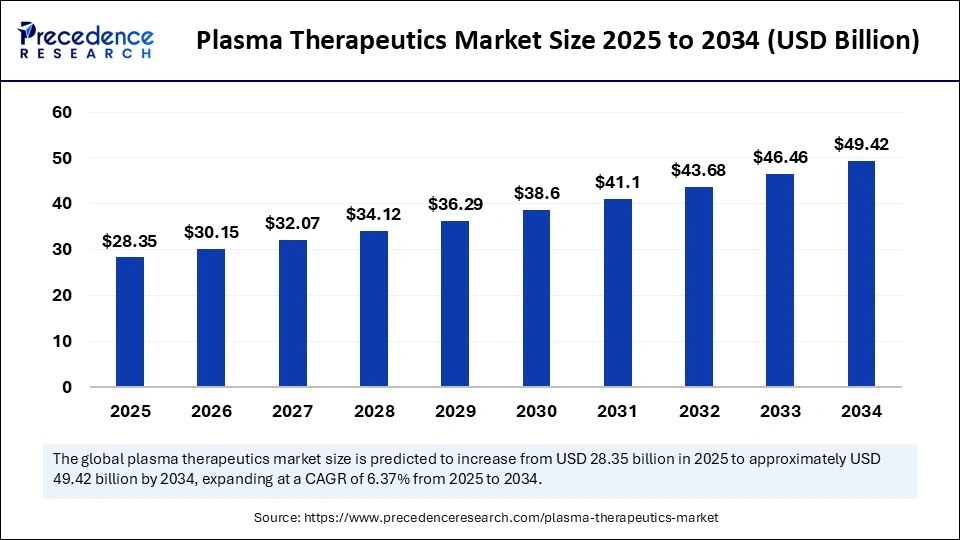

The global plasma therapeutics market size accounted for USD 26.65 billion in 2024 and is predicted to increase from USD 28.35 billion in 2025 to approximately USD 49.42 billion by 2034, expanding at a CAGR of 6.37% from 2025 to 2034. The plasma therapeutics market is growing at a rapid pace due to the rising demand for plasma-based therapies across the globe, advancements in technology, and increasing healthcare expenditure.

Plasma Therapeutics MarketKey Takeaways

- In terms of revenue, the plasma therapeutics market is valued at $28.35 billion in 2025.

- It is projected to reach $49.42 billion by 2034.

- The market is expected to grow at a CAGR of 6.37% from 2025 to 2034.

- North America dominated the plasma therapeutics market in 2024.

- Europe is expected to witness the fastest growth during the forecast period.

- By product type, the immunoglobulin segment held the largest market share in 2024.

- By product type, the coagulation factors segment is expected to grow at a significant rate in the upcoming period.

- By application, the hemophil segment captured the major market share in 2024.

- By application, the primary immunodeficiency diseases segment is expected to grow at the fastest CAGR during the forecast period.

How is AI Transforming the Plasma Therapeutics Market?

Artificial intelligence can be used in optimizing processes, ensuring quality control and improving yield during fractionation and manufacturing. Data analytics and AI models speed up the discovery of new applications for plasma proteins and biomarkers, facilitating the development of personalized medicine strategies. Moreover, AI enhances pharmacovigilance through adverse event tracking and real-world treatment outcome monitoring. As AI becomes more integrated, the plasma therapeutics market will benefit from improved efficiency, reduced costs, increased safety, and more precise treatments. This combination of biotechnology and AI is transforming the plasma therapeutics industry into a more intelligent, rapid, and responsive field.

Market Overview

Plasma therapeutics are medicines that are extracted or obtained from human plasma, which has essential proteins, namely immunoglobulins, clotting factors, and albumin. Plasma-derived products are critical in treating various health conditions, such as immune deficiencies, bleeding disorders like hemophilia, and autoimmune diseases. Immunoglobulins are used to strengthen the immunity, coagulation factors enhance blood clotting, and albumin sustains blood volume and pressure. Biotechnology and plasma processing innovations are improving the effectiveness and availability of these therapies.

The plasma therapeutics market is witnessing strong growth as the demand for plasma-derived products like human immunoglobulin is rising all around the globe. HIg is highly demanded because it is highly effective in the treatment of immunodeficiency and autoimmune diseases, as well as in enzyme replacement therapy and spa therapy. New plasma collection and fractionation centers are being built, especially within the developing economies, which are increasing access and production capacity. Additionally, drug manufacturers are spending money on research and development to come up with novel products, such as personalized and regenerative medicine. Moreover, supportive regulatory environments and governmental efforts to secure the supply of plasma products are expected to boost the growth of the market in the coming years.

What Factors are Fueling the Growth of the Plasma Therapeutics Market?

- Rising Prevalence of Chronic Diseases: Surge in chronic disorders, including autoimmune diseases, immunodeficiencies, and blood disorders, across the globe is boosting the demand for plasma-derived therapies. Such therapies provide life-saving solutions to serious and life-threatening health conditions, which is increasing the utilization rates of these therapies and compelling the healthcare systems to integrate plasma therapeutics to a greater extent.

- New Infrastructure Development: New plasma collection and fractionation plants around the globe are increasing access to plasma therapies around the world. Pharmaceutical companies are also working with local governments to build the infrastructure and ensure continuous supply of these therapies.

- Increased Awareness and Health Spending: More awareness among consumers and practitioners about plasma-related therapies and their role has exhibited a positive influence on demand. Related education, better diagnosis, and more comprehensive insurance coverage continue to influence and increase awareness and usage of plasma therapeutics.

- High Demand for Immunoglobulins: Human immunoglobulin is the most demanding plasma-derived product because of its proven effectiveness in immune deficiencies and autoimmune diseases. The steady increase in the number of patients who need immunoglobulin treatment maintains a high level of demand, which encourages manufacturers to expand their activities and develop new solutions to health care needs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 49.42 Billion |

| Market Size in 2025 | USD 28.35 Billion |

| Market Size in 2024 | USD 26.65 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.37% |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic and rare diseases is one of the major factors driving the growth of the plasma therapeutics market. Hemophilia, primary immunodeficiencies, autoimmune diseases, and certain neurological diseases are becoming more prevalent within the population due to improved diagnostic methods, as well as the aging global population. These conditions are chronic and complex illnesses, necessitating specific and prolonged care and treatment. Plasma-derived products, including immunoglobulins, clotting factors, and albumin, are essential in managing these diseases. The World Health Organization (WHO) has reported that chronic diseases currently account for nearly 70% of all deaths worldwide, emphasizing the increasing demand for therapies that offer long-term solutions.

Plasma-derived therapies are vital for immune support, blood clotting, and disease solutions, playing an indispensable role in chronic care. The demand for dependable, high-quality plasma therapies is growing alongside increased awareness and improved diagnosis. A major driver is the rising investment in healthcare infrastructure, particularly in emerging economies. Governments and the private sector are focused on expanding healthcare infrastructure to meet rising needs, including the establishment of plasma collection centers, improved storage facilities, and enhanced fractionation plants.

Increasing Investment in Healthcare Infrastructure

Increasing investment in healthcare infrastructures, especially in developing economies, is another major factor driving the growth of the market. As the global healthcare system evolves, governments and private entities are building health infrastructures to support the rising demand for new and advanced medical therapies, like plasma-derived treatments. Improved infrastructure facilitates the establishment of critical elements within the plasma supply chain. This includes the construction of modern plasma collection centers, advanced storage facilities, a cold chain, and state-of-the-art fractionation plants. These developments are crucial for the safe and effective processing, storage, and distribution of plasma-derived products, such as immunoglobulins, albumin and clotting factors.

Rising government investment, public-private partnerships, and favorable regulations further support segmental growtha. These initiatives have improved the uptake and access to plasma-based treatments, especially in rural and underserved areas. Furthermore, long-term investments in health infrastructure will be key in shaping the future of the plasma therapeutics market, as advanced care becomes more available, effective, and efficient globally.

Restraint

High Cost Associated with Plasma Collection and Processing

One of the factors inhibiting the growth of the plasma therapeutics market is the high cost of plasma collection and processing. Plasma-derived therapies are highly regulated and resource-intensive to produce. The process, from donor recruitment to final product formulation, demands adherence to safety, quality, and regulatory requirements. Plasma collection must be done using apheresis techniques, which are time-consuming and require highly specialized, expensive machines.

Plasma fractionation, purification, and pathogen inactivation are complex procedures used to prepare therapeutic products like immunoglobulins, clotting factors, and albumin. Cold chain logistics, necessary for transporting and storing plasma and its derivatives, add further financial constraints, especially in areas with poor infrastructure. Consequently, supply constraints persist, particularly when demand is high. These challenges are amplified by the logistical difficulties of collecting, storing, and transporting plasma.

Opportunity

Shift toward Personalized Plasma Therapies

The growing trend toward personalized plasma therapies presents an opportunity for the growth and development of the plasma therapeutics market. Personalized medicine focuses on tailoring treatment plans to match the genetic, biological, and health profile of each patient. These individualized approaches could potentially lead to better therapy response, fewer side effects, and increased patient satisfaction. Individualized plasma therapies provide specific interventions that may improve quality of life and increase the success rates of clinical applications by targeting specific disease manifestations.

There is an increasing need for customized plasma treatment solutions at both clinical and research levels. This shift is also driving innovation and investment in new technologies like genomics, proteomics, and bioinformatics. These tools allow researchers and clinicians to interpret patient-specific data to develop more effective plasma formulations and treatment regimens. With rising awareness and advancing technology, this transformation towards personalized plasma therapies is likely to create new opportunities for targeted treatment.

Product Type Insights

Why did the Immunoglobulin Segment Dominate the Plasma Therapeutics Market?

The immunoglobulin segment dominated the market with the largest revenue share in 2024. Immunoglobulins are the most important plasma-derived proteins that are mainly classified into two forms: intravenous immunoglobulin (IVIg) and subcutaneous immunoglobulin (SCIg). These products find extensive application in the treatment of various immune deficiencies, autoimmune disorders, neurological disorders, and infectious diseases. These treatments provide passive immunity using antibodies, assisting patients with weakened or hyperactive immune systems.

New technologies in plasma collection and purification have improved the safety and efficacy of immunoglobulin products, contributing to their widespread clinical use. Furthermore, an aging global population and an increased incidence of immune deficiency conditions have driven high demand. The segment is also expanding due to reimbursement policies and increased awareness among healthcare providers.

The coagulation factors segment is expected to grow at a significant CAGR over the forecast period. The increasing number of cases of hemophilia and other inherited blood disorders are driving the growth of the segment. Factor VIII and Factor IX are essential coagulation factors that are responsible for blood clotting. Plasma-derived proteins help the blood to clot and avoid excessive bleeding. Advances in treatment regimens, including prophylaxis and gene therapies, have revolutionized patient care, increasing demand for coagulation factor products.

Additionally, rising awareness, increased diagnosis rates, and expanded reimbursement programs are fueling market growth. The availability of recombinant and plasma-derived coagulation factors ensures a diverse product pipeline to meet varying patient needs. Ongoing research into new treatments for rare blood disorders and alternative delivery methods further support segmental growth.

Application Insights

What Made Hemophil the Dominant Segment in the Market?

The hemophil segment dominated the plasma therapeutics market with a major revenue share in 2024. Hemophilia is a hereditary bleeding disorder that is caused by a failure of the body to make enough clotting factors, resulting in prolonged bleeding episodes that must be managed throughout one's lifetime. Development of new technologies of plasma collection, purification, and fractionation has greatly enhanced the safety, quality, and effectiveness of these clotting factor treatments.

Fractionation techniques involve very low risks of pathogen transmission, and newer products like longer half-life clotting factors reduce the number of infusions needed, improving patient compliance and quality of life. Demand has also been boosted by the growing population of known hemophilia patients and increased awareness of the condition. These factors together are ensuring the continued dominance of the hemophilia segment within the market.

The primary immunodeficiency diseases segment is expected to grow at the fastest CAGR over the forecast period, driven by increasing awareness, better diagnosis, and an increased range of treatment. Plasma-derived immunoglobulin therapies are crucial in managing these conditions, providing passive immunity and reducing the frequency and severity of infections. Recent advances in diagnostic methods, such as genetic testing and immunophenotyping, have enabled earlier and more accurate diagnosis of PIDD cases globally. Furthermore, a greater understanding of the benefits of plasma-derived immunoglobulins has spread among healthcare professionals and patients, leading to wider use of these products. Less invasive methods, like subcutaneous immunoglobulin (SCIg), is more flexible than intravenous administration and promotes treatment adherence, supporting segmental growth.

Region Insights

Why did North America Dominate the Plasma Therapeutics Market in 2024?

North America dominated the market by holding the largest share in 2024. This is mainly due to its strong healthcare policies and regulatory frameworks that facilitate the broad access of patients to plasma therapeutics. The U.S. and Canada have well-established hospitals and plasma collection centers equipped with the latest technology, enabling the production of high-quality plasma-derived products, including immunoglobulins, clotting factors, and albumin. The availability of reimbursement policies and customized health insurance in the region support the adoption of these therapies, particularly for chronic and rare diseases. The FDA regulates the safety and efficacy of plasma products and therapies or medicines based on plasma proteins to ensure the quality of these treatments, bolstering market growth.

Why is Asia Pacific Experiencing the Fastest Growth in the Plasma Therapeutics Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The rising demand for plasma-derived therapies is driven by the large and aging populations in the region, coupled with increased awareness of chronic and rare diseases. Conditions such as hemophilia, primary immunodeficiencies, autoimmune diseases, and neurological disorders are becoming more prevalent, necessitating effective plasma-based therapies.

With growing healthcare needs, most countries in the region are actively investing in plasma collection and processing facilities. In addition, expanding infrastructure, developments in healthcare systems, improved regulatory frameworks, and government initiatives to promote plasma donation are contributing to the growth of the plasma therapeutics market in the region.

- In June 2024, Plasmagen Biosciences Private Limited, a Bengaluru-based company, introduced Haemocomplettan P (Human Fibrinogen Concentrate), a medicine to prevent the clotting of blood during heart and liver transplantation surgery.

(Source: https://health.economictimes.indiatimes.com)

What are the Key Trends in the European Plasma Therapeutics Market?

Europe is considered to be a significantly growing area. There is a high demand for plasma-derived therapies in the region for the treatment and management of rare, chronic, as well as various life-threatening conditions. The increasing prevalence of conditions like hemophilia, primary immunodeficiency diseases, autoimmune disorders, and neurological conditions are boosting the demand for plasma therapeutics. Germany is recognized as one of the most prominent players in the European market because of its developed healthcare system, high-level research potential, and favorable regulatory framework. Germany's reimbursement policies and patient access programs ensure that therapies are affordable and accessible to many patients. European nations are investing in healthcare system development, donor recruitment, and the implementation of high safety standards for plasma collection and processing, contributing to regional market growth.

Recent Developments

- In June 2024, Biotest, a Grifols subsidiary, announced that the U.S. FDA had approved its plasma protein therapy Yimmugo. Yimmugo is an intravenous immunoglobulin product that was produced as a replacement therapy in primary antibody deficiency syndromes. (Source: https://www.pharmaceutical-technology.com)

- In April 2024, Kedrion Biopharma extended its plasma collection facilities across Europe, boosting its production capabilities to meet the rising demand for plasma-derived therapies as well as significantly enhancing supply chain efficiencies. (Source:https://www.prnewswire.com)

- In May 2023, PlasmaGen Biosciences, a biopharmaceutical firm focused on blood plasma-derived pharmaceutical products in India and emerging markets, celebrated the official inauguration of the company's new manufacturing plant for blood plasma-derived protein therapeutics located in Kolar, Bengaluru.(Source:https://www.theindustrial.in)

Plasma Therapeutics Market Companies

- ADMA Biologics Inc.

- Bio Products Laboratory Ltd.

- BIOPHARMA PLASMA

- CSL Ltd.

- Emergent BioSolutions Inc.

- Evolve Biologics Inc.

- Grifols SA

- Kamada Ltd.

- Kedrion Spa

- Octapharma AG

- Pfizer Inc.

- Prothya Biosolutions Netherlands BV

- SK Inc.

- Takeda Pharmaceutical Co. Ltd.

Segments covered in the report

By Product Type

- Immunoglobulin

- Albumin

- Coagulation factors

By Application

- Hemophil

- Idiopathic

- Primary immunodeficiency diseases

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting