What is the Blood Plasma Derivatives Market Size?

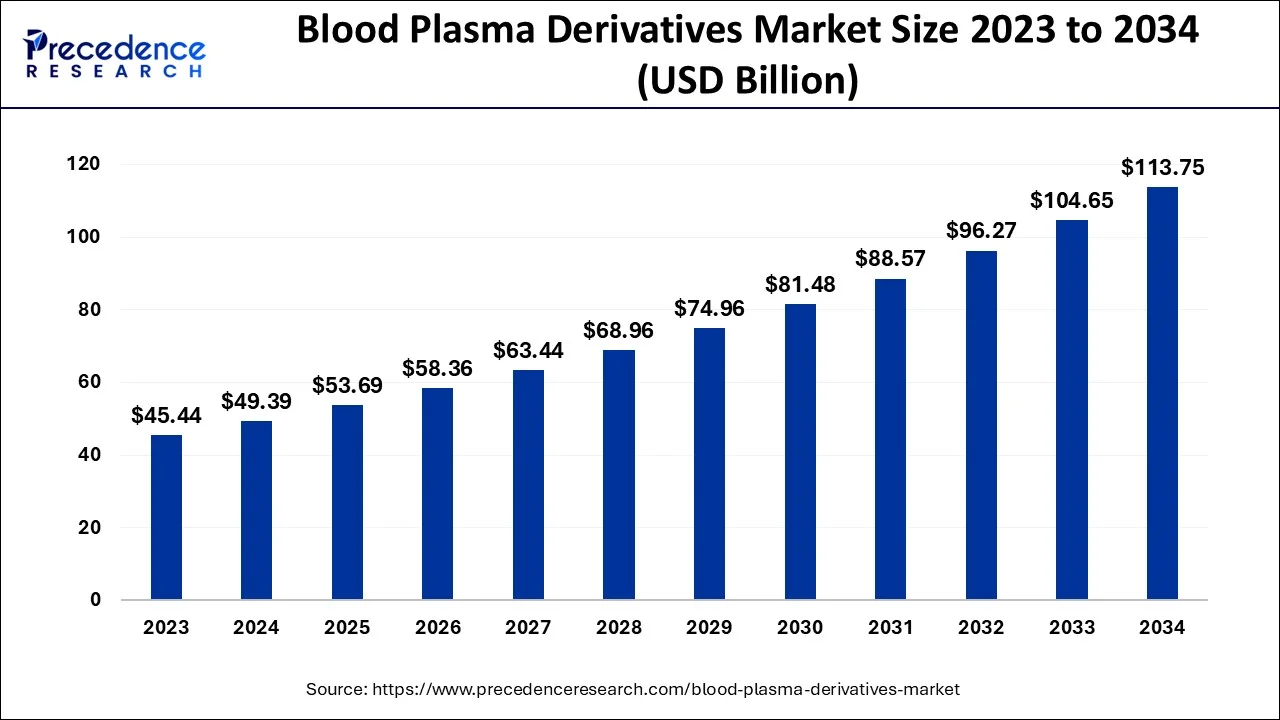

The global blood plasma derivatives market size is calculated at USD 53.69 billion in 2025 and is predicted to increase from USD 58.36 billion in 2026 to approximately USD 122.37 billion by 2035, expanding at a CAGR of 8.59% from 2026 to 2035.

Blood Plasma Derivatives Market Key Takeaways

- By type, the Immunoglobulin was the highest contributor in 2025 and accounted for 48% of the revenue share.

- By application, other applications accounted for 39% market share in 2025.

- By end user, the hospital segment accounted for 63% market share in 2025.

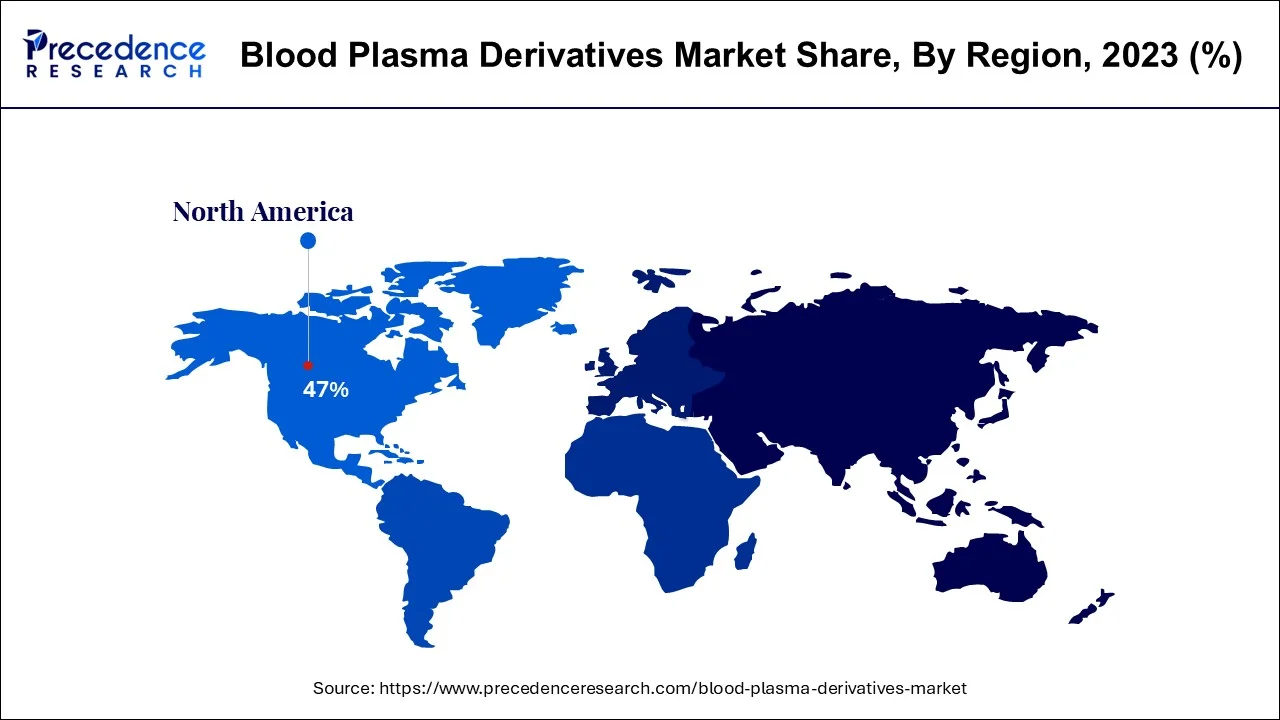

- The North America region has captured the highest revenue share of over 47% in 2025.

Blood Plasma Derivatives Market Growth Factors

The worldwide blood plasma derivatives market is noticing energetic development by expanding instances of hemophilia combined with the upgrade in the wellbeing-related issues because of the evolving way of life. Further, rising medical services consumption and expansion in immunodeficiency sicknesses are assessed to help the development of the market. Furthermore, rising government drives for plasma collection and its effective use and expanded mindfulness among individuals are driving the development of the market.

Factors, for example, rising interest in the innovative work, development of medical services areas, developing pace of geriatric populace, and expanding reception of plasma inferred items are expected to raise the pieces of the pie. The expansion in the number of endorsements for blood plasma derivatives drives the development of the market. Furthermore, a flood in the number of clinical examinations for assessing security and proficiency of a wide scope of restorative medications is expected to contribute to the development of the global market.

As indicated by the diary of BMC Infectious Disease, in November 2021, it was accounted for that the healing plasma treatment is utilized for the patient contaminated with the COVID-19. The Meta - investigation clinical preliminary is led to breaking down the proficiency and adequacy of recuperating plasma. The outcome shows the decline in the death rate in COVID-19 patients by gaining strength plasma treatment.

Besides, ascend in R&D exercises to foster high-level plasma inferred items is supposed to give gainful open doors to the extension of the worldwide market during the conjecture time frame. In addition, the presence of key assembling organizations to make and disperse plasma items and ascend in consumption of medical care items move the development of the market. Drives have been taken by the government and confidential associations to foster the drug industry and push the development of the market. In any case, the secondary effects caused because of the purpose of blood plasma derivatives, for example, unfavorably susceptible conditions, dazedness, quick pulses, and brevity in breath are supposed to confine the blood plasma derivatives market development during the figure time frame.

As per WHO, out of 250,000 individuals diagnosed to have PID (primary immune deficiencies) in the USA in 2017, roughly 125,000 get month-to-month mixtures of immunoglobulins and it is assessed that more than 300,000 patients overall get month-to-month immunoglobulins implantations for PID. The rise in chronic conditions and increasing demand for immunoglobulin drive the development of the blood plasma derivatives market.

WHO also appraises that the global population over 60 years will almost twofold from 12% to 22% somewhere in the range between 2015 and 2050 and 80% of the aging population will be living in middle-income nations in 2050. The expansion in the maturing population around the world might trigger a spike in infections that require plasma treatment. Accordingly, an ascent in the geriatric populace will assist the development of the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 53.69 Billion |

| Market Size in 2026 | USD 58.36 Billion |

| Market Size by 2035 | USD 122.37 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.59% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, End-User, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and the Middle East & Africa |

Segment Insights

Type Insights

The immunoglobulin portion ruled the blood plasma derivatives market in 2025, some of the elements driving the development of the North American blood plasma derivatives market are the rising utilization of plasma-derived products, the presence of leading driving players, the strategic developments made by the organizations in this region and this pattern is supposed to go on during the gauge time frame, inferable from advancements in R&D exercises in the medical care area and expansion in the predominance of safe lacking issues. Nonetheless, the albumin fragment is supposed to observe impressive development during the conjecture time frame because of expansion in egg whites item use for non-restorative application and ascend in the reception of albumin items.

Application Insights

The other application fragment was the significant benefactor in 2025 and is supposed to keep up with its lead during the conjecture time frame, attributable to increment in the commonness of irresistible infection, and expansion popular for plasma determined items. In any case, the immunodeficiency infections fragment is supposed to observe significant development during the conjecture time frame, inferable from ascending in the predominance of safety issues and development in medical services use.

End-User Insights

The hospitals' fragment ruled the blood plasma derivatives market in 2023, and this pattern is supposed to go on during the conjecture time frame, attributable to increment in the predominance of the constant and irresistible, for example, immunodeficiency turmoil, hemophilia, and drive taken by the government and confidential association to foster development medical care area. Nonetheless, the center portion is supposed to observe extensive development during the estimated time frame, attributable to an increment in the number of facility areas.

Regional Insights

U.S. Blood Plasma Derivatives Market Size and Growth 2026 to 2035

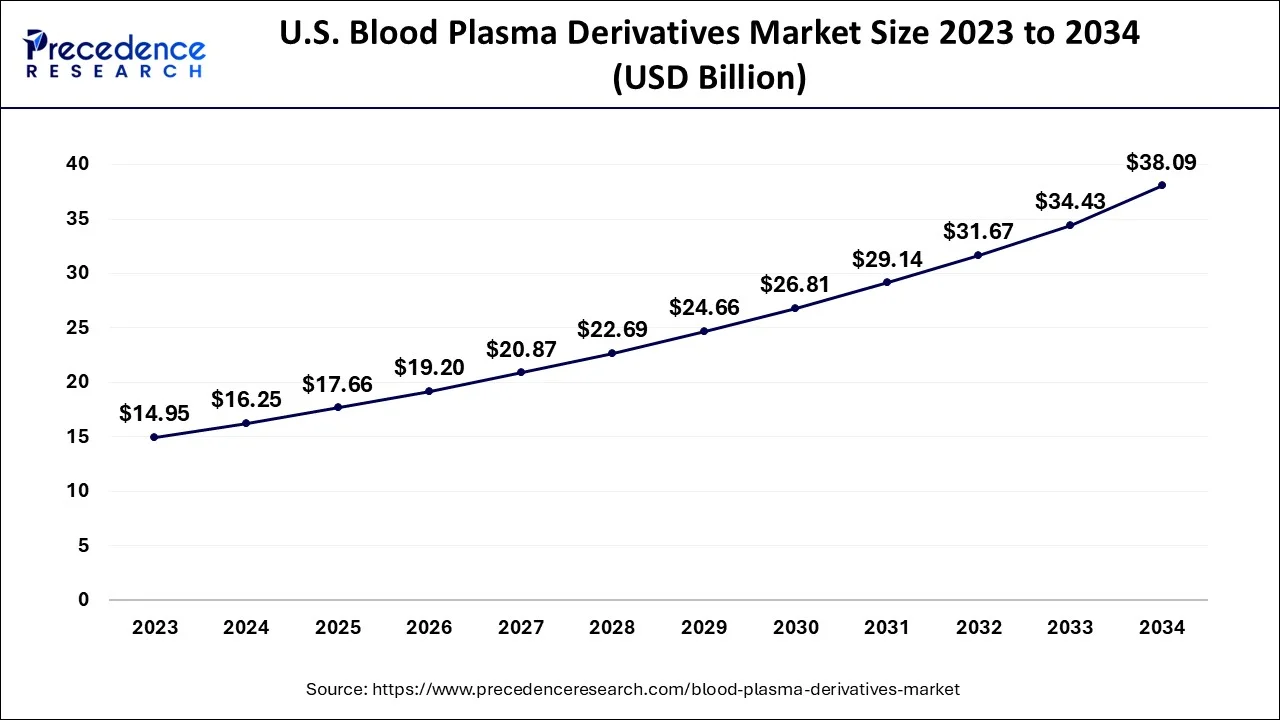

The U.S. blood plasma derivatives market size is evaluated at USD 17.66 billion in 2025 and is predicted to be worth around USD 41.15 billion by 2035, rising at a CAGR of 8.83% from 2026 to 2035.

How Does North America Dominate the Blood Plasma Derivatives Market in 2025?

North America dominated the market with the largest share in 2025, owing to its well-established healthcare infrastructure, extensive plasma collection network, and significant R&D investments. There is a high demand for treatments for rare and immune disorders in this region, which further boosted the need for blood plasma derivatives. Moreover, supportive regulatory frameworks and several initiatives by biopharma leaders are likely to continue market growth.

- In November 2025, CSL, the global biopharma leader, planned to expand its U.S. presence with investments of approximately US$1.5 billion in American capital over the next five years. This investment aims to strengthen the manufacturing capabilities of plasma-derived therapies in the U.S., create hundreds of American jobs, and help secure the U.S. medicine supply chain.

What Makes Asia Pacific the Fastest-Growing Region in the Blood Plasma Derivatives Market?

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period, driven by national initiatives, collaborations, and investments across several countries in the region. Asian Pacific countries such as India, Indonesia, China, South Korea, and Japan aim to enhance the supply and regulation of blood plasma derivatives. The region also benefits from high demand for plasma-derived therapies driven by a growing aging population and prevalence of chronic and immunological disorders.

India is considered a major player in the market within Asia Pacific.

- In November 2025, the Indian Pharmacopoeia Commission (IPC) launched a nationwide effort to improve the safety and quality of blood transfusion services and to promote the safe use of blood and its components. This initiative aims to ensure compliance with both national and international quality standards for blood and its components.

Why is Europe Considered a Significant Region in the Blood Plasma Derivatives Market?

Europe is a significant region in the market. The European market is driven by its advanced healthcare infrastructure, high plasma donation awareness, and the prominent presence of leading biopharmaceutical companies. The region also benefits from strong regulatory frameworks.

- In December 2025, the Paul-Ehrlich-Institute released a report on the supply of blood and blood products for 2024. The new EU Regulation on Substances of Human Origin aims to enhance the resilience and security of the European plasma supply.

What are the Major Factors Contributing to the Blood Plasma Derivatives Market Within Latin America?

The market in Latin America is driven by the increasing incidence of bleeding disorders, immunodeficiency, and other chronic/hematological diseases, which drives demand for therapies based on immunoglobulins, clotting factors, albumin, and other plasma-derived products. In June 2025, the Pan American Health Organization (PAHO/WHO) reported a progressive increase in voluntary blood donations across Latin America and the Caribbean, aiming to resolve challenges in achieving 100% voluntary donations.

What Opportunities Exist in the Middle East & Africa for the Blood Plasma Derivatives Market?

The Middle East & Africa (MEA) offers significant opportunities for the market, driven by public-private collaboration aimed at establishing an integrated plasma-supply platform in the region. Rising healthcare infrastructure development, such as blood storage facilities, a plasma laboratory, purification plants, and a plasma fractionation plant, also drives market growth. Additionally, rising awareness among patients and medical professionals of rare diseases, immune disorders, and the benefits of plasma‑based therapies, coupled with improved diagnostics and treatment programs, boosts the uptake of plasma‑derived treatments.

Value Chain Analysis

R&D:The R&D process for blood plasma derivatives encompasses discovery and pre-clinical research, clinical development, manufacturing and quality control, and regulatory approval and commercialization.

- Key Players: CSL Behring, Grifols, Takeda Pharmaceutical Company, Octapharma, Kedrion Biopharma, and Biotest AG.

Distribution to Hospitals, Pharmacies: The various distribution channels, including hospitals, specialty clinics, home care providers, and others, focus on delivering inpatient and outpatient treatments and specialized healthcare services.

- Key Players: CSL Limited, Grifols S.A., Takeda Pharmaceutical Company Limited, Octapharma AG, Kedrion Biopharma.

Patient Support and Services: These services consist of patient assistance programs, reimbursement help, home infusion options, and educational materials.

- Key Players: CSL Behring, Grifols, Kedrion Biopharma, Octapharma, Takeda Pharmaceutical Company.

Blood Plasma Derivatives Market Top Companies

- Bayer AG

- Biotest AG

- CSL limited

- Fusion Health Care Pvt. Ltd.

- Grifols, S.A.

- Kedrion Biopharma, Inc.

- LFB S.A.

- Octa Pharma AG

- Sanofi

- Takeda

Recent Developments

- In November 2025, CSL Limited planned the investment of approximately $1.5billion in the U.S. to advance manufacturing of plasma-derived therapies.

(Source: newsroom.csl.com) - In October 2025, Grifols Biotest introduced an innovative intravenous immunoglobulin (IVIg) therapy called Yimmugo in the U.S. for treating primary immunodeficiencies.

(Source: grifols.com)

Segments Covered in the Report

By Type

- Albumin

- Factor VIII

- Factor IX

- Immunoglobulin

- Hyperimmune Globulin

- Others

By Application

- Haemophilia

- Hypogammaglobulinemia

- Immunodeficiency Diseases

- Von Willebrand's Disease

- Other

By End-User

- Hospitals

- Clinics

- Other End Users

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting