AR VR Software Market Size and Forecast 2025 to 2034

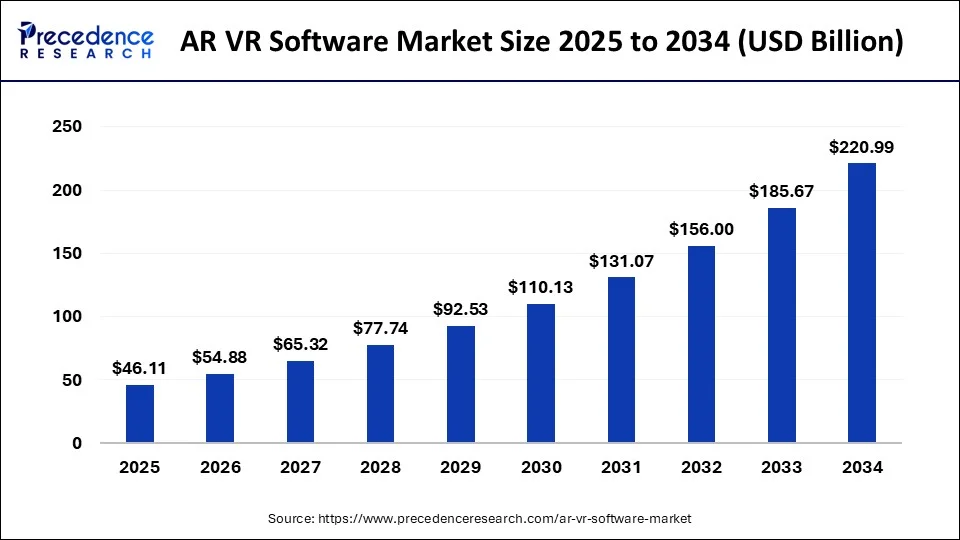

The global AR VR software market size was recorded at USD 38.74 billion by 2024, and is anticipated to hit around USD 46.11 billion by 2025, and expected to reach around USD 220.99 billion by 2034, at a CAGR of 19.02% from 2025 to 2034. The rising demand for content management systems across the world is driving the growth of the AR VR software market.

AR VR Software Market Key Takeaways

- In terms of revenue, the market is valued at USD 46.11 billion in 2025.

- It is projected to reach USD 220.99 billion by 2034.

- The market is expected to grow at a CAGR of 19.02% from 2025 to 2034.

- Asia Pacific led the AR VR software market with the highest share in 2024.

- By region, North America is expected to attain the fastest rate of growth during the forecast period.

- By technology type, the AR software segment held the largest share of the market in 2024.

- By technology type, the VR software segment is expected to grow with the highest CAGR during the forecast period.

- By software type, the game engine segment held a significant share of the market in 2024.

- By vertical, the media & entertainment segment dominated the market in 2024.

Market Overview

The AR VR software market is a prominent industry in the ICT sector. This industry deals in the development and distribution of various AR and VR software for different industries across the world. This industry comprises two types of technology, which mainly include AR software and VR software. The AR VR software industry consists of various software such as software development kits, game engines, modeling & visualization software, content management software, training simulation software, and other software. These software are used in several industrial verticals, including retail & e-commerce, media & entertainment, real estate, manufacturing, automotive, aerospace and defense, healthcare, and others. This industry is likely to grow significantly with the growth in the IT industry.

- According to Gitnux Report 2024, the number of VR consumers in the world is estimated to reach 216 million by 2025, and the healthcare sector is likely to invest US$ 5.1 billion during this period.

AR VR Software Market Growth Factors

- Growing developments related to the entertainment and media industry have led to growth in the AR VR software market.

- There has been a rise in a number of government initiatives related to the development of the IT and telecom industry across the globe.

- There is an ongoing trend of head-up displays and gesture-control devices.

- Rising use of AR software in the aerospace and defense sector for the development of platform designs.

- There are growing investments from public and private sector entities to develop the AR and VR software market.

- The advancements in AR and VR technologies impact industrial growth positively.

- The growing demand for AR and VR-supported devices across the world has accelerated the market in a positive way.

- The increasing adoption of AR and VR software in the healthcare sector.

- There are growing advancements in real-time rendering engines that generate 3D graphics.

- The increasing demand for AR and VR software from the real estate sector boosts market growth.

- The growing adoption of VR headsets around the world has driven the growth of the AR VR software market.

- Increasing proliferation of smartphones around the globe.

- Growth in gaming and entertainment: The demand for immersive experiences in the gaming industry is driving AR/VR software development. Improved graphics, real-time engagement, and immersive storytelling are increasing engagement and growth in the market.

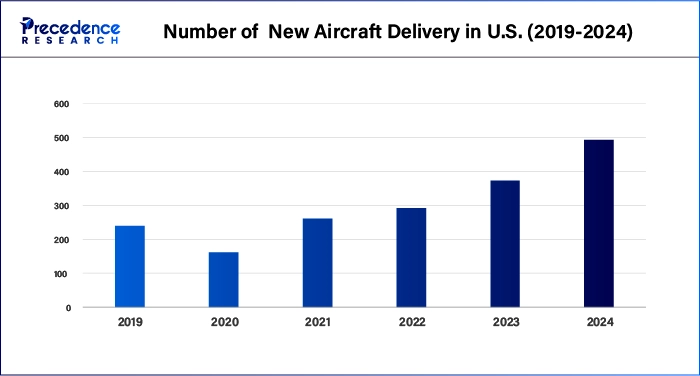

- Adoption in education and training: Educational institutions and organizations are adopting AR/VR for simulations and interactive learning. The ability to enhance knowledge retention and skill development will drive the market expansion, primarily in fields like medicine, engineering, and aviation.

- Innovation in healthcare and applications: AR/VR is having a profound impact on healthcare by accelerating surgical simulations, diagnostics, and therapies. This provides a hands-on tool for specific training in precision training and patient care, which facilitates adoption among hospitals and medical centers.

- Increased consumer demand for immersive retail: Retailers are adopting AR/VR software to create virtual try-ons, product demonstrations, and 3D showrooms. This increases customer experience and engagement, which will encourage more brands to continue to develop new AR/VR platforms.

What is the role of the AR VR Software Industry?

The advancements in AI technology play an important role in the growth of the IT industry. Nowadays, AR and VR software developers have started integrating AI into their apps to enhance personalization.AR and VR software combines AI for performing several functions in several sectors such as manufacturing, retail, military & emergency services, entertainment & gaming, and some others for enhancing the capabilities of AR and VR devices. Thus, the integration of AI in the AR and VR industry is expected to shape industrial growth in a positive way.

- In June 2024, Snap launched a new AI-enabled augmented reality solution. This solution is launched to provide users with generative AI capabilities to record videos from their smartphones.

Top 10 AR Platforms

- Niantic

- Adobe Aero

- Google ARCore

- MetaSpark

- Apple's Reality Kit

- NVIDIA XR Suite

- Unity

- Wikitude

- ARToolkit

- Sketchfab

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 220.99 Billion |

| Market Size in 2025 | USD 46.11 Billion |

| Market Size in 2024 | USD 38.74 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.02% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology Type, Software Type, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

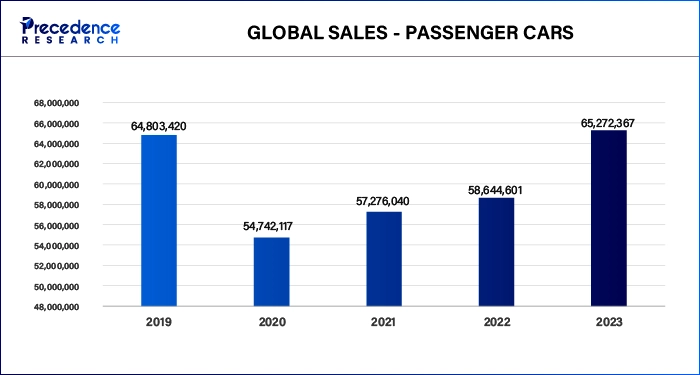

Rising demand for AR and VR software in the automotive industry

The use of advanced AR and VR software is increasing rapidly in several industries across the world. The application of AR and VR software in the automotive sector has increased for virtually designing cars before the start of the manufacturing process. Also, the use of AR and VR software helps automobile engineers identify problems earlier and helps in the cost-cutting of automotive companies. Moreover, the adoption of AR and VR solutions in vehicles, along with the increasing demand for different cars among people, has increased the application of AR and VR tools in the automotive sector. Thus, the rising usage of AR and VR software in the automotive industry is likely to drive the growth of the AR VR software market during the forecast period.

- In January 2023, Holoride launched Holoride Retrofit. Holoride Retrofit is a VR software solution that helps provide an enhanced visualization experience for all cars.

Restraint

Storage issues along with health concerns

The AR VR software industry has gained traction due to the growing usage of AR and VR tools around the world. Although there are numerous applications of AR and VR solutions, there are several problems in this industry. Firstly, the size of VR software is comparatively larger than that of other software, which causes storage-related issues among users. Secondly, the excessive use of AR and VR-supported devices can cause several health problems. Thus, storage concerns, along with health issues, are expected to restrain the growth of the AR VR software market during the forecast period.

Opportunity

Growing use of metaverse to change the outlook

Various developments are taking place in the technological sectors associated with the AR and VR industry. Nowadays, the trend of the metaverse is gaining prominent attraction among users, increasing the application of AR and VR software. The rising use of metaverse is mainly due to several factors such as immersion in digital communication, business development, learning and education, enhancing social media channels, virtual economy, and others. Thus, the increasing trend of the metaverse is expected to create ample growth opportunities for the market players in the years to come.

- In May 2024, ZF Group launched the employer branding metaverse. This launch aims to redefine the hiring process standards and showcase the authenticity of any brand.

Technology Insights

The AR software segment dominated the market in 2023. The rising demand for AR software from the IT industry to provide real-time remote assistance has driven market growth. Also, the growing application of AR software in the education sector to generate immersive learning by providing visuals to describe real facts among students is likely to propel market growth. Moreover, the increasing use of AR software in the healthcare sector to enhance surgical procedures, along with providing improved health training to medical staff, is expected to boost the growth of the AR VR software market during the forecast period.

- In June 2023, McGraw Hill announced a partnership with Verizon. This partnership is done to launch McGraw Hill AR software that enhances the learning experience using augmented reality technology.

The VR software segment is estimated to exhibit the fastest growth rate during the forecast period. The rising demand for VR software that allows risk-free practice to avoid hazardous situations has driven the market growth. Also, the increasing usage of VR software in enhancing communication and collaboration among students and teachers, along with providing safe learning environments, is likely to boost market growth to some extent. Moreover, the growing application of VR software to enable hands-on learning among working professionals in various industries is expected to propel the growth of the AR VR software market during the forecast period.

- In November 2023, Autodesk launched Autodesk Workshop XR, a virtual reality software for reviewing BIM models.

Software Type Insights

The game engine segment held a dominant share of the market in 2024. The growing trend of MMORPG games among people has increased the demand for game engine software to enhance the gaming experience, driving market growth. Also, the rising use of game engines by game developers to save time and costs associated with game development is likely to accelerate market growth to some extent. Moreover, the increasing demand for game engine software capable of producing HTML5/WebGL content for developing advanced games has boosted the market growth. Furthermore, the use of AR and VR-based game engines to provide high-quality graphics, multiplayer framework, blueprint visual scripting, full source code access, and some others is expected to propel the growth of the AR VR software market during the forecast period.

- In May 2024, Tencent launched Taris World. Taris World is an MMORPG game that supports iOS, Android, and Windows platforms & can be played on tablets, computers, and smartphones.

- In February 2024, AEXLAB launched the VAIL VR game engine. This VR-based game engine helps game developers for creating multiplayer games.

- In October 2023, Niantic launched the new Light Ship AR platform. Light Ship AR is a game engine that enables game developers to easily track and place objects using visual and mapping positioning.

Vertical Insights

The media & entertainment segment dominated the market in 2024. The demand for AR and VR software in the media & entertainment sector has increased for allowing 360-degree experience to spectators of any sports has driven the market growth. Also, the rising application of AR and VR apps in the filmmaking industry to overlay additional information and visual effects into the real-world environment for enhancing the viewing experience is likely to boost the market growth to some extent.

Moreover, companies' increasing use of AR and VR software to develop superior advertising strategies to attract numerous consumers propels market growth. Moreover, the growing trend of AR and VR headsets for enhancing the cinematic experience, along with their advantage in providing superior sports viewing angles and immersive music capabilities, has increased the demand for AR and VR software, thereby driving the growth of the AR VR software market during the forecast period.

- In April 2024, Akamai launched a new AR VR platform in the cloud. This platform is launched with the aim of enhancing productivity in the media and entertainment industry.

- In June 2023, Apple launched Vision Pro. Vision Pro is an augmented reality (AR) headset that comes with an M2 and R1 chip and is designed to abstain from motion sickness among users.

- In September 2022, Disney+ launched Remembering. Remembering is an AR-enabled short film that provides an immersive audio and video experience to users.

Regional Insights

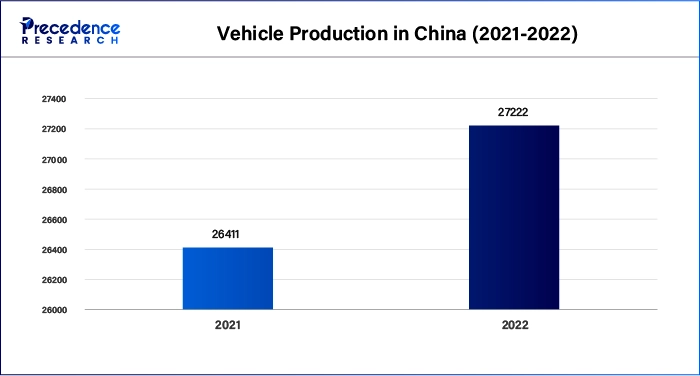

Asia Pacific dominated the AR VR software market in 2024. The rising investment in the gaming industry by private and public entities, along with the growing investment by the governments of several countries such as India, China, Japan, South Korea, Singapore, and some others for developing the retail and e-commerce industry, is expected to drive the market growth to some extent. Moreover, the increasing development in the healthcare and education sector has increased the demand for advanced AR and VR software, thereby driving market growth. Additionally, the rising development of the automotive sector in countries such as China, Japan, India, South Korea, Singapore, and some others is likely to boost the market growth to some extent.

- In July 2023, Sony made an announced to invest around US$ 2.17 billion for research and development for developing the gaming segment.

Furthermore, the presence of various local companies of AR VR software such as Intelivita Private Limited, Vostok VR, Monkhub Innovations, DeepAR, Psychic VR Lab, and some others are developing advanced AR and VR solutions across the Asia Pacific region, in turn, is expected to drive the growth of the AR VR software market.

- In January 2022, Psychic VR Lab announced a partnership with KDDI. This partnership is aimed at launching XRScape solutions for various industries in the APAC region.

North America is estimated to grow with the fastest CAGR during the forecast period. The growth of the market in this region is mainly driven by the rising advancements in the AI sector along with increasing investment by the government in countries such as the U.S. and Canada for developing the IT industry. The growing developments in the aerospace and defense sector, with the presence of several market players such as Boeing, L3 Harris, Lockheed Martin, Collins Aerospace, and some others, along with the rise in the number of real estate companies, have driven the market growth. Also, the rising development in the manufacturing sector in the U.S. and Canada has increased the demand for AR and VR software, thereby driving market growth to some extent.

- In April 2024, the U.S. government announced that it would invest approximately US$ 30 million. This investment will be made under the CHIPS and Science Act & Inflation Reduction Act for developing the overall IT industry across the country.

- The government of Canada announced an investment of US$ 2 billion in 2024 under the AI Compute Access Fund and a Canadian AI Sovereign Compute Strategy for developing the AI sector across the region.

- In January 2024, InVeris Training Solutions launched Fats VR in the U.S. Fats VR is an advanced VR-enabled training platform that allows enforcement professionals to prepare for critical situations.

Moreover, the presence of several local market players of AR VR software, such as Microsoft, Apple, Google, and some others, are constantly engaged in the development of high-quality AR and VR tools and adopting several strategies such as partnerships, acquisitions, collaborations, launches, and business expansions, which in turn drives the growth of the AR VR software market in this region.

- In May 2024, Google announced a partnership with Magic Leap. This partnership is aimed at developing high-quality AR and VR platforms for various industries.

AR VR Software Markets Top 10 Companies

- Microsoft

- Google LLC

- Apple, Inc.

- Meta

- Qualcomm

- Ultraleap

- Unity Technologies

- Hexagon AB

- Eon Reality

- Vectary

Recent Developments

- In October 2024, Luminous XR, a provider of immersive learning solutions and software, announced the launch of ‘FLOW,' a content creation tool designed for creators, developers, and enterprises to build custom virtual, augmented, and mixed reality (VR/AR/MR, collectively XR) training content. Together, FLOW and PORTAL provide users with a streamlined, end-to-end solution for creating, managing, and assessing XR training content. (Source- https://www.auganix.org)

- In December 2024, Google launched the Android XR platform for VR headsets and smart glasses. Android XR is built on the wider Android operating system that drives smartphones, tablets, Chromebooks, and Google TV media streamers. (Source:https://www.androidpolice.com)

- In November 2024, RealWear announced its acquisition of Almer Technologies, a Swiss company renowned for compact and user-friendly AR headsets. This move, backed strategically and financially by TeamViewer, a leader in enterprise AR software, aims to enhance AR solutions for frontline workers globally. (Source- https://www.fonearena.com)

- In July 2024, SailGP launched the SailGP app. The app features Augmented Reality (AR) and Virtual Reality (VR) to enhance consumers' viewing experiences.

- In June 2024, Hololight launched Hololight Hub. Hololight Hub is an enterprise-ready XR streaming platform that supports AR and VR applications to improve the experience of users.

- In May 2024, Ultraleap launched the Hyperion platform. This is a high-performance hand-tracker software that provides accuracy for leap motion controller two and AR/VR/XR headsets.

- In March 2023, Flipside XR launched Flipside Studio. Flipside Studio is a VR software that is used for developing real-time animated content that can be uploaded to various platforms, including YouTube, Twitch, TikTok, and others.

- In March 2022, Adobe launched AR and VR tools powered by Adobe Experience Cloud. These tools are developed to enhance the experience of the metaverse and digital e-commerce platforms.

Segments Covered in the Report

By Technology Type

- AR Software

- VR Software

By Software Type

- Software Development Kit

- Game Engine

- Modelling & Visualization Software

- Content Management Software

- Training Simulation Software

- Other Software

By Vertical

- Retail & E-commerce

- Media & Entertainment

- Travel & Hospitality

- Real Estate

- Manufacturing

- Automotive

- Aerospace and Defense

- Training & Education

- Healthcare

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting