What is the Molecular Computing Market Size?

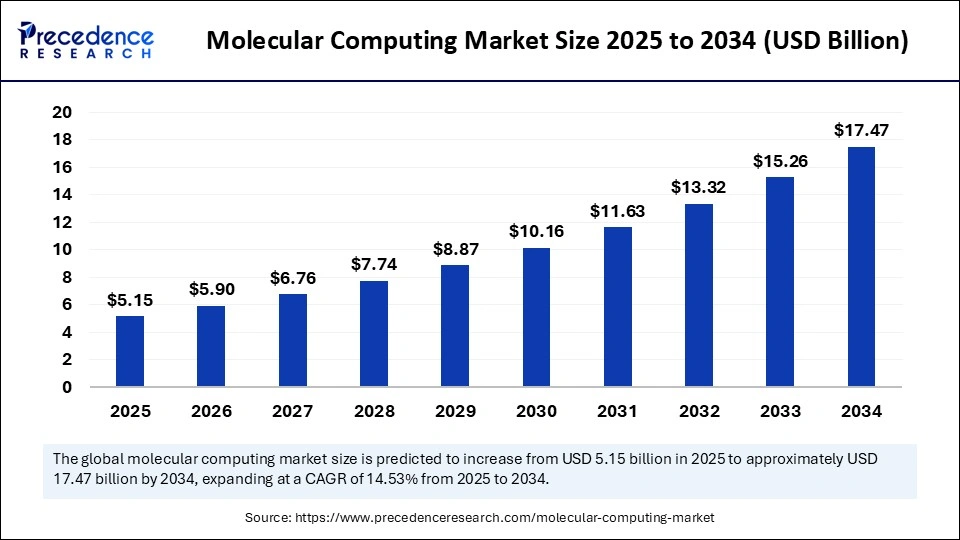

The global molecular computing market size accounted for USD 4.50 billion in 2024 and is predicted to increase from USD 5.15 billion in 2025 to approximately USD 17.47 billion by 2034, expanding at a CAGR of 14.53% from 2025 to 2034. The growth of the market is driven by growing demand for ultra-fast, energy-efficient computing solutions.

Market Highlights

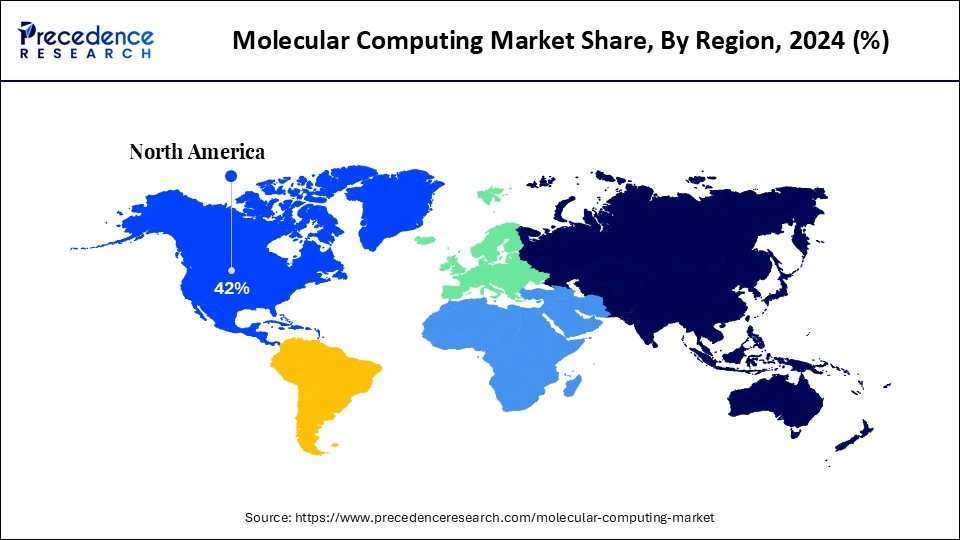

- North America dominated the global molecular computing market with the largest market share of 42% in 2024.

- The Asia Pacific is expected to witness the fastest growth during the forecasted years.

- By technology, the DNA computing segment led the market while holding a 45% share in 2024.

- By technology, the synthetic polymer / supramolecular computing segment is expected to grow at a 20% CAGR over the forecast period.

- By application, the drug discovery & molecular modeling segment captured a 35% revenue share in 2024.

- By application, the cryptography & data security segment is expected to expand at a 22% CAGR over the forecast period.

- By component, the molecular hardware segment led the market while holding a 40% share in 2024.

- By component, the platforms & integrated systems segment is expected to grow at the highest CAGR over the forecast period.

- By end-user, the academic & research institutes segment held a 38% share of the market in 2024.

- By end-user, the pharmaceutical & biotechnology companies segment is expected to grow at the fastest rate in the upcoming period.

Market Size and Forecast

- Market Size in 2024: USD 4.50 Billion

- Market Size in 2025: USD 5.15 Billion

- Forecasted Market Size by 2034: USD 17.47 Billion

- CAGR (2025-2034): 14.53%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Molecular Computing?

Molecular computing represents a new paradigm in computing, utilizing biological and synthetic molecules, including DNA, RNA, proteins, or highly engineered chemical structures, to execute computational tasks conventionally performed on silicon-based computers. This has created new horizons in computing capabilities, and the solutions are highly efficient and compact in handling complex problems, particularly in areas where high speed and minimal energy consumption are required. Its possible uses are in cryptography, artificial intelligence, drug discovery, medical diagnostics, nanorobotics, and material sciences.

Recent developments in nanotechnology and synthetic biology are enabling precision in the design and manipulation of molecules, and the practical implementation of molecular-based computing systems is becoming feasible. The increased energy consumption requirements of high-performance, energy-efficient computing solutions are compelling industries and research organizations to consider alternatives to silicon chip devices. The increasing interest in bio-compatible computing solutions for personalized medicine and nanorobotics further contributes significantly to potential.

AI Shifts in the Molecular Computing Market

Artificial intelligence is revolutionizing the molecular computing market by enhancing molecular computing's efficiency, scalability, and innovation. The implementation of AI algorithms now enables researchers to model or predict the structures of their molecules, optimize reaction paths, and design molecular circuits with greater accuracy, thereby reducing the scope of their experimental trial and error. Such synergy enables molecular computing systems to process datasets more efficiently in genomics, drug discovery, nanotechnology, and sophisticated materials sciences. Additionally, AI can accelerate the development and commercialization of molecular computing systems by providing actionable insights, optimizing experimental designs, and delivering scalable solutions.

Molecular Computing Market Outlook

- Industry Growth Overview: The molecular computing industry is set for accelerated growth from 2025 to 2034, fueled by breakthroughs in DNA computing, synthetic polymer technologies, and the integration of artificial intelligence. Key players driving this evolution include Microsoft Research, IBM Research, Illumina, Ginkgo Bioworks, and Twist Bioscience Corporation.

- Global Expansion: Global expansion, particularly into emerging markets, supports the molecular computing market by unlocking new avenues for research collaboration, biomanufacturing, and cost-efficient development environments. Additionally, growing investments in biotech infrastructure and digital transformation in these regions are accelerating the adoption of molecular computing technologies across healthcare, agriculture, and data storage applications.

- Major Investors: Molecular computing is being highly invested in by major technology companies, as well as venture capital firms and government agencies. The major funders are DARPA, NIH, NSF, and private financing from companies such as Ginkgo Bioworks, Twist Bioscience, and Microsoft Research, all of which are involved in DNA storage programs.

- Startup Ecosystem: Molecular computing is accelerating through startups in the areas of DNA synthesis, molecular hardware, and integration of AI. Major start-ups include Molecular Assemblies, Catalog DNA Computing, Evonetix, Roswell Biotechnologies, and Synthomics, which are assisting in the commercialization and application of research worldwide.

What Factors are Fueling the Growth of the Molecular Computing Market?

- Advances in Nanotechnology: Advances in nanotechnology enable the precise manipulation of individual molecules. It enables the production of miniaturized computing systems with high efficiency, increased storage and processing capabilities, leading to the development of markets and application opportunities in medicine, materials science, and biotechnology.

- Government/Private Sector Investment: Molecular computing research and startups are receiving funding from both the government and the private sector. Such strategic investments enhance technological development, infrastructure, and commercialization, leading to rapid market growth and the interest of multinational corporations in seeking next-generation computing solutions.

- Expansion in the applications of Healthcare and Biotechnology: The capability of molecular computing in handling complex biological information effectively assists in drug discovery, genomics, diagnostics, and personalized medicine. Increased usage in healthcare and biotech applications is driven by rising demand, innovation, and market expansion.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 4.50 Billion |

| Market Size in 2025 | USD 5.15 Billion |

| Market Size by 2034 | USD 17.47 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology / Type, Application, Component, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Alternative Computing

The growing need to replace traditional silicon-based computing is a major driving factor of the molecular computing market. Enabled by advancements in nanotechnology and synthetic biology, researchers can now manipulate molecules with precision, accelerating innovation across R&D and commercialization. The expanding applications in healthcare, drug discovery, genomics, diagnostics, and advanced materials further propel adoption. When combined with AI, molecular computing significantly boosts predictive modeling, optimization capabilities, and computational efficiency, positioning it as a compelling next-generation alternative. Additionally, robust support from government bodies, venture capital firms, and private investors is fueling infrastructure growth, research initiatives, and startup activity. Collectively, these dynamics are catalyzing rapid and sustained market expansion, establishing molecular computing as a high-performance, scalable, and sustainable platform for data-intensive industries worldwide

Restraint

Development Complexity

One of the primary factors hindering the growth of the molecular computing market is the significant technical complexity associated with developing and deploying such systems. Molecular computing is based on the precise control of molecules, such as those derived from DNA, RNA, proteins, or synthetic compounds. It requires advanced laboratory capabilities, nanotechnology, and expertise in synthetic biology. Molecular reactions cannot be controlled with precision and are therefore subject to error in their computation, resulting in reduced reliability. Additionally, lab prototypes are challenging and costly to scale up into a commercially viable system, which requires specialized equipment and well-trained staff. Other technical issues are how to integrate with existing silicon-based or traditional computing infrastructure. Research and development are also expensive, and commercialization is lengthy, which curtails market expansion.

Opportunity

Expanding Applications

The molecular computing market has significant potential applications in healthcare, biotechnology, and drug discovery. It can make breakthroughs in genomics, proteomics, and personalized medicine due to the ability to conduct ultra-dense parallel computations and process multifaceted biological data. Molecular computing can be used to accelerate drug discovery by simulating molecular interactions at previously unattainable speeds in mere seconds, thereby reducing research costs and shortening the timeframe. In diagnostics, it rapidly processes large amounts of data, helping to diagnose diseases early and develop a proper treatment strategy. Government initiatives, research grants, and investments by individuals to fund R&D processes and commercialization also help enhance opportunities.

Segment Insights

Technology Insights

Why Did the DNA Computing Segment Lead the Molecular Computing Market?

The DNA computing segment led the market, holding a 45% share in 2024, due to its unparalleled potential for massively parallel data processing, ultra-high-density information storage, and energy efficiency that far exceeds that of conventional silicon-based systems. DNA computing leverages the predictable properties of base-pairing and nucleotide self-assembly to perform massive parallel computations and store data in high density. The technology is especially useful in complex computational problems, especially in cryptography, bioinformatics, drug discovery, and combinatorial optimization. It is the preferred choice over other molecular platforms because of its high accuracy, stability, and scalability. The advancements in DNA synthesis, sequencing, and error-correcting technologies have improved performance, reliability, and commercial viability. Investments from government schemes, research projects, and individual investors have advanced innovation and uptake in the industry.

The synthetic polymer/supramolecular computing segment is expected to grow at a significant CAGR over the forecast period due to its modularity, flexibility, and potential for highly specialized uses. These systems are based on engineered chemical structures, which can be designed to perform desired computational tasks with desired properties. Advances in polymer chemistry, supramolecular assembly, and nanotechnology can provide a fine level of control over molecular interactions, enhancing performance, stability, and scalability. The use in targeted drug delivery, molecular sensing, nanorobotics, and smart materials, where tailorable molecular structures are necessary. The trend towards growing investments in research, cooperation between universities and startups, as well as rising venture capital investment, is driving growth.

Application Insights

How Does the Drug Discovery & Molecular Modeling Segment Hold the Largest Market Share in 2024?

The drug discovery & molecular modelling segment held a 35% share of the molecular computing market in 2024. This is mainly due to its high reliance on complex molecular modeling, large-scale data analysis, and simulation of biological interactions, all areas where molecular computing delivers superior efficiency and precision. Molecular computing can be used to perform ultra-dense parallel processing, allowing for the simulation of molecular interactions, the prediction of drug-target binding, and the optimization of compound structure more effectively than other computing methods. This has the potential to improve drug discovery cycles, minimizing the cost of experiments and enabling high-throughput screening, as well as complex molecular modeling, which is crucial for enabling precision medicine. Molecular computing provides a platform for tackling computationally intensive problems in chemistry and biology, offering a scalable and accurate solution that is an invaluable resource in drug design and modern molecular research.

The cryptography & data security segment is expected to grow at the fastest rate in the market, driven by its unmatched ability to execute highly complex encryption algorithms through massive parallelism and processing speed, capabilities that far exceed those of traditional silicon-based systems. Molecular computing enables ultra-secure data processing, high-density information storage, and strong error resistance, making it ideally suited for high-security domains such as financial services, cloud infrastructure, and government communications. Advances in synthetic biology, DNA computing, and AI integration are further expanding the segment's potential by supporting the development of secure cryptographic protocols and enabling real-time data protection at unprecedented levels. Additionally, the rising global demand for robust cybersecurity solutions, fueled by increasing concerns over data breaches and digital privacy, is accelerating the adoption of molecular computing in this space.

Component Insights

What Made Molecular Hardware the Dominant Segment in the Molecular Computing Market in 2024?

The molecular hardware segment dominated the market while holding a 45% share in 2024. This is because molecular hardware, such as DNA strands, synthetic polymers, proteins, and nanostructures, is crucial in computation. The increased demand for improved performance, as well as parallel-processing systems that can handle complex calculations in areas such as drug discovery, molecular modeling, and cryptography, is attributed to the dominance of this segment. The development of nanotechnology, synthetic biology, and methods of molecular fabrication has enabled the careful control of molecular assemblies, resulting in improved accuracy, scalability, and reliability of molecular hardware systems. Also, academic institutions, government programs, and business enterprises are making major investments in research and commercialization. The molecular hardware is the foundation of molecular computing platforms, leading to their adoption and technological advancement.

The platforms & integrated systems segment is expected to grow at a significant CAGR over the forecast period they simplify the operations of molecular computing. This segment encompasses software-based hardware systems, automated molecular synthesis systems, and computational interfaces that connect molecular hardware with analytical systems and AI-based systems. Integrated systems simplify complex molecular calculations, increase reproducibility, and permit real-time analysis of data, making them useful in drug discovery, genomics, and cryptography. Further growth is spurred in this segment by the continuous advancement of AI, automation, and high-throughput molecular technologies. Also, the growing need for scalable and easily accessible molecular computing solutions is driving startups, research, and technology firms to invest.

End-User Insights

Why Did the Academic & Research Institutes Segment Lead the Market in 2024?

The academic & research institutes segment led the molecular computing market, holding a 38% share in 2024. This is due to their central role in advancing foundational research, prototyping experimental computing models, and driving innovation in synthetic biology, nanotechnology, and DNA computing. The uses of molecular computing in these institutes include DNA computing, molecular modeling, genomics, and nanotechnology research. The segment's dominance is attributed to government funding, including grants, academic partnerships, and global research programs, in favor of next-generation computing solutions. Infrastructure, expertise, and human capital for designing, testing, and verifying molecular computing platforms are also provided through academic and research institutes.

Their contributions are critical in advancing theoretical frameworks, proof-of-concept studies, and early stages of commercialization efforts. Through innovative and developmental leadership, academic and research institutions are enhancing the adoption of molecular computing technologies, also providing a pipeline for how these technologies will be utilized in the future in healthcare, biotechnology, cryptography, and high-performance computing.

The pharmaceutical & biotechnology companies segment is expected to grow at the highest CAGR in the upcoming period. These firms utilize molecular computing to accelerate pharmaceutical discovery, molecular modeling, genomics, and precision medicine studies. The ability to perform ultra-dense and parallel computations enables the production of faster simulations of molecular interactions, high-throughput screening of compounds, and optimization of drug candidates, which significantly reduces development time and costs. Moreover, molecular computing is also being utilized to design biocompatible nanostructures, advanced therapeutics, and molecular diagnostics, which align with the increasing demands of personalized medicine. Pharmaceutical and biotech companies investing in next-generation computing platforms, academic institutions, and startup partnerships also accelerate adoption.

Region Insights

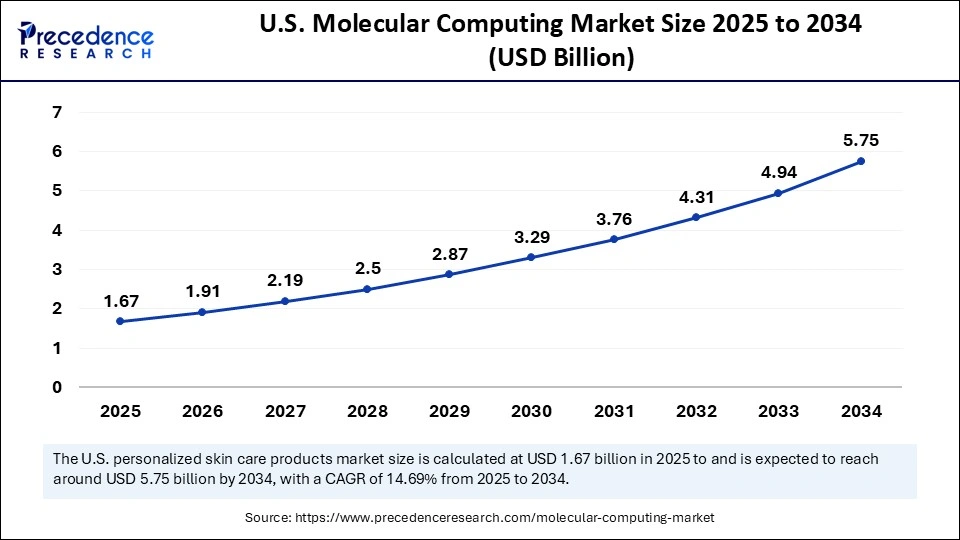

U.S. Molecular Computing Market Size and Growth 2025 to 2034

The U.S. molecular computing market size was exhibited at USD 1.46 billion in 2024 and is projected to be worth around USD 5.75 billion by 2034, growing at a CAGR of 14.69% from 2025 to 2034.

What Made North America the Dominant Region in the Molecular Computing Market?

North America dominated the global market with the highest market share of 42% in 2024. The region's dominance is attributed to its high investments in research and development, high technological infrastructure, and the presence of top academic and research institutions that focus on molecular computing, synthetic biology, and nanotechnology. The U.S. has universities, national laboratories, and private research centers that have developed groundbreaking work in the fields of DNA computing, molecular modeling, and biocompatible computing systems. Programs and grants provided by the federal government, such as the National Science Foundation (NSF) and the National Institutes of Health (NIH), have played a crucial role in funding next-generation computing research.

The U.S. is a major contributor to the North American molecular computing market, as it undertakes the majority of research, technology development, and investment. The favorable regulatory climate, a collaborative research environment, and strong intellectual property protection are facilitating the application of molecular computing in drug discovery, genomics, diagnostics, and high-performance computing applications among pharmaceutical, biotechnology, and technology firms in the U.S. Additionally, strategic alliances with university-startup-corporations help in the development of scalable molecular computing platforms. The current developments in AI, nanotechnology, and synthetic biology in the U.S. have continued to enhance the effectiveness, precision, and dependability of the system.

Why is Asia Pacific Considered the Fastest-Growing Region in the Molecular Computing Market?

Asia Pacific is expected to experience the fastest growth throughout the forecast period, driven by accelerated technological adoption, escalating research investments, and government-supportive initiatives. Innovations in next-generation computing technologies are being actively encouraged in countries such as Japan, South Korea, India, and Singapore, including DNA computing, molecular modeling, and platform-based systems utilizing synthetic polymers. The market is booming as the increased need for high-performance, energy-efficient computing in healthcare, drug discovery, genomics, cryptography, and advanced materials sciences is growing. The benefits of research and development, combined with the attractive regulatory environment, encourage both local and foreign-based firms to establish research centers and pilot manufacturing plants in the country.

China, as a dominant force in the Asia Pacific market, is emerging as a significant growth point in the molecular computing market. Research and commercialization are accelerated through intense government support, such as funding programs for nanotechnology, synthetic biology, and next-generation computing. Academic and industrial partnerships have also increased in China, which has been promoting innovation in DNA computing, molecular modeling, and synthetic polymer-based computing platforms. Pharmaceutical, biotechnology, and technology firms are moving towards molecular computing to discover drugs, genomics studies, and also in data security. The investment in high-performance computing infrastructure, AI integration, and laboratory automation in the country enhances capabilities and increases scalability.

Country-level Investments & Funding Trends for the Molecular Computing Market

- U.S.: The U.S. plays a leading role in molecular computing through substantial investments from both government entities and private stakeholders in areas such as DNA computing, molecular modeling, and synthetic biology research. Major funding initiatives from agencies like the NSF, NIH, and DARPA are accelerating commercialization, fostering startup ecosystems, and driving the integration of AI into molecular computing applications across healthcare, biotechnology, and high-performance computing domains.

- China: China is rapidly emerging as a significant investor in molecular computing, driven by government-backed initiatives and national programs focused on nanotechnology, synthetic biology, and next-generation computing research. To accelerate commercialization and regional market growth, universities, research institutes, and technology firms are actively developing DNA-based computing, molecular hardware, and AI-enhanced molecular platforms.

- Germany: Germany's focus on molecular computing centers on integrating molecular technologies with industry, healthcare, and the pharmaceutical sector. Research and development in DNA computing, molecular modeling, and bio-computation platforms are rapidly advancing, supported by public funding, EU research grants, and private-sector collaborations, positioning Germany as a European leader in molecular computing innovation.

Recent Developments

- In September 2025, Cadence Molecular Sciences (OpenEye) announced ROCS X at miniCUP Boston, an AI-powered virtual screening tool enabling 3D searches of trillions of drug-like molecules. Developed in collaboration with Treeline Biosciences, ROCS X has helped identify over 150 novel compounds for potential use in cancer drug development.(Source: https://www.cadence.com)

- In May 2025, Qubit Pharmaceuticals launched FeNNix-Bio1, a quantum AI foundation model designed to revolutionize molecular simulations in biomolecular and pharmaceutical research. Trained on synthetic quantum chemistry data, it integrates DFT, QMC, and CI methods to model interatomic forces, utilizing transfer learning for accurate scalability. The model was developed with support from exascale computing resources provided by GENCI, EuroHPC, and Argonne.(Source: https://quantumcomputingreport.com)

Top Vendors in Molecular Computing Market & Their Offerings

- Microsoft Research (DNA Storage Project): It plays a pioneering role in molecular computing through its DNA Storage Project, which focuses on encoding digital data into synthetic DNA for ultra-dense, long-term data storage. By advancing automation, error correction, and sequencing efficiency, Microsoft is laying the groundwork for scalable molecular-level data storage systems.

- IBM Research: IBM Research contributes to molecular computing by exploring molecular-level architectures and nanoscale devices for next-generation computation, including quantum-inspired and biologically relevant models. Their work integrates AI, materials science, and synthetic biology to enable future molecular computing frameworks with high efficiency and minimal energy consumption.

- Illumina, Inc.: Illumina supports the molecular computing ecosystem by providing industry-leading sequencing technologies that enable high-throughput DNA reading, which is essential for DNA computing and data retrieval. Its innovations in genomic analysis tools are critical for validating and optimizing molecular computations at scale.

- Ginkgo Bioworks: Ginkgo Bioworks is a synthetic biology company that engineers custom organisms, contributing indirectly to molecular computing through its automated biofoundry and programmable cell platforms. Its tools facilitate DNA synthesis and molecular circuit design, key enablers for bio-computational systems.

- Molecular Assemblies, Inc.: It specializes in enzymatic DNA synthesis, a critical capability for scalable and sustainable molecular data storage and computing. Their platform enables high-fidelity, sequence-specific DNA writing, directly supporting advancements in DNA-based computation and storage.

Molecular Computing Market Companies

- Molecular Assemblies, Inc.

- Catalog DNA Computing Inc.

- Cambricon Technologies

- Roswell Biotechnologies

- Helixworks Technologies

- Oxford Nanopore Technologies

- DNA Script

- NTT Basic Research Laboratories

- Evonetix Ltd.

- Synthomics Inc.

Exclusive Expert Analysis on the Molecular Computing Market

The molecular computing market is poised at a transformative inflection point, underpinned by the convergence of synthetic biology, nanotechnology, and next-generation information processing paradigms. As the limitations of silicon-based architectures become increasingly prohibitive, both in terms of miniaturization and energy efficiency, molecular computing offers a compelling post-CMOS alternative capable of addressing exponentially growing computational demands in data-intensive verticals. Advancements in DNA-based logic circuits, polymer-based memory systems, and quantum-informed molecular modeling are catalyzing a shift from theoretical constructs to commercially viable applications.

Strategic capital inflows from public and private sectors, alongside the maturation of enabling technologies such as enzymatic DNA synthesis, high-fidelity sequencing, and AI-enhanced molecular simulations, are accelerating translational R&D and early-stage commercialization. Key opportunities lie in high-throughput drug discovery, secure molecular-level data storage, cryptographic computing, and AI-native hardware architectures. With increasing participation from research institutions, startups, and incumbent tech and biotech giants, the market is positioned for robust, long-tail growth across healthcare, defense, and high-performance computing domains.

Segments Covered in the Report

By Technology / Type

- DNA Computing

- Quantum Dot Molecular Computing

- Protein-Based Computing

- RNA Computing

- Synthetic Polymer / Supramolecular Computing

By Application

- Cryptography & Data Security

- Drug Discovery & Molecular Modeling

- Diagnostics & Biosensing

- Nanorobotics & Smart Materials

- High-Performance Computing (HPC)

- Others (environmental monitoring, bioengineering)

By Component

- Molecular Hardware (molecular switches, gates, storage units)

- Molecular Software (algorithms, molecular coding systems)

- Platforms & Integrated Systems

- Services (consulting, R&D collaboration, custom solutions)

By End-User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Healthcare & Diagnostics Providers

- Defense & Security Organizations

- IT & Data Centers

- Nanotechnology & Material Science Companies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting