Artificial Disc Market Size and Forecast 2025 to 2034

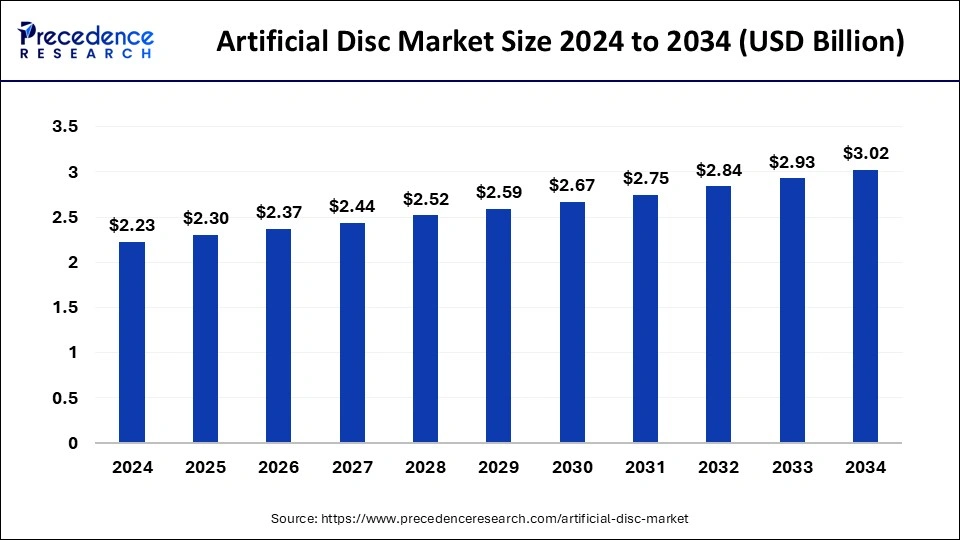

The global artificial disc market size was estimated at USD 2.23 billion in 2024 and is predicted to increase from USD 2.30 billion in 2025 to approximately USD 3.02 billion by 2034, expanding at a CAGR of 3.08% from 2025 to 2034. The increasing applications of artificial discs and a growing number of artificial disc replacement procedures considered viable for long-term therapeutic management support the market's growth.

Artificial Disc Market Key Takeaways

- The global artificial disc market was valued at USD 2.23 billion in 2024.

- It is projected to reach USD 3.02 billion by 2034.

- The artificial disc market is expected to grow at a CAGR of 3.08% from 2025 to 2034.

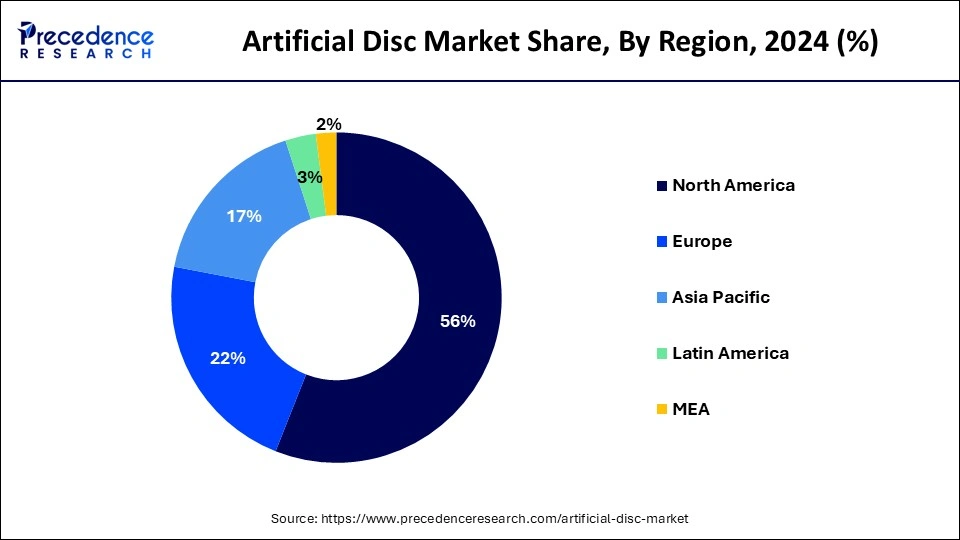

- North America held the largest market share of 56% in 2024.

- Europe is expected to witness notable growth during the forecast period.

- By type, the cervical artificial disc segment held a significant share in 2024.

- By type, the lumbar artificial disc segment is anticipated to witness notable growth during the forecast period.

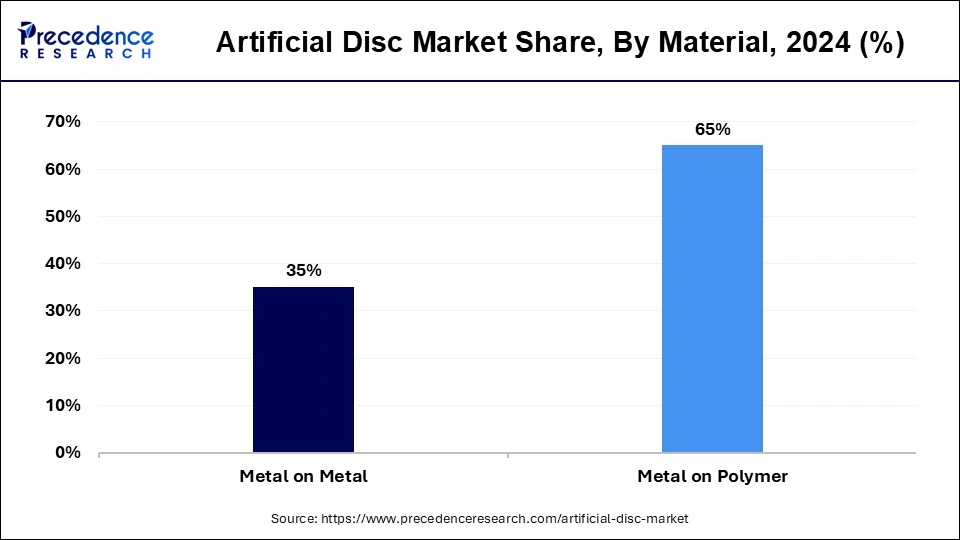

- By material, the metal-on-polymer segment dominated the market in 2024.

- By material, the metal-on-metal segment is projected to witness the fastest market growth during the forecast period.

- By indication, the degenerative spine diseases segment held a significant market share in 2024.

- By indication, the spinal trauma segment will experience significant growth over the forecast period.

- By end use, the ambulatory surgical centers segment has been the dominant force in the market throughout the study period.

- By end use, the hospital segment is expected to experience substantial growth in the market.

U.S.Artificial Disc Market Size and Growth 2025 to 2034

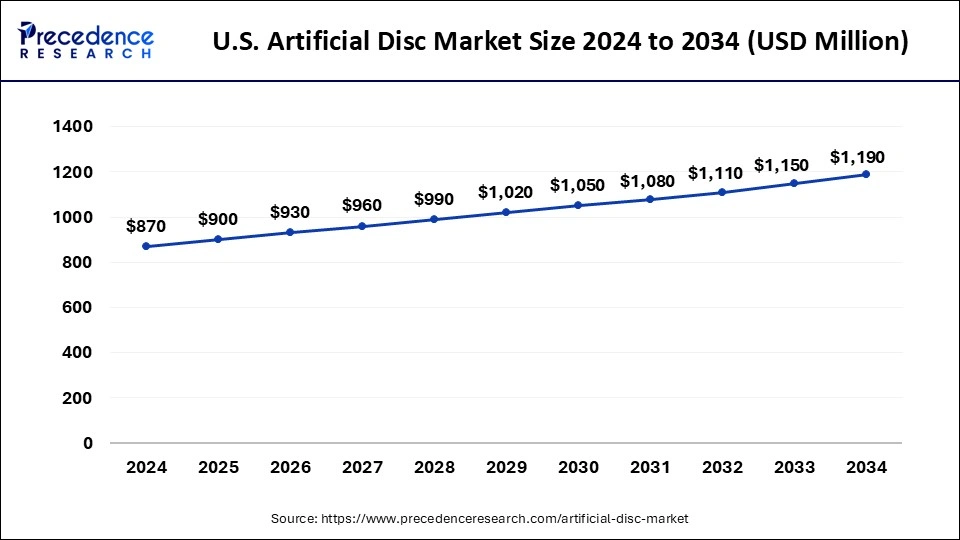

The U.S. artificial disc market size was exhibited at USD 870 million in 2024 and is projected to be worth around USD 1,190 million by 2034, growing at a CAGR of 3.18%.

United States artificial disc market trends

The aging population and growing degenerative disc diseases increase the demand for artificial discs. The advanced surgical facilities and well-developed healthcare systems help in the market growth. The growing healthcare expenditure and available funding for medical technologies like artificial discs drive market growth. The growing technological advancements in medical devices and favorable reimbursement policies for artificial disc replacement support the overall market growth.

Canada artificial disc market trends

Canada is significantly growing in the artificial disc market. The growing degenerative disc disease and aging populations increase demand for the artificial disc. The growing prevalence of spinal disorders like herniated discs, degenerative disc disease, and spinal stenosis helps in the market growth. The well-established healthcare infrastructure and presence of advanced medical technologies support the overall market growth.

North America held the biggest market share of 56% in 2024, owing to the presence of key players and advanced healthcare facilities in the United States and Canada. The region leverages extensive research, robust reimbursement systems, and a substantial patient population. Notably, the United States has spearheaded the adoption of artificial disc technologies. Anticipated growth in the North American market is fueled by a surge in degenerative bone diseases, an uptick in lower back syndromes, and heightened awareness of effective spinal disc replacement procedures. Primary healthcare providers are actively enhancing accessibility to meet the rising demand for disc replacement procedures, further propelling regional growth.

A research study published in the European Spine Journal in 2022 estimated a prevalence of lower back pain (LBP) at 1,362.08 cases per 100,000 people in the North American population. The increasing number of patients seeking diagnosis and treatment for spinal disc correction, coupled with government reimbursements supporting the adoption of disc implants, is contributing to the growth of the artificial disc market in North America.

Europe is expected to witness notable growth during the forecast period. This growth is driven by the increasing patient population in the region seeking disc replacement surgeries, which is propelled by a rising number of elderly individuals more susceptible to bone disorders like scoliosis and degenerative disc diseases. This trend, coupled with well-equipped surgical centers, a range of products from key market players, and a higher disposable income among patients, is expected to drive growth in the region. The upsurge in the geriatric demographic and the associated risk of bone disorders are foreseen to contribute significantly to the increased demand for surgical procedures aimed at the long-term management of spinal issues. Furthermore, the region's higher disposable income and the adoption of innovative surgical methods for spinal disc replacement are anticipated to bolster growth further.

- Europe is estimated to have 1,127.05 cases of lower back pain for every 100,000 individuals of the European population.

How is Germany a major contributor to the artificial discs market?

Germany is a major contributor to the advanced healthcare system. The presence of advanced medical technologies and well-established healthcare systems helps the market growth. The growing adoption of new medical technologies increases demand for artificial discs. The focus on cutting-edge.

surgical techniques and the presence of advanced neurospinal clinics increases demand for the artificial disc. The growing prevalence of degenerative disc disorders and spinal disorders increases demand for artificial disc replacement. The extensive social insurance system and reimbursement policies make artificial disc replacement affordable. Technological advancements in artificial disc designs and a less expensive process of replacement support the overall growth of the market.

Market Overview

An artificial disc is a part of arthroplasty implanted into the cervical or lumbar spine to imitate the function of injured intervertebral discs. It comprises two endplates of materials like titanium alloy, cobalt-chromium, or medical-grade polyethylene. The flexible and compressible device enables movement and flexibility while minimizing back strain. A better understanding of degenerative disc diseases and spinal-related ailments increases the demand for the artificial disc market.

The artificial disc restores a more natural range of motion and relieves back pain. Artificial disc replacement surgery involves inserting the prosthetic disc and removing the damaged disc. The specific design of artificial discs is Mobi-C, Prodisc-L, Bryan, and Prestige. The function of artificial discs is restoring spinal motion, relieving pain, stabilize the spine, and preventing adjacent segment degeneration. The different kinds of materials used for artificial discs are metal, polyethylene, and polycarbonate urethane. The metal artificial discs, like cobalt-chromium-molybdenum, offer durability and strength. The artificial disc, made up of polyethylene, is a low-friction and smooth material. The discs consist of polycarbonate urethane offers a more natural feel.

Artificial Disc Market Growth Factors

- Ongoing technological advancements, such as improved materials and designs for artificial discs, contribute to their widespread use and improved patient outcomes.

- The artificial disc market is experiencing growth due to the rising preference among consumers for minimally invasive surgeries, characterized by shorter recovery times, reduced hospital stays, and lower complication rates.

- The growing occurrence of degenerative disc diseases globally is expected to influence the situation positively.

- The market is expected to grow due to increased orthopedic surgeries, sports injuries, and trauma-related injuries.

- The market is also anticipated to grow due to the increasing aging population worldwide and the growing adoption of technology.

- The artificial disc market is poised for growth, driven by the increasing use of artificial discs and a rising number of artificial disc replacement procedures recognized as viable long-term therapeutic solutions.

- Market growth is expected to be fueled by the increasing demand for disc replacement surgeries and the higher success rates of artificial discs compared to traditional spinal implants.

Artificial Disc Market Trends

- The development of new biomaterials due to extensive research and the development of artificial discs has adopted innovative methods to find new materials like Polyether ether Ketone, advanced elastomeric compounds, and porous metals. Specialties of these materials include durability, biocompatibility, longevity, and bone-like elasticity. Due to these offerings, many healthcare companies are leveraging these new biomaterials to increase their safety, design, and efficiency in terms of working.

- Additive manufacturing or 3D printing is one of the popular methods used for creating personalized prosthetic discs as per the structure of the spinal anatomy of an individual. Customization in disc creation helps to resolve problems related to implant size and its proper placement, while offering integration and stability of the implant.

- The growing incidence of injuries related to the spinal cord is a major driving factor for the artificial disc market. Spinal cord injuries include trauma or harm to the spine structure, ligaments, nerves, and other parts of the spine, which are crucial. To tackle this issue, many companies are developing minimally invasive surgery to protect delicate tissues around the spinal cord and its structure.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.30 Billion |

| Market Size by 2034 | USD 3.02 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.08% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Material, Indication, End-use, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing prevalence of degenerative disc diseases

The increasing occurrence of degenerative disc diseases, like cervical and lumbar disc degeneration, is a crucial driver for the growth of the artificial disc market. Disc degeneration, often linked with aging, leads to persistent back and neck pain, affecting mobility and quality of life.

The global rise in the aging population is contributing to a higher prevalence of disc diseases, creating a significant demand for effective surgical solutions such as artificial disc replacement. Moreover, the artificial disc market is expected to grow with the increasing use of artificial discs and the number of artificial disc replacement procedures as effective long-term therapeutic solutions.

- In April 2022, the DISC Surgery Center in California, U.S., completed its 1000th artificial disc replacement procedure, marking a significant milestone with a 98% postoperative satisfaction rate. The surge in disc replacement surgeries and the higher success rates of artificial discs compared to traditional spinal implants are anticipated to drive the growth of the artificial disc market.

Minimally invasive spine surgery procedures

The growing acceptance of minimally invasive procedures, such as anterior cervical disc replacement with smaller incisions, is driving the adoption of artificial discs. These procedures result in less blood loss, shorter hospital stays, lower costs, and faster patient recovery than open surgeries. The appeal of these benefits is prompting many patients and surgeons to choose minimally invasive artificial disc replacement surgeries, contributing to the growth of the artificial disc market.

Restraints

High cost of cervical and lumbar artificial discs

The significant expense associated with artificial intervertebral discs and costly surgical procedures is a major obstacle impacting market growth. Artificial disc surgeries can cost between US$ 50,000 and US$ 70,000, depending on the disc type and region. These high costs restrict the number of patients who can afford the procedures, mainly due to economic factors. Additionally, the need for favorable reimbursement in developing regions further hampers the prospects of the artificial disc market.

Opportunities

Innovation and rise in demand for spinal procedures

The artificial disc market is predominantly fueled by innovations in technologies, driven by the increasing need for spinal therapies and expanding opportunities in fields like advanced predictive procedure planning algorithms and spinal robotic surgeries. The recent uptick in cervical disc injuries and corrective surgeries will contribute to market growth. Additionally, the growing global geriatric population, often developing spinal diseases due to frailty and other health issues, is increasing the number of patients seeking spinal diagnosis and opting for disc replacement procedures.

A research study published in 2022 by Acta Neurochirurgica revealed that around 33.5% of cervical spine injuries in the U.S. were treated with surgery. This indicates a growing preference among medical practitioners for corrective surgeries over traditional conservative treatment for such conditions. This shift is anticipated to boost the adoption of artificial discs and contribute to the market's growth.

New product launches and approvals

Manufacturers have significant growth opportunities by introducing new designs and models of artificial discs. The numerous product launches and approvals in recent years underscore the substantial potential in the market. Companies invest significantly in research and development to create advanced artificial discs and secure regulatory approvals. This strategic approach helps them gain a first-mover advantage and strengthen their position in the market.

- In October 2023, Silony Medical successfully acquired Centinel Spine's Global Fusion Business and related assets. This includes all of Centinel's cervical and lumbar fusion products, such as the STALIF technology platform. These products will now be integrated with Silony's Verticale posterior screw and rod fusion platform, along with its Roccia and Favo interbody fusion (IBF) systems.

Type Insights

The cervical artificial disc segment held a significant share in 2024. This is primarily due to the shift in preferences for minimally- or non-invasive therapies and the adoption of cervical disc replacements in comparison to lumbar disc procedures. The higher incidence of cervical injuries and lifestyle/work-related skeletal disorders contribute to the diagnosis of these conditions and the preference for spinal management. Moreover, market players are innovating implants specifically for cervical-oriented vertebral procedures to meet the greater demand, further fostering the growth of this segment.

The lumbar artificial disc segment is anticipated to witness notable growth during the forecast period. Artificial lumbar discs have the ability to preserve spinal motion while providing stability. In the past, fusion implants were used for lumbar disc implantation, offering stability but leading to longer rehabilitation times and impacting the patient's quality of life. The introduction of lumbar discs allows for managing nerve pinching, faster healing, and preserving spinal motility. This, coupled with a preference among experts for using lumbar discs in managing chronic lower back pain among a larger patient population, is expected to boost the growth of this segment.

- In January 2023, a new CPT add-on code for the second level of lumbar total disc replacement (TDR) procedures became effective and was issued by the American Medical Association. Centinel Spine is advancing lumbar motion preservation through clinical and product development initiatives.

Material Insights

The metal-on-polymer segment dominated the artificial disc market share of 65% in 2024. Many FDA-approved cervical total disc replacement implants in the U.S. use a combination of metal alloy-based endplates and a central core made of medical-grade plastic. This combination of metal and plastic has demonstrated a high success rate in artificial disc replacement procedures, contributing significantly to the market's expansion.

- In Feb 2023, Researchers in China developed a polymer with a metallic backbone that exhibits thermal stability, conductivity, and unique optoelectronic features. This breakthrough challenges the conventional notion that materials can be either metal or plastic, but not both. The findings were published in a scientific journal.

The metal-on-metal segment is projected to witness the fastest market growth during the forecast period. This indicates a strong preference for metal-based implants compared to other materials. Metal-based implants, including those made from cobalt, stainless steel, and titanium-based alloys, are widely used in various orthopedic implants. They are favored for being durable, cost-effective, and possessing excellent mechanical properties. Ongoing developments and research to create degradable metal-based implants are expected to boost the artificial disc industry further.

Indication Insights

The degenerative spine diseases segment held a significant market share in 2024. The increasing number of patients affected by this condition is anticipated to drive the global demand for artificial disc replacement procedures. The presence of degenerated discs in the lumbar spine raises the risk of chronic lower back pain, necessitating proper treatment. Chronic lower back pain substantially contributes to the healthcare burden, prompting several governments to introduce favorable policies.

The spinal trauma segment will experience significant growth over the forecast period. This is linked to the harm inflicted on the spinal cord, spinal column, or the bones encasing the spinal cord due to an injury. The spinal cord houses nerves responsible for transmitting messages between the brain and the body, and any damage can result in lasting alterations to bodily functions.

End-use Insights

The ambulatory surgical centers segment has been the dominant force in the artificial disc market throughout the study period. This is attributed to many spine surgeons operating in privately held or corporately managed ambulatory surgical centers. These settings offer surgeons greater flexibility in tailoring treatments for patients, shorter procedure times, and cost-effectiveness. Additionally, orthopedic surgeons can provide super-specialized treatments in these centers, surpassing the capabilities of more extensive hospital settings.

The hospital segment is expected to experience substantial growth in the artificial disc market, primarily due to the traditional preference of patients choosing treatment within the institutional system. Additionally, the increasing adoption of artificial disc procedures, more extensive medical infrastructure to meet growing surgical demands, and an efficient workflow to handle higher patient volumes contribute to the growth of the hospital segment in the market.

- In October 2023, McLeod Health initiated the construction of a new Ambulatory Surgery Center (ASC) at the McLeod Health Carolina Forest campus. This center aims to offer patients the convenience of same-day surgical procedures at a location that is easily accessible. The leadership, staff, public officials, and community members celebrated this significant development, recognizing its positive impact on the Carolina Forest and surrounding communities.

Artificial Disc Market Companies

- DePuy Synthes Companies (United States)

- Stryker Corporation (United States)

- Zimmer Biomet (United States)

- Globus Medical (United States)

- NuVasive, Inc. (United States)

- Alphatec Holdings, Inc. (United States)

- Aesculap Implant Systems, LLC (Germany)

- Orthofix Holdings, Inc. (United States)

- AxioMed LLC (United States)

- Spinal Kinetics, Inc. (United States)

- Paradigm Spine, LLC (United States)

- Joymax GmbH (Germany)

- Simplify Medical, Inc. (United States)

- Centinel Spine (United States)

- FH Orthopedics (France)

- X-spine Systems, Inc. (United States)

- LDR Holding Corporation (France)

- Medtronic (United States)

- Spineart SA (Switzerland)

- Ulrich GmbH & Co. KG (Germany)

Recent Developments

- On 23rd January 2025, a leading global medical device company, majorly focused on resolving issues with lumbar and cervical spinal disease, launched a clinically backed technology platform named TDR-total disc replacement. The company unveiled its highlights of the fourth quarter of 2024, with revenue generation of USD 30 million, showcasing 47% Y-O-Y growth. (Source: biospace.com )

- On 18th September 2024, NGMedical GmbH, a leading medical device manufacturer based in Germany and well known for its innovative technologies for spinal cord applications, launched, articulating viscoelastic cervical artificial disc MOVE-C, along with other unique spinal solutions, at the annual NASS meet held in Chicago and Eurospine in Vienna. (Source: orthospinenews.com

- In February 2024, NGMedical GmbH, a medical device manufacturer specializing in innovative spinal technologies, announced the sales launch and successful completion of the first surgery involving the MOVE-C Artificial Cervical Disc in the United Arab Emirates.

- In January 2023, the DISC Surgery Centre in California, United States, completed its 1000th artificial disc replacement treatment. The surgery set a high standard for the facility, with an impressive postoperative satisfaction rate of 98%.

Segments Covered in the Report

By Type

- Cervical Artificial Disc

- Lumber Artificial Disc

By Material

- Metal on Metal

- Metal on Polymer

By Indication

- Spinal Trauma

- Degenerative Spine Diseases

By End-use

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting