What is the Artificial Intelligence In Military Market Size?

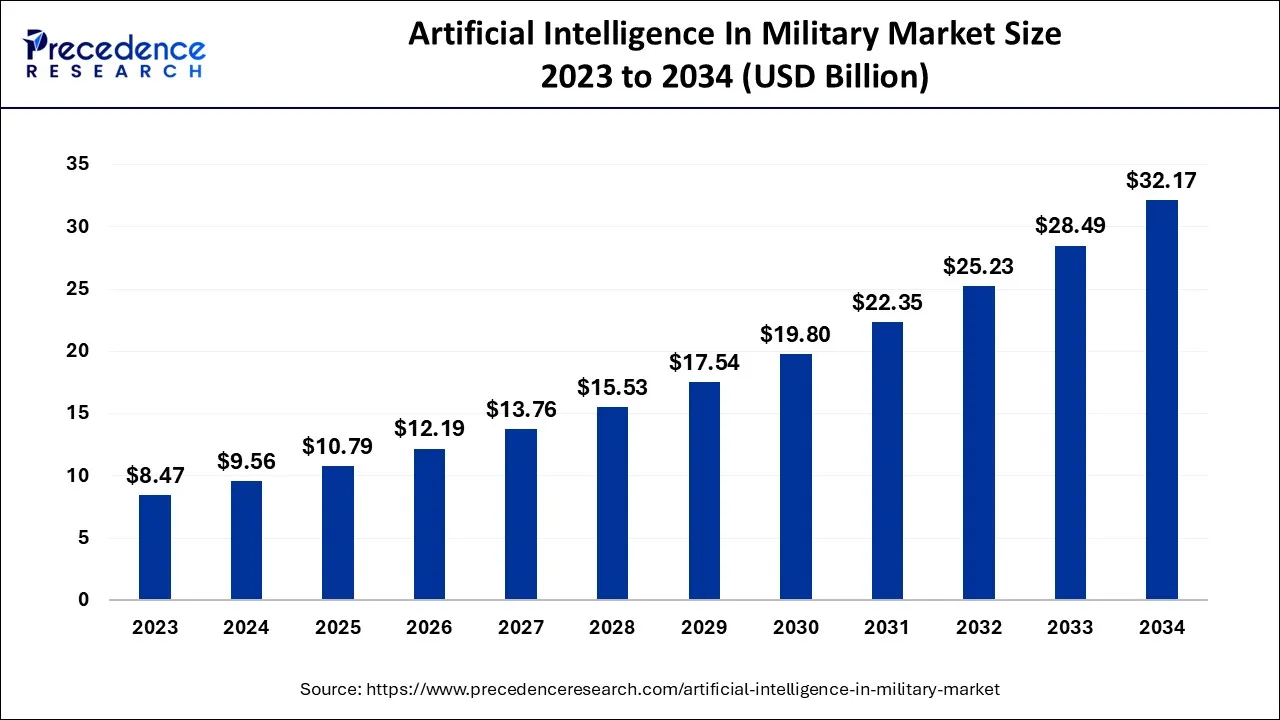

The global artificial intelligence in military market size is calculated at USD 10.79 billion in 2025 and is predicted to increase from USD 12.19 billion in 2026 to approximately USD 35.57 billion by 2035, expanding at a CAGR of 12.67% from 2026 to 2035.

Artificial Intelligence In Military Market Key Takeaways

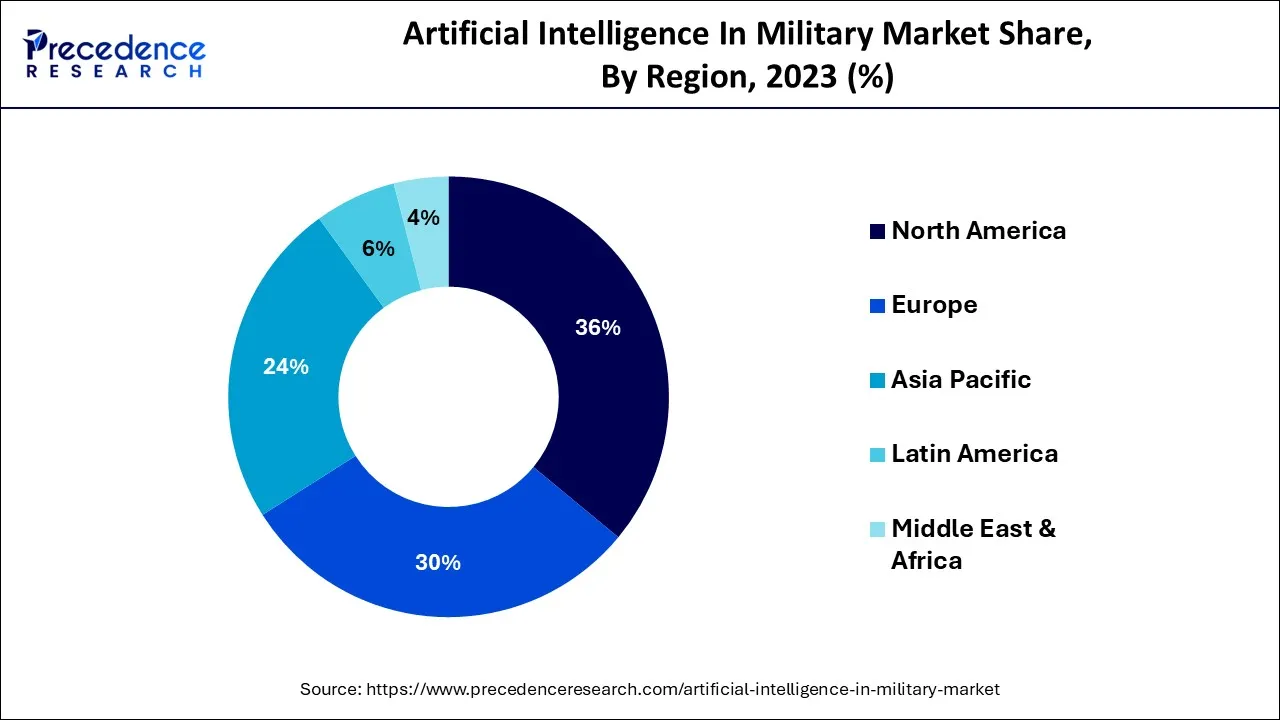

- North America led the global market with the highest market share of 36% in 2025.

- The software component segment is expected to be the largest share from 2026 to 2035.

- The hardware component segment is projected to expand significantly from 2026 to 2035.

- The advanced computing technology segment captured the largest market share in 2025.

- The AI system technology segment is predicted to grow the fastest from 2026 to 2035.

- The space platform segment is expected to have the highest CAGR from 2026 to 2035.

- The new procurement installation segment generated more than 51% of the revenue share in 2025.

- The warfare application segment will expand to the maximum market share in 2025.

- The cybersecurity application segment is expected to grow at a significantly faster rate from 2026 to 2036.

Market Overview

Modern warfare now includes artificial intelligence (AI) as a crucial component. AI has the capacity to manage massive amounts of military data effectively. It uses characteristics like computation and decision-making to improve the self-control, self-regulation, and self-actuation abilities of military systems. Additionally, the market has grown as a result of the military increasingly utilizing cloud services. Furthermore, the growing operational performance of autonomous systems may bring profitable changes to the sector. However, businesses are investigating low-cost and cutting-edge hardware solutions that effectively boost AI's performance and rhythm in the military sector; this is a key factor influencing the implementation of artificial intelligence in the military sector in the upcoming years.

Market Outlook

- Market Growth Overview: The artificial intelligence in military market is expected to grow significantly between 2026 and 2035, driven by increasing demand for autonomous systems, rising cybersecurity threats, and technological innovations.

- Sustainability Trends: Sustainability trends involve energy efficiency and carbon footprint reduction, waste management and circular economy, and AI for climate resilience and disaster response.

- Major Investors: Major investors in the market include NATO, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies, and BAE Systems plc.

- Startup Economy:The startup economy is focused on autonomy and unmanned systems, dual-use technology emphasis, and government as a catalyst.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.79 Billion |

| Market Size in 2026 | USD 12.19 Billion |

| Market Size by 2035 | USD 35.57 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 12.67% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Technology, Platform, Installation, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increased defense spending to enhance AI technologies by the government.

Most governments have established specialized departments or organizations to develop new capabilities and plan, launch, and integrate AI capabilities into military equipment. Moreover, the increasing use of artificial intelligence for predictive maintenance in military systems, as well as the incorporation of quantum mechanics into AI, is primarily responsible for generating an opportunity to develop artificial intelligence in the military sector. As international crises have increased, so have defense services. As a result of these battles, the use of sophisticated AI-enabled weapon systems has grown, and advanced inventions have been incorporated into existing systems to improve efficiency. For instance, the Ministry of Defense (MoD) declared the United Kingdom's Defense AI Strategy in June 2022, which mentioned the safe, ambitious, and responsible use of AI as well as a set of ethical guidelines to govern the military and defense sectors' use of AI. As a result, increased defense spending is propelling the growth of artificial intelligence in the military market.

Restraints

Concerns about the possibility of errors in complex battle situations

Concerns have been raised as various governments adopt AI-controlled systems for inspection and automation, declaring that human instruction on robots is essential for ensuring authority and humanitarian security. Humanitarian organizations such as Human Rights Watch are also concerned about whether government agencies are expanding "Automated Killer Robots" in order to win the AI weapons competition. Concerns have been raised, with some claiming that human monitoring of robots is required to ensure management and humanitarian protection as national authorities adopt AI-controlled schemes for automated processes and observation. All the aforementioned factors hinder market expansion.

Opportunities

Technological advancement in AI

Technological advancement is a key trend gaining traction in the military market for artificial intelligence. To strengthen their position, major players in the military artificial intelligence market are focusing their efforts on developing innovative technologies. For example, Raytheon Technologies, a US-based aerospace, and defense company, partnered with C3 AI's application platform in July 2022 to deliver next-generation artificial intelligence (AI) as well as machine learning (ML) capabilities for the US Army's Tactical Intelligence Targeting Access Node (TITAN) program. TITAN uses terrestrial and aerial sensors to collect data from high altitudes and space in order to provide targetable data and situational awareness.

Segment Insights

Component Insights

The software sector is projected to be the largest during the forecast period. The importance of artificial intelligence software in developing the IT framework to prevent security infringements is linked to the expansion of this segment. Artificial intelligence technological advancement has resulted in the invention of novel Artificial Intelligence Software and linked software development devices, which are projected to propel AI in the military industry in the upcoming years. The AI software embedded in computers is in charge of performing complicated tasks; it generates information from hardware in order to produce a smart result.

The hardware sector is anticipated to expand significantly during the projected period because of the expanding use of artificial intelligence technology for complex processes and the increased demand for specialized hardware components like AI memory and processors. The processors of artificial intelligence are neuromorphic processing components that are more efficient and faster than conventional processors. For improving artificial intelligence, memory is a key technological advancement. AI along with machine learning generates and analyzes a rising number of mission records in real time, enabling autonomous cognitive digital wars and propelling the hardware segment forward.

Technology Insights

Advanced computing is anticipated to hold the largest market share in 2025. AI support in data processing and recognition, intended to allow for timely decisions, is a primary factor driving segment growth. The combination of robotics with artificial intelligence boosts the need for the Military Artificial Intelligence (AI) Market. This artificial intelligence (AI) plans to support the military by proficiently attempting to identify weaknesses as well as facilitating settling human-level problems on the battlefield, which drives segment growth.

The AI system sector is projected to grow at the fastest rate over the projected period. Growing investment in AI technologies has contributed to the growth of the AI market. Many businesses are financing AI start-ups or AI technologies to improve the productivity of software, as AI allows them to execute better decisions as well as accomplish better results. Microsoft, for example, has invested approximately $1 billion in OpenAI, a San Francisco-based company. There is a growing investment in developing applied artificial intelligence systems, as well as a growing use of artificial intelligence technology in a variety of applications. These include robotics, virtual personal assistants, robotics-assisted driving, and autonomous vehicles.

Installation Insights

In 2025, the new procurement sector had the highest market share of 51% on the basis of installation. This is due to the government's enhanced push to incorporate AI into the defense industry, as well as the emergence of novel developments in artificial intelligence technology in the war sector. For instance, the National Security Council Secretariat, in December 2021, manages critical political, economic, energy, and security issues, and assisted the Military in establishing the Quantum Lab at India's Military College of Telecommunication Engineering to improve AI training and research.

The AI upgrade is anticipated to expand at the fastest rate over the projected period. Integrating AI into military operations improves administration, logistics, maintenance, personal management, routine exercises or activities, and training which drives the expansion of the AI upgrade sector in the military industry over the predicted years. Moreover, it has the potential to decrease institutional workload as well as free up troops for primary operations. Defense AI advancement is changing war disputes to AI-robotized digitized conflict. Furthermore, worldwide powers are getting prepared for their armed units to use advanced IT to minimize the impact of war.

Applicational Insights

The warfare sector is anticipated to expand at the largest market share in 2025. The market is expanding due to the rising demand for weapons of mass destruction. The increased testing of nuclear weapons by countries such as North Korea is also contributing to the proliferation of these weapons. As these weapons are biological, radiological, or chemical in nature, they are dangerous. The market is slowly expanding due to rising military demands ranging from intelligence, surveillance, and reconnaissance to offense/defense balances and nuclear weapons systems themselves.

The cybersecurity sector is anticipated to grow at a significantly faster rate over the predicted period. The global rate of cybercrime has increased due to the advancement of novel technologies and tools. State-wise cyberattacks also have increased significantly. Corporations and governments are rapidly adopting AI-based technologies that prevent, predict, and react to cyber risks. Machine learning and Deep learning are enabled by AI to execute predictive analytics; such AI technologies have enormous potential for military sectors and are projected to develop in critical areas which include cyber defense, decision-support systems, risk management, pattern recognition, and virus detection.

Platform Insights

The space sector is anticipated to have the highest CAGR of artificial intelligence in the military market over the predicted period, based on the platform. Space artificial intelligence involves numerous artificial satellites that serve as the backbone of various communication technology. The combination of AI and space platforms allows for effective communication between spacecraft and ground stations, which is anticipated to drive the expansion of artificial intelligence in the military market in future years.

Autonomous war vehicles, autonomous war robots, and unmanned ground automobiles are all part of the land segment. During the projected period, the increase in the need for unmanned ground vehicles to execute civilian tasks and reduce risks to human life expectancy drives the growth of the land sector in Artificial intelligence in the military market. In war scenarios, the combination of war vehicles, as well as autonomy, is critical for avoiding fatalities.

Regional Insights

U.S. Artificial Intelligence In Military Market Size and Growth 2026 to 2035

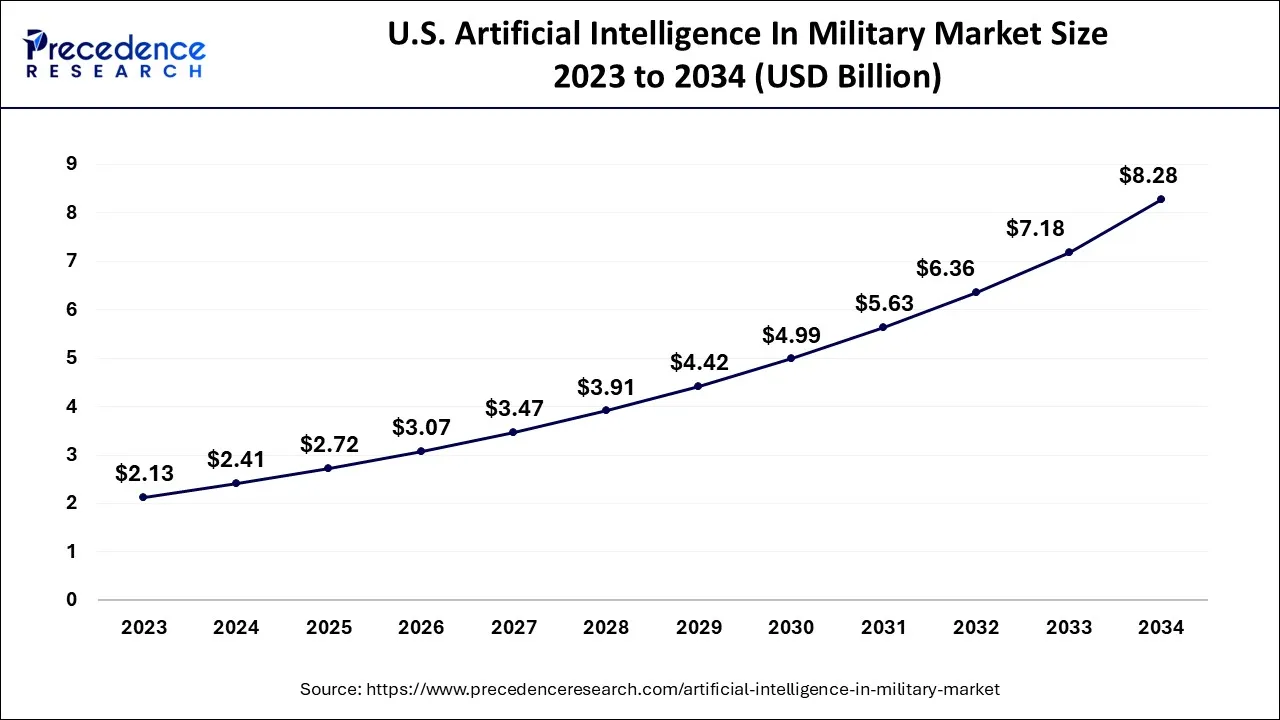

The U.S. artificial intelligence in military market size is exhibited at USD 3.07 billion in 2025 and is projected to be worth around USD 9.19 billion by 2035, growing at a CAGR of 12.95% from 2026 to 2035.

North America has the largest portion of the global military artificial intelligence market.The region's growth is primarily due to greater funding in artificial intelligence technologies by nations such as the United States and Canada. The US is progressively investing in AI systems to preserve combat superiority and overcome the risk of potential threats to communications networks, and the US is planning to increase its defense funding on AI to gain a competitive advantage over other countries.

U.S. Artificial Intelligence in Military Market Trend

In the U.S. market, driven by substantial government funding for strategic initiatives like JADC2 and the rapid development of autonomous systems to enhance mission efficiency and reduce human risk. A key technical trend is the shift to edge AI for real-time, decentralized processing in contested environments.

Asia-Pacific is estimated to observe the fastest expansion in the adoption of AIand machine learning (ML) technologies, as OEMs as well as operators increase their funding in AI integration activities throughout the supply chain. Japan, China, and South Korea have risen as the most innovative countries in the field of AI integration and development. Research is conducted on advanced AI applications in the aviation industry by numerous organizations in the region. Many aircraft and component manufacturing plants in Asia-Pacific have seen consistent benefits from the integration of AI technologies. For instance, the application of adaptive machining as well as cutting-edge robotic inspection techniques at Pratt & Whitney's Singapore facility has resulted in a consistent expansion in productivity volumes in the upcoming years.

China Artificial Intelligence in Military Market Trend

China's market is experiencing robust growth driven by led in the government's investment, strong emphasis on developing and integrating unmanned and autonomous systems, such as advanced drones, wolf robots, and unmanned combat vessels for operations across land, sea, and air domains. Enhancing intelligence, surveillance, and reconnaissance, and advanced wargaming and simulation.

How did Europe gain a notable share in the Artificial Intelligence in Military Market?

Europe's significant rise in national defense budgets is driven by geopolitical instability. Initiatives such as the European Defence Fund and NATO's DIANA program promote indigenous development and interoperability, supporting a growing ecosystem of defense-tech startups.

Germany Artificial Intelligence in Military Market Trends

Germany's market is driven by innovative defense-tech startups like Helsing and streamlined government procurement processes. The nation balances this technological push with a strong emphasis on maintaining human oversight and clear ethical governance in the use of AI for defense applications.

Value Chain Analysis of the Artificial Intelligence in Military Market

Data Acquisition & Curation: This stage involves the collection of vast amounts of data from various sensors, intelligence feeds, and surveillance platforms, which is essential for training and operating AI models.

- Key Players: Northrop Grumman, L3Harris Technologies, and various specialized data labeling service providers.

Hardware & Infrastructure:This stage focuses on providing the physical computing power and hardware necessary to run complex AI algorithms, particularly the high-performance processors and memory needed for real-time processing, often at the tactical "edge".

- Key Players: NVIDIA Corporation (AI processors and GPUs), IBM Corporation, and Lockheed Martin Corporation.

Software & Model Development: This is where the core intelligence is created, involving the design, training, and optimization of machine learning models and AI software.

- Key Players: Lockheed Martin, Raytheon Technologies, BAE Systems, and AI startups like Helsing SE and Shield AI.

Deployment & Integration: This stage involves integrating the developed AI software and models into existing or new military platforms, such as unmanned vehicles, command and control systems, and cybersecurity frameworks.

- Key Players: Lockheed Martin, Thales Group, BAE Systems, and General Dynamics Corporation.

Support & Services: This final stage involves post-deployment activities including monitoring system performance, continuous learning, software upgrades, and ongoing customer support and training for military personnel.

- Key Players: IBM, Palantir Technologies, and various specialized service providers and consultants.

Top Companies in the Artificial Intelligence In Military Market & Their Offerings

- Machine Halo: The company develops specialized AI software designed to enhance decision-making by processing complex data sets for military applications like intelligence analysis.

- Lockheed Martin: This aerospace and defense giant integrates AI capabilities into its vast array of platforms, from advanced fighter jets to missile defense systems, to improve performance and operational speed.

- Northrop Grumman: Northrop Grumman utilizes AI to fuse data from its various sensor and surveillance systems, providing comprehensive and real-time information for military operations.

- Raytheon Company:Raytheon integrates AI into areas such as predictive maintenance for defense systems, electronic warfare, and advanced target recognition technology.

- Thales Group:A global technology leader, Thales incorporates AI into its defense, aeronautics, and naval systems to enhance capabilities in areas like cybersecurity, intelligence, and autonomous naval operations.

- BAE Systems: BAE Systems employs AI for data fusion and machine learning to enable faster decision-making for commanders on the battlefield. They are developing next-generation autonomy for their platforms and using AI to improve operational efficiency and threat detection.

- IBM: IBM contributes to military AI through its services and advanced computing infrastructure, providing the high-performance hardware and support necessary for complex military AI operations.

- General Dynamics: General Dynamics focuses on the integration of AI into ground combat systems and communications networks to enable advanced capabilities like robotic combat vehicles and resilient command and control systems.

- Soartech:Soartech specializes in human-centered AI, developing technology that works collaboratively with human operators to improve performance and understanding. They focus on training simulations, intelligent agents, and enhancing human-machine teaming in military environments.

- Nvidia: Nvidia provides the high-performance processors (GPUs) and AI computing platforms that power many military AI applications, from real-time data analysis to autonomous vehicle operation.

- SparkCognition:SparkCognition offers AI solutions for predictive maintenance and operational efficiency within the defense sector, helping militaries optimize their assets and reduce downtime.

- SAIC (Science Applications International Corporation):SAIC provides systems integration and AI services to the U.S. military, developing solutions for data analytics, simulation, and cybersecurity.

- Charles River Analytics: This company develops intelligent systems and solutions for defense and intelligence clients, focusing on areas like human-machine collaboration and advanced data analysis.

- Leidos: Leidos provides a wide range of services to the defense sector, integrating AI into areas such as C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) systems, logistics, and data analytics.

- Boeing: As a major aerospace manufacturer, Boeing integrates AI into its aircraft and defense systems to improve autonomous capabilities, predictive maintenance, and overall platform performance. Their work involves both military aircraft and unmanned systems.

- GovBrain: GovBrain provides data analytics and AI-powered government relations platforms, helping defense contractors and government agencies track legislation and policy changes relevant to the military market. They offer insights to navigate the complex landscape of public sector procurement and strategy.

- ShieldAI: Shield AI specializes in developing AI pilots for autonomous aircraft, aiming to create a future where military aircraft can operate without human intervention in dangerous environments.

- SuperFlex:SuperFlex develops soft, lightweight robotic systems and exoskeletons that leverage AI to enhance human capabilities and endurance for military personnel. Their technology aims to assist soldiers with physically demanding tasks and reduce injuries.

- SRI International:A non-profit research institute, SRI International develops groundbreaking AI technologies for defense applications, from advanced robotics to sophisticated language processing and machine learning.

- DARPA (Defense Advanced Research Projects Agency):As a U.S. government agency, DARPA is at the forefront of funding and driving breakthrough research and development in AI for military use cases. Their projects push the boundaries of technology, aiming to create decisive military advantages.

- PrecisionHawk: PrecisionHawk leverages AI and drones for aerial intelligence, providing data collection and analysis services for defense and government sectors. Their technology enables enhanced surveillance, mapping, and situational awareness.

- MRX Global Holding Corp.:MRX likely contributes to the military AI market through investments or specific technology solutions, though public information is less detailed than larger defense primes. They operate within the broader tech and investment landscape relevant to defense modernization.

- Centaurus Technology: Centaurus Technology focuses on developing innovative technological solutions, likely involving AI and autonomous systems, for the defense industry. Their contributions help enhance the capabilities and efficiency of military operations.

- Hi-Tech Robotic System Ltd.:This company specializes in robotic and autonomous systems, likely providing unmanned ground vehicles and related AI technologies for military applications like surveillance, reconnaissance, and logistics support.

Recent Developments in the Artificial Intelligence in Military Industry

- In June 2025, Shield AI developed AI pilots, such as Hivemind, which successfully piloted a General Atomics MQ-20 Avenger drone demonstration. This technology allows uncrewed aircraft to perform complex maneuvers and operate autonomously without GPS or human input in the cockpit, reducing human risk. (Source: shield.ai)

- In December 2024, Lockheed Martin launched a new subsidiary, Astris AI, to deliver secure, high-assurance MLOps (Machine Learning Operations) and generative AI software across industries, including defense. Lockheed Matin has invested significantly to develop an industry-leading MLOps software capability. (Source: lockheedmartin.com)

- The United States Air Force granted Soar-Tech an agreement in January 2021 to promote programmed discourse acknowledgment as well as intellectual specialist developing ability on the side of the Air Force Warning and Control System (AWACS) mission.

- Boeing (U.S.) completed testing of five elite independent substitute planes with the ability to 'assist' the airplane's cerebrum in comprehending, analyzing, and communicating with various stages during missions in December 2020.

- IBM along with Raytheon Technologies endorsed a collaboration agreement in October 2021 to develop cryptographic, advanced AI as well as quantum solutions for various industries.

- Sea Machines Robotics and HamiltonJet contracted an agreement in March 2021 to build a novel pilot-assist technique for waterjets that use computer autonomous and vision command and control technologies.

- The US Air Force awarded Boeing a contract in January 2021 to improve automatic communication recognition as well as cognitive agent instruction capability in assistance of the Air Force Warning and Control System (AWACS) mission.

- Boeing (US) finished testing five high-performance automatic jets that can 'teach' the Aircraft's brain to analyze, understand, as well as communicate with other platforms in December 2020.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Technology

- Advanced Computing

- Ai Systems

- Learning and Intelligence

By Platform

- Airborne

- Land

- Naval

- Space

By Installation

- New Procurement

- Upgrade

By Application

- Cyber Security

- Battlefield Healthcare

- Logistics and Transportation

- Information Processing

- Warfare Platform

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting