Artificial Joints Market Size and Forecast 2024 to 2034

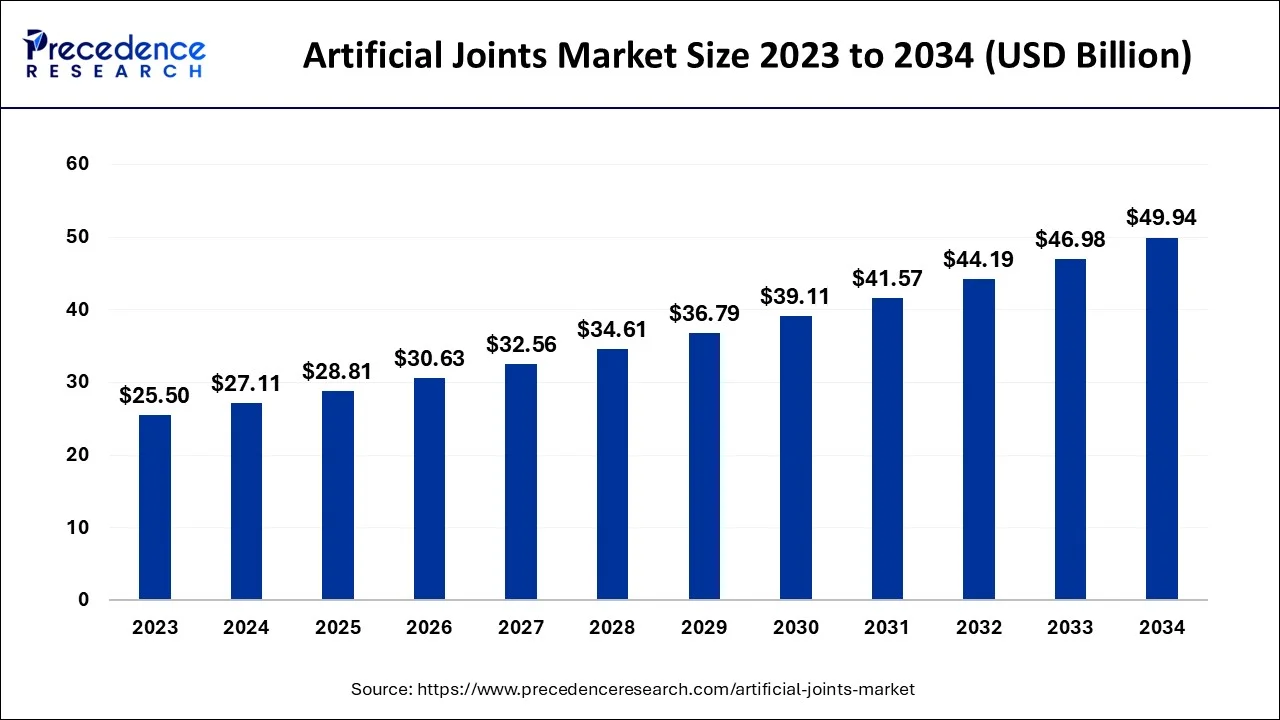

The global artificial joints market size is estimated at USD 27.11 billion in 2024 and is anticipated to reach around USD 49.94 billion by 2034, expanding at a CAGR of 6.30% from 2024 to 2034. An orthopedic prosthesis known as an artificial joint is often constructed of metal, oxonium, ceramics, etc. An arthritic or defective joint surface is replaced using artificial joints during an orthopedic surgery operation.

Artificial Joints Market Key Takeaways:

- North America contributed the largest revenue share in 2023.

- By type, the cemented joints segment is expected to expand at the biggest CAGR between 2024 and 2034 and generated the highest revenue share in 2023.

- By material type, the ceramic segment captured the highest market share in 2023.

- By application, the artificial knee joints segment captured the biggest market share in 2023 and is expected to grow at the highest rate (CAGR) between 2024 and 2034.

- By end users, the hospital segment generated a significant portion.

Artificial Joints Market Growth Factors

The fluid between the cartilage and the bones, crucial for quick, smooth, and painless joint mobility, deteriorates due to joint diseases and related issues. Osteoarthritis as well as other degenerative disorders cause joint abnormalities, necessitating arthroplasty surgery. Arthroplasties are medical procedures utilized to treat bones so that interrelated bones are able to move painlessly and effectively. This surgery is most commonly used to treat large joints such as the elbow, hip, knee, and shoulder.

An appropriate artificial joint is constructed to survive the biocompatibility of the joint, wear from kinetic impacts, and antimicrobial qualities. Ceramics (silica, zirconia, titanium nitride, hydroxyapatite, and silicon nitride), alloys (based on chromium, cobalt, and titanium), oxinium, and polyethylene (ultra-high molecular weight as well as cross-linked polyethylene) are among the materials used in artificial joints. Metal-on-ceramic, metal-on-metal, ceramic-on-metal, ceramic-on-polyethylene, and metal-on-polyethylene are materials frequently used in combination in the market.

An aging population and an increase in fat people are bringing on musculoskeletal problems, hypertension, and other lifestyle illnesses. The most common musculoskeletal condition impacting the elderly population is osteoarthritis, which has increased the demand for prosthetic joints. Additionally, various R&D projects pertaining to artificial joints accessing brain neuron impulses and joints with integrated circuits are anticipated to further propel market expansion.

However, the market's development is expected to be hampered by issues, including the high cost of artificial joints and product recalls. More than 85% of complete joint replacement methods in the U.S. are performed on the hip and knee. Similar to this, the National Joint Registry reports that in the U.K. in 2016, there were roughly 101,651 hips, 108,713 knees, 6,967 shoulders, and 722 elbow replacement procedures.

- The market for artificial joints will continue to increase because of factors, including the aging population and the rising prevalence of osteoarthritis and arthritis.

- As the world's obesity rate rises and poor eating patterns worsen, more people are having knee and hip replacement procedures, which expands the market for artificial joints worldwide.

- Adults younger than 60 who undergo total knee and hip replacement procedures contribute to the market development in developed nations, and osteoarthritis is one of the ten most debilitating illnesses in those countries.

Market Scope:

| Report Coverage | Details |

| Market Size in 2024 | USD 27.11 Billion |

| Market Size by 2034 | USD 49.94 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.30% |

| Largest Market | North America |

| Second Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Material Type, By Application and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

- Rising occurrences of obesity -The market for prosthetic knee joints is expected to grow due to the increase in the cases of obesity throughout the world brought on by the consumption of junk food, increased stress levels, as well as stress-related negligence.

- Increased use of knee replacement -Throughout the projected period of 2024–2034, the implementation of technical improvements and an increase in the need for complete knee arthroplasty as well as bicruciate retention, have driven the market. The market will grow throughout the projected period as a result of an aging population and a rise in cases of unicondylar knee replacement.

Key Market Challenges

- The unaffordability of patients - A significant obstacle to the market's expansion is a lack of people's accessible disposable income. Modern surgical techniques are extremely expensive, making it hard for the general public to choose them.

- Lack of skilled professionals – Artificial Joints are an extremely complicated technique that calls for experts with excellent ability levels. Because it undermines patients' confidence, a lack of experienced specialists in this field severely restricts the market's ability to expand.

- Strict rules and regulations - The strict laws and regulations that must be adhered to in order to get these items into the market drive up the overall cost of surgery, which poses a significant obstacle for the big market competitors. People find it challenging to choose such expensive operations since they have a limited amount of disposable cash.

Key Market Opportunities

An increase in the prevalence of knee osteoarthritis.

One of the main variables most likely to raise demand for bone procedures in the near future is a rise in the incidence of knee osteoarthritis throughout the world. The market for artificial joints is expected to rise in the following years due to an increase in the diagnostic rate of knee arthritis in the adult population. The Osteoarthritis Research Society International reports that the prevalence of worldwide knee osteoarthritis is predicted to climb along with the aging population, potentially reaching 5%.

During the projected period, the demand for knee replacement surgery is anticipated to be driven by the fast aging of the population and the considerable rise in obesity epidemics. The age range between 55 and 64 years old is associated with the greatest yearly incidence of knee osteoarthritis in the U.S., according to the Arthritis Foundation.

Type Insights

Based on Type, the artificial joint market is divided into cemented joints and non-cemented joints. The market for cemented joints is projected to expand at the highest CAGR during the forecast period, and it had the biggest share in 2023. Cemented joints provide superior suppleness, stability, and support and better anchor to the bones. These variables contribute to the segment's growth throughout the forecasted period.

Material Type Insights

The artificial joint market is divided into segments based on material, including ceramics, alloys, aluminum, and others. In 2023, the ceramic sector had the highest market share. Ceramics are also used in artificial joints, typically in the form of a ceramic-coated metal implant or an all-ceramic implant. Ceramic materials are biocompatible and are able to reduce friction and wear on the joint.

However, over the projected period, the market's greatest CAGR is expected to be recorded by the alloys segment. Titanium is a lightweight and strong metal that is often used in joint replacements because it has a high strength-to-weight ratio and is corrosion-resistant.

Application Insights

The artificial joint market is divided into artificial knees, artificial hips, artificial shoulders, and other artificial joints based on Application. The artificial knee joints category had the biggest market share in 2023 and is projected to grow at the highest rate (CAGR) during the predicted period. Factors like the aging population, which is leading to an increase in age-related musculoskeletal illnesses like osteoporosis and arthritis, and the rising obesity rate are all important drivers of the need for knee and hip replacement procedures and the corresponding implants.

End User Insights

Hospitals, orthopedic clinics, ambulatory surgical centers, and other end users have been divided into several market segments based on their ultimate use. The hospital segment took a significant portion of the market among them. Hospitals' improved amenities and expanding healthcare infrastructure are mostly to blame for this. The hospital industry is projected to maintain its leadership in the years to come.

The increase in orthopedic surgery conducted in hospitals and the rising number of patients with orthopedic injuries visiting hospitals are to blame for this. Due to the rise in the number of orthopedic clinics, the orthopedic clinic segment is anticipated to grow significantly during the projected period. Additionally, the estimated period is expected to see an increase in the demand for knee replacement goods due to the rising number of orthopedic procedures performed in ambulatory surgical centers.

Regional Insights

In 2023, North America had the greatest revenue share in the global artificial joint market, and it is predicted that the region will maintain its dominance over the market throughout the projected period. The major revenue sources for the market value in the area are the two largest economies in the region, the U.S. and Canada. The two main causes most likely to enhance demand for market expansion in North America are a rise in the number of patients with osteoarthritis and an increase in the population of older people. Additionally, throughout the projection period, the artificial joints market in the U.S. is projected to be driven by the increasing use of computer-aided implant designs, robot-assisted surgeries, and attractive reimbursement situations.

Due to the growth in the frequency of bone disease and the number of chronic diseases like diabetes, Europe is projected to have the second-largest market share after the North American area. The development of new artificial joint materials and designs, the presence of major players with a solid distribution network in the European market, and the rising demand for knee artificial joint procedures are expected to drive the market for artificial joints in Europe over the course of the projected period.

Since knee disorders are becoming more common, medical tourism is booming, disposable income is rising, and the healthcare infrastructure is progressively improving, the Asia Pacific market is expected to develop quickly over the forecasted period. Because there are fewer orthopedic physicians in these regions and because economic growth is weak, the market is anticipated to develop slowly in Latin America, the Middle East, and Africa. However, the demand for artificial joints in Latin America, the Middle East, and Africa is projected to develop as a result of an increase in orthopedic injuries and diseases as well as the acceptance of joint replacement surgeries.

Artificial Joints Market Companies

- MicroPort Scientific Corporation

- Aesculap, Inc.

- Corin Group

- B. Braun Melsungen AG

- Smith+ Nephew

- Medical Devices Business Services, Inc.

- Stryker

- Exactech, Inc.

- Zimmer Biomet

- Medacta International

- Medtronic

- MicroPort Orthopedics Inc.

- Johnson & Johnson Private Limited

- Conformis Inc.

Recent Developments

- On February 9, 2020, RISP Vision, a well-known market leader in computer vision and image processing research and development with its headquarters in Jerusalem, introduced a computer vision technology to more accurately visualize bones before knee and hip replacement procedures in order to reduce human error.

- In January 2020, Shenzhen Capital Group, a state-backed venture capital firm, assisted Lidakang Technology, a Chinese provider of artificial joints, in raising around $16 million in a Series A fundraising round.

- Exactech Inc., a US-based manufacturer of medical devices, declared in 2017 that it has agreed to be bought by TPG Capital in order to go private. With the acquisition, the private equity group intends to take on more established competitors in the orthopedic sector.

Segments Covered in the Report:

By Type

- Cemented Joints

- Non-cemented Joints

By Material Type

- Ceramics

- Alloy

- Oxinium

- Other Material

By Application

- Artificial Knee Joints

- Artificial Hip Joints

- Artificial Joints of the Shoulder

- Other Application

By End User

- Prosthetics Clinics

- Hospitals

- Rehabilitation Center

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting