Asthma Therapeutics Market Size and Forecast 2025 to 2034

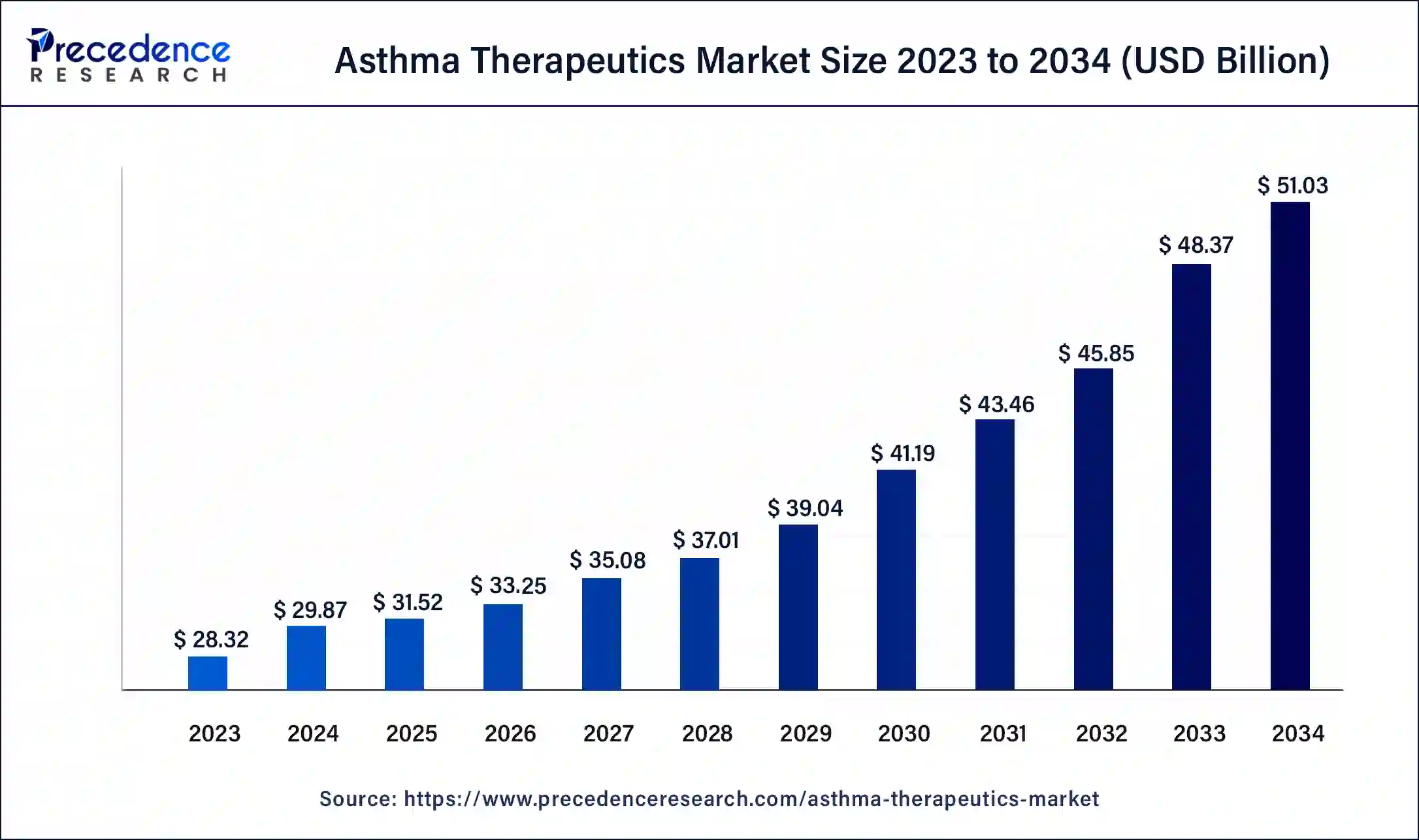

The global asthma therapeutics market size was valued at USD 29.87 billion in 2024, accounted for USD 31.52 billion in 2025, and is expected to reach around USD 51.03 billion by 2034, expanding at a CAGR of 5.50% from 2025 to 2034. The North America asthma therapeutics market size reached USD 13.03 billion in 2023. The asthma therapeutics market is driven by the rising incidence of childhood asthma.

Asthma Therapeutics Market Key Takeaways

- In terms of revenue, the market is valued at $31.52 billion in 2025.

- It is projected to reach $31.52 billion by 2034.

- The market is expected to grow at a CAGR of 5.50% from 2025 to 2034.

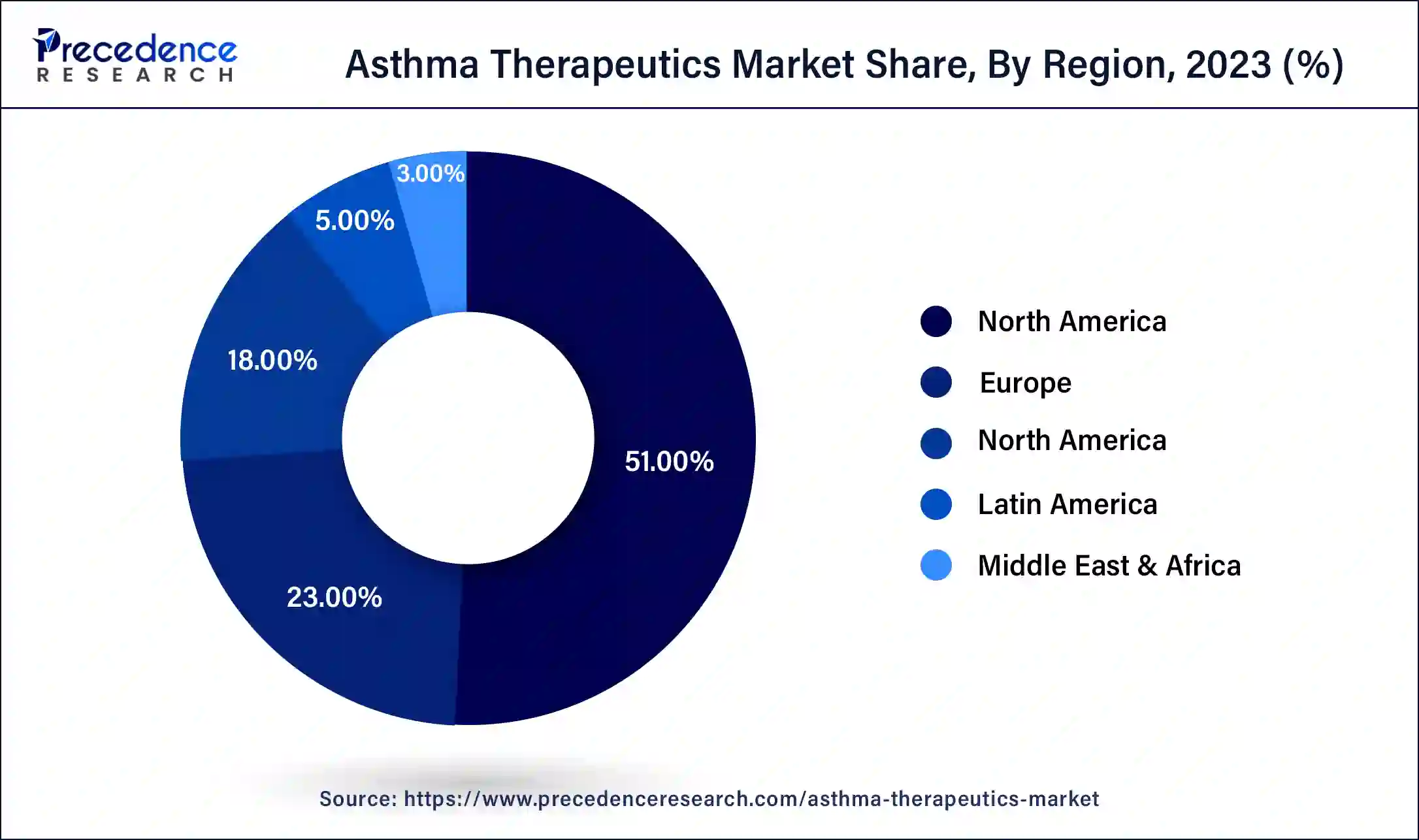

- North America dominated the market with the largest market share of 51% in 2024.

- Asia Pacific is observed to witness the fastest rate of growth during the forecast period.

- By drug class, the anti-inflammatory segment has contributed the largest market share of 63% in 2024.

- By drug class, the combination therapy segment is observed to witness a notable rate of growth during the forecast period.

- By product, the inhalers segment dominated the market in 2024.

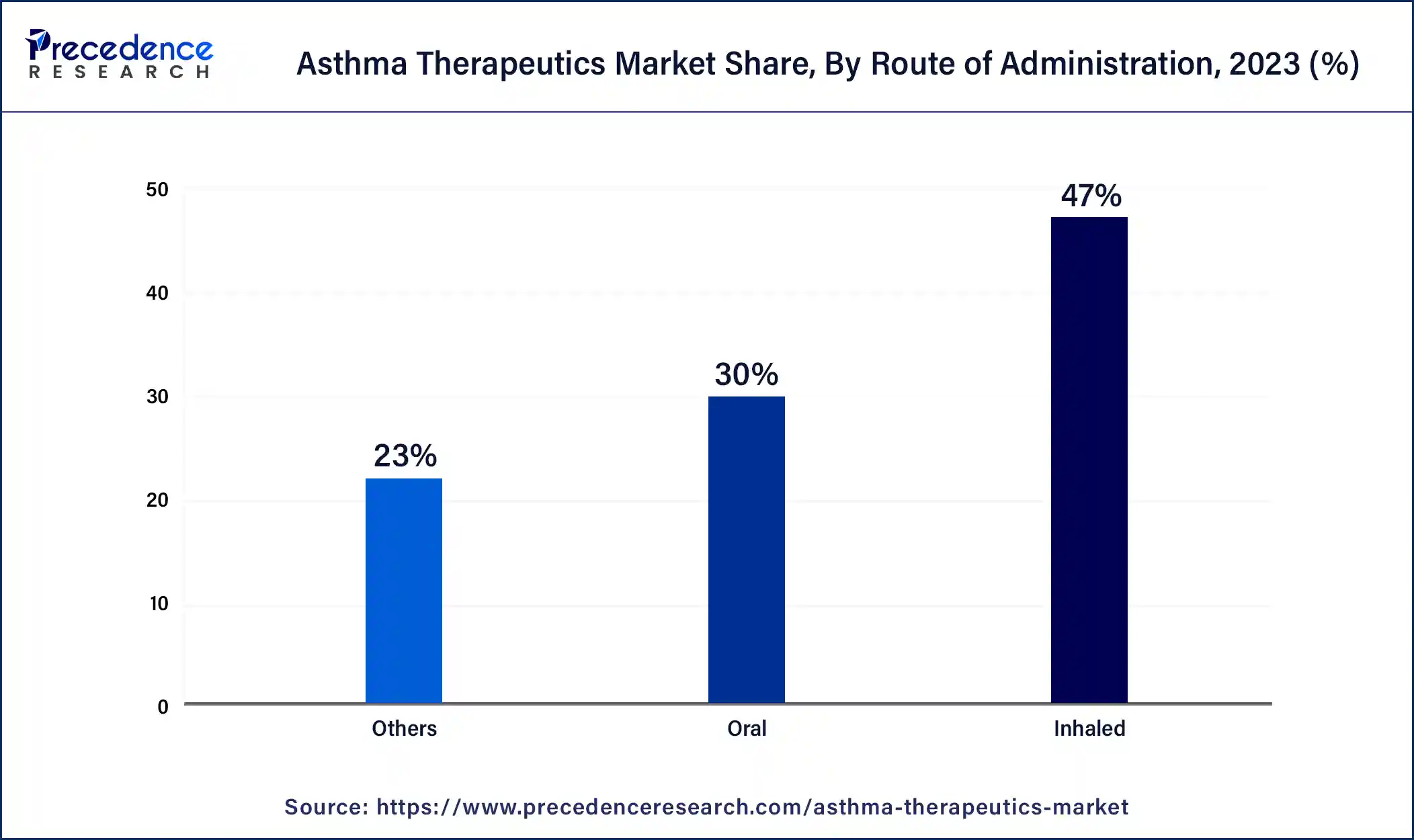

- By route of administration, the inhaled segment recorded more than 47% of revenue share in 2024.

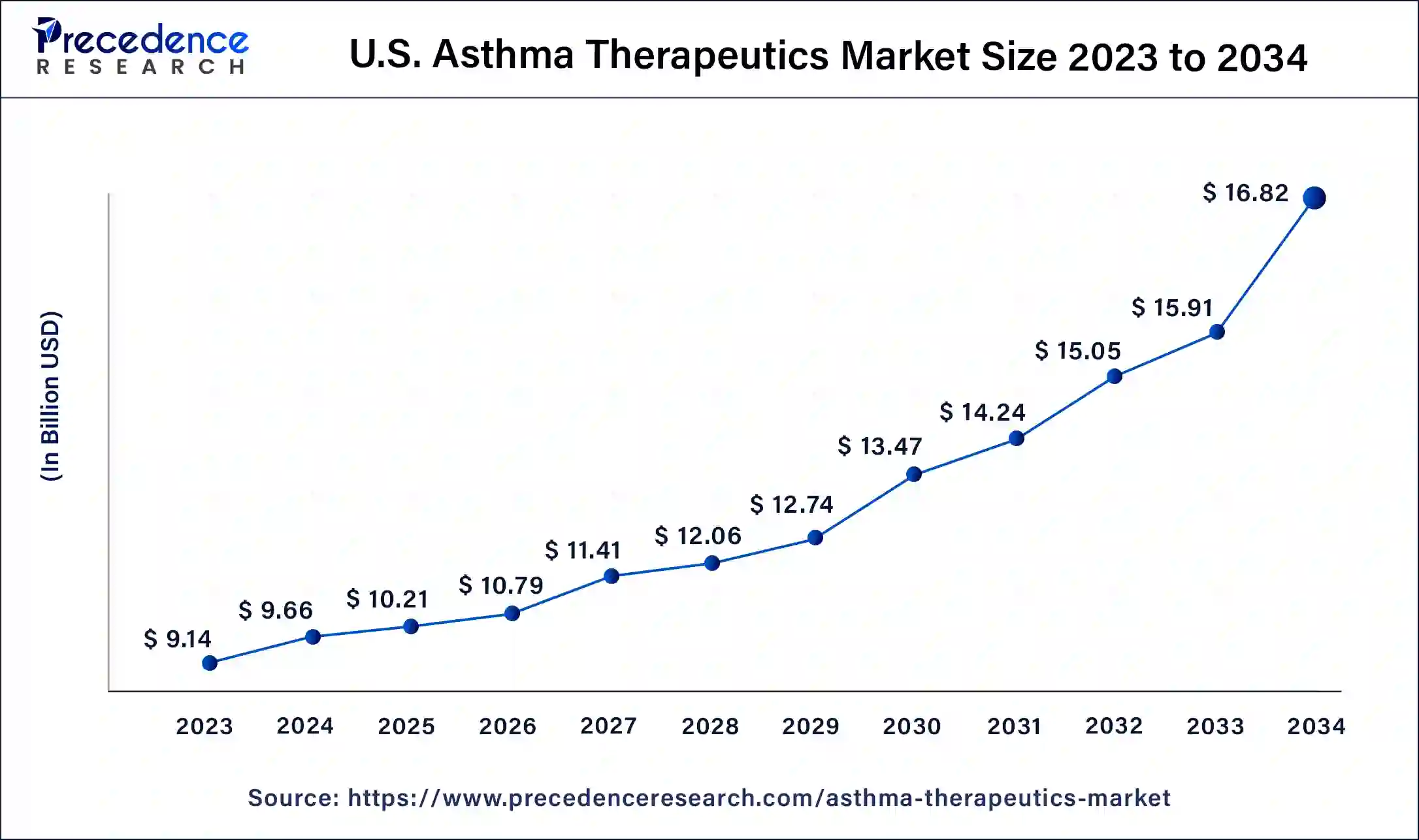

U.S. Asthma Therapeutics Market Size and Growth 2025 to 2034

The U.S. asthma therapeutics market size was estimated at USD 9.66 billion in 2024 and is predicted to be worth around USD 16.82 billion by 2034, at a CAGR of 5.70% from 2025 to 2034.

North America dominated the asthma therapeutics market with the largest share of 51% in 2024. A large percentage of the population suffers from asthma, making it a common ailment. The high prevalence of asthma in the area fuels the need for treatments. The regulatory landscape is favorable, fostering both pharmaceutical innovation and commercialization. Tight yet open regulatory environments guarantee the security and effectiveness of asthma treatments, stimulating industry expansion and capital inflows.

Researchers at Rutgers New Jersey Medical School have discovered a novel approach that may result in millions of people with asthma and other respiratory conditions, including chronic obstructive pulmonary disease (COPD), receiving more potent medication treatments.

Asia-Pacific is expected to witness the fastest rate of growth in the asthma therapeutics market during the forecast period of 2024-2034. Spending on healthcare is rising due to improving economic conditions in many Asia-Pacific nations. This promotes improved access to medical services, such as the diagnosis and treatment of asthma, which fuels market expansion. In the Asia-Pacific area, people and medical professionals are becoming more knowledgeable about asthma and managing it. Further propelling market expansion are increased education and awareness efforts that result in earlier diagnosis and treatment commencement.

- In May 2023, developing five Centers of Excellence (CoEs) in New Delhi, Ahmedabad, Cochin, and Goa is part of AstraZeneca India's ambitions to offer a systematic approach to standardized and uniform therapy of patients with severe asthma. The centers will act as the model hub for diagnosing, treating, and caring for patients with severe asthma. In turn, they will direct and assist the development of new severe asthma centers, using a systematic, guidelines-based approach to diagnosing and caring for patients with severe asthma.

Market Overview

The asthma therapeutics market revolves around the innovation, development and offering of drugs that specifically deal with asthma and other conditions caused by prolonged respiratory issues. The market offers services incorporated with simpler access to medical specialists, assistance with drug adherence, and early identification of possible exacerbations. Lessen airway inflammation to protect against long-term harm and enhance lung function.

Long-term remedies can be achieved by providing sustained bronchodilation, which lowers the likelihood of unexpected asthma episodes and investigates the possibility of changing the genes linked to the onset of asthma. Advancements in delivery of drugs and other initiatives taken for asthma disease management promote the market's expansion.

- In October 2022, A collaborative agreement was announced by Aptar Digital Health and CHIESI USA, Inc. to provide patients with COPD and asthma with a disease management platform. The Aptar Digital Health platform is designed to enhance the quality of life for individuals suffering from respiratory illnesses. The program would result in a high therapeutic regimen acceptance and demand rate.

Asthma Therapeutics Market Data and Statistics

- In September 2023, in the MANDARA Phase III trial, individuals suffering from Eosinophilic Granulomatosis with Polyangiitis (EGPA) treated with AstraZeneca's Fasenra demonstrated significantly higher rates of remission than those treated with mepolizumab, suggesting a possible therapeutic approach.

- In July 2023, to help people with COPD and asthma, Viatris, Inc. introduced Breyna Inhalation Aerosol, a generic Symbicort version with FDA approval.

- In March 2023, UC Davis Health will offer qualified patients access to the Propeller Health remote patient monitoring (RPM) service, which offers individualized treatment via sensors, a mobile application, and a website to enhance care for hazardous chronic obstructive pulmonary disease (COPD) and asthma.

- Asthma is a chronic lung illness that affects over 4 million children in the United States alone. It can cause shortness of breath, chest tightness, coughing, and wheezing.

- In 2022, the NIH began a monoclonal antibody trial to treat asthma in young people living in cities.

Asthma Therapeutics Market Growth Factors

- Worldwide, there is a rise in the diagnosis of asthma, especially in children and young adults. Patients' desire for convenient and efficient treatment options is growing.

- Enhanced drug delivery technologies, such as inhalers, to increase patient compliance and efficacy promote the expansion of the asthma therapeutics market.

- Increasing use of digital health technologies in the treatment of asthma acts as another growth factor for the market.

- Extending the amount of asthma treatments covered by insurance.

- Prevalence is influenced by environmental factors such as exposure to allergens and air pollution.

Market Scope

| Report Coverage | Details |

| Global Market Size by 2034 | USD 51.03 Billion |

| Global Market Size in 2025 | USD 31.52 Billion |

| Global Market Size in 2024 | USD 29.87 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.5% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Product, Route of Administration, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing incidences of asthma and other respiratory disorders

Millions of people worldwide have asthma, a widespread chronic respiratory disease whose incidence is rising. There is an increasing need for efficient therapies as more people are diagnosed with respiratory conditions such as asthma and associated conditions. Better diagnosis methods make it possible to identify and categorize asthma cases more accurately. More focus is being placed on creating and applying targeted therapies suited to patient profiles due to increasingly accurate diagnoses. Thereby, the rising prevalence of asthma creates a driver for the asthma therapeutics market.

Presence of robust pipeline of agents to manage asthma

A robust pipeline signifies pharmaceutical companies' continuous research and development endeavors to generate novel and enhanced therapies for asthma. In response to unmet medical requirements, this encourages innovation and may result in the discovery of more potent medications that may have fewer adverse effects. A constant flow of new goods drives market growth through an expanding pipeline. New cures make money and encourage competition among pharmaceutical companies, which benefits patients by giving them better access to cutting-edge medical care.

Restraint

Patent expiration of drugs

Generic versions of name-brand medications become accessible when their patents expire, thereby boosting competition. While this lowers consumer costs, it also means that pharmaceutical companies that make branded drugs make less money. This may discourage funding for investigating and creating novel asthma medications, reducing the chances of innovation in the asthma therapeutics market.

Opportunity

Increasing research and development for personalized medicine

Customizing medical care to each patient's unique needs is known as personalized medicine. This can include elements like genetic composition, environmental triggers, and particular symptoms in the case of asthma. Pharmaceutical companies and researchers can better understand the underlying causes of asthma and develop more tailored medicines by investing in research and development for personalized medicine in asthma treatment. Because the treatments are customized to meet each patient's specific needs, this technique enables the creation of more effective medications with fewer side effects.

Drug Class Insights

The anti-inflammatory segment dominated the asthma therapeutics market with the largest share in 2024. Asthma patients can improve their symptoms and avoid exacerbations using inhaled corticosteroids (ICS), the cornerstone of anti-inflammatory therapy. ICS helps lower airway inflammation, edema, and mucus production. The domination of this market has also been aided by other anti-inflammatory drugs, such as monoclonal antibodies that target inflammatory pathways and leukotriene modifiers. These drugs give long-term asthma control and symptomatic relief, making them crucial elements of asthma management plans.

The combination therapy segment witnessed lucrative growth in the asthma therapeutics market during the forecast period. The efficacy of combining several drugs to target different areas of asthma therapy, such as inflammation control, bronchodilation, and symptom relief, was the main factor driving this growth. When compared to monotherapy, combination medicines are more effective and frequently lead to better overall disease management, fewer exacerbations, and better symptom control.

- in June 2022, Glenmark Pharmaceuticals Limited launched Indamet, a novel fixed-dose combo medication for uncontrolled asthma in India. Due to these variables, combination therapy is anticipated to rule the market in the upcoming years.

Product Insights

The inhalers segment dominated the asthma therapeutics market in 2024. Inhalers provide a simple and effective way to administer medicine to the lungs, where it is most required to reduce asthma symptoms. Metered-dose inhalers (MDIs), dry powder inhalers (DPIs), and nebulizers are just a few of the inhaler kinds available to meet the needs and preferences of various patients.

With inhalers, patients can maximize treatment efficacy and minimize systemic side effects by precisely dosing and delivering medication to the airways.

The nebulizers segment shows a notable growth in the asthma therapeutics market during the forecast period. Nebulizers provide several benefits, including excellent medicine administration to the lungs, user-friendliness, and suitability for patients with severe asthma or inhaler resistance. Furthermore, the creation of portable and user-friendly nebulizers has been made possible by technical improvements, which have improved patient compliance and convenience.

Route of Administration Insights

The inhaled segment is registered a maximum market share of 47% in 2024. Drugs are delivered straight to the lungs using inhaled treatments, essential for controlling asthma symptoms because they operate quickly and precisely at the site of inflammation. It generally has a good safety profile compared to systemic therapies, which limit systemic adverse effects by directly addressing the afflicted location. Due to ongoing developments in inhaler technology, inhalers are now more effective and user-friendly due to better medication delivery mechanisms.

The oral segment is observed to expand at the fastest pace in the asthma therapeutics market during the forecast period. Patients consider oral drugs more appealing than traditional inhalers because they are more convenient and straightforward to administer. Furthermore, improvements in oral asthma drugs' safety and effectiveness profiles have led to a rise in their use by patients and healthcare professionals. Furthermore, oral drugs offer a more thorough method of treating underlying inflammation and bronchoconstriction than inhalers alone, helping to manage asthma symptoms on a systemic level.

Asthma Therapeutics Market Companies

- Teva Pharmaceutical Industries Ltd.

- GSK plc

- Merck & Co., Inc.

- F. Hoffmann-La Roche Ltd

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Sanofi.

- Koninklijke Philips N.V.

- BD

- Covis Pha

Recent Developments

- In August 2023, The Phase II EXHALE-1 research results for dexpramipexole have been posted online in the Journal of Clinical Immunology and Allergy (JACI), according to a statement from Areteia Therapeutics, Inc. In individuals with eosinophilic asthma, the study aimed to assess the safety and effectiveness of dexpramipexole in reducing blood and airway eosinophilia.

- In January 2023,The European Medicine Agency's Committee for Medicinal Products for Human Use (CHMP) gave AstraZeneca's Tezspire a reasonable opinion for self-administration in pre-filled, single-use pens for patients with severe asthma who are 12 years of age and older. The very nature of the Type-II label variant allows for implementing the CHMP opinion without requiring a decision by the European Commission.

Segments Covered in the Report

By Drug Class

- Anti- inflammatory

- Bronchodilators

- Combination Therapy

By Product

- Inhalers

- Dry Powder

- Metered Dose

- Soft Mist

- Nebulizers

By Route of Administration

- Oral

- Inhaled

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting