What is Autoclaved Aerated Concrete (AAC) Market Size?

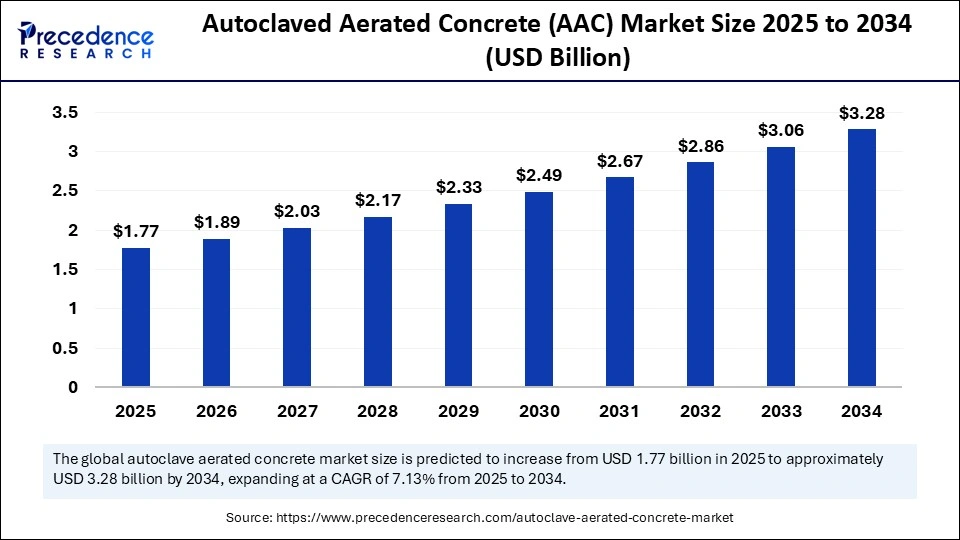

The global autoclaved aerated concrete (AAC) market size is calculated at USD 18.32 billion in 2025 and is predicted to increase from USD 19.62 billion in 2026 to approximately USD 36.18 billion by 2035, expanding at a CAGR of 7.04% from 2026 to 2035. The market growth is attributed to rising demand for energy-efficient, lightweight, and sustainable building materials driven by global carbon reduction targets and urbanization trends.

Market Insights

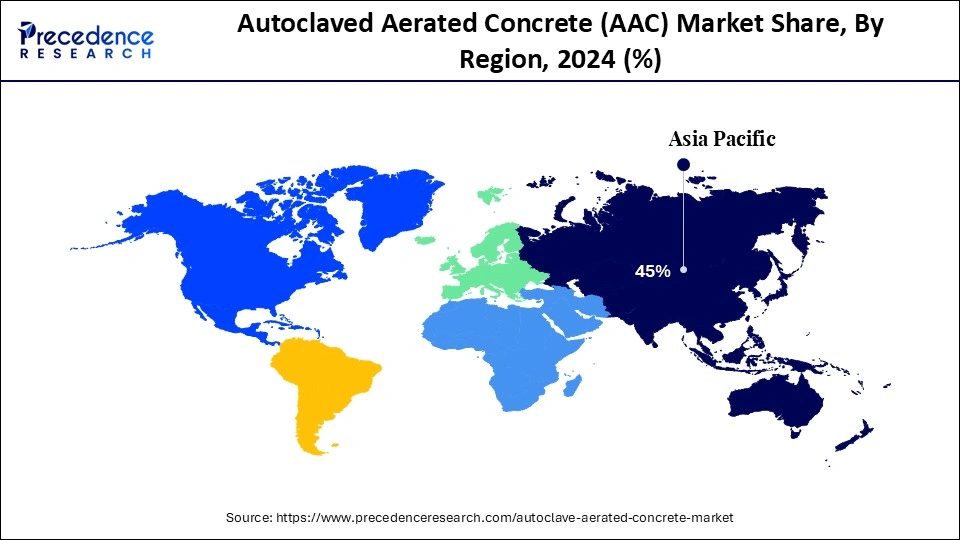

- By region, the Asia Pacific accounted for the largest market share of 45% in 2025.

- By region, the North America segment is expected to grow at the fastest rate in the autoclaved aerated concrete (AAC) market during the forecast period of 2026 to 2035.

- By element, the blocks segment accounted for a considerable share of the market in 2025.

- By element, the wall panels segment is projected to experience the highest growth rate in the market between 2026 to 2035.

- By end-user industry, the residential segment led the autoclaved aerated concrete (AAC) market.

- By end-user industry, the non-residential segment is set to experience the fastest rate of market growth from 2026 to 2035.

Market Size and Forecast

- Market Size in 2025: USD 18.32 Billion

- Market Size in 2026: USD 19.62 Billion

- Forecasted Market Size by 2035: USD 36.18 Billion

- CAGR (2025-2034): 7.04%

- Largest Market in 2025: Asia Pacific

- Fastest Growing Market: North America

Market Overview

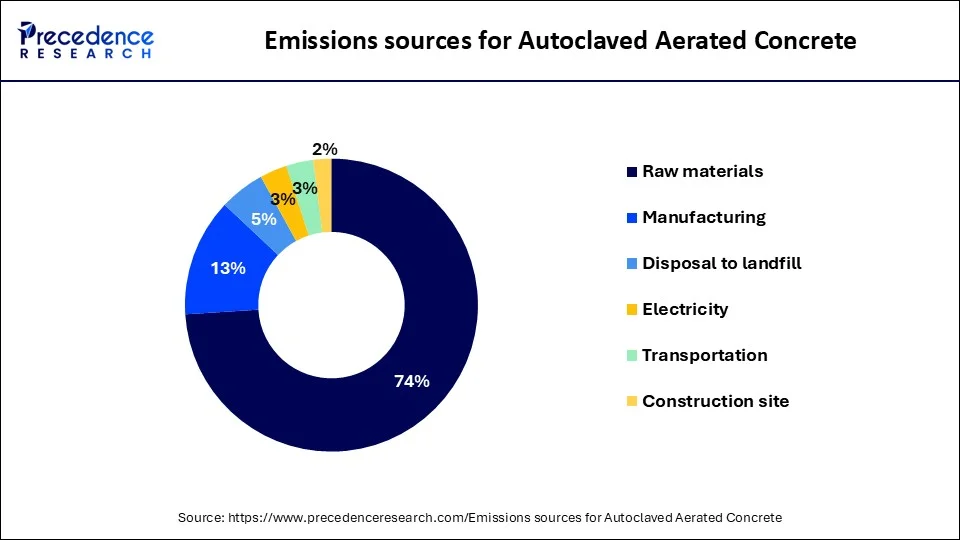

The enforced carbon cut pledges by governments and international organizations are a major driving force behind the growth of lightweight and thermally efficient building materials, such as AAC. Cement, lime, sand, water, and a foaming agent are blended in this technology. This blend is cured under high-pressure steam to create porous, lightweight blocks or panels that offer good insulation, fire resistance, and reduced raw material requirements.

According to the EA's Buildings Breakthrough Agenda Report 2024, building emissions have increased by an average of 0.7 per year since 2010. The volume of global floor area is increasing at a rate that continues to exceed the rate of efficiency improvements. Furthermore, the major economies are now mandating near-zero energy building standards, which are driving developers and material suppliers to high-insulation, low-carbon products such as AAC. (Source: https://www.iea.org)

Impact of Artificial Intelligence on the Autoclaved Aerated Concrete (AAC) Market

Artificial intelligence (AI) is revolutionizing the autoclaved aerated concrete (AAC) industry by significantly improving production efficiency, material innovation, and overall sustainability. Manufacturers are increasingly integrating AI-driven sensors, machine learning algorithms, and data analytics tools into production systems to monitor and control key parameters such as temperature, pressure, and curing conditions in real time. This intelligent automation not only ensures consistent product quality and dimensional accuracy but also minimizes material wastage and energy consumption during the manufacturing process.

Moreover, AI-powered predictive maintenance systems help identifies potential equipment failures before they occur, reducing downtime and operational costs. In addition, AI-enabled supply chain management applications are transforming logistics by forecasting market demand, optimizing inventory levels, and streamlining transportation routes to minimize carbon emissions and distribution expenses. As a result, the adoption of AI technologies is enabling AAC producers to achieve higher efficiency, lower environmental impact, and greater competitiveness in the global construction materials market.

Autoclaved Aerated Concrete (AAC) MarketGrowth Factors

- Rising Adoption of Green Building Certifications: Growing emphasis on LEED, BREEAM, and IGBC standards is driving the preference for AAC as a sustainable construction material.

- Boosting Energy Efficiency in Residential and Commercial Buildings: The lightweight and insulating properties of AAC are propelling its use to meet stringent energy performance targets.

- Increasing Urban Infrastructure Development: Expanding urbanization and smart city projects are fuelling demand for fast, durable, and cost-effective construction materials like AAC.

- Growing Government Incentives for Sustainable Construction: Policy support and subsidies for eco-friendly building materials are boosting AAC adoption across multiple regions.

- Advancements in Automated Production Technologies: Automation and AI-assisted manufacturing processes are driving efficiency, quality, and scalability in AAC production.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 18.32 Billion |

| Market Size in 2026 | USD 19.62 Billion |

| Market Size by 2035 | USD 36.18 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.04% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Element, End-use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Autoclaved Aerated Concrete (AAC) Market Regulatory Landscape

|

Country/Region |

Regulatory Body |

Key Regulations |

Focus Areas |

Notable Notes |

|

United States |

ASTM International, ICC, DOE |

ASTM C1386 (Standard Specification for AAC) International Building Code (IBC) - Energy Efficiency Standards |

Material performance Fire safety Energy efficiency |

Adoption is growing, especially in fire-resistant applications. Limited manufacturing capacity in certain regions. |

|

European Union |

European Committee for Standardization (CEN), Eurocodes |

EN 771-4 (Specification for AAC) - Eurocode 6 (Design of masonry structures) |

Structural integrity - Thermal insulation - Fire resistance |

AAC is widely used in green building projects. Compliance with EU environmental standards is mandatory. |

|

India |

Bureau of Indian Standards (BIS) |

IS 2185 (Part 3) - 1984 (Specification for AAC blocks) |

Quality control Dimensional standards - Durability |

- Encouraged for use in sustainable construction. - Increasing adoption in urban infrastructure projects. |

|

China |

National Standardization Administration of China (SAC) |

GB/T 11968 (AAC blocks) GB/T 11969 (AAC panels) |

Material properties - Manufacturing processes - Quality assurance |

Largest producer and consumer of AAC globally. Stringent quality control measures in place. |

|

Japan |

Japanese Industrial Standards (JIS) |

JIS A 5430 (AAC blocks) - JIS A 5431 (AAC panels) |

Seismic performance - Thermal insulation - Fire resistance |

Used in earthquake-resistant construction. - High demand in urban redevelopment projects. |

|

Germany |

Deutsches Institut für Normung (DIN), German Institute for Standardization |

DIN 4165 (AAC blocks) DIN 1053 (Masonry structures) |

Acoustic insulation Energy efficiency - Sustainability |

Pioneered AAC technology. Strong market presence in residential and commercial sectors. |

|

United Kingdom |

British Standards Institution (BSI) |

BS EN 771-4 (Specification for AAC) - BS 5628 (Masonry structures) |

Structural performance Thermal properties Sustainability |

Widely used in low-energy buildings. Supports compliance with UK Green Building Standards. |

Global Trends and Investment Statistics in Smart Cities, Green Buildings, and Sustainable Concrete Construction Materials

- The World Bank invests an average of USD 5 billion annually in urban development, resilience, and land, contributing to Sustainable Development Goal 11, to make cities inclusive, safe, resilient, and sustainable.

(Source: https://www.worldbank.org) - Global investment in the energy efficiency of buildings increased by around 14% from 2021 to USD 285 billion. However, investments in 2023 are estimated to have fallen to USD 270 billion due to rising borrowing costs and economic instability

- According to the World Bank, India will require an investment of USD 2.4 trillion by 2050 to meet the urban infrastructure needs of an estimated population of 951 million. This includes significant investments in climate-resilient infrastructure

- The Global Alliance for Buildings and Construction (GlobalABC) increased its membership from 258 to 289 by the end of 2023, with 41 national governments participating. This reflects a growing commitment to sustainable building practices.

- China invested approximately USD 1.2 trillion in government-led infrastructure projects in 2023. The investment spanned transportation networks, urban development, and energy sectors. China continues to lead globally in infrastructure spending, driving demand for construction materials.

- In 2023, federal, state, and local governments allocated USD 626 billion for infrastructure development. Funding targeted transportation, water treatment, and urban modernization projects. High-performance materials, coatings, and construction chemicals are key components in these projects. This investment supports both the maintenance of existing infrastructure and the creation of new public works.

- The world exported 3,264 shipments of AAC blocks, supplied by 189 exporters to 119 buyers, marking a growth rate of 757% compared to the preceding twelve months.

Between June 2023 and May 2024, India exported 65 shipments of AAC blocks to 10 world buyers, supplied by 7 Indian exporters. - The European Autoclaved Aerated Concrete Association (EAACA) has outlined a roadmap aiming for carbon neutrality in AAC production by 2050, with the potential to achieve carbon-negative status, aligning with global sustainability goals.

- In China, the utilization of solid waste in AAC production has reached 100 million tons, with industrial solid waste accounting for up to 48% of total raw material consumption, promoting a green circular economy.

Market Dynamics

Drivers:

Sustainable and Green Buildings

Autoclaved aerated concrete promotes market sustainable building with its low carbon footprint and environmentally friendly production. Its weightless construction minimizes the amount of material that is used and, at the same time, satisfies the green building standards. The developers of AAC use it to ensure that projects comply with environmental standards, sustainability standards, and an increased interest in responsible and climate-friendly building trends among consumers.

Energy Efficiency

Autoclaved aerated concrete has great thermal insulation, which minimizes the transfer of heat through walls. This reduces heating and cooling needs, enhances the comfort of the interior, and reduces long-term energy costs. AAC used in energy-efficient buildings is very attractive to those residential and commercial developers who want to save on operations and adhere to the energy efficiency standards.

Restraints:

Market Awareness and Perception

Lack of awareness among contractors and builders is a slowing-down factor of the autoclaved aerated concrete market. The traditional materials are still preferred because of familiarity and practice. The perception of strength, durability, and performance is misleading, although AAC has structural requirements and can be used appropriately, as long as it is designed and installed.

Technical and Logistical Problems

The porous property of AAC amplifies the risks of water absorption, and a protective coating is needed to eliminate cracking. Lightweight blocks increase transportation expenses over long distances. Moreover, the lack of availability of competent employees to do proper installation might have an impact on quality results, which will not be encouraged by most construction markets.

Opportunities:

Safety Features

AAC offers higher fire resistance and seismic strength, which are applicable in high-rise structures and key infrastructures. Such safety advantages assist developers in complying with stringent building codes, increasing protection to occupants, and minimizing structural risk of earthquakes or combustible areas.

Innovation of products

The increase in the need for autoclaved aerated concrete panels in floors and roofs offers new development options. The development of beams, lintels, and prefabricated elements helps to build faster, with greater design flexibility, and in new building techniques, which makes AAC a convenient tool to meet the new architectural and infrastructure demands.

Segment Insights

Element Insights

Why Are AAC Blocks Dominating the Autoclaved Aerated Concrete (AAC) Market Regulatory Landscape As the Preferred Material for Energy-Efficient Construction?

Blocks segment dominated the autoclaved aerated concrete (AAC) market in 2024, as they are lightweight, have great thermal insulation qualities, and are fire-resistant. These features will assist in minimizing energy use and increasing safety in the buildings.

As a result of AAC blocks, the construction time and wall joints are significantly reduced, which continues to make them more popular among constructors and developers. Furthermore, the growing global interest in green building practices and the use of environmentally friendly materials is expected to further drive demand for AAC blocks over the next few years.

The wall panel segment is expected to grow at the fastest rate in the coming years, owing to the advantages that make them fit a broad scope of applications, such as residential, commercial, and industrial buildings. Additionally, the increased attention to energy-efficient construction and the necessity to use materials that facilitate sustainable building practices further fuel the market.

End-use Industry Insights

Why Is the Residential Sector Dominating the Autoclaved Aerated Concrete (AAC) Market Regulatory Landscape Through Energy-Efficient and Cost-Effective Building Solutions?

The residential segment held the largest revenue share in the autoclaved aerated concrete (AAC) market in 2024, due to the growing need for efficient and sustainable housing solutions for energy consumption. The lightweight nature, thermal insulation, and fire resistance of AAC have made it the best choice for residential buildings, minimizing energy usage and enhancing the safety of occupants.

Companies such as Xella Group, H+H International, JK Lakshmi Cement Ltd., UltraTech Cement Ltd., and Aercon AAC are busy expanding their production capacities to meet this increased demand. Furthermore, the adoption of energy-efficient building materials in the residential industry is projected to increase significantly by 2025, as indicated by the World Green Building Council (WorldGBC) and International Energy Agency (IEA), contributing to the market expansion of AAC.

The non-residential segment is expected to grow at the fastest CAGR in the autoclaved aerated concrete (AAC) market regulatory landscape during the coming years, driven by the development of infrastructure in education, medical facilities, commercial centers, and industrial plants. Additionally, the increasing sensitization regarding the lifecycle cost-reduction and energy-efficiency of non-residential buildings is likely to continue its adoption in AAC.

Regional Insights

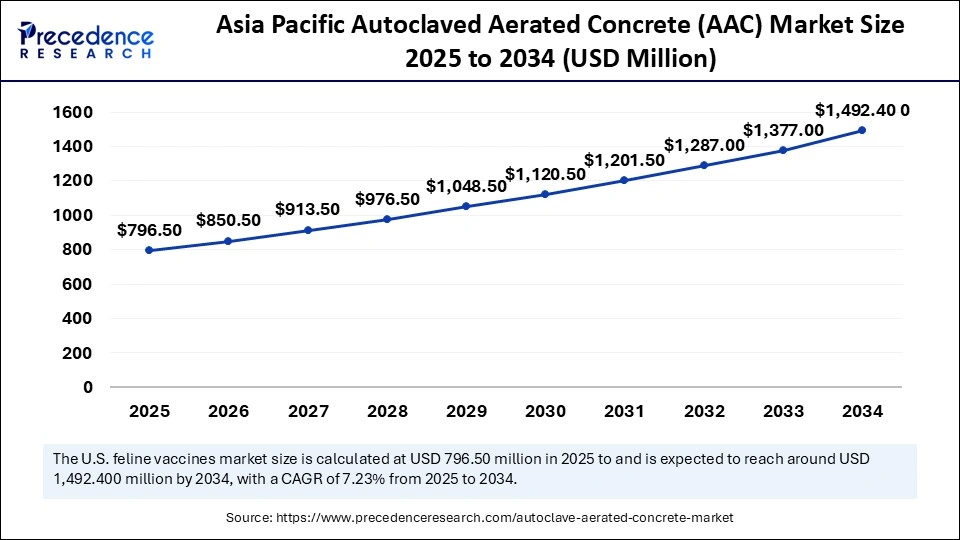

What is the Asia Pacific Autoclaved Aerated Concrete (AAC) Market Size?

The Asia Pacific autoclaved aerated concrete (AAC) market size is exhibited at USD 8.24 billion in 2025 and is projected to be worth around USD 16.51 billion by 2035, growing at a CAGR of 7.20% from 2026 to 2035.

How Is China Leading APAC's Autoclaved Aerated Concrete (AAC) Market Through Urban Housing Expansion and Green Construction Policies?

Asia Pacific led the autoclaved aerated concrete (AAC) market, capturing the largest revenue share in 2024, as a result of the fast urbanization, population growth, and the growing need for affordable housing. It is estimated that the urban population of the region will surpass 2.7 billion by 2025, spurring a massive residential and commercial building exercise.

Indian, Chinese, and Japanese governments are adopting policies of sustainable buildings, where materials of low energy consumption are being encouraged. The AAC market of the APAC region is expected to expand consistently due to stricter building regulations enforced by governments and the implementation of green building standards.

China Fuels APAC's Autoclaved Aerated Concrete (AAC) Market Growth via Urban Housing Expansion and Green Construction Policies

China has been the biggest AAC (Autoclaved Aerated Concrete) consumer within APAC because of its city housing boom and sustainable construction policies. China invested approximately USD 1.2 trillion in government-led infrastructure projects in 2023. The investment spanned transportation networks, urban development, and energy sectors.

China continues to lead globally in infrastructure spending, driving demand for construction materials. Furthermore, the penetration of affordable housing and high-end commercial complexes in China is playing a major role in the growth of the AAC market in APAC.

(Source: https://amsindia.co.in)

North America is anticipated to grow at the fastest rate in the market during the forecast period, as a result of growing concern with energy efficiency and sustainability in building. The residential construction business is still growing, with 1.8 million new residential construction starts in the U.S. in 2024, most of which use AAC panels. The market in North America is expected to expand gradually with the tightening of energy codes and the implementation of sustainable construction trends.

United States Leads North America's AAC Adoption Through Sustainable Building Initiatives

The United States has the highest number of AAC adoptees in North America due to strict energy codes and the increasing need for green construction. There is growth of local companies such as Aircrete USA, Forterra, and AAC LightTech to handle demand. According to the reports of the U.S. Green Building Council, more than 3,500 LEED-certified projects include the use of AAC in 2024. Moreover, the residential development and infrastructure creation with sustainability requirements make the U.S. a major AAC market driver.(Source: https://www.census.gov)

(Source: https://www.usgbc.org)

Europe's Use of the Autoclaved Aerated Concrete (AAC) Market

The Europe region is expected to hold a notable revenue share in the global autoclaved aerated concrete (AAC) market, driven by stringent energy efficiency regulations and strong initiatives promoting sustainable construction practices. Governments across the region are actively enforcing green building standards to reduce carbon footprints and achieve net-zero emission targets. For instance, the growing adoption of Building Research Establishment Environmental Assessment Method (BREEAM) certifications, reaching around 5,000 certified buildings in 2024, highlights the region's commitment to sustainability.

Many of these buildings incorporate autoclaved aerated concrete (AAC) panels due to their superior insulation properties, lightweight structure, and contribution to overall energy efficiency. Furthermore, the European Green Deal and national energy directives are encouraging the use of eco-friendly construction materials, further boosting autoclaved aerated concrete demand. The continuous rise in green building projects, coupled with increasing public and private sector investments in sustainable infrastructure, is expected to sustain the steady growth of the autoclaved aerated concrete market across Europe over the forecast period.

Germany Driving Europe's Autoclaved Aerated Concrete (AAC) Market With Energy-Efficient and Fire-Resistant Construction

The largest participant in the AAC market in Europe is Germany, and the use of energy and fire safety regulations is a driving force. KfW energy efficiency programs in Germany encourage the utilization of AAC in retrofit and new buildings. Additionally, the WorldGBC points out that Germany is at the forefront in sustainable building codes and low-carbon buildings. There is accelerated adoption of AAC in schools, hospitals, and office buildings.(Source:https://www.soletairpower.fi)

Autoclaved Aerated Concrete (AAC) Market – Value Chain Analysis

- Raw Material Sourcing

The production of AAC begins with sourcing essential raw materials, including cement, lime, sand, water, and aluminium powder (or other foaming agents). The quality and consistency of raw materials directly impact the density, strength, and insulation properties of blocks.

Key Players / Suppliers: LafargeHolcim, UltraTech Cement, Heidelberg Materials, ACC Limited, JK Lakshmi Cement. - Component Fabrication and Machining

Raw materials are mixed, poured into molds, and cut into blocks or panels. Precision cutting, dimensional accuracy, and controlled porosity ensure product uniformity and structural performance.

Key Players: Xella Group, H+H International, Aircrete Europe, Masa GmbH, Aercon AAC.

- Testing and Certification

Blocks undergo mechanical strength testing, thermal conductivity analysis, and fire resistance assessments. Certification ensures compliance with national and international building standards.

Key Players / Institutions: Bureau of Indian Standards (BIS), ASTM International, CEN (European Committee for Standardization), JIS (Japan Industrial Standards).

- Installation and Commissioning

AAC blocks and panels are delivered to construction sites, assembled, and integrated into building structures. Correct installation ensures load-bearing capacity, insulation efficiency, and fire safety.

Key Players / Contractors: Forterra PLC, CRH plc, Buildmate Projects Pvt. Ltd., GreenBuild Products Pvt. Ltd.

- Distribution and Sales

Finished AAC products are distributed through wholesalers, direct-to-construction companies, and retail building material suppliers. Efficient logistics and regional warehouses improve accessibility.

Key Players: Xella Group, UltraTech Cement, Hebel Australia, SOLBET Spó?ka z o.o.

Top Vendors in the Autoclaved Aerated Concrete (AAC) Market & Their Offerings

- Xella Group (Germany): Xella is one of the world's largest producers of autoclaved aerated concrete under its Ytong and Hebel brands.

- H+H International A/S (Denmark): A leading European supplier of AAC products, H+H manufactures blocks, panels, and thin-joint systems.

- Aircrete Europe (Netherlands): Aircrete Europe is a global technology and machinery provider specializing in AAC production plants.

- Masa GmbH (Germany): A major supplier of AAC plant equipment, Masa designs and delivers fully automated systems for mixing, casting, cutting, and autoclaving.

- UltraTech Cement Ltd. (India): UltraTech Cement, a part of the Aditya Birla Group, is one of India's leading AAC producers under its “Birla Aerocon” brand. The company's AAC blocks are widely used in green building and infrastructure projects across South Asia.

- AERCON AAC (USA): AERCON manufactures precast AAC products in the United States, offering wall panels, lintels, and floor systems.

- Biltech Building Elements Ltd. (India):A key player in the Indian AAC industry, Biltech produces lightweight AAC blocks for both residential and commercial construction.

- SOLBET Spoka z o.o. (Poland):SOLBET is the largest AAC producer in Central and Eastern Europe, manufacturing blocks, thin-layer mortars, and system components.

Autoclaved Aerated Concrete (AAC) Market Companies

- Aercon Florida Llc

- AKG Gazbeton

- Bauroc International AS

- Biltech Building Elements Limited

- Buildmate Projects Pvt. Ltd.

- CSR Ltd.

- H+H International A/S

- JK Lakshmi Cement

- Quinn Building Products

- Solbet Sp Z.O.O.

- UAL Industries Ltd

- UltraTech Cement Ltd.

- Wehrhahn GmbH

- Xella Group

Recent Developments

- In October 2025, Chryso, a global leader in sustainable construction solutions and part of Saint-Gobain Construction Chemicals, introduced the AdfilStrux 3000 Series, a new line of macro synthetic fibers. The series launches with AdfilStrux 3040 and AdfilStrux 3032, engineered to provide consistent 3D reinforcement for diverse applications, including slab-on-ground, precast elements, elevated decks, and tunnel linings. These fibers are designed to improve structural performance while supporting sustainable and resilient construction practices across various projects.

(Source: (https://www.chrysoinc.com) - In June 2025, Star Cement Limited, a pioneer in the cement industry, rolled out its Star AAC (Autoclaved Aerated Concrete) Blocks along with the Star Block Jointing Mortar, marking a significant step toward innovative and sustainable construction solutions. The inaugural dispatch took place at the company's state-of-the-art manufacturing facility in Sonapur, under the leadership of Shri Pradeep Purohit, COO, and Shri Magan Agarwal, Business Head. This launch positions Star Cement at the forefront of eco-friendly building materials, addressing the growing demand for energy-efficient and lightweight construction solutions in residential and commercial projects.

- In April 2025, DIC Corporation announced that its U.S. subsidiary, Earthrise Nutritionals, LLC, commenced operations in March 2025 at a new edible algae cultivation facility in California. The facility, developed with an investment of approximately ¥1.2 billion, focuses on the sustainable production of Spirulina edible blue-green algae, adhering to California's stringent food safety regulations. The new facility reinforces DIC Corporation's commitment to sustainable agriculture and smart farming solutions while scaling production capacity to meet rising global demand for nutritious and eco-friendly food ingredients.

(Source: https://www.dic-global.com) - In June 2025, POINT.P, a brand under Saint-Gobain, and Canadian company CarbiCrete announced the upcoming launch of a production line for decarbonized concrete, slated to begin in Q1 2026. Jacob Homiller, CEO of CarbiCrete, stated: “Our entry into the French market is a pivotal moment. POINT.P's commitment to sustainable housing makes them the ideal partner to scale our technology. This milestone brings us closer to making concrete a climate solution.” The new production line is expected to facilitate wider adoption of low-carbon concrete technologies in Europe, supporting sustainable construction and climate-positive building practices across the region.

(Source: https://www.nktv.in)

Segments Covered in the Report

By Element

- Beams & Lintels

- Blocks

- Cladding Panels

- Floor Elements

- Roof Panels

- Wall Panels

- Others (Including pipes, small boxes, and joint fillers)

By End-use industry

- Non-residential

- Residential

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting