Aviation Asset Management Market Size and Forecast 2025 to 2034

The global aviation asset management market size accounted for USD 206.43 billion in 2024, and is expected to reach around USD 371.19 billion by 2034, expanding at a CAGR of 6% from 2025 to 2034.

Aviation Asset Management Market Key Takeaways

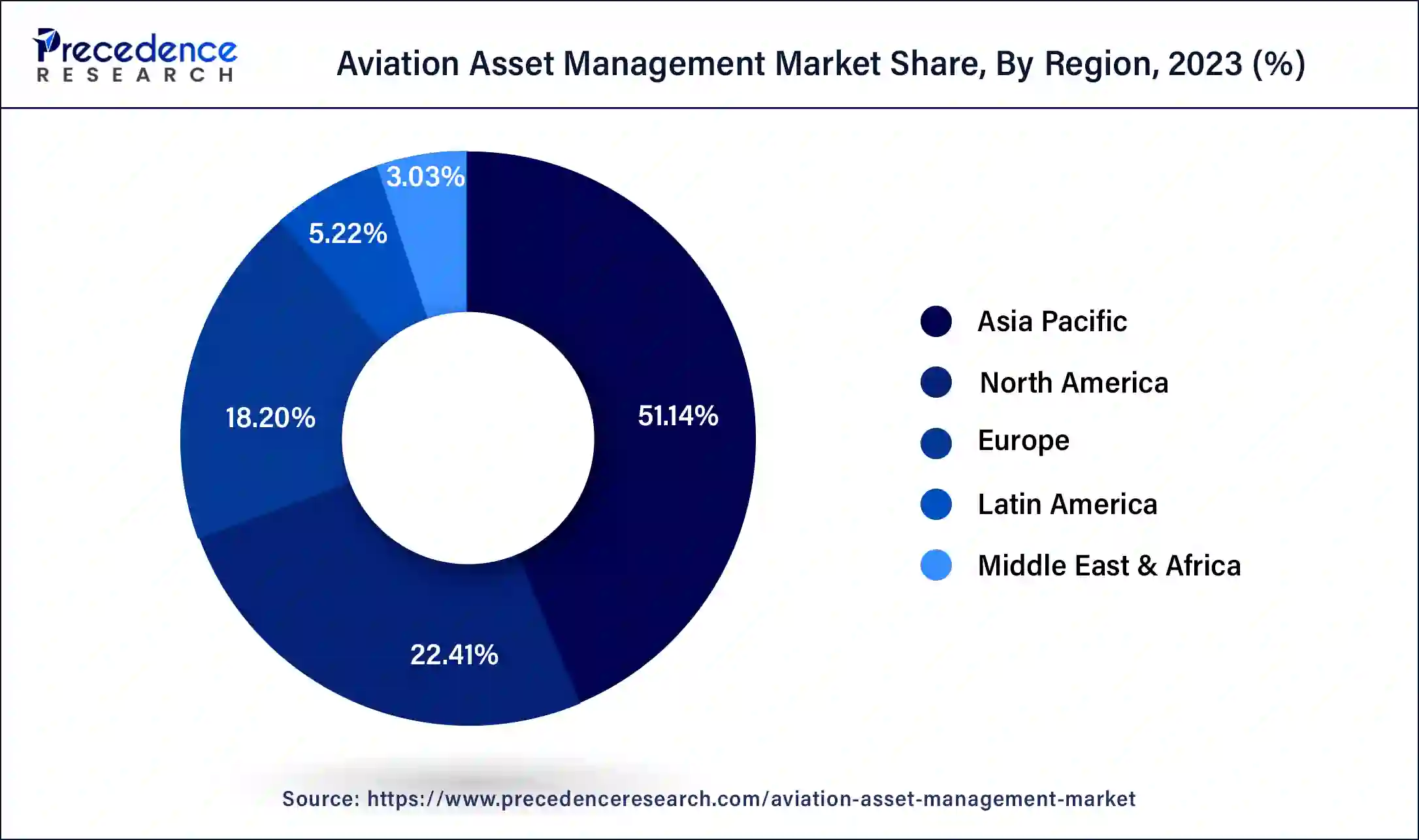

- Asia-Pacific generated more than 51.14% of the revenue share in 2024.

- By Service, the leasing segment captured the maximum share in 2024.

- By Type, the direct purchase segment is estimated to have a sizable market share from 2025 to 2034.

- By End Use, the commercial platforms segment is estimated to have the biggest market share from 2025 to 2034.

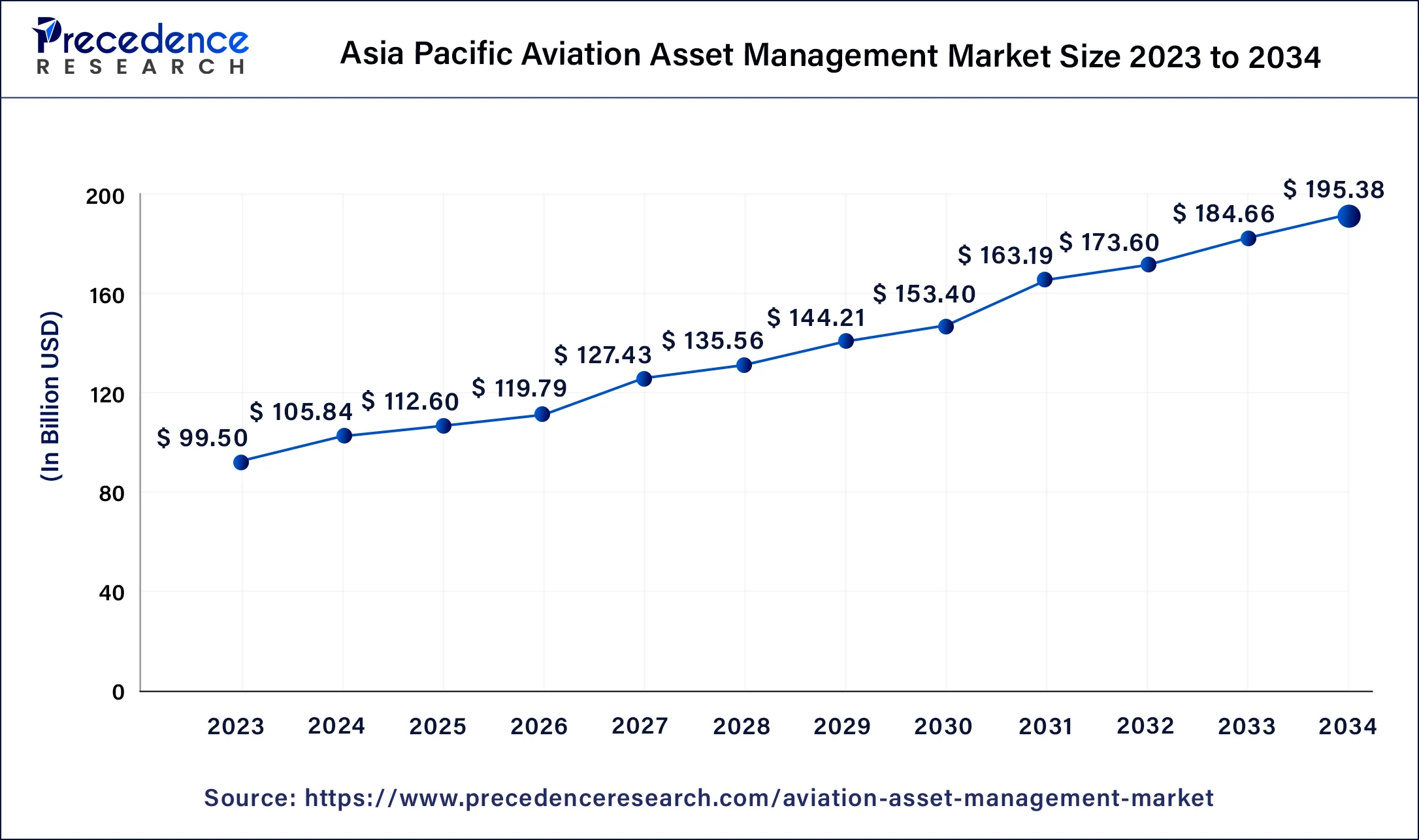

Asia Pacific Aviation Asset Management Market Size and Growth 2025 to 2034

The Asia Pacific aviation asset management market size is estimated at USD 112.6 billion in 2025 and is predicted to be worth around USD 195.38 billion by 2034, at a CAGR of 6.30% from 2025 to 2034.

For the worldwide aviation asset management industry, the Asia-Pacific region is anticipated to be the most profitable market throughout the anticipated time. Developing nations' public and private actors are increasing their investments in building out the aviation industry and growing their fleet of aircraft. For instance, in order to make India the third-largest aviation market by 2024, the nation has reduced the customs tax on aircraft manufacture, engines, and parts from 2.5% to 0%.

Additionally, by introducing supportive policies and allowing foreign direct investments in the expanding aviation industry, the leading authorities are promoting their travel and tourism industries. This is anticipated to fuel the growth of the global aviation asset management market through the year 2034.

North America is expected to grow significantly in the aviation asset management market during the forecast period. The growing aircraft fleet in North America is increasing the demand for aviation asset management. To tackle the high air traffic and enhance their maintenance, the use of aviation asset management is increasing. At the same time, the use of advanced technologies to enhance their performance is also increasing. Thus, all these developments are promoting the market growth

Market Overview

An advisory service for commercial aeroplanes is aviation asset management. Under this management, organisations like Aviation asset management limited (AAM) conduct surveys of leased aircraft and examine maintenance records. With an increase in air travellers, asset management is becoming more and more important. The increased focus of commercial airline operators on expanding their service offerings as a result of the increase in demand for aerial freight movement and in-flight passengers may be ascribed to the growth in the aviation asset management industry.

Major organisations that operate aircraft in commercial airspace are looking for ways to contract out services for aviation asset management. An important trend that is becoming increasingly popular in the aviation asset management market is technological development. Major players in the aviation asset management market are putting their attention on new technologies to create cutting-edge asset management software solutions in order to boost their market share.

Aviation Asset Management Market Growth Factors

The market is expanding as a result of an increase in air traffic, the purchase of new aircraft models with cutting-edge features, the growing importance of competitive intelligence and analytical solutions, and technical advancement. A rise in airline passenger traffic, upcoming aircraft deliveries, and a desire for lower fixed and variable management costs present investment opportunities.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 219.03 Billion |

| Market Size in 2024 | USD 206.43 Billion |

| Market Size by 2034 | USD 371.19 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Type, End Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rise in air traffic

The rise in air traffic is a crucial factor that has driven the growth of the market. Data from the International Civil Aviation Organisation (ICAO) predict that by 2035, both passenger traffic and freight volume will be doubled. Due to the comfort, convenience, and time savings provided by air travel, as well as the rising disposable income of the middle-class population, air travel is becoming more and more popular among passengers. Additionally, the availability of inexpensive airline tickets to well-liked tourist destinations around the globe is encouraging people to choose air travel. Many governments are making significant investments in the growth of the tourism sector and simplifying the visa application process for visitors from other countries.

The aviation sector benefits from the use of an asset management system since it lowers fixed and variable management expenses and is very efficient. In order to increase revenues and save costs in critical areas like fraud detection, marketing, data management, and tracking, market participants are also concentrating on enhancing their services by using intelligence and real-time analytical solutions. Therefore, over the next five years, it is anticipated that an increase in the number of passengers willing to travel via air transportation modes and supportive government policies and regulations will accelerate the growth of the global aviation asset management market.

Restraint

Economic uncertainty

The state of the global economy as a whole has a significant impact on the aviation asset management business. Any economic unpredictability or volatility may have an effect on the aviation sector, which may therefore have an effect on the demand for asset management services in this sector. For instance, a financial crisis or recession may cause airline bankruptcies and a drop in demand for air travel, which will result in an excess of available aircraft and a drop in their value. Aviation asset management organisations may experience a decline in revenue as a result, which might limit their ability to develop new products or services.

Economic uncertainty can also impact the financing of aircraft, which is a critical aspect of aviation asset management. During times of economic uncertainty, lenders may become more cautious, making it more difficult for airlines to obtain financing to purchase or lease aircraft. This can impact the demand for aviation asset management services, as airlines may delay or cancel their orders for new aircraft. The lease rates for aircraft, which are a significant source of income for aviation asset management businesses, can also be impacted by economic instability. Leasing rates may drop during uncertain economic times as airlines try to save money. This may have an effect on the aviation asset management businesses' profitability, making it more challenging for them to invest in new aircraft or increase their service offerings.

Opportunity

Growing demand for aircraft leasing

Recent years have seen a sharp rise in the market for aircraft leasing as airlines look to save costs and concentrate on their main business activities. There are several chances for aviation asset management organisations to diversify their offerings as the need for aircraft leasing keeps rising.

A wide range of services are offered by aircraft leasing businesses, including the management, financing, and purchase of aircraft. By offering services including aircraft evaluation, remarketing, and maintenance, aviation asset management firms may play a crucial part in the leasing of aircraft. Because they ensure that the leased aircraft are kept in good condition and continue to be appealing to potential lessees, these services are essential to the success of aircraft leasing companies.

Additionally, the rising demand for aircraft leasing is giving aviation asset management firms the chance to extend their clientele in new geographies. For instance, emerging nations with growing middle classes and rising air travel demand, like China and India, have a particularly strong demand for aircraft leasing. By offering their services to aircraft leasing firms operating in these areas, aviation asset management companies can access these markets.

Service Insights

Leasing services, technical services, and regulatory certifications make up the market's three service segments. Since so many businesses that operate aircraft in commercial airspace are looking for ways to outsource their aviation asset management services, leasing services held the maximum share in 2023 and are predicted to have the highest market share over the next projected years. Lease renewal, contract negotiation/renewal, and remarketing are some of the top leasing services in the aviation asset management sector.

Type Insights

The market is segmented into a direct purchase, operational lease, financing lease, sale & lease back, and other types based on type. Given that the service providers are delivering the system at affordable prices and with a variety of features, the direct purchase segment is anticipated to have a sizable market share over the projection period. By acquiring the system, the market participants in the aviation sector may take full use of its advantages and save maintenance and operational expenses associated with employing many employees to perform the same task.

End-use Insights

The market is divided into commercial platforms and MRO services based on end-use. The biggest market share is anticipated to be held by commercial platforms over the forecasted period. The need for commercial platforms is largely being driven by the ongoing increase in air traffic and the increased efforts made by the major authorities to build their respective nations' aircraft fleets to support economic development.

Aviation Asset Management Market Companies

- Cumen Aviation

- Aercap Holdings N.V.

- Aerdata (Subsidiary of the Boeing Company)

- Airbus Group

- Aviation Asset Management, Inc.

- BBAM LP

- Charles Taylor Aviation (Asset Management) Ltd.

- GA Telesis, LLC

- GE Capital Aviation Services (Subsidiary of General Electric Company)

- Skyworks Capital, LLC

Recent Developments

- In July 2025, for the acquisition of four A320neo aircraft, a collaboration between AerFin, which is an aviation asset specialist that repairs, leases, buys, and sells aircraft, engines, and parts, with a Middle Eastern investor was announced. The progressive approach to aviation asset management by AerFin was reflected with this acquisition, which helps in solidifying its commitment to offer high-quality Used Serviceable Material (USM), as well as to extend the operational life of aviation components to MROs, airlines, and lessors. Moreover, to address the growing demand for USM, AerFin is expanding its inventory by dismantling the A320neo aircraft.

- In March 2025, to launch the Strategic Capital Initiative, which focuses on the acquisition of on-lease narrowbody aircraft, specifically Airbus A320ceo and Boeing 737NG models, along with an aim of deploying over $4 billion in total capital, a collaboration between FTAI Aviation Ltd. and One Investment Management was announced. The previously established $2.5 billion asset-level debt financing, which was arranged by ATLAS SP Partners and Deutsche Bank, and equity commitments will fund this initiative. Maintaining the asset-light business model, along with the utilization of the maintenance capabilities, and expanding the market presence of FTAI will be the main goals of this collaboration.

- In 2022,Flydocs, a UK-based provider of asset management solutions, teamed up with SGI Aviation Services, a Netherlands-based provider of aviation asset management services, to create a financial asset management software solution. This solution will be available to various owners of aviation assets through Flydocs' digitized asset management tools, maximizing the value of assets through the use of technology and support.

- In February 2022,AirAsia agreed to lease at least 100 VX4 eVTOL aircraft from the Irish-based aircraft leasing firm Avolon. By enhancing passenger mobility in the air, this agreement is anticipated to assist the former in changing the way people travel by air. The airline will benefit from this and remain competitive.

Segments Covered in the Report

By Service

- Leasing

- Technical

- Regulatory certifications

By Type

- Direct Purchase

- Operating Lease

- Finance Lease

- Sale & Lease Back

By End Use

- Commercial Platforms

- MRO Services

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting