What is Aviation IoT Market Size?

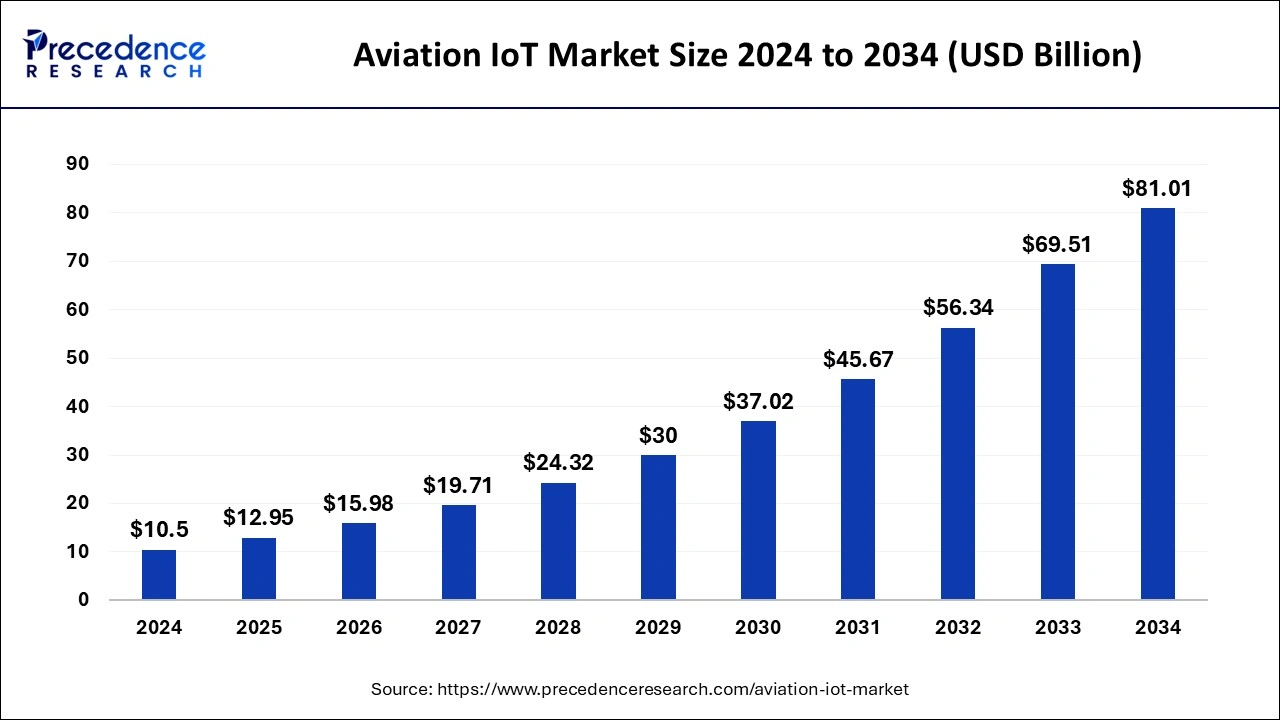

The global aviation IoT market size is estimated at USD 12.95 billion in 2025 and is predicted to increase from USD 15.98 billion in 2026 to approximately USD 81.01 billion by 2034, expanding at a CAGR of 22.67% from 2025 to 2034. The growing trend of air travel with an emphasis on passenger experience is anticipated to drive market growth.

Market Highlights

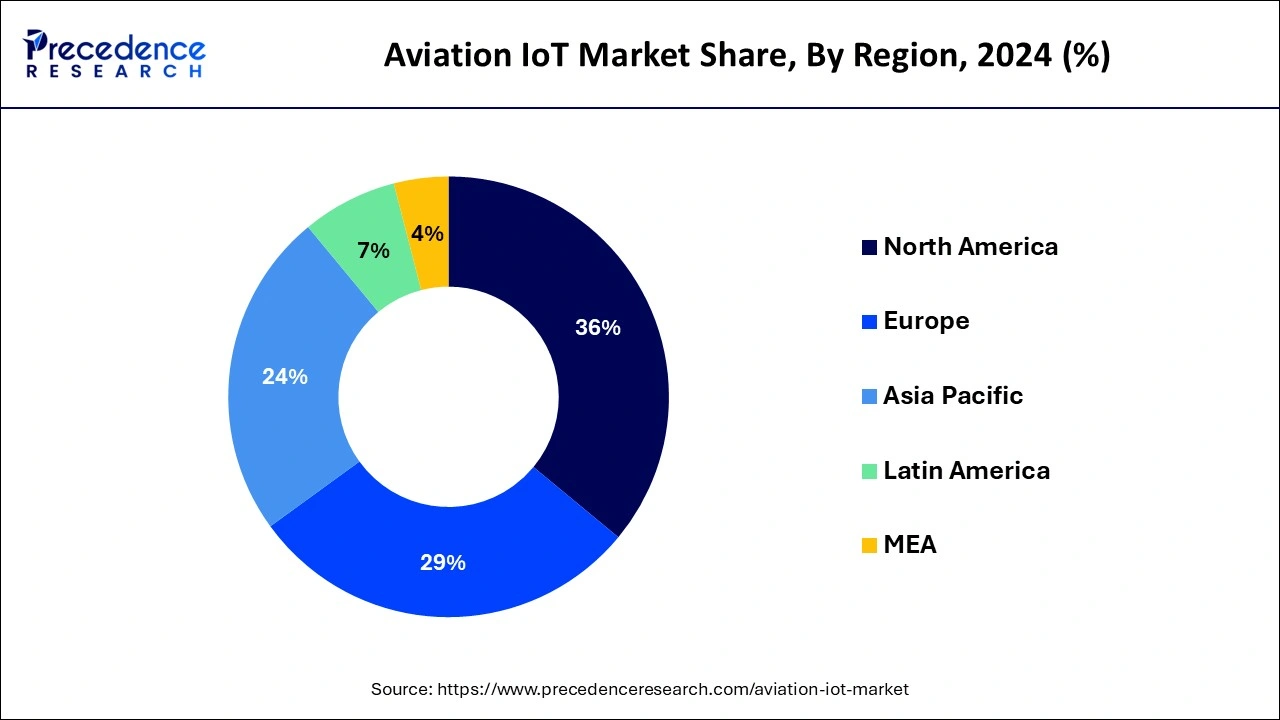

- North America has contributed more than 36% of market share in 2024.

- By application, the asset management segment has held a substantial market share of 31% in 2024.

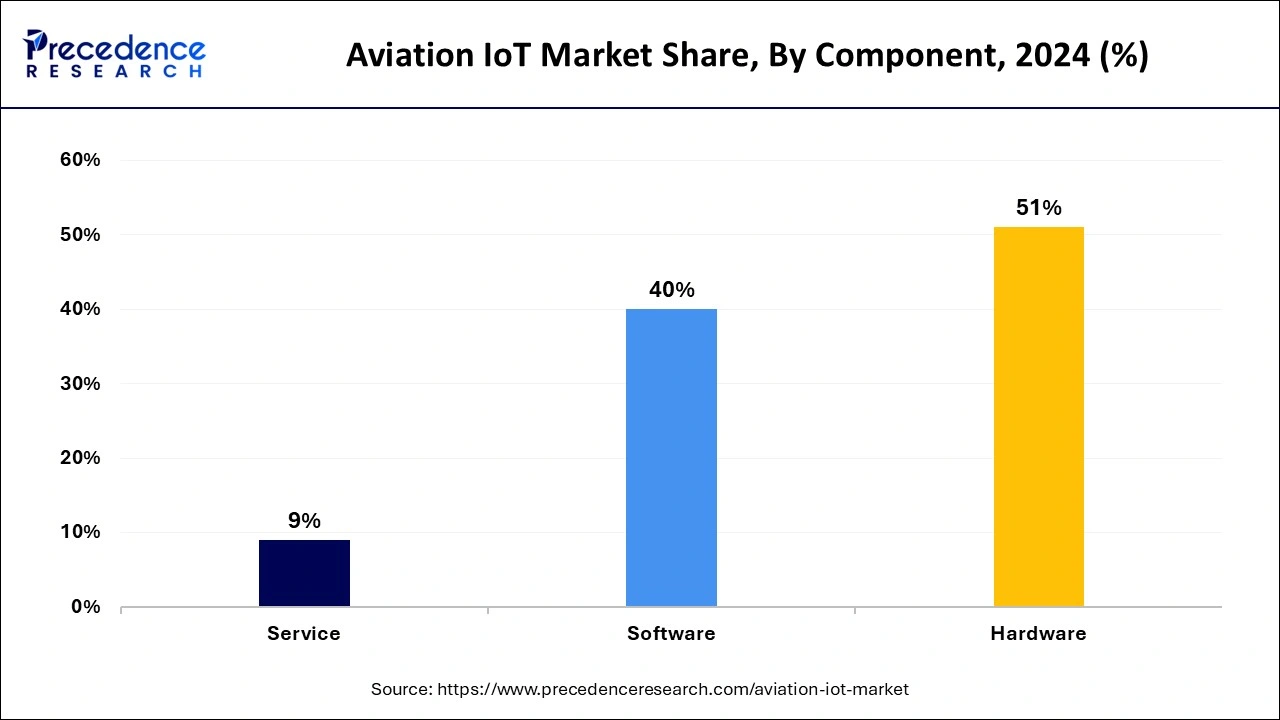

- By component, the hardware segment has recorded the largest market share of 51% in 2024.

- By end-use, the airport segment has accounted the biggest market share of 36% in 2024.

Market Overview

The aviation IoT market revolves around the services offered with the integration of IoT technologies like sensors, devices, connectivity, and analytics for the airline industry. It connects devices and systems to collect, analyze, and use data for improving operations, enhancing passenger experience, and strengthening safety and security in aviation. Aviation IoT solutions allow real-time monitoring, predictive maintenance, automation, and data-driven decision-making in aircraft maintenance, fleet management, passenger services, cargo tracking, and airport operations.

The aviation IoT market includes various applications, technologies, and stakeholders such as airlines, airports, aircraft manufacturers, MRO providers, and other aviation service providers. Airlines and airports are embracing IoT technologies to streamline operations, cut costs, and boost efficiency. IoT solutions like real-time monitoring, predictive maintenance, and automation enable data-driven decisions, process streamlining, and automation, resulting in better operational efficiency. The aviation sector is prioritizing to enhance the passenger experience.

Aviation IoT MarketGrowth Factors

- The growing demand for enhanced efficiency and safety within the aviation sector is a key driver behind the expansion of the aviation IoT market.

- The growing demand for air traffic solutions from emerging economies and the implementation of automated aircraft monitoring are expected to create new opportunities for the aviation IoT market during the forecast period.

- IoT technology offers cost savings for airlines through real-time aircraft health monitoring and threat analysis, driving increased adoption in the industry.

- During the pandemic, prolonged aircraft stays in airport hangars increased the demand for IoT technology for regular maintenance.

- Advancements in Machine Learning (ML) and Artificial Intelligence (AI) are expected to fuel industry expansion, enabling various aviation-related applications.

Recent Trends

- Rise of Connected Aircraft Systems: Airlines are increasingly adopting IoT-based systems to monitor aircraft health, track performance, and ensure real-time communication between ground stations and flight crews.

- Smart Airport Operations: IoT is being used to streamline baggage handling, passenger check-in, and predictive maintenance, enhancing overall airport efficiency and passenger experience.

- Data-Driven Decision Making: Airlines are leveraging IoT-generated data to optimize routes, fuel consumption, and maintenance schedules, reducing operational costs and downtime.

- Integration with AI and Cloud Platforms: Combining IoT with AI and cloud technologies is enabling predictive analytics, enhancing flight safety, and supporting better asset management.

- Cybersecurity Advancements: With the growing number of connected devices in aviation, companies are investing in advanced cybersecurity frameworks to safeguard sensitive operational and passenger data.

- Enhanced Passenger Experience: Airlines and airports are utilizing IoT for highly personalized services, including real-time baggage tracking and tailored in-flight entertainment recommendations, to improve customer satisfaction and brand loyalty.

- Smart Cargo and Logistics Management: IoT is revolutionizing cargo operations with real-time tracking, climate control solutions, and RFID labels, ensuring efficiency, security, and minimizing loss of goods.

Market Outlook

- Raw Material Sourcing: Superior sensors, communication modules, and aircraft-grade electronics are essential to aviation IoT systems. To guarantee a steady supply and lower the risks associated with worldwide material shortage,turers are increasingly utilizing regional sourcing and digital tools like blockchain and artificial intelligence.

- Supply to Governments and Airlines: Both direct airline investments in fleet connectivity and predictive maintenance, as well as government programs like smart airports and air traffic systems, are used to implement IoT solutions. Timely delivery of hardware and software is ensured by dependable supply chains and close collaboration with regulators.

- Aftermarket Services and Upgrades: Software upgrades, sensor retrofits, predictive analytics, and lifecycle support are examples of aftermarket services. Airlines can eventually take advantage of new IoT capabilities thanks to these upgrades, which also increase the value of current aircraft, boost operational effectiveness, and decrease downtime.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.95 Billion |

| Market Size in 2026 | USD 15.98 Billion |

| Market Size by 2034 | USD 81.01 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 22.67% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Application, By End-Use, and By Component |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Operational efficiency and cost savings

Airlines and aviation stakeholders rely on IoT technologies to enhance operational efficiency, optimize procedures, and reduce maintenance, fuel consumption, and downtime costs. IoT-powered predictive maintenance technologies enable airlines to monitor aircraft component health in real time. General Electric's Predix platform integrates engine IoT sensors to gather temperature, pressure, and wear data. By analyzing this data, airlines can predict potential breakdowns, schedule maintenance preemptively, and minimize unscheduled downtime and associated costs.

- Research by the International Air Transport Association (IATA) indicates that predictive maintenance can lead to a 30% decrease in unscheduled maintenance, which results in cost savings for airlines.

Restraint

Data security and privacy concerns

In the aviation IoT market, safeguarding data security and privacy is paramount. The vast amount of sensitive information exchanged among networked devices poses significant risks if not adequately protected. Unauthorized access, data breaches, and cyber-attacks are serious threats that require careful attention. Recognizing this, the Federal Aviation Administration (FAA) emphasizes the importance of robust cybersecurity measures, especially for IoT-connected aviation infrastructure. A PwC study highlights the aviation industry's vulnerability to cyber threats due to increased digitalization and connectivity. Ensuring the security of IoT devices is crucial to safeguarding sensitive data and maintaining trust among passengers and stakeholders.

Opportunities

Advanced connectivity solutions

The rapid advancements in high-speed connectivity, such as 5G, satellite communication, and edge computing, present significant opportunities for the Aviation IoT market. These technologies enhance data transmission speed and reliability between aircraft systems, ground operations, and data centers, improving overall connectivity and communication within the aviation ecosystem. The integration of 5G technology holds immense potential for the aviation IoT market, offering faster data speeds, lowered latency, and raised network capability compared to previous generations. Aircraft equipped with 5G connectivity can transmit and receive data at unprecedented rates, enabling various applications and services.

The Convergence of Communications and Aerospace Ecosystems Satcom operators and telcos merged with satellite communications (satcom) to form a new company in June 2023, giving them the chance to collaborate on improving service quality and coverage globally. The release of Release 17 by the Third Generation Partnership Program (3GPP) in the middle of 2022 has been a major driver of this convergence. Utilizing current 5G core network (CN) capability, repurposing reference signals, and adjusting to the form factor of mobile phones are all part of this integration.

Operational optimization and safety and maintenance improvements

The aviation industry's pursuit of efficiency and cost-cutting has fueled the adoption of IoT technologies. These solutions provide timely data insights, allowing airlines and airports to enhance flight schedules, streamline ground operations, and minimize maintenance downtime, leading to improved efficiency and cost savings. Moreover, the introduction of IoT-based predictive maintenance has enabled airlines to anticipate potential issues with their aircraft, engines, and components. By monitoring sensor data in real-time, airlines can efficiently schedule maintenance tasks, reducing unscheduled downtime and enhancing overall safety.

Segment Insights

Application Insights

The asset management segment held a substantial market share in 2024 for the aviation IoT market. Given the aviation industry's reliance on costly assets and the expanding fleet size due to rising passenger traffic, effective asset management and tracking are becoming increasingly crucial for enhancing operational efficiency. Aviation asset management offers solutions to boost crew and fleet operations' productivity, thereby driving growth in this segment.

The passenger experience segment is expected to see the fastest growth rate in the aviation IoT market during the forecast period. In the aviation IoT passenger experience application, technology is leveraged to enhance the journey for air travelers. IoT solutions play a role in improving tailored offerings, in-flight entertainment, and connectivity. For instance, IoT-based platforms offer passengers instant updates regarding their flights and journeys, personalized entertainment choices, along with non-stop connectivity throughout the journey.

- In Oct 2023, an article was published that said Generative AI is being utilized by Emirates Airlines to enhance customer service and crew training. By leveraging the latest advancements in technology, the airline aims to reduce wait times for call center inquiries, enhance the training process for cabin crew members, and optimize flight routes for efficiency. This demonstrates the significant potential of generative artificial intelligence in revolutionizing various aspects of the airline industry.

Component Insights

The hardware segment has dominated the aviation IoT market with the largest share of 51% in 2024. This dominance is mainly due to the wide adoption of various IoT hardware components like sensors, actuators, and gateways in aircraft and airports. These components play a pivotal role in collecting and analyzing real-time data, empowering the aviation sector to make effective decisions. With aviation's increasing focus on safety and operational efficiency, the demand for IoT hardware is poised to grow further, facilitating the monitoring and automation of routine tasks. the hardware segment is expected to remain essential in the aviation IoT industry.

The software segment is poised for substantial growth with a significant CAGR forecast for the coming years for the aviation IoT market. This growth is primarily driven by the increasing adoption of data visualization in aviation. There is a rising demand for aviation IoT software as it facilitates the collection of vast amounts of data, aiding in decision-making processes related to air traffic control, baggage tracking, maintenance, and other crucial areas. Furthermore, developers are focusing on creating software that is compatible with a wide array of IoT hardware devices installed in airplanes and airports worldwide, contributing to the segment's anticipated expansion.

An article published by the Economic Times in June 2023 said Indian software and digital technology play a vital role in various industries, including aerospace and automobiles. highlights the growing significance of Indian talent in powering vehicles and aircraft, especially as these industries rely more on sophisticated digital technologies and algorithms. The lower cost of Indian talent compared to developed countries further drives the offshoring of digital engineering work.

End-use Insights

The airport segment accounted for a significant revenue share in 2024. Airports are the main revenue generators in the aviation IoT market. They serve crucial functions in the aviation industry, including passenger services, air traffic control, and ground operations. Using technology, airports improve security measures, handle baggage more efficiently, and streamline overall operations within the aviation IoT framework. IoT solutions enable real-time monitoring of airport infrastructure, resulting in improved efficiency and ensuring passengers experience seamless travel processes.

the airline segment is growing steadily. The segment is experiencing steady growth as airlines prioritize ancillary revenue generation. IoT technology proves crucial in offering airlines access to real-time data and enhancing the in-flight cabin experience for passengers. With the increasing prevalence of smartphones, there is a rising demand for in-flight internet connectivity and personalized entertainment options, creating avenues for significant ancillary revenue for airlines. Moreover, the adoption of intelligent baggage monitoring and advanced cabin climate control solutions can enhance the passenger experience, driving growth in the segment.

Regional Insights

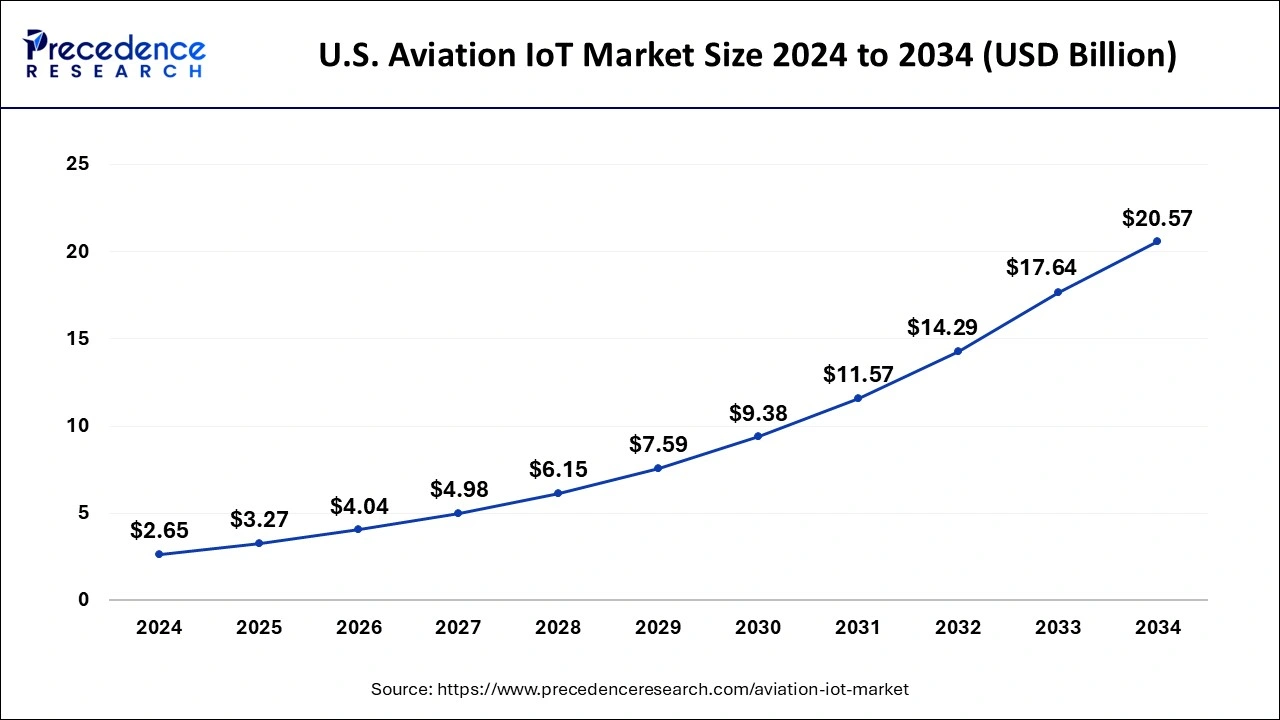

U.S.Aviation IoT Market Size and Growth 2025 To 2034

The U.S. aviation IoT market size reached USD 3.27 billion in 2025 and is projected to be worth around USD 20.57 billion by 2034, poised to grow at a CAGR of 22.74% from 2025 to 2034.

North America dominated the aviation IoT market securing the largest market share of 36% in 2024. This was primarily driven by the region's well-established aviation industry, particularly in the United States and Canada. These countries along with other developing areas carry a sophisticated` environment to adopt advanced technologies for various sectors. Therefore, the region holds potential to sustain its dominance in the market for the upcoming period.

Furthermore, the region is seen as a center for multiple OEMs including leading manufacturers across the globe that generally focus on adopting technologies for the betterment of industries. In addition, the potential of cutting-edge aviation infrastructure in the United States with growing focus on passenger experiences create a driving factor for the aviation IoT market to grow in North America.

Asia Pacific is observed to witness the fastest rate of expansion in the aviation IoT market during the forecast period. The growth of the market is fueled by major factors such as rising air traffic in developing countries, government support for the improvement of aviation sector and infrastructure along with rising private investments in the airline industry. Countries including India, China, Japan, Singapore and South Korea are observed to witness the growth while being significant contributors to the market with the expansion of tourism in these countries.

Morever, the capability of adopting technologies at a faster pace in these countries along with the penetration of advanced solutions in the airline industry to offer seamless operations will act as major drivers for the aviation IoT market in Asia Pacific.

Aviation IoT Market Companies

- Honeywell International, Inc.

- Tata Communication

- Cisco Systems, Inc.

- Huawei Technologies Co. Ltd.

- IBM Corp.

- Aeris Communication

- Microsoft Corp.

- Tech Mahindra Ltd.

- Wind River Systems, Inc.

- SAP SE

Recent Developments

- January 2024- Airbus opened a new ZEROe Development Center in Stade to develop revolutionary hydrogen technologies.

- In May 2023, the International Civil Aviation Organization (ICAO) released a new set of guidelines for the use of IoT in the aviation industry. The guidelines address a variety of topics, including data security, privacy, and interoperability.

- In April 2023, Delta Air Lines announced that it had installed a new IoT-powered baggage tracking system at its Atlanta airport hub. The system uses sensors to track the location of baggage in real time. This information is used to help passengers track their baggage and to identify any delays or disruptions in the baggage handling process.

- In March 2023, Airbus announced that it had partnered with Palantir Technologies to develop a new IoT platform for the aviation industry. The platform will collect and analyze data from various sources, including aircraft sensors, weather data, and flight schedules. This data will be used to improve the safety and efficiency of Airbus's operations.

- In February 2023, Lufthansa Technik announced that it had installed a fleet of 500 connected sensors on its aircraft. The sensors will collect data on engine performance, fuel consumption, and other metrics. This data will be used to improve the efficiency and safety of Lufthansa's operations.

Segments Covered in the Report

By Application

- Ground Operations

- Passenger Experience

- Aircraft Operations

- Asset Management

By End-Use

- Airport

- Airline Operators

- MRO

- Aircraft OEM

By Component

- Hardware

- Software

- Service

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content