What is the Aviation Analytics Market Size?

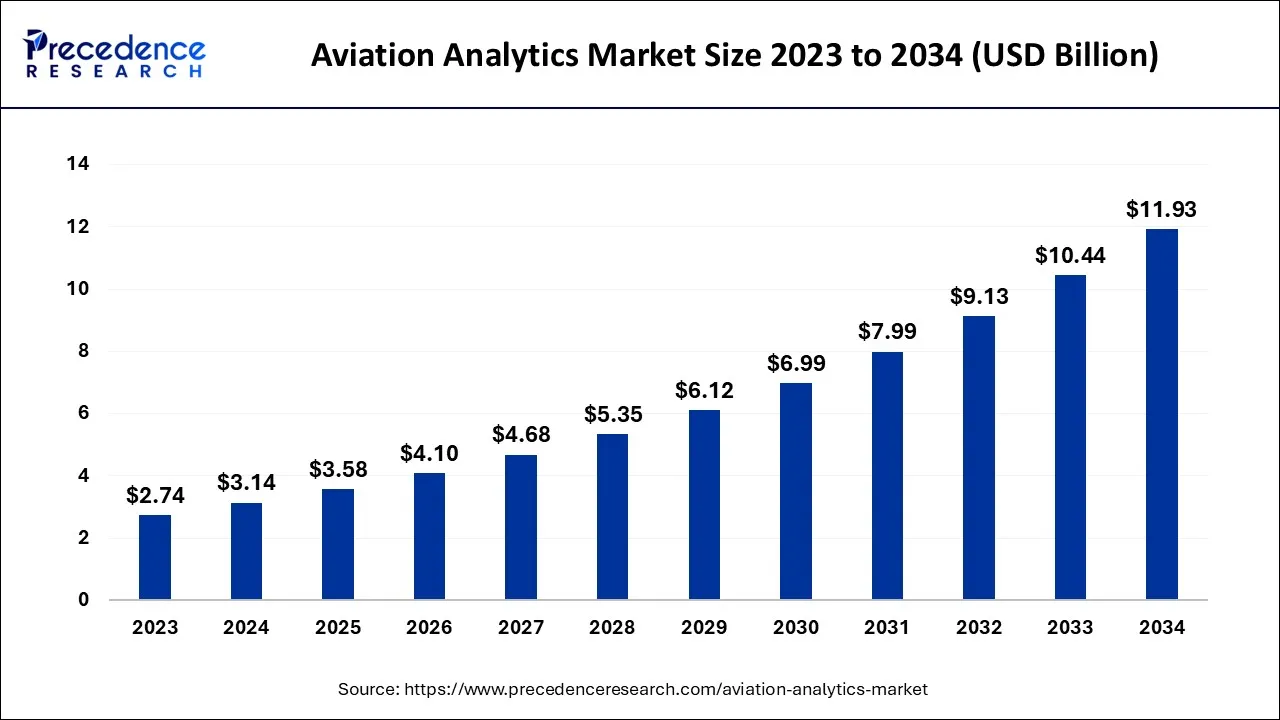

The global aviation analytics market size is accounted at USD 3.58 billion in 2025 and predicted to increase from USD 4.10 billion in 2026 to approximately USD 13.42 billion by 2035, representing a CAGR of 14.13% from 2026 to 2035.

Aviation Analytics Market Key Takeaways

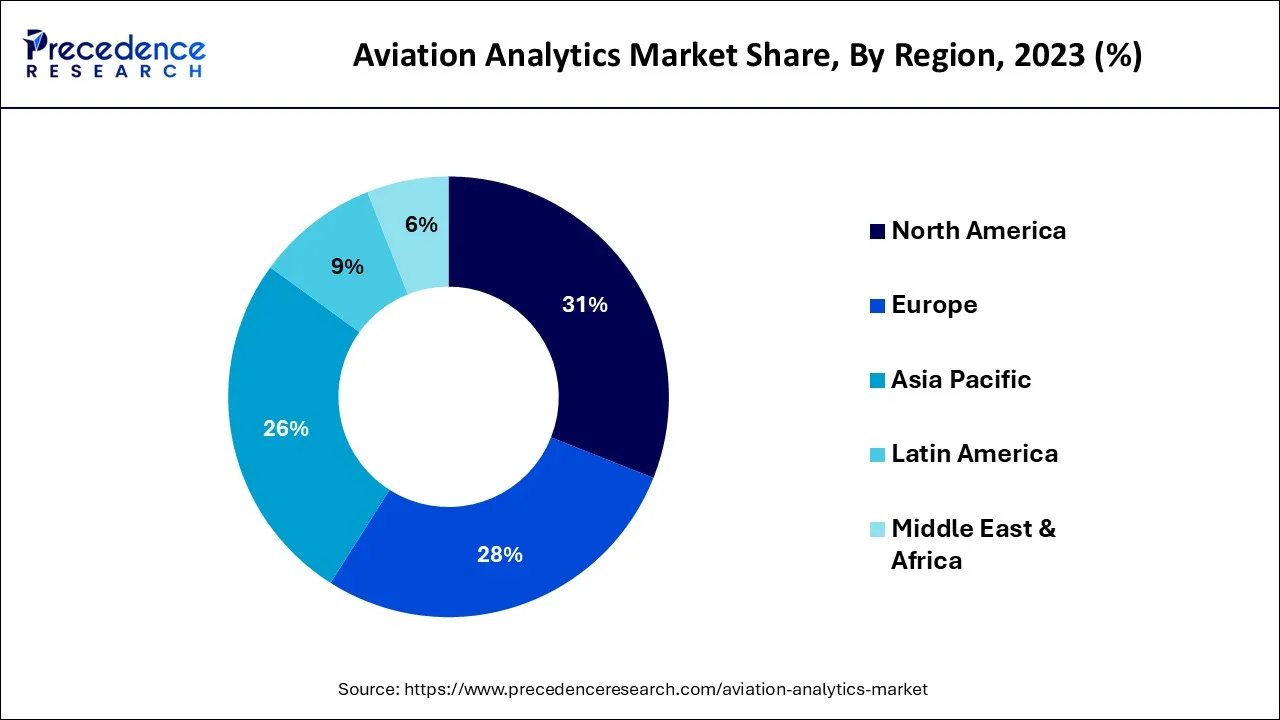

- North America led the global market with the highest market share of 31% in 2025.

- By Business Function, the finance segment led the global market in 2025.

- By End User, the airline segment dominated the global market in 2025.

- By Component, the software segment contributed to the largest revenue share in 2025.

- By Application, the customer analytics segment recorded to the biggest revenue share in 2025.

Market Overview

The computational technology known as aviation analytics offers data statistics and information on operational activities, weather forecast data, and real-time flight data. It evaluates and analyses the enormous amount of data produced. Inventory, flight risk, fuel, revenue management, and customer analytics all make extensive use of it. Information can be analyzed, optimized, and managed using a variety of technologies, including monitoring and data and descriptive statistics.

It helps to improve operational strategy and execution while also promoting productivity, efficiency, transparency, maintenance, client satisfaction, and risk management. In order to give meaningful information to airports, airlines, aviation stakeholders, and other business sectors like marketing and sales, finance, maintenance, and repair, aviation analytics is frequently employed.

How is AI Redefining the Aviation Analytics Market?

AI is redefining the overall landscape of the aviation sector. AI has been integrated into modern airports to streamline operations, boost security, and personalize passenger experiences. Also, AI-based platforms are adopted by airline companies to optimize flight routes, manage crew schedules, and automate tasks. Moreover, numerous AI developers have started developing advanced AI platforms to enhance maintenance operations and improve fuel management.

- In October 2025, CAMP Systems International launched AI Operations Manager. This AI management is designed to transform aviation maintenance through predictive intelligence.

Aviation Analytics Market Growth Factors

One of the main elements fostering a favorable outlook for the market is the considerable global growth of the aviation industry. The management of real-time data, such as navigation databases, connectivity, flight operational operations, and aircraft maintenance, is a common use of aviation analytics. Accordingly, the widespread use of products to cut operating costs and predict client preferences as a result of rising passenger traffic is promoting market expansion.

Also, a number of technical developments, such as the combination of big data and artificial intelligence (AI) to conduct mechanical analysis, boost productivity and security, and forecast unplanned failure, are fueling the market's expansion. Also, the market growth is being positively impacted by the rising need for real-time analytical solutions to boost profitability, tracking, fraud detection, and data management. In addition, it is projected that significant research and development (R&D) activities and the execution of several government initiatives to enhance aviation safety will propel the market toward expansion.

Market Outlook

- Industry Growth Overview: The aviation analytics market is experiencing strong growth, driven by digital transformation, AI, big data, and IoT, with a focus on fuel efficiency, predictive maintenance, operations, and passenger experience, despite challenges.

- Major investors: Major investors and key players in the Aviation Analytics market aren't just VCs but include large tech firms (IBM, Oracle, SAP, Microsoft), aerospace giants (Boeing, Airbus, GE, Honeywell), and consulting firms.

- Global Expansion: This global growth is fuelled by an increasing demand for operational efficiency, predictive maintenance, and the integration of big data and AI technologies across the aviation industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.58 Billion |

| Market Size by 2035 | USD 13.42 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 14.13% |

| Largest Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component, By Business Function, By End User, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased demand for corporate process optimization through the application of structured analytical solutions

The rising competitiveness in the aviation industry is motivating businesses to adopt advanced data analyticsin order to maintain their market share globally. By utilizing data analytics, aviation companies can achieve high sales and operational profitability. With analytical tools like forecast analysis, profitability analysis, sales analysis, competitive analytics, and dependability analytics, businesses may gather, organize, analyses, store, and retrieve enormous volumes of data about their markets and consumers.

Restraint

Absence of highly qualified personnel in the sector

As the use of real-time analytical solutions, particularly "Big Data" analytics, has recently increased, a workforce with analytical abilities is now necessary. Lack of competent labor could slow the overall aviation passenger traffic's explosive expansion. The expansion of the aviation analytics market is also restricted by a lack of experienced personnel, which is a key obstacle to current data and analytics initiatives, despite the rise in data usage and consumption.

It is challenging to integrate traditional and contemporary aircraft equipment, and it takes a significant financial and technical effort. New gadgets can have various protocols that make them challenging to adopt. Due to a lack of adequate analytical capabilities, integrating old data systems with modern technology takes time and effort and may divert a company from its main business operations.

Opportunity

Large-scale data production in the aviation sector

The amount of data used in the aviation industry is substantial and difficult to manage and evaluate. The FAA's Air Traffic Organization (ATO) manages over 2.8 million airline passengers and more than 50,000 flights per day across more than 30 million square miles of airspace. More than 2.5 million characteristics are gathered by sensors on a single aero plane, with engine data being one of the most important. Any business decision requires access to these enormous amounts of data.

Segment Insights

Business Insights

The aviation analytics market is divided into sales and marketing, finance, maintenance, repair & operations, and supply chain according to business function. The finance segment dominated the aviation analytics market in 2023. Airport finance analytics includes information on the airport's revenues, costs, profitability, payables and receivables, assets, and significant financial ratios. Airports are embracing and investing in this industry more and more as a result of these causes.

End User Insights

The aviation analytics market is segmented into Airlines, Airports, and Others based on end-user. The airline sector led the aviation analytics market in 2023. Due to the rising need for aviation analytics across a range of commercial applications, airlines all over the world are employing them. The increasing popularity of air travel and the opening of new air routes are two major factors fostering the airline industry's expansion.

Component Insights

The aviation analytics market is divided into two segments based on components: service and software. In 2023, the software sector gained a sizeable sales share in the aviation analytics industry. It is because businesses are investing more money in implementing cutting-edge software and solutions. The need for such upgraded items is also being fueled by the expansion of market participants. Also, such software would assist aviation businesses in enhancing their operations and increasing income.

Application Insights

Flight risk management, fuel management, inventory management, revenue management, customer analytics, and navigation services are the various applications in the aviation analytics sector. In 2023, the aviation analytics market's highest revenue share was attained by the customer analytics segment. It is as a result of the great demand for drones with aviation analytics to satisfy consumer needs. In addition to embracing customer-centricity by using predictive analytics to improve decision-making, the airlines are investing a lot of money in learning about customer preferences and behavior.

Regional Insights

What is the U.S. Aviation Analytics Market Size?

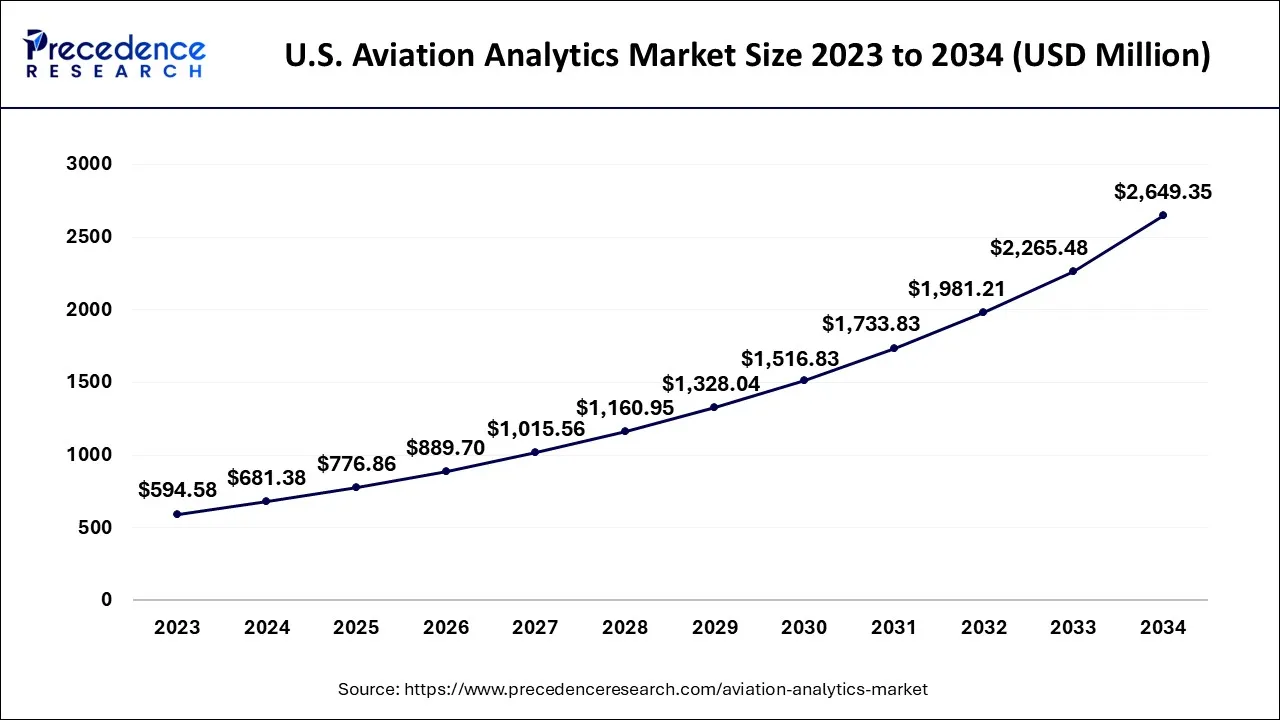

The U.S. aviation analytics market size is exhibited at USD 776.86 million in 2025 and is projected to be worth around USD 2,966.82 million by 2035, growing at a CAGR of 14.34% from 2026 to 2035.

Why Did North America Hold the Largest Share of the Aviation Analytics Market?

North America held the largest share of 31% in aviation analytics market in 2025 due to its established aerospace industry, high adoption of advanced technologies, strong presence of key players, and substantial investments in research and development. The region also benefits from a large number of airlines and airports, which generate vast amounts of operational data, driving demand for analytics solutions to optimize performance, enhance safety, and improve customer experience. Additionally, favorable government regulations and a competitive market environment further support North America's leadership in aviation analytics.

How is Asia Pacific Evolving in the Aviation Analytics Market?

Over the years, Asia-Pacific has developed into an important aviation center. Due to a rise in demand for air travel, the growing economies in the area, including China and India, are seeing enormous growth in their own civil aviation businesses. As a result, a significant growth rate in Asia-Pacific sales is anticipated during the forecast period. Because to strong domestic demand, China is driving the resurgence of commercial aviation worldwide and assisting airlines in experiencing financial recovery.

Due to high demand from both civilian and military customers, it has grown to be a significant aviation industry hub throughout time. Over the years, commercial aviation has made significant contributions to China's aviation industry. Due to an increase in domestic air passenger traffic, which is predicted to grow at a pace of 4.4% by 2040, China is currently the world's largest market for aviation. The expansion of the market would also be aided by an increase in the number of airports in the area. The development of 21 new greenfield airports in India was given the nod by the Indian Aviation Ministry in March 2022.

U.S. Aviation Analytics Market Trends

In North America, the U.S. dominated the market owing to a surge in air traffic and heavy investments in airport tech, along with the emphasis on safety, efficiency, and passenger experience. Also, data-driven strategies facilitate marketing, customise offers, and track passenger behaviour for better journeys.

Europe Takes Flight: Aviation Analytics Market Soars on Data-Driven Transformation

Europe is expected to grow at a notable rate over the forecast period. The growth of the region can be attributed to its stringent EU regulations and government mandates, pushing analytics for security, safety, and sustainable operations. Furthermore, the European Green Deal initiatives necessitate airlines to cut emissions and enhance energy efficiency.

Germany Aviation Analytics Market Trends

The growth of the country can be driven by its robust air traffic and strong economy, which makes travel accessible and affordable. Moreover, the presence of major domestic players such as Technik and SAP SE helps fuel market advancements and the adoption of analytics solutions within the country.

How is the Opportunistic Rise of Latin America in the Aviation Analytics Market?

Latin America is expected to grow at a considerable CAGR during the forecast period. The market in the region is driven by the growing adoption of AI-based analytics platforms by airlines to enhance numerous applications, including revenue management and fuel management. Additionally, the rapid investment by the governments of several nations, such as Brazil and Argentina, in modernizing airports is positively contributing to the market. Moreover, the increase in the number of aviation MRO providers is expected to propel the growth of the market in this region.

- In December 2025, the government of Argentina invested around US$500 million. This investment is made to modernize 13 airports across the nation.

(Source: https://derechadiario.com.ar )

What Opportunities Exist in the Middle East & Africa for the Aviation Analytics Market?

The Middle East & Africa (MEA) presents immense opportunities for the market, driven by the rapid adoption of advanced analytical software by airports in several nations, including the UAE, Qatar, South Africa, and Saudi Arabia. The integration of AI-enabled inventory management solutions in modern airports to enhance the capabilities of baggage handlers is playing a prominent role in shaping the market landscape. Moreover, the rapid investment by the government for deploying advanced analytical tools in military aircraft is expected to foster the growth of the market in this region.

- In November 2025, Dubai Airports partnered with Assaia. This partnership is aimed at deploying an AI-driven turnaround management system across all aircraft stands at DXB.

(Source: https://dig.watch/updates )

Top Companies in the Aviation Analytics Market & Their Offerings

- Airbus: Offers the Skywise open data platform, which provides solutions for predictive maintenance and operational efficiency by integrating data across fleets and enabling performance benchmarking for airlines.

- IBM: Delivers intelligent asset management through its IBM Maximo platform, which uses AI and IoT data to monitor fleet-wide asset performance, automate maintenance workflows, and forecast inventory needs.

Other Major key Players

- Accelya Group (Vista Equity Partners)

- SAS Institute, Inc.

- OAG Aviation Worldwide Limited

- IGT Solutions Pvt. Ltd.

- Mu Sigma, Inc.

- SAP SE

- Oracle Corporation

- IBM Corporation

- General Electric (GE) Co.

- Ramco Systems Limited

Recent Development

- In October 2025, Veryon unveiled Veryon AIRE. Veryon AIRE is an AI-based platform designed to enhance the capabilities of aircraft maintenance.

(Source: https://avitrader.com ) - In July 2025, Spire Global launched an aircraft weather exposure analytics platform. This platform is developed to measure aircraft-level exposure by using flight trajectories and weather forecasts.

(Source: https://www.investing.com ) - In June 2025, Cirium launched OTP AI, an AI-enabled platform designed for deriving precise insights and streamlining resources in the aviation sector.

(Source: https://www.cirium.com ) - In June 2022,OAG and The Pacific Asia Travel Association entered into a cooperation (PATA). Via the PATAmPOWER platform, this partnership aims to give PATA members better access to distinctive and trustworthy aviation data. Through analysis, events, and more data exchange, the agreement would also enable both organisations to provide the Asia Pacific visitor economy with additional insight and knowledge.

- The largest oil and gas firm in Brunei Darussalam, Brunei Shell Petroleum, and Ramco Systems have partnered since May 2022. In accordance with this cooperation, Ramco would provide Brunei Shell Petroleum with its Aviation, Aerospace, and Military software. Moreover, Ramco's Aviation Software would give BSP components for Flight Operations, CAMO, Maintenance, Safety & Quality, and Technical Records, providing BSP with a cutting-edge digital platform.

- In May 2022,SAS Institute and iCoupon, the world's top digital vouchering platform for airports, partnered. Through this collaboration, the airline and its clients would have easier access to its premier digital vouchering platform. Together, the businesses would integrate its automated vouchering system into SAS's current operations, giving customers on delayed flights a simple, streamlined vouchering option.

- A cooperation between GE Aviation and the British multinational armaments, security, and aerospace corporation BAE Systems was established in April 2022. To design, test, and provide energy management components for GE's recently announced megawatt (MW) class hybrid electric propulsion system in development, BAE Systems was chosen by GE Aviation as part of this alliance.

Segments Covered in the Report

By Component

- Services

- Software

By Business Function

- Sales & Marketing

- Finance

- Maintenance

- Repair & Operations

- Supply Chain

By End User

- Airlines

- Airports

- Others

By Application

- Customer Analytics

- Flight Risk Management

- Fuel Management

- Revenue Management

- Inventory Management

- Navigation Services

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting