Bariatric Surgery Devices Market Size and Forecast 2025 to 2034

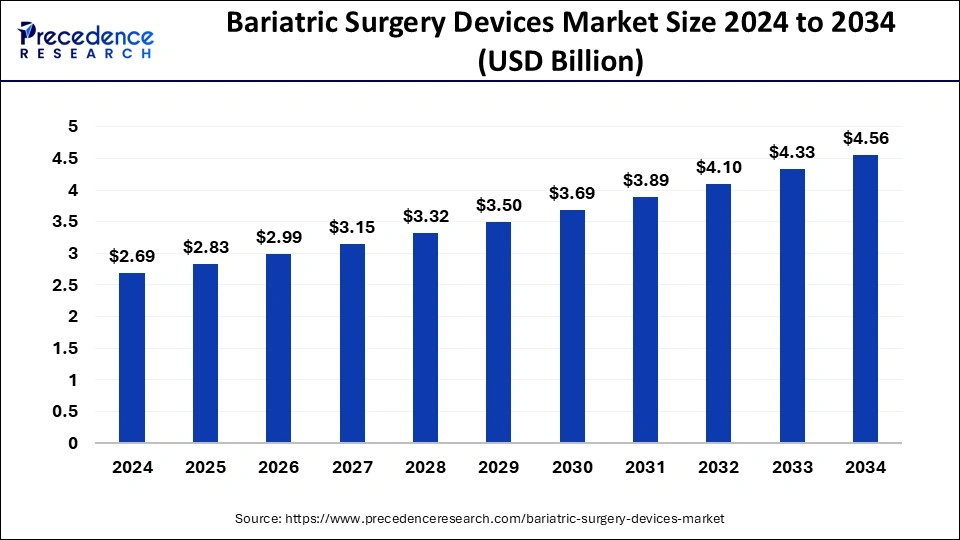

The global bariatric surgery devices market size accounted for USD 2.69 billion in 2024 and is predicted to increase from USD 2.83 billion in 2025 to approximately USD 4.56 billion by 2034, expanding at a CAGR of 5.43% from 2025 to 2034. The bariatric surgery devices market is observed to be driven with the rising prevalence of obesity across the globe.

Bariatric Surgery Devices Market Key Takeaways

- The global bariatric surgery devices market was valued at USD 2.69 billion in 2024.

- It is projected to reach USD 4.56 billion by 2034.

- The bariatric surgery devices market is expected to grow at a CAGR of 5.43% from 2025 to 2034.

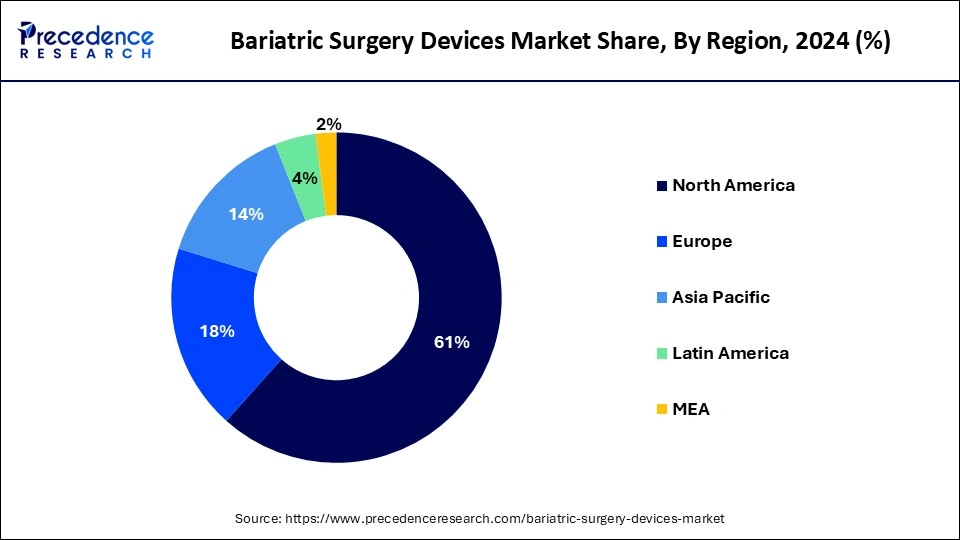

- North America held the largest market share of around 61% in 2024 while promising significant growth throughout the forecast period.

- Asia Pacific is observed to be the fastest growing marketplace during the forecast period.

- By product, the minimally invasive surgical devices segment dominated the market in 2024 with revenue share of 90%.

- By procedure, the non-invasive bariatric surgery segment dominated the bariatric surgery devices market in 2024.

- By procedure, the gastric bypass is expected to grow at the fastest rate during the forecast period of 2025-2034.

U.S. Bariatric Surgery Devices Market Size and Growth 2025 to 2034

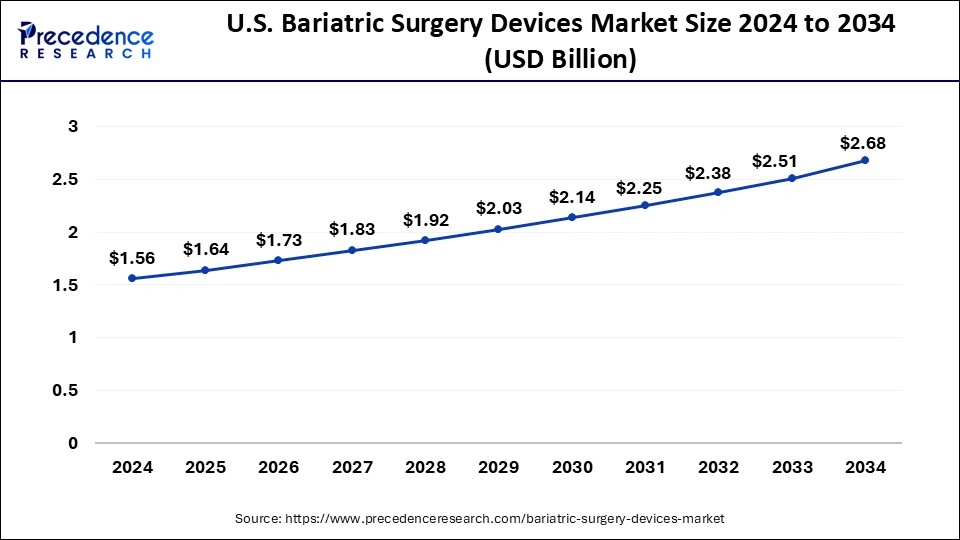

The U.S. bariatric surgery devices market size was evaluated at USD 1.56 billion in 2024 and is projected to be worth around USD 2.68 billion by 2034, growing at a CAGR of 5.56%.

North America led the global market with the highest market share of 61% in 2024. Whereas the region promises sustained growth during the forecast period. North America has one of the highest rates of obesity globally, with a significant portion of the population affected by obesity-related health issues such as type 2 diabetes, cardiovascular diseases, and hypertension. The increasing prevalence of obesity drives the demand for bariatric surgery as a treatment option, thereby fueling market growth. The region boasts advanced healthcare infrastructure, including state-of-the-art hospitals, specialized bariatric surgery centers, and skilled healthcare professionals. Access to advanced medical facilities and expertise in bariatric surgery procedures contributes to the region's dominance in the market.

North America is a hub for technological innovation in the healthcare sector, including the development of advanced bariatric surgery devices and techniques. The region benefits from continuous research and development efforts aimed at improving the safety, efficacy, and outcomes of bariatric procedures, further driving market dominance.

- About four out of 10 Americans are affected by obesity as per the data from the Centers for Disease Control and Prevention (CDC).

- According to the World Obesity Federation predicts that by 2030, one in seven men and one in five women will be affected by obesity.

- In the United States, black people have the highest rate of obesity that is 49.9%, compared to Hispanic adults which stands at 45.6%.

Asia Pacific is observed to witness the fastest rate of expansion during the forecast period in the bariatric surgery devices market. Asia Pacific is experiencing a significant increase in obesity rates, driven by changing lifestyles, urbanization, and dietary habits. As obesity becomes a growing health concern, there is a higher demand for bariatric surgery as an effective treatment option, leading to increased adoption of bariatric surgery devices. Many countries in Asia Pacific are investing in expanding and upgrading their healthcare infrastructure to meet the needs of their growing populations. This includes the establishment of specialized bariatric surgery centers and the training of healthcare professionals in bariatric surgery techniques, further fueling the growth of the bariatric surgery devices market in the region.

Asia Pacific is witnessing rapid advancements in medical technology, including innovations in bariatric surgery devices. Advanced surgical techniques, minimally invasive procedures, and the development of novel devices are making bariatric surgery safer, more effective, and less invasive, driving the adoption of these procedures and devices in the region.

As per the report, the total number of adult adults with obesity cases doubled between 2020 and 2035 in both Pacific Island countries and the Western Pacific region.

Europe is observed to grow at a considerable growth rate in the upcoming period, fueled by increasing obesity levels and heightened awareness of surgical weight-loss alternatives. Minimally invasive techniques like laparoscopic sleeve gastrectomy and gastric bypass are gaining popularity due to their safety and effectiveness. Innovations in surgical instruments and robotic technologies are improving precision and surgical results. Additionally, supportive healthcare policies and reimbursement systems are motivating both patients and hospitals to adopt bariatric surgical treatments, particularly in Western European countries.

Germany is emerging as a pivotal market for bariatric surgery devices in Europe, driven by a rising rate of obesity and growing acceptance of surgical options. The country's advanced healthcare system and the availability of skilled surgeons facilitate the widespread adoption of minimally invasive bariatric surgeries. Hospitals in Germany are incorporating robotic-assisted technologies and advanced stapling systems, while insurance coverage and awareness initiatives are further enhancing the landscape of bariatric surgery in the country.

Market Overview

The bariatric surgery devices market refers to the industry involved in the development, manufacturing, distribution, and sale of medical devices specifically designed for use in bariatric surgery procedures. Bariatric surgery, also known as weight loss surgery, is a surgical procedure performed on individuals who are severely obese and have not been successful in losing weight through diet, exercise, or medication.

The market for bariatric surgery devices includes a wide range of products and equipment used during different types of bariatric procedures, such as gastric bypass, sleeve gastrectomy, gastric banding, and biliopancreatic diversion with duodenal switch (BPD/DS). These devices may include surgical instruments, staplers, gastric bands, gastric balloons, gastric sleeves, trocars, and other tools specifically designed for use in bariatric surgery.

Bariatric Surgery Devices Market Growth Factors

- The growing economic development of the countries results in increased disposable income in the population which tends to the shift in lifestyle, adoption of unhealthy lifestyle, eating habits and rising consumption of junk foods.

- The increasing number of people suffering from overweight conditions or obesity is driving the demand for surgical procedures that drive the growth of the bariatric surgery devices market.

- The technological advancements in the healthcare industry across the globe are observed to promote the growth of the market.

- The increasing prevalence of obesity in the adults and geriatric population due to the rapid adoption of modern lifestyle results in the increased consumption of junk and excessive intake of calories are contributing to the growth of the market.

- The rising investment in cutting-edge technologies like robotics surgical procedures is contributing to the growth of the bariatric surgery devices market.

Major Key Trends in Bariatric Surgery Devices Market

- Shift Toward Minimally Invasive Surgeries: Both patients and surgeons are increasingly opting for laparoscopic and robotic-assisted bariatric procedures due to decreased pain, shorter hospital stays, and quicker recovery periods, which is propelling the use of specialized surgical instruments.

- Technological Enhancements in Stapling Devices: Recent advancements in stapling and energy-based instruments are enhancing surgical accuracy, minimizing complications, and improving overall results, prompting hospitals to upgrade to the latest bariatric surgical tools.

- Growing Emphasis on Patient-Centered Care: Healthcare providers are developing comprehensive post-surgical programs that include dietary assistance and lifestyle coaching to promote sustained weight loss success, thereby increasing the demand for dependable surgical options.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.43% |

| Market Size in 2025 | USD 2.83 Billion |

| Market Size by 2034 | USD 4.56 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Procedure |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The rising cases of obesity

The increasing obesity cases in the population is one of the major concerning factors around the world. The rise in obesity results in many severe health conditions like cardiovascular disease, hypertension, diabetes, high blood pressure, etc. Bariatric surgery is considered the last option of treatment for obesity across the healthcare sector. Shifting lifestyle standards and unhealthy lifestyles are contributing to the rise in diseases like obesity in urban areas. Obesity is continuously evolving as a major problem worldwide which is driving the demand for bariatric surgery due to its effective treatment for severe obesity and results in the recovery from obesity-related problems. Thus, the increasing number of cases of obesity is driving the growth of the bariatric surgery devices market.

Restraint

High-cost surgeries

The cost factor associated with bariatric surgeries creates a major restraint for the bariatric surgery devices market. Bariatric surgeries are often expensive procedures, requiring specialized equipment, skilled healthcare professionals, and post-operative care. The high cost of these surgeries may deter patients, particularly those with limited financial resources, from opting for bariatric treatment options. In regions with limited access to healthcare services or where healthcare costs are disproportionately high compared to average incomes, the high cost of bariatric surgeries may pose a significant barrier to access. Economic constraints may prevent individuals from seeking or undergoing surgery, resulting in underutilization of bariatric surgery devices and related technologies.

Opportunity

Technological advancements

The technological advancements in the healthcare sector and the integration of technologies in the surgical devices and procedures are observed to create a lucrative opportunity for the bariatric surgery devices market. Advancements in surgical technologies, such as minimally invasive procedures and robotic-assisted surgery, have revolutionized bariatric surgery. These techniques offer improved precision, shorter recovery times, and reduced risk of complications, making bariatric surgery more accessible and appealing to patients. Newer bariatric surgery devices are designed to improve patient outcomes by promoting greater weight loss, reducing post-operative complications, and enhancing long-term success rates. These advancements increase patient satisfaction and confidence in bariatric surgery as an effective treatment for obesity-related health conditions.

- In February 2024, Virtual Incision Corporation announced the launch of MIRA™ Surgical System (MIRA), the one of a kind miniaturized robotic-assisted surgery (miniRAS) device, for the adult colectomy procedures with the approval of U.S. Food and Drug Administration (FDA).

Product Insights

The minimally invasive surgical devices segment dominated the bariatric surgery devices market with the largest market share in 2024. The growth of the segment is attributed to the rising adoption of the devices to reduce requirement of the large surgical incisions. These types of surgical devices cause smaller incisions and lesser pain post-surgery.

The minimally invasive surgery devices include surgical instruments, implants, and catheters. Additionally, the technological advancements in the minimal invasive surgeries like stapling, vascular sealing, and suturing are driving the growth for the segment in the market. The rising concern about the time taken in the surgery and after marks of surgeries in the body is driving the demand for the minimally-invasive surgical devices in the healthcare sector that promotes the growth of the segment.

The non-invasive surgical devices segment expected to grow at the fastest rate in the bariatric surgery devices market during the forecast period. Non-invasive surgical devices are associated with lower risks of postoperative complications, such as infections, bleeding, and hernias, compared to invasive surgical techniques. This factor contributes to the preference for non-invasive approaches among both patients and healthcare providers, driving the dominance of this segment in the market.

Non-invasive surgical devices enable surgeons to perform bariatric procedures with greater precision and control, resulting in improved patient outcomes, including reduced pain, shorter hospital stays, and faster recovery times. As a result, patients experience better overall satisfaction with non-invasive approaches, further fueling the dominance of this segment.

Procedures Insights

The non-invasive bariatric surgery segment dominated the bariatric surgery devices market in 2024. Non-invasive procedures typically involve less risk and fewer complications compared to traditional surgical approaches. As a result, patients are more inclined to opt for non-invasive bariatric surgery, leading to higher demand for devices associated with these procedures. Patients increasingly prefer non-invasive options for weight loss surgery due to factors such as quicker recovery, reduced pain, and lower risk of post-operative complications. The growing emphasis on patient-centered care and personalized treatment options further drives the demand for non-invasive bariatric surgery devices.

The gastric bypass segment is expected to grow at the fastest pace in the bariatric surgery devices market during the forecast period. Gastric bypass surgery has a long history of successful outcomes and is supported by extensive clinical evidence demonstrating its efficacy in achieving significant and sustained weight loss. Patients undergoing gastric bypass surgery typically experience greater reductions in excess body weight and improvements in obesity-related health conditions compared to other bariatric procedures. Gastric bypass surgery is favored by many bariatric surgeons due to its well-established techniques and favorable outcomes. Surgeons often have extensive experience and expertise in performing gastric bypass procedures, leading to higher patient satisfaction and lower complication rates compared to less commonly performed bariatric surgeries.

Bariatric Surgery Devices Market Companies

- Allergan Inc.

- Covidien Plc

- Johnson and Johnson

- Intuitive Surgical Inc.

- GI Dynamics Inc.

- TransEnterix Inc.

- USGI Medical Inc.

- Semiled Ltd.

- Cousin Biotech

- Mediflex

Recent Developments

- In May 2023, Olympus launched the POWERSEAL Sealer/Divider for the Europe, Middle East & Africa market. This bipolar device aids surgeons with cutting-edge dissection and sealing techniques for both open and laparoscopic surgical procedures.

- In February 2024, Appalachian Regional Healthcare (ARH) in the United States unveiled advanced bariatric procedures utilizing the innovative da Vinci Xi robotic system. The healthcare team at the center successfully performed the first Modified Duodenal Switch, or SADI-S (Single Anastomosis Duodeno-ileostomy with sleeve gastrectomy), alongside a Robotically Assisted Roux-En-Y Gastric Bypass (RYGB).

- In February 2024, BariaTek Medical completed the first human implant of BariTon. This groundbreaking device is delivered endoscopically and includes gastric and intestinal components, aiming to replicate the results of weight loss surgeries, particularly sleeve gastrectomy and bypass surgery.

- In February 2024, Providence East Hospitals launched its latest weight-loss center east in the medical building situated at 3270 Joe Battle Suite 180 in far East El Paso, on February 15, 2024.

- In February 2024, most of the pharmaceutical companies like Cipla, SunPharma, Dr Reddy's, and Lupin some of the leading generic drugmakers are predicting the weight-loss market is about to reach $100 billion a year and all said they are about to start working on the version of Novo Nordisk's Wegovy.

Segments Covered in the Report

By Product

- Minimally Invasive Surgical Devices

- Non-Invasive Surgical Devices

By Procedure

- Noninvasive Bariatric Surgery

- Sleeve Gastrectomy

- Gastric Bypass

- Rivision Beriatric Surgery

- Mini-gastric Bypass

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting