What is the Biceps Implants Market Size?

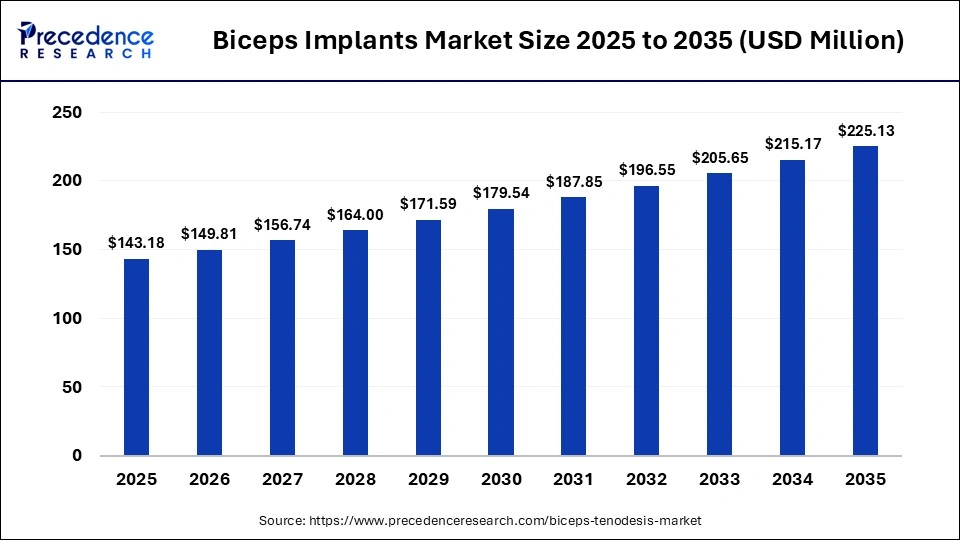

The global biceps implants market size was calculated at USD 143.18 million in 2025 and is predicted to increase from USD 149.81 million in 2026 to approximately USD 225.13 million by 2035, expanding at a CAGR of 4.63% from 2026 to 2035.The biceps implants market is booming due to a surge in demand for cosmetic enhancement, a rise in sports-related injuries, and enhancements in non-invasive surgical approaches, which lead to rapid recovery and better, safer outcomes.

Market Highlights

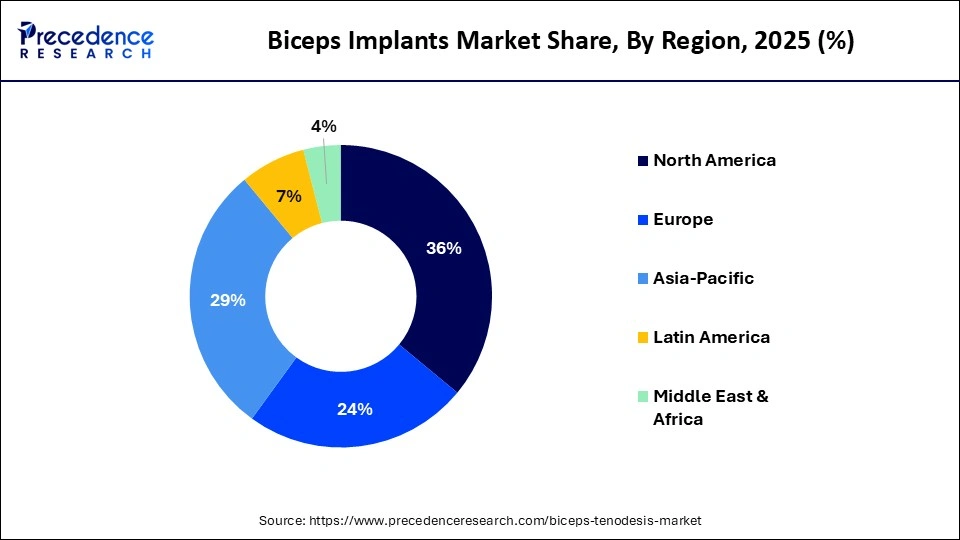

- North America dominated the market, holding a share of approximately 36% in 2025.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period.

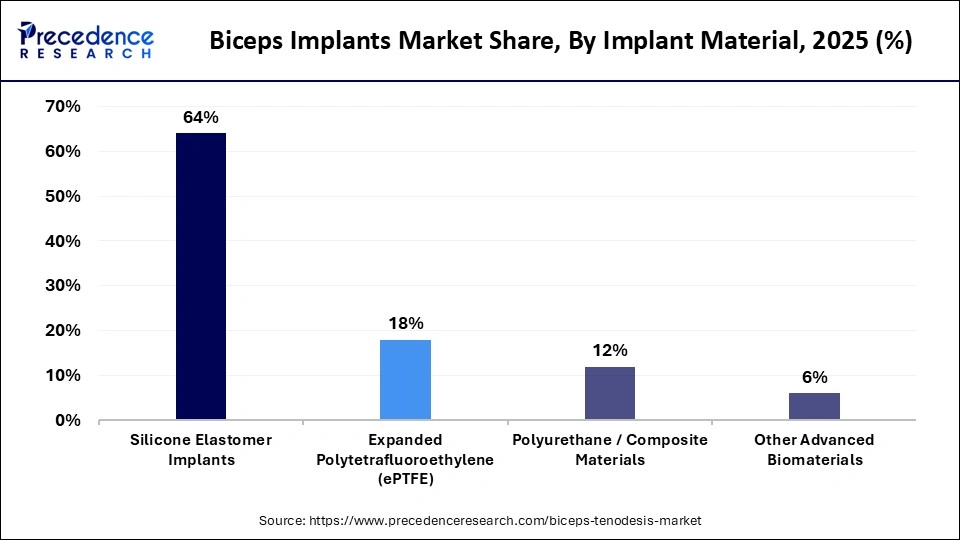

- By implant material, the silicone elastomer implants segment held the largest biceps implants market share of approximately 64% in 2025.

- By implant material, the polyurethane/composite materials segment is expected to grow at a remarkable CAGR between 2026 and 2035.

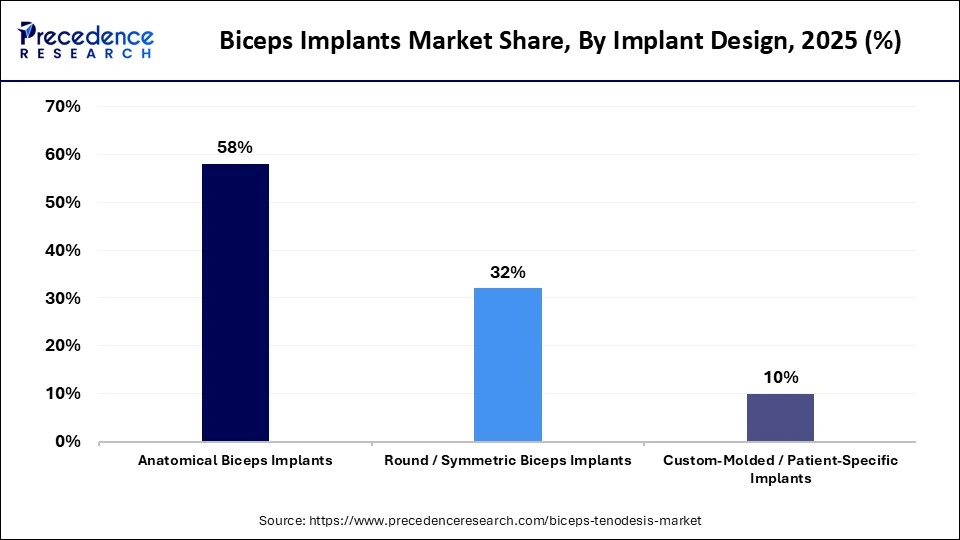

- By implant design, the anatomical biceps implants segment held a major market share of approximately 58% in 2025.

- By implant design, the custom-molded/patient-specific implants segment is expected to be the fastest-growing segment during the forecast period.

- By end-user, the aesthetic & cosmetic surgery clinics segment dominated the market with a share of approximately 58% in 2025.

- By end-user, the ambulatory surgical centers (ASCs) segment is expected to grow at the highest CAGR over the studied period.

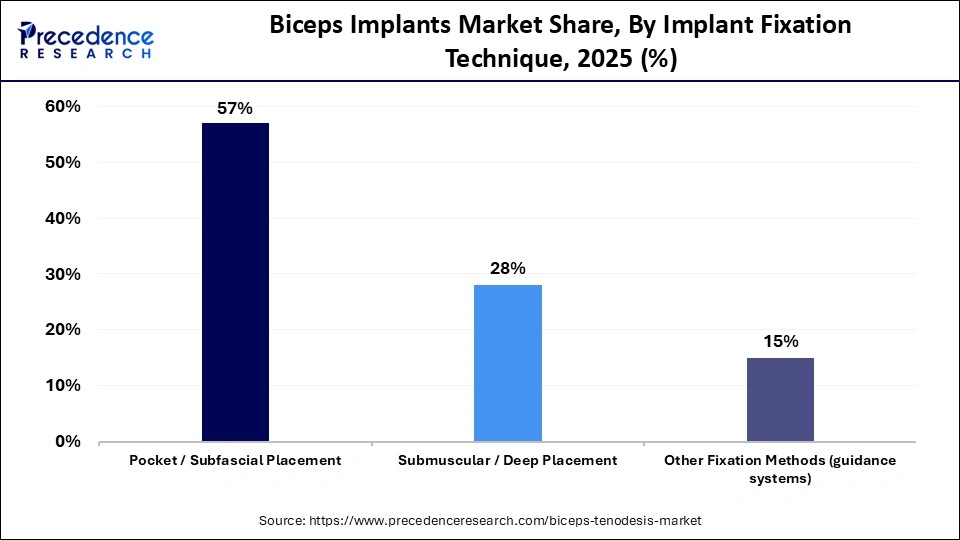

- By implant fixation technique, the pocket/subfascial placement segment led the market with a share of approximately 57% in 2025.

- By implant fixation technique, the other fixation methods segment is expected to show the fastest growth in the forecast period.

What are the Defining Characteristics of the Biceps Implants Market?

The market is experiencing exponential growth due to an increase in demand for male aesthetics and reconstructive and sports-related injuries. This market whirls around the development, production, and surgical application of implants that aim to improve the cosmetic, structural, and functional integrity of the bicep brachii muscle.

This market is further expanded by improved understanding of treatment options for muscular atrophy, a surge in disposable income, and the rise of medical tourism for cost-efficient, superior-quality surgeries. The amalgamation of 3D-printed titanium material is making an appearance to enhance durability and bio-acceptance. This market is supported by a rise in ambulatory surgical centers, which provide convenient, affordable, and effective procedures.

What is the Role of AI in the Biceps Implants Market?

AI is remodelling the biceps implants industry by enhancing surgical accuracy, facilitating personalized treatment, and improving smart active monitoring in bicep implants. Bicep implants are referred to as bionic arms, wherein AI plays an essential role in making these devices smarter, more responsive, and customized.

Artificial Intelligence analyzes 3D images to design an implant that matches individual anatomy, enhancing the fit and reducing complications in reconstructive surgeries. It reduces human error and operative time and improves structural alignment during surgeries. While AI is advancing in this sector, it is also facing significant hurdles, including high investment costs, the need for high-quality data, and the demand for thorough clinical validation.

Biceps Implants Market Trends

- Growing Aesthetic Demand: Its expansion in this market is due to a surge in demand for the perfect body in the male physique, a rise in social media influence, and the need for safer implant technologies. Men generally seek a certain physique, which is often unattainable by exercise alone; hence, they are opting for these procedures.

- Dominance of Minimally Invasive Techniques: As the current market is leaning more towards non-invasive and small incision surgical approaches to attain superior aesthetics with faster recovery times and minimize complication risks, this has led to the dominance of minimally invasive techniques in this market.

- Technological Advancements & Customization: Technological advancements like 3D printing have enabled customized, patient-specific solutions in reconstructing post-traumatic muscle injuries and strive for improved, authentic, natural-looking results.

- Medical Tourism Focus: These are fostering patients' engagement by combining premium cosmetic procedures with specialized restorative recovery environments.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 143.18 Million |

| Market Size in 2026 | USD 149.81 Million |

| Market Size by 2035 | USD 225.13Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Implant, Implant Design, End-User, Implant Fixation Technique, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Implant Material Insights

Why Did the Silicone Elastomer Implants Segment Dominate the Biceps Implants Market?

The silicone elastomer implants segment dominated the market with a share of approximately 64% in 2025 due to their superior biocompatibility, longevity, adaptability, and realistic texture. They are solid, non-liquid implants that deliver immediate, durable volumetric correction for cosmetic, reconstructive, or trauma-related injuries. The market is boosting due to a surge in demand for male aesthetic procedures, increased awareness of this procedure, and a rise in corrective procedures after tendon rupture.

The polyurethane/composite materials segment is expected to grow at the fastest CAGR in the market between 2026 and 2035 due to its ability to provide high-quality biocompatibility, tailored mechanical properties, and facilitate tissue biointegration, minimizing long-term complications. As the market pivots towards aesthetic rather than functional outcomes, these advanced materials provide better results than traditional silicone.

Implant Design Insights

Which Implant Design Segment Led the Biceps Implants Market?

The anatomical biceps implants segment led the market with a share of approximately 58% in 2025 due to their ability to better mimic the human bicep muscle than any other alternative implant design. They provide more aesthetic, proportionate, and realistic results. They also provide superior longevity and realistic anatomical implants, resulting in higher patient satisfaction, which further boosts the segment's growth.

The custom-molded/patient-specific implants segment is expected to grow with the highest CAGR in the market during the studied years. As the market is pivoting towards personalized medicine propelled by superior anatomical fit, enhanced cosmetic results, and higher surgical accuracy, demand for custom-molded implants is increasing. This implant design provides superior comfort and minimizes the risk of complications, further expanding the segment's growth.

End-User Insights

Which End-User Segment Dominated the Biceps Implants Market?

The aesthetic & cosmetic surgery clinics segment held the largest revenue share of approximately 58% in 2025 due to a surge in male aesthetic consciousness, technological advancement in implant material, and a rise in medical tourism. These clinics deliver specialized, high-end care customized to the increased demand for muscular, defined bodies. Patients prefer clinics because they offer personalized solutions such as 3D-printed patient-specific implants and specialized minimally invasive techniques, enabling faster recovery time and safer outcomes.

The ambulatory surgical centers (ASCs) segment is expected to expand rapidly in the forecast period. Due to affordability, faster patient recovery, reduced infection risk, and improved convenience, the same-day non-invasive procedure. ASCs significantly reduce exorbitant medical expenses as patients do not need to stay overnight. It is further propelled by aging, a huge demographic needing orthopedic solutions, a favorable reimbursement model, and an advanced, safer surgical approach.

Implant Fixation Technique Insights

How the Pocket/Subfascial Placement Segment Dominated the Biceps Implants Market?

The pocket/subfascial placement segment held a major revenue share of approximately 57% in the market in 2025. It is a leading technique for bicep implants, as it balances the desire for a realistic, enhanced aesthetic with a safe, stable, and minimally invasive surgical approach as compared to placing an implant deep under the muscles. This technique helps to camouflage the implant and reduce complications. Although this technique requires a longer and more precise surgical approach, it provides long-term benefit in patient satisfaction.

The other fixation methods segment is expected to witness the fastest growth in the market over the forecast period. It is growing rapidly due to its superior biomechanical strength, reduced bone damage, and rapid recovery. The growth of other methods is propelled by technological advancements and clinical advantages. The growing research and development activities, increasing investments, and advancements in medical technologies lead to the development of novel fixation methods.

Regional Insights

How Big is the North America Biceps Implants Market Size?

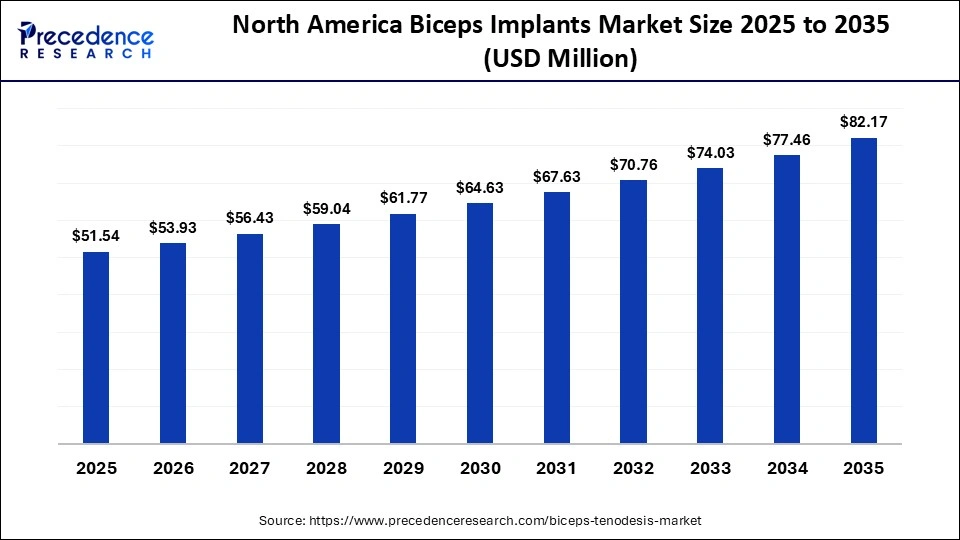

The North America biceps implants market size is estimated at USD 51.54 million in 2025 and is projected to reach approximately USD 82.17 million by 2035, with a 4.77% CAGR from 2026 to 2035.

What are the Key Drivers of the North American Biceps Implants Market?

North America held a major market share of approximately 36% in 2025. It is expanding rapidly in this market due to high disposable income, robust healthcare infrastructure, and the presence of major companies. This region's market maturity is supported by high beauty consciousness, enabling a surge in spending on cosmetic and reconstructive procedures. The surge in the incidence of sport-related injuries and muscular deficits has propelled the demand for reconstructive bicep implants. The regional market is boosted by an experienced consumer base, combined with high standards for safety and regulatory compliance for FDA-approved products.

What is the Size of the U.S. Biceps Implants Market?

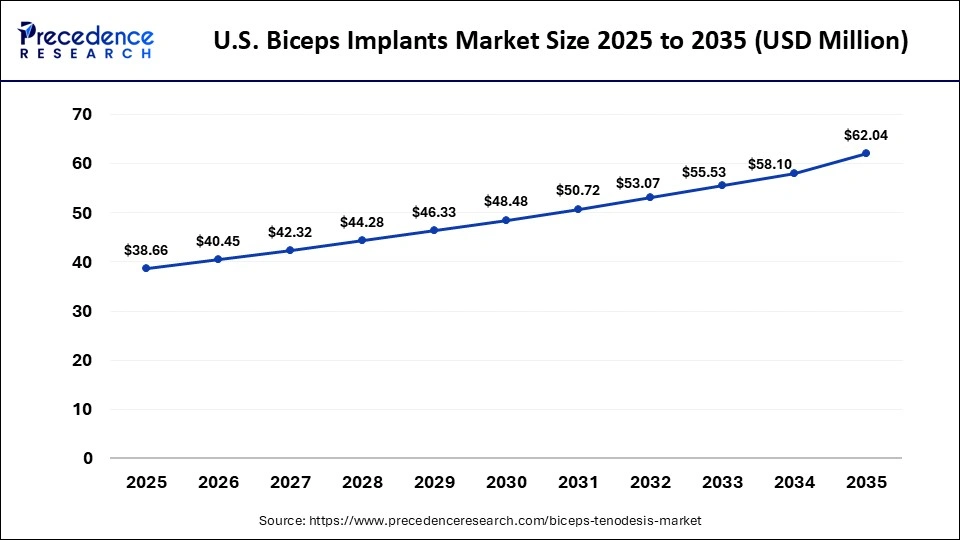

The U.S. biceps implants market size is calculated at USD 38.66 million in 2025 and is expected to reach nearly USD 62.04 million in 2035, accelerating at a strong CAGR of 4.84% between 2026 and 2035.

U.S. Market Trends

The U.S. dominates the North American region in the market due to high patient awareness regarding cosmetic enhancement, robust healthcare infrastructure, and high incidence of sport-related injuries needing reconstructive procedures. Many top manufacturers and distributors of orthopedic and reconstructive implants have a strong presence in the U.S. High disposable incomes and spending on specialized, premium, and personalized implant solutions further drive market growth.

According to a recent article, open tenodesis was the most common procedure in the U.S. for isolated long head of the biceps tendon (LHBT) management from 2010 to 2019. The incidence of open tenodesis increased by 180% from 2010 to 2019, accounting for 49% of all isolated LHBT procedures.

Why is Asia-Pacific Growing with the Highest CAGR in the Biceps Implants Market?

Asia-Pacific is expected to be the fastest-growing region in the foreseeable period. The surge in disposable income, enhanced aesthetic awareness among men, rise in medical tourism, and advancements in implant technology. The desire for a muscular and well-defined physique, influenced by social media and wellness culture, also propels the market. The rise in minimally invasive techniques that offer rapid recovery time, less pain, and reduced complications is boosting this market.

China Market Trends

China's leadership is driven by a huge patient demographic, rapid urbanization, and a surge in demand for aesthetic and muscle augmentation procedures, as well as orthopedic and reconstructive surgeries. The market is further boosted by rapid industrialization, robust government support, and a cost-effective consumer market. Various government initiatives, like volume-based procurement and NMPA regulatory reforms, are further expanding the market in this region.

Which Region has Shown Remarkable Growth in the Biceps Implants Market?

Europe is expected to experience significant growth in the coming years due to high disposable income, a surge in awareness about body contouring, and the prevalence of skilled plastic surgeons. This market is propelled by a surge in demand for male aesthetic enhancement, an increase in the availability of superior quality, advanced biocompatible materials, and an accelerated trend of medical tourism for cosmetic procedures. A well-established healthcare ecosystem makes cosmetic surgeries more accessible and cost-effective to a broader population.

Germany Market Trends

Germany dominates the market in Europe due to their advanced healthcare infrastructure, huge number of orthopedic surgeries, and robust R&D for implant innovation. Germany is a main center for specialized orthopedic clinics and hospitals for advanced and niche procedures. This market further expanded due to its aging population, coupled with a rise in the desire for cosmetic and reconstructive surgeries for muscle definition and trauma recovery.

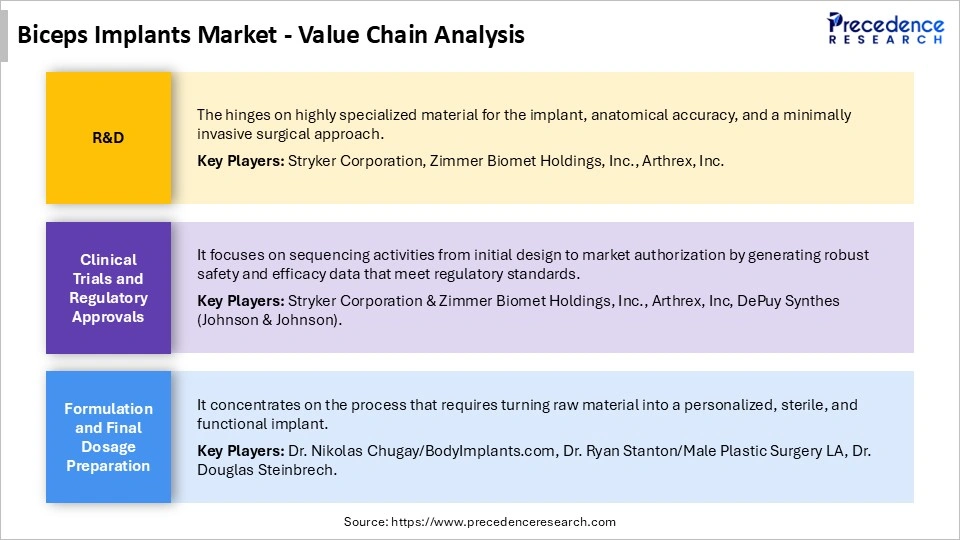

Biceps Implants Market Value Chain Analysis

Who are the Major Players in the Global Biceps Implants Market?

The major players in the biceps implants market include Arthrex, Inc., Smith & Nephew PLC, DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet Holdings, Inc., Enovis Corporation (DJO Global), CONMED Corporation, Acumed LLC, Aesculap, Inc. (B. Braun Melsungen AG), Össur HF, Medtronic PLC, Sebbin, Implantech, Aesthetic Dermal

Recent Developments

- In June 2025, OSSIO Inc. launched Small OSSIOfiber 2.5 mm suture anchors that provide tissue fixation by using smaller, stronger, and smarter material, which improves several surgical procedures, including Brostrom repair for lateral ankle instability. (Source: https://www.businesswire.com)

- In July 2025, MIT researchers developed a new bionic knee for people with above-the-knee amputation. This bionic knee integrated into tissue can restore natural movement. The new system offers more stability and enhanced control over the movement of the prosthesis. (Source: https://news.mit.edu)

- In October 2025, Johnson & Johnson MedTech today announced the U.S. launch of its INHANCE INTACT, a total shoulder replacement system designed for tissue-sparing surgery, providing day-one post-op mobility. The system allows surgeons to perform shoulder replacement procedures with enhanced joint visualization, enabling faster rehabilitation. (Source: https://orthospinenews.com).

Segments Covered in the Report

By Implant Material

- Silicone Elastomer Implants

- Expanded Polytetrafluoroethylene (ePTFE)

- Polyurethane/Composite Materials

- Other Advanced Biomaterials

By Implant Design

- Anatomical Biceps Implants

- Round/Symmetric Biceps Implants

- Custom-Molded/Patient-Specific Implants

By End-User

- Aesthetic & Cosmetic Surgery Clinics

- Hospitals/Multi-Specialty Centers

- Ambulatory Surgical Centers (ASCs)

By Implant Fixation Technique

- Pocket/Subfascial Placement

- Submuscular/Deep Placement

- Other Fixation Methods (guidance systems)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting