What is the Bioherbicides Market Size?

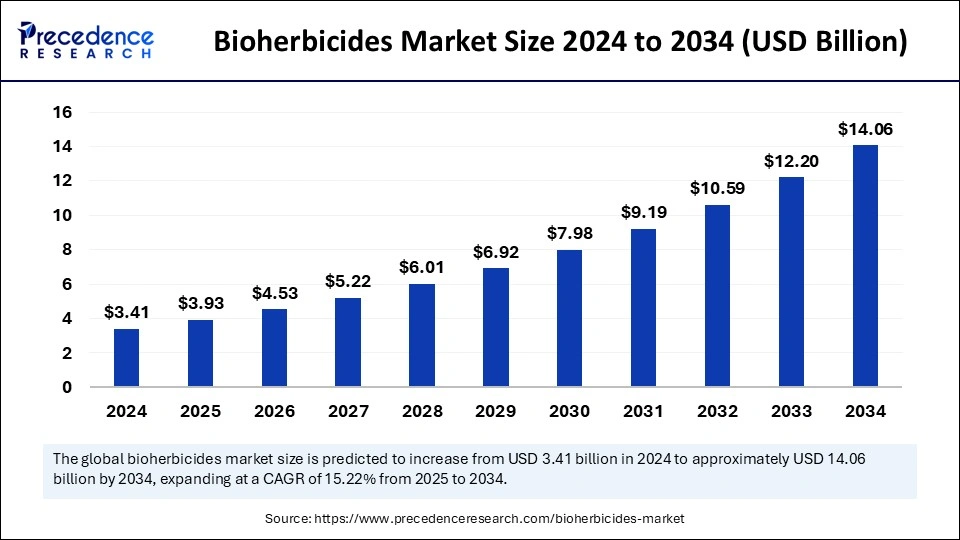

The global bioherbicides market size is valued at USD 3.93 billion in 2025 and is predicted to increase from USD 4.53 billion in 2026 to approximately USD 14.06 billion by 2034, expanding at a CAGR of 15.22% from 2025 to 2034. The increasing environmental concerns and the rising demand for eco-friendly alternatives drive the growth of the bioherbicides market.

Bioherbicides Market Key Takeaways

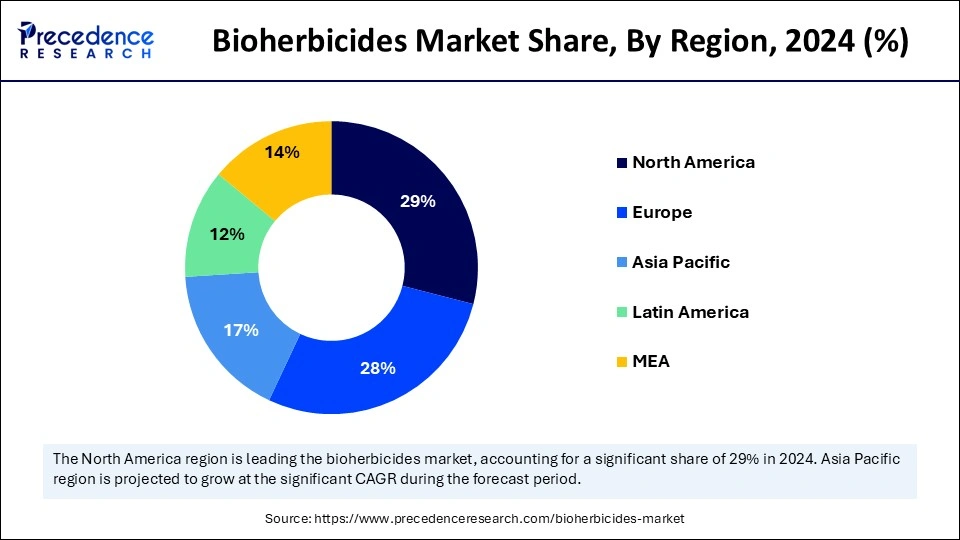

- North America dominated the market by holding more than 29% of the market share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 15.8% between 2025 and 2034.

- By application, the fruits and vegetables segment accounted for the major market share of 29% in 2024.

- By application, the turf & ornamental grass segment is anticipated to grow at a remarkable CAGR during the forecast period.

Is Bioherbicide the Future of Sustainable Farming?

The bioherbicides market centers around offering innovative, sustainable alternatives to conventional chemical herbicides, emphasizing developing, producing, and distributing weed control solutions derived from natural sources. The primary aim of this market is to promote sustainable agricultural practices while minimizing the ecological impact associated with weed management. This commitment aligns with the increasing consumer demand for organic food and the urgent need to reduce chemical applications in farming. A fundamental driving force behind this shift is the effort to mitigate the adverse effects of synthetic herbicides, including soil and water pollution and harm to non-target organisms. Furthermore, the rise of herbicide-resistant weed populations and the necessity to lower human exposure to toxic chemical residues in food and the environment are significant considerations. Continuous research and development activities to enhance bioherbicides' efficacy, stability, and application techniques further support the bioherbicides market.

Bioherbicides Market Growth Factors

- Increasing Environmental Concerns: There is a growing awareness regarding the detrimental effects of synthetic herbicides on the environment, particularly concerning soil degradation and water contamination. This significantly boosts the demand for more sustainable alternatives to synthetic herbicides.

- Shifting Focus Toward Sustainable Agriculture Practices: With the increasing focus on organic farming, the demand for bioherbicides is increasing. Consumers are increasingly willing to pay a premium for organic products, thus incentivizing farmers to explore and adopt sustainable weed management solutions.

- Regulatory Policies: Governments around the world are enacting more stringent regulations governing the use of chemical pesticides, restricting their availability and promoting the use of bioherbicides in agricultural practices. These regulatory frameworks push the agricultural sector toward more environmentally sustainable weed control methods.

- Adoption of Integrated Pest Management (IPM) Strategies: The implementation of IPM emphasizes a holistic approach to pest control, incorporating various strategies, including the use of bioherbicides, to reduce dependence on synthetic chemicals. This strategy is gaining traction as it offers a more sustainable and effective means of managing weed populations.

- Technological Advancements: Ongoing research initiatives are leading to the discovery of novel and more effective bioherbicides. Additionally, innovations in formulation and application techniques are continuously enhancing the performance and usability of these natural herbicides, reflecting a significant advancement within the market.

Market Outlook:

- Industry outlook: The bioherbicides market is poised for rapid growth from 2025 to 2034, driven by drivers like stricter limits on certain chemical herbicides and stewardship initiatives that drive growers to adopt biological options as compliant, lower-residue alternatives. This regulatory push shortens the time to adoption in sectors sensitive to public scrutiny and export standards. The second one is that the global spread of herbicide-resistant weeds compels farmers to diversify control tactics; bioherbicides provide mode-of-action diversity and compatibility with mechanical and cultural controls, enhancing long-term weed-management sustainability.

- Major Investment: The major investor is AgriBio Ventures, which invests in early-stage microbial and fermentation platforms, accelerating strain discovery and scaling fermentation technologies that lower production costs and improve formulation robustness. FMC Corps funds commercialisation, distributor partnerships, and registration efforts in priority geographies, enabling quicker market entry and wider farmer outreach.

- Sustainability Trend: Sustainability is the market's lodestar: demand for low-residue produce, regenerative agriculture initiatives, and consumer preference for eco-friendly inputs create fertile ground for bioherbicides. These products reduce non-target impacts, support biodiversity in agroecosystems, and fit well into circular and low-chemical production claims. Moreover, lower environmental remediation costs and improved ecosystem services pollinator health, soil microbial diversity, strengthen the sustainability case for biological weed control.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 14.06 Billion |

| Market Size in 2025 | USD3.93 Billion |

| Market Size in 2026 | USD 4.53 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.22% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Rising Awareness of Drawbacks of Synthetic Herbicides

Farmers are becoming more aware of synthetic herbicides' detrimental effects on diverse ecosystems, water quality, and soil vitality. This, in turn, boosts the demand for sustainable agricultural practices that prioritize environmental conservation, ultimately driving the growth of the bioherbicides market. With the growing awareness of health and wellness, consumers are increasingly favoring organic food and products, which necessitates the adoption of bioherbicides. Additionally, stringent government regulations governing the use of chemical pesticides and policies advocating for environmentally friendly agricultural methods contribute to this shift.

Restraint

Low Efficacy and High Production Costs

Despite the advantages offered by bioherbicides, there are several challenges that hinder their widespread adoption. One major concern is that bioherbicides may not provide the same rapid and consistent weed control as synthetic herbicides. Their performance can be heavily influenced by environmental factors such as temperature and humidity, leading to variability in effectiveness. Bioherbicides' production cost is higher than their synthetic counterparts, which may limit their use in price-sensitive markets where cost competitiveness is crucial. Bioherbicides, being natural products, often have shorter shelf lives and may require specific storage conditions to maintain their efficacy. This can pose a logistical challenge for farmers. In addition, limited awareness among farmers regarding the benefits and proper use of bioherbicides hampers the growth of the bioherbicides market.

Opportunity

Research and Development Efforts

The ongoing research and development initiatives aimed at enhancing the efficiency, stability, and application methods of bioherbicides present exciting opportunities in the market. There is a potential for the creation of novel bioherbicides that offer a broader spectrum of weed control, significantly benefiting agricultural practices. The rise in demand for organic food products offers immense opportunities for manufacturers of bioherbicides as consumers increasingly seek chemical-free options. Moreover, integrating bioherbicides with advanced agricultural technologies for targeted applications can improve overall efficiency and reduce operational costs. The development of new bioherbicides that specifically target particular types of weeds or crops also opens avenues for targeted solutions in pest management.

Application Insights

The fruits & vegetables segment dominated the bioherbicides market with the largest share in 2024. Chemical herbicides often pose significant health risks to consumers and lead to ecological disruption by leaving harmful residues on fruits and vegetables. In contrast, bioherbicides present a safer and more sustainable option for weed management, effectively lowering chemical residue levels and promoting long-term soil health. The rise in demand for organic fruits and vegetables augmented the segment.

The turf & ornamental grass segment is expected to expand at a significant CAGR over the studied period. This is mainly due to the rapid shift toward organic gardening and lawn care practices. This, in turn, boosts the demand for bioherbicides that comply with organic certification standards. These natural alternatives are essential for maintaining the health of turf and ornamental grass, reducing reliance on harmful synthetic chemicals. As consumer interest grows in organic green spaces, bioherbicides emerge as a viable solution for effective weed control while simultaneously safeguarding the health of plants, soil, and the surrounding ecosystem.

Regional Insights

U.S. Bioherbicides Market Size and Growth 2025 to 2034

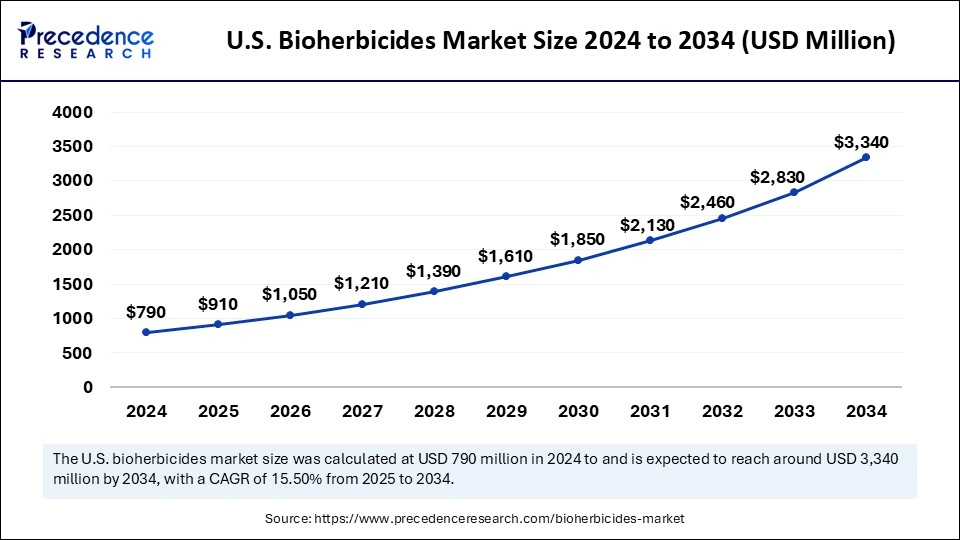

The U.S. bioherbicides market size is exhibited at USD 910 million in 2025 and is projected to be worth around USD 3,340 million by 2034, growing at a CAGR of 15.50% from 2025 to 2034.

North America registered dominance in the bioherbicides market by capturing the largest share in 2024. This is mainly due to the strong focus on organic farming, particularly in the U.S. and Canada. With the heightened demand for organic food, organic farming practices have gained immense popularity, leading to increased demand for effective weed management solutions, including bioherbicides. A rapid shift toward sustainable agricultural techniques is propelled by heightened environmental awareness and a growing consumer preference for organic products. This shift favors bioherbicides as a viable alternative to traditional synthetic herbicides, which have faced criticism for their environmental impact.

In Canada, the agriculture sector is particularly significant within the Prairies province, where vast fields of crops are cultivated. Health Canada plays a critical role in regulating pesticides, including bioherbicides, ensuring their safety and effectiveness for agricultural use. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and Health Canada are placing greater emphasis on identifying safer alternatives to chemical pesticides, creating a favorable environment for the growth and implementation of bioherbicides.

North America boasts a dynamic research and development ecosystem where universities and private companies collaborate to innovate and advance bioherbicide solutions. As farmers gain more knowledge about the advantages of bioherbicides, such as reduced environmental footprint and improved soil health, they are increasingly willing to incorporate these products into their farming practices.

Asia Pacific is projected to witness the fastest growth in the market for bioherbicides during the forecast period. The region boasts a vast agricultural sector, which is driving the need for sustainable and effective weed control options. There is heightened awareness regarding the detrimental environmental effects associated with conventional chemical herbicides, including soil degradation and water pollution, which are prompting farmers to shift toward sustainable farming practices.

Governments around the region are actively enacting policies to foster sustainable agriculture. China, in particular, stands out as one of the largest agricultural producers globally. The Chinese government is proactively encouraging sustainable farming techniques, focusing on reducing reliance on chemical pesticides. The rising demand for organic fruits and vegetables further contributes to the growth of the Asia Pacific bioherbicides market.

Europe

Europe is considered to be a significantly growing area. The region's strong commitment to sustainable agricultural practices and environmental stewardship is a key factor boosting the regional market growth. The European Union has enacted stringent regulations regarding the use of chemical pesticides, compelling farmers to explore alternative solutions like bioherbicides. Initiatives like the European Green Deal are pivotal in promoting a transition to sustainable farming methodologies. With the growing health-conscious population and the rising concerns about environmental sustainability, there is a marked increase in demand for organic products. Germany can have a stronghold on the European bioherbicides market. This is mainly due to the rapid expansion of the organic food sector. Germany's focus on sustainable agricultural practices and environmental protection further boosts the adoption of bioherbicides.

France and Italy are experimenting widely in vineyards and orchards, integrating bioherbicides with mechanical and cultural control practices to protect terroir quality. Germany is balancing rigorous regulatory standards with strong agricultural R&D, creating an environment where well-validated biologics can scale when efficiency and IP protection align. Spain and Portugal show growing interest in bioherbicides for fruit and olive production, where residue constraints and export value support adoption. Together, these countries from a testbed for commercialization strategies and farmer education models.

Middle East Africa

Will Arid Climates in the Middle East and Africa Embrace Biology for Weed Control?

Adoption in the Middle East & Africa is uneven but promising: water scarcity, the high value of irrigated crops, and rising interest in sustainable export agriculture drive selective uptake. In arid and semi-arid zones, bioherbicides that reduce the need for mechanical weed control and enable water-efficient operations are attractive, provided formulations are stable under heat and saline conditions.

Limited regulatory infrastructure, fragmented distribution, and variable farmer awareness slow broader adoption, yet pilot projects in high-value horticulture and greenhouse systems show tangible promise. Regional success will depend on rugged formulations, local demonstration projects, and PPPs that support registration and farmer extension.

The UAE and Israel Bioherbicides Market Trends

UAE and Israel are notable for advanced protected-culture and precision-agriculture programs that trial bioherbicides in greenhouse vegetables and date-palm systems; their tech ecosystems support formulation adaptation and controlled-environment testing. In South Africa, commercial fruit and viticulture producers are experimenting with integrated biologicals to meet export residue criteria, supported by strong local agri-research institutes. Across North Africa, interest exists in reducing labour costs and improving exportability, but scaling requires local manufacturing or reliable import channels. Training extension services and public demonstration farms will be key to shifting farmer perception.

Latin America

Can Latin America Scale Bioherbicides Across Vast Farming Frontiers?

Latin America offers both opportunity and complexity: vast commercial farms of soy, maize, sugarcane create scale demand, while smallholder and specialty producers of fruits, coffee offer early-adopter niches. Large soybean and sugarcane landscapes wrestle with herbicide resistance, making bioherbicides attractive as resistance-management adjuncts yet field consistency and cost per hectare are critical constraints.

Supply-chain logistics across remote production zones and the need for cold-chain or stable formulations influence commercial viability. Successful market entry often requires local trials, collaborations with agro-input distributors, and tailored registration strategies responsive to national regulatory frameworks.

Chile and Colombia Bioherbicides Market Trends

Chile and Colombia may lead uptake in high-value fruit, berry, and coffee sectors where residue limits and export markets incentivize biological alternatives. Across the region, co-development with local formulators and distributor partnerships will accelerate farmer access and confidence.

Bioherbicides Market Value Chain Analysis:

- Raw Material Sourcing: Raw material sourcing revolves around microbial strains such as fungi, bacteria, and plant-derived bioactives. These include species of Trichoderma, Colletotrichum, Pseudomonas, Bacillus, and botanical extracts like essential oils or allelopathic compounds.

Key players: Microbial Discovery Companies, Fermentation & Biotechnology Manufacturers and Agricultural Biological Formulators. - Distribution to OEMs: Bioherbicide ingredients are supplied to OEMs through a structured distribution pathway. Fermentation labs deliver bulk microbial biomass or concentrated extracts to formulation companies, which convert them into wettable powders, granules, capsules, or liquid suspensions.

Key players: Integrated Crop-Protection Companies and Contract Manufacturers (CMOs)

Top Companies in the Bioherbicides Market & Their Offerings:

Here are crisp, polished one-sentence importance statements for each company you listed:

- Marrone Bio Innovations Inc: Marrone Bio Innovations is significant for pioneering microbe-based weed-control solutions that enhance sustainable agriculture without relying on synthetic chemicals.

- Emery Oleochemicals: Emery Oleochemicals plays a key role by supplying bio-based fatty acids and natural derivatives that serve as essential ingredients in eco-friendly herbicidal formulations.

- Harpe Bio: Harpe Bio is important for developing next-generation, plant-derived herbicides that offer effective weed control with an environmentally benign footprint.

- Verdesian Life Sciences: Verdesian Life Sciences contributes to the market by advancing nutrient-use efficiency products that complement bioherbicides and improve overall crop performance.

- Certified Organics Australia PTY Ltd: Certified Organics Australia is vital for its leadership in organic weed-management solutions designed specifically for certified organic farming systems.

- Syngenta: Syngenta remains influential for integrating biological weed-control technologies into its global crop-protection portfolio, accelerating mainstream adoption.

- Special Biochem Pvt. Ltd: Special Biochem Pvt. Ltd is important for manufacturing microbial and botanical bio-inputs that support safer, regionally relevant weed-control alternatives.

- Seipasa: Seipasa contributes meaningfully by producing plant-based and microorganism-derived biopesticides that align with clean-label and residue-free agriculture.

- FMC Corp: FMC Corporation is significant for expanding biological solutions through R&D and partnerships, helping bridge conventional chemistry with modern bioherbicides.

- Bioherbicides Australia PTY Ltd: Bioherbicides Australia PTY Ltd is essential for its research into native microbial species and natural compounds that offer region-specific weed suppression.

- Herbanatur: Herbanatur plays a role in producing botanical herbicide extracts that appeal to growers seeking fully natural and non-synthetic weed control tools.

- Certis Biologicals: Certis Biologicals is pivotal as one of the leading global suppliers of biological crop-protection products, accelerating the commercial scale availability of bioherbicides.

Bioherbicides Market Companies

- Marrone Bio Innovations Inc.

- Emery Oleochemicals

- Harpe Bio

- Verdesian Life Sciences

- Certified Organics Australia PTY Ltd

- Syngenta

- Special Biochem Pvt. Ltd

- Seipasa

- FMC Corp

- Bioherbicides Australia PTY Ltd

- Herbanatur

- Certis Biologicals

Recent Developments

- In April 2024, Seipasa, a leading Spanish biotechnology company, announced that it is working to register an entirely new bioherbicide in the global marketplace. This novel product is set to enhance the company's product portfolio, offering a premium and high-value solution that aligns with modern agricultural practices. Seipasa's commitment to innovation presents exciting possibilities for sustainable farming and highlights the vital role that advanced agricultural products play in supporting farmers worldwide.

- In December 2022, FMC Corporation entered into a collaboration with Micropep Technologies (Micropep) to develop biological solutions to control destructive herbicide-resistant weeds that reduce crop yields. The collaboration enables both companies to accelerate the development of natural weed control products for corn and soybeans.

Segments Covered in the Report

By Application

- Grains & Cereals

- Oil seeds

- Fruits & Vegetables

- Turf & Ornamental Grass

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting