What is the Biopesticides Market Size?

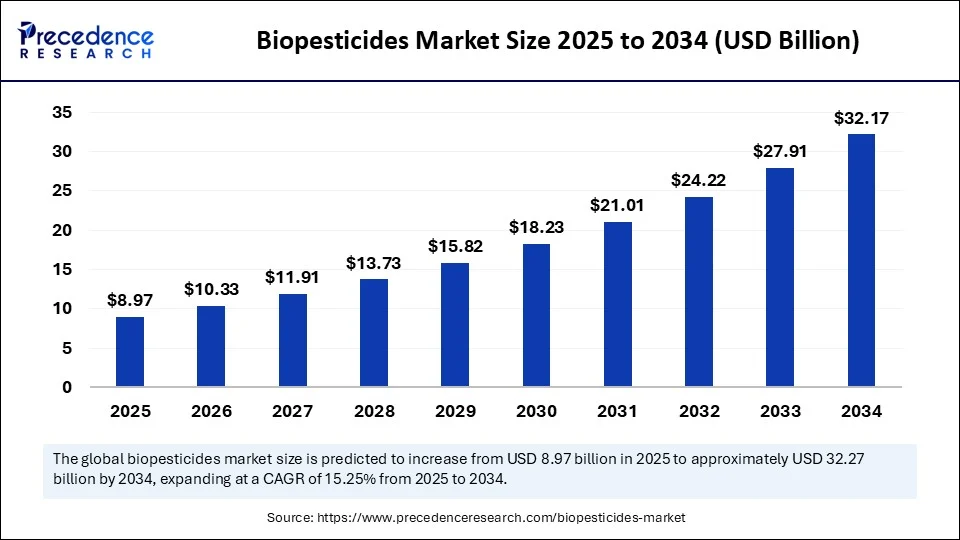

The global biopesticides market size is valued at USD 8.97 billion in 2025 and is predicted to increase from USD 10.33 billion in 2026 to approximately USD 36.43 billion by 2035, expanding at a CAGR of 15.04% from 2026 to 2035.The biopesticides market is experiencing significant growth, driven by increasing demand for sustainable agricultural practices and environmentally friendly pest control solutions. With projections indicating substantial market expansion over the coming years, biopesticides are poised to play a crucial role in the future of agriculture.

Biopesticides Market Key Takeaways

- In terms of revenue, the global biopesticides market was valued at USD 8.97 billion in 2025.

- It is projected to reach USD 36.43 billion by 2035.

- The market is expected to grow at a CAGR of 15.04% from 2026 to 2035.

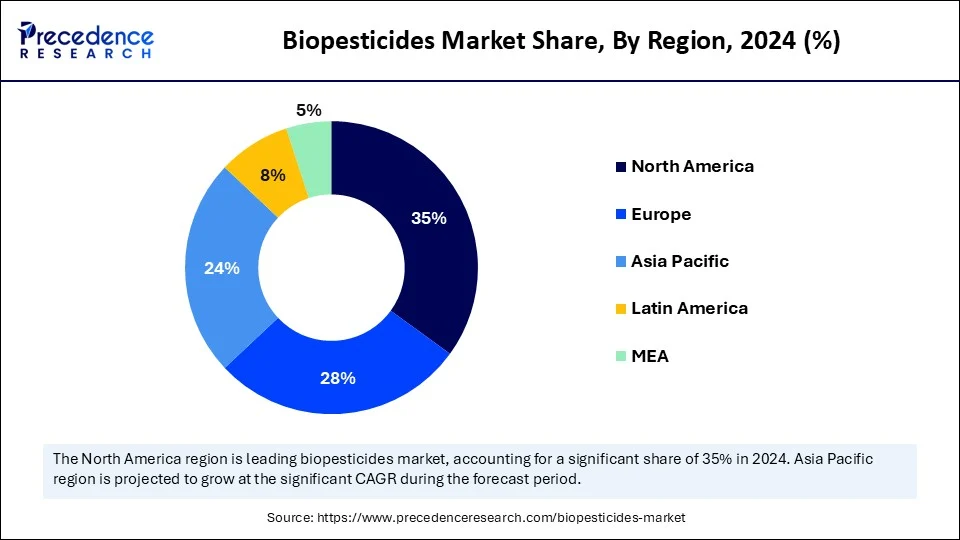

- North America dominated the global biopesticides market with the largest market share of 35% in 2025.

- By region, Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By product type, the bioinsecticides segment led the market in 2025.

- By product type, the biofungicides segment is expected to grow at the fastest CAGR during the forecast period.

- By mode of application type, the foliar spray segment accounted for a considerable share in 2025.

- By mode of application type, the seed treatment segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By formulation type, the liquid formulation segment captured the biggest market share in 2025.

- By formulation type, the dry formulation segment is set to experience the fastest CAR from 2026 to 2035.

- By crop type, the fruits & vegetables segment contributed the highest market share in 2025.

- By crop type, the cereals & grains are the fastest growing during the forecast period.

- By distribution channel application, the indirect segment held the largest market share in 2025.

- By distribution channel type, the direct segment is projected to experience rapid growth over the coming years.

- By end-user type, the commercial farmers segment generated the major market share in 2025.

- By end-user type, the horticulture & greenhouse growers segment is projected to expand rapidly in the coming years.

How AI is Impacting the Biopesticides Market?

Artificial Intelligence is playing an increasingly critical role in reshaping the biopesticides industry by enhancing precision, efficiency, and predictive capabilities. AI-driven platforms are being deployed to analyze crop health, soil conditions, and pest infestation patterns in real time, enabling farmers to apply biopesticides more effectively. Machine learning models can forecast pest outbreaks, reducing reliance on reactive measures and improving yield protection. Furthermore, AI-powered simulations help researchers accelerate the discovery and development of new microbial strains and formulations, significantly cutting down the R&D timeline. In logistics, AI systems optimize the supply chain, ensuring biopesticides are stored and transported under ideal conditions to extend shelf life. Additionally, AI-based digital advisory services are bridging the knowledge gap among farmers by providing personalized recommendations for biopesticide usage. Collectively, these advancements are positioning AI as a transformative catalyst for scaling biopesticides adoption globally.

A recent study revealed that A team led by scientist Vijay Murugesan, who has Indian origins, has utilized Artificial Intelligence (AI) and supercomputing to discover a new battery material that could greatly reduce the dependency on lithium in batteries. This finding is the result of collaboration between Microsoft and the Pacific Northwest National Laboratory (PNNL) in the United States, which employed Microsoft's Azure Quantum Elements to analyze a remarkable 32 million inorganic materials. Within a mere 80 hours, the AI-assisted method refined this vast selection down to 18 promising candidates for battery advancement.

Market Overview

The biopesticides market refers to the global industry focused on the production, commercialization, and application of pest management solutions derived from natural or biological origins, including microorganisms, plant extracts, and naturally occurring substances. Unlike conventional chemical pesticides, biopesticides offer eco-friendly, sustainable, and residue-free solutions that target specific pests with minimal impact on beneficial organisms and the environment. The market plays a pivotal role in integrated pest management (IPM) programs. It is increasingly driven by regulatory support, rising consumer demand for organic produce, and restrictions on chemical pesticide use.

The biopesticides market encompasses the global sector dedicated to the production and use of pest management solutions derived from natural or biological sources. These solutions include microorganisms, plant extracts, and naturally occurring substances that provide an eco-friendly alternative to conventional chemical pesticides. Biopesticides are recognized for their ability to target specific pests while minimizing harm to beneficial organisms and the environment. This market is integral to integrated pest management (IPM) programs, which emphasize sustainable agriculture practices. Rising regulatory support and consumer demand for organic produce further propel the growth of this market. As restrictions on chemical pesticide use increase, biopesticides are becoming a vital component in modern agricultural practices.

Market Key Trends

- A rising shift from chemical pesticides to natural alternatives.

- Increased regulatory support for eco-friendly crop protection solutions.

- Integration of biopesticides into organic and precision farming systems.

- Advancements in microbial and botanical formulations.

- Expanding use of digital agriculture tools for biopesticide application.

- Growing consumer demand for chemical-free and sustainable food.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 36.43 Billion |

| Market Size in 2025 | USD 8.97 Billion |

| Market Size in 2026 | USD 10.33 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Source, Mode of Application, Formulation, Crop Type, Distribution channel, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Sustainability: The New Imperative for Agriculture

The strongest driver for the biopesticides market is the global shift toward sustainable farming practices. Farmers and agricultural stakeholders are under mounting pressure to minimize chemical residues in food production. Biopesticides, being eco-friendly and biodegradable, fit seamlessly into this sustainability mandate. Governments are reinforcing this trend by restricting the use of harmful agrochemicals and incentivizing natural alternatives. Moreover, rising consumer awareness regarding food safety and environmental health has created a direct pull in demand. The integration of biopesticides within integrated pest management strategies is also reducing overall input costs for farmers by minimizing pest resistance issues. As a result, the market is witnessing heightened adoption not only in developed economies but also in emerging markets, where sustainability has become a competitive differentiator.

Restraint

Shelf Life and Awareness: The Dual Challenge

Despite strong growth potential, the biopesticides market faces challenges in terms of product stability and farmer awareness. Many biopesticides have shorter shelf-lives compared to synthetic chemicals, which complicates storage and distribution. In rural and remote regions, this results in lower adoption due to logistical hurdles. Additionally, a large segment of farmers, particularly in developing economies, lacks awareness of how biopesticides function and their long-term benefits. This knowledge gap often leads to reliance on traditional chemical pesticides that offer immediate results. Furthermore, inconsistent regulatory frameworks across countries make global commercialization more complex. Overcoming these challenges will require industry stakeholders to invest in education, research, and development for more stable formulations and innovative delivery mechanisms.

Opportunity

The Untapped Potential of Emerging Economies

One of the greatest opportunities lies in expanding biopesticide adoption across emerging economies. Regions such as Asia, Africa, and Latin America face increasing agricultural pressures due to growing populations and food demand. These markets also experience high levels of chemical pesticide use, leading to soil degradation and resistance issues. By introducing biopesticides as cost-effective, environmentally sound alternatives, companies can tap into massive growth potential. Furthermore, the rise of organic farming in these regions creates fertile ground for expansion. Strategic collaborations with governments, agricultural cooperatives, and NGOs can help overcome awareness and distribution barriers. With tailored formulations suited to regional pests and climatic conditions, emerging markets present a long-term growth avenue for the biopesticides industry.

Product Type Insights

Why Are Bioinsecticides Dominating the Market?

Bioinsecticides continued to dominate the biopesticides market in 2025 due to their widespread application in managing crop-damaging pests. Farmers prefer them as a safer and more sustainable alternative to synthetic chemical pesticides, particularly in staple crops like wheat, maize, and rice. Their efficacy in pest control while maintaining ecological balance has positioned them as the backbone of biopesticide adoption. Increasing demand for organic-certified produce has further fueled their dominance. Moreover, supportive government policies promoting reduced chemical usage continue to reinforce their market leadership.

Bioinsecticides are a category of biopesticides specifically designed to control insect populations using naturally occurring substances. These products often utilize microorganisms, such as bacteria or fungi, as active ingredients to target specific pests while minimizing harm to beneficial insects and the environment. One notable advantage of bioinsecticides is their lower toxicity compared to conventional chemical pesticides, making them safer for humans and wildlife. They are integral to integrated pest management (IPM) strategies, helping to reduce chemical pesticide use and promote sustainable agriculture. As consumer demand for organic produce grows, bioinsecticides are gaining traction among farmers looking for eco-friendly pest control solutions. Ongoing research and development are expanding the range of bioinsecticides available, enhancing their effectiveness and application methods in various agricultural settings.

Fungicides are set to experience rapid growth in the forecast period, driven by the increasing incidence of fungal infections affecting fruits, vegetables, and high-value crops. Their role in integrated pest management systems is expanding, especially in controlled cultivate environments like greenhouses. Farmers increasingly favour bio-fungicides due to their ability to minimize crop losses without leaving harmful residues. Advances in microbial and fungal strains used in formulations are also accelerating their adoption. With growing consumer awareness about food safety, the bio-fungicide segment is poised to capture substantial market share.

Source Insights

How Is Microbial Leading the Biopesticides Market in 2024?

By source, the microbial segment continues to lead the biopesticide sector, thanks to its versatility and broad-spectrum action against pests and diseases. Derived from bacteria, viruses, and protozoa, they are extensively used across both large-scale agriculture and smallholder farming. Their adaptability to multiple crops and climatic conditions strengthens their appeal. Additionally, innovations in fermentation and formulation technologies have improved their shelf life and efficacy. With regulatory support for microbial solutions, they remain the preferred choice for sustainable farming practices.

Microbial biopesticides are derived from naturally occurring microorganisms such as bacteria, fungi, and viruses, which are effective in controlling agricultural pests and diseases. These biopesticides work by either directly infecting pests or by producing substances that inhibit their growth, providing a targeted approach to pest management. One of the key advantages of microbial biopesticides is their ability to enhance soil health and promote beneficial microbial communities, leading to improved crop resilience. Additionally, they are less likely to cause resistance in pests compared to traditional chemical pesticides, making them a sustainable option for long-term pest control. Research and development in microbial formulations are rapidly advancing, with scientists exploring new strains and combinations that can further enhance efficacy and environmental safety. As the agricultural sector shifts towards sustainability, microbial biopesticides are increasingly being recognized as a vital component of integrated pest management (IPM) strategies.

Meanwhile, fungi-based biopesticides are witnessing rapid growth, driven by their effectiveness in controlling plant pathogens and soil-borne diseases. Strains like Trichoderma and Beauveria bassiana are gaining popularity among horticulturists and greenhouse cultivators. These products offer longer-lasting effects and contribute to the restoration of soil health. Rising investments in research and biotechnology are enabling the development of new fungal strains with enhanced field performance. The increasing shift toward residue-free crop protection is further propelling this segment.

Fungi play a crucial role in the biopesticides market, particularly as a source of bioinsecticides. They are used to control various pests and diseases that affect crops, providing an environmentally friendly alternative to traditional chemical pesticides. Fungal biopesticides are known for their specificity, targeting harmful insects while minimizing harm to beneficial species. As research advances, new fungal strains are being developed to enhance effectiveness and broaden the range of pests that can be managed. The growing trend toward organic farming practices has significantly boosted the demand for fungal biopesticides. With their natural origins and sustainable applications, fungi are positioned as a key player in the future of pest management and sustainable agriculture.

Mode of Application Insights

Why Is the Foliar Spray Segment Dominating the Market?

Foliar spray continues to dominate the biopesticide sector, due to its ease, effectiveness, and quick action on crops. It ensures better coverage, direct pest contact, and higher absorption efficiency. Farmers often prefer this method for large-acreage cultivation of cereals and grains. The flexibility of foliar sprays across multiple crop types and growing conditions strengthens their dominance. Technological advancements in spraying equipment are also making this method more efficient and cost-effective.

Moreover, as biopesticides gain traction, collaboration between tech companies and agricultural firms will be essential in creating user-friendly platforms for farmers. This partnership can enhance data accessibility and create an environment where informed decisions can be made promptly, ensuring optimal pest management strategies. Ultimately, with ongoing research and technological advancements, the future of biopesticides looks promising, reflecting a significant shift towards sustainable agricultural practices that align with environmental conservation goals.

Seed treatment is witnessing rapid growth. By safeguarding seeds at the germination stage, it enhances plant vigor and minimizes the need for repeated pesticide applications later. Farmers are increasingly adopting seed treatment to ensure better crop yields and reduce overall pesticide use. Advances in coating technologies and compatibility of biopesticides with modern seed varieties are supporting this growth. With sustainable farming practices gaining traction, seed treatment is expected to expand rapidly.

Formulation Insights

How Is Liquid Formulation Dominating the Market?

Liquid formulations continue to dominate the biopesticide sector in 2025, owing to their ease of application, quick mixing with water, and higher effectiveness. They are widely used in foliar sprays and drip irrigation systems, making them suitable for both small and large farms. Enhanced stability and shelf life of liquid-based biopesticides have further strengthened their market position. Framers also prefer them due to reduced application complexity. As precision farming expands, liquid formulations are likely to remain the most dominant choice.

Dry formulations are witnessing rapid growth, following to their convenience in handling, transport, and storage. They are especially favored in regions with limited infrastructure for cold storage. These formulations also provide controlled release, ensuring longer-lasting effects in the soil. Their compatibility with seed treatment methods further enhances their adoption. With increasing demand for cost-effective and durable solutions, dry formulations are projected to expand at their fastest pace.

Crop Insights

How Are Fruits & Vegetables Dominating the Market?

Fruit and vegetable formulations continue to dominate the biopesticide sector, driven by rising consumer demand for fresh, organic, and residue-free produce. These high-value crops are highly susceptible to fungal and insect infestations, making biopesticides an essential protective measure. Greenhouse and horticultural farming practices are further boosting adoption in this segment. Export markets, with their strict residue regulations, also drive the use of biopesticides in fruit and vegetable cultivation. This growth trajectory is expected to accelerate in the coming years.

Cereals and grains are witnessing rapid growth, as this segmentation forms the backbone of global food security. Biopesticides are increasingly used to protect high-volume crops from pests and diseases while maintaining sustainable cultivation practices. Farmers rely heavily on bioinsecticides and microbial biopesticides to safeguard staple crops like rice, wheat, and maize. Government-backed programs for residue-free food production also support their use in this segment. Given their large-scale cultivation, cereals and grains will continue to dominate.

Distribution Channel Insights

How Are Indirect Sales Dominating the Market?

Indirect sales continue to dominate the biopesticide sector. The indirect market for biopesticides involves various intermediaries, such as distributors, retailers, and wholesalers, that facilitate the product's journey to the end-user. This channel can expand the reach of biopesticides to a broader audience, allowing smaller farmers access to these products through established local outlets. With an increase in e-commerce, the indirect market is evolving, providing multiple purchasing options for consumers. However, reliance on intermediaries may dilute brand messaging and create inconsistencies in product knowledge among retailers. Despite these challenges, the indirect market can leverage established networks to enhance distribution efficiency and reduce logistics costs. Ultimately, the growth of the indirect market highlights the importance of accessibility and convenience in the biopesticides industry.

The direct market is the fastest-growing in the market. The direct market for biopesticides is characterized by a strong connection between producers and end-users, allowing for immediate access to pest management solutions. This approach fosters direct communication, enabling farmers to receive tailored recommendations and support from manufacturers. By engaging directly with customers, companies can quickly adapt their products to meet the specific needs and preferences of regional markets. The direct channel often leads to a strong brand loyalty, as farmers develop trust in the quality and effectiveness of the biopesticides they use. Additionally, direct sales can enhance profit margins for producers by eliminating intermediaries. Overall, the direct market's dominance reflects a shift toward personalized service and immediate access to sustainable agricultural products.

End User Insights

How Are Commercial Farmers Dominating the Market?

Commercial farmers continue to dominate the biopesticide sector, as they cultivate large-scale farms where sustainability and productivity must coexist. Their adoption is driven by regulatory compliance, cost efficiency, and growing market demand for pesticide-free crops. Large farming enterprises are increasingly integrating biopesticides into integrated pest management systems. Partnership between governments and commercial farmers to promote bio-based agriculture also enhances usage. With large-scale acreage under their purview, commercial farmers will continue to dominate this channel.

- In August 2025, the Left Democratic Front (LDF) government announced new regulations to implement a recently passed law. This law aims to provide farmers with unrestricted land use rights on land designated exclusively for agricultural purposes. Additionally, it includes provisions for housing for landless settlers in the high-range districts, particularly in Idukki and Wayanad, areas that received land allocations in the 1970s.(Source: https://www.thehindu.com)

The horticulture & greenhouse growers market is the fastest-growing segment, driven by their need for high-quality produce with minimal chemical residue. Controlled environments make biopesticides particularly effective for this group. The segment benefits from innovations in fungal biopesticides and seed treatment applications. Growing consumer demand for organic fruits, vegetables, and flowers is driving the increased adoption of these products. As urban farming and hydroponics expand globally, greenhouse and horticulture channels are set to grow at a faster rate.

Biopesticides Market: Value Chain Analysis

- Harvesting and Post-Harvest Handling

The process of collecting and managing biopesticides after harvest entails gathering, processing, and storing the biological agents at the appropriate stage of maturity to preserve their effectiveness and viability.

- Storage and Cold Chain Logistics

The storage of biopesticides and the logistics of cold chain management focus on maintaining the biological viability and efficacy of temperature-sensitive items from production to use via a regulated, temperature-controlled supply chain. This necessitates a rigorous compliance with defined temperature ranges, typically between 2°C and 8°C for refrigerated items and even lower for frozen ones, along with safeguarding against light and humidity.

- Distribution to Wholesalers/Retailers

To effectively distribute biopesticides to wholesalers and retailers, manufacturers should strategically align with established distribution partners through online platforms such as IndiaMART or Justdial. It's essential to formulate a robust go-to-market strategy that encompasses market penetration and customer engagement. Furthermore, leveraging market insights and analytics from firms like Kline + Company will facilitate a deeper understanding of industry dynamics and consumer behavior, enabling manufacturers to tailor their distribution approach for optimal impact.

Key players: IndiaMart and Justdial

Regional Insights

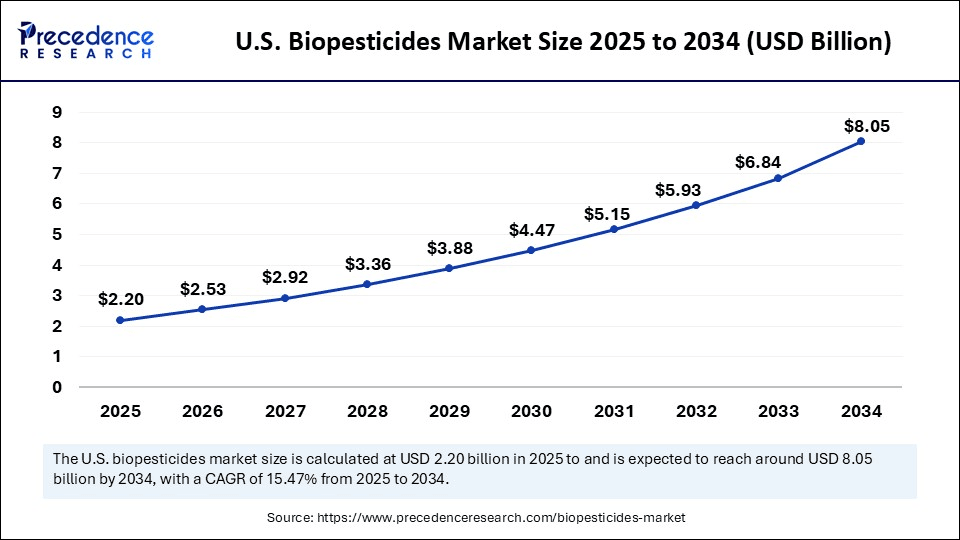

U.S. Biopesticides Market Size and Growth 2026 to 2035

The U.S. biopesticides market size is exhibited at USD 2.20 billion in 2025 and is projected to be worth around USD 9.06 billion by 2035, growing at a CAGR of 15.2% from 2026 to 2035.

Why Does North America Lead the Biopesticides Market?

By region, North America dominated the global market in 2025, due to its advanced agricultural practices, strong regulatory support, and widespread awareness about sustainable farming. The region benefits from a robust infrastructure for biotechnology research and a proactive stance on limiting chemical pesticide usage. Farmers in the U.S. and Canada are early adopters of eco-friendly crop protection methods, driven by consumer demand for organic produce. The presence of leading biotech companies and research institutions further strengthens innovation in microbial and botanical-based solutions. Additionally, government subsidies and farm advisory services are encouraging large-scale adoption. This well-rounded ecosystem positions North America as the most influential region in shaping global biopesticide growth trajectories.

Is Asia Pacific the Next Growth Frontier?

Asia Pacific is emerging as the fastest-growing region for biopesticides, supported by rapid population growth, food security concerns, and increasing regulatory restrictions on synthetic pesticides. Countries such as India, China, and Japan are actively promoting organic and residue-free farming practices. Rising awareness among farmers, coupled with growing consumer demand for safe food, is accelerating the adoption of natural crop protection products.

Furthermore, the region's large agricultural base provides vast potential for scaling biopesticide use across diverse crops and climates. Strategic investments by global players, along with supportive government initiatives, are enhancing accessibility and affordability. With its dynamic agricultural landscape, the Asia Pacific is poised to become the epicenter of future biopesticide market expansion.

What are the Advancements in the Biopesticides Market in Europe?

Europe is experiencing significant growth in the market. The region's growth is propelled by stringent EU regulations that favor environmentally friendly pest control methods and a strongly evolving consumer shift towards organic products. Countries like Germany, France, and the UK are leading players in the market, highlighting rapid biopesticide adoption and promoting sustainable farming practices.

Germany Biopesticides Market Trends: The region's market is characterized by a robust regulatory framework that encourages research and development. The country also has regulatory support, which is crucial for fostering innovation and market growth.

What are the Key Trends in the Biopesticides Market in Latin America?

Latin America is experiencing substantial market growth and will continue to grow in the upcoming years. The market is expected to grow significantly in the coming years, fueled by growing awareness about the downsides of conventional pesticides and a surge in demand for sustainable agricultural practices. Moreover, the growing government initiatives to support research and development activities would further fuel the market growth.

Brazil Biopesticides Market Trends: The region's market is characterized by innovation, with companies actively investing in research and development of novel biopesticides. The market is also witnessing a shift towards microbial and plant-based biopesticides, due to their efficacy and affordability.

What are the Reasons for Growth in the Biopesticides Market in the Middle East and Africa?

The Middle East and Africa are experiencing steady growth in the market. This growth is driven by factors such as an increase in agricultural activities, a rising awareness of sustainable farming practices, and government initiatives that are aimed at reducing chemical pesticide usage. Countries like South Africa and Kenya are leading players in the region, focusing on biopesticide adoption to enhance food security and agricultural sustainability.

South Africa Biopesticides Market Trends: The region's unique climatic conditions and diverse crops open up various opportunities for the biopesticide market. As the agricultural sector continues to evolve, the interest in biopesticides is expected to grow even further.

Value Chain Analysis of the Biopesticides Market

- Raw Material Sourcing

Bio-pesticides are the formulated form of active ingredients based on microorganisms such as bacteria, viruses, fungi, and nematodes, including plant extracts and semi-chemicals.

Key Players: Valent, Koppert, Certis - Manufacturing Process

This stage involves creating a stable formulation, conducting field trials to test efficacy in real-world conditions, and ensuring the product's stability and safety.

Key Players: Syngenta, Corteva, Bayer - Regulatory Approval

Regulatory approval is a critical phase where the biopesticide must comply with governmental regulations. This includes submitting the product for approval, complying with all necessary steps.

Key Players: Nutrien, IFFCO, Yara

Biopesticides Market Companies

- Bayer CropScience

- BASF SE

- Syngenta

- UPL Limited

- FMC Corporation

- Corteva Agriscience

- Marrone Bio Innovations

- Valent BioSciences (Sumitomo Chemical)

- Certis Biologicals

- Novozymes A/S

- Andermatt Biocontrol AG

- Koppert Biological Systems

- BioWorks Inc.

- Stockton Bio-Ag (STK)

- Vegalab S.A.

- Lallemand Plant Care

- Bionema Ltd.

- Gowan Company

- GreenLight Biosciences

- Biotech International

Recent Developments

- In June 2025, in a significant advancement for sustainable spice agriculture, researchers at the ICAR-Indian Institute of Spices Research (ICAR-IISR) in Kozhikode have developed an environmentally friendly biopesticide targeting cardamom thrips (Sciothrips cardamomi). This notorious pest leads to substantial economic losses in cardamom production. With cardamom cultivated across more than 70,000 hectares in India, these thrips inflict considerable damage, adversely affecting 30-90% of the capsules and diminishing yields by approximately 45-48%. This results in a monetary loss estimated between 2.0 to 4.0 lakhs rupees per acre, jeopardizing farmers' economic viability and impacting the export quality of this economically significant spice.(Source: https://www.pib.gov.in)

- In August 2025, to fork strategy, the green deal, their flagship product, represents the first insecticide in a decade to bring a completely new mode of action that focuses on the neuromuscular system of insect pests. Despite its impressive effectiveness and environmental safety, both our product and the wider category of peptide-based biopesticides are currently facing significant regulatory hurdles in Europe.(Source: https://agfundernews.com)

Segments Covered in this Report

By Product Type

- bioinsecticides

- biofungicides

- Bionematicides

- Bioherbicides

- Others (e.g., attractants, repellents, rodenticides)

By Source

- Microbial

- Bacteria (e.g., Bacillus thuringiensis, Bacillus subtilis)

- Fungi (e.g., Trichoderma, Beauveria)

- Viruses (e.g., Baculoviruses)

- Biochemical

- Plant Extracts

- Semiochemicals (pheromones, allelochemicals)

- Beneficial Insects & Predators

- Others

By Mode of Application

- Foliar spray

- Seed treatment

- Soil Treatment

- Post-Harvest Treatment

- Others

By Formulation

- Liquid Formulation

- Dry Formulation (Powder, Granules, Dusts)

- Others

By Crop Type

- Cereals & grains

- Fruits & vegetables

- Oilseeds & Pulses

- Turf & Ornamentals

- Others (industrial crops, specialty crops)

By Distribution channel

- Direct Sales

- Indirect Sales (Distributors, Retailers, E-commerce)

By End User

- Commercial Farmers

- Horticulture & greenhouse growers

- Home Gardeners & Small Growers

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting