What is the Anti-Money Laundering Market Size?

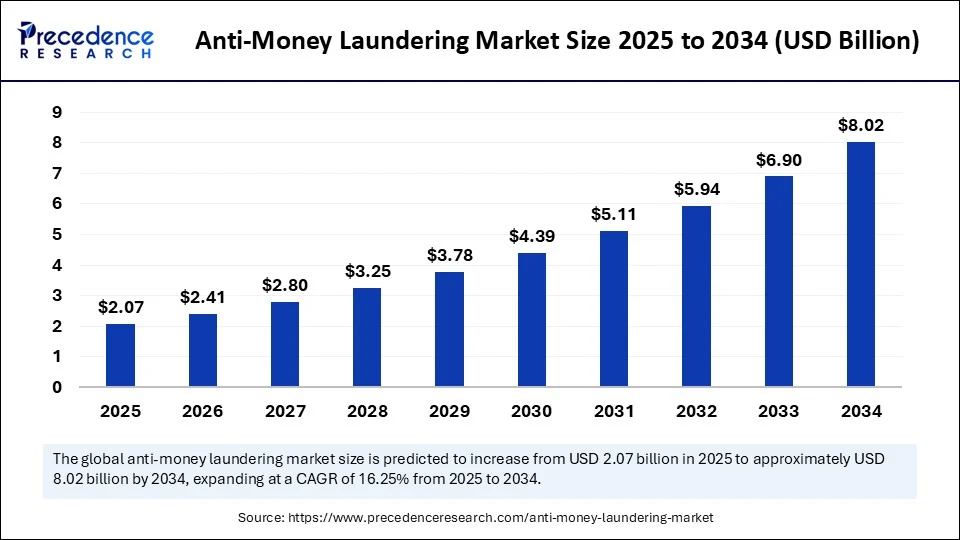

The global anti-money laundering market size is accounted at USD 2.07 billion in 2025 and predicted to increase from USD 2.41 billion in 2026 to approximately USD 9.14 billion by 2035, expanding at a CAGR of 16.01% from 2026 to 2035. The market is driven by rising regulatory scrutiny, increasing financial crimes, and the growing adoption of AI-powered compliance solutions worldwide.

Anti-Money Laundering Market Key Takeaways

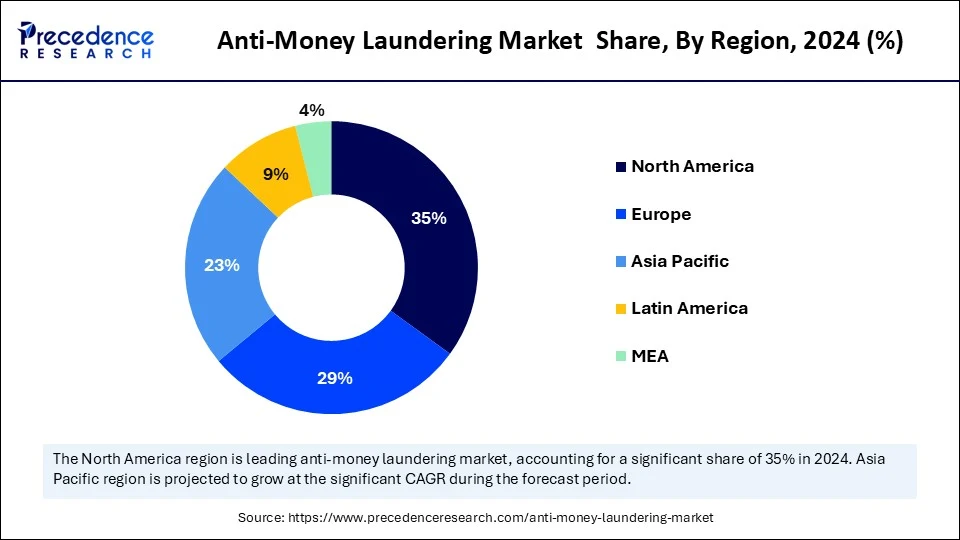

- North America dominated the global anti-money laundering market with the largest market share of 35% in 2025.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By solution type, the transaction monitoring segment captured the biggest market share of 35% in 2025.

- By solution type, the trade-based AML analytics segment is anticipated to show considerable growth over the forecast period.

- By component, the software segment contributed the highest market share of 70% in 2025.

- By component, the services segment is anticipated to show notable growth over the forecast period.

- By deployment model, the on-premises segment generated the major market share of 40% in 2025.

- By deployment model, the hybrid deployment segment is anticipated to show considerable growth over the forecast period.

- By organization size, the large enterprises segment held the largest market share of 60% in 2025.

- By organization size, the small & medium-sized enterprises (SMEs) segment is anticipated to show considerable growth during the forecast period.

- By end-user industry, the banking, financial services & insurance (BFSI) segment captured the maximum market share of 50% in 2025.

- By end-user industry, the FinTech & payment service providers segment is anticipated to show considerable growth over the forecast period.

How is AI Integration Transforming the Anti-Money Laundering Market?

These systems effectively supplement AML systems by providing a higher accuracy of detection of any suspicious activity with fewer false alarms, which have a way of overwhelm the analysts. Artificial Intelligenceand ML allow data to be analyzed within large amounts of data quickly, detecting obscure patterns and adjusting to evolving money laundering techniques, and consequently, are essential in the battle against more advanced money laundering tactics.

The accuracy and detection capabilities of AI-based AML systems improve with time as the systems learn and advance by analyzing the incoming data. This integration increases the effectiveness in responding to the changing regulatory requirements, also allows organizations to keep pace with emerging threats. As a result, the deployment of AI and ML in the proposed AML solutions offers a revolutionary possibility to both vendors and users of the solution.

How Does E-commerce & Online Marketplaces Accelerate the Anti-Money Laundering?

The anti-money laundering market is highly diverse in terms of software tools and services aimed to help prevent, identify, track, and report financial crimes associated with money laundering and other criminal acts. They are distributed across an array of models and serve financial institutions, government bodies, and industries susceptible to financial crime. The primary users include financial companies, including banks, insurance, mortgage lenders, online banks, where business matters such as real estate transactions, gaming and gambling media, and investment institutions, and the internet payment services providers who are adopting AML solutions to prevent fraud and ensure transparency.

The market has been experiencing a high growth rate, especially due to the increase in the number of online transactions and high rates of digitalization of the financial sector. Mobile payments, online banking, and digital wallets are gaining popularity and broadening the risk environment, and superior monitoring is required instead of lowering financial anomaly detection rates, is required to stop money laundering. The growth of e-commerce and online marketplaces, which have been driven by the consumer shift towards desiring convenience, has increased the importance of having a strong AML framework to allow tracking of non-cash transactions to ensure fraud, bribery, corruption, and terrorist financing risks are reduced.

What Factors Are Fueling the Rapid Expansion of the Anti-Money Laundering Market?

- Rising Financial Crimes: The high rates of fraud, money laundering, terrorism financing, and identity theft are some of the drivers that have seen financial institutions and industries deploying superior quality AML solutions. Such tools identify uncertain transactions as they occur, retrieve assets, and secure the economic system against economic destabilization due to illicit operations.

- Pressure in the form of regulatory compliance: International and local regulating authorities are imposing high standards of compliance on banks and insurers, and payment providers. Organizations are investing thick in AML, ensuring transparency, effectiveness in detecting high-risk events, and that reporting is streamlined to avoid heavy fines and damages to their reputations.

- Technological Advancements: These technological advancements level up the accuracy, automate the reviewing of alerts, diminish the number of false positives, and optimize the overall efficiency of monitoring. Technological advancements that allow the proactive identification of the sophisticated patterns of financial crime are contributing to the explosive growth of the market.

Anti-Money Laundering Market Outlook:

- Market Growth Overview: The anti-money laundering market is growing steadily due to stricter regulatory compliance requirements, rising financial crimes, and increasing adoption of digital banking and online transactions. Advances in AI, machine learning, and data analytics are further driving demand for more efficient and automated AML solutions.

- Global Expansion: The market is expanding worldwide as financial institutions and enterprises across regions strengthen compliance frameworks to meet evolving regulations. Emerging markets in Asia-Pacific, Latin America, and the Middle East & Africa present strong opportunities due to rapid digitalization, growing fintech adoption, and improving regulatory enforcement.

- Major Investors: Major investors include leading financial institutions, fintech companies, technology providers, and private equity firms, along with governments and regulatory bodies. Their investments support technology innovation, platform development, and large-scale deployment of AI-driven AML solutions, accelerating market growth and adoption globally.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 9.14 Billion |

| Market Size in 2025 | USD 2.07 Billion |

| Market Size in 2026 | USD 2.41 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 16.01% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Solution Type, Component, Deployment Model, Organization Size, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Financial Crimes Detection Efforts

The recent surge in financial crimes has contributed to the detection of crimes, which has become a primary factor increasing demand in the anti-money laundering market. However, increased pressure is being imposed on banks to engage in stricter processes to detect and stem suspicious transactions as money laundering and related crimes become sophisticated. These initiatives are the enhancement of internal controls, expanding reporting procedures, and the incorporation of more futuristic monitoring systems that would have the ability to perform real-time monitoring. The threat of financial crimes will only warrant the need to have an AML solution in place that will counter it, and it is only logical that there is an increasing demand for the application of such robust AML solutions.

Restraint

High Cost and Operational Process

High financial investment in the deployment of AML fintech software and costly operations are some of the key inhibitors of the anti-money laundering market. Installing the solutions may involve a substantial investment in infrastructure, training of the staff, as well as integration with the systems, which may overwhelm the resources of smaller and medium-sized fintech companies with tight budgets. In addition, the process of adaptation to new and even untested technologies becomes another issue, as organizations might find it difficult to maintain a smooth functioning of the activities during the process of transitioning to traditional systems.

Opportunity

Increasing Adoption of Advanced Analytics in AML

The increase in the use of advanced analytics offers a considerable prospect to the anti-money laundering market. In AML, the methods allow systems to identify complicated money laundering distributions, financial criminal activities, identity theft, and inconsistencies in cross-border transactions with higher precision. Moreover, predictive and prescriptive analytics can enable financial organizations to find suspicious activity and, in addition, predict possible risks and suggest remedies. Advanced analytics can enable organizations to build and reinforce compliance frameworks and enhance operational efficiency, and keep pace with financial crime techniques.

Solution Type Insights

Why Did the Transaction Monitoring Segment Lead the Anti-Money Laundering Market in 2025?

The transaction monitoring segment led the market in 2024 because of the increasing cases of financial crimes worldwide. The transaction monitoring solutions are a necessity for financial institutions, as they can analyze high volumes of transactions in real-time to ensure that suspicious activities are identified and to remain compliant with the strict regulations. Regulatory authorities and governments are increasingly enforcing guidelines on organizations, and to ensure compliance, organizations are adopting strong monitoring frameworks to reduce risks and prevent penalties. The financial crimes have grown in sophistication, and thus the market needs to have high-quality and effective transaction monitoring systems, which has solidified the dominance of the segment.

The trade-based AML analytics segment is expected to grow at a significant CAGR over the forecast period, due to the complexity in global trade networks and due to the risk of trade-based money laundering. As international trade increasingly grows, this presents a chance of allowing illicit actors to legitimize illegal funds by carrying out misinvoicing practices, submission of falsified documentation, and other manipulative practices. Trade-based AML analytics solutions allow organizations to analyze cross-border transactions, browse trade patterns, and identify anomalies that may denote fraudulent or suspicious activities.

Component Insights

What Factors Enabled the Software Segment to Capture the Largest Revenue Share in 2025?

The software segment held around 70% share in the market in 2024, due to the rising popularity of more advanced monitoring and compliance software among banks, financial services, and payment solutions provider companies. The ML software is vital when it comes to detecting suspicious activities, improving false transaction declines, and is vital ensuring regulatory compliance. The partnership with more advanced technologies like artificial intelligence, machine learning, and big data analytics has also augmented the power of the software as they act in real time to analyze extensive data loads to determine any possible risk quickly and efficiently. Both of these innovations make fraud detection activities more accurate, also assist organizations in streamlining their compliance processes, which lowers the reliance on such activities that involve a lot of time and are very costly.

The service segment is expected to grow notably in the anti-money laundering market, owing to the increasing popularity of specialized competence and compliance support services amongst financial institutions. Most international companies are currently working on the development of AI-based AML systems that can allow banks and financial institutions to detect suspicious transactions much faster, mitigating risks and enhancing the comprehensiveness of the subsequent compliance process. These services can offer instantaneous insights through the application of artificial intelligence and machine learning and automated monitoring functions, and reduce the cost of manual interventions. Further, AML services provide custom consulting and managed services to enable organizations to make better decisions and respond to the changing methods of financial crimes.

Deployment Model Insights

Why do On-Premises Deployments Dominate the Anti-Money Laundering Market?

The on-premises segment led the market while holding a 40% share in 2025, because financial organizations and institutions still rely on an in-house compliance infrastructure. On-premise deployments are more preferred when maximum control and data protection, and adherence to regulations are a priority for the organization. The advantages of on-premise AML software are that it offers deployment autonomy to organizations and is therefore particularly desirable where data sensitivity is critical, as is the case in highly regulated environments. Although the shift to cloud-based solutions is promising, on-premises implementations are important in organizations where there is a need to minimize the organization's exposure to the outside world, and also through extensive control of compliance. Such a tendency demonstrates the emphasis on secure and customizable on-premises solutions in preserving the development of the market.

The hybrid deployment segment will experience a high growth rate in terms of CAGR during the forecast period by taking advantage of the benefits of on-premise-based systems and cloud-based systems. The hybrid model offers flexibility, scalability, and elevated capacity to organizations. Hybrid implementations enable financial institutions to operate the most critical data and compliance applications within on-premises systems but take advantage of cloud-based, high-performance analytics, AI-driven monitoring, and machine learning models. As financial crime continues to grow in its complexity, the hybrid model is emerging as a trendy option among institutions looking to modernize their compliance strategy and, simultaneously, ensure strict access controls to sensitive data and operational resiliency.

Organization Size Insights

What Drove Large Enterprises in the Anti-Money Laundering Market in 2025?

The large enterprises segment led the market. These organizations are also doing business in different jurisdictions, which makes them subject to more rigid regulatory positions and the increased risks of financial crimes. The size of transactions that large enterprises process and their international operations will, in many cases, expose them to sophisticated money laundering networks, and an efficient AML system is essential. The big organizations can afford to implement full-scale AML systems and integrate them with the enterprise compliance system. The increasing technological scrutiny in many jurisdictions around the world, and possible fines, further make large corporations prioritize their AML efforts.

The small & medium-sized enterprises (SMEs) segment is expected to grow at a significant CAGR over the forecast period under consideration as the number of SMEs becomes more knowledgeable about the requirements of compliance and reputational risks. These solutions are scalable and allow an SME to access highly sophisticated transaction monitoring and risk assessment solutions that are not very costly to set up. In addition, regulators are also increasing their focus on the financial ecosystems, and SMEs understand that they need to integrate AML processes to control the risk of punishment and reputation losses within their natural partners and customers. The increased availability of AI-driven and SaaS-licensed AML is giving SMEs a newfound ability to reinforce their compliance models.

End-User Industry Insights

Which End-User Industry Dominated the Anti-Money Laundering Market in 2025?

The banking, financial services & insurance (BFSI) segment held around 50% share in the market in 2025. Artificial intelligence, machine learning, and big data analytics-driven advanced solutions are being implemented to improve transaction monitoring, customer due diligence, and suspicious activity reporting. The global financial institutions that deal with considerable volumes of operations daily have seen a rapid increase in the need to reflectively monitor such cases in a real-time fashion. In addition, compliance requirements keep changing by regulatory authorities, and they are a significant focus area for BFSI players.

The FinTech & payment service providers segment is expected to grow substantially in the anti-money laundering market. With digital financial services growing at impressive rates, fintechs and PSPs are some of the prime targets of money laundering transactions, due to their speed, accessibility, and reach across geographies. Compliance standards are becoming stringent on such institutions, and thus, they need to implement effective AML technologies to keep operations secure. Highly customizable payment monitoring systems are of particular interest to fintechs and PSPs because they are automated, AI-powered, cloud-based solutions that provide affordable and scalable compliance solutions. As the volume of transactions has increased and with cross-border operations also on the rise, the financial sector has been exposed to greater risks of fraud, identity theft, and financing terrorists, triggering the need to deploy powerful monitoring and reporting solutions.

Regional Insights

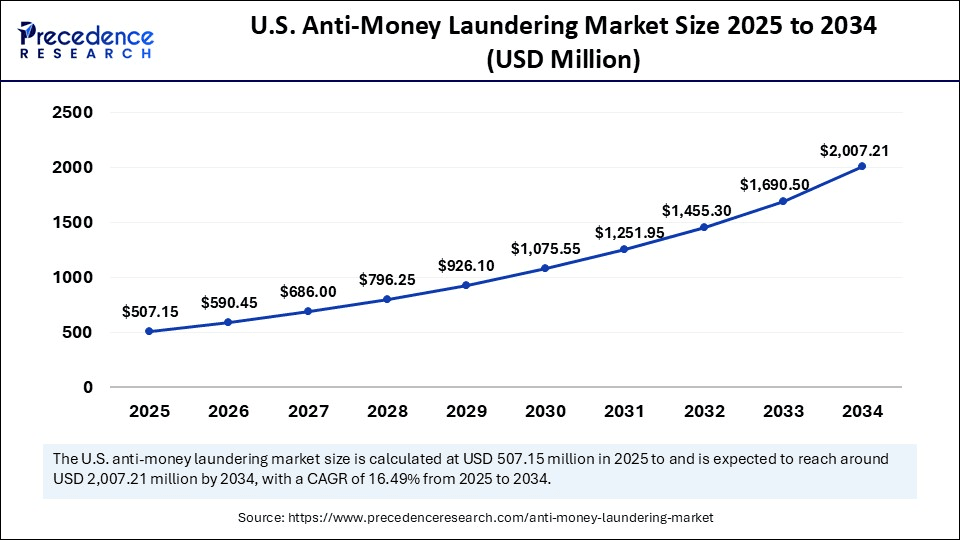

U.S. Anti-Money Laundering Market Size and Growth 2026 to 2035

The U.S. anti-money laundering market size is exhibited at USD 507.15 million in 2025 and is projected to be worth around USD 2,323.92 million by 2035, growing at a CAGR of 16.44% from 2026 to 2035.

Why Did North America Dominate the Global Anti-Money Laundering Market in 2025?

North America led the global market with the highest share in 2025 due to advanced AMLs among banks, payment providers, and insurance firms. In addition, North America has an emphasis on technological advancements, and artificial intelligence, machine learning, and big data analytics are being actively incorporated into the AML systems to monitor in real-time and detection of patterns. The advent of the increasing number of financial transactions on digital mediums and, thereby, international financial movements also requires a more advanced compliance system. The existence of established financial centers such as New York and Toronto supports the continued domination of the region in the global movement of AML.

Stepping into AI and Automation Solutions: Expanding the U.S. Market

The U.S. is likely to see a massive boom in the anti-money laundering market. Increasing levels of financial crime, such as identity theft, fraud, sources of funding for terrorists, and major money laundering schemes, are fuelling the need to implement sophisticated compliance provisions. In addition, heavy fines on organizations that fail to comply are also a strong incentive in terms of making more investments in AML systems. Major financial institutions are starting to implement artificial intelligence, automation, and blockchain in greater numbers to enhance detection footprint and eliminate drain sources within their operation. The high investment potential and powerful regulatory push make the U.S. one of the driving factors of the global market.

Why is Asia Pacific Projected to Witness the Fastest Growth in the Anti-Money Laundering Market?

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period, due to high economic growth, financial systems modernization, and an increased number of cross-border financial activities. The upsurge in digital banking, e-commerce interventions, and fintech inventions, risks of riches risks has significantly risen necessitating AML compliance to be at the forefront. Regulators throughout the region are increasingly becoming even stricter in their regulatory frameworks to meet global standards, and as such, financial institutions within the region have had to consider the advanced AML technologies.

Rise in Uptake of Developing Financial Techniques: Exploring the Japanese Market

The anti-money laundering sector in Japan is projected to see moderate growth, fuelled by more robust regulation and uptake of emerging financial technologies. With the upsurge of internet banking, use of mobile phones in carrying out financial transactions, and online financial transactions, the threats of financial crimes have been further escalated, prompting financial institutions to adapt more advanced AML systems. The highly controlled financial environment in Japan and its increasing dependence on technology-driven solutions are fostering the increased need for real-time monitoring, risk-labeling, and automated reporting systems.

What is Driving Significant Growth in the European Anti-Money Laundering Market?

The European anti-money laundering market is poised for significant growth from 2026 to 2035, due to increasing controls and cross-border financial transactions. The enactment of the European Union anti-money laundering directives (AMLD) obliges the member states to exercise strict compliance regulations, causing the financial institutions to ensure their AML structures are fortified. Banks and other financial service providers are focusing on modern AML technology, such as AI-based transaction monitoring, risk-based judgment, and data analytics tools, to meet these obligations and prevent high fines. Further, financial fraud and cybercrime-fueled cases are supporting the use of advanced systems.

Empowerment of Stricter Regulations landscape: Fostering the UK market

The U.K. anti-money laundering market will be among the markets with a lot of growth due to factors including as the industry being one of the centers of finance globally, and the sophistication of financial crimes has been on the rise. The climate in the AML environment in the country can be traced to the strict regulatory climate that is being supported by the Financial Conduct Authority (FCA) and the National Crime Agency (NCA). The pressure created by the U.K. in the sphere of financial transparency and accountability forces the banks and fintech companies to invest in the development of advanced AML software with the possibility of using artificial intelligence and machine-learning functions.

Extensive International Agreements are Supporting Latin America

Ongoing lucrative growth of the anti-money laundering market in Latin America has been propelled by the persistent international agreements, as numerous countries have signed the Central American Convention for the Prevention and Repression of Money Laundering. This is a standardisation measure against money laundering in the region. Moreover, the vital contribution of the Inter-American Convention on Mutual Assistance in Criminal Matters is boosting regional cooperation on criminal investigations, including those related to money laundering.

Emerging Major Cases: Assisting the Brazilian Market

Such as the Lava Jato is a huge corruption scheme in Brazil, comprising Petrobras, which led to many convictions and substantial international cooperation with countries such as the United States, Switzerland, and other Latin American nations to recover laundered funds.

Exceptional Regional Cooperation is Fueling the MEA

A significant growth of the anti-money laundering market in MEA is influenced by the robust regional cooperation, including the UAE and Egypt's Money Laundering and Terrorist Financing Combating Unit (EMLCU) signed a Memorandum of Understanding (MoU) in February 2023 to boost bilateral cooperation and information exchange. Alongside, Jordan and the UAE are also collaborating in the leadership of the Middle East and North Africa Financial Action Task Force (MENAFATF) for 2025 and 2026.

Enforcing Technologies & Regional Summits: Spurring the African Market

Specifically, the increasing emergence of cloud-based AML solutions, mainly by Small and Medium Enterprises (SMEs) in developing markets, such as Nigeria and Kenya, is propelled by the need for affordable, scalable systems. In August 2025, a regional anti-money laundering summit was conducted in Addis Ababa, Ethiopia, to develop joint plans and accelerate collaboration among African nations to eliminate financial crime.

Top Companies Operating in the Market & Their Offerings

- Temenos AG

Provides comprehensive banking software with integrated AML and compliance modules that use real-time monitoring, risk scoring, and analytics to help financial institutions detect and prevent financial crime. - Verafin Inc.

Offers AML and fraud detection platforms for banks and credit unions, leveraging shared data networks and machine learning to identify suspicious activity and streamline regulatory reporting. - Trulioo Information Services Inc.

Delivers global identity verification and KYC solutions that help organizations meet AML compliance requirements by validating customer identity across multiple international data sources. - ComplyAdvantage

Provides AI-driven AML screening, transaction monitoring, and risk intelligence solutions to help institutions detect financial crime, manage risk, and meet regulatory compliance obligations. - Accuity (Accuity Inc.)

Offers risk and compliance solutions, including AML screening, sanctions lists, and KYC data to support financial institutions in managing regulatory risk and preventing illicit financial activity. - EastNets Holding Ltd.

Delivers AML compliance and payment risk management solutions with regulatory reporting, screening, and case management tools for banks and financial institutions across global markets. - Ascent Technology Consulting

Provides automated compliance content and risk management products using AI and machine learning to keep AML programs updated with regulatory rules and improve operational efficiency. - Jumio Corporation

Offers identity verification and KYC/AML solutions using biometric and AI technology to authenticate users, prevent fraud, and help organizations comply with anti-money laundering regulations.

Key players Offerings:

- SAS Institute Inc.- It usually facilitates various solutions for monitoring, risk management, and compliance tools led by advanced analytics and AI.

- NICE Actimize (Nice Ltd)- It has explored Transaction Monitoring, Customer Due Diligence (CDD/KYC), Watch List Filtering, and Case Management.

- LexisNexis Risk Solutions- A vital company offers solutions through its RiskNarrative platform, which leverages end-to-end capabilities for risk assessment, onboarding, and monitoring

- Oracle Corporation- A major leader specializes through its Oracle Financial Crime and Compliance Management (FCCM) solution suite, a complete set of applications available on-premises or as a cloud service.

- FICO (Fair Isaac Corporation)- A company provides FICO Siron Anti-Financial Crime Solutions to manage AML and Know Your Customer (KYC) compliance.

Anti-Money Laundering Market Companies

- SAS Institute Inc.

- NICE Actimize (Nice Ltd)

- LexisNexis Risk Solutions

- Oracle Corporation

- FICO (Fair Isaac Corporation)

- ACI Worldwide Inc.

- Fiserv, Inc.

- BAE Systems (Applied Intelligence)

- Thomson Reuters Corporation

- Refinitiv (LSEG / World-Check)

- Experian plc

- Temenos AG

- Verafin Inc.

- Trulioo Information Services Inc.

- ComplyAdvantage

- Accuity (Accuity Inc.)

- EastNets Holding Ltd.

- Ascent Technology Consulting

- Jumio Corporation

- IBM Corporation

Recent Developments

- In September 2024, Tech Mahindra partnered with Discai, the unit of KBC Group, to launch KYT AML, an AI-based anti-money laundering solution. The solution reduces inefficiency that transaction monitoring is known to cause, and increases regulatory and adherence levels through leveraging combinations of AI and rule-based systems.(Source: https://www.techmahindra.com

- In February 2024, NICE Actimize launched three generative AI AML products to fight financial crimes. These improvements save time on manual research, SAR filings are 70 percent faster, and investigations are up to 50 percent faster. The solutions raise the efficiency levels, improve the way compliance is managed, and simplify regulatory reporting by the financial institutions of the globe. (Source: https://www.niceactimize.com)

- In June 2023, Google Cloud added an AI-based AML product that can better detect money laundering. The solution will decrease compliance costs, false positives, and increase risk identification with machine learning.

(Source:https://www.prnewswire.com) - In March 2025, NICE Actimize, a subsidiary of NICE Systems, secured USD 100 million in funding led by Blackstone Growth. The capital will accelerate the company's innovation and growth in the anti-money laundering software sector.

(Source: https://www.stocktitan.net) - In May 2025, the EU's Fifth Anti-Money Laundering Directive (5AMLD) took effect, enhancing AML rules for virtual currencies and improving transparency of beneficial ownership. AML software providers are expected to update their solutions to help financial institutions comply with these new regulations.

(Source: https://www.nortonrosefulbright.com)

Segments Covered in the Report

By Solution Type (Functional Modules)

- Transaction Monitoring Systems

- Know-Your-Customer / Customer Due Diligence (KYC/CDD)

- Sanctions & PEP Screening

- Case and Alert Management

- Currency Transaction & Regulatory Reporting

- Trade-Based AML Analytics

By Component

- Software

- Services (Managed & Professional)

By Deployment Model

- On-Premises

- Cloud

- Hybrid

By Organization Size

- Large Enterprises

- Small & Medium-Sized Enterprises (SMEs)

By End-User Industry

- Banking, Financial Services & Insurance (BFSI)

- Insurance

- FinTech & Payment Service Providers

- Wealth & Asset Management / Investment Advisers

- Gaming & Gambling Operators

- Cryptocurrency Exchanges / Virtual-Asset Service Providers

- Government & Public Sector

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting