What is the Anti-theft System Market Size?

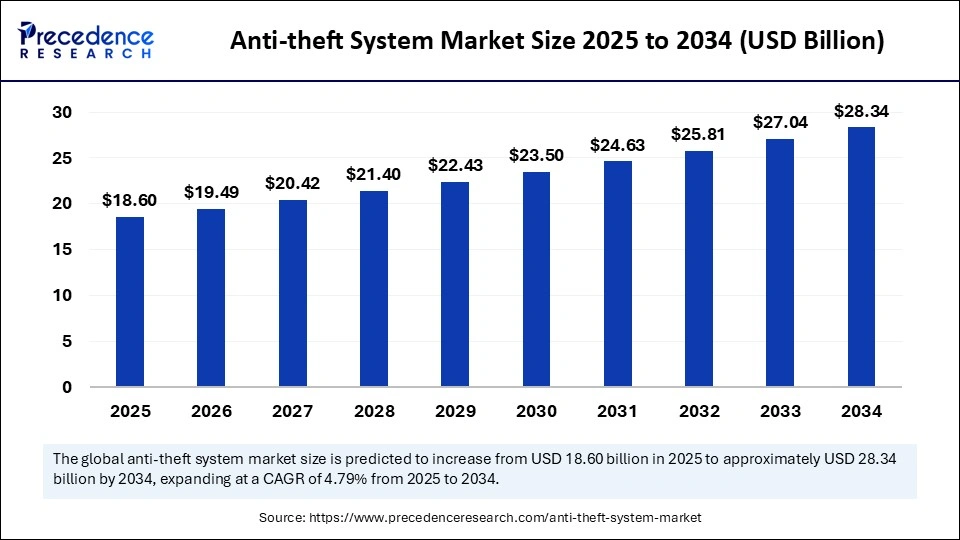

The global anti-theft system market size is calculated at USD 18.60 billion in 2025 and is predicted to increase from USD 19.49 billion in 2026 to approximately USD 28.34 billion by 2034, expanding at a CAGR of 4.79% from 2025 to 2034. The growing demand for rising concerns over vehicle security, rapid urbanization, growing awareness of asset protection, and rapid advancements in technology are expected to drive the growth of the market for anti-theft systems over the forecast period. Additionally, the market is rapidly expanding in various developing and developed regions, particularly the Asia Pacific, fuelled by the increasing presence of key players and the increasing need for effective anti-theft measures.

Anti-theft System Market Key Takeaways

- In terms of revenue, the global anti-theft system market was valued at USD 17.75 billion in 2024.

- It is projected to reach USD 28.34 billion by 2034.

- The market is expected to grow at a CAGR of 4.79 % from 2025 to 2034.

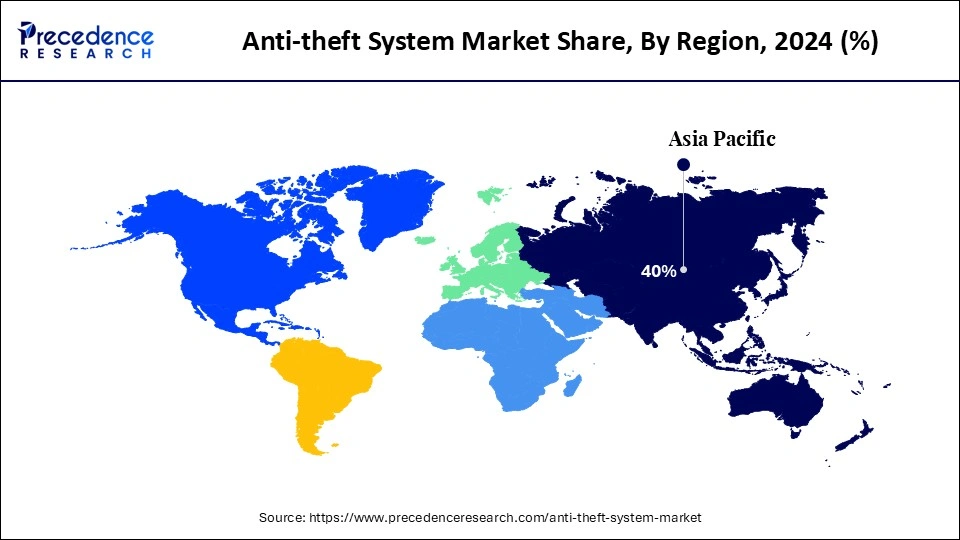

- Asia Pacific dominated the anti-theft systems market with the largest market share of 40% in 2024.

- North America is anticipated to grow at the fastest CAGR during the forecast period.

- By product type, the electronic immobilizers segment captured the highest market share of 30% in 2024.

- By product type, the GPS/GSM tracking & biometric systems segment is expected to witness a significant share during the forecast period.

- By technology, the RFID & smart card technology segment captured the biggest market share of32% in 2024.

- By technology, the biometric authentication segment accounted for considerable growth over the forecast period.

- By application, the automotive segment generated the major market share of 45% in 2024.

- By application, the residential & smart homes segment is expected to grow significantly during the forecast period.

Protecting Assets Worldwide: The Rise of Advanced Anti-Theft Systems

The global anti-theft system market refers to the technologies, products, and solutions designed to prevent unauthorized access, theft, or loss of vehicles, consumer goods, and other assets. These systems include electronic immobilizers, alarms, biometric sensors, GPS/GSM tracking, and RFID-based solutions deployed across automotive, retail, residential, and commercial sectors. Growth is driven by increasing vehicle theft rates, rising consumer awareness of security solutions, strict insurance & regulatory requirements, and technological advancements such as IoT-enabled systems, smart sensors, and AI-powered surveillance.

- In January 2025, the World Economic Forum reported that 42% of organizations have now experienced deepfake-driven social engineering attacks.

(Source: https://keyless.io)

How is Innovation Impacting the Market?

In today's rapidly evolving technological landscape, artificial intelligence emerges as a driving force and holds potential for significant growth and innovation in the anti-theft system market. AI integration is rapidly transforming the anti-theft system market through predictive analytics, advanced threat detection, and real-time response capabilities. 9AI-powered facial recognition and anomaly detection are being increasingly embedded into anti-theft systems, assisting in identifying potential intrusions before they occur. AI-driven surveillance and predictive analytics can detect anomalies and potential security risks. The incorporation of AI is making anti-theft systems more proactive and intelligent across various sectors. The rising shift toward connected vehicles, smart homes, and automated commercial facilities creates demand for AI-driven anti-theft systems.

Market Outlook

- Industry Growth Offerings- The anti-theft system industry is scaling with smart, connected offerings like AI-driven anomaly detection, IoT-enabled GPS trackers, biometric access control, and cloud-based monitoring. Advanced immobilizers, predictive analytics, and multi-layer security suites are accelerating market growth.

- Global Expansion- The global anti-theft systems market is expanding rapidly as demand surges across regions, especially in Asia Pacific and North America, for connected, AI-powered security solutions in vehicles, homes, retail, and commercial spaces.

- Startup ecosystem- The anti-theft systems startup ecosystem is booming, with emerging players like Ambient.ai (AI-driven camera intelligence) and Jimi IoT (smart vehicle and cargo security) leveraging IoT, cloud platforms, and computer vision to deliver next-gen, automated theft deterrence.

What Are the Latest Trends in the Anti-theft System Market?

- The growing demand for smart solutions across the automotive/transportation, consumer electronics, BFSI, government & defense, retail & e-commerce, and residential & commercial real estate sectors accelerates the growth of the anti-theft system market.

- The rising adoption of advanced anti-theft technology, such as biometric access, IoT, and GPS tracking, is expected to fuel the market's revenue during the forecast period.

- The supportive government policies and regulations for vehicle safety are expected to contribute to the overall growth of the market.

- The rapid urbanization and surge in disposable income are expected to propel the expansion of the anti-theft system market in the coming years. The growing purchasing power of consumers creates significant demand for convenient security solutions.

- The rise in crime rates globally and increasing security concerns are significantly boosting the anti-theft system market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 28.34 Billion |

| Market Size in 2025 | USD 18.60 Billion |

| Market Size in 2026 | USD 19.49 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.79% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Theft Rates and Security Concerns

The increasing demand for green hydrogen and technological advancement are expected to boost the growth of the anti-theft system market during the forecast period. The global surge in incidents of theft, burglary, and unauthorized access across residential, commercial, and industrial sectors drives the demand for advanced anti-theft systems. As thieves are increasingly leveraging sophisticated methods, this encourages consumers and businesses to seek more robust security technologies. The increasing value of advanced electronics, personal property, and vehicles significantly escalates the need for advanced and reliable security systems to protect assets. Several key market players are increasingly focusing on driving innovation and development in anti-theft technologies to expand their market reach and enhance their product offerings with a focus on advanced security measures.

Restraint

High costs

The high initial cost is anticipated to hamper the market's growth. The initial cost required for purchase, installation, and ongoing maintenance of advanced anti-theft solutions, especially those incorporating technologies. The high cost of anti-theft systems has led to slow adoption, particularly in middle and lower-income countries. Additionally, the technical complexity and integration issues associated with old buildings or vehicles are likely to limit the expansion of the global anti-theft system market.

Opportunity

How is the growing demand for connected and electric vehicles (EVs) impacting the market's growth?

The growing demand for connected and electric vehicles (EVs) is expected to present lucrative growth opportunities for the anti-theft system market during the forecast period. The rising vehicle theft incidents and increasing production and sales of connected and electric vehicles (EVs) have substantially increased the need for anti-theft systems, particularly in emerging economies. Connected and electric vehicles (EVs) are increasingly integrating advanced digital systems that require robust cybersecurity protection and integrated anti-theft features. Several manufacturers are shifting towards offering integrated anti-theft solutions that combine security features with various advanced vehicle functionalities. Automakers are increasingly integrating safety features, such as GPS/GSM-based vehicle tracking, RFID & smart cards, steering locks, remote keyless entry (RKE) & smart keys, electronic immobilizers, and biometric driver identification systems into connected, luxury, and electric vehicles, which is driving the expansion of the market in the coming years.

- In September 2024, Lexus unveiled its plan to enhance anti-theft measures in its vehicles through a groundbreaking new partnership with security specialist Tracker Network (UK). As an additional safeguard, compatible Lexus models can be fitted with a sophisticated Tracker S7 device, free of charge. This device is accredited by Thatcham Research, the UK's automotive risk intelligence organisation, and approved by insurers.(Source: https://media.lexus.co.uk)

Segment Insights

Product Type Insights

Which Segment Is Dominating the Market by Product Type in the Anti-theft System Market?

The electronic immobilizers segment dominated the global anti-theft system market in 2024, driven by rising vehicle theft rates and stringent government mandates. Electronic immobilizers are a type of anti-theft system that prevents the engine from starting unless the authorized or correct key is used. The growing awareness of vehicle security and asset protection among consumers is driving the adoption of advanced anti-theft solutions. Electronic Immobilizers offer various benefits such as theft prevention, advanced security, and enhanced security.

On the other hand, the GPS/GSM tracking & biometric systems segment is expected to witness remarkable growth during the forecast period, owing to the surge in theft rates, stringent government regulations, and rapid technological advancements. An anti-theft system combining GPS/GSM tracking and biometrics, such as fingerprint and facial recognition, provides security for authorized access. GPS can track the exact vehicle's location while GSM sends real-time alerts to the owner and authorities through SMS. The integration of GPS for real-time vehicle location tracking, GSM for alerts and remote control, and biometric methods such as fingerprint and facial recognition significantly enhances security and effectiveness by deterring theft and improving recovery.

Technology Insights

What Causes the RFID & Smart Card Technology Segment to Dominate the Anti-theft System Market?

The RFID & smart card technology segment held a dominant presence in the anti-theft system market in 2024. The adoption of RFID (Radio Frequency Identification) and smart card technologies as an anti-theft system assists in enhancing security through real-time tracking, improving inventory management, and reducing losses from theft, as well as boosting operational efficiency across various sectors such as retail, automotive, BFSI, and others. RFID and smart card technology use radio waves to accurately detect, track, and authenticate individuals or objects. Smart cards are widely used to provide advanced security through features such as secure authentication, encryption, and safeguarding data from unauthorized access.

On the other hand, the biometric authentication segment is expected to grow at a notable rate. The biometric authentication segment is experiencing significant growth, fuelled by the rapid advancements in innovative technologies such as facial recognition and fingerprint scanning. Biometric authentication is gaining immense popularity as an advanced anti-theft system, especially for vehicles, where it provides personalized and multi-layered security through fingerprint, facial, or voice recognition to improve overall user experience. Some common examples of biometric authentication include fingerprint scanning and driver identification through voice recognition.

Application Insights

What Has Led the Automotive Segment to Lead the Market in 2024?

The automotive segment held the largest market share in 2024. The growth of the segment is attributed to the global surge in increasing vehicle theft incidents, rising public awareness of the benefits and necessity of anti-theft devices. Stringent government regulations mandate the installation of advanced technologies as safety features, such as GPS/GSM-based vehicle tracking, RFID & smart cards, steering locks, remote keyless entry (RKE) & smart keys, biometrics, and electronic immobilizers. Moreover, the increasing production and sales of vehicles, especially in emerging nations, are expected to significantly accelerate the growth of the anti-theft market during the forecast period. On the other hand, the residential & smart homes segment is projected to grow at a CAGR between 2025 and 2034. The increasing demand for advanced security technologies, including remote monitoring capabilities, video surveillance, motion detection, intelligent alerts, smart sensors, and IoT-enabled security systems primarily drives the growth of the segment. The integration with smart home ecosystems offers a more holistic and secure user experience. The monitor and control ability of home security from anywhere via mobile apps and voice integrations provides convenience and improved security to homeowners.

Regional Insights

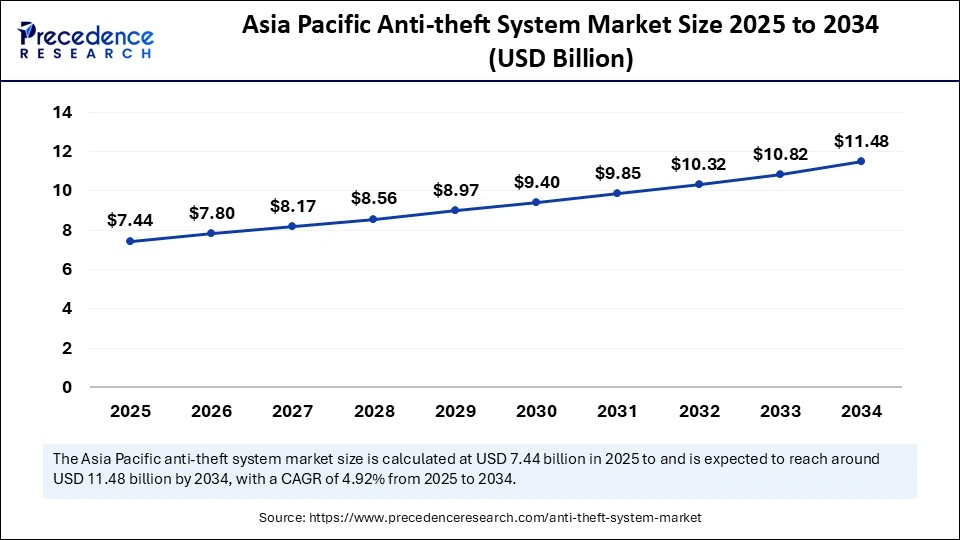

Asia Pacific Anti-theft System Market Size and Growth 2025 to 2034

The Asia Pcific anti-theft system market size is evaluated at USD 7.44 billion in 2025 and is projected to be worth around USD 11.48 billion by 2034, growing at a CAGR of 4.92% from 2025 to 2034.

Asia Pacific held the dominant share of the anti-theft system market in 2024. The region's rapid growth is driven by the surging theft cases, expanding demand for IoT and connected car security solutions, rapid urbanization, surge in disposable incomes, rising security concerns, rapid automotive sector, rising security awareness among property owners, and demand for advanced anti-theft systems across various sectors. Moreover, the integration of modern security technologies, such as GPS tracking,biometrics, electronic immobilizers, IoT-enabled systems, smart sensors, and AI-powered surveillance, is expected to propel the growth of the anti-theft system market in the region. The region has a large-scale production capacity of vehicles, especially in countries like China, Japan, India, and South Korea, which increases the demand for advanced security in both passenger and commercial vehicles, the rapid expansion of connected car technology, and insurance-driven security requirements. Governments in the region are increasingly implementing stringent government regulations to promote vehicle safety and security, driving the demand for advanced security features in new vehicles. Such a combination of factors contributes to the expansion of the anti-theft market in the Asia Pacific region.

China Strengthens Security with Smart Anti-Theft Solutions

The China market is expanding as businesses and households increasingly prioritize asset protection. Rising investments in smart cities, commercial security, and connected homes are driving demand for advanced solutions like biometric sensors, cloud-based monitoring, and real-time tracking. Technological innovations, combined with government initiatives promoting safety and loss prevention, are accelerating adoption across automotive, retail, and industrial sectors, contributing to steady market growth.

Europe Sees Growing Demand for Advanced Anti-Theft Systems

The Europe market is increasing due to heightened focus on security across automotive, retail, and residential sectors. Rising awareness of smart security solutions, adoption of IoT-enabled monitoring, AI-powered surveillance, and advanced GPS/GSM tracking are driving growth. Stringent regulations, insurance mandates, and government initiatives to reduce theft and enhance asset protection are encouraging businesses and consumers to invest in electronic immobilizers, alarms, and RFID-based anti-theft systems across the region.

UK Adopt Next-Gen Anti-Theft Technologie

The UK market is growing as consumers and businesses seek smarter ways to protect assets. Rising demand for integrated security solutions, including real-time monitoring, cloud-based management, and mobile-enabled alerts, is fueling adoption. Expansion in commercial complexes, retail stores, and high-value residential properties, along with increasing investments in innovative alarm systems and access control technologies, is driving steady market growth across the country.

North America Is Expected to Grow at the Fastest Rate in the Market for Anti-theft Systems

On the other hand, North America is expected to grow at the fastest rate in the market during the forecast period. The fastest growth of the region is mainly fuelled by the growing demand for advanced security features, rising vehicle theft and crime rates, strong presence of major automotive and security companies, the integration of advanced technologies like GPS, smart cards, and biometrics, and rising awareness among vehicle owners and property owners regarding security risks. The regional market's growth is experiencing growth supported by a rising focus on key market players on strategic partnerships and acquisitions to expand their market reach and enhance their product offerings. Supportive government initiatives and regulations promote vehicle safety, as well as the growing demand for smart solutions across the automotive, retail, electronics, residential, and others. The rapid technological advancements include biometric authentication (fingerprint and facial recognition), AI-driven surveillance, RFID systems, IoT-enabled systems, smart sensors, and AI-powered surveillance, as well as predictive analytics to detect anomalies and potential security risks, driving the market expansion during the forecast period.

U.S. Anti-Theft Systems Market on Rise

The U.S. market is growing due to rising vehicle thefts, increased consumer awareness of security solutions, and stricter insurance and regulatory requirements. Adoption of advanced technologies such as AI-powered surveillance, IoT-enabled systems, smart sensors, and GPS/GSM tracking is accelerating. Growth is also supported by the automotive, retail, residential, and commercial sectors, which are investing heavily in electronic immobilizers, alarms, and RFID-based solutions to enhance safety and prevent losses.

Anti-theft System Market Companies

- Arlo: AI-powered smart home cameras with cloud storage and monitoring services.

- Wyze: Affordable smart cameras, video doorbells, and sensors with app control.

- Vivint: Professionally installed integrated home security with cameras, locks, sensors, and 24/7 monitoring.

- SimpliSafe: DIY security kits, outdoor cameras, and contract-free alarm monitoring.

- Canary: All-in-one indoor/outdoor security devices with HD video, siren, two-way talk, and cloud/local storage.

Other Major Key Players

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Godrej, Securitas AB

- GALLAGHER GROUP LIMITED

- Tyco Security Products, Dahua Technology Co., Ltd.

- Honeywell International Inc.

- CP Plus Corporation

- ASSA ABLOY, ADT

- ADT

- Netatmo

- Brinks Home Security

- Frontpoint

Recent Developments

- In June 2025, Samsung encouraged smartphone users across the UK to enable and update the latest anti-theft features available on Samsung Galaxy devices. This activity supports the UK Home Office's ongoing work to drive new nationwide action to tackle mobile phone thefts. Samsung issued a public safety security message alert today, which will reach over 40 million Samsung Account holders in the UK this week, through customer communication channels and the Samsung Members platform.(Source: https://news.samsung.com)

- In July 2025, Keyless, the leader in privacy-preserving biometrics, announced the launch of its Biometric Attack Prevention technology: a multi-layered defense system that virtually eliminates the risk of deepfake attacks on authentication systems. Keyless authentication is multi-factor by design, meaning that both the user's face and the device used for enrollment are needed for a successful authentication.(Source: https://keyless.io)

Segmentation Covered in the Report

By Product Type

- Alarms

- Electronic Immobilizers

- Steering Locks

- Biometric & Face Recognition Systems

- GPS/GSM-Based Vehicle Tracking

- RFID-Based Systems

- Remote Keyless Entry (RKE) & Smart Keys

- Others

By Technology

- Ultrasonic Sensors

- Passive Infrared Sensors (PIR)

- Microwave Sensors

- GPS/GSM Communication

- RFID & Smart Card Technology

- Biometric Authentication

By Application

- Automotive

- Residential

- Commercial

- Industrial

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting